Abstract

This study sought to evaluate the factors that affect the stock performance of listed companies after mergers or acquisitions with Chinese-related entities. It utilized the CAPM analysis, financial method, and regression analysis to achieve its objectives. The study came up with interesting and insightful findings. First, the shares ownership structure practiced in China was found to act as a deterrent to efficient and effective M&A activities. It was revealed that investors and shareholders still exercise a lot of caution when it comes to dealing with Chinese-related firms since they still hold the view that China’s government is the majority shareholder in these companies. The ownership structure was accused of negatively affecting the stock performances. Other factors that were found to invariably affect stock performance after the mergers and acquisitions include information about pending mergers and acquisitions, the level of efficiency and synergies achieved by the M&A events, the company’s earning ability and its ability to repay short-term and long-term debts.

Introduction

Background

Mergers, acquisitions, and organizational restructurings form a big component of the corporate finance world in today’s futuristic global economies. Almost every day, investment bankers and dealmakers are embroiled in intensive meetings ultimately aimed at bringing separate organizational entities together. When they are not in the business of developing big companies from separate outfits, corporate strategy and finance dealers are involved in doing the opposite – breaking up huge organizations through management processes such as spin-offs and carve-outs. Interestingly, these actions are splashed across major television channels and newspapers around the world since the mergers and acquisition (M&A) deals are often worth millions, or even billions of dollars (Picot 9). The deals made in Wall Street and other high places often inform the fiscal fortunes of the organizations involved for years, sometimes decades, to come.

In a non-technical language, M&A refers to the facet of organizational strategy, finance, and management that deals with purchasing, selling, or combining different companies together with an ultimate objective of aiding, financing, or assisting a budding organization in a given industry to achieve rapid growth and development without necessarily having to start from scratch (Bruner 5). From the annals of history, it is clear that the first phase of M&A took place between 1897 and 1904, and was largely triggered by economic factors and business goals. Today, most M&A activities continue to be influenced by the same factors. The macroeconomic environment, including the growth in GDP, interest rates, and financial policies continue to be major determinants in designing the process of M&A between various companies or organizations.

The fact that global M&A deals grab the attention of major information outlets is undeniable. For instance, the 2008 merger involving the loss-making Delta Airlines of the US and Northwest Airlines for a staggering $18 billion became fodder for news channels and newspapers. Investors rushed to the stock markets to buy shares of the combined companies since the merger occasioned them to become the world’s biggest airline, with a pooled fleet of almost 800 airplanes and a market share spanning 70 countries (Webb, para.1). But this is as far as it goes. Many more mergers that have been concluded recently have failed to elicit interest from investors due to their poor performance on the stock markets.

The fundamental principle behind merging or acquiring a firm is to create shareholder value that will be over and above the total sum values of the two organizations combined (Weston & Weaver 43). In brief, M&A events are informed by the rationale that two companies merged together are often more valuable than a pair of disconnected companies. The most ardent, assiduous, and conscientious managers will inarguably agree to this fact, especially when times are rough at the macroeconomic level as it was the case during the 2008 financial crisis. During such times, strong companies act to acquire other business entities to achieve the multidimensional objectives of gaining a foothold on the existing and emerging markets, remaining strategically competitive, and introducing cost-efficient strategies (Reed, Lajoux, & Nesvold 12). Commanding a greater market share and improving efficiency in product or service delivery are seen as vital requirements if shareholders’ value is to be increased. In most cases, the target companies for M&A readily agrees to be purchased or even advertise themselves for sale when all factors – internal and external – are against their survival as distinct entities.

The present financial crisis that nearly decimated global economies especially in the US and Europe triggered widespread mergers and acquisitions as huge corporations tried to manoeuvre their way out of the turbulent economic times. The 2008 financial crisis is by far the most critical to have rocked industrialized nations since the stock market crash of the late 1920’s (Andrews, 2009). It is thought to have been occasioned by the US housing bubble as well as a dramatic slump in stock market values. The factors not withstanding, huge conglomerates such as the Lehman Brothers and Merrill Lynch found themselves on the brink of collapse. Indeed, the news about their bankruptcies shocked the whole world, adversely affecting stock market values on a global scale. For instance, the Dow Jones plummeted by more than 500 points after the collapse of the Lehman Brothers, signifying the single worst day for the stock exchange markets since 9/11 terrorist attacks of 2001.

Historical information reveals that companies and corporations fall back to mergers, acquisitions, and bailouts when the financial and market upheavals proves too challenging to master. The 2008 scenario was not any different. Companies, especially in developed nations, offered themselves for possible mergers and acquisitions to avoid falling into the pit of bankruptcy, insolvency, or even outright liquidation and ruin. According to Woods, M&A allows a plummeting organization to fail stylishly without being given any chance to spread contagion (18). Last year, the Bank of America acquired the badly battered brokerage firm Merrill Lynch, while Wachovia was acquired by Well Fargo, Inc. The almost insolvent investment firm Morgan Stanley merged with another investment firm to become Morgan Stanley Smith Barney.

Chinese companies and investors actively took part in acquiring some of the firms that were threatening to go under in the US and some western countries. China had also been inevitably affected by the financial crisis by the virtue of their status as the world’s third major economy and the second major trading nation (Zheng & Tong 23). However, China had not been hit as hard as the US and some European countries such as the UK, Spain, France, and Italy. Indeed, China’s economic growth rate for 2008 only slowed down to about 9% while other major economies around the world were reporting negative or dormant growth rates (Bristow, para.5). The fall was attributed to shrinking Chinese exports, a scenario that was directly related to financial upheavals at the global markets. The Economy had grown by 11.9% in 2007 (Watts 9). But overall, China’s economy had faired relatively well in difficult times, and investors still had the required capital needed to acquire the failing companies particularly in the US and Europe.

The Problem Statement

Available data points to the fact that Chinese companies are becoming more and more dominant on the world’s economic stage. According to available statistics, only 5 Chinese firms had been included in the 1998 Fortune 500 list of the leading corporations in the world. The US had 185 companies included in the 1998 list. But in 2008, 37 Chinese firms made it to Fortune’s list of leading companies, while the U.S. firms decreased to 140 (Dumaine, para.2). Indeed, the number of acquisitions, mergers, and takeover bids made by Chinese corporations internationally has drastically increased from 2000. According to analysts, the current financial crisis affecting most economies around the world has propelled Chinese companies to buy cheaply into strategically placed foreign firms that were formerly considered too expensive to buy (Watts 9). Many economic analysts attribute this scenario to exponential economic growth rates that China has been able to achieve especially from the onset of the new millennium.

Many analysts believe that most Chinese entities are taking advantage of plummeting asset values occasioned by the current financial crisis to flex their muscles in international mergers, takeover bids, and acquisitions (Xianing, para.1). A recent survey commissioned by the Royal Bank of Scotland (RBS) revealed that China’s international M&A activity is likely to increase in 2009. According to the survey, 63% of the polled respondents expect the country’s level of international M&A operations to increase within the next 12 months, while only 21% expect the level to plummet. The survey confirmed what international economic pundits have been saying all through – Chinese firms and investors are still eager to achieve a global outlook through international acquisitions. This year, China’s direct outbound investment is expected to grow 14% year on year to around $60 billion. In 2008, the country’s international M&A transaction activities accounted for over 24% of Asia’s total outbound M&A investment.

But M&A activities are known to affect stock performances the world over. According to Coffee, Lowenstein, & Rose-Ackerman, “…stock price movements of the acquired firms will be affected in advance of the merger transaction by knowledge of the forthcoming merger” (218). In most instances, the stocks of the acquired or merged company increase in value just before and after the M&A event. Such an increase mirrors an encouraging market view of the probable effects of the merger. According to Kay, available evidence from the stock market reveals that most merger and acquisition announcements invariably increase the marked value of the target firm. According to him, the target business entity “…is, on average, valued more highly than the sum of the two merging companies…more or less, the whole of that gain goes to the shareholders of the company which is acquired” (147).

Judging by the above arguments, M&A events should bring positive results to shareholders by positively stimulating the stock performance of the combined firm in the stock markets. While this has been constantly observed in some M&A events, it is not universally binding for all the activities held to date. In more than one occasion, the stock performance of listed companies has gained or plummeted after M&A events. However, no authentic studies have been conducted to reveal the factors that affect the stock performance of listed companies when Chinese firms are involved in domestic or outbound M&A transactions. It is this gap that the study sought to fill.

