Abstract

An intensely competitive environment characterizes the present day investment banking. This is due to the proliferation of Internet and advancement of information and communication technologies, which have not only widened the range of financial products and services, but also provided an extensive knowledge to the customer about the products and services including the quality levels offered by different players in the industry. This has necessitated the adoption of a suitable marketing strategy by the investment banks. This study investigates the role of marketing in the promotion of business by investment banks. The role and impact of relationship marketing is the central focus of the study. The study discusses the salience of relationship marketing through the case studies of HSBC and Citigroup. The study suggests the identification of the proper customer segment to realize the full potential of relationship marketing, in view of the costs involved in implementing the relationship marketing.

Introduction

The success of a bank depends more on the perceptions and preferences of its customers. (Yavas et al., (2004) have identified the significant impact of customer perceptions and preferences on the growth of a banking institution. According to Chumpitaz & Paparoidamis, (2004) analyzing markets based on the perceptions of the customers and designing a customer delivery system based on such analysis enables the banks to gain competitive advantages. When a bank follows the objective of meeting the customer needs and enhancing the quality of its services, the bank is sure to gain and sustain distinct competitive advantages. The development of information and communication technology has as significant influence in the way a bank or other financial services organization conduct its business and maintain the relationship with its customers (Dabholkar & Bagozzi, 2002). The pressure on banks to enhance their profitability has forced them to move away from the traditional transactional and quick sale approach towards an improved relationship-based approach to market their products and retain the customers (Duddy & Kandampully, 1999; Moria, 1997).

Number of studies have analyzed the relationship between service quality and customer retention in the context of banks and other financial institutions (e.g. Ranaweera & Neely, 2003); Caruana, 2002). In this context, Bei & Chiao, (2001) identified the quality of service level as an important element in attracting and retaining customers by financial institutions. Reichheld & Schefter, (2000) reconfirm that by providing superior quality service using automated services, the financial institutions could accomplish higher rate of customer retention. Within this context, this study analyzes the role of marketing strategies by investment management institutions including investment banks in attracting and retaining customers. The study focuses on the concept of relationship marketing.

Investment Banking – an Overview

There exists a close relationship between banks, financial markets and the macro economy. This relationship has been studied in the past in detail by several researchers (Cameron, 1997; Goldsmith, 1969) ). These studies reveal that well-developed financial markets are necessary for the overall economic development of any nation. The investment banks form the foundation for the development of financial markets.

In broad terms, investment management companies consist of firms whose activities relate to issuing, distributing and selling securities and other related financial products. The activities of investment banks include underwriting, brokerage and market making. Commercial banks and several other financial institutions are involved in investment banking activities. The firms operating in this industry appear to have significant competitive advantage in undertaking investment banking activities and other brokerage related activities. “Historically many of the securities firms have specialized in one or more of the product market areas, such as institutional brokerage, retail brokerage, exchange floor brokerage or corporate and municipal finance. Other firms have engaged in a relatively full range of securities activities, but limited themselves to a particular region of the country.” (Hayes et al., 1983)

Competition among the investment banking institutions has received great attention during the recent period. Proliferation of Internet and other information and communication technologies has increased the customer knowledge on the availability of various financial products and services and their relative merits and demerits. Consequently, the customers have become well informed of the intricacies of investing their surplus funds and their choices and expectations of services from the investment banks have gone up tremendously. This has necessitated the investment banking institutions to adopt suitable marketing strategies to market their products and services successfully.

Economic globalization, cross-border activities and consolidation have made the investment banking industry go through incredible transformation. The business environment today witnesses a number of banks crossing international borders to market their products and services in various geographical locations across the world. The role and importance of investment banking can be seen from their engagement in public and private market transactions for corporations, governments and investors and in providing a number of benefits to these participants. Importance of investment banks is also enhanced because the services and efficiency of them affect the financial markets and ability of investment banks in minimizing the cost and maximizing profits is important for both the banks and their clients. Investment banks also contribute to the improvement of various industry segments. (Radic & Fiordelisi, 2008)

Investment banking can be defined as the service of intermediation between issuers of stocks and investors through their involvement in advisory, mergers and acquisitions, debt capital markets and equity capital markets. There are a number of factors, which have acted as key drivers for the proliferation of investment banking institutions and their expansion on a global basis. Some of these drivers include globalization initiatives aided by cross-border investment flows, increased accumulation of investment assets owned by large corporations, securitization and economic deregulation measures adopted by different countries in the wake of economic globalization. Gardner and Molyneux (1997) have identified similar factors, which facilitated the evolution of the present day investment banking like the advancement in technology, changes in regulatory frameworks, distribution of property rights and other economic forces that have an effect on the investible funds of individuals and entities.

Considering the scope of this research and the complexity of the investment banking business, the literature definition of investment banking is provided below:

“Investment bank’s business can be categorized in to five main areas: broking (the broking of securities is commodity business in which firms appeal to customers mainly on price and integrity); trading (the trading of securities drives on market volatility); investment banking (represents the underwriting of new issues and advisory work also referred to as Mergers and Acquisitions); fund management (includes both retail and wholesale fund management); interest spread (income derivatives from borrowed funds).” (Gardner & Molyneux, 1997).

Full service and boutique are the two kinds of investment banks. Full service investment banks offer clients provide a range of services to their clients to meet their specific needs. These services include “underwriting, mergers and acquisition advice, trading, merchant banking and prime brokerage.” (Radic & Fiordelisi, 2008) For example, Goldman Sachs is one of the investment banking institutions that offered services in investment banking, trading and principal investments, asset management and security service. In contrast to the full service investment banks, boutique investment banks offer specialized services in specific segments of the market and they do not form part of any larger financial services institutions. An example may be found in Greenhill, which specializes in “Advisory services in Mergers and Acquisitions, financial restructuring and Merchant banking.” (Radic & Fiordelisi, 2008) Similarly, Lazard offers “Financial advisory and Asset Management services.” (Radic & Fiordelisi, 2008)

The role of marketing in investment banking can be seen from the fact that investment banking is mainly a revenue-motivated business. For most of the investment banks, earnings from the investment banking activity constitute only a part of total earnings. In order that the investment banks maximize the contribution to the total revenue from the investment banking activity, it becomes important that suitable marketing strategies are developed and implemented.

