Abstract

This correlational study will utilize a descriptive quantitative research technique to evaluate the relationship between leadership style in financial institutions and organizational performance in the crisis-hit economy. Consecutive studies have revealed that the effectiveness of an organization is more often a manifestation of the values and rational planning of powerful players within and outside the organization (Hambrick & Mason, 1984). According to Melton (2009), a considerable number of financial institutions were negatively affected by the 2008 economic crisis in the US and other major economies of the world. Yet in similar economic circumstances, some organizations continued to perform exemplary well (Long, 2009; Gladkova, 2008). Governments and organizational managers are continually engaged in concerted efforts aimed at coming up with strategies to assist organizations wade through the turbulent economic waters (Soros, 2008). However, two critical areas need to be evaluated to determine if they can complement the efforts made by stakeholders to assist organizations during times of economic hardships. First, the capacity of leadership style to successfully steer organizations to greater performance in the face of economic hardships needs to be evaluated. Second, the capacity of leadership style in influencing employee empowerment and productivity also needs to be looked into. This study will aim at providing adequate responses to these conjectures by seeking to know if transformational leadership style can be depended upon to steer organizations towards greater performance when other economic factors seem to hold them back.

Introduction

The outcomes achieved by any organization are partially predetermined by the characteristics of individuals who are directly involved in the day-to-day running of the entity. The strategies, performance, and effectiveness of the organization are often perceived as manifestations of the values and rational planning of powerful actors within and outside the organization (Hambrick & Mason, 1984). Organizational theorists postulate that the performance of an entity is not a direct function of the practiced leadership style alone (Drucker, 2001). Rather, performance is affected by a multiplicity of factors such as geographical location, leadership structures and styles, capital inflows, goal and need orientation, employee orientation, among others. Studies conducted over time reveals a relationship between leadership style and organizational culture, with the latter being extremely important in determining the organizational performance in the marketplace (Morhart, Herzog & Tomczak, 2009). However, while the relationships between leadership style and organizational performance have been independently evaluated before, few studies have focussed on how transformational leadership can assist organizations to wade through recurrent economic crises witnessed globally.

Today, more than ever before, organizational leaders are increasingly faced with the momentous task of steering their respective organizations to financial independence and efficiency against a backdrop of repetitive economic downturns and upheavals (Melton, 2009). Indeed, the latest round of economic crisis has not fully subsided. Every so often, the global economy recedes into a pronounced meltdown, if not an absolute recession (Rubin & Buchanan, 2008). The latest round of financial meltdown thought to have been occasioned by the US housing market crash and subprime mortgage lending crisis, have destabilized organizations more than any other recession since the Great Depression of the 1930s (Kotz, 2009). In the US alone, big multinational organizations such as Merrill Lynch, Bear Stearns, AIG, and the Lehman Brothers have fallen under the heavyweight of the ongoing global financial upheavals, sending thousands of employees into unproductiveness (Lowe-Lee, 2008). According to the UN News Centre (2009), the latest economic crisis continues to push the world’s most susceptible individuals into the periphery of abject poverty, starvation, and early death. Indeed, mass layoffs and salary reductions have become the buzzwords for many organizations today.

However, many organizations continue to be strong in the face of economic adversity (Blankenburg & Palma, 2009). As large conglomerates such as Merrill Lynch and Bear Stearns bow towards bankruptcy suits and acquisitions, others such as Proctor and Gamble, Hewlett-Packard, Dell, Google, and Microsoft persist to register impressive performance under similar economic conditions (Long, 2009; Gladkova, 2008). This kind of scenario calls for a paradigm shift in the way leaders is looked upon as key change agents in the organization. Williams (2009) posited that the world’s assiduous and conscientious managers are best known in tough economic times. During the many economic recessions that have rocked the world’s economic scene, organizations have been able to stand the test of time due to leaders who have vehemently distinguished themselves by having the capacity to motivate employees to action when situations threaten to get out of control (Long, 2009). Consequently, the answer to why some organizations continue to perform remarkably well while others fail in hard economic situations may inarguably lie in the style of leadership. Interestingly, some of the organizations that continue to perform well in hard economic times utilize uncomplicated leadership styles. Harter (2006) postulated that “leadership can be understood as the promise of simplification and complexity expressing the bounds of an inescapable tension” (p.77).

