Introduction

Good budgeting and financial planning can be the determining factors in an individual’s financial future. However, good personal financial planning is not an easy fete to achieve; it requires a lot of discipline, dedication, and sacrifice. In order to have a financial base that is stable for the future, one is advised to start saving / investing from a tender age. Such an approach allows one to develop a habit of saving and spending wisely. Children are taught about the value of a budget and the need for discipline when spending. Developing such attributes and discipline helps the young person to take up discipline in spending and always having a budget as habit.

A scholarly debate about the need for an education that facilitates development of skills has sought to establish the credence of such projections. Is the ability to save and spend money wisely inborn or a developed habit? This paper explores how one can be trained to become a wise spender and subsequently, develop a habit of saving. The paper examines the underlying facts about saving, spending, and budgeting. The paper further looks into why it is vital to become wise in money matters. Such an overview provides concrete evidence about why it is important to learn saving and saving money at a tender age.

What is Money?

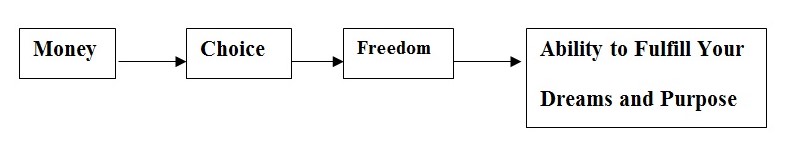

What is money? This is one question that many people have asked and there are different meaning (s) / definition (s) that have been given to it. Before we look at the importance of understanding the values of learning about personal finance before adulthood, it is important to understand what money is and the impact it has on our lives (Ryan, 2010). The figure below summarizes what is money. It also outlines the positive role money can play in your life:

Money: Most youths start earning money way before they become adults, however due to lack excellent personal finance skills, they end up misusing the money by making wrong choices on how to spend the money. Therefore, with excellent personal finance skills, these youths will be able to manage their finances well when they get into adulthood.

Choice: Having money at disposal makes one feel empowered and in control. Money inspires confidence. It is a great source of motivation and focus when working and developing schemes aimed at self-improvement. This then gives an individual the choice to do what they wish. However most teenagers who have this choice tend to make wrong financial decisions in life and this usually affects their future. In fact, exposure to money at teenage has been blamed for drug abuse and irresponsible sexual behavior. By understanding, the importance of personal finance teenagers will have an idea of how to spend money once they become adults.

Freedom: Freedom to spend is what money gives to an individual, however poor personal financial planning among the teenagers has given this freedom a bad meaning. In most cases, young people have misplaced perceptions about money. They tend to believe money provides an opportunity for extravagance, showing off and indulgence in waywardness. They misuse the freedom by being impulse spenders. This leaves them with no savings for future investment or emergency. This habit is maintained and is observed throughout a child’s life and it is extended to a person’s adulthood. Teaching teenagers the positive values of personal finance will enable them utilize well this freedom.

Dreams and Purpose: A good house, a dream car, a yearly holiday, a real estate investment, shares on the stock market is what everyone dreams when they start generating income. In most situations though, poor planning and budgeting makes this dreams unrealistic and unachievable especially among teenagers. Since the young person developed a character that allows him to be extravagant, impulsive buyer and poor in budgeting, he/she is faced by the possibility of poverty and financial crisis throughout his life. Therefore educating them on the importance of personal finance can help turn these dreams into reality.

There are five main segments of personal finance: assessment, setting goals, creating plan, execution and finally monitoring and reassessment. These are vital in developing the discipline of saving and budgeting.

Assessment: An individual can assess his / her personal financial situation by either using the financial balance or the income statements. In most cases, the financial balance sheet comprises of personal property like cars, share investments, real estate investments among others while the personal income statement comprises of income and expenses of an individual.

Goal Setting: The goals set by an individual can be either short term or long term. Long terms goals are always set with retirement in mind and they may include real estate investment in either land or house. Such savings can be realized throughout life if one has set goals, adhered to a plan of action, and carefully set his priorities. Short-term investment includes investment in a car or buying shares in the stock market. The importance of setting the financial goals can help one in controlling his / her spending culture.