Marketing – a Background Note

“The concept of marketing is the exchange process in which two or more parties give something of value to each other to satisfy perceived needs.” (Kurtz, 2008) People exchange money for goods or services depending on their needs and preferences. The services may be both tangible as well as intangible and exchange of money can take place in return for a combination of goods and services. Although marketing has always been regarded as a part of business, the importance of marketing has varied through time and the history of marketing has passed through, different periods concerning manufacturing, sales and customer relations. After the periods of Great Depression and World War II the marketing era emerged during which there had been a shift in the focus from products and sales towards satisfying customer needs.

The shift from the seller’s market to buyer’s market created the need for consumer orientation by the businesses. The need for the companies to market their products and services increased and this brought changes in the marketing concepts. Marketing assumed a conceptual base in which a company-wide customer orientation to achieve a long-term success of the business became the primary element (Kurtz, 2008).

The objective of marketing strategies has undergone major changes in the last decades towards building the commitment of the customer towards a brand or a dealer. The development has taken the forms of (i) creating customer satisfaction through the delivery of superior quality products and services, (ii) building brand equity, which is facilitated by factors like perceive quality, brand loyalty, association of the customer towards the brand, trademarks, packaging and convenience of distribution channels, and (iii) creating and maintaining relationships. Of these three forms, customer satisfaction by delivering quality products and services and creating and maintaining customer relationships have been particularly pursued by bankers.

Relationship marketing enables financial institutions develop mutually beneficial and valuable long-term relationships with the customers (Ravald & Gronroos, 1996). O’Mally & Tynan, (2000) observe that relationship marketing works more effectively in cases where the customers are highly involved in the services provided by the institution. More specifically in the case of investment banks and other financial institutions, customer oriented relationship marketing programs facilitate free and meaningful flow of information between the institutions and the customers. Such a flow of information enhances the positive feeling of the customers towards the bank, which leads to increased satisfaction and relationship strength (Barnes & Howlett, 1998; Ennew & Binks, 1996). Past studies provide knowledge about the nature and importance of relationship between customers and banks from the perspectives of customer and business (O’Laughlin et al., 2004; Madlill et al., 2002).

Although relationship marketing can be extended to all types of customers of banking institutions, Carson et al., (2004) are of the view that it need not be directed towards all the customers. Usually, banks have both profitable and unprofitable customers and in most cases the profitable customers subsidize the unprofitable ones (Zeithaml et al., 2001). Investment banks find it difficult to retain profitable customers, because of the increasingly competitive environment. The financial institutions specialize in offering attractive services and prices to the profitable customers to lure and retain them. Since investments in all the customer segments are not likely to result in yielding similar returns, relationship marketing is directed towards the most profitable market segments only. The profitable segments are identified by the associated income and wealth (Abratt & Russell, 1999).

Within the realm of investment banking, relationship marketing has a significant role to play, as the present day customers are well informed about the level of service quality they can expect from the financial institutions offering various investment services and other financial services products. The objective of this paper is to analyze the role and function of relationship marketing as one of the marketing strategies of investment management companies especially the investment banks.

Aims and Objectives

The central focus of this study is to evaluate the role of marketing in promoting the investment banking activities of investment banks and other financial institutions. In the process of studying this central aim, the research accomplishes the following goals.

- To study the impact of changes from the traditional transaction-based marketing towards relationship-based marketing on the business of investment banking

- To examine and evaluate the different marketing strategies being followed by investment banks in managing their business including the product offerings and service offerings by the investment management institutions

- To make a comparative study of the marketing strategies of HSBC and Citi Bank to compare and contrast the strategies for their effectiveness

Research Questions

The current research through a comparative case study and a review of the relevant literature attempts to find answers for the following research questions.

- What are the usual marketing strategies adopted by the investment banking institutions to market their products and services?

- What are the significant motivating factors for the investment banks to turn towards relationship marketing?

- What is the target population for the marketing strategies of investment management companies and how effective the marketing communications of these institutions in reaching the target population?

Method

This research uses a ‘positivist case research’ approach, and a qualitative research method of multiple-case study design to analyze data and information relating HSBC and Citi Bank. Even though this study does not differ greatly from other studies, it identifies the effectiveness of the role of relationship marketing in investment banking activities as compared to a transactional marketing approach and to this extent; the study differs from past studies. This study is different as it evaluates the major reasons for the investment banks to take up relationship marketing as one of the prime marketing strategies.

Significance of the Study

In the present day competitive business environment and global exposure of investment management institutions, devising an appropriate marketing strategy has assumed prominence. It becomes essential that the managers should have a thorough understanding of the marketing concepts and latest developments in the application of marketing concepts in the field of investment management. Relationship marketing has been found to be of relevance in the context of marketing by the investment banks. From the customer perspective, the relationship with a particular bank becomes important to decide and maintain such relationship for a longer period. From the bank’s perspective retaining of profitable customers is of prime importance ad this involves the implementation of relationship marketing strategies in conducting the business. Therefore, the study of the role and impact of relational marketing strategies on the investment banking becomes important. To this extent, the current study attempts to add to the existing knowledge on the different facets of relationship marketing in investment management field.

Structure

This dissertation is structured to have different chapters concentrating on the different aspects of research. Following the first chapter introducing the topic of study and laying down the research boundaries in the form of research aims and objectives and research questions, is chapter two presenting a review of the available literature. Chapter three describes the research method. Chapter four contains the findings of the research from the case studies and an analysis of the findings. Concluding remarks and few recommendations for future research are presented in the final chapter five.

Literature Review

The objective of this chapter is to present a review of the relevant literature on the topic of role of marketing in investment banking. The review will add to the exiting body of knowledge by reviewing the past research findings and theoretical contributions on the concept of relationship marketing and its influence on customers for financial service products. The determinants of customer satisfaction and customer loyalty in investment banking are also reviewed.

