Executive Summary

This report details a marketing plan for a motorized / electric shopping cart for the UAE market. It is recognized that the UAE has some of the largest shopping malls globally, and the number keeps on increasing tremendously. However, the shopping experience has not been easy, especially for physically challenged shoppers and aging ones who find it difficult to move with loads or push regular trolleys for longer distances.

The company will promote the electric shopping cart as a solution to such challenges. There is not much competition in the UAE currently. However, the company would focus on intense marketing campaigns to create awareness about the existence of such a product. Moreover, it must convince retail outlet owners to replace some regular trolleys and baskets with the electric shopping cart.

The company will slowly penetrate the UAE market. Hence, it will grow slowly from modest profits using low-cost strategies to large profits perhaps after five years. The marketing strategies adopted will eventually ensure the success of the company.

Marketing Report for Electric Shopping Cart in the UAE

Introduction

This is a report detailing a marketing plan for a motorized shopping cart (also known as an electric shopping cart) in the UAE.

The Product: Motorized Shopping Cart

The mission and SMART objectives of the business

The company will collaborate with large shopping malls and grocery stores in the UAE to offer the most reliable and efficient motorized shopping carts for customers who require convenience during shopping.

After one year of operation, the company will be providing quality motorized shopping carts to 25% of all shopping malls and grocery stores in the UAE.

Product Description

The product chosen for the UAE market is a motorized shopping cart. The cart is also referred to as electric shopping cart. This shopping cart is installed with an electric motor and navigation control systems (Ingram, 2002). The motorized shopping cart is installed with an occupier seat switch. It is activated by the occupant’s weight. The electric shopping cart can also act as a wheelchair. The product is suitable for supermarkets and other expansive shopping outlets. It is designed for shoppers with physical disabilities, either permanent or temporary, and they have challenges shopping while walking or using normal shopping carts and baskets. The motorized shopping cart is generally meant to enhance shopping experience among the above-mentioned customers (Narula, Shah, & Rokde, 2014).

The target market for electric shopping cart consists of supermarkets and other expansive shopping malls in the UAE, specifically Dubai. Supermarkets and shopping malls have clients who do not fully depend on wheelchairs. Nevertheless, they find shopping to be convenient when they use electric shopping cart because the normal shopping cart is difficult to push, particularly when filled with items. Moreover, it could be difficult to walk across large stores with merchandise specifically for customers who may not cover long distance.

A positioning statement on the benefits

- Facilitates shopping experience for disabled and elderly

- Reach a higher target market

- Shoppers will find it convenient to use electronic shopping carts installed with Shopping Assistance Unit, which will ensure provide easier, faster and interactive access of data to the users to locate products easily (Narula, Shah, & Rokde, 2014)

Market Analysis

Geography

The UAE market has been selected for the product. The UAE now hosts some of the world largest shopping malls (Bouyamourn & Scott, 2014). There are more than 90 shopping malls in Dubai alone, and the number is expected to rise as the retail sector becomes more vibrant. A recent study indicates that the UAE retail sector will experience tremendous growth because of its unexploited huge potential (Dubai Government, 2013). Notable increments in sales have been noted. These trends have been attributed to major economic expansion, enhanced household consumption, embracing current shopping practices, and wealth brought by expatriates. Moreover, it is also observed that the population of Dubai continues to increase, which attracts more investors in the UAE. Expatriates, tourists, and residents continue to drive retail activities in the UAE. Moreover, the retail sector is growing as tastes, preferences, needs and large disposable incomes continue to increase in the UAE. Retail outlets are therefore extremely important motorized shopping cart for the UAE. These attributes will drive the sales of the product.

Segmentation

For the electric shopping cart, retail outlets have been segmented into the following categories.

- Grocery Retailers

- Modern Grocery Retailers

-

-

- Convenience Stores

- Discounters

- Forecourt Retailers

- Chained Forecourts

- Independent Forecourts

- Hypermarkets

- Supermarkets

- Convenience Stores

- Traditional Grocery Retailers

- Independent Small Grocers

- Other Grocery Retailers

-

Size and current and anticipated growth rate

Currently, only one store, Kiddie Kruzzer in Dubai was identified as a dealer in electric motorized shopping carts. As such, it is difficult to quantify the market opportunities. It therefore appears that the market is highly fragmented.

