Abstract

The work ‘The Competitiveness of the Hungarian Economy from the viewpoint of Foreign Investors in Business Consulting Services’ is devoted to the peculiarities of the Hungarian economy. This issue id of current importance today, because I political and social situations in the countries of Eastern Europe.

According to a position of the Hungarian foreign policy the management of consequences of globalization demands the coordinated actions of the world community as a whole, and in particular – the developed democratic states. There is an imperative need in maintenance of regular dialogue and cooperation, expansion of rendering assistance in questions of globalization.

A great attention is paid to the business consulting services.

Background

In the beginning of 90-ies Hungary was quickly and without blood released from the domination of communistic system and has successfully created the operating parliamentary democracy and market economy. The change in political regime was accompanied by change of values in a democratic direction. Therefore the country, and together with it and foreign policy of Hungary have undergone the radical restructurings, there was an object in view of connection to commonwealth of the western democracies, to the organization of NATO and the European Union. Owing to the policy of the democratic governments followed one after another, achievements of the country and a wide political consensus Hungary in 1999 becomes a member of NATO, and in 2004 – the European Union. The new status defines a place of the Hungarian Republic and its political aspirations in the world – its foreign policy simultaneously serves interests of the nation and joint foreign policy aspirations of the EU.

Specifically Hungarian ethnic question

About the third of numerical structure of the nation belong to the Hungarian national minorities living owing to system of peace treaties in the end of the First World War outside the country in territory of the neighbouring states. These national minorities, despite of historical shocks, were able to keep the ethnic accessory, culture.

The European integration represents a historical opportunity of association of the Hungarian nation within the limits of the Europe. Thus, it is clear, that the Hungarian foreign policy, respecting with the standard international principles of protection of minority, supports aspirations of Hungarians living abroad to preservation of their unity, including and based on the coordination of will of the majority and minority aspirations corresponding the European spirit to autonomy. The improvement of position of minority, expansion of their rights and giving of the international status by it is important, characteristic for new foreign policy shape of Hungary aspiration.

Globalization

Hungary is touched by both favorable, and not favourable influences of this process. Hungarians also excite menacing to development of economic of the tendency, competitive struggle for the limited power resources, growing protectionism, an aggravation of the problems caused by poverty and an insufficient level of development. The events of the recent past by drama image confirm that a quickly extending epidemic or ecological accident is capable to shake the whole region.

Hungary – a member of the European Union: as the member of the European Union Hungary wishes to use in a full degree the opportunities which have increased owing to membership and carries out the duties connected with it. Hungary aims the deepening in integration, it is equal as well as to expansion of cooperation of community. Hungary was the first which ratified the Constitution of the European Union, is one of participants of formation of Joint foreign policy and policy of safety, and by virtue of it pays special attention to questions of development of attitudes with neighbouring countries. Hungary aspires to keep the achievements of the Union reached up to this moment, successfully functioning policy of commonwealth, and, simultaneously, supports the necessary reforms. The basic purpose is that the EU remained opened and capable to accept new members, and also promoted long-term safety of the country by increase of stability and well-being of our environment, as in narrow and wide sense of a word.

Hungary supports equal political, economic and cultural relations with the direct neighbours. From the European countries Hungary has the plenty of neighbours. Among them it is possible to find the EU countries-members and the countries which just about them, and also the states having various prospect of connection. Hungary is interested in democratic, in a vein of creation of market economy development of the southern and east neighbours.

The Central European regional cooperation is called to express the general regional interests within the limits of the EU. Especially strong communications are available with Austria and Slovenia with which Hungary carries out cooperation within the limits of Regional Partnership. Democratization, economic stability and achievement of the European level by the neighbouring countries, not being members of EU, are the important purpose of the Hungarian foreign policy. It is basic interest of policy of safety of Hungary, its economic and national-political interest. The extreme nationalism is denied, the national-ethnic hostility, being the basic destabilizing factors in this country and the environment. On the basis of developed in a Thessaloniki Programs Hungary renders the effective support of Serbia adjoining it and Montenegro, and also other states of the Western Balkans in achievement of the purposes of integration. Hungary also is substantially interested in democratic and economic development of the largest neighbour – Ukraine, therefore transfer of the experience helps and promotes occurrence for it in the future of the European prospect.

Hungary supports neighbours and the initiatives: rendering assistance to Ukraine within the limits of cooperation in the field of the international development, and within the limits of Segedskiy Process the assistance of Serbia and Montenegro appears.

Hungarian Membership in the European Union and the Alliance of NATO does not contradict Russia to be the strategic partner for Hungary. The purpose is to promote a practical embodiment during a life representing a basis of cooperation between the European Union and Russia of agreements between the EU and Russia about four spaces, to performance expiring in 2007, and accordingly, to the conclusion instead of it the new Agreement on Partnership and Cooperation of the EU – Russia. Possibly, owing to joint efforts and cooperation with Russia as one of defining players of world politics and the international community, it will be possible to find the answers to global calls of the century, such as the international terrorism, drug-trade much more quickly, the distribution of the weapon of mass defeat, or, for example, a HIV-infection, the bird’s flu, etc.

Russia within the limits of presidency in “Group of eight” can render the essential assistance in reduction of the most essential problems of the global world. Last years the Hungarian-Russian relations in all spheres of mutual relations, beginning from political dialogue at the highest level, through impressing results in the field of trade and economic cooperation up to long-awaited, both for Hungarians, and for Russians, many-sided and substantial actions of cultural seasons, develop with a great scope.

The United States take a special place in the system of the international relations. Hungary is connected with the USA with the strong relations based on the general values and unity of interests. Hungary considers important that, despite of global calls, attention of foreign policy of the USA to the Europe and hungarian region was kept since it is of one their components of maintenance of stability. From the Hungarian party it is necessary to carry support of the American and Canadian investments into the Hungarian economy, stimulation of scientific cooperation, expansion of sphere of public relations and contacts to long-term intentions between people.

Europe also has collided with the fact of the changes which have occured in the world. A part of those is the increasing importance of Asian-Pacific region in economy and the policy. Hungary also gives more and more attention to the relations with the Asian and Pacific countries. The purpose of the Hungarian policy in Asia is the deepening of economic cooperation and its distribution on all those countries located along Pacific Ocean which from the political and economic point of view is opened for cooperation. We give a special value to the development of relations with Japan and China owing to the place borrowed by these countries in the international relations and economy, and also volume of the bilateral trade turnover and foreign investments.

For last decade he Hungarian relationship with Australia have become stronger. It is pleasant, that both in Hungary, and in many Asian and Pacific countries the interest to cultural values of each other is observed. Hungary, being the participant of Joint foreign policy and policy of safety of the EU, since 2005 takes part in the ASEM-process – organized between the EU and ASEAN dialogue on the universal questions of Asia connected with calls in economic sphere, of social policy and policy of safety, at participation of corresponding bodies of both organizations.

For the last decades the countries of Latin America have considerably promoted on a way to democratization, market economy and public progress. Process of economic integration of the countries of region has begun. Hungary, despite of geographical remoteness aspires to strengthen trade and economic relations and interaction at realization of new projects of development.

In Africa the relationship of Hungary with the states have the economic character. Expansion of relations can be motivated by the use of the new opportunities which have presented in this area.

Maintenance of the greatest safety for citizens of the country belongs to the aspirations of the Hungarian government. In the global world threat the safety does not know borders. Therefore Hungary provides the safety together with the allies by strengthening safety of the international community.

Hungary is a member of NATO and guarantees the safety by the participation in the activity of alliances. NATO is considered as the major forum for the dialogue concerning transatlantic policy of safety and cooperation and support aspirations to repulse calls of a world scale, and also its further expansion in case candidates on the introduction accept the general values, and also satisfy to the criteria, being with conditions for preparation for membership. Hungary supports strategic partnership between NATO and the European Union, participates in realization of the European policy of safety and defensive policy, and also during creation to 2007 of joint Italian-Hungarian-Slovene fighting division.