Background of the Study

Long (2009) postulated that quality leaders are known for their capacity to initiate and maintain an action in the organization. Not only must the leaders be able to actively convert their own intentions into action but they must also have the capacity to convert their employees into change agents. Leadership style is widely perceived to have a direct correlation to organizational performance regardless of whether such style is authoritarian, participative, transactional, transformational, free reign, or servant leadership (Sims, 2002). Leadership style can be described as the manner and approach used by leaders to provide direction in their respective organizations, implement fundamental plans, and motivate employees (Hastings & Potter, 2004). According to Avolio & Bass (2004), leadership styles are built on diverse assumptions, theories, and are conceptualized by individuals based on a multiplicity of factors that includes organizational culture and personal beliefs, normative systems, and preferences. Consequently, it is widely believed that leadership style and efficacy of communications between leaders and their employees are fundamental determinants of team success and organizational performance (Kocher, Progrebra & Sutter, 2009).

In the past few decades, management professionals have undergone a critical transformation in the way they define organizational leadership and what their perceptions are towards it (Morhart, Herzog & Tomczak, 2009). In today’s competitive business environment, leadership approaches have mutated from a traditional autocratic approach to an imaginative, participatory approach (Sims, 2002). However, this transformation should not be misconstrued to mean that old leadership styles are bad for our organizations and new ones are effective. Rather, diverse leadership styles are needed for diverse leadership situations and each organizational leader must adequately know when to display a particular leadership approach. It follows that autocratic leadership, which allows for limited team involvement in decision-making processes cannot be blacklisted as ineffective the same way that democratic leadership, which allows for employee participation in decision-making processes and consensus-building cannot be termed as the best leadership style (Kocher, Progrebra & Sutter, 2009).

The rapid pace of change and economic difficulties confronting organizations in modern times have resulted in passionate calls for more adaptive, resourceful, and flexible leadership (Bass et al, 2003). Bennis (2001) argued that adaptive organizational leaders’ function more efficiently in environments of economic upheavals by assisting the organization to make sense of the difficulties faced by both leaders and followers and then responding to those difficulties using appropriate procedures. Accordingly, adaptive and flexible leaders are known to work in a mutual relationship with their followers to produce creative and practical solutions to a multiplicity of complex problems facing organizations today while actively developing their employees to handle a diversity of other leadership responsibilities. According to Harter (2006), economic challenges such as the ones presented by the current financial meltdown need not mean that leaders should lower their standards for leadership. Rather, such economic challenges call for leaders to raise their sights and incorporate dynamic leadership styles to stay afloat in the turbulent economic waters. Long (2009) postulated that economic hardship times call for organizations to be led by power leaders since they have the ability and capacity to get their followers to accomplish fundamental objectives in a manner that increases their confidence.

In a study aimed at evaluating the implications of leadership style on military performance, Bass et al (2003) found that both transformational and transactional leadership styles enhanced the performance of army platoon units especially in times of high pressure and uncertainty. This particular study also revealed that transactional leadership has the capacity to reduce employee turnover especially in high risk engagements. A leadership study done on 48 senior managers established that developmental leadership style is the most enviable style as it is commonly linked to the creation of employee empowerment and organizational growth in addition to enhancing employee motivation and satisfaction (Rao & Rao, 2002). The study also revealed that benevolent leadership style, also known as relationship dominant style, has the capacity to trigger dependence, resentment and avoidance of work. These studies serve to show that diverse leadership styles have the ability to produce differing organizational results, especially in performance.

Bennis & Thomas (2002) argued that outstanding leaders are known for their ability to deal with adversity. Indeed, one of the most dependable indicators of true leadership comes from the leader’s ability to internalize true meaning in difficult situations and to learn how to steer the organization to greater performance even in the most trying of circumstances. A study done by Bennis and Thomas on 40 senior leaders engaged in business and public sector revealed that an outstanding leader must posses the capacity to engage other players in shared meaning and a sense of integrity encompassed in a strong set of personal and organizational values. Consequently, outstanding leaders emerge stronger than they were before in the face of adversities such as economic recessions. Kanter (2003) argued that effective leadership style is one that utilizes both psychological and strategic decision making processes to bring distressed organizations back to profitability.

Problem Statement

Rao & Rao (2002) posited that the rarest resource in a world that is continually engrossed in economic downturns and upheavals is the leadership talent that is capable of incessantly transforming organizations to perform better and be competitive in tomorrow’s world. Presently, very few external factors affect business organizations more than economic recessions (Melton, 2009). In 2008, the world woke up to yet another circus of large multinationals especially in the financial sector filling for bankruptcies under the heavy weight of economic downturn (Soros, 2009). Other businesses experienced plummeting sales, employee redundancies, cut-throat competition, low consumption and spending levels and postponements of key capital investments (Melton, 2009).

