Introduction

Financial markets are characterised by diverse modes of transaction. Particularly, market variations are noted in the degrees of performance and participation in financial dealings. The diversification of such markets can also arise from the competitions that exist within the global business environment. Due to such diversities, it is important to make comparisons with a view of coming up with the best model for determining market liquidity. The best structure for financial exchange should minimise the cost of transactions by promoting a favourable market price among others. The ease of converting the available assets into monetary units is known as liquidity. It can be increased based on the available market technology, especially in the energy sector and service industry among others. Many investors see a lucrative source of returns in the renewable energy sector since it is durable and involves low investment cost. Most of the assets are converted into cash to simplify transactions that occur immediately. In the business scenario, shares are converted into money. Monetary units are an easier mode of transaction. This essay provides a review of various literatures on liquidity models with a view of examining the role of facilitating transactions in the stock market. Particular attention is given to the performance of the international economy, liquidity factors, and transaction models and their limits.

Background

The stock market trade plays a crucial role in improving the economy of a country. This trading system increases the inclination of the stock market that accounts for the growth industries. Currently, many investors have focused on stock markets to accumulate funds that are used to expand businesses. They are also used to invest in new opportunities (Arestis, Luintel, and Luintel 1479). Efficient handling of equity markets ensures stable financial conditions that promote diversification of risks. Governments also encourage international investors to monitor the performance of the equity market since they can promote the economic growth rate and internal trading systems (Arestis, Luintel, and Luintel 1479). Numerous researchers have attested that the performance of the equity market solely depends on the liquidity of the trading assets (the amount of cash that is used in trading). In economic terms, either the stock market performance can increase or decrease based on various liquidity factors. Indeed, a relationship between liquidity and economy has been deduced (Arestis, Luintel, and Luintel 1479).

In the context of this essay, various literatures on market liquidity models will be discussed in detail. It will elaborate the factors that determine market liquidity. It will also analyse how such factors are used to indicate whether liquidity exists within a market. Although market liquidity is regarded as a complex concept, it is rather literary since it can be understood as the ease of performing trade based on securities. Liquidity is the efficiency of translating market assets into monetary units with an aim of easing transactions. Most assets are converted into cash to simplify transactions that occur immediately. In the business setting, Arestis, Luintel, and Luintel reveal that shares are converted into money to form an easier mode of transaction (1479). Liquidity can be achieved through many ways such as trading cash. A crucial factor that influences trade is the availability of information that reflects an investors’ behaviour on trading system (Arestis, Luintel, and Luintel 1482). The economies of countries are influenced by the commercial dealings of various sectors that are significantly influenced by fluctuations in buyer and seller integration. The equity market is influenced by the liquidity of the assets that are used in the trading process. Therefore, the integration of buyers and sellers influences the nature of investments that are targeted to various economic landscapes. This situation has significant effects on the long-term performance of the stock market (Baruch, Karolyi, and Lemmon 2169).

Aspects that various researchers have identified as promoters of equity markets include the creation of liquidity, investments, modification of risks, and maintenance of efficient information dissemination among others (Ang 536). Nonetheless, there has been a feeling that an in-depth understanding of such undertakings is paramount to sound investment. Most traders in the financial market observe prices disparities (Klaassen 179). Most stock market traders appreciate the importance of liquidity, especially its ability to attract flows, influence market sizes and exchange rates among other factors while ensuring a high sense of transparency. Such importance varies across regions. For example, Asia has a relatively small and weak relation that is seen between the flow and volume of equity (Klaassen 179). Regardless of the fact that liquidity determines the performance of the stock market, price fluctuation has lately raised concern amongst many investors. Indeed, most stockholders who that operate in developed economies have become more cautious about the trends of the performance. As a result, they have developed a tendency of losing interest of the equity market trade since most managers and chief executive officers only sell their shares without buying (Peress 20). Barber and Odean confirm that the performance of the stock market is clearly related to liquidity (785).

Other researchers have developed different perceptions. For instance, Aduda, Masila, and Onsongo reveal that liquidity deteriorates the economic growth rate of a country through its advantages (2221). The sustained securities in the market reduce saving rates due to the immense increase in returns and investment by substitution strategies. A fall in the saving rate and other factors that pertain to capital accumulation and liquidity of the stock market lead to slower economic growth rate (Aduda, Masila, and Onsongo 2221). Liquidity has also been known to lessen insecurity and uncertainty over and above increasing the frequency of investments. This situation results in a reduction of the overall saving rate, which is an implication of a falling economic growth (Aduda, Masila, and Onsongo 2221). In addition, Ang mentions that economic growth is directly proportional to various investor activities that are undertaken in a given country (2220). The realisation of liquid assets takes a long time. As a result, most investors are reluctant in obliging themselves to slow transactions (Ang 536).

