Introduction

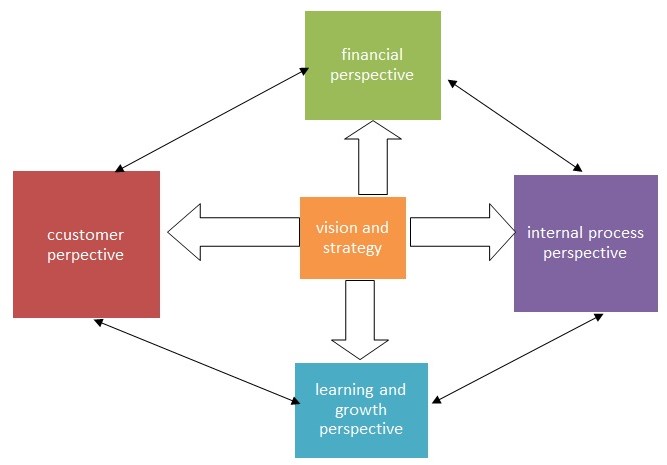

Balanced scorecard (BSC) is a framework for strategic performance management used to help companies monitor performance and execute its strategy (Brown, 2007). It is among the most widely used tool with high satisfaction ratings. BSC divides performance monitoring into four perspectives:

- Financial perspective: focuses on financial goals of the company or organization. The financial performance can be tracked as well as shareholder value.

- Customer perspective: focuses on customer goals, such as the attributes of the product.

- Internal processes: this perspective is interested in the operational objectives aimed at delivering products or services to the client.

- Learning and growth perspective: it covers training, systems and databases, leadership, training, and other intangible assets or drivers that influence future success of the firm.

Balanced scorecard was developed by Robert Kaplan and David Norton. It’s a measurement system that considers financial, customer, business process, and learning growth.

Historical development

The need for non financial measures to motivate, measure, to gauge Company’s performance did not start with BSC. In 1950s, General Electric (GE) had suggested a similar measure for evaluating its performance. The performance, under the measure, was based on eight non-financial metrics (Keyes, 2005). Unfortunately, the management did not pursue the measure with sufficient dedication and it soon fizzled out.

At the time when GE was experimenting with a new measure, professors at Carnegie-Mellon University were developing a similar measure. Their work introduced the term “scorecard” in management parlance.

Peter Drucker introduced his now famous management by objectives in his publication of his 1954 book, “The Practice of Management.” He basically advocated for non financial measure of performance.

In the 1960s, Robert Anthony proposed a new framework for planning and control. In his analysis, he identified strategic planning, operational control, and management control as the three systems for his proposed framework (Keyes, 2005).

Despite the preliminary work done at GE, the writings of Drucker and Anthony, companies continued to rely heavily on financial information to focus on short-term performance until 1990.

Between 1975 and 1990, emergence of Japanese management movement challenged western leadership in important industries (Makhijani & Creelman, 2011). Their management philosophy differed markedly with western style where managers were preoccupied with short-term financial performance. The western companies had failed to improve their operations to enhance total quality and short-cycle management. These glaring failures paved way for a measure that incorporated intangible assets.

Balanced scorecard

Financial reporting that has been in use for a long time only reported on past performance, but provided no details on how future performance would be.

To cut down costs, a firm can spend less on customer service, but such action will comprise its future profitability due to poor service. On the surface, the earnings will appear satisfactory at the end of the financial year. The architects of balanced scorecard wanted to develop a system which would help firms balance short-term gains with long-term considerations (Nair, 2004). Balanced scorecard considers other performance measures, apart from financial measures. Kaplan and Norton were convinced that pre-occupation with financial measures was unwise because important aspects of business such as business process, customer satisfaction, and learning measures were critical for the business survival in future.

Balanced scorecard tries to find a balance between the following measures:

- External and internal

- Objective and subjective

- Current results and future results

Industrial revolution brought tremendous changes into the world. Through advances in technology, goods could be produced in large quantities and cheaply for the population to consume. The major assets in these industrial enterprises were equipments, plants, and properties. Valuing these assets was (is) fairly easy using financial accounting systems. Nowadays, the core value of a firm in its innovative processes, human resources, and customer relationships and they cannot be easily valued by financial accounting system (Nair, 2004).

Balanced scorecard goes beyond the financial measures to include internal processes, customer relationships, leaning and growth, and of course financial perspective.

