Introduction

Foreign Direct Investment (FDI) in China is one of the most flagrant outcomes of China’s open door policy, which was implemented in December 1978. China became the largest FDI recipient by replacing the United States (US). During the year 1998, China had engrossed $267 billion worth of FDI and had secured 324,712 foreign invested projects. The FDI in China concentrated their major part on the eastern coastal areas.

During the period, “between1989-1998 the eastern region has attracted most FDI. The central and western regions attracted only 9 percent and 3 percent of the total FDI inflows, respectively. In terms of per capita FDI, the central and western regions achieved only $8.63 and $1.67, respectively, far behind the level of the eastern region’s $45.98 and the national average of $21.19.” (Buckley, Clegg, Wang & Cross 2002).

Statement of objective

The principal question considered in this project is, what is the relation between differences of regional human capital and FDI attracted by China? The objective is to measure the regional income inequalities due to the impact of the contribution of FDI in China.

This paper presents the causes of regional disparities in China in the presence of Foreign Direct Investment (FDI). “The impact of inter-regional economic relationship and trade-cum-FDI on regional income inequality and the transmission of mechanisms are investigated. The interactions between economic structure, trade-cum-FDI, human capital inequality and regional income gap and the role of fiscal and financial systems are analyzed in the regional development context.” (Trade- cum- FDI, human capital inequality and regional disparities in china: the singer perspective 2007).

Personal interest

It is strongly believed that the cumulative characteristics of human capital and the availability of physical and financial capitals are the major determinants of economic growth. Accumulation of human capital has an important role in the selection of location by any firm. In the true sense, the availability of foreign capital and the elastic supply of skilled labourers may increase the growth prospects as a complementary effect. The presence of foreign investors in the home country can provide better treatment in the cause of education and other career objectives. Moreover, a good human capital endowment makes a more attractive investment climate for foreigners.

Literature Review

Literature Review refers to collection of materials on a topic of previous record which helps in the present study. A Literature Review can be referred as a simple summary of the source explaining the key points of the study thus combining the summary and synthesis. A summary is a recap of the important information of the source but synthesis is to re-organize that information. (Literature reviews 2007).

Lv Na and W.S Lightfoot have done a study about the “Determinants of foreign direct investment at the regional level in China”. The study analysed five factors in 30 regions of China. The period chosen for the study was 2002. Statistical regression was the tool used for the study and “conclude that the government should consider encouraging the FDI through the further development of a skilled workforce.” (Na & Lightfoot 2006).

Albert Guangzhou Hu, and Robert F. Owen have done a study titled “Gravitation at Home and Abroad: Regional Distribution of FDI in China”. The study was focused on examining the regional gap in the China which attracts FDI. The three theories like Agglomeration economies, comparative advantage and FDI location tournament was used to explain the FDI inflows among the Chinese regions. 1990s was the concentrated period of time.

Theories of FDI location states that location selected by a profit maximizing foreign firms is based on the return from the investment. A number of factors determine the potentiality of site for FDI. The regions competitive advantages was based on good existing infrastructure, skilled labor force, and low wage which reduce the transaction and operational costs of FDI. A thorough literature review was done to find out the driving forces of FDI location in China by the researchers.

Previous study by Cheng and Kwan for finding the determinants of FDI location based on the data from 1985 to 1995 covering 29 provinces also had the same opinion that good infrastructure and attractive policy from the government influenced the foreign investors to come over China. The findings were as follows: “OECD investors prefer location close to other foreign investors and a strong local industrial base; HMT investors respond much more enthusiastically to comparative advantage differences and tax incentives. However, OECD investors in inland China behave similarly as HMT investors.” (Hu & Owen 2005).

The study concluded that the FDI distribution in China showed a widening gap in investment between the regions over the past two decades.

Research method and data analysis

Success of a research depends upon the methods used in it. If the research is not properly planned, then the whole research turns out to be a failure thus leading to false conclusion. The research methodology gives an understanding of the research, how to conduct it to achieve success. Redman and Mory has defined “research as a systematized effort to gain new knowledge.” (Kothari 2005, p.3).

There are mainly two approaches of research such as qualitative and quantitative research methods. From the term itself we can identify that quantitative research measures the quantity and qualitative research measures the quality. Qualitative method is an inductive approach to develop concepts and theories. The data collection in this approach is done directly by interviews, focus groups or observations. In quantitative method, data can be expressed in numerical form.