Creating a Financial Plan: Planning has been a core principal in self-development. People need to learn how to be principled when spending. Principles allow ethical behavior and responsible practices. It is advisable to seek advice / help from financial advisor on the best way to create a successful financial plan. This plan will help you in reducing impulse spending; know when, where and how much to invest and finally creating a good financial plan help one manage well his / her income and expenditure.

Other advantages of having a good financial plan are ensure the value and growth of your investment and capital, provide financial security for your (future) family, it will also ensure financial independent when you retire.

Implementation: The implementation of a personal financial plan should be in phases depending on one’s income status; however, the key to successful implementation lies in the discipline and sacrifice of the individual. This is the underlying truth about developed savings and spending habits. If one has developed such abilities, he/she is able to implement successfully a personal financial plan.

Monitoring and re-evaluation: A good personal financial plan should be re-evaluated more often; this will help someone be able to tell whether he / she should increase her / his investment. It is only through monitoring and re-evaluation that one can tell if all the five segments of the financial plan are being put in practice.

What are The Values of Learning Personal Finance before Adulthood?

Cultivating the culture of saving in children is the most important thing any parent can do for his / her children. This is because it will help the child develop a sense financial independence and accountability before they reach adulthood. This financial maturity and accountability holds the key to the future of the child in terms of the investments they will have. According to Dotnet (2010), there are a few important reasons as to why teenagers should learn about personal finance before adulthood.

The importance of a saving culture and responsible expenditure helps one manage his finances and develop. Such a culture helps one accumulate savings, which can be turned into a significant investment. Many people boast of how they started up businesses from their high school or college savings. The savings were transformed into a small business that later became a chain of outlets and finally a fully-fledged business or company.

Importance of Learning about Personal Finance before Adulthood

Cash Flow: Most teenagers are always tempted to spend carelessly (Impulse spending), therefore instilling the positive values in them on the importance of personal finance will help them be better managers of their finances and investors too. Having financial knowledge and how your money is flowing and how it is being managed is the best thing that any person can have (Dotnet, 2010).

Fear and Insecurity: Most young investors fail not because they lack sound financial base but because of fear and insecurity of investing. Empowering teenagers to understand the concept of personal finance before they reach adulthood will help them overcome this fear and be able to be risk takers when it comes to making crucial money related decisions as well as in terms of investments. Most youths have “fat” bank accounts but because of fear and insecurity of making a loose they have become afraid of making any meaningful investments. In most situations thou; most youths who are afraid of investing don’t know where the cash they have come from and where it might end up if they invite, therefore helping them overcome this fear is the key to financial independence and maturity (Dotnet, 2010).

Utilization: Another importance of understanding personal finance is that it gives one better knowledge / understanding on the utilization aspect. Educating the youth on this will help them overcome most financial mistakes that most people make and they include; being impulse spenders and spending all the cash on luxiourous things. In addition to that knowing about utilization will help the individuals recognize the importance of saving whatever little they get for the future (Dotnet, 2010).

Credit Cards and Personal Finance

The credit card has been dubbed as the personal finance menace. It allows the holder to buy anytime he wants and access money anytime anywhere. It is alarming how many people have ended up in financial ruin courtesy of the credit card. Most financial mistakes made by teenagers are because of the use of the credit card. The credit card gives one the authority to buy goods and services and pay for them later; this means that the holder of a credit card can access goods on credit. Due to this, most teenagers have become poor credit card handlers and they end up overspending the credit available to them. The teenagers also tend to use the credit of luxury things and forget about saving and investing for their future. That is one reason as to why most teenagers are being educated on the importance of personal finance before adulthood.

The Credit Card Act of 2009

The US government adapted the Credit Card Act in 2009. The aim of this act was to oversee just and transparent activities in relation to the extension of credit to the consumer (House of Representatives, 2010). The Credit Card Act of 2009 was adapted in order to regulate business in the following areas: unjust interest rates increase, exorbitant and unnecessary fee charges, timing of card payments and seeks to protect responsible card holders. The act also aims at enhancing penalties for credit defaulters, it will help to promote financial literacy and protect small businesses for unnecessary exploitation.