Most organizational leaders are overly concerned about how best to weather the economic storms when news of foreclosures, credit crunches, write-downs, stock nosedives and soaring fuel prices start trickling in as was the case in the latest round of economic downturn (Melton, 2009). The fact that the 2008 economic meltdown occasioned by the burst of the housing bubble in the US housing industry claimed more victims than any other recession since the 1929 Great Depression is undeniable. Yet in many organizational studies conducted in the recent past, most business executives view economic recessions as good opportunities to enhance business productivity (Melton). Kanter (2003) postulated that leadership qualities and style are fundamentally important in steering an organization towards greater financial independence during such critical moments. An Accenture study conducted in 2003 revealed that most leaders who succeeded in steering their organizations out of murky economic waters had to set their priorities based on their capacity to create value and how well they corroborated with customers to enhance value. This means that organizational success is largely dependent on leadership style.

According to Drucker (2001), many studies have been conducted to evaluate the correlation between leadership and organizational performance. However, few comparative studies have been conducted to evaluate the correlation between different leadership styles and organizational performance during economic crisis. In the United States, the 2008 economic recession affected the financial sector more than other sector (Melton, 2009). This study will address the problem of determining and evaluating the effectiveness of leadership styles practiced by the CEO’s and other senior-level managers in navigating their respective financial institutions out of the economic and financial hardships occasioned by the 2008 economic recession in the United States.

Purpose of the Study

The purpose of this study will be to evaluate if transformational leadership style can be used to steer organizations towards enhanced performance and efficiency in the face of difficult economic situations. This study will aim to achieve this objective by undertaking a critical evaluation of the leadership style and performance benchmarks in selected financial institutions that witnessed the 2008 economic recession. In particular, the study will be interested in determining whether transformational leadership style is related to employee empowerment and motivation. By fulfilling the above, the study aims at developing new benchmarks for transformational leadership capable of dealing with the multiplicity of economic problems that continues to affect organizational performance in the 21st century.

Rationale

Today, more than any other time before, the threats presented by economic recessions never ceases to influence organizational performance and outlook (Shiller, 2001). Signs of crisis-hit economies, including depressed stock market performances, massive employee layoffs and bankruptcy announcements continue to trigger some form of mass hysteria in the corporate world as organizations manoeuvre their way out of the murky economic waters of today while still trying to map out what tomorrow holds for them (Melton, 2009). According to this author, various strategies have been forwarded to cushion organizations from the harsh effects of economic recessions. However, many strategies such as stimulus packages offered by governments to cushion vulnerable organizations are often too costly and sometimes ineffective (Soros, 2008). As such, a major policy shift towards how organizations and governments strategize to remain afloat in times of financial upheavals and economic downturns is in order. According to Bass et al (2003), some leadership styles such as transformational and transactional leadership have been found to greatly assist the military during times of uncertainty. Without abandoning the current conventional strategies put in place to steer organizations away from economic doldrums, there is need to develop leadership qualities and styles that will greatly assist organizations to remain productive even under harsh economic conditions.

Research Questions and Hypotheses

This study will be concerned with evaluating if transformational leadership style can be used to steer organizations towards enhanced performance and efficiency in the face of difficult economic situations. As such, it will be directed by the following research questions and subsequent hypotheses

- Research Question 1: What is the relationship between transformational leadership style and organizational performance?

- H01: No relationship exists between transformational leadership style and organizational performance.

- HA1: There is a correlation exists between transformational leadership style and organizational performance.

- Research Question 2: What is the relationship between transformational leadership style and employee productivity?

- H02: No relationship exists between transformational leadership style and workers productivity.

- HA2: There is a correlation between transformational leadership style and employee productivity.

- Research Question 3: How does transformational leadership style assists organizations during times of economic crisis?

- H03: Transformational leadership style does not assist organizations during times of economic crisis.

- H A3: There is a correlation between transformational leadership style and organizations’ survival rate in during economic crisis.

Theoretical framework

According to Sekaran (2006), a theoretical framework “is a conceptual model of how one theorizes and makes logical sense of the relationships among the several factors that have been identified as important to the problem” (p. 87). Consequently, an effective theoretical framework for this study must be able to bring into the fore the various diverse interrelationships that exists between leadership style, organizational performance and economic crisis. This study will utilize the full range leadership theoretical framework developed by Bass and Avolio in 2000 and used to measure transformational leadership, transactional leadership and passive leadership, also known as Laissez faire leadership (Stedman & Rudd, 2006). This model utilizes the Multifactor Leadership questionnaire (MLQ). For the purposes of the theoretical framework, leadership can be defined as “the reciprocal process of mobilizing, by persons with certain motives and values, various economic, political, and other resources, in a context of competition and conflict, in order to realize goals independently or mutually held by both leaders and followers” (Burns, 1978, p. 435).