Role of Liquidity in Stock Market Performance

Performance is one of the indicators that help venture capitalists to determine the future of an investment in the stock market. The progress of a business is studied through close monitoring of price and index variations of the stock. The indexes communicate the possibility of the future investment based on the predicted aggregation of buyers and sellers. The ease of transaction in a market plays a crucial role in determining its feasibility. To understand the future of an economy, the stock market performance must be monitored closely. A rise in stock prices is an indicator of improved business performance in the near future. The role of liquidity is to ensure the flow of stock prices has an impact on market performance (Arestis, Luintel, and Luintel 1480). A 2010 survey that was conducted Hameed, Kang and Viswanathan revealed that the successfulness of the equity market was based on liquidity (257). As a result, many companies can invest because of security and improved profitability. Numerous researchers have also attested that liquidity mobilises investment growth and savings to various companies; hence, it determines their long-term growth in terms of economy. Although such benefits occur due to liquidity, sometimes liquidity has adverse effects on the equity market performance (Aduda, Masila, and Onsongo 214). A research that was conducted by Aduda, Masila, and Onsongo revealed that an increase in profit and returns for investment due to liquidity leads to a reduction of saving rates (219). They further elaborated eased transactions ensure security by minimising uncertainties through the reduction of savings that are prone to security issues. Insecurity that results from uncertainty reduces the rate of investment while more security (or less uncertainty) has adverse repercussions on savings (Aduda, Masila, and Onsongo 218). These two countering events compel investors to have dwindling commitments in the aggregation of buyers and sellers. This situation significantly affects its performance. Liquidity also enables investors to acquire more assets, which are then sold immediately at a reduced price whenever a need arises to alter their portfolios or gain access to savings (Aduda, Masila, and Onsongo 220). In this context, liquidity determines the performance of the equity market.

Although the liquidity determines the performance of the stock market, price fluctuation has lately raised concern amongst many investors (Choi and Yang 567; Barber and Odean 781). A relationship exists between equity market performance and liquidity. According to Barber and Odean revealed that a decline in liquidity and order sizes grow with uncertainty of execution delays (782). On the other hand, impact price uncertainty increases with the size and reduces with liquidity (Brennan and Subrahmanyam 441). Another survey that was conducted by Hou showed a positive correlation between liquidity and stock market performance since width, depth and immediacy are variables that are implemented in calculation of share and relative strength indices with a view of determining stock performance (1113). According to Dasgupta and Prat, most investors value the equity market business due to performance that is directly related to market liquidity (83).

A separate study that was conducted by Menkveld and Wang in 2013 showed that stock prices were directly proportional to liquidity (571). The situation improved market performance due to circulation of profits. Forbes and Warnock, who attested that the ease of transaction is closely linked to the value of the equity market, also noted a higher correlation between liquidity and performance (235). Concisely, the results indicated by the researchers mentioned above indicate a relationship between liquidity and performance of the equity market. Therefore, it can be hypothesised that liquidity influences the performance of the stock market (Forbes and Warnock 236).

The role and Relation between Liquidity and Economy

Aspects of equity markets such as creation of liquidity, savings, diversification of risks, and ensuring efficient information flow among others play a critical role in economic development. Economic development requires large long-term investment in capital. Examples of such investments include factories, machines, and infrastructure among others (Klaassen 179). However, the creation of liquidity in the equity market system can hinder such developments due to the inability to invest in long-term businesses.

Liquidity has significant effects on the integration of buyers and sellers; hence, it influences economic development. This situation is realised through quick returns in terms of profits due to the market performance (Klaassen 181). Stock market liquidity causes a quick growth of the economy due to the positive effects of improved investments (Klaassen 180). As a result, the equity market can be regarded as barometers of a country’s economy.

According to Chiang and Zheng, reduced market performance leads to a decline in economic growth due to the low liquidity that exists (1911). An underperforming equity market is characterised by few liquid assets that are used in the transaction. A survey that was conducted by Chiang and Zheng revealed that reduced economic performance resulted in unstable equity market (384). The situation was also affected by the condensed liquidity of assets. For instance, Africa has been performing poorly economically due to abridged performance in the stock market (Lagos 913). The reduction of performance is primarily caused by the unwillingness of investors to buy shares. In such cases, reduced liquid assets are experienced. Characteristics of equity markets such as creation of liquidity, savings, and modification of risks, acquisition of information, and investment efficiency among others are paramount to economic development (Ang 537).

Other researchers have different perceptions. Numerous researchers attest that market liquidity deteriorates the economic growth rate of a country through its advantages (Ang 536). The sustain securities in the market reduce saving rates due to the immense increase in returns and investment by substitution strategies. Furthermore, liquidity leads to reduction of insecurity and uncertainty besides increasing the investment rate (Edmans and Manso 2395). This situation results in a reduction of the overall saving rate, which is an implication of a falling economic. Reduced investor commitment is also evident due to the manner in which the assets are liquefied in the equity market. The quick process can weaken the obligations of capitalist ventures, a situation that slows down trade and industry development (Ang 539). In addition, economic growth is directly proportional to various investor activities that are undertaken in a given country.

Characteristics of equity markets such as creation of liquidity, savings, and diversification of risks, acquisition of information, and investment efficiency among others are paramount to economic development. Sustaining both qualitative and quantitative vicissitudes in the economy requires a stable investment capital (Klein and Olivei 861). Examples of such investments include factories, machines, and infrastructure among others. However, easy-going transactions can hinder derail such improvements because of unsustainable short-term activities that create profitability gaps. In most cases, market liquidity sustains economic growth at the global level. This situation can be established through risk sharing in projects with high returns that are diverted to projects that boost the economy.

Liquidity Factors

Market liquidity is noted by monitoring a variety of factors that include turnover and turnover ratio that show trading volume, bid-ask spread that highlights the cost of trading, daily price ranges that indicate market resiliency, and information on trading among others. These factors play a central role in determining the feasibility of equity markets, especially in competitive business landscapes. Therefore, investors should factor them in weighing the profitability of their ventures in the near future (Klein and Olivei 861).

Turnover and Turnover Ratio

Market turnover is used to show data that can be used for comparison in time-series (Bekaert, Harvey, and Lundblad 1783). Turnover can be obtained by dividing the number of shares that a company can trade over a particular duration by the average shares that are outstanding for that period. A company has a higher liquid shares when the turnover is high. It is true that a higher turnover in a company indicates presence of liquidity.