Measures included in the balanced scorecard include the following:

Financial perspective:

- operating income

- return on capital

- added economic value

Customer perspective:

- market share

- percentage customer retention

- customer satisfaction

Business process:

- quality of products or services

- cost

- throughput

Learning and growth:

- skills set

- extent of employee satisfaction

- ability to retain employees

The above for perspectives are separate from each other. They are, however, logically connected to form a whole. For instance, business processes are dependent on the work of employees, which falls under learning and growth perspective. The four are interdependent. Improved performance on one perspective positively influences the others.

Each of the perspective listed above must have the following:

- Objectives e.g. profitable growth

- Measures e.g. net margin of growth in profits

- Targets e.g. percentage growth in net margin

- Initiatives: these are action programs designed to achieve set objectives

Balanced scorecard and strategic management

The original goal of balanced scorecard was to help improve performance. With time, however, it became evident that balanced scorecard could as well be used in strategic management. It can facilitate following:

- Clarifying strategy

- Communicating objectives

- Planning

- Getting feedback and learning

The four perspectives of balanced scorecard

The process of adopting balanced scorecard starts with developing the strategy of the organization from its vision and mission. Strategic themes themselves are culled from vision and mission statements from the perspectives based on the four perspectives of balanced scorecard.

Financial perspective is used to define the financial goals of the firm. The measures instituted determine whether the company is making sufficient progress in increasing profits and decrease costs. By achieving financial objectives, a firm can essentially realize its mission. However, financial performance is necessarily affected by cutomers, firm’s internal processes, and learning and growth.

The quality of products and services are determined by internal processes of the producer. Internal processes perspective is used to help identify processes that must be adopted to help the firm serve customers excellently. Internal processes metrics are introduced to ensure quality and productivity in the production process. Metric developed can be one that ascertains the level of customer’s satisfaction in terms of quality of products or services consumed.

Customers form the third perspective. The way the organization presents itself to the customers is critical to the fulfillment of its objectives. As such, then, the firm must find ways satisfying the customer. One way of doing is by offering superior service.

Learning and growth perspective is sometimes labeled as “enablers”. This is because it supports the other three perspectives. It helps the management identify gaps in the other three perspectives that are possibly working against the firm’s mission.

Benefits and pitfalls

Viewing an organization through the four perspectives afforded by the balanced scorecard is beneficial for decision making. This is because all the crucial data for decision making are condensed and classed under the four perspectives.

A manager can be able to view unrelated measures under a single report. This way, managers can have their hands on all measures across the entire breath of the operations of the organization. A single measure cannot be given undue attention to the loss of others that are equally important. Balanced scorecard also helps an organization assess its programs for strategic impact in an objective way.

However beneficial, balanced scorecard should be approached with caution. It’s important to co-opt an expert to sit in on the implementation team. Sufficient time should be allowed for implantation. Hurried implementation, especially if it’s not guided by an expert, is doomed to flop. Also, its success is dependent on current and updated information from all the operations of the organization. Synthesizing such huge amount of information may not be possible for many organizations. In that case, the first step should to enhance the firm’s ability to generate and synthesize information before rushing to implement balanced scorecard (Olve & SjoÌ, 2002).

The action steps in balanced scorecard implementation

Formulating the mission statement

The mission statement should briefly state the purpose of the organization. To be included in the mission statement is the operation of the organization to impact on stakeholders maximally.

The vision

The vision statement captures the intended future of the organization for the next few years. It should not be abstract, but rather represent a realistic view of what is desired. Developmental strategies should be built on the vision of the company.

Conduct a SWOT analysis

A SWOT analysis is intended to identify the strong points the organization can build on, and the weak ones to work on. It’s a tool that can be used to get inputs from all stakeholders. A weakness in an organization is a sign of process deficiency. Identifying the weak processes is very important in improving operations. Threats facing an organization should be identified to develop strategies for confronting them. Opportunities offer an organization room for growth. All the aspects of SWOT analysis should be incorporated into the strategy.

After conducting SWOT analysis, strategic ideas that crop up should be slotted in to a large category of similar ideas. This will help is developing a strategy map. SWOT analysis gives useful information about the operations of the organization. This information can be used for strategic planning and for handling other issues that may emerge in the organization.