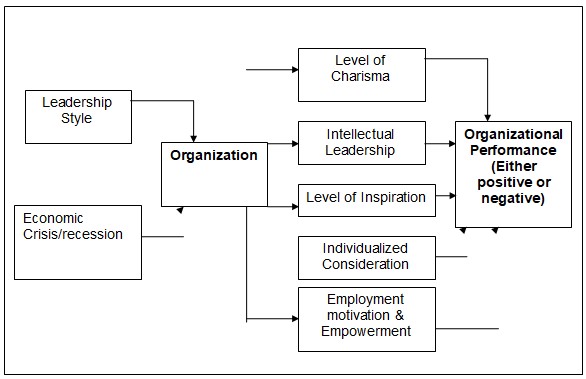

Since this research is only interested in measuring transformational leadership, a conceptual model that revolves around the fundamental dimensions developed by Bass and later refined by Bass & Avolio (2000) in their full range leadership theoretical framework will be used. In the 1990 version, Bass postulated that the four major tenets of transformational leadership are charisma, inspiration, individualized consideration and intellectual stimulation (Bass, 1990). Accordingly, the transformational leadership style and economic crisis will form the independent variables while the level of leaders’ charisma, inspiration, intellect in leadership, and usage of individualized consideration techniques will form the dependent variables. Other dependent variables will include employee motivation and empowerment level, foreclosures and organizational performance. Figure 1 provides a simplified version of the theoretical framework.

Nature of the Study

The study will utilize a descriptive research technique to evaluate the relationship and nature of association between transformational leadership style and organizational outcomes in turbulent economic times. Hopkins (2000) postulated that quantitative research is a formal, purposeful, and systematic technique used to test relationships and evaluate cause-and-effect associations among different variables. In an attempt to establish the nature of relationships among the identified variables, the study will utilize the Multifactor Leadership Questionnaire discussed above to gain useful insights about leadership orientations, employee feedback on the type of leadership style used in regards to facilitating motivation and empowerment as well as the overall organizational performance.

This study will utilize a survey approach in data collection. Surveys can be effectively used when the study is interested in descriptive, explanatory, or exploratory evaluation (Sekaran, 2006). In addition, this research will utilize other previous studies covered in the review of related literature to undertake a hypothesis-testing evaluation aimed at explaining the nature of relationships that exist between leadership style and organizational outcomes in turbulent economic times. Hypothesis-testing can be employed in this type of situation since it “goes beyond mere description of the variables in a situation to an understanding of the relationships among factors of interest” (p. 119).

Significance of the Study

Memories of massive bankruptcy announcements and takeover bids occasioned by harsh economic realities in 2008 and 2009 are still fresh on the minds of many organizational leaders (Melton, 2009). While many organizations failed because of harsh economic realities on the ground, many others failed due to poor leadership and organizational structures. These failures have played a vital role in driving more people towards abject poverty and premature death (UN News Centre, 2009). This particular study aims at coming up with a body of knowledge that can be extensively used by organizational leaders in reviewing their leadership styles in the wider context of stimulating performance within their respective organizations. The leadership benchmarks that this study aims to achieve could be used to improve leadership styles and techniques in the face of continuous economic adversity. This study aims at coming up with information on how leadership style can be used to motivate and empower employees for optimum performance. A motivated and inspired workforce forms the dream gift of any organization since it facilitates productivity and good reputation (Kotler & Lee, 2005).

Definitions and Key Terms

Economic Recession: used to describe a situation in which the gross domestic product (GDP) of a country records a negative economic growth for at least two consecutive financial quarters. (Melton, 2009)

Multifactor Leadership Questionnaire (MLQ): Also known as MLQ 5X short, this tool is used to measure and evaluate a broad range of leadership styles, from passive leaders to transformational and transactional leaders (Bass, 1998).

Assumptions and Limitations of the Study

Several assumptions have to be made for this study to be complete. First, this study assumes that organizations are affected by economic downturns in a negative manner. The study does not make provisions for the notion that some organizations could indeed be benefiting from the ever repetitive economic crises while it is indeed obvious that some organizations stand to benefit from situation that hurt others. Another assumption made by the researcher is that leadership qualities and styles exist in individuals leading the organizations and can be conceptualized and quantitatively measured using the necessary research instruments. One of the research instruments that the researcher assumed could be extensively used in measuring the leadership style is the Multifactor Leadership questionnaire. The third assumption made by this study is that transformational leadership is an effective style of leadership. This assumption is made based on previous studies conducted by researchers, key among them the study findings presented by Long (2009), Hamblick & Mason (1984) and Rao & Rao (2002). However, the study findings for this particular study could be different depending on the data received from the field.