Introduction

The investment banking industry across the world has gone through significant transformation due to cross border activities and consolidation taken place in the industry (Radic & Fiordelisi, 2009).. A higher disposable income available with the consumer increases the chances marketing more investment products. Transformation in fiscal policies and deregulations and improvements in the financial services sector help the growth of the market for investment banking products (Radic & Fiordelisi, 2009). Traditionally, the preponderance of these products is distributed through financial intermediaries who work on a commission basis. However, with the development of newer financial service product offerings and intense competition among market players, the necessity for evolving new techniques and strategies for marketing of these products has evolved (Kunst & Lenmink, 2000; Stafford, 1996). Once again, this information needs to be substantiated One of the relevant concepts in marketing is the relationship marketing, which is found to be more influential in establishing and maintaining customer loyalty and satisfaction for improved performance of retail as well as investment banks (Berry, 1983; Dwyer et al.,1987; Gronroos, 1994; Gummesson, 1994; Sheth & Parvatiyar, 2000).. This may be so, but who says so – is it your opinion? If so, it is not valid in a literature review

In the modern customer centric competitive business environment, customer satisfaction, service quality and customer loyalty have proved to be the major factors in establishing a casual and cyclical customer relationship, which is vitally important for the growth of investment banking business (Jamal & Naser, 2002) With a higher perceived level of service quality, the customer remains more loyal and satisfied which in turn increases the business of the investment banks (Lloyd-Walker & Cheung, 1998). More specifically, financial institutions such as investment banks have increasingly understood the strategic importance of customer value. With this realization, the institutions are continuously striving to evolve and implement innovative strategies that could enhance customer relationships. (Kunst & Lenmink, 2000; Stafford, 1996). In this context, it is to be noted that the product offerings of many financial service products are almost similar and only slight product differentiation is possible (Lim & Tang, 2000). This characteristic of the products makes the value of the loyal customers more important for the financial institutions. Such loyal customers are likely to use the services of the investment banks more, spread word-of-mouth, withstand the offers from the competitors and recommend the services of the particular banker to other potential customers. Developing close ties with clients is sure to result in the growth of business of business entities (Reichheld, 1993). In view of the excessive cost to be incurred in attracting new customers, the institutions seek to develop and maintain long-standing relationship with the customers, so that they can increase the profitability of the organization (Ennew and Binks, 1996). The present day banks have started using relationship marketing in the place of transaction-based marketing, which considers the relationship with the customers as an important element. For developing sustained relationship, customer satisfaction has been identified to be one of the essential prerequisite (Oliver, 1980).

Crosby and Stevens (1987) have attributed satisfaction in the service of organizational members, satisfaction at the quality level of customer service and satisfaction with the functioning of the whole organization as the determinants of better customer relationship.

Within this context, this review presents an analytical description of relationship marketing and its influence on business growth of financial service providers including investment bankers.

Marketing Function – an Overview a general marketing definition will suffice – Done

“The concept of marketing is the exchange process in which two or more parties give something of value to each other to satisfy perceived needs.” (Kurtz, 2008)A simple marketing model promoted by Kotler & Armstrong, (2000) explains marketing as the process of handing over the goods and services against tendering of money in return. Effective marketing implies the transfer of details about the products from the trader to the potential purchaser as an important element. An effective advertising message informs the consumer, about the attributes of the product or brand of the company and the feedback from the consumer to the company will inform the company about the perception of the customers on the quality of the product or service marketed by the company.

Consumer behaviour is one of the important determinants of marketing strategies. Blackwell et al., (2001) define consumer behaviour as actions taken by people, when purchasing, using and getting rid of products or services. Consumer behaviour with respect to certain product or service is analyzed to ascertain the response of the potential customers to different advertising strategies of an organization. The firm makes an analysis of consumer behaviour for creating unique selling point. This selling point is developed to attract target audience so that the firm can reach its objectives of growth. The company must have a thorough understanding of the client attitude in order to maximize the return on its investment on sales promotion activities.

Based on the analysis of the consumer behaviour, a firm will create and implement its marketing strategies around those factors, which influence customer behaviour. There are a number of factors, which influence the buying decision of the consumers. These factors include the prior purchasing habits of the purchasers, their present preferences, impact of environmental factors and the influence of the advertising and sales promotion programs launched by the company. Other demographic factors like age group, profession, qualifications, personal traits and standard of living of the consumer influence the customer’s choice. Brand loyalty represented by the preconceived thoughts about the quality and functionality of the products or services also has influence on the buying decisions of the consumers. Kotler, (2006) identifies culture as one of the basic determinants of the consumer choices (p. 124). Culture in this context represents the norms and beliefs of the society. In addition, culture also covers the customs learnt from the society, which ultimately become the value of the society (Fill, 2002, p. 83).

Customer satisfaction with respect to the quality and utility of the product or service is another major factor, which needs to be considered in attracting and retaining customers for any product or service. In this context, relationship marketing is the new paradigm in marketing literature, which has challenged the existing marketing theories and philosophies (Kotler, 1991; Gronsroos, 2004; Gummesson, 1997). Relationship marketing is a strategic tool used to study the needs and preferences of the customers and their attitudes, so that a firm will be able to build long-term relationship with them. In the investment-banking context, relationship marketing is of particular importance, as the investment banks have to establish and maintain successful relationships with the customers to thrive among stiff competition. The following section presents a review of relationship marketing and its application to investment banking.

Review of Relationship Marketing

Establishing, developing and maintaining successful relational exchanges characterize the process of relationship marketing. “The essence of these activities is to decrease exchange uncertainty and to create customer collaboration and commitment through gradual development and ongoing adjustment of mutual norms and shared routines.” (Anderson, 2001) When the customers are retained over a number of transactions, there is the likelihood that both the buyers and sellers may profit from the experience gained through undertaking the previous transactions. The basic aim of relationship marketing is to enhance the profitability of the organization by accessing a larger proportion of specific customers’ lifetime spending instead of trying to maximize the profitability because of individual transactions (Palmer, 1994). The competitive environment of businesses forces the firms to find a different route to garner competitive advantage by forming relationships with the customers so that there is significant improvement in business outcomes such as quality, efficiency and effectiveness (Nowak et al., 1997). The approach of relationship marketing involves a deviation from the traditional competitive approach to one that involves collaboration. Characteristic of relationship marketing involves collaboration, long-term focus, commitment to and trust in relationship among partners, establishing and achieving mutual goals and objectives and a relatively fewer number of business partners and inter-dependence (Dwyer et al., 1987; Kanter, 1994; Iacobucci & Ostrom, 1996; Nowak et al. 1997). Based on these characteristics, reciprocity can be identified as the core concept of relationship marketing. According to Bagozzi, (1995, p 275) reciprocity is a disposition and a feeling that one should “return good for good in proportion to what we receive.” Gronroos, (1990, p 138) has reflected the concept of this relationship in his definition of marketing as:

“Marketing is to establish, maintain, and enhance (usually but not necessarily long-term) relationships with customers and other partners, at a profit, so that the objectives of the parties involved are met (Gronroos, 1990).

