Problem Statement

Introduction

This dissertation essentially illustrates the insight of the changing role of independent financial advisers in the UK linking with retail investors respond and the factors touching the investor’s motivation and exploration under the regulatory exercise introduced by the ‘Financial Services Authority’ that emerged and developed in the financial advisory market through long practice. The Financial Services and Markets Act 2000, FSMA1 amendments, orders, and FSA2 regulations those issued within 2013 are under force to regulate the investment market in the right direction that would focus economic growth by creating new employment opportunities, but some of the regulations creating huge unemployment and job cut where IFAs are under serious threat. People always urge for the effectual regulatory authority to adopt sustainable and standard investment opportunities that would safeguard their investment along with fair and responsible behavior from the IFAs with full compliance with the legal and regulatory framework, where FSA would be liable for any market dispute and would not be acceptable to the society. To investigate and explore such IFAs related issues and their changing attributes, this dissertation has prearranged six major chapters maintaining standard research framework social science, the first chapter- problem statement would discover the background problem associated with the IFAs operation, and the literature review would explore the theoretical structure that supports to design the research. The third chapter of this study would classify a suitable methodology that describes the technique of gathering primary data, how to scrutinize them in the extent of independent financial adviser’s behavior; moreover, the fourth chapter represents finding and discussion by analyzing the data from both primary and secondary data and the fifth chapter would assist to illustrate conclusion and recommendation correspondingly.

Background of the problem

Collinson (2012) pointed out that by introducing RDR3 the FSA has banned the commission-based sales of wealth management service or financial advisory services that have been implemented from January 2013; the impact of such restriction has seriously distressed the wealth management industry of UK where a large number of sales representatives would lose their existing job. Almost 21,700 independent financial advisers (IFAs) are threatened to shut down their businesses or they have to shift their business at RFA4 model where they have no experience, at the same time RFA market would become vulnerable to the extreme burden of unparallel competition that the market has never evidenced. Under the direction and guidance of the RDR, the IFAs are no longer allowed to charge any commission from the financial institutes to market their financial products, but they are entitled to charge an upfront fee from the customers. To bring transparency and trust by removing misrepresentation, fraudulent sales, risk, and unethical behavior of the IFAs, the RDR guided that is necessary to save the customers from hidden commissions that they receive from the companies, rather a direct upfront would provide insights for customers what they are paying for which service.

BBC (2011) reported that under the global financial crisis and its consequential recessionary economy, the independent financial advisers have no more significance while people are under pressure to spend their savings to meet the regular expenditures and are not willing to pay for selecting an appropriate mortgage, pension, and investment, thus the restriction imposed by the FSA has a greater implication. With such a reality, the question of educational qualification of the IFAs, area of specialty, cost of advice that they provide, mode of payment and transparency, and risk analysis capabilities are the most critical issue that the customer would take into consideration (Abrego 2012; Simon 2012; and Somerset 2013).

Read (2011) added that the watchdogs were failed to identify the manipulations of HSBC, but while it went for an accusation that the evidence of regulation violation came into daylight and HSBC started to keep its efforts in the direction to rebuild its reputation by taking customers liability and providing penalties. HSBC invited a press conference and proclaimed that it will take responsibility for all the deprived clients of NHFA even those were previously taken financial advice from NHFA before the involvement of HSBC with the company, but the customers are not ready to forget the mis-selling scandal easily and the hope to proving good PR may be hampered. Due to the boom of the mis-selling scandal, it was proved that thousands of old persons were sold unfortunate investment bonds of HSBC by NHFA, the uneven and eventually costly financial products were selected for them broken the regulatory duty of the IFA and destabilized the market trust (Lewis 2013; Myddelton 2012; and Millers 2012).

Under the above circumstances, the FOS5, FSA, and FSCS6 have established under FSMA – 20007 to generate coordinated market dynamics that would remove the unethical performance of the financial advisers and capable to safeguard the retail investors in Britain, the regularity steps themselves generated a new dimension of crisis in the market. The concurrent financial advisory market of the UK has been going through an unsteady condition and facing diverse challenges, and engenders with enormous complications linking with a variety of stakeholders, regulatory agencies, and voluntary organizations that are working to strengthen the market (Grange 2013 and Simon 2013). By the way of such background problem, the author of this dissertation has decided research with the emergence and the development of the IFAs policy that would assist to settle on the regulatory approaches acceptable to the financial advisers, people, and the policymakers to resolve existing dilemmas with the changing role of independent financial advisers.

The rationale of the research

Many scholars in the financial advisory market have tried to expose the solution of the question what is the reason for increasing demand for IFAs in the UK, how the independent financial advisers are influencing the retail investment market, and how appropriate is the Retail Distribution Review to administer and develop the IFAs business operation by increasing investor’s confidence. Some other researches kept further concentration to stabilize the market from mis-spelling and commission-based unethical deals by the independent financial advisers. Most of the contemporary researchers have scrutinized the standards of RDR protocols, investors’ relationship management along with regulatory restructuring in the FSA guideline including FSCS complaints, but no landmark research agenda has been raised yet to investigate how the regulatory framework for IFAs has greatly influenced to align with unethical market conduct linking with their past, present future trend.

BBC (2011) also added that the FSA as the regulator of the financial service industry conducted several inquiries and studies with the operational and profit-making strategies of the IFAs and identified several areas to promote and sell financial products like the retail financial market. The study identified the most unethical norms of the advisers that they are taking a commission from the financial institutions for promoting their products and at the same time they are charging the customers for advice, keeping the commission earning fact hidden, they are charging high hourly rate on the customers. It was the regulatory duty of the FSA to rescue the customer from the unethical and profit hunger nature of the advisers, thus they introduced RDR as a guiding principle to safeguard the financial market from associated risk and vulnerability.

The justification of this research is to analyze historically the roles of financial advisers in Britain that is knowledgeable by examining the real scenario of the market, to evaluate to what degree the present market regulation of FSA is efficient in dropping the unethical performance of the IFAs. At the same time, research has aimed to raise the consciousness of regulators to introduce appropriate market strategies to mitigate the harmful attitude of the financial advisers by educating them and to demonstrate the policymaker’s associated prospect and risk factors of RDR from a coordinated viewpoint of the investors and IFAs. Furthermore, this dissertation has intended to lend a hand with depth insight of IFAs that ultimately enrich the academia, investor, and regulators with enhanced understanding regarding the unethical practice of IFAS pointing to the driving force that leads to align with mis-spelling, wrong advice providing, higher fees and commission charges comparing their regulatory duties guided by FSA and financial ombudsmen service.

Research Question and Objectives

The research conducted until now with the independent financial advisers has concentrated on the degree of their compliance with regulatory framework or their market misconduct including the problem and prospect of the IFAs to emphasize the increasing role of IFAs to strengthen retail investment market, but not identified any linkage of unethical behavior with the regulatory framework.