The study may also be confronted with the limitations of time and financial resources. Issues of validity and reliability may as well arise in the data gathering exercise due to the usual reasons of high non-response rate and lack of understanding of the questionnaire questions by respondents. Due to financial constrains, the study may not be able to engage a large sample size and therefore problems may arise when the study findings are generalized to the larger population. The study will also be limited in scope since it will concentrate on evaluating leadership styles of organizational leaders whereas leaders exist in other divergent spheres of life.

Organization of the Remainder of the Study

The study will comprise five chapters, namely: Introduction, review of related literature, methods section, study findings and discussions, and finally, conclusions, recommendations and future research areas. Chapter one, presented above, discusses the background, statement of the problem, study objective and key research questions and hypotheses, theoretical framework, and the value of the study. Chapter two will concern itself with the review of related literature for this particular study, including an assessment of relevant theories related to the key research questions and hypotheses. The methods section will comprehensively cover the research design, data collection techniques, data analysis, and issues of validity and reliability. Chapter four will contain the research findings and discussion, while chapter five will presents some significant conclusions, recommendations and future research areas.

Methodology

Introduction

The purpose of this study will be to evaluate transformational leadership and its relevance to organizational performance and efficiency in the face of difficult economic situations such as the incessant economic crises. In particular, this study will examine leadership style and organizational performance in selected financial institutions that witnessed, and were affected by the 2008 economic recession. The study will also aim to determine whether transformational leadership style is related to employee empowerment and motivation. This section deals with research methodology and techniques that will be utilized to ensure these objectives are achieved.

Research Design

This correlational study will utilize a descriptive quantitative research design to measure the relationship between leadership style and organizational performance. A descriptive research design will also be utilized to evaluate the association between leadership style and employee empowerment in organizational setting. According to Hopkins (2000), most quantitative research designs purposes to determine the association between the independent variable and the dependent or outcome variable. There are two types of quantitative research designs – descriptive and experimental. According to Sekaran (2006), the study subjects are usually measured once in descriptive research designs, while the subjects are measured before and after a certain treatment in experimental research designs. A descriptive research design best suits this particular study since it will be concerned with establishing associations between leadership style and organizational performance rather than establishing causality as it would be the case in an experimental research design. Sekaran (2006) argues that correlational studies are best suited in situations where the researcher aims to delineate the key variables that are associated with a given phenomenon. According to Richey & Klein (2007), a descriptive research design is the best in this particular study since it enables the researcher to observe and measure the behaviour of a subject or variable in its natural environment without influencing it in any way.

It is essential to mention that this particular study will employ a survey technique to collect the requisite data needed to prove or disprove the study’s key hypotheses. Sekaran (2006) posited that surveys are extremely effective when the researcher is mainly interested in descriptive, explanatory, or exploratory assessment. A survey obtains fundamental information needed to measure the associations between variables by way of self report, that is, the subjects responds to a set of questions posed by the researcher either directly or through the use of other procedures such as online protocols. In this particular study, the information will be gathered through the use of Multifactor Leadership Questionnaire (MLQ) for leaders and a specifically prepared questionnaire for subordinates. According to Richey & Klein (2007), a descriptive survey technique best suits this study as it has the capacity to provide a precise account of the characteristics, perceptions, behaviours, attitudes, values and knowledge of a particular variable, subject, situation or organization under study. In the same vein, a comprehensive review of related literature will be carried out with the aim of undertaking a hypothesis-testing study to explain the nature and scope of the associations that exist between leadership style on one hand and employee empowerment and motivation on the other. According to Sekaran (2006), hypothesis-testing technique can offer great assistance to this study since “it goes beyond mere description of the variables in a situation to an understanding of the relationships among factors of interest” (p.119).

Target Population

The target population for this study will be limited to CEO’s, HR professionals and subordinates working in the financial sector in the US. According to Sekaran (2006), a study population, also known as the target population, is described as all the components – subjects, objects, events, individuals, situations – that meet the essential sample standards for inclusion in a study. The term ‘financial institution’ is mostly used to denote any type of organization that collects money from the public and invests them in financial assets such as deposits, loans and other financial securities rather than investing in tangible assets (Bhole, 1992). Financial institutions include banks, credit companies, trust organizations, consumer finance companies, insurance firms, savings and loans, investment firms, pension funds, stock brokerage firms and mutual funds. According to Melton (2009), financial institutions were hard hit by the ongoing economic recession in the US, with some filling for bankruptcy while others were forced into unprecedented acquisitions and mergers. Accordingly, this study will target banking institutions, investment firms and credit companies doing business in the US to evaluate if transformational leadership style can be used to enhance organizational performance and efficiency especially in difficult economic times.