Relationship marketing in a conceptual context developed during the 1980s. The concept emerged as an alternative to the then prevailing transactional view of marketing, because of the realization that many exchanges particularly in the service industry were mostly relational in nature rather than transactional (Berry, 1983; Dwyer et al.,1987; Gronroos, 1994; Gummesson, 1994; Sheth & Parvatiyar, 2000). Within the context of a banking setting, relationship marketing has been defined as “the activities carried out by banks in order to attract, interact with, and retain more profitable or high net-worth customers.” (Walsh et al., 2004 p 469) Therefore, the objective of relationship marketing can be identified as increasing the profitability of the customer while ensuring the provision of a better service to the customers. A number of studies with their empirical findings have established the positive association between relationship marketing strategies and effective business performance (e.g. Naidu et al., 1999; Palmatiyar & Gopalakrishna, 2005).

In the marketing of banks, relationship marketing has attained a significant position (Holland, 1994; Stone et al., 1996). In respect of banking services, Keltner, (1995) has observed that German banks as compared to the American banks have been able to maintain a consistency in their market position during the 1980s and early 1990s by following the principles of relationship marketing concept. Nevertheless, it is important to understand that relationship marketing by itself will not automatically result in stronger customer relationships. When the financial institution follows the principle of relationship marketing, the customers will exhibit different levels of closeness in their relationship with the banks, which could strengthen the ties between the bank and its customers (Berry, 1995; Liljander & Strandvik, 1995). Relationship marketing strategies will become more attractive when they are made to enhance the perceived benefits of engaging in relationships (O’Malley & Tynan, 2000). However, O’Laughlin et al., (2004) argue that not all customers will like to engage in relationships with banks. The authors further argue that close customer relationships in banks are rare and the relationships are weakened by the increase in the proliferation of Internet and other self-service technologies. Sweeney & Morrison, 2004) advocate finding new technologies as relationship facilitators and make strategic use of them in building customer relationship (Payne & Frow, 2005).

Several scholars have studied customer satisfaction in the banking industry in detail (Ahmad, 2002). These studies have focused on the integration of customer management with customer services and optimization of customer relations (James, 2004). Before the role of relationship marketing in investment banking is reviewed, the following section reviews the desired level of relationship outcomes, customer satisfaction and customer loyalty aspects as they apply in the context of banking in general. This review is expected to expand the knowledge on different aspects of relationship marketing in the context of customer service in banking industry.

Customer Relationship and Satisfaction

Customer orientation and satisfaction is identified to be one of the basic tenets of relationship marketing. Saxe & Weitz, (1982) argue that sales personnel who are customer oriented always strive to improve the customer satisfaction on a long-term basis. Subsequent research has shown that a firm’s relationship with its customers is influenced more by the customer orientation (Clark, 1997; Yavas et al., 2004). On the study of customer satisfaction in the field of marketing of financial services, it was observed that while customer oriented employees are able to evolve positive influence, sales oriented employees could develop only a negative impact on customers’ relationship satisfaction (Bejou et al., 1998). Customer relationship quality and customer relationship satisfaction are the customer evaluation measures normally used to reflect transactional and relational types of exchanges (e.g. (Bejou et al., 1996; Crosby et al., 1990; Lang & Colgate, 2003; Abdul-Muhmin, 2002; Rosen & Surprenant, 1998). Research has established a positive relationship between service quality and satisfaction in the banking sector (Ennew & Binks, 1999; Jamal & Naser, 2002; Ting, 2004). However, the constructs in this context are highly correlated and sometimes it might become difficult to separate them to transactional interactions. This has been found to be even more difficult from a relational perspective. Therefore, it can be stated that in long-term relationships of banks with customers, perceived service quality and satisfaction are likely to be merged into one phenomenon, which helps in an overall evaluation of relationship satisfaction.

In the context of service market, especially financial services, the market environment has become even more competitive, with the increasing intensity in price competition. This has made shifting of loyalty of customers as an acceptable practice. Many of the industries have started focusing on rearranging their marketing budgets such that more resources are diverted to defensive marketing with the intention to retain the customers (Patterson & Spreng, 1998). According to Gummesson, (1998) there are a number of initiatives undertaken to improve customer retention, including value chain analysis, customer satisfaction and loyalty programmes. Customer satisfaction has been regarded as the basis for firm success as satisfaction is inextricably linked to customer loyalty and retention. Studies have established the link between customer satisfaction and customer retention and they have identified other factors such as “the level of competition, switching barriers, proprietary technology and the feature of individual customers” (Bloemer & Lemmink, 1992; Bloemer & Kasper, 1995; (Sharma & Patterson, 2000). Fournier & Mick, (1999) have observed the relationship between customer satisfaction and customer loyalty to be more complex than it was perceived earlier. Sharma and Patterson (2000) identify a significant impact of customer satisfaction on customer loyalty. Customer satisfaction as a direct antecedent leads to a greater commitment in business relationships (Burnham et al., 2003) and it greatly influences the repurchase intentions of the customers (Morgan & Hunt, 1994). However, it is worthwhile to mention that the impact of satisfaction on commitment and retention is likely to vary in accordance with the nature of industry, product or service or environment.