The statutory power allocated to the FOS, FSA, and FSCS have joint objectives to conduct regulatory, supervisory, and arbitrational power to settle complaints from the retail investors, such legislative binding upon the IFAs would boost the capabilities of the advising firms who are interested in reducing unethical conduct applying the new knowledge and prospects directed by RDR. The objective of the financial service authority is to support investors and advisers with appropriate ethical standards mentioned in the retail distribution review of the UK that may be a sign of the economic and business reality for the independent financial advisers who are paying attention to sustain in the business by introducing investment decisions with regulatory compliance and fees conformity.

This study would scrutinize the substantial performance of the financial advisers, emergence to improving their roles in the financial advisory market of the UK by adopting concurrent political economy of economic downturn along with global investment trend that would contribute to motivating the IFAs to serve retail investors with trustworthiness. The main objective of this dissertation is to investigate, ‘do the historical perspectives of independent financial advisers and their changing market conducts influenced by the regulatory pressure with investor’s unwillingness to pay fees’ to argue on this investigation this study would look for following research questions

- To what extent the theoretical framework of legislation has allowed the IFAs to conduct their business in the UK;

- What is the historical contribution of the IFAs to emerge and develop the retail investment market in the UK?

- To what extent the role of regulators have succeeded to strengthen the market and safeguarding the investors?

Literature Review

The Theoretical Framework for Independent Fiscal Advisers

The Financial Services and Markets Act 2000

Mwenda (2006) and HM Treasury (2013) mentioned that the FSMA 20008 came into implication on 1st December 2001 to frame establish statutory protection against market abuse in the UK, before that the supervisory duty to check and balance the financial institutions was transferred to the FSA from the Bank of England under the BEA -19989. ORC (2002) added that historically the investors were free to take suggestions from anyone as the financial service industry was kept free from all regulatory control, the advisers were self-motivated people without any institutional qualification or licensing. The uncontrolled financial service industry evidenced during the seventies and eighties with growing financial scandals of cheating and robbing investors’ money, in the late nineties, the first legislative framework to regulate investors and advisers was introduced through FSA -198610 and came into implication on 29 April 1988. FSA -1986 was replaced by section – 153 of the FSMA – 2000 where the financial service authority has empowered to make written regulations for financial institutions, which was the function of the central bank before; however, it is the legislative framework that prolongs the present statutory regime.

ORC (2002) explored that the FSMA – 2000 has generated a long-lasting and significant effect on the financial advisory market in the UK by introducing the Financial Services Authority which is the exclusive regulator of the market and empowered to authorize, regulate, and investigate without any other interference. The statutory duty of FSA has mentioned in section 2 of FSMA – 2000 and pointed four dogmatic objectives as to establish market confidence, bring financial stability, safeguard the investors, and reduce financial crimes and scandals, the customer’s protection is another aim of FSA where it urged to provide a clear explanation of associated risk. In section-5, it has mentioned that the general principle for financial service consumers arguing that they would make their own investment decision with self-responsibility while section -19 pointed out that without authorization from FSA none of the individuals could conduct advisory service. Under the section-23 of the FSMA -2000 urged that the violation of the general principle would be considered as a criminal offense and breach of any agreement with a customer could be panelized by recovering money or property or adopting particular compensation for undue action of the adviser (section-28).

The Financial Services Authority

FSA (2011) mentioned that in 1997 government of the UK decided to reform the structure of supervision the financial institution amalgamating with investment services regulation and providing the supervisory duty upon SIB11 by changing its official name ‘Financial Services Authority (FSA) to strengthen the retail investment market removing irregularities and financial scandals. After the formulation of FSA, the first reformation took place in 1998 aimed to transfer the supervisory responsibility of the banking sector to the Bank of England, in 2000; FSA was entitled as the listing authority by transferring power from LSA12, in 2001 while the FSMA- 2000 gained Royal Assent FSA gained more extended responsibility with statutory power. The dynamic performance of FSA lead it to gain more power to conduct duties of some other governmental organizations for instance in 2004, it has taken the responsibility of mortgage regulation and general insurance business regulation and in 2010 the government proclaimed to establish FSA as the ‘single financial services regulator’ along with two new agencies those works together.

FSA (2011) added that it regulates the majority of financial services markets including exchanges and firms by introducing standards of their operation and obligatory compliance and taking necessary action against organizations that fail to comply with the guideline provided by FSA to meet statutory objectives. There are 29,000 authorized firms, who are providing financial advisory service in the retail investment market of the UK, where FSA look after their financial crimes like money laundering, financial market abuse, and any kind of dishonesty to investors, the aim of FSA in this regards is to safeguarding the investors with increasing market confidence and raising public awareness.

Financial Ombudsman Service

FOS (2012) mentioned that the Financial Ombudsman Service is not a market regulator or trade body nor investor’s alliance, but an independent agency and its role is as a specialist to resolve disputes roused among the investors and firms who are providing financial services without any bias to any party that would be free, fair, and impartial. FOS13 has organized and empowered under section 17 of the FSMA – 2000 along with section – 59 of the CCA – 200614 that provided the power and area where FOS could work and described the types of responsibility it would perform with appropriate jurisdiction to its neutral role in the arbitrations.

The area covered by the ombudsman service of the FOS is all the actions that are regulated by the FSA, for instance, compliant deposits, providing advisory service on the investment products along with mortgage and insurance policies as well as consumer credit activities that embarks under the CCA – 2006. At the same time, FOS deals with every retail financial advisory organization those are corresponding to the FSA along with the entire commercial holdings those deal with consumer credit authorized by the OFT15 within the territory of the UK. FOS also deals with some other businesses those are originated from Europe other than the United Kingdom but have customers in the UK, this type of involvement is called voluntary jurisdiction and is ready to receive any sorts of complaints linking with previous businesses that are not functioning in the financial market at present.

Financial Services Compensation Scheme

FSCS (2012) pointed out that ‘Financial Services Compensation Scheme’ is an independent agency of the UK established under the FSMA – 2000 that raised a statutory fund to provide compensation to the valid customers while the FCA16 authorized financial advisers to fail to pay their claims or the investors cheated by the IFAs at any extent of advisory service. Crown (2012) explored that the Financial Services Act – 2012 has amended Section 38 and Schedule 10 of the FSMA- 2000 and facilitated the regulator to establish FSCS by introducing new rules to mitigate the liabilities that occur due to wrong performance or omissions of authorized successors and unable to satisfy such claims due to their insolvency. FSCS provides its service to the customers free of cost and does not deals with the complaints against firms those firms who are not authorized by FCA but handles those case where the firm has closed trading operation due to inadequate assets required to meet up customers claims along with active firms suffering from insolvency (Neighbor, Ulrich & Milikan 2010). FSCS, FOS, are FCA are the three different organizations keeping their diverse role in the retail investment market of the UK, but working together and striving to achieve their common objective enhance market mobility by removing unethical conduct of the financial advisors and ensuring the safety for retail investors who seek advisory service from the authorized firm (Hill & Heaney 2010).