![]()

Assuming that a company X accrued 50 billion shares in an equity market during the last year, its turnover will be approximately 167 times in a market where its average outstanding shares of the trading period are 300 million. This figure indicates liquidity in the enterprise stock market. The turnover ratio is arrived at when the turnover is divided by the amount issued in a given period (Bekaert, Harvey, and Lundblad 1788). The turnover ratio determines the holding periods for conducting stock market business. Whenever the turnover ratio is high, short holding periods are exhibited. The turnover ratio is also used to measure market liquidity through indication of trading and float volumes on a daily basis (Bekaert, Harvey, and Lundblad 1783). High turnover ratios imply existence of price volatility.

Bid-Ask Spread

The bid-ask spread represents the discrepancy between the seller and that of the buyer (Armstrong et al. 31). Most investors and traders monitor the movement of bid-ask spread in the event of the transaction. Transactions that fall within the intended prices of the traders are regarded as favourable. In such cases, the bid-ask spread is small due to favourable low trading costs. The market liquidity can be easily understood because the bid-ask spread shows data that is timely and well implemented together with the turnover. The bid-ask spread has information on market liquidity because it indicates transaction costs (Armstrong et al. 31). A bid-ask spread ensures that traders do not pay more than the bidding price.

Daily price range to turnover ratio

Daily price range to turnover ratio is the regular set value that is arrived at when the lowest transaction price is subtracted from the highest transaction price then divided by turnover in trading time or day (Chan, Hong and Subrahmanyam 947).

![]()

A small ratio of daily price to turnover ratio indicates smaller prices in each trading system. This situation shows a resilient market that ensures smooth and quick trading. Stabilisation of daily prices can only be realised when the turnover ratio declines. The market liquidity is demonstrated by the resilience of the daily price range to turnover ratio (Chan, Hong and Subrahmanyam 948).

Price Movements

The volatility of price movements indicates liquidity. When the prices move gradually or increase in smaller bits in the stock market, chances are that the market liquidity is high. When the market liquidity is less, the prices change quickly and abruptly. Price movements are usually caused by the fluctuating market information, uncertainty, supply, demand, and the psychological factors of the traders (Louhichi 625). The stock is valued based on the new information on the stock or exchange rates. This situation ensures that the adjustment of prices either escalates or drops (Louhichi 629). The nervousness of traders or investors towards the future trends of the stock market arises from the perceived uncertainty. This state of affairs can result in increased volatility of prices. Uncertainty causes changes in stock prices at different times. However, psychological factors play a critical role in amplifying the information about the stock market that influences the prices (Mondria 1837). Supply and demand can also cause price fluctuation in the equity market.

Market Microstructure

The structure of the market can determine the extent of liquidity. This situation is achieved by monitoring the trading system and prices (Ferreira, Manso, and Silva 70). Examination of the liquidity characteristics can also help an investor to define the extent of market liquidity. The features that are taken into consideration include tightness that elaborates the size of bid-ask-spreads, depth that shows the volume of trades that can be conducted without affecting the current prices, and resilience that indicates the speed at which the prices influence trading trends (Kerry 181).

Current Models and Approaches in increasing Market Liquidity

High liquidity in the equity market results in increased satisfaction and participation of traders. As a result, most of the traders tend to use various approaches to increase their liquidity assets for trade. Such techniques are discussed below.

Spatial and Time Consolidations (Electronic Call Market)

Various cases of continuous markets portray reduced inherency in liquidity. Intermediaries, market producers, and experts majorly offer spatial and time consolidations. Transactions costs under these conditions can be enhanced by introducing artificial liquidity (Chang et al. 2205). At high liquidity periods, the traders under the call markets must offer lower transaction costs as compared to their counterparts in continuous markets (Chang et al. 2206). The organisation of call market can be achieved through the determination of price scan, which is double-sided auction. The markets prevail in times that are pre-specified (P) when the transactions are eased by establishing direct contact with the sellers. Orders are taken at the exchange from a period p0< P up to period P. Orders with or without contingencies are then aggregated and displayed to the traders for transaction (Chang et al. 2206). A trader is in a position to observe the changes in aggregate demand and supply in the call market. These traders end up realising greater or higher supplies that increase their liquidity. Monopolistic auctioneers in the call market primarily apply this method. The auctioneers must ensure that they offer discounts on transaction costs to traders who began participating in the call market at an earlier stage (Chang et al. 2207).

Microstructure Approach

The microstructure model provides an elaborated framework to comprehend the trading intensity and transaction costs that translate to returns. Investors who use this model must put into account the costs that are expected when the transactions are made. Conditions of the market such as demand and supply among others that are related to liquidity are examined (Koziol and Sauerbier 81).

Maximisation of Social Welfare

Maximisation of the total surplus in the market can increase liquidity through social welfare maximisation for traders (Krusell et al. 393). This situation can be achieved through the cumulative utility minus costs of all traders. Another technique is the reduction of the overhead costs such as fees, and labour among others. The cash is included in the main assets to increase the liquid assets. Investors can also sell several unproductive assets to generate more revenue. This revenue is can be added to the existing liquid assets. Investors also tend to practice longer negotiation techniques to keep payable money for considerable periods (Hung et al. 456). Such finances are also used to generate income in the stock market. Other techniques that can be used to increase liquidity include models in which uncertainty exists amidst the stock volatility.