The market is expected to grow. For instance, in the year 2011, one customer started to write letters and call shopping centers across the UAE asking them to introduce electric shopping carts to make shopping easier for persons with disabilities (Badam, 2011).

This lobbying effort was meant to create awareness about the existence of such motorized shopping carts and the need to introduce them in the UAE.

Any unmet or poorly served needs

As previously mentioned, in the year 2011, a disabled woman who uses wheelchair found it difficult to shop around the UAE because of her physical conditions. She once visited shopping malls in the West and had a great experience with electric shopping carts. In short, the UAE shopping malls, despite their large sizes, have failed to cater for customers with permanent or temporary physical disabilities. The electric shopping cart will therefore provide convenience and ease of shopping for such customers.

The six macro trend categories

Demographic forces: the population of the UAE continues to rise steadily. Shopping malls and supermarkets are the major shopping destinations for residents and tourists. Customers will obviously require electric shopping carts to enhance their shopping experiences.

Economic forces: many UAE residents, tourists, and expatriates have large disposable incomes. This implies that they are most likely to spend more while shopping in the UAE. As such, retail outlets require motorized shopping carts for large merchandise purchases.

Socio-Cultural forces: retail outlets in the UAE have been accused of ignoring the plight of people with disabilities who cannot walk longer distances while shopping.

Technological forces: it is noted that new electric shopping carts are fitted with systems to assist customers to locate items faster.

Political forces: no laws in the UAE compel retail outlets to provide electronic shopping carts to customers with temporary or permanent physical disabilities.

Ecological forces: these forces are no applicable for the product per se.

Wants and needs, features and benefits

The electric shopping cart is an alternative to the popular regular shopping carts, but it is generally meant for shoppers with temporary or permanent disabilities, which limit their movements and pushing heavier carts around shopping malls.

Specifically, the electronic shopping cart will have enhance power on ramps and inclines; manage over 220 kg of merchandise and an occupant; maneuver tight bends; different basket options; and unique, impact resistant outer layer.

Electric shopping carts will improve shopping experiences. It is also expected that the electric shopping cart will be fitted with systems to assist customers to locate items faster in large retail stores.

Pricing, purchasing, and demands

The electronic shopping cart will be imported from the US and sold to local shopping malls and other retail outlets in the UAE.

It is estimated that each electronic cart will cost about AED 3,300. This price is relatively affordable.

The demands for the electronic shopping carts in the UAE has largely been restricted by a lack of knowledge about their existence and perhaps few customers demanding to use them.

Given the rising number of shoppers and improved awareness, retail outlets will demand these products to meet expectations of their shoppers.

Competitor Assessment

The Industry

The company will act as a distributor or wholesaler of manufactured electric shopping carts from the US. Although motorized shopping cart has been in existence since 1970s, normal manual shopping carts (trolleys) and baskets have dominated the market. Given the chosen, there would be minimal competition.

The industry’s five competitive forces

Barriers to entry are most likely to deter the company from entering the UAE market. Capital requirements are generally high for several motorized shopping carts and, thus, barriers to entry are high. The product will also require substantial costs related to advertisement in order to communicate its benefits (product differentiation). In addition, costs associated with switch could deter some retailers. For instance, many retail outlets use trolleys and baskets, which cost them substantial capital. Retailers will incur additional costs to acquire new electric shopping carts (Porter, 1998).

The bargaining power of buyers will definitely reduce profitability of the company. It is imperative to recognize that most retail outlets already have some trolleys and shopping baskets. The bargaining power of buyers is high. As such, they may perceive electric shopping cart as less important to their service. Moreover, buyer group is concentrated and, they are expected to buy in large volumes, which will increase their bargaining power. From competitive perspective, electric shopping carts are generally standard and could only have minimal differentiating features. Hence, alternative suppliers could meet the needs of the market.