Burnham et al., (2003) present another view in that they argue that customer commitment cannot be construed to depend only on satisfaction. Relational switching costs are expected to strengthen the relationship commitment, since such costs represent a barrier to exit from the existing relationship. High switching barriers would force the customer to stay or to perceive that they have to stay with service providers who do not consider the satisfaction created in the relationship. On the other hand, Jones et al., (2000) observe that customer satisfaction is usually the key element in ensuring repeat patronage of customers and this outcome generally depends on the intensity of switching barriers in the context of providing effective service. Under certain circumstances, even though a customer is less satisfied with a service provider, he would still choose to continue with the same provider because of the higher perceived cost of leaving the services. The customer has to consider the costs in switching a supplier. It involves set-up costs and termination costs. The set-up costs include the cost of finding the new service provider who would be able to provide the same or better performance as the previous provider or the opportunity cost of foregoing exchange with the incumbent. The termination costs include the relationship-specific idiosyncratic investments created by the customer, which might have no value outside the relationship (Dwyer et al., 1987). This is applied more particularly in the context of investment banking in the form of exit and entry charges on investments routed through the investment bankers.

The service encounters can be viewed as a social exchange in the light of interactions between the service provider and customer becoming a crucial component of satisfaction. This provides a strong reason for the continuance of the relationship (Barnes, 2002). “In a services context, considering the level of interpersonal contact needed to produce services, there is a range of psychological, relational and financial considerations that might act as a disincentive for a hypothetic change of service providers.” (Petruzzellis et al., 2008)

Relationship Marketing in the Context of Banking

Fierce competitive trends and saturation in the financial service product markets have enhanced the need to garner effective competitive advantages by banking institutions. The growing demand for the banking products and service through new media like Internet have forced banks to respond quickly to new changes challenges in customer demand and to meet them, with new and improved business models (Methlie & Nysveen, 1999; Jun & Cai, 2001; Bradley & Stewart, 2003). Gronroos, (1994 and Berry, (2002) have identified the long-term relationship with customers as the key success factor in the service industry, which enormously increases with the electronic channels. “The proliferation of new channels and the high demand for differentiated products has presented customers with a wide choice in terms of which service to use in order to profitably interact with the bank.” (Petruzzellis et al., 2008)

The latest extension in portfolios benefits both the customers and banks alike. Banks are provided with the opportunity of capitalizing on the beneficial characteristics of the newer product lines and channels of marketing. For example, electronic channels enable the banks to reduce the costs of interacting with the customers through the substitution of labor-intensive processes with the use of automated devices and sales processes (Campbell, 2003). In addition, the interactions resulting from face to face consultation enhance the opportunities for cross selling of the products (Clemons et al., 2002).

It is imperative that the banks undertake an active management of the usage of customer’s service so that the bank would be able to benefit from the different strengths of its portfolio. In this process, the banks are under an obligation to understand the ways the customers may adopt for choosing between the portfolios. The banks should also understand the circumstances under which the customers make these choices. This understanding will help the bank in identifying the factors that are relevant in influencing the customer choice and their relative importance in making the choice.

Eastlick & Liu, (1997) observe that the decision by the customers to adopt a service is driven primarily by the perceived benefits and perceived costs of using the new product. The adoption of the product thus depends on the ‘value’ the product can provide to the customer. The ‘value’ in this case is represented by the service quality of the product Montoya-Weiss et al., (2003) and the convenience the customer can derive out of using the product (Black et al., 2002; Devlin and Yeung, 2003). The customers will also consider the risk involved in conducting the transaction using the product (Black et al., 2002; Grewal, Levy, and Marshall, 2002; Reardon and McCorkle, 2002) and the costs of carrying out the transactions through the product (Devlin, 2002; Fader, Hardie and Lee, 2003). Perceived convenience, service quality and price are the key bank attributes which influence the perceived value of a service (Bhatnagar and Ratchford, 2004). The perceived value of service therefore depends on the moderating effects such as circumstances under which the customer chooses the service and the distinguishing features of the customer himself (Mattson, 1982). It is to be inferred that the importance of the bank attribute among convenience, quality and price for choosing a service is most likely to vary depending on the situations and customer features. In consistent with the literature, it is possible to distinguish between two dimensions of loyalty. They are: (i) a past loyalty that is more associated with the customer’s behavioral loyalty (Snehota and Söderlund, 1998; Chaudhuri and Holbrook, 2001). This loyalty represents the relative importance of a specific banking service in the previous transactions decision of the customer (ii) a cognitive loyalty, which implies the behavioural intention of using the banking service in future (Methlie and Nysveen, 1999; Van Rail et al., 2001).

“ The perceived service quality, satisfaction and past loyalty are antecedents of the intention of continuing to use the service or future loyalty.” It is therefore important that the banks should ensure that they provide a service of high quality for surviving in the highly competitive market and for garnering a sustainable competitive advantage in the long-term, which cannot be replicated by the competitors (Mefford, 1993; Jun and Cai, 2001).

In the context of social capital effect on the usage or choice of banking service and its consequent impact on customer loyalty, commitment on the part of the bank becomes a key construct as identified by the social exchange literature (Thibault and Kelly, 1959) and the relationship marketing literature (Berry and Parasuraman, 1991). As perceived by the customer, the relationship with a particular bank is so important that the buyer may decide that it is worth investing in special effort to maintain such relationship for an indefinite period of time (Tellefsen, 2001; Coote et al., 2003). Such long-term relationship enhances the exchange relationships and acts as stimulation for promoting the willingness of partners’cooperation and complying with mutual requests. The partners are able to share information and engage in joint problem solving exercises (Morgan and Hunt, 1994). Commitment also acts to prevent the negative effects of switching costs (Fullerton, 2003). Lack of commitment on the part of the customers will make them switch the service provider more frequently than the committed customers, and thus results as being a more powerful determinant in retaining customers than continuance commitment.

