Executive Summary

The report explains the performance of two products that is to be decided on as an investment appraisal. Some of the key decision tools are: the net present value of the cash flow and use of risk adjusted discounting rate of return (Brigham and Houston 2011). The relevance of this appraisal technique is that the net present value depicts the future value of the project in the present years and thus it is easy to ascertain the project to be invested. Positive net present value depicts positive returns from investment. The relevance of risk adjusted discounting rate of return to the topic is that it gives a return that is free from risk of inflation and uncertainty and thus the project is risk-free implying that the investment decision is worthwhile.

The Net Present Value

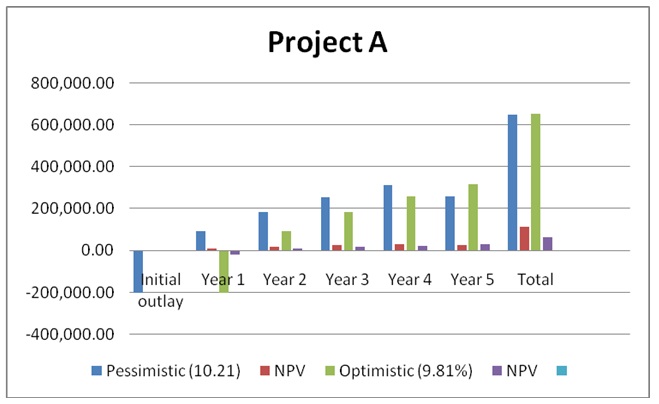

Project A

The optimistic net present value of the project depicts a positive rate of $316,274.18 for the five year investment projections. This positive value implies that a return worth $316,274.18.14 will be earned in five years time from now to the business if the firms opt for this investment. The relevance of this value is that it portrays the present value of the future worth of investment and thus it will be easy to make investment appraisal.

Risk Adjusted Discounting Rate of Rate of Return.

Positive Net present value worth $ 65,808.33 will be realized where the Net Cash Flow of Project (A) is subjected to risk-adjusted discounting rate of return. This amount is quite low from the above Net present value, since the element of risks and uncertainty has been eliminated on the return (Bragg 2010). Projecting cash flow for the net for five years would pose uncertainty, since there is business risk and, as a result, to obtain an accurate cash flow prediction, it is deemed to ensure that uncertainties are eliminated by subjecting the cash flow to risk-adjusted discounting rate. Therefore, the investment is still worth because a positive return will be earned from investment which is totally risk-free.

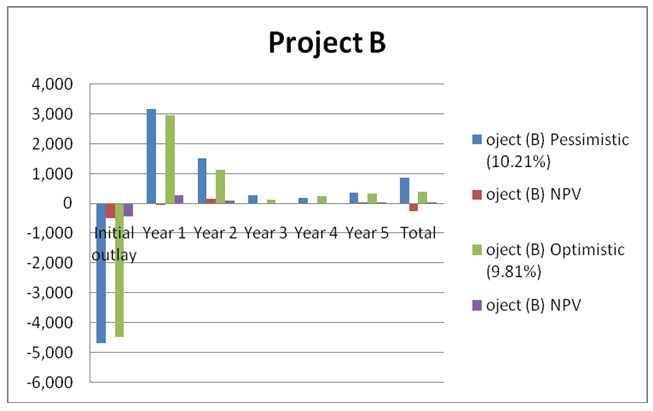

Project B

The Net Present Value

The project will portray a positive net present value worth $258.24 which is quite low as compared for project B. The cash flow is projected for the next five years and its present value is determined in ascertaining the worth of investment. The risk-adjusted discounting rate of return to the project depicts a value worth $-766.75. This value depicts negative returns to the project when it is subjected to risk-adjusted discounting rate. Therefore, the outlay is not worth investing since there will be a negative return to the project as the undiscounted cash flow depicts a positive trend (Thomsett 2002). RADR=RF-B (market premium), where RF is the risk free rate of return, B is the beta of a levered firm or effect of inflation.

The simplified Risk Adjusted Discounting rate of return (RADR), therefore,

Risk Adjusted Discounting rate = risk free rate of return + Beta (Market premium) Pessimistic = 7.41 +0.56(5) = 10.21

In conclusion, the project that yields a positive return for outlay should not merely be considered as worth investing since other future uncertainties may affect the performance of returns as anticipated (Palepu and Healy, 2007). It is, therefore, prudent for financial analysts of the company to subject the projected cash flow to risk-adjusted discounting rate of cash flow in order to realize the real value of investment after getting rid of future uncertainties which may distort the anticipated cash flow.

References

Bragg, M 2010, Cost Reduction Analysis. Tools and Strategies, John Wiley & Sons, London

Brigham, EF, & Houston, JF 2011, Fundamentals of Financial Management Concise, Cengage Learning,USA.

Palepu, G, & Healy, P 2007, Business Analysis and Valuation, South-Western: Cengage Learning, London

Thomsett, R 2002, Radical Project Management, Prentice Hall Professional, Sydney.