Defining Independent Financial Advisers

Worthstone (2011, p.44) reported that IFAs are professionals who provide independent advice and ClearlySo (2011, p.81) pointed out that they are responsible to provide advice on financial issues to their customers. In addition, they suggest appropriate financial products from the whole of the market (Worthstone 2011, p.44; and ClearlySo 2011, p.81). At the same time, they concentrate on the goods that go to the retail market (Worthstone 2011, p.44; Ren 2006; and ClearlySo 2011, p.81). However, there are more than 50 thousand financial advisers in the UK among them 54% or 26 thousand are IFAs who play a vital role to bring the success of the social investment sector (Boffey 2011, p.3; Worthstone 2011, p.44; and ClearlySo 2011, p.81). More than half of IFA service providers currently outsource and the cost is the main deliberation when choosing an outsourcing partner (Boffey 2011; and Morgan 2010, p.26). In contrast, financial consultants are helping institutional investment houses and suggesting them regarding many aspects, such as appropriate strategy or plan for the future development, corporate chart, and implementation plan using existing portfolio management (Worthstone 2011, p.44; and Deloitte 2012 and ClearlySo 2011, p.81). However, IFAs who are directly authorized by the FSA are eligible to provide advice about the entire market of financial services whereas the jurisdiction or power of appointed representatives is limited to a representative panel of the products (Boffey 2011, p.3; Worthstone 2011, p.44; Wragge & Co LLP, 2013 and ClearlySo 2011, p.81).

Retail Distribution Review

Kissoon & Ealham (2013) explored that the Retail Distribution Review was introduced in 2006 and went through several discussions and came into implication in December 2012 to remove irregularities in the retail investment market occurred by the independent financial advisers with less qualification and inferior ethical standards. The financial market regulator FSA identified the market scenario before the RDR approach pointed out that the UK retail investment market has been threatened with two major challenges, first one is the poor performance of the firms and unfortunate returns on investors due to inefficient advisory service. FSA urged that the increased risk in the market and uncontrolled scandals of the financial advisers are continuously losing customers’ trust, to protect customers and to administer the market operators it is essential to amend the related legislation to strengthen the market, thus FSA proposed to introduce RDR. Meanwhile, FSA makes it clear that the RDR regulation has aimed to address only the life policies and pension scheme along with some other financial products that put forward to the disclosure of the financial asset and fundamental product and services those have demand for advisory services. Under such a background of the market, FSA urged that the legislative framework of RDR would engage its efforts to introduce three major initiatives as strictly banning commission, transparency of advice, and implementing effectual professional standards. The major changes in the financial advisory service by introducing RDR are as follows –

- The most significant change bought by RDR is the ban of banning of commission, it strongly urged that for all investment products the hidden commission and advisory charges couldn’t sustain simultaneously, thus the provision of sales commission and hidden promotional discounts would be replaced by direct adviser charges.

- All the financial advisers would be transparent about their advisory fees it would be agreed upon both parties consent whether it is upfront or payable on the due date (Webb 2012; and Phillips 2012);

- In case of the product providers are giving advisory service in a discounted fees, but realize that discount by selling the said product would be strongly prohibited;

- In the case of vertically integrated independent advisers, those are attached agents as well as their own sales representative, the advisory fees, and product charges would be separated and transparent

- RDR kept clear provision for the product those sold before the implication of this legislation would continue receiving that in the proposition settled before.

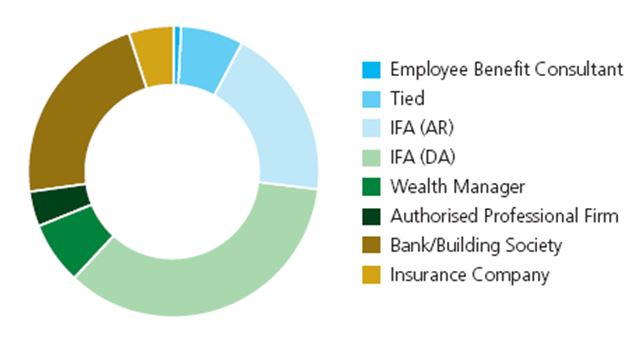

The following diagram illustrates the distribution channels of financial advisory services that firms are involved with the market as:

Here, figure 1 demonstrated that there are four channels of advisory service distribution, but the provision of RDR has emphasized the intelligibility of advice by clarifying into two categories as follows –

- Every financial adviser working in the jurisdiction of RDR would mention their categories to the customer whether they are either ‘independent adviser’ or ‘restricted adviser’

- Advisers would allow their customers to explain product features clearly and the customers are now conscious free to select their product accurately from a product variety;

Another vital area that RDR emphasized strongly professional standards of the financial advisers and set out that –

- To be an authorized financial adviser, an individual needs to have a minimum professional qualification set out by FAS regulations;

- All authorized financial advisers are required to complete 35 hours of ‘Continuing Professional Development every year successfully conducted by CPD agencies;

- The financial advisers would positively maintain the SPS17 issued by the authorized professional bodies

The Effectiveness Regulation to Strength Market

The Impact of RDR in the Market

Oxera (2009) argued that in the pre-RDR era, the composition of the retail investment market of the UK consists of huge providers, a range of advisers, diverse categories of distribution channels, and a large number of consumers or investors where the advisers have free access without any barrier along with the scope of vertical integration. There was no hindrance for market entry for any new product or fresh adviser, due to unparallel competition among the product producers; they welcomed a diverse range of advisers to boot up sales, and the advisers engaged their highest effort to suggest the products that have higher commission. The unethical performance and unholy alliance of the financial product produces and different advisers turned the market scenario very dangerous where the advisory service consumers have no safeguard and encountered different types of financial fraud or cheating at a different level of the market.

Kissoon & Ealham (2013) also added that to assess the impact of RDR implication in the financial advisory market, the impact would be measured from an integrated scale coordinating the viewpoints of providers, advisers, consumers, and regulators including auditors, without such coordination the assessment of the impact of RDR would not be justified. The Impacts of RDR implementation on the advisory service consumers (in other words ‘retail investors’) are that the regulatory bindings of RDR boosted the confidence level on the financial advisers, the consumer could now think that they have last resort of getting compensation under RDR in they encounter with any mis-spelling or financial fraud. The RDR has generated a superior scope for consumers to improve their knowledge and understanding in this area, especially they would clear that they have to pay upfront fees for the advice he gets and would be free from the bias of any provider, thus consumers would be able to increase his savings with future intention to invest on right products. Research with the consumers of the financial advisory market illustrated that they are willing to pay £100 to £150 for advisory service while the increasing insights of the 30% of consumers have intended to select investment products on the self-directed way without taking any advice from commercial advisers.