Detailed elaboration of the Call Market Model

A call market model offers a different means of trade to that of the continuous auction market. The call market model uses an electronic system whereby auctioneers have to disclose the nature of the aggregate supply and demand to the traders whose orders exist. Most traders make purchase requests in time (t) when there is a high accumulation of orders (Chang et al. 2209).

For instance, assuming that an investor has one share to buy or sell in the stock market, the time when the order is placed in the call market is (t), the opening time for call market is t0, and the time when all the orders have been executed is T. The problem is to determine the maximum utility based on the behaviour of the investor. There is also a need to establish the favourable time when the order is supposed to be placed in the call market to gain maximum returns. In this case, the cumulative number of traders who have placed their orders for the time (t) is taken to be N (t). V indicates the value that is related to the call market performance of N by the time t, while the cost of placing the order at the time (t) is C. The value V is used to measure the benefits that are realised from a higher liquid market. Most traders under security markets prefer non-volatile prices (Chang et al. 2208). Such traders are always reluctant to commit themselves to the equity markets due to price uncertainty. As a result, it is assumed that their benefits increase (Chang et al. 2210).

If the traders who placed their orders with respect to their reluctance risks that are incurred for waiting after their orders have been placed are coded Ỷ and the same prices are offered to all investors, the value V of liquidity is seen to be equal amongst all the traders. The reluctance is distributed with respect to the density function f (Ỷ) that is continuous in the range of [Ỷ, Ỷn]. Linear disunity is assumed to lie between the time (t) and T. A utility of trader Ỷ who places an order at (t) time is determined using the following equation.

![]()

A trader has to place the order at time (t) to ensure maximisation of utility that is calculated by the following equation (Chang et al. 2210).

Maximisation of Utility

![]()

For instance, a stock-specific contingency can bar a trader from making an order that exceeds a stipulated maximum percentage, while the market-wide contingency can ensure that the exposure after the call of a trader in a market is only determined by a particular value.

Limitations of the Model and Ways of filling the Gaps

The microstructure approach does not use straightforward empirical tests. This model only inspires investors to choose the relevant liquidity proxies that are explanatory. However, it is essentially used in markets that experience frictions (Koziol and Sauerbier 181).

The Role of Innovation in enhancing Market Liquidity and Economy

Many researchers have attested that there is a clear link between innovation and market liquidity or vice versa (Berry and Waldfogel 5). This situation can only be achieved through properly laid out channels of innovation that affect the markets or the innovation itself. It can be hypothesised that innovation enhances market liquidity and the economy of a given country. Business entities can determine the best pricing models that ensure efficient stock market liquidity to improve their involvement in trade through innovation of new techniques. Such technological developments can also ensure lower liquidity premium prices; hence, they result in the reduction of capital equity costs in business (Fang, Tian and Tice 2085; Hiroux and Saguan 3136). In addition, these trade strategies are used to finance R&D investments with a view of improving the market liquidity and economy. Innovations also ensure that unused resources are converted into liquid assets for faster stock market transactions that lead to quick returns in a bid to improve the economy.

According to Berry and Waldfogel, innovation is realised through the acquisition of resources from small business entities as well as mergers that exist between various enterprises (6). Investors of small businesses sell their illiquid resources to obtain cash that is used for trading due to higher stock market liquidity. This strategy can be used to improve trade and economy. Innovations in new enterprises lead to increased aggregate liquidity that can reduce the cost of the transaction (Comerton-Forde and Tang 337).Redistributed or reallocated of the assets can be implemented to boost the economy in a more effective way. Technology and innovation promote the creation of liquidity through the reduction of production costs. This situation is seen in terms of the immobilised capital due to the production techniques that lead to increased liquidity at reduced prices (Hendershott, Jones, and Menkveld 4; Ahern and Harford 527).

Innovation also helps in the creation of new designs and techniques that ensure reduced production costs on liquidity. Most governments ensure that benchmarks and their issuance are effectively distributed with respect to maturity spectrums that boost liquidity in bonds (Hendershott, Jones, and Menkveld 5). Innovations in various new entities or entrants in the market influence improved production processes that directly leads to improved liquidity. The technology pace in the current business scenario has enabled liquidity to be designed in a way that ensures frequent returns on trade in an attempt to benefit the society by boosting the economy. Innovation has led to improved methods of conveying information concerning liquidity or details about the stock market exchange. Information on security and future trading patterns can influence the increase or decrease in market liquidity (Hendershott, Jones, and Menkveld 6).

Numerous researchers have confirmed the existence of a relationship between market liquidity and information efficiency (Dass, Nanda, and Xiao 3). The efficiency of information is brought about by improved innovation in information technology. Higher liquidity in the market enables traders to place their orders in time because of the available information concerning business trends. Dass, Nanda, and Xiao attested that more customers who are informed tend to trade during higher and peak volume periods (5). This situation results in increased liquidity.

Innovation in market infrastructure ensures improved liquidity due to the detailed understanding of market breadth, transparency, and depth among other characteristics. A research that was conducted by Dass, Nanda, and Xiao in 2012 to establish the relationship between innovation and liquidity revealed that the ease of transaction in a market system is significantly affected by the implemented technologies. It was also noted that innovation led to improved stock market liquidity that promoted reduction of production costs (Dass, Nanda, and Xiao 6). When the cumulative innovation and liquidity are compared, the expenditure in aggregate R&D is seen to be stronger in small enterprises due to their stringent mechanisms (Klonowski 335). This situation increases liquidity, which implies an improved trade.