The bargaining power of suppliers could affect the company. The company will work with a few manufacturers based in the US. Besides, the UAE market is currently considered as not one of the most important markets for these suppliers, but the force is generally low.

Threat of substitutes will affect the company’s possible earnings by restricting prices that it can charge to realize a profit, and it is considered moderate. Other trolleys and baskets are available. Besides, motorized shopping carts are only meant for a small segment of shoppers with physical challenges.

Threat of new entry is generally low because of the capital requirements. Moreover, these products are not readily available in the UAE. The first few players will ultimately dominate the market.

Key success factors

The company intends to import motorized shopping cart with only good features.

The proposed low cost pricing strategy will be critical for success and reduce costs of switching.

Only best quality products will be provided to customers.

The company will create competitive capabilities through excellent customer service, enhanced operations, knowledge personnel and excellent distribution networks all creating synergy to change shopping experiences across the UAE.

Competitors meeting the needs of the market

While few retailers stock the product, they have not generated the expected awareness to drive mass sales. The company intends to work closely with various market segments to satisfy these needs.

Competitive advantages and disadvantages

The current competitors only have the advantage of being the market leaders. However, they have not penetrated the market.

The company intends to embark on creating mass awareness and working with individuals with physical impairments to convince shopping malls and retailers to introduce motorized shopping carts.

Competitive responses

Competitors are most likely to react by lowering their prices, increasing promotions, advertisement, and open more distribution centers.

The company intends to counter these responses by intense sales and demonstrations across the UAE.

Marketing Strategy

SMART marketing objectives

- Market Share Objectives

To acquire 25% of the market for electric shopping cart by December 2016

- Promotional Objectives

To increase awareness of the use of electric shopping carts in the UAE from 1% to 25% by December 2016

- Objectives for Survival

To manage market unknown conditions by effective pricing strategies

- Objectives for Growth

To increase the size of the UAE operation from AED 0 in June 2016 to AED 650,000 in May 2017

- Objectives for Branding

To make the company’s electronic shopping cart the most preferred brand in the UAE by 2016

- Profitability Objectives

To attain about 25% return on capital employed by December 2016

Overall marketing strategy

The overall marketing strategy for the company will generally concentrate on creating effective relationships with shopping malls and other retail outlets to assess and comprehend their needs and provide motorized shopping carts for such needs.

Offering positioning

A convenient solution for shopping in expansive shopping malls with ease for physically challenged shoppers.

Product decisions

Motorized shopping carts with navigation systems to find products fast and can support over 220 kgs of merchandise.

Pricing decisions

- Objectives: to attract customers, cover costs, and realize modest profits

- Pricing strategy: a low-cost product that most retailers can afford for their customers

Pricing specifics: electric shopping cart will be sold on specific prices based on their capacities and distinct unique features. Besides, the company will be responsible for replacing exhausted batteries at the market rates, charge AED 20 as service fee, and install gadgets to control movements aimed at minimizing theft at AED 20 per shopping cart every month. There are numerous reported cases of customers driving away in electric shopping carts after shopping.

Distribution decisions

Channels structure: the company will choose specific locations within the UAE market. In addition to brick and mortar stores, the company will also have a strong online presence where potential customers can review the products before actual demonstration and sales. Moreover, digital sales will be important for the company. Direct selling and shipping to customers will be considered, but the company will not use any intermediaries to protect its profits and image (Ferrell & Hartline, 2010).

Push strategy: the company will adopt a push strategy. In this case, the company will take its motorized shopping carts to various target customers for demonstration and subsequent selling. It will strive to ‘push’ the motorized shopping cart to many retail outlets in the target market. Moreover, there would be showroom demonstrations for customers.

Promotional strategy

Integrated marketing communications objectives and plan will ensure a consistent message across all platforms.

The major objectives would be to create brand awareness. All advertisement and promotional efforts will ensure that the company can inform all its potential customers about the motorized shopping cart. The following market objectives will be considered appropriate:

- To create brand awareness among 50% all segments of retailers in the UAE by December 2016

- To position the company’s electric shopping cart as unique and convenient brand for the identified shoppers

- To inform potential customers about the motorized shopping cart

The IMC plan

The IMC plan will account for all various means that the company intends to use to communicate its product and services to the UAE. The plan will account for marketing, promotion, advertising, public relations, and communication using both traditional and modern media strategies (Belch & Belch, 2014).