The distribution of the weapon of the mass destruction, the organized crime not recognizing borders, occurrence of the incapacitated states represent a call of threat of new type for all countries of the world. Struggle against terrorism became a priority overall aim of transatlantic cooperation. As a member of the United Nations, the European Union and NATO Hungary is aimed to strengthen the regional and global safety. The Hungarian soldiers and civilians bear service in the structure of the missions which are carrying out the activity within the limits of the United Nations, the European Union and NATO in many parts of the world, in Kosovo, Bosnia-Herzegovina, Afghanistan, in territory of Iraq.

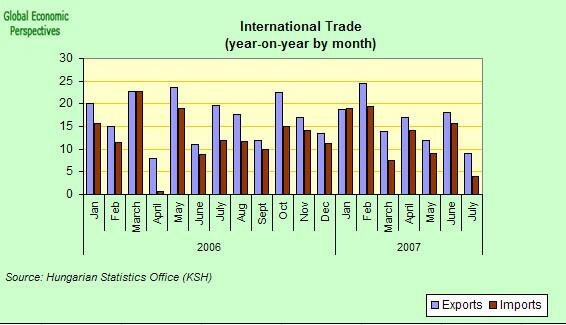

The Hungarian economy connects to system of the world economy, and within the limits of it is to economic system of the Europe by means of world trade. The development of the Hungarian economy, with a high degree of an openness even in the international comparison, is defined by external conditions. The global economic growth, quickly developing world trade represent favorable external conditions for the Hungarian economy. As a result of steady growth of the foreign trade turnover has considerably extended assortment of the goods offered in the Hungarian trading network, and the cancelling of the foreign trade duties has created opportunities for more significant presence of the Hungarian goods on foreign markets. The volume of the foreign trade turnover for one decade has increased three times therefore on a boundary of a millennium it has made 150 % of gross national product, that is a parameter of extremely high external economic openness and in the international plan.

The major economic partners of Hungary are the countries of the European Union, to them goes about 80 % of the Hungarian export. In trade with these countries at Hungary the significant active of the foreign trade balance is observed. The largest foreign trade partners of Hungary are: Germany, Austria, France, Italy and the Great Britain. The structure of the Hungarian export is characterized by prevalence of an industrial output, and within the limits of its leading position borrows export of mechanical engineering. Relative density of machines and automobiles in total amount of the Hungarian export borrows 60 %, production of a manufacturing industry makes 28 % from total amount of export where the pharmaceutical and chemical industries first of all are allocated. Traditionally Hungarian export of the food-processing industry makes 6 % from total exports while the cumulative share of energy carriers and raw material hardly reaches 5 %. Owing to the introduction of Hungary into the European Union have got stronger the international trading relationship of the country. The wide system of the international trading contracts of the European Union assists also to the Hungarian enterprises. The Hungarian firms aspire to use properly advantages of this system, both at an inner-union level, and in the markets outside the European Union. For last year the Hungarian export for limits of EU has increased in the rates considerably exceeding averages. Therefore Hungary considers the countries of Asia, Pacific region, Persian gulf, Mediterranean, and also the Latin American countries as long-term partners, the opportunity of cooperation with which enterprises owing to transformations to system of the world economy grows.

For the last one and a half decades Hungary has turned in favourite investors a place for direct foreign investments. Alongside with a geographical position of Hungary in the center of region and presence in its territory of the largest international highways it became possible first of all owing to and to that Hungary has a significant amount of well qualified labour and corresponding rules of the European Union the transparent investment environment. Not in the last instance and favorable conditions of a life, and cultural values of Hungary do attractive a life in it for foreigners. Occurrence of the large foreign enterprises considerably promoted the modernization of the Hungarian economy, maintenance of dynamics of its growth, preservation of old workplaces and creation new. The inflow of the functioning capital within was considerably accelerated, that promoted that the Hungarian economy has risen on a strong path of growth. Since change of a social regime the volume of direct foreign investments into Hungary by the end of September, 2005 has reached 53 billion euro. And falling for the soul of the population the share of the operating capital in Hungary invariable is the highest in the Central-East Europe region. The greatest share of foreign investments in the form of the operating capital goes to competitive processing branches (manufacture of automobiles, electromachines, the chemical industry) and in sphere of services.

On a boundary of millennium in the separate countries entered the new stage of dvelopment: at invariable defining value of import of the capital export of the capital begins also. In this respect Hungary plays the leading part in region: the volume of investments of the Hungarian capital abroad for today exceeds 6 billion dollars, investments concentrate in East-European direction.

Since 1989, Hungary has started to prove as strong, completely functioning market economy. After the strict reforms in 1995 – 1996, meaning innovations in the field of privatization, liberalizations and attraction of foreign investments, the economy of Hungary of the beginning noticeably to improve: the share of export constantly grows, unemployment decreases, the rate of inflation is stably reduced and the number of investments into the country increases. As a result of these reforms Hungary – now one of quickly developing and most open economy of the Europe. An economic situation as well as the short-term forecast practically for all countries with transitive economy now is better, than ever during the last decade. These countries owing to influence of a great demand on import the Western Europe experience export boom which feeds growth their gross national product. Hungary continues to show strong economic growth. Investments into Hungary make more than 23 billion dollars, since 1989. The external duty of Hungary has been subject to sharp fluctuations. In 1998 the external duty has increased in comparison with 1996 on 6%, in 1999 on 1 % since 1998 and in 2001 on 2 %. At the same time, despite of a low level of dynamics of a duty in percentage in relation to gross national product the given parameter in many respects exceeds similar parameters in neighbouring countries and makes according to 2002 62 %. According to 2003, the Hungarian sovereign debt was second-largest among the countries of the Central Europe with transitive economy. At present the external debt of Hungary makes nearby 29,4 billion US dollars.

Within two decades after the end of the World War II Hungary has turned from mainly agrarian country to the industrially-agrarian country. In 1968 Hungary has started carrying out of the economic reform known under the name “the new economic mechanism”. The greater autonomy during manufacture and decision-making on sale and selling has been given to the industrial and agricultural enterprises; trade with the western countries has considerably extended; the domestic prices approached with the prices in the world markets more and more, and it was given a wide freedom to people to be engaged in all kinds of fine private business. In 1990 Hungary has begun the transition to free market economy. Some important economic measures have been accepted in the beginning of 1990 year, however the main reforms have begun in 1995 when the Minister of Finance Lajosh Bokrosh has presented the radical program. The new government has started introduction of market economy by the reduction of a share of a state property, increase in a share of foreign capitals in investments and to removal of obstacles for clearing the market and introduction of the open competition. To 1994 the share of a private sector in an internal total production has increased up to 45 %, and direct foreign investments have increased from 200 million up to 5 billion dollars. However sharp transition has caused the significant budgetary deficiency and has put many people on a side of survival. In 1995 after introduction of reforms by Bokrosh the promotion of Hungary on a way to market economy has typed rates. The growth of foreign investments which made a half of all foreign investments into the countries of former east block proceeded. In 1995 to Hungary it has been directed more than 4 billion dollars of direct foreign investments (FDI), in 1996 and 1997 3,6 billion dollars have been invested.

Hungary is the industrially-agrarian state. The infrastructure, the educational level, qualifications, social mobility and an innovative susceptibility of the population is rather high developed. The most important natural resources of Hungary are fertile grounds and water resources. More than half of grounds of the country – arable, the climate also favours to development of an agricultural sector. The deposits of mineral energy carriers are rather modest: high-quality coal extract in Comlo, brown coal in Northern mountains (near Ozd) and in Transdanubia. The most significant mineral resources are bauxites (one of the richest deposits in Europe), manganous ores (mountain Bakon), copper and zinc ores. The extraction of the lead ores, uranium, molybdenum, and dolomite is conducted. As Hungary aspires to reduce the dependence on import of oil, a priority direction in the development of power the atomic power stations receive.