Technology in USA and its role in enhancing Liquidity and Economy

The United States of America (USA) has immensely invested in technology in an attempt to ensure sustained development. Various factors that are considered in the realisation of the successful economy in the US include skilled workforce, well-paying jobs, and clean and safe environment that is characterised by energy efficiency to cut expenditure (Hassan, Sanchez, and Yu 88). Technology also ensures the reduction of pollution and development of a highly competitive private sector that guarantees completion of the global market system. The USA technology systems envision a steady increase in educational systems where learners are scientifically inspired and can conduct technology-based research with an aim of improving both the national and global economy (Bazilian et al. 337). Therefore, technology plays a critical role in promoting the market liquidity due to the existence of proper designs that increase productivity efficiently. In addition, technology has a positive direct influence on the market infrastructure (Hassan, Sanchez, and Yu 89). Innovations and/or the improvement of already existing technology systems have been found useful in maximising production with minimal incurrence of costs.

Hassan, Sanchez, and Yu reveal that the infrastructure is categorised into two dimensions that include the infrastructure within an enterprise and that at the market interface (92). Infrastructure within the enterprise can only be improved through the implementation of advanced technology because any production process is required to produce a quality outcome. The operational stages must depict a trend of reduced costs with increased output in terms of liquidity. This practice is done by observing the economies of scale. The development of technology in modern business environments has resulted in tremendous improvement of small business entities, especially in the USA. Improvement of market infrastructure is achievable through the development of technology. Payment settlement systems are covered through well-developed market infrastructure. According to Hassan, Sanchez, and Yu Liquidity in market infrastructure is improved through proper addressing of various risks that are involved in trading to influence the capital costs (93). Technology in the market infrastructure influences the traders’ behaviour directly or indirectly. The diversity of behaviours among traders results in heterogeneity in the market set up. This situation is evidenced by transaction needs, various risk assessment methods and investment techniques. Proper utilisation of such varied features ensures improved liquidity.

Information technology is a valuable asset that enables investors to be sure of accuracy and information trends about the stock market exchanges rates. This situation results in improved liquidity during transaction (Hughes, Liu, and Liu 705). Various studies have revealed that the relationship between information efficiency and stock performance leads to increased liquidity. The efficiency of information is due to improved technology. Chiang and Zheng posit that the speed of information proliferation determines the feasible opportunity costs in a market environment (1911).

The Role of the Service Sector (Blue chip) in Market Liquidity

Information technology in the USA is majorly diploid to ensure rapid economic growth through trading (Turner and Barker 4). Most of the businesses that foster the growth are service-based. These service industries include the banking, insurance, real house and the Blue Chip systems among others. Blue Chip is a financial company that sells quality products and services to consumers. The US has heavily invested in the service industry since it is one of its primary sources of economic growth (Turner and Barker 7). The service sectors have strived to reach top-notch operations due to sheer sizes and integration with other sectors to provide job opportunities, suitable environment for entrepreneurship, and active links of the USA to the rest of the world based on economic aspects.

In the modern USA economy, service sectors are commanding in terms of job opportunities. For example, the American Express, AT&T, Citigroup, Disney, McDonald’s, JP Morgan, Sears, and Wal-Mart companies have joined efforts to form the Dow Jones index of blue-chip that falls under the service sector. The payrolls of the service sector in the USA economy have risen to 65-percent with approximately 40 million employees (Turner and Barker 10). About 85-percent of the workers who are not based in the farming industry are employed in the service sector. The private sector commands almost 82-percentage of the service sector jobs. This situation implies improved liquidity that is a significant boost to the further development of the US economy.

Turner and Barker posit that information technology has also played a critical role in shifting the economy towards the service sector (12). A recent ranking of the USA service sector with respect to investment in information technology and relative total capital investment ratio revealed that ten service industries capture the first top ten positions in the global market landscape. This rise is observed due the advancement in information technology. The service sector plays a critical role in linking the intensity of the service economy and information technology. This state of affairs has created a large market for trade. The improvement of service sectors such as the Blue Chip industry has significantly boosted the growth of the stock market trade. This set of circumstances has further increased the ease of transactions in the market (Turner and Barker 11). As a result, many enterprises have gained access to quick returns that have in turn led to immense growth of the country’s economy.

The future of Renewable Energy and the Economy and its relation to Market Liquidity

The energy economy in the global scenario is seen as the most influential factor in decision-making among various governments worldwide. The current consumption rate is skyrocketing; hence, an issue of sustainability has to be addressed. Energy consumption has increased significantly due to skyrocketing demands that influence the prices of commodities in all sectors. However, various means of creating alternative sources have given rise to the establishment of renewable energy forms that have led to the development of new economies that ensure sustainability of markets. According to Lehmann and Gawel, many investors and governments around the world are currently turning towards investing in the renewable energy sector with their emphasis laid on the strategies that are supposed that are aimed at reducing credit risks concerning the investment (597). As a result, most governments, especially the EU, have opted to provide support to various firms that venture their assets in the renewable energy.

Currently, companies invest in the renewable energy sector in a variety of ways. The first method is the direct investment that is mostly evident in Germany and France. For instance, the Allianz Company has utilised about €1.3b in the recent past to buy wind farms. The Germany’s Munich Reinsurance Company also bought wind farms and solar plants that were worth €1b. The second way entails indirect investment. The Pension Insurance Corporation, which is a UK-based company, bought a public solar finance bond whereby it invested about $40m in Solar Power Generation Ltd bond. The third way of investing in renewable energy is using public traded assets. In this scenario, investment is made in public firms that generate the renewable energy. An example is the Greencoat UK Wind Firm, Bluefield Solar, and Iberdrola Renewables among others companies. Most investors concentrate in such ventures due to their lucrative and consistent yield that is usually coupled with long-term cash flows (Zhang and Wei 1804).