Study objectives

The general objective of the study was to unearth the factors that affect the stock performance of listed companies after undergoing mergers or acquisitions with Chinese-related entities. The study aimed to achieve this objective by undertaking a critical analysis of listed companies in the financial sector that had undergone mergers and acquisitions with Chinese companies in the recent past, and comparing them with other listed companies that had undergone mergers with non-Chinese entities. The following were the specific objectives:

- Identify some of the important elements of stock performance and financial ratios that funds management and investment institutions would want to focus on in M&A activity

- Come up with a wealth of information to assist managers of listed companies in making informed decisions on M&A events

- Evaluate the financial health of companies that have been acquired or merged with Chinese-related entities by looking at their organizational structure, ownership composition, and marketing synergies

- Capture important parameters on the valuation of target’s price for companies acquired or merged with Chinese entities in relation to companies acquired or merged with non-Chinese entities.

Key Study Hypothesis

The study was guided by the following propositions

- H1: Companies acquired or merged with mainland China entities will achieve better financial performance on stock price in the future.

- H2: The Company’s ownership structure is constructively associated with the performance of listed companies on the stock markets

- H3: Firms undertaking mergers and acquisitions with Chinese-related firms would have the ability to meet their short-term and long-term financial obligations due to high economic growth rates witnessed in China

- H4: Chinese acquired companies are returning higher profits on shares than what is reflected on the stock markets

- H5: The level of industry-specific profits is constructively associated with performance of merged/ acquired companies at the stock exchange

Value of Study

The value of this study can never be underestimated. Many shareholders around the world invest huge sums of money in the stock markets with the express objective of reaping handsome results. According to Kay, companies do exist so that they are able to return profits to their shareholders (12). The study came up with a body of knowledge that could be used by investors and companies when making investment decisions. Information received from this study will go a long way in assisting companies and other organizations to make informed decisions about the options available and financial ramifications of investing in Chinese-related entities through M&A events. This is fundamentally important especially during this time when many companies are reeling under heavy financial and economic pressure occasioned by the current economic crunch.

The study also filled the information gap that existed about the real factors that affects the financial performance of most companies at the stock markets after successfully undergoing mergers or acquisitions with Chinese-related entities. According to Watts, many Chinese companies and investors are known for their insatiable appetite of utilizing upheavals in the world’s financial and economic markets to buy cheaply into other firms and organizations (9). Do the Chinese investors manipulate prices on the stock markets to deny shareholders the value for their money? Why do Chinese outbound acquisitions and mergers continue to achieve mixed results at the stock markets while the parent companies perform exemplary well in Mainland China? Through this study, these and other lingering questions about Chinese M&A events were effectively answered.

Review of Related Literature

Introduction

Mergers and acquisitions (M&A) continue to form fundamental components of business strategies and decisions the world over since they were first introduced into the business environment in the late 1890’s. They have continued to grow in scale and magnitude, rising to unprecedented levels in times of high economic growth and rising stock market prices, and declining during dull economic times. Earlier documented studies revealed that almost two-thirds of the M&A events conducted prior to 1990 were absolute failures in the sense that they failed to earn the requisite cost of capital for the target firm or the product market activity involved. However, later studies suggest that strategic M&A concluded between the 1990s have indeed achieved formidable results (Weston & Weaver 7).

Successful M&A activities should be seen as “an addition, not a substitution for internal improvements” for both the acquired and acquirers, together with their shareholders (Weston & Weaver 7). Indeed, winning M&A transactions of the 21st century are often arranged on the basis of achieving more strength and efficiency for the concerned parties as opposed to offering stimulus financial packages to a drowning company. However, the latter is still very much possible, especially during difficult economic conditions as it is the case now. The fundamental principle behind merging or acquiring a firm is to create shareholder value that will be over and above the total sum values of the two organizations combined. Shareholders must be seen to benefit. However, some M&A events have caused a lot of disdain from shareholders due to the negative effect they bring on the stock performance of some listed companies.

Mergers and Acquisitions: Definition

The terms – mergers and acquisitions – are used by many people as though they are synonymous. According to Bruner, mergers and acquisitions are viewed as potential strategies that assist business entities to fine-tune and fulfill their business strategies (6). In most cases, the rationale behind engaging in M&A boils down to the fact that they offer better options than building another entity from scratch. However, the terms are used to explain completely different processes. An acquisition occurs when one organization, due to varying reasons, takes over all the business processes of another entity and establishes itself as the exclusive new owner. When the deal is successfully concluded, the target company ceases to exist legally. In such a scenario, the buyer’s stock persists to be traded at the stock markets if the acquirer happens to be listed. If the acquired firm is listed, its stock’s value is transferred to the acquirer company (Picot 54).

On the other hand, a merger occurs when two organizations, often of about the same size, come together and formulate strategies to coexist and engage in business as a single entity. The ownership and operations of the two companies are surrendered to the new company. In equal measure, the stocks of both companies are surrendered to give way to the issuance of a new stock that will reflect the value of the two merged companies. According to Bruner, a corporate merger is formed when two entities combine their assets and liabilities to form a single business enterprise (18). For example, Daimler-Benz and Chrysler used to be two different companies until they merged into a new company – Daimler Chrysler. Such a merger can be termed as an ideal merger of equals.

However, such types of mergers are very rare in practice. In many real-life situations, buyouts are proclaimed as mergers to curtail the negative connotations exhibited when a company is said to be acquired by another. Other mergers involve two separate entities that are of dissimilar financial standing. In such instances, one firm, often the acquiring firm, issues new shares to the investors of the other entity, commonly referred to as the target company (Bruner 19). In financial terms, an exchange of stock is occasioned in which the acquiring firm issues new shares to the investors of the target firm at certain ratio. The lack of information as to whether a concluded deal is either an acquisition or a merger have on more than one occasion been accused of duping shareholders that their investments are in safe hands while the opposite is true. Purchase deals have been passed out as mergers to hoodwink the shareholders. In many instances, outright acquisitions are announced as mergers to make the takeover more appetizing.

The Operating Synergy Theory

Various theories have been formulated over time to explain why M&A events take place. The operating synergy theory argues that economies of scale and scope assist acquired or merging firms to gain high levels of efficiency and financial independence that is in excess of the sum of the merging entities (Weston & Weaver 166). This theory takes cognizance of the fact that M&A events are ignited by inadequate levels of activity in both firms necessary to take full advantage of the economies of scale. In such a scenario, the two entities can only achieve operating economies of scale through effecting a merger – horizontal, vertical or conglomerate. The theory holds that operating economies do arise due to indivisibilities of required resources such as employees, equipment, and overhead. According to the theory, the productivity of these resources is definitely enhanced when they are spread over an expanded number of units of output (Pathak, para.1).

In respect of this, the theory is of the opinion that operating economies are achievable through mergers between two entities that exercise their core competencies in different areas or fields. In practice, the theory suggests that two firms engaged in different core competencies, such as R&D and Marketing, would compliment one another and achieve greater operating economies if they are able to merge into a single entity. In such type of arrangement, “the total value from the combination is greater than the sum of the values of the component firms operating independently (Weston & Weaver 83). This theory has been used to structure and effect many deals world wide. However, it may not hold much water in trying to explain some of the merger deals and acquisitions that never live enough to achieve operating economies that would benefit shareholders through ensuring that their stocks continue to perform well at the stock markets.

Triggers of Mergers and Acquisitions

Mergers and acquisitions are triggered by many factors. According to Weston & Weaver, the cost of doing business has drastically increased, occasioning some companies to merge, be acquired, or acquire other strategically placed entities to reduce operational costs (3-4). The desire to achieve an international status coupled with emerging new business opportunities in other areas has fuelled M&A activities. The need to remain competitive in the ever-shrinking world markets and the accelerated pace of technological advancements has informed the decisions of assiduous managers to look elsewhere for business expansion activities.

Favorable economic and financial settings are known to trigger M&A activities. However, economic and financial difficulties are also known to occasion mergers and takeovers (Weston & Weaver 4). For instance, many M&A transactions have taken place between 2000 and 2007 due to positive economic growth rates achieved by many world economies. The economic and financial crisis that erupted in the US in late 2007 spreading to other major world economies has also led to an increase in M&A activities between 2008 and now as companies and organizations reposition themselves to avoid insolvency and bankruptcy problems.

Mergers, Acquisitions, and the Stock Market

Stock market activities are fundamentally related to the day-to-day operations of the listed companies. One step in the wrong direction is more than what is practically needed to send a spiraling effect on the stock performance of listed companies. In 2008, the news about planned takeovers and bankruptcy announcements for previously respected investment firms such as Merrill Lynch and Lehman Brothers shocked the whole world, adversely affecting stock market values on a global scale. For instance, the Dow Jones plummeted by more than 500 points after the collapse of the Lehman Brothers, signifying the single worst day for the stock exchange markets since 9/11 terrorist attacks of 2001. Merrill was acquired by Bank of America, igniting wild flares at the stock markets worldwide (Woods 38).