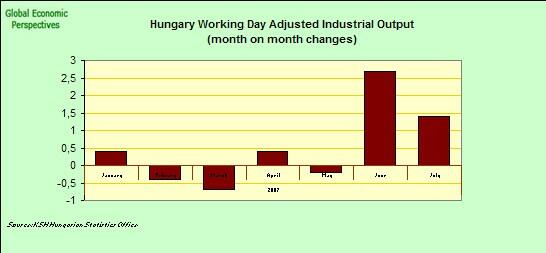

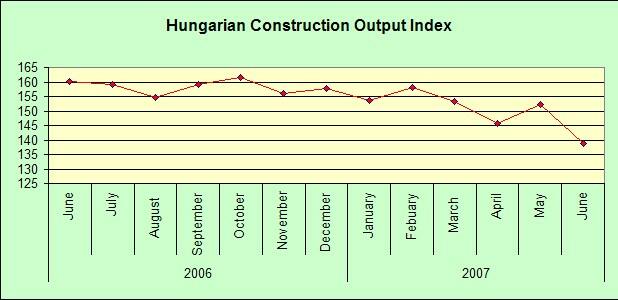

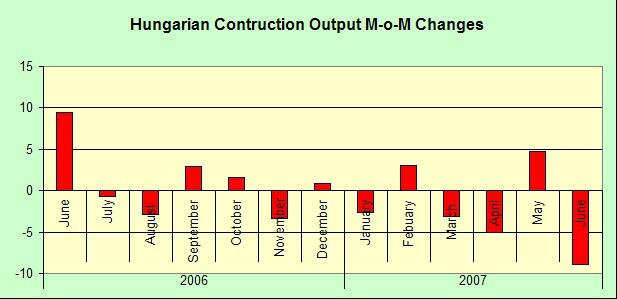

For 10 months of 2006 of industrial outputs has increased for 1,8 % in comparison with the last year. The most significant growth (2,6 %) was observed in the field of a process industry. The increase in manufacture is received due to export. Export of goods let out by the industry, has increased for 4,5 %, and internal realization was reduced to 0,1 %. The leading part in growth of export realization of industrial production the mechanical engineering has played. The chemical branch has appeared the most competitive among traditional industrial sectors: to the middle of 1990 growth of its manufacture has made 25 %. There were also new perspective branches: manufacture of means of telecommunications and the automobile equipment. In the first 10 months 2002 in a building industry rapid growth is observed. Manufacture in a building industry has increased for 21,5 % in comparison with the last year. The basic role among sub-branches growth of productivity of underground and construction has played. Significant capital investments in an infrastructure of transport and communication, and also municipal networks have been carried out, there was an acceleration of construction of industrial and trading objects and shopping centers. While in the beginning of 90-ies years solving share in a building industry was made by the large state enterprises, since 1994 more than 60 % of manufacture are necessary already on the companies which are being the domestic joint-stock property. The share of the foreign capital in a building industry has exceeded 1/3, and in the field of manufacture of building materials makes 70 %.

One of the major branches of the Hungarian economy is tourism which makes about 10 % of gross national product. The material resources of tourism are more than 140 thousand places in objects of accommodation of various categories. In tourism about 300 thousand people are involved that makes population of 7 % of population. In 2001 the profits from tourism have made 4,4 billion euro, and the balance has made +2,9 billion euro. Hungary receives from above 30,7 million foreign visitors, and for 11 months of 2006 – 29,4 million. The average duration of stay of foreign tourists in the country is 3-4 days.

In Hungary are grown: wheat, corn, a sugar beet, sunflower, an onions, cucumbers, pepper. Manufacture of wine is developed, basically table wines, popularly Hungarian Tokaj wine (from slopes of mountain Tokaj) are made. The industry on processing the agricultural production is developed: vegetable canned food, compotes, juices, a canned meat. In comparison with the last year for 10 months 2006 the realization of agricultural production was reduced to 5 %. The number of cattle has increased for 3,5 %, and the livestock of pigs and birds was reduced accordingly to 11,1 % and 6,5 %. The realization plant-groing and gardening production was reduced. The realization of fruit – on 13,8 % at the same time has increased, and grapes and wine – was reduced to 5,4 %. The export of food-processing industry has increased for 2,6 %.

More than a half of national income is given with foreign trade. More than 2/3 of export is carried out by the EU countries: Germany, Austria, Italy, the Netherlands. The structure of export: production of mechanical engineering of 51,9 %, other industrial goods of 32,7 %, the foodstuffs and production of the food-processing industry of 10,5 %, raw material 2,9 %, energy carriers and the electric power of 1,9%. The structure of import: the production of mechanical engineering of 46,5 %, other industrial goods of 40,2 %, energy carriers and the electric power of 6,6 %, the foodstuffs and production of the food-processing industry of 3,7 %, raw materials 3,0% the Volume of domestic trade has increased for 10 months 2002 for 11,4 %. Within a year rate of growth was reduced. In total amount of retail trade the greatest share (31,4 %) was made with articles of food. The volume of direct foreign capital investments in 2006 has made 2,4 billion euro. The sum of direct foreign investments together with the credits given by investors for joint ventures (joint venture) and a material payment in the constituent capital of the joint venture to the beginning of 2002 has come nearer to 28 billion euro, and the quantity of the enterprises with participation of the foreign capital exceeds 26 thousand. In the end of 2006 in Hungary per capita it was necessary 2340 euros of foreign investments. 45 from 50 largest multinational companies of the world already are present in the Hungarian market. They create one third of gross national product of Hungary and will involve 43 % of the labour borrowed in the industry. Most of all the capital has come from Germany, the United States of America, France, Austria and Holland, powerful investors are Israel, Switzerland and Italy. The largest capital investments have been realized in the field of communication, electric power industry, gas and water supply, a process industry. The essential investments of the foreign capital were carried out in financial and bank sectors.

In Hungary after the change of a social order from year to year there was an essential increase in quantity of economic societies and other private businesses. Now in the country only 800 000 economic organizations work. In Hungary the economic societies, cooperative societies, private businessmen, and also the Hungarian branches of businesses of a foreign site use the right to conduct enterprise economic activities. Among the operating economic organizations the 96,5% are microbusinesses with the number less, the share of small businesses makes 2,7 %, the average businesses of 0,6 % while the large enterprises make only 0,2 %.

Some kinds of the commercial organizations operate now: general partnership, special partnership, a society with limited liability (Open Company) and joint-stock company. After the signing of the constituent document, having secured with departmental sanctions necessary for the beginning for activity, the commercial organization begins the existence from the date of registration in judicial body (which carries out the registration and supervision of activity of the commercial and noncommercial organizations) on the location of firm. In parallel with it the organization should be registered in tax centre and in the centre of social insurance.

From all the forms of the commercial and noncommercial organizations in 2006 the most popular are special partnerships (47 %), behind them follow the Open Company (40,4 %) while the joint-stock company represent only 1,1 %. From the general number of the registered organizations 96,6 % are the microenterprises (with number of workers less than 10 persons), the share of small enterprises (from 10 up to 50) makes 3,4 %, the average (from 50 up to 200) 0,9 %. The large enterprises (more than 200) make only 0,1 %.

Since 1999 in Hungary the individual businessmen can be not only the domestic physical persons, but also the citizens of the countries-members of the EU. The local administration on the basis of the corresponding documentation and necessary departmental sanctions gives out to the applicant the certificate for the individual business. The state gives the number of the current account for social insurance, tax and statistical codes. Foreign policy aspirations of Hungary in world aspect are directed on maintenance of the world, safety and well-being of the nation, success of the European integration, on maintenance of kind attitudes with neighbours and participation in the international cooperation pursuing the purposes of safety and reflection of global threats.

Hungary, with the thousand-year statehood is the average country with 10 million population, not rich with natural resources. Hungarians which close relatives in the Europe are Finns and Estonians are known for the resource, creativity, and are proud of the hospitality, readiness to receive visitors. The historical experience of the Hungarians promotes their openness, readiness for cooperation and mutual understanding – these values characterize participation of Hungary in the international community.