Selection of Participants

This study aims to employ convenience sampling technique to select a sample of 20 financial institutions from each of the three targeted categories, namely banking institutions, investment firms and credit companies. According to Hopkins (2000), a sample is defined as the elements or subjects selected by a researcher for purposes of determining or evaluating a phenomenon about the complete population from which the subjects are taken from. According to Sekaran (2006), it is easier to use convenience sampling since respondents are included in the sample by the virtue of being in the right location at the right time. In this perspective, a total of 120 CEOs’ and HR Professionals will be selected from the 60 financial institutions in the 3 broad categories. This means that each financial institution will be represented by two senior personnel – one from the general management component of the organization and the other from the human resource department. Five subordinate staff will be selected from each financial organization for purposes of completing the specifically prepared questionnaire. This means that this study will engage a total of 420 respondents – 60 CEOs, 60 HR Professionals and 300 subordinate staff. The selection of respondents will also be done through convenience sampling. According to Bryman (1989), convenience sampling is mostly used in organizational studies since it ensures a high response rate. The senior respondents will be selected based on the following criteria:

- Must be senior leaders who have held their positions for a period not less than three years

- Must be willing and ready to participate in the survey

- Must exhibit through knowledge and understanding of a variety of leadership skills

- Must have led their respective organizations during times of economic turmoil

- Must be 21 years of age or older

- Be of either sex or any cultural orientation, race and nationality

Variables

According to Avolio & Bass (2004), the full-range leadership model has the capacity to measure three forms of leadership styles – transformational, transactional and laissez-faire. However, this study will be interested in measuring how transformational leadership style affects organizational performance and employee empowerment in periods of economic hardship. Accordingly, transformational leadership style and economic crisis will form the independent variables while the respondent’s leadership qualities in terms of charisma, inspiration, intellect in leadership, and usage of individualized consideration techniques will form the dependent variables. Other dependent variables include employee empowerment, employee motivation and organizational performance. In the model, transformational leadership variable will be measured using the five scales in the full-range leadership model, namely the idealized influence (attribute), intellectual or logical stimulation, inspirational motivation, individualized consideration and idealized influence (behavioural). Transactional leadership style is represented by three scales, namely contingent reward, active or dynamic management by exception, and inactive management by exception (Avolio & Bass, 2004). In measuring organizational performance, the study will rely on the employees’ level of satisfaction on the leadership style demonstrated by their leaders, willingness to exercise extra effort in terms of motivation, and their perceptions about organizational performance and effectiveness in relation to the leadership qualities and effectiveness exhibited by their respective leaders.

This study will focus on transformational leadership style as it relates to the full-range leadership model. In the model, Idealized Attributes (IA) measures both the perception of pride internalized in employees for being associated with the organizational leader and the perception of how such a leader exhibits a sense of power and confidence in leading the organization (Avolio et al., 1991). In addition, IA is also interested in measuring employee perceptions of their leader’s ability and capacity to go beyond his or her self-interest for the overall good of the organization (Avolio & Bass, 2004). According to the two authors, this scale has a reliability level or alpha of 0.77. Having a reported alpha level of 0.70, the Idealized Attributes (IB) measures and evaluates the perceptions held by employees about their leader’s most fundamental values and beliefs, moral and ethical ramifications, sense of purpose, and collective sense of mission (Avolio et al., 1991).

In the full-range leadership model, Inspirational motivation (IM) represents another scale used to evaluate transformational leadership style. IM measures employee perceptions on the leader’s motivational strategies in terms of providing meaning to their work environments and enhancing team spirit, enthusiasm and optimism (Avolio & Bass, 2004). This scale has a reported alpha level of 0.83. Intellectual Stimulation (IS) is yet another scale used in the full-range leadership model to measure transformational leadership. Avolio et al (1991) posited that leaders who exhibit IS are known to inspire their followers’ endeavours to be innovative, creative and dynamic by probing assumptions, reframing challenges and approaching old scenarios in new ways. Avolio & Bass (2004) argued that leaders with properly developed IS capacity always include the contributions of their followers in any process designed to address the problems facing the organization. Its reliability level is tagged at 0.75.

The last scale in the model that will be used to measure transformational leadership is Individual Consideration (IC). According to Avolio et al (1991), leaders exhibiting IC pay adequate attention to their followers’ needs and requirements for achievement and growth by engaging in coaching and mentoring the followers. In essence, such leaders hold the capacity to develop the followers to consecutive higher levels of potential, giving them new learning opportunities and supportive environments in the process. The scale has a reliability level of 0.80 (Avolio & Bass, 2004). Consequently, all the above stated attributes and characteristics can be effectively used to measure how transformational leadership is related to organizational performance in the crisis-hit economy.