Under the RDR provision, the adviser has to be either independent or restricted with appropriate qualification and the professional standard they have to attend CPD every year and maintain SPS that the advisers could consider as an extra burden that ultimately prevents easy access to the advisory market. The impact of RDR has illustrated in the following diagram –

The figure above illustrates that the implication of RDR would shift the role of advisers is to ensure accessibility of information for the consumers where the breadth of information provided from basic to advanced information array would be considered as their strength, due to banning commission, they would execute direct upfront fees whether restricted or independent adviser. At the same time, due to banning commission, the financial product produced would be free from all pressure of undue pay to the advisers and would be attentive to improve the product attributes that would ultimately ensure the welfare of the investors and society as well.

Nature of Advice and Existing Gaps

Hurman & Costain (2012) added that FAS conducted several landmark types of research with the retail investment market in recent years that emphasized the ‘savings gap’ raised from the advice gaps that have been experienced in the UK market for a long time without any question to the quantification and magnitude of the advisers. The evidence-based research demonstrated that the question raised on how to improve the saving gap has addressed that without mitigating the advice gaps, it is quite difficult to meet up the saving gap in the society, thus the pubic policy around the country argued to settle the advice gaps to generate market mobility. The challenge of improving the present situation of ‘advice gap’ has deeply concerned with the major focus of policymakers and regulatory authorities how the retail investors could be motivated and develop their sphere of understanding that could be equipped to connect with a variety of available services in the market and make them confident to selecting right product along with fair service provider. More essentially, the regulatory role of FSA has demonstrated the enthusiastic desire to establish a dynamic investment market where HM Treasury are eager to provide the highest latitude to implementing the objectives of FSA, by their close regulation the market already defined to towards forwarding looking acceleration and continuously going to reflect desired public policy. FSA pointed out that the advisory market has the following advice gaps

- People have the potential to generate more savings, which is not attained due to the advisory gap;

- The resultant savings gap exists in the economy that hampers investment

- Advisers are not yet qualified to the higher extent of professional and ethical standards;

- For any specific situations, consumers encounter with any crisis, there is no scheme for crisis management advice, it is assumed that the wider wisdom of definition indicates lacking in the policy activity,

- The ongoing policies look like automatic enrolment where the possible prospect to take advantage of the employment relationship has not been addressed;

- There is no scope to recognize the good consumer results and necessitate a harmonized approach connecting the public options along with regulatory policy;

- FSA strongly believes that the consumers have enough chance to save more, but there is no marketing campaign to motivate people;

- FSA has not yet made it clear where the ‘more saving’ is a policy matter or regulatory issue (Brown & Murphy 2003);

- Although FSA identified that, various consumers could take advantage of the ‘simplified advice service’, there is no particular guideline or safety measure not yet taken ((Webb 2012; and Phillips 2012);

- FSA strongly believes that the RDR would bring more mobility in the investment market, but after implication without having practical data, it aligned to reform RDR, which is a vital policy gap in the advisory market.

Changing nature of Financial Advice

FSA (2012) explained that the adoption of RDR and ban of the commission would bring a diverse change in the variety of advice to their natural strength and associated up-front charges mutually agreed by the consumer and adviser while the dynamics of the retail advice market necessities diverse delivery channels and mechanisms to ensure effectual service delivery to potential investors. To understand the changing nature of financial advice, it is essential to have appropriate knowledge with the advice model presented by Hurman & Costain (2012) is as follows

The model above illustrated the several categories of advice defined as below:

- Full Advice

Through depth research with the consumer’s financial wants and capabilities and taking into account his importance of the whole along with interdependence factors with full compliance of the regulatory issues the adviser would suggest a variety of applicable regulated and non-regulated investment products for customers selection with any bias to any company; - Focused Advice

Under this category of advice, the adviser would draw his attention to the particular area of financial needs that the consumer has been encountering at present, with the intensity of research along with exact recommendations would exclusively concentrate to meet up that needed area, for instance, protection scheme, pensions plan or annuities arrangements; - Simplified Advice

FSA (2012) and FSA (2013) explored that there is no defined form of simplified advice in the FSA guideline, but it is an advice model that would be shared with consumers in an automated and process-driven method that easily delivered by face-to-face discussion, over the telephone or through the internet, it may not address the concurrent financial needs of the consumer; - Basic Advice

FSA (2004) added that the government has introduced a new category of advice called ‘basic advice’ to handle stakeholder products organized with the easy and less time-consuming process to provide advice to consumers concerned to purchase any one of the stakeholder products like cash deposit, medium-term investment, stakeholder pension or child trust funds; - Generic Advice

Within this category of advice, the adviser would measure the consumer’s needs and organizes the plan and recommendation that would prevent the further needs of regulated advice, for instance, the precise recommendation to pull out, making improvement, modification, or cancellation of any particular regulated product or investment scheme of a specific provider, this type of advice needs lower depth research; - Execution Only

The process of order taking where the consumer has his viewpoint to select any product but looks to the comments of the providers who presented his service only execution purpose (Congdon 2009; and Freireich & Fulton 2009) - Assisted Non-advised

FSA (2006) explained this category of advice where the consumer has information about a particular product but would like to consult or make an informed decision arguing whether the product serves his purpose, it also looks like ‘Execution Only’ advice;

Associated threats of IFAs due to RDR

BDO (2012) as part of parliamentary findings, conducted a landmark research on the impact of RDR and urged that there is a tremendous risk of imposing the extra burden of high cost on the consumers account for shifting framework post-RDR would involve deductions from the premium of consumer and would be passed to the IFAs according to which fees they mutually agreed. Some of the studies indicated although the advice and the consumer would settle the fees before their agreement, consumers would be willing to pay from their profit earning, thus, without regulatory watchfulness and authentic customer engagement in the market, the present charge bought by RDR regarding commission ban would just stay behind a different hidden excuse. BDO (2012) made the study on 280 IFAs all over the country regarding their viewpoint on the RDR and urged that RDR would bring very marginal change in the market through its direct charges on the customers and transparent fees structure, 90% of the IFAs urged that they needed to have the remuneration higher than pre-RDR era. In the Pre RDR era, the IFAs were charging 2.9% along with regular trail commission per year 0.6% for an investment of £50,000, in the post-RDR for the same investment amount they are expecting to charge the fees at the rate of 2.8% along with 0.8% annual fees that ultimately increase 0.2% above the pre-RDR practice.