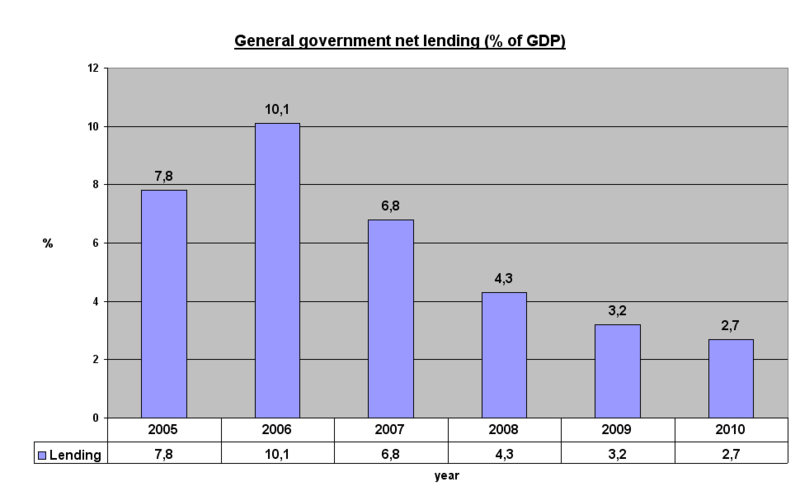

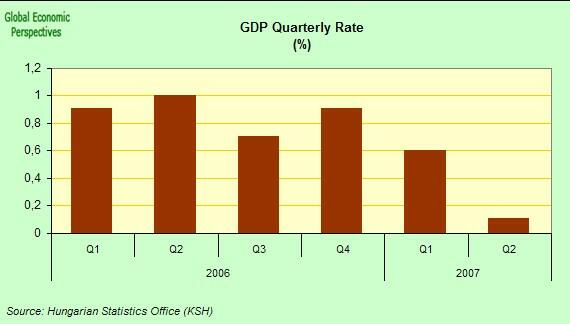

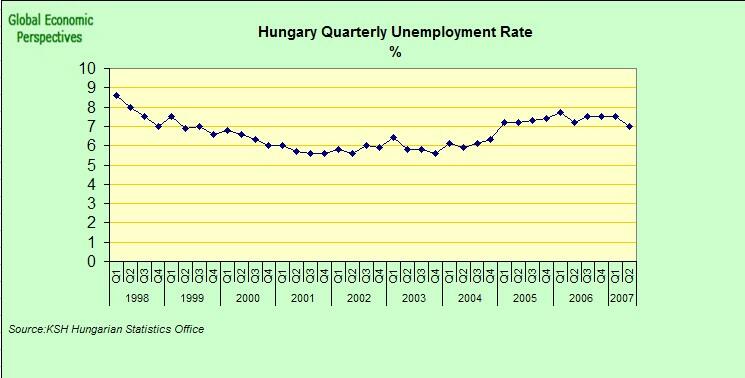

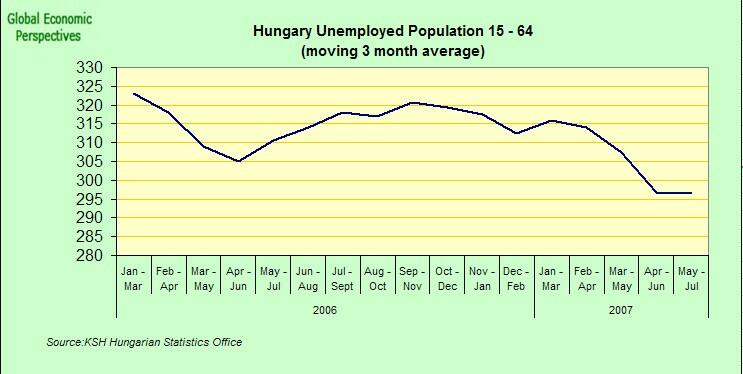

The important problems for transitive economy of Hungary were inflation and unemployment that lately have decreased essentially. Inflation in 1998 made 14 %. By 2000 it was possible to lower to 10 %. For 2 years inflation has decreased almost for five percent and in 2002 has made 5,3 %. For 2005 in Hungary inflation has made 3.7 %. The economy of Hungary is characterized by constant budgetary deficiency. In 1998 it made almost 5 % from gross national product. By 2003 it was possible to lower budgetary deficiency to 3,3 %, but to 2005 it has again increased up to 6,5 %. A key problem now for Hungary is the decrease in budgetary deficiency from present 6,5 % of gross national product up to 3 % in 2008. Gross national product for 2004 made 149,7 billion dollars, though in 1998 only 75,4 billion US dollars. Gross national product per capita (according to 2005) makes 15900 dollars. In 1995 it made 7550 dollars per capita, thus for 10 years the gross national product has grown for 8350 dollars, almost twice. For 2005 the real growth of gross national product makes 3,7 %. Distribution of gross national product on sectors looks as follows: agriculture – 3,9 %, industry – 30,9 %, services – 65,3 % (data of 2005). From approximately 10,01 million people, living in territory of Hungary, labour of the country are only 4,2 million, 8 % of which are involved in agriculture, 27 % – in industries and the remained 65 % in services. The Rate of unemployment according to 2000 has made 5,8 %. To 2005 it has approximately remained at the same level, about 6 %.

The income of the budget of 2000 has made 13 billion dollars, while the charge 14,4 billion dollars. The important branches of economy of Hungary are metallurgy, building materials, food stuffs, textiles and motor industry. The level of growth of the industrial industry makes 3,1 % according to 2002. Also the increase in export of an industrial output which in 2003 made 18,3 % of all export of Hungary is observed. It has been caused by the improvement of labour productivity of workers (from 9,9 % up to 16,7 %), and also with decrease in a rate of unemployment to 5,8% in 2002. Some areas of the country, especially the East and rural areas, suffer from is disproportionate high rate of unemployment and slower economic growth. The government has taken steps to raise incomes of the population, increasing pensions, the minimal salary and various privileges for families and students. The real wages have increased for 6,7 % in 2005. The Rate of inflation was reduced from 18,4 % in 1997 to 5 % in 2003. The Rate of inflation in 2005 made 3,7 %. In 2003 the industrial sector made 77 % from all industrial production, 57 % from internal sales and 94 % from industrial export. The output in industrial sector has increased for 18,3 % in 2003. The export of Hungary is equivalent to 60 % of gross national product. Approximately 86 % of export of the country in 2004 have been directed to the countries of the Organization of Economic Cooperation and Development and 74% to the EU countries. Since 1989, the private sector has increased from 20 % up to 80 % of gross national product.

From the resulted above data it is possible to imagine full enough picture about economy of Hungary. Despite of problems of inflation and unemployment, in economy of Hungary stable economic growth is observed. The basic priorities of economic policy in the country for today are: restoration of the order in public finances, increase in rates of growth of productivity and decrease in chronic external deficiency of the country.

It is possible to make a number of conclusions of a general characteristic of the country, its social and economic development:

- First, the favourable geographical position of the country in the Central part of the Europe promotes its economic development. The factors favorable development of the country are: rather warm climate, good fertility of soils, and also the presence of hydrothermal sources.

- Secondly, the state system of Hungary facilitates ways of its integration with the boundary countries that favorably influences a national economy.

- Thirdly, it is necessary to note, that there are both favorable, and adverse factors of economic growth of the country. Nevertheless, the action of he last factors is considerably blocked by effect of influence of positive factors. It proves to be true high rates of growth, both separate sectors, and all economy as a whole.

Now the economy is directed on economic growth, there is a growth of quantity of plants and factories, the number of employed increases, rates of inflation decrease. Thus, it is possible to speak about successful development of the country last decade.

It has historically developed, that Hungary serves as a crossroads of trading streams in Europe. Dividing borders with the developed EU countries in the West and developing countries in the south and the east, Hungary represents not only the export market, but also the central point of deliveries in region. Though Hungary has steady trading communications with the European neighbours, the United States remain the fifth on size the trading partner. In 2003 Hungary has moved from 50 to 48 place among the largest trading partners of the USA. Commodity circulation of Hungary in 2002 has reached 65,3 billion US dollars. Export has made 31,4 billion dollars, while import – 33,9 billion dollars. The negative balance of trading balance in 2002 has made 2,5 billion dollars.