Measures

This study will utilize the Multifactor Leadership Questionnaire, also known as MLQ 5X (Short Form), to evaluate the relationship between transformational leadership and organizational performance. The study will also utilize a specifically prepared questionnaire to evaluate the employees’ perceptions and attitudes on leadership and organizational performance. The two questionnaires will be validated to ensure that they are able to measure the intended variables. The data gathering instruments will be designed to match the decisions needed to be made from the resulting data. Data will be gathered from individuals who have the capacity to contribute information needed to effectively answer the key study hypotheses. To further ensure the validity of the questionnaires used in this particular study, the respondents will be ensured of protection and confidentiality (Sekaran, 2006).

According to Bass & Avolio (2004), the MLQ is a short all-inclusive survey instrument used to evaluate the full range of leadership styles – transformational, transactional and laissez-faire. Developed from the 1995 Bass & Avolio’s full-range leadership model, MLQ has the capacity to identify the characteristics of various types of leadership styles, including assisting leaders to discover how their leadership skills are perceived; not only by their own selves but also by the individuals they lead (Antonakis, Cianciolo & Sternberg, 2004). Tajeda, Scandura & Pillai (2001) argued that MLQ 5X is one of the most favoured tools used to measure transformational and transactional leadership styles and behaviours in organizational context. Although previous versions of MLQ have faced sharp criticism due to their inability to generate empirical findings (Tajeda et al., 2000), the instrument is psychometrically viable as revealed by Bass & Avolio (1995), Bass (1998) and Avolio et al (1999).

Bass & Avolio (2004) posited that the MLQ 5X survey instrument have many advantages over other techniques used to measure leadership attributes. Not only does the technique have the capacity to measure and demonstrate the key issues that separate exceptional leaders from marginal ones but it also has a mechanism that can be effectively used to distinguish effective leaders from ineffective ones at all organizational levels (Avolio et al., 1999). The technique is very easy to administer, takes a short time to complete, and have been comprehensively researched on and validated (Antonakis, Avolio & Sivasubramaniam, 2003). The MLQ technique has been utilized by over 200 research studies, doctoral dissertations and master thesis since its inception in 1995 to evaluate a wide range of leadership styles (Bass & Avolio, 2004). Antonakis, Cianciolo & Sternberg (2004) reported that MLQ technique has been used on numerous occasions to measure organizational outcomes related to the followers’ keenness to exercise extra effort to perform in the organization, followers’ level of satisfaction with their leaders and the general leadership effectiveness. These variables will be included in the questionnaire that will be administered to subordinate members of staff. Overall, the MLQ 5X instrument utilizes the five-point Likert scale (Bass & Avolio, 2004). Accordingly, respondents are expected to rate their leadership behaviours and styles by indicating the frequency of occurrence of certain leadership behaviours and attitudes.

Procedures

Once the required number of financial institutions is selected, the CEOs’ of the selected institutions will be reached by either e-mail or phone to discuss the purpose of the study as well as to determine if they will be willing to participate. The CEO’s will also be requested to allow the participation of selected subordinate members of staff within the chosen financial institutions. After acquiring the verbal or written consent to participate from the relevant authorities in the selected organizations, materials containing the instruction sheet, the questionnaire for subordinates, and the MLQ 5X (Short Form) will be dispatched by email. The instruction sheet will specifically outline the CEOs’, HR professionals and employee participation, including detailing the available channels that the respondents can use to reach the researcher in the event of any misunderstanding or misconception of the questions contained in the survey tools. A valid email address will be given for use by the respondents when posting the completed documents.

Length of Participation

According to the study’s time-frame, all the participants will be given one full week to complete the relevant questionnaires before posting them by email to the researcher. All participants will be duly instructed to spend about one hour of their time over the course of the given week to respond to the questions. The questionnaire to be completed by subordinates is expected to take around 30 minutes to complete, while the MLQ 5X (Short Form) for leaders is expected to take between twenty and twenty-five minutes to complete. It is estimated that the consent forms will take another five to ten minutes to complete.

Attrition/ Non-Compliance

Little attrition or non-compliance is expected in this particular study since it will not require an extensive commitment of time. Indeed, the process of completing the questionnaires is expected to take one week. However, to prevent any instances of non-compliance, instructions will be clearly stated on the forms encouraging the respondents to get in touch with the researcher once they encounter any difficulty. A reminder notice will also be posted a few days before the lapse of the week set for data collection to remind all participants to duly complete the questionnaires.

