COVID-19 pandemic negatively impacted most of the companies globally. In early 2020, steel mills experienced a reduction in demand for still products, and due to the economic recession and depression, the demand for steel decreased (Lambert, 2021). Most companies that rely on steel for production and manufacturing reduced their demand for steel because the global economy was facing a great recession. The determinants of demand portrayed by this market situation are; expectations about the future; the global community had a low expectation about the future because of the increased cases of COVID-19. The future of the companies that rely on steel for production was unpredictable, and therefore the companies made a move to reduce their demand for steel (Lambert, 2021). The companies tried to prevent losses that may be generated from purchasing more raw materials, which will produce products that will not be sold because of the contracted economy.

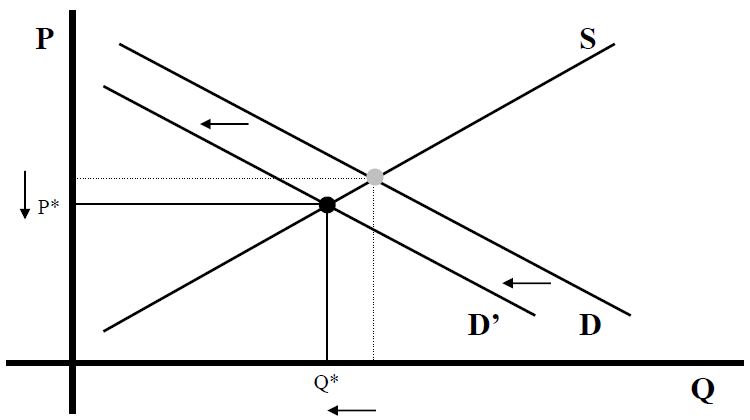

The second determinant of demand is the size of the market; the onset of COVID-19 has led to the contraction of markets all over the world. Many companies that rely on steel have experienced low demand hence reducing their market sizes to avoid more expenditures that may lead to losses (Lambert, 2021). The two factors affected the demand for steel; the mills reduced steel production, which lowered the prices of steel during that time. During this time, the changes in demand and supply led to the changes in the prices of steel in the market. Steel mills decreased their supply of steel in the markets to respond to the reduced market demand for steel (Lambert, 2021). This lowered the prices of steel during that period. The changes in prices follow Graph B, as shown below in graph 1.0.

However, the reduction in demand for steel did not last long; many companies that manufacture products that rely on steel began to demand more steel as many consumers of steel products adapt to the current living conditions (Lambert, 2021). As consumers spend most of their time at home because of the lockdown, the demand for products such as refrigerators and grills increase. The increased demand forced the companies that manufacture refrigerators, grills, and other steel products to demand more steel from the steel rolling mills.

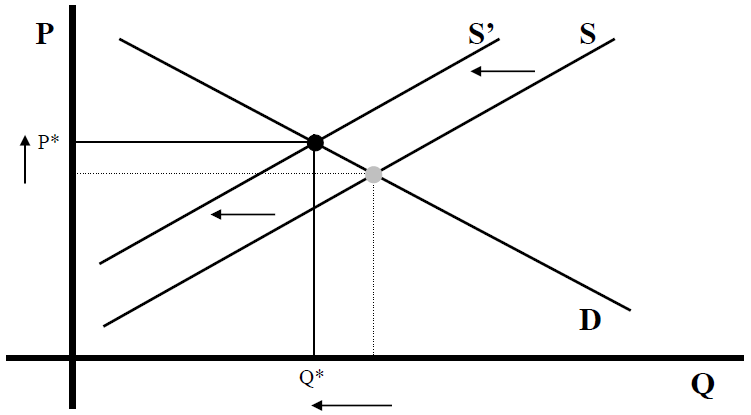

The rebound for the steel forced the steel mills to increase the prices for the steel by 200 percent because of the abrupt increase in demand for the steel products. Other sectors like construction industries and projects also increased the demand for steel hence gearing the steel mills to double the prices for steel (Lambert, 2021). The supply curve shifts inwards because steel mills are ready to supply fewer products at higher prices because of the sudden change in the demand for steel. The pattern of changes follows Graph D as shown below in graph 2.0.

Currently, there has been an increase in prices for oil and gas. The rise in prices is generated from the determinants of demand, such as the size of the market (Boysen et al., 2019). After long-term COVID restrictions globally, many nations, including the United States of America, have had the need to open up the economy so that businesses can rise again (Marcos, 2021). Many governmental activities depend on taxes that are generated from business products and other day-to-day activities. After loosening the regulations, many people decided to expand on their activities as lockdown reduced many businesses’ profits. Movements were allowed, and the demand for crude oil and its products shot up than expected (Marcos, 2021). The rise in demand was so high, thereby leading to an increase in prices of crude oil as well as its complementary goods in the market.

Another factor that led to increase prices of oil products is the government limitation placed on exports. The regulations have impacted the supply and demand for oil and oil products globally (Marcos, 2021). This regulation led to an increase in the cost of production, thereby leading to the rise in the prices of oil and its products in the market. The refinery maintenance with respect to summer has led to an increase in the prices of oil and its products. Many oil refineries companies in the market undergo maintenance, thereby reducing the supply of oil and oil products in the market. The production cost and the cost of transportation of oil products is increased (Marcos, 2021). The oil refinery companies increase the cost of the oil and its products to cater to the high production costs in the market (Marcos, 2021). The consumers are willing to pay high prices for the quantity of oil being supplied in the market, thereby depicting graph A of demand and supply. Graph 3.0 below shows the demand and supply of oil and oil products leading to increased prices of the products.

References

Boysen, N., Briskorn, D., & Schwerdfeger, S. (2019). Matching supply and demand in a sharing economy: Classification, computational complexity, and application. European Journal of Operational Research, 278(2), 578-595.

Lambert, L. (2021). Steel prices are up 200%. When will the bubble pop? Fortune.

Marcos, C. (2021). Gas prices are expected to keep climbing through August. The New York Times.