The IMC plan will act as roadmap for the company to utilize while delivering its messages to target retail outlets. It will the most important tool for external interactions with the audience. The plan will account for the electric shopping cart launch in the UAE.

Copy platform

- The product – an electronic shopping cart that will enhance shopping convenience for physical impaired customers, including the elderly

- The primary issue the advertising must address – address a lack of awareness about the product

- The communication objectives are meant to elicit responses from the target retail outlets

- The target segments, as listed above, are mainly retail outlets and expansive shopping malls

- The main selling idea and primary benefits include convenience and improved shopping experience among physically impaired customers

- The creative strategy statement or campaign theme will revolve around convenience shopping to attract more shoppers in retail outlets who would otherwise not visit

Media plan

The main objective is to create a brand awareness and elicit reactions from target customers to ensure that they buy motorized shopping cart. For successful brand awareness, the company intends to ensure sustained frequency and steadiness. The media plan will establish the electric shopping cart as a convenient product that can ease shopping and increase frequencies of shopping among physically challenged customers. Moreover, it would important for customers to understand that electric shopping carts are not bought regularly and, therefore, it would be necessary for retail outlets to acquire them from the company when they consider purchase. The company is most likely to use the following media for its marketing campaigns. The media plan, a constituent of IMC plan, is meant to show multiple possibilities that would optimize frequencies, reach, and profitability for the company.

- Television – the company will use popular television channels, such as STAR Plus, SAB TV, Abu Dhabi TV, and Ajman TV among others. The advertisement will be timed during summer holidays and festive seasons when shopping frequencies are high. Retail outlet owners and physically challenged customers will learn about the product from advertisement campaigns. These channels will appeal to business communities locally. The company will consider prime time, including during news hours and other weekdays. These periods are associated with mass viewing of television among the business community. These ads are expected to reach many target customers during the chosen time.

- Radio – the company will consider Dubai Radio and Dubai Eye radio stations for advertisement. These stations will reach consumers who speak English and Arabic. There are target clients who constantly listen to radio stations because they have identified with such media and their related programs. Radio timing will also follow prime time tactics.

- Magazine and newspapers – the company will consider popular magazines and newspapers in the UAE for its advertisement. These magazines will include Retail ME for Retail Middle East, City Beat, City Stars, City Life, Malls of the Emirates, and Living in the Gulf. Some newspapers for consideration may include the Emirates News Agency or WAM, Emirates Business 24/7, Khaleej Time, and The National among others. While the lists of potential magazines and newspapers could be long, the company will determine the most appropriate and popular in a given category. These magazines and newspapers fit well with most of the target customers because they are popular among the business community. The company will negotiate special rates for advertisement placement with these media houses.

- Direct mail – the company will send electric shopping cart catalogues to target customers. It also intends to create a database for regular mailing to reach a wider a market that other media cannot reach fast or create intimate appeal. This approach will ensure that the company can share new arrivals and designs in the stock (Spiller & Baier, 2012).

- The Internet – the company will have banner ads in frequently visited Web sites in the UAE. These Web sites may be affiliated with the above-mentioned newspapers and magazines. The company will also consider social media platforms for product advertisement and communications.

Trade and consumer promotion plan

The company will use trade promotions, which may include merchandise allowances. The main objective of trade promotions would be to get retail outlets to buy electric shopping carts that they otherwise would not because of available trolleys and baskets (Mullin, 2010). These promotions will advance the push strategy adopted by the company.

For a new business, the company understands that it would be difficult for most retailers to switch easily to electric shopping carts.

Personal selling plan

The company will use personal selling to address three issues. First, it will address concerns of potential customers, including the need for information about electric shopping carts. Second, the salespersons will ask for sales once they have presented the product. In this manner, the company will be able to collect information on what is holding some customers back from purchasing. Finally, personal selling plan will also provide opportunities for follow-ups after the presentation and further chances for addressing concerns. The company will also use follow-ups to determine customers’ satisfaction with the product.