Stock performance is one of the conventional ways used to measure whether M&A transactions have been successful in creating value for the concerned entities and their shareholders (Bowman, Fuller, & Nain 9). In such instances, industry analysts may either utilize the short-run or long-run stock performance of the merged entities or the acquiring firm as the basis of evaluating the value created by the transactions. The short-run stock performance is mostly used by analysts as it is able to offer the most dependable evidence that value has indeed been created. In an efficient and effective capital market setting, stock market prices are known to fluctuate quickly to new information filtering in such as pending or already concluded mergers and acquisitions. Changes in the stock performance are almost noted immediately depending on the intensity and magnitude of the M&A transactions.

The long-run stock performance of the acquiring firm or the merged partners can also be used to measure whether the acquisitions or the mergers created any value for the shareholders. This measure is usually utilized 3 to 5 years after the initial acquisition or merger announcement. According to Bowman, Fuller, & Nain, “…certain acquirers significantly underperform their peers in the long-run, thereby casting doubt on the conventional wisdom that stock prices adjust quickly and fully during the environment period” (9). Undertaking a long-run study on the stock performance is also advantageous as it reveals abnormal performance that may be relative to other non-acquiring entities of the acquiring firm rather than existing market forces. This has been observed in situations where mergers and acquisitions are concluded in jubilation, only for the shareholders to suffer in silence due to plummeting values of their shares later on. Abnormal performance in stocks can be evaluated by subtracting the stock’s return of a non-merging organization from the stock performance of the acquiring company. However, both the acquiring and the non-merging firm must be of equal status – size and mark-to-book ratio. The following components must be fundamentally evaluated in any M&A activity to ensure that stock performances of listed companies are not negatively affected before, during, and after the M&A process.

Shareholders Value

The financial value that a company is able to offer its shareholders determines its success or failure in the long run. All companies – public or private – work for their respective shareholders, investors, and stockholders. According to Hunt, the group includes private individuals, financial management firms, arbitrageurs, independent companies, mutual funds, and company employees (3). These shareholders obtain their stock either from the entity itself or from an initial public or private offering transacted by other investors on the stock market. In the same vein, shareholders and investors also acquire stocks from a private sale occasioned by stock allocation in an M&A deal. Once they acquire the shares, the investors become naturally inclined to expect a significant return on their investment. Indeed, the mandate given to the management by the shareholders is to assist in creating and increasing value for them by operating the affairs of the company with a lot of prudence.

A sound M&A strategy must therefore always underscore the need to achieve shareholders’ value more than anything else. If a company is publicly listed, “…its stock price is its daily bolometer of shareholder value” (Hunt 3). All the actions that a company undertakes, including realizing yearly financial reports, raising capital, or undertaking cost reduction strategies, will be reflected in the value of its stocks. A company stock increases in value if its positive actions and operations outweigh the negatives. This is the ultimate reward that a company can give to its shareholders. It, therefore, comes as a surprise for many shareholders when previously performing firms on the stock market begin to backtrack immediately after undergoing successful M&A with some acquirers.

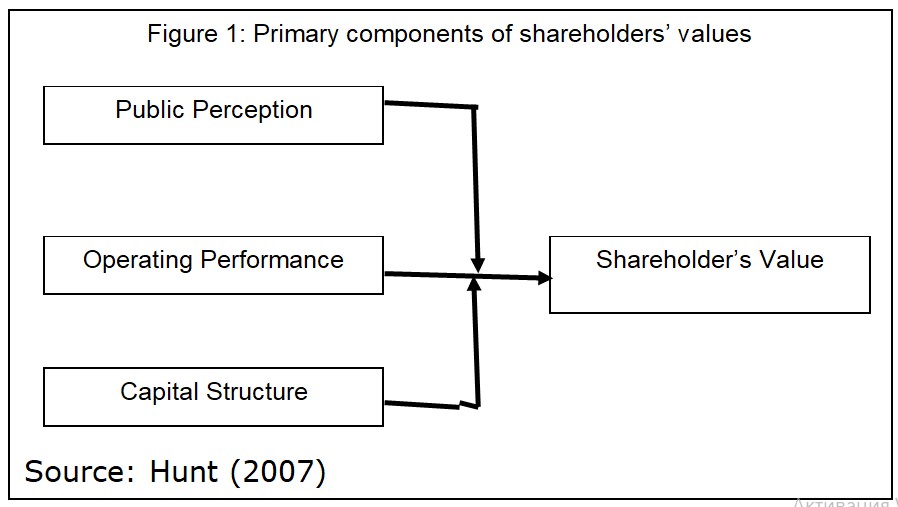

Mergers and acquisitions play a fundamental role in creating value for shareholders. According to Hunt, the shareholder value is informed by the following pivotal elements (Hunt 4).

- Companies operating performance: this element integrate many yardsticks that are inarguably used in financial analysis, and includes, earnings ratios, gross margin ratios, operating margins, leverage, yearly growth rates, among others. An entity has the ability to increase its operating performance through using internal and external channels such as enhancing marketing strategies, raising commodity prices, sampling new markets, and engaging in M&A activities

- Capital structure: an entity’s balance sheet provides the shareholders and other investors with important highlights about its health and stability at the end of any trading month, financial quarter, and year. In the perspective of mergers and acquisitions, a company’s balance sheet and other financial disclosures will largely assist in the valuation of stocks. These financial documents are often used in M&A activities to evaluate if the two entities have the capability to deliver on their promises for the sake of shareholders

- Public perception: Positive perception of a company by the public is a value in itself. The illustration below shows how the three elements are interrelated.

Valuation of Stocks

According to Bruner, the total post-merger valuation of two business entities should always be equal to the pre-merger values if all synergies have been excluded (38). However, this is not usually the case in practice. In most instances, the value of the individual firms after the merger will be different from the pre-merger value owing to the fact that the exchange ratio of the shares may not reflect the values of the two firms with respect to one another. After, the merger, the exchange ratio is mostly skewed due to the fact that the shareholders of the acquired firm are paid a premium for their shares. But this may only be for a short while depending on the nature of the acquiring firm.

For the two merging firms to achieve the true value of their shares, the synergy created must be directed towards revenue enhancements and outlay savings (Bruner 40). The combined revenue of two companies engaged in similar activities such as banks tend to plummet upon undertaking mergers since the businesses offer overlapping activities in the same market, effectively alienating some customers in the process. It is therefore imperative for the merging partners to initiate cost saving strategies aimed at counteracting the revenue decline. This can only be done by ensuring the synergies resulting from the merger or acquisition are more than the initial values of the two entities.

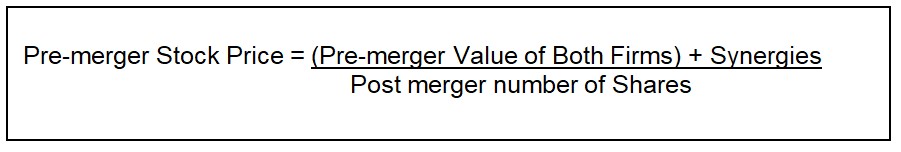

Ideally, mergers and acquisitions should always ensure the security of the shareholders. An ideal merger or acquisition should always ensure that stocks held by shareholders do not loose value (Brunner 56). However, this is not usually the case in practice. Brunner suggests that the best way forward for the merging companies is to use a formula that would equate both the post-merger share price and the pre-merger shares value of the acquiring entity. This formula should be used to obtain the value of the synergies required to ensure that stocks prices do not plummet in the event of a merger or acquisition. The formula is as follows:

Consequently, the success of any M&A should be deliberated by whether the value of the acquiring entity is enhanced by it (Brunner). This is not always the case in many instances.

According to Bowman, Fuller, & Nain, accurate business valuation is a vital aspect of any M&A activity as it has a direct bearing on the share prices (9). The objectives used to inform M&A transactions such as the attainment of synergy, enhanced revenue, creation of market power, cross-selling, geographical diversification, deregulation, economies of scale, empire-building, resource transfer, and others, have a direct impact on stock performance. Chinese investors are known to take advantage of macroeconomic factors such as the ongoing financial crises to buy cheaply into business outfits affected by such external factors (Xianing, para.1). Many analysts believe that such underhand practices do not reflect the accurate value of a business entity, and may end up affecting the performance of a listed company at the stock markets.