The current market performance of renewable energy indicates an improvement of about US$244b in renewable power and fuel. Europe, China, and the US captured almost three-quarters of the amount. A closing gap is also exhibited in the investment between the renewable energy and fossil fuel by about 12 percent since 2011 (Zhang and Wei 1805).

Currently, a falling trend in the costs of renewable energy has encouraged capitalist ventures to invest more fortunes in the sector due to further development of power technology. Recent studies indicate that the prices of PV technology have fallen by around 80-percent in the last half a decade. Due to the fall in the cost, the productions of both wind and solar powers (measured in megawatts) have tremendously increased between 2011 and 2012. A greater extent of diversification in the investment is likely to result in positive results for the investors. Renewable energy is currently a crucial factor that leads to reduced market liquidity. Most investors are faced with challenges of difficulty market conditions and increased bank requirements that hinder sustenance of high liquid assets. The renewable energy investment is illiquid; hence, most investors in the near future will most likely venture because it has enduring returns (Lehmann and Gawel 599).

Although such benefits exist, the renewable energy investment faces some downsides that include technological risks. The technology is improving and dynamic in nature. However, the equipment in place can become obsolete due to the emergence of alternative techniques that are more robust. Another risk is associated with the geographical terrains. Due to unpredicted changes in weather, the volatility that is associated with generating such energies can lead to losses.

Although the renewable energy investment is seen as illiquid, the liquidity aspect in the electricity market can still be achieved through the wholesale energy trade. The traders can keep records or constantly monitor the number of times the power produced is traded. Due to the enduring nature of investment, the electricity trade market can remain liquid due to the establishment of robust pricing that is relatively stable.

World’s Electricity Demand & Supply and its Growth

Advancement of technology in developed and developing nations has necessitated the demand and supply of energy in the form of electricity. The demand for electricity can be closely monitored during the peak hours on a daily basis (Asif and Muneer 1388). The supply must be shaped in a way that meets the demand reliably. Electricity can be derived from both clean sources and fossil-based fuels. The emergence of renewable sources such as wind, solar, tidal waves, hydro, and geothermal among others also contribute a favourable percentage to the electricity supply (Asif and Muneer 1389).

The current global demands and supply of electricity is resilient due to the issues of financial crises and global recession. The global energy sector contributes to a greater percentage of GDP shares (Asif and Muneer 1388). The consumption of electricity at the global level in the recent past has been reduced by about 1.5 percent as (Asif and Muneer 1390). This reduction was exhibited in the whole world with exception of Asia and the Middle East. Both North America and Europe recorded a drop of 4.5 percent in demand. Countries such as Japan have recorded a 7-percent decrease in electricity usage. However, countries that exhibit a rapid economic growth such as China and India among others have experienced increased demand and consumption of energy by a positive 6 and 7 percent respectively (Richardson et al. 1878).

The world’s record of electricity consumption as at 2004 was 15,406 Tera-Watt (TWh) from all sources that included fossil fuels and renewables. Although the global consumption of electricity is said to be reducing, the USA is still the world’s leading consumer of electricity with a demand of 3,656 TWh. It is followed by China with an average consumption of about 2,170 TWh and Japan at 946 TWh (Richardson et al. 1893). The graph below shops the world’s top ten electricity consumers.

The following graph illustrates the Per Capita Annual Energy Demand by Country.

Daily Domestic Electricity Demand

Daily consumption of electricity at the domestic level in the USA alone is approximately 4387 kWh per year. About 1000 generation stations that account for over 80-percent of the energy sector can supply electricity to nearly 650,000 households. A comparable annual demand in the European countries is about 2000kWh for every person (Richardson et al. 1878). The following figure illustrates the daily electricity demand per capita in Europe.

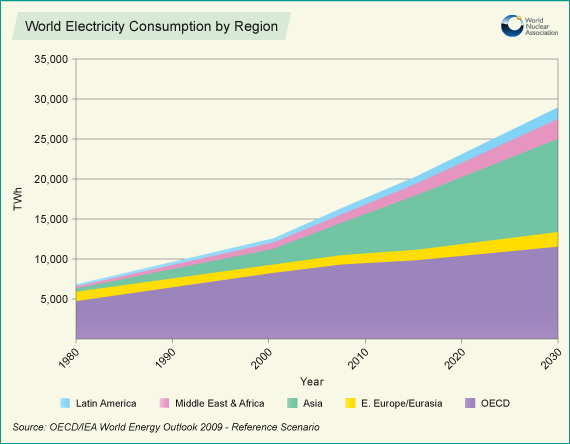

It can be inferred from the figure that the average daily demand in the near future can either double or triple. The following graph is a representation world’s electricity consumption based on regions.

Contribution of Electricity or Clean Energy in Market Liquidity

In a free and liberalised energy market, the electricity systems should be efficient to provide the experience of lively competition. The traders in the electricity market are usually wholesalers or institutions (Haas et al. 2186). These market experts always provide means and mechanisms that incorporate non-vertical integration of electricity in trade. They must also ensure that proper management of electricity prices. Pollitt posits that this strategy is essential since favourable prices ensure high liquidity that encourages new entries into the electricity supply chains (14).