Public relations plan

The public relations plan will also account for the marketing objectives as previously mentioned, identify target audience, appropriate messages, and the most suitable approach.

The company will target storeowners and their customers who are most likely to use electric shopping carts. These PR activities are expected to be executed within the budget and with available resources.

The communication will cut across various channels, including online platforms, such as Twitter, Facebook, and LinkedIn among others and SMS campaigns.

The company will demonstrate why people should use electric shopping cart, its beneficial features, and low costs all aimed at pushing the product into the market.

Marketing Budget

The total marketing budget is expected to be about AED 77,700 annually. The company does not intend to incur much cost during promotions before any actual sales are realized. Hence, this budget will be adjusted upwards once the company gains some market share, preferably six months after the operations.

The level of effectiveness and efficiency expected from each activity

The company will adopt simple approaches to assess the level of effectiveness and efficiency of its marketing activities. Generally, these approaches will include monitoring sales, request for information, visits at the retail stores, Web site traffic, and phone calls.

- Monitoring traffic at the store during advertisement and asking customers how they heard about the electric shopping cart and the company

- Account for direct marketing and sales team’s efforts

- The company will assess sales during the marketing periods (this will have to account for both cumulative and delayed effects of advertisement and promotion)

- For print advertisements, customers will present some coupons for gifts once they purchase the product

- The company will consider incentives for customers who mention that they are responding to campaigns, and this strategy will assist the company to identify the best media

- It will install dedicated phone lines for customers and track their orders

- It will assess Web site traffic once it has launched and advertised the product

- For online advertisements, the company will use Google Analytics to track responses and click-through rates

For actual figures on effectiveness of these campaigns, the company will have to compute return on investment (ROI).

[650,000-77,700] /77,700 = 7.37 %. Hence, 7.37% would be the simple ROI for the company based on its marketing efforts.

Implementation and Control Plan

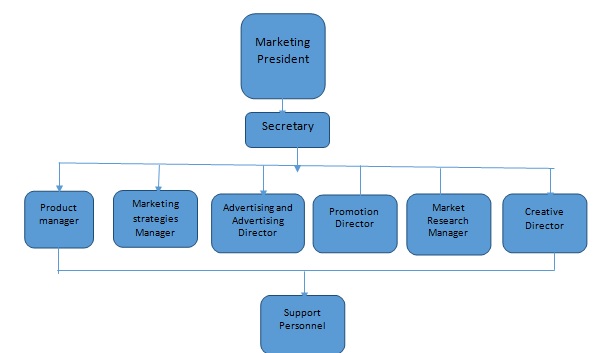

An organizational chart for marketing people and functions

Templates of strategic and/or operational control “dashboards” for key marketing management functions

Forecasts and Pro Forma

An evidence-based forecast of projected sales

The sales are expected to grow marginally in the first three years.

References

Badam, R. T. (2011, May 10). Drive for electric shopping carts in malls. The National. Web.

Belch, G., & Belch, M. (2014). Advertising and promotion: An integrated marketing communications perspective (10th ed.). New York: McGraw-Hill.

Bouyamourn, A., & Scott, A. (2014). Bigger is better for UAE supermarket shoppers. The National. Web.

Dubai Government. (2013). Retail. Web.

Ferrell, O. C., & Hartline, M. D. (2010). Marketing Strategy (5th ed.). Mason, OH: South-Western.

Ingram, S. S. (2002). Electric shopping carts add convenience. Rome News Tribune. Web.

Mullin, R. (2010). Sales Promotion (5th ed.). London: Kogan Page.

Narula, H., Shah, M., & Rokde, S. (2014). Smart Shopping Cart using a Product Navigation System. International Journal of Engineering and Technical Research, 2(10), 206-209.

Porter, M. (1998). Competitive Strategy. New York: Free Press.

Spiller, L. D., & Baier, M. (2012). Contemporary Direct and Interactive Marketing (3rd ed.). Chicago, IL: Racom Communications.