Stock Market Volatility and Abnormal Market Returns

In a layman’s language, stock market volatility can be described as the variance experienced in any trading day at the stock markets. Many stock markets around the world are known for their volatility as the value of stocks goes up and down. Analysts believe the trend is an expression of investors’ nervousness. Although the trend has a likelihood of occasioning risky situations at the stock markets, it may as well indicate the onset of a rebound, beneficial to investors in most cases (Sagner 18). Brunner suggests that “the degree of volatility of a stock (or other asset) is measured by the standard deviation of price movements” (317).

In the US, stock market volatility is measured by the Chicago Board of Options Exchange (CBOE), principally through the CBOE Volatility Index (VIX). The CBOE NASDAQ Volatility Index (VXN) is used to evaluate stock market volatility for technology stocks. While the VIX tracks the rate of price movements in the S&P 100, the VXN utilizes the NASDAQ 100 stocks to measure the speed of stock’s price movements. According to Siegel, Shim & Hartman, both VIX and VXN capture a weighted average of the approximated volatility of 8 stocks on a particular index (12). This is calculated every single minute over the CBOE’s trading day, enabling the indices to record a lot of fluctuations in stock value in any particular trading day.

Two researchers utilized a sample of 25 large mergers effected between 1996 and 2004 to study the relationship between mergers and the volatilities of equity options (Tian 178). The results of this study indicated a statistically significant relationship between mergers and an increase in volatility at the stock markets beyond what had been indicated. Stocks’ volatility increased more in cases where the mergers were only meant to achieve portfolio combination of the target company as well as the acquiring firm. The increase in stocks’ volatility recorded clearly suggests that markets participants, including the shareholders of the merged firms, expect mergers to enhance risk. Integration risks coupled with real or imagined doubts about the degree to which efficiency will be gained by the merged firms are possible explanations for the increase in stocks’ volatility.

The term ‘abnormal return’ is usually defined differently depending on the field of use. In finance, the term basically describes the difference or variation between the expected return of a share or security and the actual return. On most occasions, abnormal returns are caused by events such as mergers, acquisitions, organizational restructurings, dividend announcements, lawsuits, and yearly financial disclosures (Larose 18). In financial terms, such events hold key information that has a price on the financial markets. In the stock markets, the term is used to describe the difference between single stock performances against the average market performance over a specific timeframe. The S&P and Nikkei 225 are some of the broad indexes used to refer to the average market performance in some of the stock exchanges around the world.

Change in Ownership Structure

According to Weston & Weaver, M&A activities are able to successfully change the ownership structure of an entity through share repurchases, leveraged buyouts, and dual-class recapitalizations (7). However, the change in ownership structure does not come easily since its one of the most sensitive issues in M&A transactions. Many shareholders, especially of the target firm, are sent to a restless mode by the very mention of an impending acquisition or merger. Depending on the nature of the new acquirers, some shareholders may start to offload their shares en-mass, creating market upheavals at the stock exchange. On the other extreme end, a looming M&A activity may occasion an unprecedented rush for the stocks of both firms by shareholders and investors, pushing the stocks prices upwards in the process (Picot 189).

According to Peck & Temple, complete acquisitions affect the ownership structure more than partial acquisitions (83). In the same vein, complete acquisitions are more likely to reverberate resoundingly across the stock markets, occasioning more negative results than positive ones. This is mostly due to the fact that complete acquisitions often come with a complete overhaul in the ownership structure. Accordingly, “…one might expect the restructuring to lead to greater improvements in efficiency than acquisitions of entire firms” (83). Peck & Temple argues that horizontal mergers are best placed to ignite positive stock performance in listed companies than complete acquisitions as they do not overwhelmingly alter the ownership and management structure of the firms.

Mergers and Acquisitions with Chinese-related Firms

Chinese mergers and acquisitions market has grown progressively since 2000. For instance, China recorded around 225 concluded M&A deals in 2000, with a total disclosed value of US$ 42.8 billion. In 2006, China was able to successfully conclude over 800 M&A deals, worth approximately US$ 95 billion (Qian, para.1). According to Qian, China’s two stock exchanges had a market capitalization of US$ 2,400 billion, with a strong upward drift in transaction volume. China is one of the very few countries to adopt a dual-track equity system – tradable and non-tradable shares. The latter shares are owned by government agencies, which are ultimately the dominating shareholders of many listed organizations.

Presently, China has one of the fastest-growing economies in the world. Indeed, when other major economies have been reeling under the unpleasant effects of the 2008 financial meltdown, with some registering negative or stunted growth rates, China was able to register an impressive economic growth rate of around 9% in 2008. This coupled with an enormous domestic consumption rate due to a high population growth rate and plausible economic reforms initiated by the government makes China a worthy bet when it comes to investment decisions (Wolf 8).

Today, markets and investment opportunities in China have been opened up, unlike in the past when the government was too strict on international investors. The Chinese regulatory regime was previously very hostile to M&A transactions, especially cross-border M&A activities. In the same vein, Chinese investors have upped their appetite for international representation by engaging in outbound investment much more than it was usually the case in the past (Wolf 9). International investors can now purchase existing Chinese entities and also undertake restructuring programs for their existing investments in China through acquisitions, mergers, and spin-offs. This was impossible some few years ago. The mix – international investors and local Chinese investors – have speedily expanded the M&A Market in China.

Despite the freedom, a web of legal hurdles still exists in mainland China, especially in relation to the acquisition of Chinese firms by international investors. The most effective way to go around these hurdles for foreign investors is to undertake offshore transactions of the M&A activities. These deals are mostly concluded in Hong Kong or the Cayman Islands (Norton & Chao, para.5). These transactions usually occur when business enterprises in China are held and managed through offshore holding companies. Under such circumstances, international investors can easily purchase the shares of the business enterprises under the investment regulations of the applicable foreign jurisdiction. This partly explains why most M&A deals involving Chinese-related firms are usually conducted in Hong Kong. However, the effects of these deals reverberate across Hong Kong, Shanghai, and Shenzhen stock markets, and indeed in other stock exchanges around the world.

Analysts predict that 2009 will be a year of mergers and acquisitions in China mainly because of the economic downturns affecting economies at a global level (Huishu & Hongmei, para.1). The relaxation of rules and regulations by the Peoples’ Republic of China government has only served to fuel the desire of many corporations and conglomerates to invest in China as an avenue for market entry or expansion. China is also known to play an increasingly fundamental function in the worldwide supply chain. What’s more, the government has been disposing some state-owned assets to private companies. The massive investment opportunities available in China have therefore mutated into a two-way prognosis. First, Chinese domestic organizations have been actively seeking to partner with international investors to further their competitive clout and market representation. Second, the Chinese market offers plenty of openings for companies yearning to invest in China (Wolf 13).

Equity Acquisitions in China

Foreign companies may directly or indirectly obtain equity in a Chinese target company either from the existing shareholders or the target firm itself. According to Wolf, the legal framework of the target firm does not change in an equity acquisition; the ownership structure changes (9). Most international investors use the equity acquisition method to penetrate Chinese-related entities of strategic importance since it’s the simplest and fastest to complete. According to existing Chinese laws, a foreign investor may embark on equity acquisition through the following channels.

- Indirect Equity Acquisitions: this kind of acquisition is made possible when the target company has an offshore equity’s interest in a Foreign Invested Enterprise (FIE). To effect the M&A deal, the foreign company obtains the equity of the foreign-invested enterprise offshore investor. This method is mostly preferred as government approvals are not obligatory to effect a deal. The FIE’s registered equity holder remains unchanged (Wolf 10).

- Direct Equity Acquisitions: in this type of acquisition, the international company obtains equity in a local strategic company from the active international or domestic equity holders pursuant to a binding equity acquisition accord or from the target company through a regulated subscription for new equity (Wolf 10). This type of acquisition must be subjected to the Chinese approval authorities for them to be considered binding.

In China, a purely domestic enterprise wishing to be acquired or merged with another foreign company is required by law to convert into a FIE. As such, the legal nature of the target company will definitely change since the approval process for institutionalizing an FIE would be enforced. In such a scenario, the laws and conventions governing the operations of FIEs absolutely become applicable to the target company. The impact created by changes in operational rules and conventions must be carefully considered in the assessment of M&A transactions. As it is the case in other countries, the target firm must get a unanimous approval nod from all shareholders before transforming itself into an FIE (Wolf 15).