Relationship Marketing with respect to Investment Banking and Financial Products

There are a number of factors, which influence the marketing of the financial service products. These products are service based offers and therefore are characterized by a high degree of intangibility and complexity. These characters in turn provide a high level of variability depending on the market situation. Factors such as type of demand, delivery style, duration, and significance to the client also influence the marketability of these products. The peculiarities of financial services products may lead to a conclusion that relationship marketing is the right approach applicable only within the financial services product categories. However, it must be understood that the specificity of relationship marketing to the financial services products is attributed mainly because of the high risks involved and the necessity for a long-term relationship in view of the involvement of the client for carrying out the service delivery process (Ennew & Binks, 1996). In the case of investment banks, it becomes necessary to establish a balance between the transactional marketing and relationship marketing strategies for arriving at an optimal position. However, the point at which the investment bank balances both marketing strategies cannot be permanent because of the interaction of various factors enumerated above. “The existence of the changing circumstances determines an instable area or a danger area for both parts of the optimal position, following the calculation difficulty or even impossibility at a certain time of the results generated by the different relationship or transactional strategies.”

The main risks arising out of the calculation of this optimal point between transactional marketing and relationship marketing can be described as below:

- In respect of implementing transactional marketing strategies, the bank may not be able to recognize the wishes of the customer for a higher level of involvement on the part of the organization (to be reckoned as the customer service type activities undertaken by the investment bank)

- In respect of applying relationship-marketing strategies, the bank is likely to overestimate the quality level of the service expectations by the customer. This might result in the client migrate towards a competing institution, that offers a higher qualitative level to a lower price.

A hybrid managerial approach can be thought of a possible solution, which might take into account the possible changes in the business situation. According to Gronross, (1995, p 252) irrespective of the investment bank or the institution adopting mostly transactional or relationship marketing strategies, there may be situations when the company may have to address the needs and preferences of customers in different market segments. The hybrid managerial approach requires the application of multiple marketing strategies, which would provide for the development and maintenance of discreet changes necessitated by shoppers segments. In this case, the bank has to be satisfied with lesser degree of profitability. At the same time, the bank should strive for maintaining and intensifying the relationship with profitable clients. “In conclusion it cannot be possible neither profitable for an organization to create close relationships, personal and long lasting with all the clients, which involves a differentiated approach, based on segmentation principles that will combine elements of relational marketing and transactional marketing in accordance with the clients profile and its importance for the company.” (Filip & Pop, 2007)

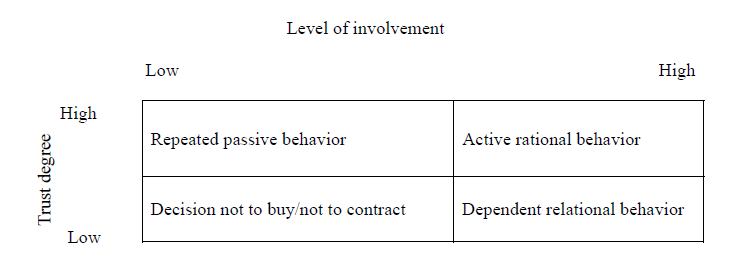

Just in the same way, the clients may also adopt a differential approach depending on the type and complexity of the products involved. According to a study conducted in the banking market in the United States, there are differences between transaction oriented and relationship oriented clients (Quoted in Mohamed et al., 2002). Sixty-two percent of the clients interviewed confirmed that in general tend to be confident, based on their own strengths acquired by searching and analyzing financial information. They also seem to be price sensitive. The remainder 38% of the interviewed clients responded that they are mostly interested in personal service and are not sensitive to the price. A similar study conducted in the UK financial services market has developed a model that typifies the shopping behavior in the market in accordance with two basic factors, which are instrumental in motivating and determining the individual choices of the clients. The two factors are (i) the level of involvement and (ii) the degree of uncertainty (that generates some level of trust in the banker) (Beckett et al., 2000). The following figure represents these customer behavioral patterns.

Customer Loyalty and its Dimensions in the Banking Services

Customer Loyalty

According to Zeithaml et al (1996), behavioral consequences lead to either retention or rejection by the customer, which in turn affects the profitability of the banks. There are a number of secondary factors, which influence the involvement of the client in relationship with the investment banking organization. Successful customer relationship management focuses on a complete understanding of the factors that affect the needs and preferences of the customers (Fox, Stead, 2001).These factors include the control of the client, participation of the client and the level of contact. The risks perceived by the client influence the uncertainty or degree of trust the client places on the banker. The risks in this case are determined primarily by the complexity of the products and services and the uncertainty of the results associated with the contracted product. The model exhibited, generates four types of client behavior. They are (i) repeated – Passive Behavior, (ii) rational active behavior, (iii) decision not to buy/not to contract and (iv) rational dependent behavior. A short description of these behaviors forms part of the later part of this section.

Behavioral intentions are construed as the indications of the intentions of the customers as to whether to remain with the bank or not. Zeithaml et al (1996) view customer loyalty as a bonding to the organization. Following the study of Zeitaml et al (1996) Sirdemukh, Singh, Sabol (2002) have defined customer loyalty as a state of intentions, which signals the motivation of the customers to allocate a higher share of the category wallet to a particular service provider. Ganesh, Arnold and Reynolds (2000) found loyalty as a combination of commitments to the relationship and other explicit loyalty behavior. The authors however have established an important distinction. Ganesh, Arnold and Reynolds (2000) have made a classification of loyalty behaviors into active and passive loyalty behaviors. Active loyalty behaviors signify the proactive behaviors of customers or behavioral intentions, which need conscious and deliberate efforts on the part of the customers to develop. Repeat patronage, positive words of mouth and expansion of service usage can be considered as parts of the active loyalty behaviors. On the other hand, passive behaviors are caused by a state of resistance to change to the existing relationship with the service provider. Passive behaviors include resistance to switching; even significant changes take place in the relationship with the service provider. Passive behavior also arises because of service environment, price insensitivity and self-state retention.

Repeated – passive Behavior

In this case, the clients show a reduced level of involvement towards the financial product because the clients have full knowledge and are conscious of the principal characteristics of the products on offer. With a low level of involvement and limited perception of uncertainty, the clients can be said to be behaving in a passive manner. This implies that the clients would involve them in repeated interactions without actively looking for alternative service providers or offers. The relationship marketing literature describes this type of behavior as “behaviorist loyalty.”