Electricity and clean energy linked directly or indirectly to the employment sector. The situation results in an improvement of the GDP. The clean energy and electricity contribute to employment directly in sources that provide such forms of energy or indirectly in various sectors that supply goods and services by consuming the energy. The employees use their income and create demands for products and services in other sectors (Pollitt 16). This set of circumstances results in an aggregate electricity demand and employment; hence, it improves the economy.

Soonee et al. reveal that most investors focus on the solar energy as a primary source of investment (9). For instance, the Solar City Company is an investment that offers solar bonds to customers who are willing to invest in the renewable energy sector. The duration stipulated for such bonds is normally short, ranging from several months to one or two years. These durations lead to the creation of more market liquidity. More liquidity in the clean energy investments results in increased income for the traders (Klonowski 335). Growth has been noted among retail investors and institutions that have invested in clean energy. This situation has resulted from reduced operational costs in the clean energy and electricity sector in the recent five years.

Liquidity in the electricity market can be improved through efficient monitoring of the number of times the electricity produced is traded (Weber 3185). This state of play benefits the consumers through the various ways. Firstly, the presence of liquidity ensures new entrants in the market. It also increases price transparency, which paves a way for healthier competition among others. The wholesalers in the electricity market improve liquidity through by establishing long-term availability of products that provide support to hedge risks that are associated with exposure. The wholesalers also offer robust prices round the clock to promote the electricity market in the near future.

Conclusion

The essay has comprehensively elaborated the literature about the liquidity, its models, and the relationship that exists between technology, energy, the service sectors among others the economy. The essay has further elaborated the liquidity factors and the models that are used to facilitate market transactions. It is realised that the increase in growth of the economy is directly related to the liquidity of assets that are used for trade. The stock marketers and investors are always cautious about the market trends and other factors that influence the frequency of trade. Such actions enable investors to monitor various risks that arise from market liquidity. However, further research should be conducted on the relationship between renewable energy and liquidity since it is an emerging investment element. A clear understanding of liquidity in clean energy should also be studied since most of such assets are illiquid in nature. A deeper understanding of how such investments improve market liquidity should be investigated further.

Works Cited

Aduda, Josiah, Jacinta Masila, and Eric Onsongo. “The determinants of stock market development: The case for the Nairobi Stock Exchange.” International Journal of Humanities and Social Science 2.9 (2012): 214-228. Print.

Ahern, Kenneth and Jarrad Harford. “The importance of industry links in merger waves.” The Journal of Finance 69.2 (2014): 527-576. Print.

Ang, James. “A survey of recent developments in the literature of finance and growth.” Journal of Economic Surveys 22.3 (2008): 536-576. Print.

Arestis, Philip, Ambika Luintel, and Kul Luintel. “Financial structure and economic growth: evidence from time series analyses.” Applied Financial Economics 20.19 (2010): 1479-1492.

Armstrong, Christopher, Mary Barth, Jagolinzer Alan & Riedl Edward. “Market reaction to the adoption of IFRS in Europe.” The accounting review 85.1 (2010): 31-61.

Asif, Muhammad and Tariq Muneer. “Energy supply, its demand and security issues for developed and emerging economies.” Renewable and Sustainable Energy Reviews 11.7 (2007): 1388-1413. Print.

Barber, Brad and Terrance Odean. “All that glitters: The effect of attention and news on the buying behavior of individual and institutional investors.” Review of Financial Studies 21.2 (2008): 785-818. Print.

Baruch, Shmuel, Andrew Karolyi and Michael Lemmon. “Multimarket trading and liquidity: theory and evidence.” The Journal of Finance 62.5 (2007): 2169-2200. Print.

Bazilian, Morgan et al. “Re-considering the economics of photovoltaic power.” Renewable Energy 53 (2013): 329-338. Print.

Bekaert, Geert, Campbell Harvey and Christian Lundblad. “Liquidity and expected returns: Lessons from emerging markets.” Review of Financial Studies 20.6 (2007): 1783-1831. Print.

Berry, Steven, and Joel Waldfogel. “Product Quality and Market Size.” The Journal of Industrial Economics 58.1 (2010): 1-31.

Birol, Fatih. World energy outlook 2010. New York, NY: International Energy Agency, 2010. Print.

Chan, Justin, Dong Hong and Marti Subrahmanyam. “A tale of two prices: Liquidity and asset prices in multiple markets.” Journal of Banking & Finance 32.6 (2008): 947-960. Print.

Chang, Rosita, Ghon Rhee, Gregory Stone and Ning Tang. “How does the call market method affect price efficiency? Evidence from the Singapore Stock Market.” Journal of Banking & Finance 32.10 (2008): 2205-2219. Print.

Chiang, Thomas and Dazhi Zheng. “An empirical analysis of herd behavior in global stock markets.” Journal of Banking & Finance 34.8 (2010): 1911-1921. Print.

Choi, Hyuk and Cheol-Won Yang. “Information risk and asset returns in the Korean stock market.” Asia-Pacific Journal of Financial Studies 36.4 (2007): 567-620. Print.

Comerton-Forde, Carole and Kar Tang. “Anonymity, liquidity and fragmentation.” Journal of Financial Markets 12.3 (2009): 337-367. Print.

Dasgupta, Amil and Andrea Prat. “Information aggregation in financial markets with career concerns.” Journal of Economic Theory 143.1 (2008): 83-113. Print.

Dass, Nishant, Vikram Nanda and Steven Xiao, Intellectual Property Protection and Financial Markets: Patenting vs. Secrecy, 2014. Web.

Edmans, Alex, and Gustavo Manso. “Governance through trading and intervention: A theory of multiple blockholders.” Review of Financial Studies 24.7 (2011): 2395-2428. Print.