Share Acquisitions in Chinese Listed Companies

Most shares of listed companies in China are not freely transferable. Any foreign acquisition of such shares is often regulated in reference to the nature and amount of shares acquired. Most shares of listed companies are classified according to the approving authorities holding them. For instance, Listed [A] Shares, usually denominated in renminbi, are generally held by locals only, while the class [B] listed shares, denominated in foreign currency, are openly held by foreign nationals (Tian 266). However, there may be a few exceptions in the classifications. Although the capital structure of many public listed companies is comprised of a marginal quantity of tradable listed shares in relation to a majority of non-tradable government-owned shares, the situation is changing slowly due to the recent economic liberalization strategies spearheaded by the PRC government.

International M&A activities targeting Chinese domesticated companies are not common. However, matters change when the domestic listed company has some offshore interests in another foreign company. As it is the case, many Chinese listed companies have overwhelming interests in Hong Kong, an island of convergence for all major world economies (Tian 266). But in mainland China, many foreign investments in listed Chinese organizations usually take the form of negotiated minority stakes, aimed at establishing a strategic alliance. In general terms, foreign investors are more interested in making a financial investment than acquiring operating control. As already mentioned, this is because of the regulatory frameworks that exist in mainland China.

According to Tian, the acquisition of majority shares in Chinese companies is possible due to the relaxation of some regulations upon China’s ascension to the World Trade Organization (WTO) treaty (266). However, this largely remains possible in theory, not practice. According to the government’s legal frameworks, a foreign investor must acquire 30% of the listed company – not the listed shares – for the process to be termed as majority acquisition. In such circumstances, the most appealing option left for foreign investors is to utilize indirect equity acquisition mainly from Hong Kong to gain entry into Chinese markets. In both countries, a takeover can be successfully concluded by concession, initial public offerings, or market acquisitions on the stock market (Wolf 47).

Mergers, Acquisitions, and Stock Market Reactions in China

On more than one occasion, Chinese listed companies have invoked global attention with several loaded, high-profile, and high-end cross-border mergers and acquisitions. Most of these deals have been made possible by the government’s desire to relax some of the burdening rules and regulations that used to undermine M&A transactions. But it cannot escape mention that the PRC government forms the majority shareholder in many of the acquiring firms involved in these deals (Tian 267). Many investors are worried that some of these deals may have been unnecessarily pushed through by the government with no regard whatsoever to the interests and aspirations of minority shareholders. Indeed, research done on cross-border M&A activities by Chinese listed companies showed that many international investors were very skeptical about Chinese cross-border M&A transactions involving the PRC government as the majority shareholder. This skepticism had a direct impact on the performance of shares of the listed companies on the stock exchange (Chen & Young, para.1).

A study conducted on 1148 Chinese mergers and acquisitions concluded between 1998 and 2003 revealed that tender offers in the Chinese stock markets, especially from foreign investors, were very rare due to the share segmentation system practiced in China (Chi, Sun, & Young, para.1). It has been mentioned elsewhere that shares were been offered for sale as minority tradable shares and majority non-tradable shares held by the government and other private persons. According to the study results, there is a substantially positive abnormal return on the stock market during the first six months of the merger or acquisition – mostly between a listed company and a non-listed target firm. However, long-run abnormal returns occasioned by the M&A activity were found to be insignificant. The political advantage possessed by the acquiring companies due to the state-dominated ownership structure made the companies to significantly perform well on the stock markets due to the widespread appeal that such deals had on the investors.

In 2004, Chao, Huang, & Young conducted an M&A study on 92 Chinese A-share listed organizations about their performance at the two Chinese stock markets upon successful completion of the M&A transactions. The researchers used the improved assets yield to evaluate the performance of the stocks before and after the acquisitions. They also used multivariate regression examination to evaluate the factors that manipulated M&A performance. The results reinforce the findings indicated above that the stock performance of listed companies undertaking mergers and acquisitions in China rises within the first six months, plummeting later on (Chao, Huang, & Young, para.1).

Financial ratio, M&A Activity, and Stock Performance

Financial ratio, also known as accounting ratio, basically describes a ratio of two selected numerical values mined from the financial statements of a business entity, and mostly used to access and evaluate the overall financial performance of the entity (Reeds, Lajoux, & Nesvold 120 ). Financial ratio, along with other ratios found in the finance field, maybe aptly used by managers, shareholders, and creditors to evaluate the strengths and weaknesses of the firm in question in relation to other firms of the same size and structure. According to Siegel, Shim, & Hartman, the market value of shares can be used to ascertain the financial ratios of organizations if they are listed on the stock exchange (69). The financial ratio may be articulated as a decimal value or indicated as an equivalent percentage value.

The values used in the calculation of financial ratio are usually derived from the company’s financial statements such as the balance sheets and income statements. The data is more often than not based on the accounting methods and standards utilized by the companies. According to Reeds, Lajoux, & Nesvold, financial ratios form a fundamental component of financial statement analysis in any business enterprise (120). They are mostly categorized depending on the financial facet of the business earmarked for evaluation. Financial ratios permeate objective financial comparisons between companies, industries, and between a single entity and its industry average. They have also been used to compare different time phases in the financial performance of a company.

According to Reeds, Lajoux, & Nesvold, financial ratios hold no meaning at all unless they are evaluated against other factors in the financial performance of a company (122). The ratios must be compared to other factors such as the financial performance of another company over the same period of time or the past financial performance of the company under evaluation. However, it may prove challenging to compare financial ratios of separate companies that proscribe to different accounting methods and different accounting practices. It should also be noted that there is no internationally recognized standard for evaluating the data in the financial statements to come up with financial ratios. In the same vein, the terminologies used to describe the various categories of the financial ratios may be inconsistent between organizations, industries, timeframes, and countries.

Financial ratios come in handy in M&A activities as shareholders and investors would always want to use them to evaluate the financial clout of the two entities. The ratios are also used to evaluate the financial performance of the combined entities once the merger or acquisition has been concluded. According to Marie, an organization’s financial performance is a fundamental gauge of prospective M&A success both in the short-run and long-run (4). Accordingly, the target’s firm financial ratio must be evaluated against the industry and competitor yardsticks. Abnormal financial ratios – year-to-year or industry averages – should always be investigated and the reasons behind the abnormality accessed. The financial ratios chosen in any M&A activity must always guarantee effective evaluation of the target’s viability in several fundamental areas, including:

- Short-term debt-paying ability: financial ratios in this analysis may include cash ratios, quick acid ratios, and current ratios

- Liquidity Activity: important liquidity ratios to look out for include accounts receivable and inventory turnovers, solvency ratio, price/earnings ratio, day’s sales in receivables, and day’s purchases in inventory.

- Ability to meet long-term obligations: A company’s financial performance in this area can be aptly evaluated using debt-to-equity ratios and gross margin ratios.

- Profitability: profitability ratios that can be successfully used to evaluate financial performance during pre and post M&A activities include the gross profit ratio, profit margin ratio, return on shareholders equity, and return on the firm’s total assets.

To achieve success in the evaluation of the financial strength and weaknesses, the above ratios should be evaluated for the combined entities, not just the target or the acquired entity (Marie 5). These ratios must take into account some extenuating factors such as the suggested integration, arranged process eliminations, and the arising cost savings. All in all, financial ratios are some of the best tools that managers can use to determine the problem areas that need attention in the process of integrating mergers or acquisitions. Through the analysis of financial ratios, shareholders will also be kept in the know about the nature and expected performance of their shares on the stock exchange. Below, some of the financial ratios that can aptly assist in discerning the direction of shares on the stock market are looked into.

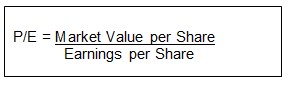

Price-Earnings Ratio

This ratio, also known as price multiple-equivalent, is commonly abbreviated as P/E ratio. It is a valuation ratio of an organization’s current share price evaluated in relation to its per-share earnings. A high P/E is good news for shareholders and investors as it means that the company will achieve high earnings growth in the future (Bragg 67). However, P/E is not conclusive in determining the financial performance of a company by itself. It is fundamentally important to evaluate the P/E ratio of one organization in relation to other entities within the same industry. Better still; the P/E can also be evaluated against the organization’s own historical P/E. the ratio is sometimes referred to as ‘price multiple’ since it reflects how much investors are prepared to pay per dollar of earnings. The formula is as follows:

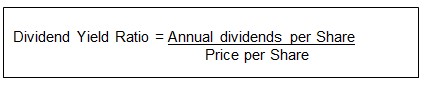

Dividend Yield Ratio

According to Bragg, a dividend yield is a type of financial ratio that is used by analysts to evaluate how much an organization pays out in dividends in relation to its share price (137). It is equivalent to the return on investment for stocks held by shareholders and investors in the absence of any capital gains. The ratio is mostly used to calculate how much cash flow a shareholder or investor is getting for each dollar (unit) invested in an equity position. The dividend yield ratios are mostly used by shareholders as a compass tool to direct them to the best companies to invest their money in. The formula is as follows:

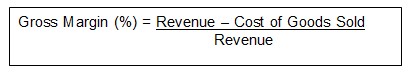

Gross Margin Ratio

The gross margin ratio signifies the percent of the overall sales revenue that an organization retains after removing all direct costs correlated with the production of goods and services. A high gross margin ratio is a good indicator that the company is financially sound as it is able to retain more money to service other needs and obligations (Deselle & Zgarrick 249). In other words, the gross margin ratio represents the percentage of each dollar (unit) that the entity is able to retain as its gross profits. The levels of gross margin are known to vary drastically from one business to another and from one industry to the other. It is calculated as:

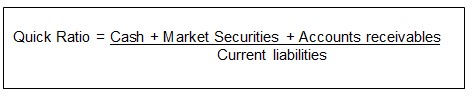

Quick Ratio

The quick ratio also referred to as the acid-test ratio or quick acid ratio is an important indicator to show the organization’s short-term liquidity. According to Siegel, Shim, & Hartman, the ratio is mostly used by both managers and investors to evaluate an organization’s ability to meet its short-term requirements using its near cash or most liquid assets (8). Higher quick ratios are always advantageous to the operations of a company. The difference between this ratio and the current ratio is that it excludes inventory from the current assets due to the length of time needed to “convert inventory into cash” (8). A decrease in a company’s quick acid ratio reflects a decrease in its liquidity, translating to the fact that a company will most probably be unable to repay a maturing debt if it is called upon to do so. A company with a deteriorating quick ratio is often unable to access short-term funds from financial lenders. The quick ratio is calculated as:

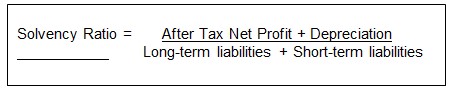

Solvency Ratio

According to Sagner, a solvency ratio is used to evaluate an organization’s ability to meet long-term requirements and obligations. The ratio successfully evaluates the size of an organization’s after-tax income in relation to its total debt obligations. In measuring the solvency ratio, the non-cash depreciation expenses should be excluded from the after-tax income. The ratio offers a clear picture of a company’s ability to continue meeting its financial obligations. Solvency ratios generally vary from industry to industry. However, a solvency ratio of more than 20% is regarded as financially healthy. In financial terms, companies with lower solvency ratios are most likely to default to paying their debt obligations. The ratio is normally calculated as follows:

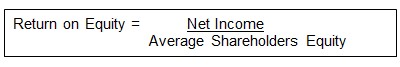

Return on Equity (ROE)

ROE basically means the amount of net income returned by a company evaluated as a percentage of the investors’ equity. ROE measures an organization’s profitability by comparing the amount of profit that the company is able to generate together against the capital invested by shareholders (Loth, Para1). ROE should be expressed as a percentage. Higher ROE percentages offer better returns to the shareholders. It can be an efficient tool when used to evaluate the profitability of an organization to that of other companies operating in the same field. ROE is calculated as:

Current Ratio

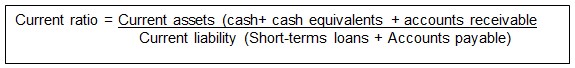

The current ratio is mostly used to evaluate a company’s ability to repay its short-term financial obligations. It can be calculated using the following formula

Methodology

Introduction

This study aimed at evaluating the factors that affect the stock performance of listed companies after mergers or acquisitions with Chinese-related entities. In terms of methodology, most studies engaged in analyzing the effect of M&A transactions on the stock performance of listed firms tend to utilize two major types of empirical methods. First, a number of empirical studies compare pre- and post-merger stocks performance on listed firms to know the factors that may be involved in causing the fluctuations in stock performance. Second, researchers have been known to use an event-study type methodology to get down to the factors believed to be affecting the stock performance of listed companies after successfully concluding M&A activities (Brunner 243). In this respect, a number of cross-border studies conducted using the second alternative – event-study methodology – have on more than one occasion revealed that M&A events accrue substantial stock market valuation increases for both the target and the acquirer, especially within the first six months after the transaction (Chao, Huang, & Yang). Amazingly, while there is a myriad of quantitative studies in the U.S. and Europe devoted to this matter, there is a paucity of empirical studies on the same in China in particular and Asia in general.

Theoretical Framework

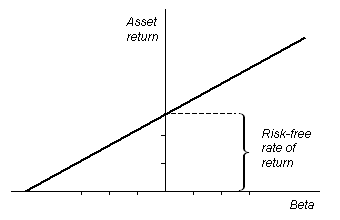

This study heavily relied on the Capital Asset Pricing Model (CAPM) to examine some Cumulative Abnormal Returns (CAR) for some selected listed companies that have either merged or undertaken acquisition transactions with Chinese-related entities. In financial terms, CAPM is mostly used to establish a theoretically appropriate required rate of return of an asset, if the said asset is to be supplemented by an already existing well-diversified portfolio, taking into account the said asset’s non-diversifiable risk (Harrington 65). The model takes into consideration the asset’s sensitivity to systematic risk, often symbolized by the quantity beta (β) in financial terms. The model also considers the expected returns of both the market and theoretical risk-free assets.

This study specifically dealt with the factors that affect the stock performance of listed corporations once they undertake mergers or acquisitions with Chinese companies. In this respect, the CAPM model was used in the initial analysis to show if the mergers or acquisitions resulted in positive or negative growth. According to Harrington, the model is mostly used to price an individual asset or a portfolio (70). The study utilized the security market line (SML) and its effects on the expected risk (beta). The SML enabled the researcher to evaluate the reward to risk ratio for the shares of the selected M&A listed companies aligning to Chinese entities in relation to that of selected non-Chinese merged companies.

In theoretical terms, when the expected return rate for any tradable share is deflated by its beta coefficient, “the reward-to-risk ratio for individual shares in the market is equal to the market reward-to-risk ratio. Empirically, the formula therefore is:

![]()

It is imperative to note that the market reward-to-risk ratio is synonymous to the market risk premium. Therefore, a financial analyst can obtain the CAPM by rearranging the above formula to solve for E(Ri):

![]()

Where:

- E(Ri) = Expected return on capital shares/ assets

- Rf = risk free rate of interest. In China, there is risk-free interest arising from government’s shares and bonds (non-tradable shares).

- βi= Beta coefficient. This is the sensitivity of the shares/ asset returns in relation to market returns. It can also be measured as:

![]()

E (Rm) = Expected return of the market

E (Rm) – Rf = the variation between the expected market rate of returns of tradable shares/ assets and the risk-free rate of return. In financial terms, it is known as the market/ risk premium. The above formula reveals that individual risk premium is synonymous to the market premium multiplied by the beta coefficient. Therefore, when the formula is restated, it translates to: E(Ri) – Rf = βi (E (Rm) – Rf).

The above graph represents the security market line describing a relationship between the beta coefficient and the shares/assets expected rate of return (Source: Harrington)

Research Design

Bearing in mind that the study would heavily rely on posted financial data to achieve its results, the researcher utilized both event-study methodology and financial method to evaluate the factors that influenced the stock market performance of listed companies after undergoing mergers and acquisitions with Chinese-related entities. According to Ortiz & Ghosh, an event study is basically a statistical method used to evaluate the impact of an occurrence or event on the total value of a company (104). Mergers and acquisitions are always viewed as events that could either positively or negatively impact on the value of the company, including its shares and assets. Some M&A activities have created more value to the company while others have acted to destroy it. According to Ortiz & Ghosh, the basic concept in an events-study methodology is to look for an abnormal return that can be attributable to the occurrence or the event under study by conducting adjustments for the return that originates from the shares or assets price oscillation of the market as a whole (105). Investors and shareholders bet their monies on whether an M&A activity would be able to increase or lower stocks prices.

Using the CAPM model discussed in the theoretical framework section, the researcher was vehemently able to measure the economic/ financial effects brought by mergers and acquisitions of companies with other Chinese-related entities through conducting an evaluation of the abnormal returns. In an earlier study, Jensen & Ruback found out that target companies of successful mergers earn significant positive returns on their shares while the shareholders of the acquiring firms may indeed earn nothing in returns. In the study, positive returns of between 20% and 30% were achieved by the shareholders of target companies within the fast six months from the successful completion of M&A activities (Bruner 72).

The validity and authenticity of using an event-study methodology in financial studies rely much on the efficiency of the stock market to such an extent that it can necessitate the use of the CAPM model to capture the factors influencing the performance of individual stocks on the market (Bragg 81). In some occasions, the efficiency may not be achievable due to varied reasons. For instance, it is extremely challenging to use the CAPM model on some countries due to frequent oscillations occasioned by institutional transformations and political instabilities.