Moreover, the 70% of the IFAs urged to boost their advice charges greater than pre-RDR era, they also not clear when, and how the payment would be made, if the payment process remains same as the pre-RDR era that must works as a commission of the previous period although it is predicted that adviser’s remuneration would be more transparent. On the other hand, as the RDR urged for professionalism in the industry, the highly qualified IFAs could not be trapped into the barrier of any fix charges for a higher level of service, but there is no indication in the RDR higher profiled IFAs would charge while some of the IFAs are intended to charge £160 per hour as an average. Due to the shifting nature of the advisory service, the industry experts urged that it would increase the overall cost of the industry that directly influence the consumers and generate hindrance to the easy access for advice that creates more advice gap in the market.

The Changing Face of IFAs

Evans, Cohen & Power (2012) presented the changing face of the IFAs arguing that most of the big IFA firms have aligned to comply with the RDR by proclaiming their strategic responses to the fresh approach of changing nature of advice regime without providing any pressure to the regulators. Another group of big firms intends to shift to the upmarket channel where they only deal with consumers with minimum resources of £50,000 and they are not interested to work with mass-market investors arguing that the mass-market consumers with little investment opportunities would not be interested to pay higher IFAs charges. On the other hand, many IFAs are going to pact with the affluent customers and aligned to work with the more profitable products while the mass-market kept unaddressed or left for small or weak IFAs who are striving to sustain with minimum returns, At the same time, most fresh entries of the IFA market are thinking to change their job for lack of confidence that they could not sustain with the changing face of IFAs business.

Power et al (2012) also pointed out that the increasing unwillingness of the customers to pay for the advisory service of IFAs, has been decreasing the demand for advice in the retail, moreover negligence of the big IFAs to the small investors would generate further dilemma of advice gap where new groups of alternative advice providers enter in the market. It has already been evidenced that 9% of the present investors already started to use accountants or solicitors those are prepared to pay a reasonable level of fees, as an alternative source of advice some on the banks and insurances are using websites and the IT technology integration could reduce the demand for IFAs.

Research Methodology

This section aims to prepare a framework of a research process to evaluate the changing role of the Independent Financial Advisers in the UK

Questionnaire Design

It is widely used to collect factual data or direct information (Cohen, Manion & Morrison 2007; Zikmund 2006; and Leung 2012). Two major objectives in designing questionnaires are in designing to maximize the response rate and to obtain accurate relevant information ensuring an acceptable quality and avoiding ambiguity (Malhotra 2009; Saunders, Thornhill & Lewis 2006; Sekaran 2006 and Leung 2012). However, the questionnaire of this dissertation will include some fundamental issues, such as simple questions related to the changing role of IFAs, awareness of the customers regarding retail investment products, customer behavior, cost structure and payment method, customer satisfaction, required qualifications under a new legal framework, and so on.

Data Collection

The questionnaires will be distributed to friends, international financial advisers, customers (age between 45 and 54), and some renowned firms to get a response regarding the changing role of the IFAs. However, volunteers and friends will be responsible to distribute the questionnaire (using email or another method) to the participants where the target group can provide feedback or leave it.

The Sample

All the data for this study will obtain from the questionnaires sent to about 100 target people in London, Bristol, Manchester, and another province during March and April 2013; however, the following table gives more information about the sample –

Data Analysis and Results

To produce a valuable analysis and measure data, analytical tools of Microsoft Excel will be used and the data measurement method will be based on Likert scales. To assess the changing nature of IFAs, this study would use a 5-point Likert scale to identify the influential factors that are shifting the nature of business where the scales indicates – Strongly Agree = 5, Agree, 3 = Neutral, 2 = Disagree, 1= Strongly Disagree,

Findings and Results

What is your education level?

Among the respondents, 13.75% of the IFAs have school level education even not appear A -level exam, 43.75% have GCE level of education, and 26.25% of respondents have a Bachelor degree while there are only 15% respondents have a masters degree and 1.25% respondents have Ph.D. degree.

How long you are in the IFAs business

According to the survey report, 5% of the participants were working for one year or less time, 13.75% of respondents were working for one to three years, 31.25% respondents were working for more than three years, but less than five years. In addition, the highest 45% of respondents have job experience over seven years, but less than ten years; however, only 5% of respondents have long experience working as financial advisers in different companies, which indicates that the respondents were highly experienced to give feedback about the changing the role of IFAs.

Do you agree that the minimum qualification required for IFAs introduced by RDR would prevent new entries

Among the 80 respondents, 50% of the total participants strongly agreed and 26.25% participants agreed with the statement, 12.5% of respondents were neutral; however, 7.5% participants disagreed and 3.75% participants strongly disagreed with the question that the minimum qualification requirement for IFAs introduced by RDR would prevent new entries.

Do you think that due to RDR implication, some IFAs would lose their current job for non-compliance

According to the survey report, 55% of the total participants strongly agreed and 18.75% participants agreed with the statement, 6.25% of respondents were neutral; however, 15% of participants disagreed and 5% participants strongly disagreed with the question that some IFAs would lose their current job for non-compliance of the new provisions.

Would you think that RDR would generate professionalism in the market with higher pay for highly qualified IFAs

From the response of the target group, 25% of the total participants strongly agreed and 20% of participants agreed with the statement, 10% of respondents were neutral. Surprisingly, 35% of participants disagreed and 10% of participants strongly disagreed with the question that RDR would generate professionalism in the market with higher pay for highly qualified IFAs.

Do you think that RDR would change the nature of financial advice?

Among 80 respondents, 25% of the total participants strongly agreed and 20% of participants agreed with the statement, 10% of respondents were neutral; however, 35% of participants disagreed and 10% of participants strongly disagreed with the question that RDR would change the nature of financial advice.

Does the new provision would generate an advice gap

From the response of the target group, 35% of the total respondents strongly agreed and 25% of participants agreed with the statement, 15% of respondents were neutral, 20% of participants disagreed and 5% of participants strongly disagreed with the question that new provision would generate advice gap.

Would the implication of RDR create a saving gap?

According to the survey report, 35% of the total participants strongly agreed and 18.75% participants simply agreed with the question, 10% participants disagreed and 7.5% participants strongly disagreed with the question that the implication of RDR would create a saving gap; however, 28.75% respondents were neutral as it is a new provision for which it should require additional time to assess the position.

Do the implication of RDR would generate cost-saving for customers

Among 80 respondents, 10% of the total participants strongly agreed and 20% of participants agreed with the statement, 15% of respondents were neutral; however, 25% of participants disagreed and 30% of participants strongly disagreed with the question that the implication of RDR would generate cost saving for customers.

Would you think that the role of FSA is turning to regulatory anarchism upon IFAs?

From the response of the target group, 30% of the total respondents strongly agreed and 27.5% of participants agreed with the statement, 10% of respondents were neutral, 12.5% participants disagreed and 20% of participants strongly disagreed with the role of FSA is turning to regulatory anarchism upon IFAs.

Do you think that the FSA would be capable to bring mobility by implementing RDR?