In 2004 57,6 % of export of Hungary is the export of production of mechanical engineering, on other manufactures – 31,0 %, energy carriers and an electricity – 1,9%, the foodstuffs and food – 7,5 %, raw material – 2 %. As to import 51,6 % are necessary production of mechanical engineering, the other industrial goods – 35,3 %, energy carriers and the electric power – 8,2 %, the foodstuffs and the food-processing industry – 2,9 %, raw – 2,0 % (2001). The basic importers are: Germany (26,4 %), Italy (8,3 %), Austria (7,9 %) and Russia (6,8 %). In external commodity circulation in January, 2004 the basic trading partner of Hungary was Germany, volumes of import in which have made 674,9 million euro, while export – 920,8 million euro. The general trade between the United States and Hungary has exceeded 3,9 billion dollars In 2004, that on 13 % is more than volumes of 2003. Volumes of export of the USA to Hungary have increased for 17 % while volumes of the Hungarian export to the USA have increased in turn on 9 %. According to the Hungarian statistical data for 2004, the USA – the fifth on size the export market of Hungary conceding the positions only of Germany, Austria, Italy and France. So, apparently from resulted above data, foreign trade of Hungary is focused on cooperation with the western developed countries (the USA and the EU). The given fact testifies to intentions of the state to strengthen the positions in the world market of the goods and services. Very low share of raw material and energy carriers in export of Hungary speaks about a high level of development of economy and about comparative independence of the country of fluctuation of the prices for raw material in the world, small states so dangerous to the majority.

The place of the country in the international exchange of technologies cannot be considered separately from its economic development. The present stage of economy of Hungary forces the Government of the country think of preservation of low rates of inflation, decrease in size of budgetary deficiency, and also to allocate means for scientific and technical progress. As the world practice, only shows the countries, seriously engaged highly technological innovations and capable to deliver on the market the high-intellectual goods, can be considered successful. Having considered that fact, that on a world scene the competition between the countries is very high, the governments should not only create favorable conditions for development of a science, but also development of technologies. Realizing that fact, that modern economy of the XXI-th century are based on knowledge, the government of Hungary has decided to undertake attempts on a way of becoming of such economy. According to data, Hungary is in the list of the first 6 countries, capable to construct new intellectual economy and a society.

In connection with successful development of economy of Hungary, many multinational companies have placed the research centers in territory of the country, in particular in the field of a pharmaceutical industry, information technologies, motor industry and telecommunications. During 1998-2004 the number of the research centers has increased from 258 to 496. In connection with the economic growth caused by connection to EU, and a high level of foreign investment the market of information technologies of Hungary has grown on 8 % in 2001 and on 8,9 % in 2002. This figure invariable grew, making 10 % in 2003 and 12 % in 2004. Expenses of the government for new information technologies have made on various data 175-210 million dollars in 2003. Hungary has already attracted the attention of many investors on behalf of the largest companies. Company Motorola has opened in Hungary branch on researches and development with staff in 400 persons, and Nokia has opened the similar organization with staff in 500 persons. Many of the vacancies are occupied by the Hungarian experts.

In Hungary there is a surplus of skilled programmers and engineers which can work for one eighth that pay to their American colleagues. There are also other advantages – an opportunity of maintenance with good habitation, loyal to foreign investors the legal environment and economic-geographical position, convenient for expansion on the markets of other countries of the East Europe. The purpose of Hungary is to outstrip neighbours (Poland and Czechia) which too aspire to become the centers of high technologies Central and the East Europe. Hungary conducts active trade in computers. In 2003 the quantity of the sold personal computers in Hungary made 292992 units estimated in 274 million of dollars, that on 10,1 % more than in 2002. Trade marks led by the USA as the leading supplier make approximately 60 % of all computer sales. According to 2004 they take following positions: Compaq (20,4 %), IBM (12,0 %), Hewlett – Packard (8,2 %), Alba comp (6,9 %), NEC CI (4,3 %), Dell (4,4 %), DTK (3,4 %), Fujitsu Siemens (3,1 %). At the given stage Hungary experiences the investment boom. Advancing all other branches to Hungary rough rates develop high technologies. The divisions in Hungary have opened Nokia, IBM, GE, HP and other giants of high technologies.

In the sphere of economic growth the provided dynamics of gross national product has made 4 % that was a little bit above in comparison with the previous years. The advancing rates investments increased, export of goods and services extended, the manufacturing industry quickly developed. The parameters financial equation of the Hungarian facilities have improved its competitiveness has raised. The positive shifts in the field of improvement of financial balance and increase of competitiveness have been reached in the big degree due to a suspension of the further increase in real incomes of citizens, and also owing to artificial maintenance of the overestimated rate of national currency, that created preconditions for the intensive inflow of “hot” money.

In the field of the euro Atlantic integration the basic efforts of the Hungarian government have been concentrated to end of preparation for the introduction in 2004 in the European Union, and also on the subsequent adaptation to membership in this organization. Before the expansion of the EU documents on end of negotiations between the Russian Federation and Hungary within the limits of operating working group on preparation for the introduction of Russia in the World trading organization have been signed. One of the most vital issues for Hungary after its introduction into the European Union has appeared performance of rigid requirements on maintenance of economic equation.

The states which have joined the European union use a “sparing” mode of a transitive stage since 2007. Corresponding requirements will be shown to Hungary, including the use of sanctions at their non-observance. The specified circumstances in addition the push the country leaders to purposeful restoration of financial balance of national economy.

Research Objective

- description and analysis of a phenomenon, finding out new information about the subject;

- outlining the information concerning the subject and presenting a new synthesis of this information through literature survey, interviews, or corresponding methods;

- presenting and verifying the hypotheses concerning the research subject ;

- solving the research problem; presenting the alternative solutions; presenting the validity criteria for the alternative solutions; prioritizing the alternative solutions; further development of one or several solutions; identifying alternative concrete solutions and evaluating their universal applicability; presenting risk analysis for alternative solutions and a concrete action plan.

Research parameters

Speaking about the research parameter, it should be mentioned that there are many questions to answer, because the economy of Hungary is not stable yet and requires many amendments. Though my target is to define the level of competitiveness from the point of view of consulting serviced that is done in the part ‘Research Objective’.

The hypothesis I’m going to prove is the high competitiveness of the Hungarian economy.

The structure of the research

The research consists of the abstract part that gives a general view of the work. The next part – introduction includes the state of the problem for today and suggests some possible solutions.

The literary review contains some points of view to the problem and suggests some possible solutions taken from the original sources: books, journals, and internet recourses.

The research contains conclusions and appendixes. The materials represented there were used for the research.

Literature review

By the present time Hungary has created the economy of the open type completely corresponding norms of the international commercial law. Hungary is the member of WTO (from 1995). The total sum of the foreign capital which has acted to Hungary from1989 to 1998 has made 20 billion dollars It is more than 50 % of all foreign investments directed to the regions of Central and Eastern Europe. According to the National Bank of Hungary from, total volume FDI for 2006 has made 1,674.8 million dollars thus Germany is the second, after the Netherlands, the largest source of investments, accordingly – 446 million dollars and 492,4 million dollars, the USA take the third place with volume in 197.1 million dollars, then the Great Britain (102.3 million dollars), Austria (67.9 million dollars), France (59.8 million dollars).

It is necessary to note, that about 70 % of total volume of FDI in 1999, and it is 1,169.2 million dollars, has acted from the countries-members of the European currency union. In general the share of the countries-members of EU in the total volume of FDI has made 76 % that corresponds 1,277.8 million dollars.

Considering the distribution of investments on branches, it is necessary to note, that the most significant share from the general number of investments is directed to the industrial sector of Hungary, to be exact, in mechanical engineering, to the electrical engineer, electronics – up to 30 %. Now this sector gives more than 40 % of all industrial production of Hungary and 60 % of export to the countries EC.

At the second place on volume are investments into the enterprises of communication, on the third – the investments in the real estate. Investments into construction which have recently grown, however their share in the sum of all investments to the Hungarian economy makes only 3 %.

The FDI can come to the country in the various forms: it can be contributions to construction of the new enterprise, the basis of joint venture, investment of expansion of a corporate network of the enterprises or privatization. Privatization has rendered significant influence on all industrial structure of the country, becoming also a source of large receipts in the budget. Due to inflow of the foreign capital the government of Hungary manages to cover constantly existing deficiency of current clauses of the balance of payments. So, according to data of Ernst & Young the volume only direct foreign investments into Hungary has made 180 % of deficiency of the balance of payments. According to the Hungarian national bank, in 2004 the total volume of the foreign capital which has acted in the country, corresponded 2.631 billion dollars, that substantially surpasses annual deficiency of the balance of payments which has made 2.076 billion dollars. For today about 40 % of the industry of Hungary is in hands of foreign investors.