The strategic organizational approach in respect of repeated – passive behavior clients would be different for a new bank and the one that has already consolidated its position in the market. The new banks will encourage clients to enjoy an active relational context in order to win a higher market share. With a view to meet the competition from the newcomers, the existing banks will maintain the clients in the present relational context and at the same time will bring new developments to the products and services and they will improve upon the existing delivery systems.

In the investment or any other financial banking system, the institutions have the chance of retaining the repeat – passive behavior customers for a longer duration, because of the low perception of the clients about the offers of rival service providers and the higher migration costs involved.

The Rational Active Behavior

In this relational context, the involvement of the customers in terms of their control on the processes, participation and contact is high. With the complexity of the products and services, the degree of trust of the clients is also high. “Clients that buy in accordance with the rational factors are those that have enough personal abilities and information that allow them to understand the nature of the products and to realize pertinent comparisons between offers of the players on the market.” (Filip & Pop, 2007)

These types of customers do not exhibit any loyalty nor do they consider having any relationships with an organization. They do not mind changing the insurers every couple of years. This behavior of the clients is also encouraged by the lack of communication from the service providers on a periodic basis on the development of new facilities, awards and products. Increased level of consciousness, involvement and information of the consumers in this sector enable the clients to transfer them from a repeat – passive behavior to an active rational behavior. This transformation necessitates the banks to increase the value of their services to the clients.

Decision not to Buy/Not to Contract

In this relational context, those consumers who do not buy or contract any financial services products are included. The consumers do not buy or do not contract because they do not show any involvement towards the offer of financial products or services; neither do they have the means to conclude any transactions with the banks. However, they represent a potential client base for any financial service provider or an investment bank.

Rational Dependent Behaviour

The clients in this relational context show a dependent relational behaviour, in which there is a high degree of involvement from the clients but a low degree of control and safety level because of their need for complex financial products. The clients are in need of consultations from the banks or any third party agencies to decide on the specific product choice for investment. That is why these clients are described as dependent clients. They form a relationship with the banks on their will so that they can reduce uncertainties and perceived risks in their investments. In the process, they structure a typical model of buying pattern.

The results of the study by Beckett on the financial market of United Kingdom reveal that contracting complex financial products or instruments display large proportion of dependent-relational behaviour from the clients. The financial instruments or products in this case include investment or pension plans, in respect of which majority of respondents conveyed lack of confidence and information to make well-informed investment decisions. Therefore, these clients choose to resort to the services of the specialized personnel from the bank or insurance companies or to the services of an external consultant for enabling them to take complex investment decisions.

Trust

Moorman et al. (1992) define trust as “the willingness to rely on an exchange partner in whom one has confidence.”Since the customers of banks pay in advance to buy the products and services of the bank based on the promises of the bank, they must be willing to rely on the ability and skills of the bank to deliver its promises (Berry, 1996). Reichheld & Shefter (2000) argue that trust is an essential prerequisite for loyalty in banking services, especially where the transactions take place at a distance and away from the perceptions of the customer. Morgan and Hunt (1994) reiterate the importance of trust in retail banking, as the trust can influence the chances of retention of the existing customers. Trust is an important element in the relationship between bank and its customers than even the price.

Success of word-of-mouth marketing depends largely on the trust that a bank can create in the minds of the existing customers (Jones & Sasser, 1995). Customer perception of the trustworthiness of a bank is valuable not only from the point of view of satisfaction of the existing customers but also in attracting new customers. Bowen & Shoemaker (1998) are of the opinion that because of the high-level risk perception inherently involved in the financial service product offerings, it is usual that potential customers are more likely to get personal recommendations from friends and relatives when they have to choose a service provider. The potential customers would rely more on the opinions of the existing customers rather than relying on the claims made by the banks. Foster & Cadogan (2000) observe when an existing customer recommends a bank to a third party; he undertakes a certain level of risk on his own credibility towards the third party. This credibility is likely to erode if the bank fails to provide quality service and backs up the recommendation of the existing customer.

Commitment

The level of commitment maintained by the banker and the customer through shared values and relationship termination costs has a positive relationship with the level of trust the customer invests in a bank (Morris et al. 1999). Commitment has a key role to play in the relationship-marketing concept (Morgan & Hunt, 1994). The quality of customer-service provider relationship is largely influenced by the level of commitment exhibited by the bank. According to Moormann et al. (1992), commitment is “an enduring desire to maintain a valued relationship.”Commitment thus implies a positive evaluation of a long-term relationship (Bowen & Shoemaker, 1998; Moorman et al, 1992; Morgan & Hunt, 1994). This makes commitment as a key to customer retention for a long-term (Amine, 1998). Bendapudi & Berry argue the customer relationship with the bank may be constraint-based, where the customer has the necessity to maintain the relationship or it may be dedication-based, where the customer wishes to maintain the relationship. Commitment can also be considered as a good predictor of the future intentions of the customer and his loyalty (Baldinger & Rubinson, 1996).

In summary, commitment can be considered as a function of the personal attachment, the customer develops towards the service provider. It can also be related to the perceptions of the customer about the bank vis-à-vis its competitors and commitment is the orientation towards a long-term relationship with the bank.

Summary

In meeting its objective of presenting a review of relevant literature, this chapter described the factors instrumental in establishing a customer-centric competitive business environment. The review identified satisfactory interaction with the clients and developing a sustained relationship with the clients as the base for developing marketing strategies by institutions offering financial service products. This chapter provided an overview of marketing and discussed in details the salient aspects of relationship marketing. Relationship marketing has been identified to be the development of interactions between purchasers and marketers and the purpose of relationship marketing is to ensure that the seller profits from the experience of such continued exchanges. The review identified customer orientation and satisfaction as the basic tenets of relationship marketing and provided a detailed discussion on these tenets. There has been a detailed review of the strategic implication of relationship marketing in the context of banking. The relationship marketing in the context of investment banking and financial service products was discussed in detail. The chapter presented discussion on different types of consumer behaviour with respect to the investment and other banking services and financial services products. Because of the feasibility, the competitors are able to imitate the product and service differences, which prevent any one financial institution acquiring sustainable competitive advantages. This forces the institutions to work continuously on finding new sources and taking efforts to make them stand out from the crowd. For this, the organizations use a brand image, interactive channels of distribution, and marketing communication for the promotion of long-lasting relationship with the clients.

