Executive Summary

Felix has a former roommate who owns Orohena Pearls (OP), an established business that supplies Tahitian Pearls. OP is located near Pape’ete in Tahiti and is ready to conduct business with Felix on a six-year deal. The nature of the business involves OP providing Felix with exclusive rights to selling Tahitian Pearls in Swaziland. To secure this deal, Felix has to pay upfront according to their agreement. The average selling price for the pearls in Tahiti is XPF 14,800 each. Furthermore, OP is ready to sell the products to Felix on a discount basis upon receipt of payment for each order. Felix found that to transport the goods by air, he would have to pay XFP 1,800 for every pearl, and the price included insurance. Felix intends to order from OP every month, which would enable him to maintain a minimum stock supply of about four weeks.

OP Swaziland will function as the branch of the main firm founded by the business person. The company would start as a branch of who is Bill and thus would integrate the arrested firm rule at the main organization in the country. For many years, OP has encountered few challenges with the market offering skilled and experienced personnel as well as a significant consumer base. Moreover, OP has management composed of experienced leaders who are willing to extend their expertise to the international market. Their decision-making strategy is all-inclusive and is centralized, and includes employees at operational and strategic levels. The firm has a market entry plan that involves exploiting the sector’s monopolistic nature that has been existing for a long time. Moreover, the industry of operation has encountered few developments for a long time.

Main Report

The main target market is Swaziland; therefore to successfully conduct business in the environment the business needs to consider numerous factors. To achieve this goal, the business needs to account for the culture of the people and the medium enterprising firms operating within the country. Thus, the company needs to research the target market because this will ensure that the firm attains better performance. By targeting the right market, the firm gains a competitive advantage over other firms. The advantage the firm gains is as a result of finding a good location, which favors its products. Because Felix has a friend in Central Business District in Zurich (Paula, who owns two jewelry shops in the Zurich area), it provides him with an effective plan to utilize the existing market. Felix’s primary operation strategy is providing quality products and services. As a result, he will be able to provide personalized services, which is key in building the company’s brand.

Within the entrepreneurship field, it is significant to extend numerous benefits for the functional factors as strategies. The plan for the functional field is the focus for various configuration logistic sectors and competencies that provide strategic and tactical challenges insights faced by the business person. An entrepreneur always develops business well-defined business models that will ensure the smooth operation of the firm. The business has several issues and one of the most significant ones is cash flow. Thus, Felix needs to have the cash flow for his business to thrive and grow. The inflow of cash must be budgeted for and controlled every time, especially during a recession. When there is adequate cash flow, there is the maximization of profit, particularly from sales. When possibilities of delays in receipt of particular payments exist, the business risks the chances of being insolvent due to reduced profits. Thus, there higher chance that if the business improves its internet-based activities, it would significantly perform in the current business environment.

The second phase of a business involves modeling a business venture, which is made easier through the use of the internet. The advantage of modeling a business venture cash flow is that it facilitates optimal financial planning and resource utilization. The other significant part of modeling is that it enables business forecasting and integration of liquidity cash. However, since Felix’s firm operates as a contracting company, some challenges may arise. Such challenges include managing its cash flow in situations involving several contracting projects. Several contracting projects include managing different projects and that may include resources such as raw materials and labor. As a result, the organization may not complete some of these projects. Research shows that these are essential when it comes to effectively solving organizational problems (Dalton, 2017). Thus, the primary target market includes the increasing cultural interest users and medium enterprises, learning institutions, and large firms.

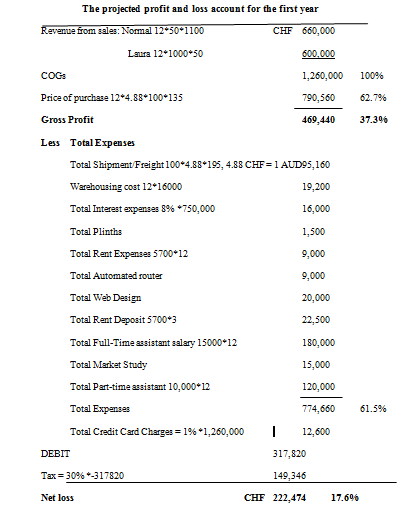

Evaluation of profit and loss

The profit and loss evaluation is often calculated monthly and demonstrates the company’s income and daily expenses. The advantage of this statement is that it provides insight into whether the company is making losses or profiting from its daily operations. Some of the major components of the profit and loss evaluation include expenses, gross profit, cost of goods sold (COGs), and revenue. To perform this evaluation, the gross profit fewer expenses must be equal to sales less cost of goods sold, and the result would represent the net profit (Atrill, and McLaney, 2011). In this case, the formula would be, Sales – COGS = gross profit – expenses = net profit. In other words, this means that the higher the gross profit of the business, the higher the profits gained from business operations. Furthermore, the net profit also shows the amount of profit the business earned before tax.

The analysis demonstrates that the revenue must grow to more than CHF 1,500,000 for the company to make profit. According to Dalton, (2017, p. 50), when there is value creation for stakeholders, then the business strategies are efficient for its daily operation. In this context, it is important for the management of the company to create value for stakeholders. Since it is a new business, it is essential for the leadership of the company to return investments to its stakeholders. The advantage of this framework is that the organization will be able to retain its investors thereby securing the future of the business. Felix’s business is currently showing a lot of potential and is improving its operation. Involving stakeholders in the daily business operations develops confidence in the business. As a result, they would continue to invest in the firm thereby providing more finances to support it. The profit and loss statement should be shared with stakeholders to provide more insight concerning the business operations. Currently, to get started, the Felix requires around CHF 800,000.

Conclusion and Recommendations

The purpose of this evaluation was to validate and construct a company venture founded on financial measures and catalogs of multiple scales and the capabilities of an organization. The evaluation considers the beliefs and perceptions of the leadership of the organization. Reduction and construction were performed by reinforcing different techniques that suit the business. To ensure that the business is successful, the approach took into consideration the organization’s competencies and the concept of OP as an organization. Despite resigning his job, the analysis shows that there are significant pieces of evidence that would enable Felix to succeed in this particular business venture. Moreover, there are certain uncertainties that Felix should consider before venturing into the business. Such uncertainties include customer reception, customer services, and the quality of the products. Thus, it is recommended that he researches customer preferences. Furthermore, Felix should consider acquiring about CHF 800,000 to ensure that his business is covered during its initial stages. The Swaziland market is an essential area to sell pearls; Felix should consider the quality of his products to ensure he eliminates stiff competition.

Reference List

Dalton, M., (2017). Men who manage: Fusions of Feeling and Theory in administration. Routledge.

Atrill, P. and McLaney, E. (2011). Financial accounting for decision makers. 6th ed. New York: Prentice Hall/Financial Times.