According to the survey report, 25% of the total participants strongly agreed and 21.25% of participants simply agreed with the question, 5% of respondents were neutral, 22.5% participants disagreed and 26.25% participants strongly disagreed with the question that the FSA would capable to bring mobility by implementing RDR; however, it is new for which it is not possible to assess.

Discussion

Cost and Area of Financial Advisers

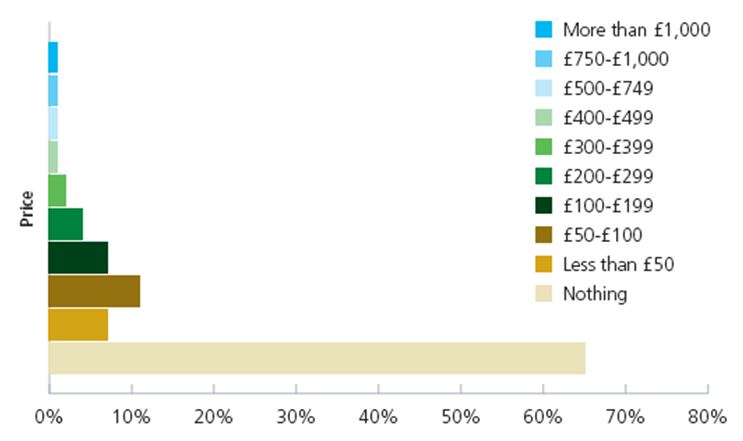

Hyde (2012) stated that all IFAs can charge up-front fees for their services from 01 Jan 2013 due to a change of rules and regulation of the Financial Services Authority. They can charge fees as the new system is commission-free (Hyde 2012; Boffey 2011; and Morgan 2010). According to the traditional policy, the payment system was commission-based (a small percentage is taken off though upfront fees were usually waived) for which the advisers had to wait for a long-time to get payment (Hyde 2012; Boffey 2011; and Morgan 2010). At the same time, IFAs will no longer obtain any fee from the production company from the beginning of the fiscal year 2013 (Savvy 2012; Boffey 2011; Morgan 2010; Deloitte 2012; and Hyde 2012). In addition, Hyde (2012) argued that they can ask £200 an hour from this year considering expertise on the issue and high-quality advice; however, this researcher has analyzed survey report of CoreData Research and mentioned that most of the customers are not interested to pay more than £40 an hour. However, the price range depends on several factors, such as the expertise of the advisers, location, and the area (Hyde 2012; Bruyn 1991; Boffey 2011; Morgan 2010; and Deloitte 2012). On the other hand, about 10% of respondents of that survey report stated it should be completely free because advice is not always reliable due to lack of knowledge or professionalism (Hyde 2012). At the same time, Aviva had surveyed to know the perception of the customers about the fees of financial advisers and 65% of respondents stated that they like nothing for this service and 8% of respondents mentioned that they can pay less than £50 (Boffey 2011; Hyde 2012; and Deloitte 2012). According to the report of Aviva, about 11% of participants were ready to pay £50 to £100 and only 2% respondents were ready to pay £200 to £299; however, the following figure shows more details about the survey report –

Therefore, the cost should be fair and competitive for the high professional service; however, the IFAs should consider the importance of transparency of charging (Boffey 2011; Hyde 2012; and Deloitte 2012). However, the researchers have also mentioned that the customers have to be cautious since cheaper service does not mean high-quality service; therefore, they concentrate on the qualification of the financial advisers (have to realize the problems and needs of the customers) before fixing price (Savvy 2012; Boffey 2011; Morgan 2010; and Hyde 2012). However, the new regulation allows the advisers to ask for a fixed charge in advance or for each hour of the adviser’s time (Savvy 2012; Boffey 2011; Morgan 2010; and Hyde 2012).

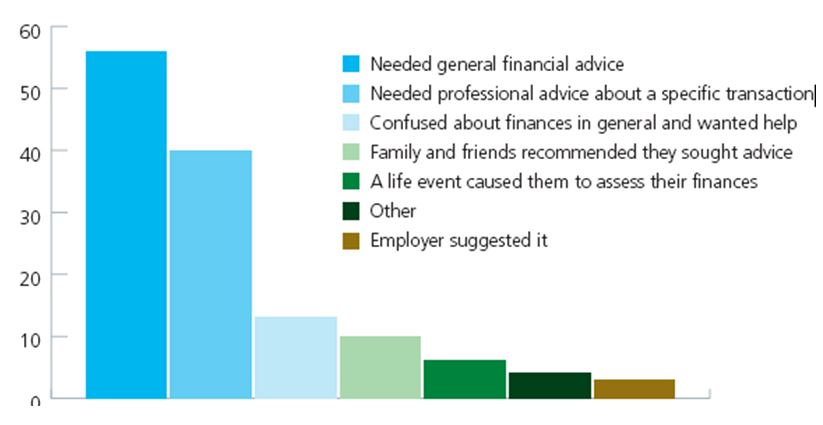

On the other hand, Boffey (2011) surveyed to identify the service areas for financial advisers and the reasons for which the customers go to the IFAs; however, 55 respondents of that survey stated that they need general financial advice and 40 participants argued that they need general financial advice about a specific transaction. According to the report of Aviva, about 11% of participants stated that they cannot decide about investment plan; however, the following figure explains more details about the survey report –

However, the IFAs mainly advise the customers about retail investment products, such as stocks and shares ISAs (nonretirement), personal or stakeholder pensions, endowment policies, exchange-traded funds, group personal pensions, life insurance policies, tax, mortgage, a collective investment scheme, and so on (Power 2012; Ren 2006, and Masons 2012).

Supply and Demand for Independent Fiscal Advisers

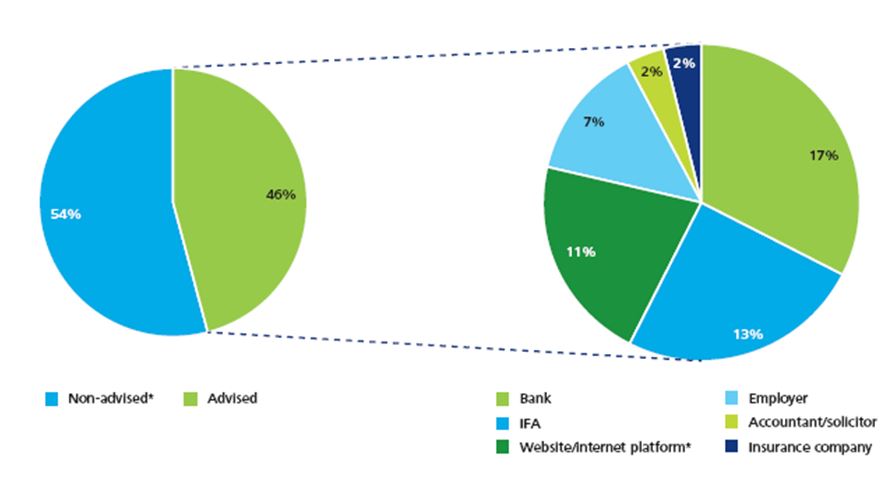

According to the report of (Boffey 2011), there are more than 50000 financial advisers in the UK; however, the following figure explains more details about the survey report –