Due to the above limitations, the researcher found it necessary to use the accounting method in conjunction with the events method to get a clear picture on the factors that lead to the disturbance of stock performance – positive or negative – upon successful completion of M&A transactions with Chinese-related entities. The accounting method uses financial ratios, often achieved from financial disclosures such as companies’ income statements and balance sheets, to explain the fluctuations witnessed in the stock markets before and after M&A activities. The method has been successfully used by other researchers. For instance, Meeks (1977) successfully used the Return on assets (ROA) financial ratio to show that M&A activities made the ROA of the acquiring firm to plummet. Mueller (1980), using the same methodology, found that the profitability of the bidding firms suddenly slumped upon entry into M&A activities. To him, the economic and financial gains arising from M&A activities appear to be negligible (Bragg 102).

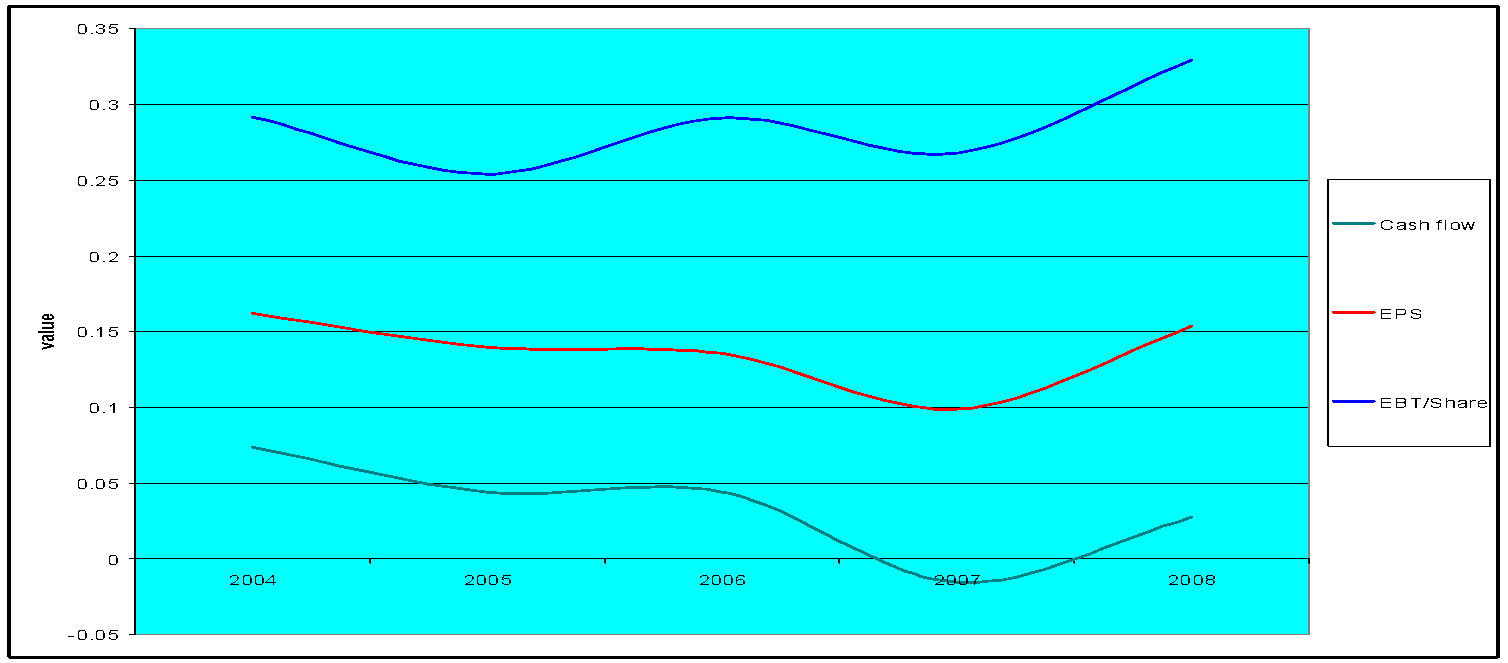

Financial indicators were obtained from listed financial firms that had engaged in M&A activities with Chinese-related firms as well as financial firms that had engaged in M&A activities with non-Chinese firms to study the factors that affect the stock performance of these companies upon undertaking the M&A events. In this perspective, the researcher examined how price/earnings share (P/E), return on asset (ROA), dividend yields, operating cash flows (OCF), and other financial indicators fluctuate during and after the M/A activities, and also between the merged Chinese and non-Chinese merged companies. Other important indicators that the researcher used include the current ratio, quick acid ratio, gross margin ratio, and solvency ratio.

Data sources and Sampling

The data gathered for this research were secondary data, mainly mined from audited financial results and other financial disclosures filed in the internet-based financial databases such as Investors Digest and Yahoo finance. To achieve validity in the results, the researcher chose to work with data from financial institutions such as banks and investment firms. The details involved in the data collection process can be detailed as follows: First, the process of identifying and evaluating the firms that took part in M&A transactions in 2007 was carefully carried out. The M&A announcement dates were used as a basis for selection. All the companies used for this study had been listed on the New York Stock Exchange, London Stock Exchange, and Hong Kong Stock Exchange. The selection was as follows

- 15 listed financial institutions that have initiated M&A events with Chinese-related entities in 2007

- 15 listed financial institutions that have initiated M&A events with other business entities that are not of Chinese origin in 2007

The researcher used the purposive sampling method to collect data of the 30 M&A events involving 41 financial institutions. Accordingly, the non-probability sampling procedure was best for this study since the researcher wanted to study two predefined groups – listed companies that had engaged in M&A activities with Chinese entities and other companies that had engaged in M&A activities with non-Chinese-related entities (Marimuthu, para.1). In this perspective, the researcher had to rely on some form of individualized judgments in the process of meeting the specific requirements for the study. To be included in the sample, the two sets of companies must have undertaken M&A transactions in 2007. In the same vein, all the companies used in comparing the stock performances must have fulfilled the requirements and registrations needed for them to become listed members of their respective stock markets.

Identification of variables

Broadly building on other approaches developed by other scholars on the identification of financial variables, the researcher employed a multiplicity of financial indicators to assist in the definition of the strategic factors that affect the stock performance of listed companies upon concluding M&A events with Chinese-related firms. These indicators are comprised of measures of financial performance such as capital/ ownership structure, liquidity, solvency, profitability, asset and liability composition, and financial innovation and efficiency. Other indicators include capitalization, credit risk, diversity earnings, and trading volume. These indicators basically form the independent variables for the study. As a dependent variable, the researcher measured variations in stock performance between the two sets of companies. Variations in the stock price of pre and post-M&A events were also taken into account.

Results

Introduction

This study was specifically set up with the intention of unearthing the factors that affected the stock performance of listed companies after mergers or acquisitions with Chinese-related entities. The data that had been collected on financial institutions proved worthwhile in helping to answer some of the study objectives and propositions. As already mentioned elsewhere in the body of this study, other studies had been conducted, especially in the US and Europe, to evaluate the factors that affected the performance of listed companies on the stock exchange after undertaking M&A activities with other entities. But very few studies had been done to analyze the factors in relation to M&A activities with Chinese companies. The results of this study are presented below.

Pre and Post-merger period: Measuring Cumulative Abnormal Market Returns

One of the study’s key objectives was to evaluate the stock market behavior of shares of listed companies immediately before and after the M&A activities with both Chinese and non-Chinese-related financial institutions. The CAPM model was used to evaluate the cumulative abnormal market returns of two sets of financial institutions – those that had successfully concluded M&A activities with Chinese-related entities and those that had successfully completed M&A transactions with non-Chinese entities. However, the researcher chose to rely on M&A events that happened in 2007 due to the extensive computations involved when using the CAPM model.

To effectively compute the abnormal market returns, the researcher divided the M&A event period of 2007 (t0, t2) into pre-M&A announcement sub-period (t0, t1-1) and post M&A event announcement sub-period, indicated by (t1, t2). It should be noted that (t1) is a connotation representing the date of M&A event announcement. For effective use of the CAPM model, the researcher had to approximate the expected returns that can be occasioned by holding the stocks of both sets of companies even in the absence of the M&A activity. This estimation is used as yardsticks for evaluating the abnormal returns arising from the M&A activities. In this perspective, the researcher used the period that preceded the announcement of M&A events (t0, t1–1) as the statistical basis to establish the day-after-day expected returns using the CAPM framework. The CAPM analysis involved some complex analysis. Below is a summary of the steps taken to arrive at abnormal market returns for the two sets of companies used for the study.