The analysis of structure of foreign capital investments shows the, that after transnational corporations (30,26 %) the highest share in total amount of such investments belongs to the Dutch companies (25.48 %) that answers historical traditions of the Hungarian economy. The important role is played by the Americans (13,33 %) and French (8,99 %) investors.

Greatest volume is necessary on the large American companies, such as Ameritech International, General Electric, General Motors, US West, Alkoa. For today in Hungary the quantity of the companies, the owner or which co-owner are German firms, totals some thousand while the companies of the USA, having concentrated on large business, are co-owners of 400 enterprises. According to last research lead in the beginning 2000 German- Hungarian commercial and industrial chamber (DUIHK) which within seven years traces a situation among the German companies operating in Hungary, one of acute problems for their development for the first time had been named lack of qualified personnel.

Charges also have increased on 22 %. The last is the reason of that many German companies search for an opportunity to transfer the most expensive manufactures to the east and the south of the country. More than 1/3 of total amounts of industrial production of Hungary are necessary on mechanical engineering, thus almost 40 % of total amount of machine-building manufacture production of motor industry (makes engines, accessories and the electronic equipment for cars). The basic volume of foreign investments has been directed to this branch. In Hungary there are branches of such giants of motor industry, as Ford, General Motors, Opel, Suzuki.

However, despite of all this stunning success, it would be desirable to ask – and what does actually Hungarian economy represent today? On a background of intensive growth of last years of the Hungarian industrial export and constant increase in volume of industrial production which are provided exclusively with activity of the multinational corporation, on internal industrial as actually and consumer, the market growth is very insignificant. Privatization in the country has been lead resolutely and quickly. Result of an openness of process for foreigners became that the foreign capital has selected Hungary as the jumping-off place in region of CEC, and for today from 50 largest multinational corporations 35 are located in the country. The viability of the Hungarian economy is also provided with other participation of the foreign capital. That fact is characteristic also, that today the most consecutive supporters of the further liberalization of trade in CEC are transnational corporations for which opening of the markets of region became a component of investment strategy.

Hungary, as well as region of CEC became some kind of arena of partnership and a competition between the USA and Germany. In an arsenal of Germany there are on advantage the economic mechanisms which it uses for an establishment of own domination in region. Always actively supporting promotion of the western institutes on the east, Germany has concentrated the efforts to creation on the borders of group of the states (Hungary belongs to their number also) which will follow in a waterway of its economic policy. By virtue of historically developed reality Germany has closer communications with Hungary; therefore arrival of the German capital to the country was natural process. During political-economical transformations for the last years there was a cardinal reorientation of foreign economic relations of Hungary, first of all to Germany. Last for today strongly borrows position of the leading trading partner of Hungary and in the lead on volume of capital investments. Now the German capital is present practically at all strategically important branches of economy of Hungary. The economic conjuncture in Germany now is the defining factor for financial-economic development of Hungary. Besides it, Germany considers Hungary as jumping-off place for an output on the markets of the Southeast Europe.

For today the USA are still interested at the presence and leadership at the Europe and fastening of such model on continent for long enough term. It is one of the main reasons of their interest to the region of the Central Europe, and Hungary in particular. Thus military-political levers of influence are priority. Nevertheless, not wishing to admit absolute leadership of Germany in economic sphere, the United States fix also the economic positions in the market of the Central Europe. The transfer of manufacture to Hungary has allowed the American companies to reduce the price of cost of let out production and to expand its commodity market. And the introduction of Hungary and other countries-applicants into the EU will lead to easing of mechanisms economic are sewn up, the general liberalization of the market of the European Union and consequently, will provide free movement of the American goods and services in territory of region.

The activization of activity of the American companies in the east of Hungary where one of the largest transport units of continen is located, has for an object an output on the markets of the East Europe, and in the long term – Russia. At the same time for today not all economic requirements of the European Union are achievable for Hungary. There are the problems connected with development of ecologically pure manufactures and carrying out of pension reform, there is opened a question on development of an infrastructure and a transport network. One of the sharpest and stubborn problems still has an agricultural production and manufacture of food stuffs – spheres, in which Hungary traditionally played one of the leading parts in the world market.

In order to retain their competitiveness and dynamic growth, Hungarian enterprises are required to apply up-to-date technologies and introduce cutting edge processes. That is why people are looking for the world-class solutions to be competitive on the new European market or any part of the world. Deloitte offers such solutions through its experienced Hungarian and foreign consultants, thus ensuring the use of best industrial practice also in this region.

This specific expertise gained in the areas of several industries: financial institutions, public utilities, telecommunication, industrial production and public administration serves as a basis for their specialized management consultancy services.

Hungary is Europe’s 11th most attractive target for foreign investors according to the latest European Attractiveness Study commissioned by Ernst & Young. Having lost a significant portion of its attractiveness to Asia, Europe still remains the premier destination for foreign direct investments (FDI), and that, within the continent, central Europe is gaining importance.Ernst & Young’s annual survey shows that the top investment location in 2006 was the UK in the amount of projects launched, and Poland in the amount of jobs generated. The analysis finds Hungary in midfield both with its 108 newly launched projects (11th position) and 10,906 jobs generated (seventh place).The study showed that central and eastern Europe was the third most attractive region in 2006, behind top achiever western Europe and having lost second position to China for the first time. Europe’s relative ability to attract investments altogether dropped by 13%, in spite of the fact that both indexes of the FDI hit new highs in the continent. “Compared to the actual numbers it is more important to know that, regarding the ratio of FDI per capita, Hungary is leading in the region,” secretary of state Géza Egyed of the Ministry of Economy and Transport commented on the survey. The key contributors, to whom Hungary primarily owes its position, are Germany – with 30 projects, the country’s largest investor – and the USA (with 28 projects). They are followed by other investor countries with significantly fewer projects: Japan, Austria, and finally the UK and France (seven and four projects each), adding a bit of variety to the FDI landscape.In Hungary, 10,906 new jobs were generated by foreign investments in 2006, which represents a 9.7% increase on 2005. Nearly two thirds of the respondents said that they felt the attractiveness of central Europe would increase.”The most important fact we’ve learnt from this survey is that, after the continuous decrease in all major indexes concerning the ability to attract FDI since 2000, in 2006, the drop finally came to an end,” explained Egyed. “It would be a premature conclusion to talk about a ‘trend’ after only one year, but these figures are surely reassuring,” he added.

The survey also showed a very important pointer in the direction of major changes and developments needed to improve relations with investors. “Quality reforms are essential to maintain and improve the attractiveness of Europe and Hungary. This is our chance to stay abreast of cheap Asian labor,” pointed out István Havas, Country Managing Partner of Ernst & Young. The results indeed show a clear guidance on the priority list of the investors. According to those respondents planning actual investments in the county, the flexibility of the labor market is the single most important change necessary. Additional key areas of reform include modernization and simplification of the regulatory environment, and steps to encourage innovation and investment in research and development. Decreasing labor costs, perhaps surprisingly, is not on the top list of the most wanted reforms, according to business decision-makers. “We regard Ernst & Young’s survey as a very reliable source of information; however, the Ministry of Economy and Transport doesn’t plan to analyze and process these data any further,” the secretary of state told The Budapest Sun. “We are more likely to use this as a confirmation of what we already know,” Egyed added.

It is worth mentioning that according to the interview, the specialization of the company Ernst & young consists in the systematization of decisions, orientation on developing business, and advantage is given to service business. Ernst & Young today is the unique company in Hungary which can give the full service cycle including:

- Consulting (administrative, marketing, financial, investment, personnel, service, psychological);

- Trainings;

- Workshops on development and introduction of decisions and the internal documentation;

- Coaching for heads;

- Development of documents demanded by the client;

- Recruiting of heads and the personnel (including head-hunting);

- Testing, selection, an estimation of the personnel by means of the Estimated centers (Assessment Centre);

- Legal consulting and the audit, a full complex of accounting service, logistical and transport service (by means of the companies-partners);

- Primary both secondary marketing researches and development business-plans;

- Branding: Development and promotion of brands “on a turn-key basis”, development of advertising campaigns;

- Development the Internet-strategy, structures and design a web-sites. A web-design.