Ethical Feasibility

Precautionary steps will be taken to ensure that all the methods used to ask for participation, generate needed information, analyze data and report the study findings comply with the set ethical standards, including the rules and regulations set by the University’s Internal Review Board. Care will be taken to ensure that all measures that will be utilized to evaluate the various variables under study meet professional standards of reliability, validity, relevancy, consistency, and usefulness, in line with the intended purpose of the study. A non-disclosure agreement will be made between the researcher and the respondents to safeguard confidentiality and privacy of information. The respondents will also be accorded other rights such as the right to self determination and informed consent to facilitate the ethical credibility of the whole research process (Sekaran, 2006). The participants will also be given the right to decline participation and to withdraw at any stage of the exercise. A copy of the study findings will be made available to the selected organizations while making sure that information about the participants and their contributions is not made available to safeguard their right to privacy. To ensure confidentiality, the respondents will not be required to give personal information when filling the questionnaires.

Data Collection

As already mentioned, the study will utilize both MLQ 5X (Short Form) for leaders and a specifically prepared questionnaire for subordinates. The two sets of questionnaires will be coded numerically according to the three major categories of financial institutions selected for the study. These categories include banking institutions, investment firms and credit companies. The duly filled questionnaires will be organized according to the nature of respondents, nature of the financial institution and the location of the organization. The MLQ 5X data collection instruments will be filled by CEOs’ and HR professionals while the questionnaire will be filled by selected members of staff in the lower cradle.

Data Analysis

Both MLQ 5X (Short Form) and the subordinate questionnaire are expected to yield quantitative data, though the latter may contain some qualitative data due to the open-ended questions. Quantitative data from the field is expected to be cleaned, coded, entered and analyzed using a reliable statistical package such as SPSS. The Microsoft Office Excel will also be of great assistance in analyzing data and drawing graphical representations. A descriptive analysis will be done on the reported scores arising from the MLQ 5X (Short Form) to determine their mean scores. Accordingly, the scores will be used to determine the leadership behaviours demonstrated by the CEO’s and HR professionals. Quantitative data arising from the specifically prepared questionnaire for subordinates will also be analyzed using descriptive analysis and frequencies to show important benchmarks of leadership style, organizational performance and employee empowerment. Qualitative data arising from open-ended questions in the subordinates’ questionnaire will be analyzed through a procedure known as qualitative content analysis. In most occasions, qualitative content analysis is used to perform a systematic analysis on verbal and written communications with aim of measuring the variables using quantitative means (Sekaran, 2006). In the analysis of related literature, key words and repetitive phrases will be decoded with the objective or proving or disapproving the key study’s hypotheses (May, 2001).

Limitations of Methodology

This particular study purposes to evaluate if transformational leadership can be used to guide organizations towards enhanced performance and efficiency in difficult economic situations. While this is an important area of study since it will generate a body of knowledge to be used by leaders as best leadership practices in economic crises, the objectivity of the data collected may be compromised since an economic crisis is subjective to organizations. In most occasions, economic crises have been known to negatively affect organizations. However, the study may be presented with a challenge of understanding the actual intensities of the 2008 economic crisis in relation to individual financial organizations. Melton (2009) postulated that some financial institutions may have been shielded from the real effects of the 2008 economic crisis due to their huge customer base. Melton suggested that unforeseen political influences also had a role to play judging by the way some financial institutions were assisted financially by the federal government during the 2008 financial crisis while others were left to go under. The latter factor may indeed compromise the quality of data received from the field since political influences may be portrayed as effective leadership styles on the part of CEOs. To deal with this limitation, necessary care will be taken during the sampling process to only include financial institutions that manoeuvred the latest economic crises on their own without necessarily receiving any financial stimulus packages from the government.

This study specifically intends to sample banking institutions, investment firms and credit companies for purposes of data collection. However, it is challenging to categorize financial institutions using the above stated categories since many are known to offer a wide range of services under one roof (Bhole, 1992). According to Bhole, Many financial institutions offer a multiplicity of services to cater for the ever increasing customer demands and fend off competition from other players. In the same vein, different segments of the financial sector were affected differently by the 2008 financial crisis, with investment and credit receiving the bulk of casualties (Melton, 2009). This study is specifically interested in evaluating how leadership affects organizational performance during times of economic crises. As such, the limitation described above may limit the study in its quest to unearth the stated objective. To avoid this scenario, a comprehensive review of financial institutions operating in the US will done with a view of segregating institutions dealing with the financial packages targeted for study.