Fang, Vivian, Xuan Tian and Sheri Tice. “Does stock liquidity enhance or impede firm innovation.” The Journal of Finance 69.5 (2014): 2085-2125. Print.

Ferreira, Daniel, Gustavo Manso and Andre Silva. “Incentives to innovate and the decision to go public or private.” Review of Financial Studies (2012): 70. Print.

Forbes, Kristin and Francis Warnock. “Capital flow waves: Surges, stops, flight, and retrenchment.” Journal of International Economics 88.2 (2012): 235-251. Print.

Haas, Reinhard, Gustav Resch, Christian Panzer, Sebastian Busch, Mario Ragwitz and Anne Held. “Efficiency and effectiveness of promotion systems for electricity generation from renewable energy sources–Lessons from EU countries.” Energy 36.4 (2011): 2186-2193. Print.

Hameed, Allaudeen, Wenjin Kang and Shivesh Viswanathan. “Stock market declines and liquidity.” The Journal of Finance 65.1 (2010): 257-293. Print.

Hassan, Kabir, Benito Sanchez and Jung-Suk Yu. “Financial development and economic growth: New evidence from panel data.” The Quarterly Review of economics and finance 51.1 (2011): 88-104. Print.

Hendershott, Terrence, Charles Jones and Albert Menkveld. “Does algorithmic trading improve liquidity.” The Journal of Finance 66.1 (2011): 1-33. Print.

Hiroux, Céline and Marcelo Saguan. “Large-scale wind power in European electricity markets: Time for revisiting support schemes and market designs?.” Energy Policy 38.7 (2010): 3135-3145. Print.

Hou, Kewei. “Industry information diffusion and the lead-lag effect in stock returns.” Review of Financial Studies 20.4 (2007): 1113-1138. Print.

Hughes, John, Jing Liu and Jun Liu. “Information asymmetry, diversification, and cost of capital.” The Accounting Review 82.3 (2007): 705-729. Print.

Hung, Mao-Wei, Bing-Huei Lin, Yu-Chuan Huang, and Jian-Hsin Chou. “Determinants of futures contract success: Empirical examinations for the Asian futures markets.” International Review of Economics & Finance, 20.3 (2011): 452-458.

Kerry, Will. “Measuring financial market liquidity.” Journal of Risk Management in Financial Institutions 1.2 (2008): 181-190. Print.

Klaassen, Johann. “Sustainability and Social Justice.” Responsible Investment in Times of Turmoil. Springer Netherlands, 2011. 179-191. Print.

Klein, Michael and Giovanni Olivei. “Capital account liberalisation, financial depth, and economic growth.” Journal of International Money and Finance 27.6 (2008): 861-875. Print.

Klonowski, Darek. “Liquidity gaps in financing the SME sector in an emerging market: evidence from Poland.” International Journal of Emerging Markets 7.3 (2012): 335-355. Print.

Koziol, Christian and Peter Sauerbier. “Valuation of bond illiquidity: An option-theoretical approach.” The Journal of Fixed Income 16.4 (2007): 81-107. Print.

Krusell, Per, Toshihiko Mukoyama, Ayşegül Şahin and Anthony Smith. “Revisiting the welfare effects of eliminating business cycles.” Review of Economic Dynamics, 12.3 (2009): 393-404. Print.

Lagos, Ricardo. “Asset prices and liquidity in an exchange economy.” Journal of Monetary Economics 57.8 (2010): 913-930. Print.

Lehmann, Paul and Erik Gawel. “Why should support schemes for renewable electricity complement the EU emissions trading scheme.” Energy Policy 52 (2013): 597-607. Print.

Louhichi, Wael. “Does trading activity contain information to predict stock returns? Evidence from Euronext Paris.” Applied Financial Economics 22.8 (2012): 625-632. Print.

Menkveld, Albert and Ting Wang. “How do designated market makers create value for small-caps.” Journal of Financial Markets 16.3 (2013): 571-603. Print.

Mondria, Jordi. “Portfolio choice, attention allocation, and price comovement.” Journal of Economic Theory 145.5 (2010): 1837-1864. Print.

Peress, Joel. “Product market competition, insider trading, and stock market efficiency.” The Journal of Finance 65.1 (2010): 1-43. Print.

Pollitt, Michael. “Evaluating the evidence on electricity reform: Lessons for the South East Europe (SEE) market.” Utilities Policy 17.1 (2009): 13-23. Print.

Richardson, Ian, Murray Thomson, David Infield and Conor Clifford. “Domestic electricity use: A high-resolution energy demand model.” Energy and Buildings 42.10 (2010): 1878-1887. Print.

Soonee, S.K. et al. “Point of Connection Transmission Pricing in India.” International Journal of Emerging Electric Power Systems 14.1 (2013): 9-16. Print.

The Central Intelligence Agency. The World Factbook: 2011, Sterling, VA: Potomac Books, 2011. Print.

Turner, Martin and Jamie Barker. “Examining the Effects of Rational Emotive Behavior Therapy (REBT) on the Irrational Beliefs of Blue-Chip Professionals.” Journal of Rational-Emotive & Cognitive-Behavior Therapy (2014): 1-20. Print.

Weber, Christoph. “Adequate intraday market design to enable the integration of wind energy into the European power systems.” Energy Policy 38.7 (2010): 3155-3163. Print.

Zhang, Yue-Jun and Yi-Ming Wei. “An overview of current research on EU ETS: Evidence from its operating mechanism and economic effect.” Applied Energy 87.6 (2010): 1804-1814. Print.