Thus, work is constructed on a principle net-working of virtual projects that allows:

- To involve the best experts of Hungary from the leading companies, not raising thus of expenses and costs of services (experts are involved only on the project);

- To guarantee quality of work as the project one expert-professional coordinating work of all involved experts operates, instead of simply manager of projects;

- To provide high speed of performance of projects and mobility in replacement of experts;

- Considerably to lower expenses, not reducing thus qualities of work.

The international partnership of PricewaterhouseCoopers is the largest accounting and business consultancy firm in the world. With approximately 140,000 employees in 150 countries in 1999, the company offers auditing services, tax and legal advice, financial advice, business process outsourcing, and management consulting services. The partnership was created in 1998 from the merger of two Big Six accounting firms: Price Waterhouse and Coopers & Lybrand.

Accounting practices were necessitated by the increasingly complex and sophisticated needs of businesses during the early 19th-century Industrial Revolution. Accounting as a profession emerged over several decades in the United States, and by 1898, the year in which Coopers & Lybrand was founded, there was not yet a single school of accounting. Furthermore, the only texts available were British and these often failed to address American problems and practices.

Accountants therefore received their training on the job, initially as bookkeepers, the most able and talented ones trained by their supervisor in accounting practices and procedures. This was the route taken by the four American founders of Coopers & Lybrand: William M. Lybrand, brothers T. Edward Ross and Adam A. Ross, and Robert H. Montgomery. All had worked in the same firm of Heins, Lybrand & Co. in Philadelphia and had received the same training; all four would be active in establishing accounting as a profession. The Ross brothers, Adam and Edward, were pioneer members in 1897 of the Pennsylvania Association of Public Accountants, one of the few professional associations for accountants in the country. During this time, a British accounting firm known as Cooper Bros. & Co., founded by William Cooper, was celebrating its 44th anniversary. Nearly 60 years later, the American and the British firms would merge into Coopers & Lybrand International.

Deloitte’s Central European Private Equity Confidence Survey reflects the expectations of private equity professionals focusing on Central Europe. The survey has been conducted twice a year since March 2003 and the results are based on questionnaires sent to professionals in private equity firms covering the following Central European countries: Estonia, Lithuania, Latvia, Poland, Czech Republic, Slovakia, Hungary, Romania, Moldova, Bulgaria, Macedonia, Slovenia, Croatia, Bosnia & Herzegovina, Serbia, Montenegro, and Albania.

Deloitte in Hungary is one of the leading professional services organizations in the country. With more than 300 people the practice serves many of the country’s largest companies, public institutions, and successful, fast-growing growth companies. Our internationally experienced professionals strive to deliver seamless, consistent services wherever our clients operate.

Deloitte in Central Europe consist of local entities in 17 countries devoted to excellence in providing professional services. With access to the intellectual capital of approximately 150,000 people worldwide including more than 3,400 in Central Europe, our affiliates deliver services in four professional areas: audit, tax, consulting, and financial advisory.

The characteristic features if the good investment climate in Hungary:

- Hungary is the country with operating market economy, legal and constituent structures which are bases for the further strengthening and development of market economy of any country;

- It is the country with political stability;

- Hungary is the center of the Europe, the crossing of the basic transport ways;

- According to data of supervision of the financial market for the first half-year of 2001 There were trading operations with foreign stocks in volume 10,5 billion Hungarian forints carried out;

- The economy of Hungary is developing further with constantly accruing rate. By the estimation in 2002 the real gross domestic product has increased on 5,5 % that has allowed to rank Hungary as the European country with the highest growth of economy.

- For the past 10 years since the time of political and economic reforms, about 3500 foreign businessmen have opened in Hungary the firms making 70 % of the exported goods and providing with employment the fifth part of all able-bodied population of the country;

- It is the forth year when it is possible to ascertain two-level rise of industrial production. For the first 10 months of the last year it made nearby 205, however for the past of 5 years efficiency of the Hungarian industry has increased on 63 % that has allowed Hungary to become the leader of region;

- The forint became the convertible monetary unit that has allowed the Hungarian currency system to get rid of all restrictions. The citizens of the country having currency savings on the bank accounts, can freely dispose their money resources;

- The Rate of inflation here is always predicted and averages 10 % a year. Besides for last decades Hungary has reached a great success in national economy development;

- The share of Hungary in the general international investment fund in region, excepting the CIS, makes about 40 %. Including the CIS – 35 % It is because of Hungary has followed a way of liberalization of economy much earlier.

The direct investments into Hungary have exceeded in 2001 35 billion crones. There are more than 30 thousand companies with foreign participation in Hungary, and their share in total export exceeds 70 %. In 90th the concerns Volkswagen, General Motors, Ford and Suzuki have put the beginning of new, dynamically developing branch of manufacture in Hungary. These companies were involved to Hungary with the cheap and qualified labour, and also 10-years privileges under the taxation. At universities of Budapest and Miskolc there were new centres of science. The last government of Hungary together with business circles has developed the plan defining seven strategic areas where the state supports the chosen project at a rate of 25-33 % for development of investments, and remained two thirds become covered due to a private sector.

According to McAfee R. P. (2006) the attraction of investments from the West is promoted also by relative cheapness Hungarian labour: in recalculation on consumer ability of the national currencies the average salary in Hungary makes only 30 % from a similar average indicator of the European Union. The important role in inflow of investment capital is played also by the political stability of the country and rather favorable investment climate which managed to be generated by the government of Hungary. It is enough to tell only, that the profit tax of managing subjects in Hungary is established in 18 %, and actually – in view of tax privileges – makes 12 % (for the majority of the large enterprises with foreign participation which use tax privileges to the greatest degree, – less than 7 %). One of channels of inflow of the foreign investments to the national economy is privatization. Investors have got wide access. As a result of 30 % of all foreign capital has been involved on a line of privatization.

For the attraction of the large multinational corporations, the following specific form has been developed – free customs territories of industrial type which today provide 28 % of gross output of manufacturing industry of Hungary, and also almost 45 % of its export. Rather new form of attraction of the foreign capital is the industrial parks in the Hungarian practice, which annual volume of manufacture reaches 16 % of all industrial production (thus 4/5 made here production is realized on foreign markets). By the end 2000 the foreign investments which have been saved up in economy of Hungary, have exceeded 23 billion dallars, and the enterprises with participation of the foreign capital make 40 % of gross national product, provide 75 % of its export.

At the same time by a boundary of centuries the given model of economical growth in Hungary gradually began to settle itself: privatization has approached to end, the competition for foreign investments has become aggravated between the countries of the region (and more advantage-grounds were borrowed today with Czech and Poland where privatization is on rise), the tendency to the repatriation of the profits foreign investors began to amplify, and as the result it was slowed down or even the annual volume of the foreign investments into the economy of Hungary began to decrease. The resources of cheap trained labour also remained only in the backward Eastern and Nothern regions of the country. Meanwhile the multinational corporation began to transfer in Hungary the higher parts of cycle-economic production (realization, marketing, research and development), showing demand for the employees having higher education. Last 2 years Hungary began to spend more for the system of education (up to 11 % of the state budget). If before change of political situation higher education was received by the 8 % of youth, now, this number is 33-34 %.

According to McAfee R. P. (2006) all this has induced the Hungarian government to bring the essential corrective amendments into the model of economical growth. In the center of the new approach still there is an attraction of the foreign capital, however, already on the basis of a highly skilled labour and innovative activity. The problem of a new stage, in particular, includes mobilization of domestic sector of small and average business as the accessory manufacturer and the subsupplier for ungarian branches of the multinational corporation. For the realization of this new model of economical growth the government has developed so-called ” Plan by Secheni ” (by the name of the Hungarian reformer of the XIX-th century). There are 7 programs of development, on which financing in 2001-02 appear. From the state budget it is planned to allocate 626, 7 billion. (billion dollars).