Building strategy map

A strategy map captures strategic themes. Strategic themes help in defining and making performance indicator s and objectives actionable. These themes are incorporated in the four perspectives of balanced scorecard model.

Defining strategic themes

Categorized strategic themes are placed on the strategy map. Once this is done, each strategic theme is discussed before going to the nest step which is planning process. Discussion of the strategic theme should incorporate the following:

- Definition of the theme: In defining it, the input during SWOT analysis should be considered. Assumptions made and all discussion points related to the themes should be considered.

- Its importance of the firm: this will answer the “why” question with regard to the strategic theme.

Identification of performance indicators and strategic objectives

Coming up with the actions that organization must do to achieve its mission is as a result of putting into operation strategic themes by the process of defining strategic objectives. This is followed by putting in place performance indicators, which gauge success (or lack of it). Indicators are different from metrics. Indicators are less precise as they track trends and determine in a general way whether the direction strategic objectives are taking on (Makhijani & Creelman, 2011). If the performance is heading south, an investigation should be instituted and remedial actions taken.

Tips for successful implementation of balanced scorecard

- Implementation process should be directed by a leader well grounded in the knowledge of the business, as well as balanced scorecard (Pangarkar & Kirkwood, 2009). A member of the staff may not be the best to drive the implementation. Also, as noted earlier, implementation time should be realistic. It should not be too long or too short.

- The first meeting for the team tasked with implementation should define what balanced scorecard is and clarify terms associated with it. According to multiple surveys, implementation has been found to be bogged down unnecessarily along the way by assuming that everyone on board is conversant with meanings of words commonly associated with balanced scorecard.

- Managers find it hard to define strategic objectives of the fourth perspective i.e. learning and growth. This is because it concerns itself with areas such as culture and training, which are intangible. A leader tasked with implementation should have that in mind. Also, metrics and action plans are defined last for this perspective.

- Change will be inevitable. Implementing balanced scorecard introduces reorganization that will ultimately lead to change. During implementation, there should be careful consideration of the impact change in one component will have on others and the general operations of the organization.

- Objectives should be cascaded down to the level of operations.

Balanced scorecard software

Balanced scorecard is not complex. However, it is labor intensive because information has to be collected, reported, and distributed. Office software can help ease the information part of BSC. In a large organization, information is collected over several layers where a lot of people are involved. This can create problems because information has to manually pass over many hands. In this case, balanced scorecard software for reporting would be good to mechanize the process of producing reports.

According to a survey done in 2009, about a third of all organization that have implemented balanced scorecard used some form of software to ease the process of producing and distribution of balanced scorecard reports (Niven, 2006). Also, as at February of 2011, there was over 100 software applications designed to support the process of collecting, reporting, and analyzing data collected for the purposes of balanced scorecard.

Conclusion

There are many approaches that can be used to develop strategy. The choice should be dictated by the characteristics of the organization and its unique circumstances. Balanced scorecard is especially suited for an organization that is knowledge based. In this kind of companies, the key drivers are based on intangible assets. Traditional financial accounting systems are awfully inadequate to capture intangible assets for presentation to all interested parties. Kaplan and Norton indentified this shortcoming and that is why they developed balanced scorecard as a remedy.

Apart from measuring performance, balanced scorecard can be used as a tool for strategic management. For many organizations, balanced scorecard provides the best strategic planning tool. Sometimes, balanced scorecard is used together with other planning models.

References

Brown, M. G. (2007). Beyond the balanced scorecard: improving business intelligence with analytics. New York: Productivity Press.

Keyes, J. (2005). Implementing the IT balanced scorecard: aligning IT with corporate strategy. London: Auerbach.

Makhijani, N., & Creelman, J. (2011). Creating a balanced scorecard for a financial services organization. Singapore: John Wiley & Sons (Asia).

Nair, M. (2004). Essentials of Balanced Scorecard. Hoboken: John Wiley and Sons Ltd.

Niven, P. R. (2006). Balanced scorecard step-by-step: maximizing performance and maintaining results (2nd ed.). Hoboken, N.J.: Wiley.

Olve, N., & Sjöstrand, A. (2002). The balanced scorecard. Oxford: Capstone Pub..

Pangarkar, A. M., & Kirkwood, T. (2009). The trainer’s balanced scorecard: a complete resource for linking learning to organizational strategy. San Francisco, CA: Pfeiffer.