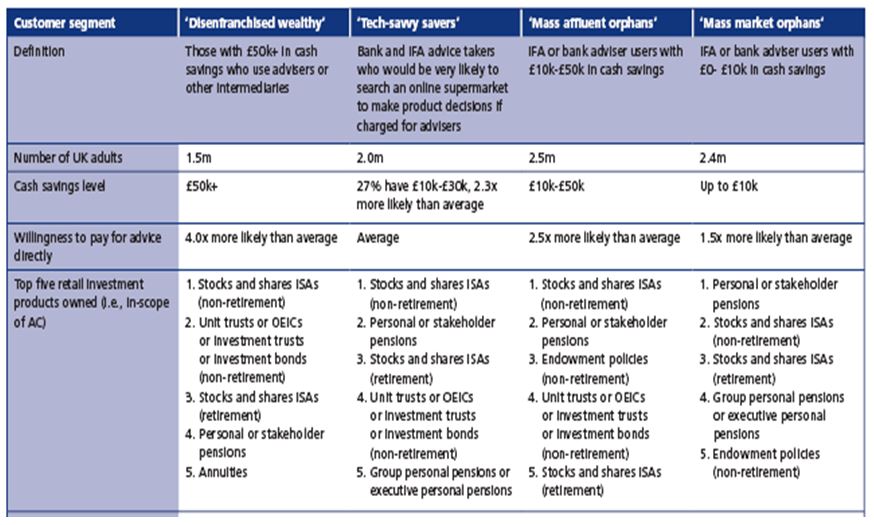

More than 81% of people of the UK are confused about their financial plan because they like to rely on experts as the IFAs act as the gatekeepers to investment decisions for which the demand for financial advisers is too high in this country (Boffey 2011, p.3; Wragge & Co LLP 2013 and ClearlySo 2011). However, Deloitte (2012, p.2) addressed 4 main groups of customers and the following figure explains more details about the customers of retail investment products –

In addition, the following figure demonstrated that 54% of the total purchasers have not taken any advice from the service providers; however, 46% of purchasers have taken service and among them 13% of people considered IFAs to invest their funds for the future. On the other hand, a significant number of the purchasers relied on the bank to take decisions; however, the following figure gives more information –

The New Approach to Financial Advice

Financial advisers get a long-time for preparation to adjust with the new provisions as it includes new payment policy along with formalizing qualifications within the profession, and so on (Heaney 2012; Standard Life 2012; and Bulford 2012). The customers will be able to assess the service of the independent financial advisers (Heaney 2012; Standard Life 2012; and Bulford 2012). However, Heaney (2012) designed the changing role of the IFA under the new law, for instance

Claims against IFAs

Simon (2012) added that millions of retail investors in the UK are unnecessarily paying a huge commission to the IFAs for not to doing anything; for instance, 90% of the consumers in the retail investment market do not know that they are altogether paying £2.9 billion to the IFAs even they don’t take advice from them any longer. The banks, fund managers, and insurance companies who have sold their different policies, pension schemes, or investment bonds to the investors through the IFAs in the pre-RDR era, those IFAs are still getting trail commission at the same rate, some investors urge it as an unethical task and would like to get back their money from the IFAs.

Collinson (2012) explained that the organizations providing financial advice in the UK market protested this regulatory step arguing that 90% of the customers are paying only £25 per hour instead of £50 – £250 or 1% of the total investment volume if these charges are imposed on the customer they would certainly leave to engaging financial advisers. In response to the RDR, most of the financial institutes are reducing the number of their IFAs and decreasing their mass-market retail advice, for instance, Royal Bank of Scotland already dismissed 618 advisers, HSBC discharged around 700 advisers and Lloyds lockouts direct advice service for small investors. As a result, the financial advisory market of the UK has aligned with the vulnerable situation with 5.5 million financial service seekers with 86% qualified IFAs, a large number of commission-based salespeople, stock market financial advisers with major asset management groups are in serious threat with the regulation of retail distribution review (Clarke 2012; and Lansdown 2012).

The Citywire (2013) and Pinsent Masons (2013) reported that SRA18 the regulatory body of lawyers in the UK urges its members not to recommend their clients to the independent advisers but requested to forward to the restricted one, as a process of regulatory reformation, the lawyers may be trapped into to claim of negligence if they advocate for IFAs. The Law Society has given a clear explanation in this regard notifying that the solicitors have the chance to be twisted with the mis-selling scandals while the recommended financial advisers directly benefited by sales of a particular product at any means, the ill-equipped advisers could advise clients to a choice inferior product from their interest and motivation out of professional ethic.

Read (2011) pointed out that the mis-selling scandal of IFAs has been raising is a hazardous phase where HSBC bank has to pay £10.5 million penalties, the number of such shameful advice are endless among the British financial institutes due to ineffective endowment of regulatory framework during the eighties and nineties. In the penalty case, NHFA is an IFA working with HSBC; the ‘Age UK’ is a leading charity of the senior citizens that gained huge bribe around £22 million to refer its members to the NHFA for financial advice for long-term care fund of the olds. The investigation by the watchdogs of the FSA identified that NHFA has a sales relationship with HSBC for their financial products and it has strong practical managers who arbitrated to keep away from massive failure for future advice-seekers, when the scandal came into public views, the HSBC bank refused that they are not aligned with such unethical deals.

How Technology Could Assist To Implication of RDR

GBFR (2013) pointed out that the implication of RDR has aimed to bring transparency of the relationship among the investor, IFAs, and product producer, the most prevalent characteristic of the scheme is that service consumers have to pay IFAs for the advice that they get and the fees would be either upfront paid or by a negotiated commission on investment. The essence of RDR developed the understanding that advice is no longer available for free of cost, but the actual fear is that it has negatively impacted the UK savings gap and it is at the top all-time while the regulators have little anxiety with such market alignment. Such changing nature of the retail investment market would lead the IFAs to represent value-added services to compete with other IFAs, while the integration of the IT technology could provide enhanced opportunities to attract customers. IFAs could develop their dynamic website where they would be able to learn customer has needs and address them very specifically through their feedback and suggestion via the internet. The web portal would also provide an opportunity for IFAs to maintain consumer behavior analysis by engaging wealth management platforms and to keep in touch with the customers through automated messaging and fair explanation of service charges, with such value-added service the investors would think that they are with right IFA. By integrating wealth management software, IFAs could add more dynamics of value-added services where the customer would get independently to his account could view the status of his previous products, and could place an online order for any further new product.