Rit = α1 + βiRmt + έit : Represent t=t0 and t=t1-1, i =1. (1)

Where:

Rmt = returns on the stock market in timeframe t.

Rit = (Pit – Pit – 1)

Pit – 1

Here, the model adopted an uninterrupted compounded rate of return of:

Rit = 1n (1+rit) and also Rmt = 1n (1+rmt). In this respect, the day-to-day abnormal returns (AR) of pre M&A event [t= t0 to t=t1-1] and post M&A event [t=t1 to t=t2] can be calculated as:

ARit = Rit – E(Rit) (2)

Representing:

E(Rit) = αi + βiRmt can be interchanged for t=t0 to t=t2 (3)

After the above stage, the researcher then performed an aggregation across the share prices for the two sets of companies to evaluate both the average abnormal return (AAR) and the average cumulative abnormal return (CAR). This was done using the following formulas.

CARt = Σt AARt (cumulative abnormal return) and AARt = 1 Σ N ARit (4)

t=t0 i=1

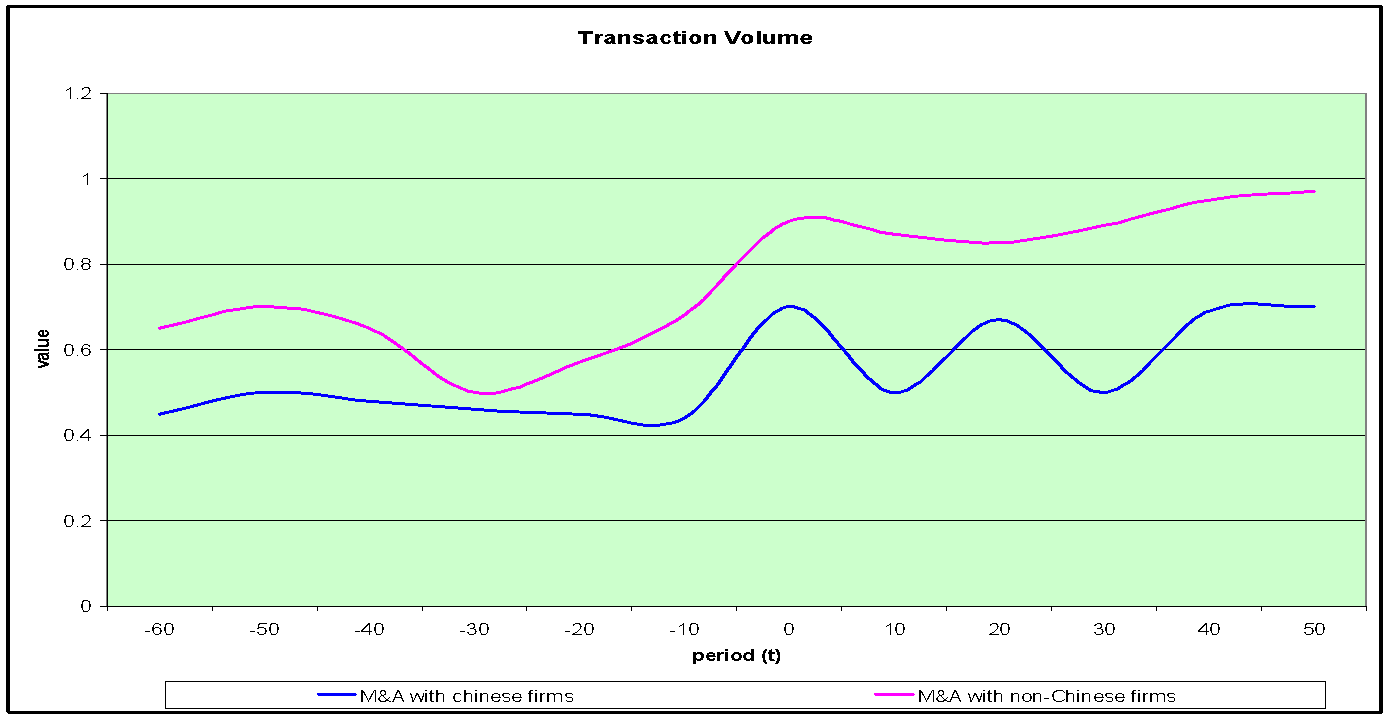

From the extensive data collected for the study, the pre-merger announcement period (-50,-1) is synonymous to (t0, t1-1). In the same vein, the post M&A period (0, 39) is synonymous to (t1, t2). Interestingly, the AAR and CAR for M&A events involving Chinese-related firms were significantly negative during the merger period. However, the AAR and CAR for M&A events involving non-Chinese financial institutions showed some substantially positive results during the same period. Table 1 and Table 2 Below reveal the results.

Table 1: Descriptive statistics for Selected M&A Events (2007)

Table 2: Significance test for selected M&A events (2007)

Various explanations were sought for the negative AAR and CAR revealed by the selected M&A events involving a hybrid of international financial institutions and local Chinese financial institutions during the merger period. The researcher had hypothesised that companies undertaking M&A events with Chinese-related firms will achieve better financial performance on stock price and impressive financial ratios in the long-run. However, the AAR and CAR computations done on selected companies that had undertaken M&A events with Chinese-related entities in 2007 showed negative returns on the stock price for the period immediately preceding the M&A process. However, it should be noted that the computation were done for 2007 only due to the extensive nature of calculations required.

The significantly negative returns showed by M&A events between foreign financial institutions and Chinese-related entities was indeed very different from the experiences noted in other countries around the world. In general, this observation can be linked to the PRC government’s unfriendly approach when it comes to investment matters. The shares prices could not occasion positive abnormal returns due the fact that many shareholders and investors exercise a lot of caution when investing in China due to uncomfortable, sometimes harsh, legal frameworks. According to Tian, many foreign investments in listed Chinese organizations usually take the form of negotiated minority stakes, aimed at establishing strategic alliances (266). In general terms, the foreign investors are more interested in making financial investments more than acquiring operating control. As already mentioned, this is so because of the regulatory frameworks that exists in mainland China.

Again, the negative returns occasioned by information about impending M&A events with Chinese-related firms can be attributed to the fact that PRC government forms the majority shareholder in many of the acquiring firms involved in these deals (Wolf 23). Accordingly, many shareholders and investors are uncomfortable with the government’s presence, with majority holding the view that these deals may have been unnecessarily pushed through by the government with no regard whatsoever to the interests and aspirations of minority shareholders. A research commissioned by two researchers on cross-border M&A by Chinese listed companies showed that many international investors were very sceptical about Chinese cross-border M&A transactions involving the PRC government as the majority shareholder (Chen & Young, para.1). This scepticism had a direct impact on the performance of shares of the listed companies on the stock exchange. The share segmentation system – tradable and non-tradable shares; class A and class B shares – practiced in China can also be used to explain the decline in shares price after information of impending M&A events between some international financial institutions and Chinese entities came into light.

Despite the above negative discrepancies witnessed during the period preceding M&A activities, the CAPM model used in the computations found that transaction volumes for the companies undertaking M&A activities with Chinese-related companies as well as the companies undertaking M&A events with non-Chinese-related firms spiralled positively at the date of announcement (t=0). The stocks prices maintained stability, rising gradually during the post-merger period as shown by the graph below. This observation vehemently shows that many stock markets around the world treat the announcements of mergers, acquisitions, and restructurings as valuable piece of information that is capable of triggering appreciations of stock prices. According to Bowman, Fuller & Nain, stock market prices are known to fluctuate quickly to new information such as pending or already concluded mergers and acquisitions (9-11)

In respect of this, it can be said that information about pending mergers and acquisitions causes the stock prices to plummet first before they begin to appreciate steadily after the announcement day. Once again, the negative information may be attributed to the fact that many investors and shareholders don’t trust the Chinese government. According to Tian, many M&A transactions initiated by the PRC government may not be wholly focused on improving the value of the state holding companies (23).

Results from the Financial Method

In terms of size, most of the acquiring firms selected for the study were found to be around seven times bigger than the target companies. It should be noted that size was measured by the value of total assets owned by the companies. This data was hived off from balance sheets, income statements, and other financial disclosures released by the companies selected for the study. According to the disclosures, the acquiring firms – foreign or Chinese – applied more cost efficient strategies than the targets. Many targets from both sides of the divide had higher loan and non-core interest earnings to total assets ratios. In the same vein, acquiring firms had significantly more capital leverages than the target firms. The table below shows the differences in financial might between the acquiring firms and the targets.