Each of these programs of development includes some subroutines. So, the program of development of business unites 3 subroutines: developments of small and average business; promptings of “bridges”; stimulations of investments. Programs of development of “Plan by Secheni” in September 2000 have been published on a site of Ministry of Economics of Hungary, so the wish to take part in their realization of domestic and foreign investors had enough time for studying and necessary preparation. Budgetary assignments will be allocated on competition in the form of irrevocable state support. The government, in view of end of mass privatization in the country, plans to develop within the limits of ” Plan by Secheni ” the subroutine of stimulation of investments of ” the third generation “: alongside with the assistance of the new foreign investments to stimulate closer integration into the domestic economy and the further investments of foreign firms which have already based in territory of Hungary.

The result of the economic policy focused on attraction foreign capitals was that 3/4 of foreign trade commodity circulations were realized through the foreign enterprises. A share of foreigners in the structure of the property of Hungarian economy has reached 30 %. By present time from 200 of the largest Hungarian enterprises 160 are in the partial or full property of the foreign companies, and as a whole each tenth enterprise in Hungary has the foreign partner, co-founder or the owner. Under the control the foreign capital there are 90 % of branch of communications and distant communication, 70 % of the bank-financial sector, 60 % of the power of the country. Two thirds of production Hungarian manufacturing industries give the enterprises which are being in foreign properties (it exceeds even the parameters of Ireland to which experience they like to refer). The greatest volume of capitals, naturally, is provided by the transnational corporations (multinational corporation). In Hungary 70 multinational corporations to some extent (or it is assembly of finished articles, or manufacturing of components and semi finished items to them) are presented, almost all from them have the world popularity.

According to McAfee R. P. (2006) such dominant presence of foreigners in the country does not cause appreciable negative reaction any more in many respects owing to the satisfaction of many economical expectations. For example, the salary of the citizens working at the enterprises with the foreign participation, on 30 % exceeds the average level, thus they make practically half of all borrowed in national facilities (for comparison: in Czech – 20 %, in France – 26 %). The investments, besides the mitigation of social questions, provide fast and counterbalanced economical growth, development of export and improvement of the foreign trade balance, stabilization of budgetary receipts, introduction of high technologies, creation of new workplaces. The labour productivity on the foreign enterprises makes 60 % from the level of the country-donor, nevertheless in 3 times exceeds average in Hungary.

However, despite of active connection of Hungary to the processes of globalization (The consulting firm “Kearney” in last research has carried Hungary to the group of the “aggressively-globalized” countries), the Hungarian experts understand, that by virtue of rather small size of territory and a population, the Hungarian market of capitals gradually approaches the limit of the saturation. The factor-terminator in investment policy is the competition from other countries. In neighbouring countries processes begin which do them more attractive for investors in comparison with Hungary. For example, negative consequences for Hungary can have the proclaimed liberalization in Czech, the beginning of privatization in Romania, etc. In these conditions the government uses any opportunity for attraction of investors, especially when it is a question of large investments. So, only the information on possible carry of the companies of BMW of manufacture of cars from the Great Britain in Hungary initiated target visit of the prime minister accompanied by Ministers of Finance and economy to Germany, during which Hungarian party has declared the intention to give under this project a powerful package of privileges.

For the performing of the problem of annual attraction put by the government for the foreign investments in 1,5-2 billions dollars, in the end of 1999 the intermediate term strategy of stimulation the foreign capital investments has been accepted. It is aimed not so much at maintenance of inflow of the foreign capital, but on its deduction in the country. By means of the measures stipulated within the limits of strategy the government expects to achieve the improvement macroeconomical parameters of development of the country, to realize other problems, in particular, to reduce regional disproportions, to raise competitiveness the Hungarian small and average business to improve an ecological situation.

The most preferable forms of attraction the foreign investments is the construction of industrial objects, trade and a hotel facilities “on a turn-key basis”, the involvement of various designs on increase in the capital of enterprises already placed here, creation of the joint venture, their association in a network, formation of strategic alliances are considered. In the end of 80 – ies and beginning of 90-ies the primary form of attraction of the foreign investments was the creation of the joint venture, in the middle 90-ies the accent was displaced aside privatizations. However, if in peak 1995 a share of the foreign capital in incomes of the budget of privatization has made more than 3 billions forints, in 1997 – only 0,3 billion forints. And in 1998 already 22 % of all investments were in the form of construction “on a turn-key basis”.

So, the intermediate strategy points out the following basic directions:

- Strengthening the trust of investors. Here belong the formation of favorable image of the country in opinion of foreign investors; the development of communication strategy in view of stable and dynamical development of Hungarian economy last years, memberships in NATO, preparations for the entering the EU, growing ratings of credit status of the country, the perfection of activity created during various time of special structures for rendering assistance to foreign investors: Associations of the joint venture (has appeared in the beginning 90-ies.), Hungarian Societies under investments and development of trade (it is created in 1997), Investing Consulting centre (it is created in 1998 for carrying out the constant consultations and dialogue between the large foreign investors and government).

- Direct means of stimulation of investments (granting of privileges to the large investors). Include, in particular, decrease half 18 % of the rate of the corporate tax (profit tax) – and without that one of the lowest in the Europe – within five years in case of the investment in development of manufacture not less than 1 billion forints (4 million dollars) and under the condition of annual growth of a sales volume on 5%. The same privilege operates concerning the construction of hotels, though, its action is limited by the year 2002 and the rod of annual growth of sales volume (services) is lifted up to 25 %. Up to the end of 2010 full clearing of payment of the corporate tax operates if the investor puts 10 billion forints (40 million dollars), under the condition of annual growth of a sales volume on 5 % and maintenance of a gain borrowed at the enterprise not less than on 500 persons.

In case of reinvestment of all gained profit the enterprise is released from payment of 20 % tax to dividends.

For the interests of development of backward areas of Hungary in social and economical relation, the list if which is affirmed by the government, clearing of payment from the corporate tax within 10 years is working, if the volume of investments has exceeded 3 billion forints (11,5 million dollars). The same is about privileges in case of capital investments into the areas in which the rate of unemployment during two years exceeded 15 %. The investor, who uses business zones for investments, receives privileges in 6-10 %. In case of realization of separate, especially important investing projects, the additional privileges for a bilateral basis are given.

To the indirect means of investment stimulation belong: the maintenance of low rates of the corporate tax and the tax to dividends, stimulation of investors concerning the reinvestment of profits (for example, by means of the publication of the encouraging statistical data about the prospects of development of Hungarian economy), preservation of the vision system up to the entering the EU, development of infrastructure, a measure on expansion of a circle and quality of Hungarian subsuppliers work. Recently the profit repatriation was reduced a little: in 1998 the country has left 980 million dollars, in 1999 – only 630 million dollars. However, in opinion of experts, it only confirms an empirical rule: export of capitals is reduced, if processes in economic are favorable.

In turn the foreign investors consider as a key condition for the investing means in Hungary to be the change of social priorities and stability carried out without revolutionary shocks in social and political areas. There are some other factors which are favourable for the investing climate of Hungary: the macroeconomical balance and the balanced growth, extending the internal and foreign markets, an opportunity of an output on the markets of other countries, legal “transparency”, perfection of an infrastructure, the relative cheapness and high qualification of a labour, mobility and creativity of Hungarian managers. The refusal of the EU countries to Hungarians in the request of partial financing the construction of motorways in east direction within the limits of the program of development of an infrastructure partly denies those assumptions, as if the foreign investors proved in the country for simplification to itself of the subsequent penetration on the markets of Russia and other CIS countries.

According to McAfee R. P. (2006) among the comparative advantages between Hungary and Poland here it is possible to allocate the presence multilevel systems of investing grants, and also a great number of the programs promoting attraction the foreign capital investments. The target program of economical developments contains a number of positions, concerning perfection of the infrastructure of the industrial parks. The basic program of technical developments touches the questions of maintenance the research and development sector in the field of high technologies. The acceptance of the program of the foreign tourism development has already led profit increasing. The gain of incomes of tourism on third has exceeded a corresponding level of 1999. The program of regional development has several blocks devoted to the foreign capital investments.