What is the relationship therefore between the credit card act of 2009 and the need for the teenagers to know the values of personal finance before adulthood? This can be explained in reference to some of the clauses of the act.

Harsh Penalties: This act will help the teenagers be more responsible on how they use the card since misusing the card will lead to harsh penalties being imposed on them, which in the end it might have negative long-term effects on the personal finances of the youths. This is one of the reasons as to why they should be taught about the importance of personal finance before they reach their adulthood. The penalties may also be extended to companies that violate the customers’ rights and privileges in relation to the credit card.

Financial Literacy: One of the requirements that will be required for having some credit card privileges will be financial literacy. The financial literacy will include knowledge on when to use the card and the limits that one is allowed, it will also cover knowledge on the time duration that one allowed to make the payment after using the card. It is because of this that the teenagers need to learn the values of personal finance before they are allowed to use the credit card in making major businesses transactions.

Exorbitant fees: In some scenarios, the customer is changed extremely high fees on some transaction and this in most cases inconveniences the cardholder and favors the financial institutions. The lack of knowledge of this may make the clients feel exploited, therefore before adulthood, it is important for the youth / teenager to be aware of all “disciplinary” charges that may be levied on the bank / financial institutions in case such a mistake occurs. However such implications are only measures that help curb abuse of the card while on the other hand, benefiting the issuer of the credit card.

Equality in Application and Timing of Credit Payment: This clause also favors the end users in that it prevents the banks from setting unrealistic deadline for the payment credit card. This is because of the deadlines are intentionally set by the banks in order to penalize the clients. For the customers who may not be aware of this, they will be left frustrated because of paying “illegal” fines. Such a repercussion is an important ingredient of limiting the cardholder from extravagance and abuse of the card.

Terms and Conditions: This aspect covers both the consumers and the bank. For the clients, the act requires that the bank be given notice (45 days) incase there is going to be an increase in the interest rates or any other charges that might be increased. It also states that the client should be made aware on when the card can be renewed and the time duration that the client will use for the repayment of his / her credit. The penalties for late payment should also be explained to the clients by the financial institutions / banks. These are some of the issues that teenagers should be taught about early in life before they are allowed to use credit cards. Attaining such knowledge arms them with knowledge that suffices to help them manage their spending habits.

Small Business: For the youth who dream of venturing into business, the act comprehensively protects them. Under the act, the Federal government is mandated with the responsibility of educating the small business people on the aspects of information technology and as a government help in the preventing the loss of credit card data. This gives motivation to those who will wish to venture in business / entrepreneurship as a source of earning a living. Many young people have made use of such provisions and have developed admirable businesses. In fact, the young people should be mentored to develop skills that can help them become entrepreneurs. Developing skills in entrepreneurship is important. It arms one against lack of opportunity. One is able to master a business process that he can rely on as a source of income. As mentioned earlier, many small businesses developed by young people have turned into successful business empires that rank as equal opportunity employers. There are existing empowerment programs that support and facilitate small businesses. Subscribing to such opportunities will help young people to learn to become self reliant and develop their own businesses.

As such, learning money management is an integral lesson. A young person is able to develop a habit of being a money manager. The person is able to discipline himself when handling money and he/she adopts to a culture of responsible expenditure, consistently saving and developing his life. Eventually, one attains financial independence and prosperity.

Summary

The need for financial independence and “good life” is one of the main reasons that most young people misuse the credit card. This has made it necessary for them to be taught on the values of personal finance, banking and saving at a tender age. The main reason for this is to help them be wise when it comes to handling income and expenditure.

All has not been smooth all along since most of the youth believe they should have total control over their money and they believe the future will take care of itself which is not the case. Since youths spend most of their time in schools and other learning institutions that There is need to entrench the idea of personal finance in the curriculum of schools and colleges in order to help them cultivate the culture of saving for a better future.

References

Dotnet, (2010). The Importance of Learning about Personal Finance. Web.

House of Representatives (2010). The Credit Card Accountability Responsibility and Disclosure Act: The Card Act of 2009. Web.

Ryan (2010), Why is Learning Personal Finance Important? Web.