Conclusion & Recommendation

Recommendations

This study would urge to implementing following suggestions to stabilize the retail investment market from the present vulnerable condition

- The House of Commons (2011) presented a dangerous scenario of RDR implication, the aggregate trail commission paid to the IFAs could be highest £1 billion per year, to protect this amount, FSA invested £500 billion of public money is monopolistic regulatory attitude without consideration, it is essential to reduce regulatory cost;

- Under the present vulnerable condition of the financial advisory market, this study would recommend the IFAs to undertake a comprehensive and fair analysis for their consumers to provide realistic advice to their clients with the full ethical standards without any bias and unfair monetary deal,

- It is also recommended that IFAs would be too attentive to improve their strength by developing professionalism and introducing innovative and value-added services (The Chancellor of the Exchequer 2012);

- This research would also suggest implementing ethical training for the IFAs for not to align with financial scandals, any further scandal would seriously destabilize the retained investment market;

- This research would also suggest integrating IT and effectual software for investment management that would assist in reducing huge costs;

- FSA use outsourcing service for its different research market study and other IT-related services

Conclusion

In the era of Information technology every individual has free access to information, why should pay for investment information, – there is no rational logic of conducting an RDR implication scheme for six years with billions of pounds of investment. FSA has just wasted huge public money for RDR implication, with very small investment, just developing a national web portal for all investment schemes with a competitive analysis of all products could easily achieve the objectives of RDR, and the investors and IFAs both would be facilitated to ensure their transparency from that portal. It is more significant to cut bulky investment for regulators, rather it would be more effectively engage that money for new job creation for the small IFAs and their employees who would lose their jobs due to RDR implication.

References

Abrego, 2012, IFA Centre publishes client-friendly guide to RDR. Web.

BBC 2011, How changes to independent financial advice affect you. Web.

BDO 2012, Research Into Adviser Charging Preliminary Findings: RDR Could Result In Higher Consumer Costs. Web.

Boffey, G 2011, Aviva Report: The Value of Financial Advice – June 2011. Web.

Brown, H & Murphy, E 2003, The Financing of Social Enterprises: A Special Report, The Bank of England, London.

Bruyn, T, S 1991, The Field of Social Investment, Boston College, Massachusetts.

Bulford, T 2012, The end of the IFA ‘long con’. Web.

Clarke, H 2012, A quick and simple guide to RDR from Octopus – Octopus Investments. Web.

ClearlySo, 2011, Investor Perspectives on Social Enterprise Financing. Web.

Cohen, L, Manion, L & Morrison, K 2007, Research Methods in Education. 6th edn, Routledge, New York.

Collinson, P 2012, FSA ban on commission-based selling sparks ‘death of salesman’ fears. Web.

Congdon, T 2009, How to Stop the Recession: a leading UK economist’s thoughts on resolving the current crises, Nesta, London.

Crown 2012, Financial Services Act 2012. Web.

Deloitte, 2012, The Retail Distribution Review (RDR) – Will The Changes Affect You?. Web.

Evans, P Cohen, S. & Power, 2012, Bridging the advice gap Delivering investment products in a post-RDR world. Web.

FSA 2004, Handbook development. Web.

FSA 2006, Advised and non-advised sales. Web.

FSA 2011, History. Web.

FSA 2012, Finalised guidance: Simplified advice. Web.

FSA 2013, Who are we? Web.

FSCS 2012, Questions and Answers. Web.

FOS 2012, About the Financial Ombudsman Service. Web.

Freireich, J & Fulton, K 2009, Executive Summary Investing for Impact Social and Environmental, Monitor Institute, London.

GBFR 2013, Can technology help to reduce the UK savings gap? Web.

Grange, B 2013, Just how much is financial advice worth? Web.

Heaney, K, 2012, The new approach to financial advice. Web.

Hill, K & Heaney, V 2010, Investing in Social Enterprise: the role of tax incentives. Web.

HM Treasury 2013, The Financial Services and Markets Act 2000 (Threshold Conditions) Order 2013. Web.

Hurman, N, & Costain, I 2012 Advice Gap Research. Web.

Hyde, D 2012, £40 or £200 an hour… what’s the right price for financial advice? Web.

Kissoon, A & Ealham, G 2013, Retail Distribution Review – an introduction. Web.

Lansdown, H 2012, Independent financial advice. Web.

Leung, W 2012, How to design a questionnaire. Web.

Lewis, M 2013, Financial Advice: When, How & Why to Get It. Web.

Malhotra, N 2009, Marketing Research- An Applied Orientation. 5th edn. Prentice-Hall, London.

Masons, P 2012, The RDR: advice services. Web.

Millers, V 2012, The Retail Distribution Review: how will it affect structured products? Web..

Morgan, J 2010, The cost of implementing the RDR professional changes. Web.

Mwenda, K, K 2006, Financial Services Regulation and the Concept of a Unified Regulator. Web.

Myddelton, H 2012, A new approach to financial regulation: draft secondary legislation. Web.

Neighbor, H. Ulrich, G & Milikan, J 2010, Money for Good Impact Investing Overview. Web.

ORC 2002, General Introduction To The Regulation Of Financial Services. Web.

Oxera 2009, Retail Distribution Review proposals: Impact on market structure and competition. Web.

Phillips, T 2012, Getting the right advice: Clear rules for financial advisors. Web.

Power, 2012, Bridging the advice gap Delivering investment products in a post- RDR world. Web.

Read, S 2011, Mis-selling scandal: Who can you trust? Web.

Ren, H 2006, An Investigation of the Demand for Financial Advice in China’s Retail Investment Markets. Web.

Saunders, M, Thornhill, A & Lewis, P 2006, Research Methods for Business Students. 4th edn, FT Prentice Hall, London.

Savvy, 2012, How much should you pay for independent financial advice? Web.

Sekaran, U 2006, Research Method for Business, John Wiley & Sons, London.

Simon, E 2012, Investors pay IFAs millions for doing nothing. Web.

Simon, M 2013, Would you pay £500 for unbiased advice? Web.

Standard Life, 2012, The new approach to financial advice. Web.

The Chancellor of the Exchequer 2012, A new approach to financial regulation: securing stability, protecting consumers. Web.

The Citywire 2013, Lawyers urged to only recommend independent financial advisers. Web.

The House of Commons 2011, Retail Distribution Review Fifteenth Report of Session 2010–12. Web.

Webb, S 2012, Just how much is financial advice worth? Web.

Worthstone 2011, FSI to Congress: Uniform Fiduciary Standard, SRO for Investment Advisers Critical. Web.

Wragge & Co LLP, 2013, The Role of Tax Incentives in Encouraging social Investment. Web.

Zikmund, W 2006, Business Research Methods. 7th edn, Harcourt Publishers, Orlando.