Mainly secondary data is used for the study. Secondary data is gathered from internet sources, published materials available in internet and public document such as books, reports on surveys conducted by other researchers related to the research topic. Various types of information published in newspapers and magazines are also adopted for this research. Statistical data is collected from the websites like China Statistical Yearbook 2008, Invest in China etc.

Data Analysis

The study variables included the selected regions, gross domestic product of China, its workforce in total, FDI inflows in different regions of China. It was found that regions with high labour force shows increased foreign direct investment especially from 2005 to 2008. Simple random sampling is used to select the regions of China in which analysis is done.

Table showing the FDI inflows in China from 1999 to 2008.

(Foreign direct investment in China 2009).

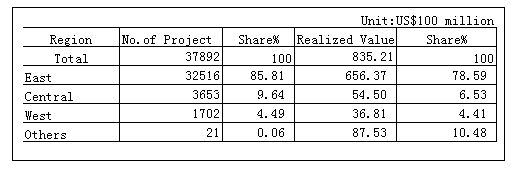

Table showing the three regions of China and their FDI distribution

Table showing labor force in China from 2003 to 2007Some of areas in the Eastern region are Beijing, Tianjin, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan where the FDI inflows is high. Shanxi, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, and Hunan are the states in the Central region. Some of the states in the Western region are Inner Mongolia, Guangxi, Sichuan, Chongqing, Guizhou, Shaanxi, Gansu, Qinghai, Ningxia, etc. (FDI, utilized by east, central, west parts of china in 2007 2009).

(China statistical yearbook 2008 2008).

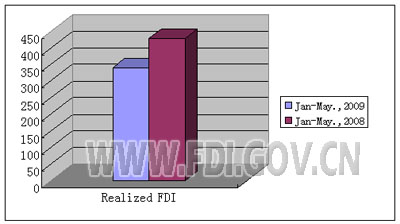

Table showing the FDI distribution of 2008 and 2009.

Table showing the Gross Regional Product in China from 2003 to 2007.

(China statistical yearbook 2008 2008).

Results

The human capital in the three regions east, central, and west shows that eastern region has been attracting the FDI. This is due to the skilled labour force in eastern part of China and the increased per capita income. We can apply strategies for the development of other regions by increasing the potential labour forces, and other key elements for production in those areas thus attracting FDI inflows. The number of employed persons also has increased from 2003 to 2007. Western region shows less FDI inflows. By comparing the present and previous year’s statistics of foreign investment, a decrease of 33.78% has shown in 2009.

Even though there has been a decrease in the FDI inflows, it is generally seen that low wage cost and availability of cheap labour has increased the FDI inflows over the past years. The reason for the present decline can be the current financial crisis.

Conclusion

China should “stick to the principles of active and reasonable utilization of foreign capital, combine foreign capital absorption with economic structure adjustment and industrial upgrading promotion, the improvement of socialist market economy system, the reinforcement of enterprise competitiveness, the expansion of export and development of open economy, the vigorous exploitation of China’s western area, and promotion of regional economies’ harmonious development.” (China’s absorption of foreign investment n.d.) From the above analysis we can reach a conclusion that FDI in China have a link with regional human capital, labour force and GDP.

References

Buckley, P J, Clegg, J, Wang, C & Cross, A R 2002, FDI, regional differences and economic growth: panel data evidence from china: introduction, BNET. Web.

China statistical yearbook 2008: national accounts: 2-14 gross regional product and indices 2008, National Bureau of Statistics in China. Web.

China’s absorption of foreign investment: China’s policy direction of absorption of foreign investment n.d., Invest in China. Web.

China statistical yearbook 2008: employment and wages: 4-1 employment 2008, National Bureau of Statistics in China. Web.

FDI, utilized by east, central, west parts of china in 2007 2009, Invest in China. Web.

Foreign direct investment in China 2009, The US- China Business Council. Web.

Hu, A G, & Owen, R F 2005, Gravitation at home and abroad: regional distribution of FDI in China: abstract. Web.

Kothari, C R 2005, Research Methodology: Methods & Techniques, 2nd edition, New Age International.

Literature reviews 2007, Handout and Links. Web.

Na, L, & Lightfoot, W S 2006, Article request: determinants of foreign direct investment at the regional level in china: findings, Journal of Technology Management in China, vol. 1, no. 3, pp. 262-278, Emerald. Web.

News release of national assimilation of FDI from January to May 2009 2009, Invest in China. Web.

Trade- cum- FDI, human capital inequality and regional disparities in china: the singer perspective: abstract 2007, Economic Change and Restructuring, vol.40, no.1-2, p.137-155, Springer Boston. Web.