The newly published preliminary estimation of fourth quarter GDP growth rate seems to consumer confidence in the stock market. The GDP is estimated to have grown at an annual rate of 5.7% since the third quarter. This is the fastest growth rate since the third quarter of 2003. This highlights the fact that the U.S is recovering ahead of other developed countries from the worst financial crisis since the Great Depression. (Alves, “The Euro’s woes continue”, Jan 30th 2010) Many people look at this data and suggest that the U.S is officially out of recession. That is why they think the GDP growth trend is likely to continue and that consumers should use this opportunity to invest in:

- U.S Dollar, and

- Crude oil

Real GDP growth trends

2009 was one of the worst years in American economic history after the hardship of the 1920s. The economy shrank more than 6% on a quarter-to-quarter (QoQ) basis. It was a period of turbulence and of panic on the streets. Every two or three days a bank would be foreclosed. The country experienced the biggest stock market crash since 1929. Nevertheless, the second quarter started better on a QoQ bases, but still shrunk around 1%. It was not until the third quarter where the GDP came back to positive value. What astonished investors was the fact that the preliminary GDP estimation for the fourth quarter showed a surprising figure of 5.7%.

As we can clearly see on the graph, a short-term up trend has been forming for the U.S. GDP growth rate. With two constructive quarters showing a positive GDP growth rate, many economists and politicians began to declare that the U.S. economy is coming out of the recession. Economist discussed the reasons behind this growth trend. Many thought that the new rules and regulatory norms in private investments have encouraged investors to invest. Personal consumption was brought up as an argument, but it was not that convincing since the jobless rate was the highest in decades.

Another strong argument brought was the increase in exports. This increase of exports was deeply affected from the weakening of the US dollar toward other hard currencies like the Euro of British Pound.

Road to recovery

During the first quarter of 2009 many Americans found themselves unemployed. Estimates showed that more than 2.1 million people lost their job during this time, in correspondence to a 6% decline of GDP. This loss of jobs continued the next quarter and seemed unstoppable. Eventually, the economy began to rise up again. For example, on November NFP showed that 64000 jobs were created during that month.

Nevertheless, even though less people are losing their jobs as GDP came back to the growth zone, the aftershock effects are still felt from consumers. The road to recovery is still upwards and not an easy one. I will try to explain it the best I can so that you and I will be aware of what is ahead of us.

In the mean time, something we must not forget is that the general price level also formed a similar paten as the jobless rate. The price level decreased significantly during the first two quarter of 2009 because of GDP contraction. It began recovery only on the fourth quarter where inflation rates were 1.8% for November and 2.7% for December respectively.

Here we return to the above mentioned fact of the increase of GDP during the third and fourth quarter. As mentioned, economics rank private investments and exports as two possible factors that have influenced this return in positive value of the GDP. In fact, an increase in private investment likely impacts on creating more jobs for the private sector. Private investments help that credit begins to flow into the economy again.

While an increase in export means more demand for domestic goods. Thus factories have more work to do and they need additional work force to manufacture the goods. This affects unemployment by increasing the job offer in the market. In addition, these investments and factory orders increases consumer confidence by providing more people stable income. The December consumer confidence reached 55.9, highest among the year comparing with 25.3 back in march. These factors altogether encourage personal consumption, (Lahart, “Growth hits 6-year high”, Jan 30 2010) which accounts for 70% of GDP, therefore push up the general price level.

U.S. Dollar

As mentioned above the increase in exports has been affected by the decrease in value of the US dollar compared to other currencies like the Euro and British Pound. The ‘health’ of the dollar is important for every one of us since we pay our bills in this currency. If the currency looses value, decreases in value due to inflation, this means that our revenues also decrease in value. Think about it! We can buy fewer goods and get fewer services for the same amount of dollars than before. This is especially true for goods and services that we import from other countries. That is why the value of the dollar and the ratio with other currencies are important for our daily lives. If you want to get a vacation in Europe, for example it will literally cost you more with a weak dollar than with a strong dollar.

Weak Dollar

The U.S. dollar started its rapid depreciation since March 2009 right after the Federal Reserve announced the starting of its new money printing program. That was a major blow to investors and to the market in general. Of course this was not the only reason that leads to the depreciation of the US dollar. Several other reasons need to be mentioned in this regard which leaded to an aggressive depreciation of the dollar. Some of them we have listed below. They are what influenced the most in the value of goods and services that we get in our daily lives.

The interest rate on U.S dollar was so low, that it was floating between 0% -0.25%, which makes it the cheapest currency to borrow for carry trade (borrows from low yield currency and invests in high yield currency to earn interest). Although official document shows that the benchmark rate is only 0.25%, a little higher than Japan’s 0.1%, Feb was aggressively buying U.S Treasury notes, pushing the interest rate to literally zero.

The Federal Reserve is providing a lot of money into the economy through so-called quantity easing program, which in reality was money printing. Investors believe that this would reduce the value of dollar in long run thus aggressively shorted dollar against other currencies.

U.S economy was in bad shape, thus capital flow to other economy with higher growth potential. This capital outflow will increase the supply of dollar on foreign exchange market thus reduce the value of dollar.

Strong Dollar

Having said enough for the weakness of the dollar let us now have a look at the other side of the medal. We have already mentioned before that during the last quarter of the year the economy showed a stable growth of the GDP together with a decline in unemployment rates. Combined with a raising inflation rate, these factors form a sound environment for you to invest in dollar. If you have been hit hard from the financial crisis this is a chance and opportunity you should not miss. If you have not been hit as hard from the financial turmoil of last year still you cannot afford to miss this opportunity. We have listed for you some of the major reasons why you should go on investing in dollars:

- Inflation rate above 2% creates room for central bank to raise interest rate thus close the interest rate gap between U.S. dollar and other major high yield currency. (Alves, “Dollar rallies as FOMC fuels bets on higher rates”, Jan 27th 2010) This will make borrowing through U.S. dollar more expensive. Thus reduce carry trade by using dollar.

- Raising GDP growth makes Federal Reserve considering to quite quantity easing program (Annual beige book, Jan 26th 2010). This will provide confidence for dollar’s value.

- U.S. economy is growing faster than many of its counter parties. (Shah, “Dollar rally could resume,” Jan 21th 2010) For instance, UK economy is only growing at 0.1% for Q4 (“Pound falls on weak U.K. GDP data”, Jan 26th 2010). This would attract a lot of investment to America thus increase the demand for dollar, so increase the value of dollar.

Crude Oil

Crude oil is the second opportunity factor that we invite you to consider investing in. The basic reason why we present crude oil as an investing opportunity to you is because it is closely linked with the growth of the U. S. economy. In order to better understand this you have to realize that the:

- U.S. is the biggest consumer of crude oil in the world.

- U.S. GDP is 14 trillion, almost three times bigger than the Japanese economy, whose GDP is at around 5 trillion and ranked the second biggest economy in the world.

- U.S. GDP value is greater than the sum of the second, third and fourth economy added together.

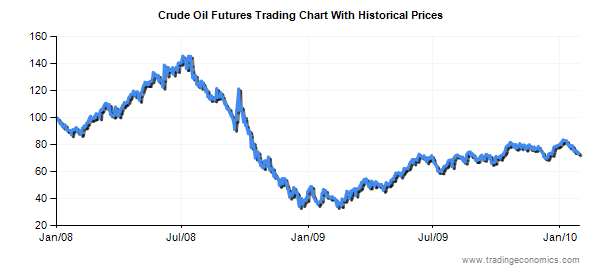

Therefore do not be surprised by the fact that in the past year crude oil has shown a positive correlation with the growth of the U.S. economy. As the U. S. economy entered into recession during the last quarter of 2008 and the first and second quarters of 2009, the price of oil began to fall dramatically. Gradually, it began to rise again when the US GDP started to show positive signs of growth, as shown by the graph below.

The rise in US GDP has led to more people getting employment opportunities, thus more revenues. This situation helped increase the consumption of oil which affected the price of oil.

The crude oil price hit $35 per barrel on March at the time when U.S. GDP declined almost 6%. As America economy recovers, the oil price rise to a high point of $85 per barrel during December, but then dropped back to $70 per barrel because China, a new star on the far east were tightening its economy to prevent it from overheating. (Poon and Batson, “China targets inflation as economy runs hot,” Jan 21th 2010) People panic too much. Although China has been growing at a spectacular rate of 10%, it doesn’t mean that it consumes more oil than the United States does.

From the table above we can see that even though growing at a slower rate, the U.S. economy still produces more value of goods. To fuel this growth of the world’s largest economy, U.S. would require a lot more crude oil. Therefore, if the U.S economy is going to further expand, the recent weakness in crude oil price provide investors with rare opportunities. In fact, this situation offers an excellent entry point for anyone who is interested in investing in crude oil on the long run. Of course that the profits of this investment are long term and one cannot expect to have a quick return of investment with huge profits. But on the long term it is surely one of the most profitable investment forms in circulation.

Generally speaking, the quick recovery of the market has shown the strength of the U.S. economy. With the strong increase in GDP associated with rising inflation rate and falling unemployment rate, you should take this opportunity to invest in crude oil and dollar.

References

Alves, F, (2010), “Dollar rallies as FOMC fuels bets on higher rates”, The Wall Street Journal

Alves, F, (2010), The Euro’s woes continue (Electronic version). The Wall Street Journal

Bureau of Economic Analysis, (2010), “Advance estimates of gross domestic product” Fourth quarter 2009. Web.

Lahart J, (2010), “Growth hits 6-year high”, The Wall Street Journal

Poon T, Batson A, (2010), “China targets inflation as economy runs hot”, The Wall Street Journal

Unknown Author, (2010), “Pound falls on weak U.K. GDP data”, The Wall Street Journal London

Shah N, (2010), “Dollar rally could resume”, The Wall Street Journal.

Trading economic, (2010), “Crude oil future prices Chart”.

U.S. Federal Reserve, (2010), The Annual Beige book, Washington, DC: The Federal Reserve board. Web.