The next chapter on research methodology will describe the research method adopted for conducting the current study.

Research Methodology

The objective of this chapter is to provide a brief account of the research design engaged for completing the research on the role of marketing in investment banking. Denzin and Lincoln (1998), suggest that the research design is to be chosen based on the topic of study and the research objective to be accomplished. The research design is to be based on the context of the proposed research and the availability of resources to conduct the research. The current study aims at examining the role of marketing in promoting investment banking. Considering the nature of the research, it was proposed to use a qualitative research approach.

This chapter while providing a basic idea on different aspects of social research, it deals with the justification for using the qualitative research method. Significance of case study method and its suitability to the current research also forms part of this chapter.

Research Philosophy

Research philosophy accounts for the manner of gathering and analyzing information on a particular social phenomenon taken for study. Research philosophy also describes the method of interpreting the findings of the research. Different philosophies of research approach are contained in the term Epistemology. Epistemology differs from doxology, in that epistemology deals with the things identified to be true in nature, while doxology deals with what is believed to be true. Any scientific research attempts to transform things from the state of what is believed to be true to a state where everyone knows things based on facts and interpretations, and this transformation is done through the process of enquiries of different types. Positivism and interpretivism are the two major research philosophies identified by Western scientists in the realm of social and scientific research.

“Post-positivism” is a research approach, which is an offshoot of positivism identified as a research philosophy at a later stage. Critical realism advocates that scientific knowledge and approach cannot alone clarify certain issues. There is a difference between positivism and post-positivism. All observations gathered through interpretations are considered fallible under post-positivism. Therefore, post-positivism consider all the observations to have some sort of inherent shortcomings and that it is possible that all theories can be modified by looking at them closely. “Where the positivist believed that the goal of science was to uncover the truth, the post-positivist critical realist believes that the goal of science is to hold steadfastly to the goal of getting it right about reality, even though we can never achieve that goal,” (ResearchMethods, 2006). The discussion has led to the adoption of critical realism, which is the common form of post-positivism as the appropriate research philosophy for completing the current study on the role and influence of advertising in the promotion of investment banking. Post-positivism suggests the use of qualitative research as it is possible to address the social phenomenon from a subjective perspective through qualitative research. This supplements the decision to adopt a qualitative research method for the current research.

Characteristics of Quality Research

Denzin & Lincoln, (1998) enumerate the basic elements of qualitative research through their definition of the term, which is as follows:

“Qualitative research is multimethod in focus, involving an interpretative, naturalistic approach to its subject matter. This means that qualitative researchers study things in their natural settings, attempting to make sense of, or interpret, phenomena in terms of meanings people bring to them,” (Denzin & Lincoln, 1998).

The comprehensiveness of this definition explains the nature of qualitative research, in which it identifies the purpose of qualitative research, is to address and interpret complex human experiences and situations. Such experiences and situations become the nucleus of qualitative research approach, which is followed in many of the social researches. Qualitative research does not stop with the mere testing of the hypothses. It extends to the provision of greater insight, discovery and interpretation into the issue under study to enlarge the knowledge of the researher as well as those who follow the findings of the research. The salience of qualitative research is that the approach recognizes the importance of understanding people and their inclination towards functioning under social and cultural contexts. Therefore, there is a high level of motivation for engaging qualitative research in studying social issues. Kaplan & Maxwell, (1994) argue that quantitative research does not enable the particiants to interpret the phenomenon from a social and institutional context. Statistical and quantitative analysis will not be able to do a subjective analysis of the issue. This is one of the shortcomings associated with the quantitative research approach. In view of the inherent ability to adapt to different social situations, qualitative research approach is used for the current research.

Case Study Research

Yin (1984) is the pioneer in shaping the case study method of social research. Subsequently several researchers and theorists have contributed to the development of this research method and thus case study is made to assume an important position in the social research methods. The attractiveness of case study is improved because this method studies the phenomenon in a natural setting, which is the essence of any qualitative research and this makes the method a viable research approach.

“Case studies become particularly useful where one needs to understand some particular problem or situation in great-depth, and where one can identify cases rich in information,” (Noor, 2008).

The consideration of case study as a research method depends on a number of factors, which need to be evaluated before the researcher decides on the method. Case study can be considered as an ideal one, when the research focuses on contemporary social issues or events that occur in a natural setting. Case study also proves to be of immense value and support in respect of studies on social phenomenon, where there are no established and strong theoretical base for the research. However, in those cases, where there are a number of variables, which need to be manipulated to conduct the research, case study cannot prove to be the appropriate design. The selection of case study as the research method, therefore, depends on the nature of the research issue rather than the decision of the researcher to use the method.

Strengths and Weaknesses of Case Study Research

There have been various critical analyses on the nature and utility of case study as a research method. Lack of scientific rigour and reliability has been identified as one of the major shortcoming of this method. This makes case study unreliable for generalizing the findings of the research. However, case study method can be construed as dependable for obtaining a holistic and contextual view of the social issue or a series of social phenomena under observation. With the investigation of multiple sources involved in the research process, case study has the ability to provide an overall view of the social problem under research. Yin (1984) confirms that there is the possibility of generalizing under case study, when the researcher compares the findings from multiple case studies. With this comparison, the researcher can arrive at some generalized pattern or form of replication in the process of the social issue studied.

Data Collection

According to Yin (1984) there are different forms of case study. Exploratory case study method is used normally in conducting research in respect of business related issues. Explanations on how and why certain social phenomena take place are provided by descriptive case study. Studying organizational processes is facilitated by explanatory case studies. For the research on the role of marketing on investment, banking a descriptive case study method has been used. In this method, the researcher observes the process and sequence of operations in a selected organization and reports on the findings. Data can be collected using any of these six types of data collection methods involved in case study research approach. They are; (i) documents, (ii) archival records, (iii) interviews, (iv) direct observation, (v) participant observation and (vi) artefacts. The researcher has the option to use one or a combination of more methods to collect data and the choice of method depends on the nature of the study. For the current research documents, archival records in the form of professional journals, books and other relevant literature have been used for data collection.

Summary

This chapter provided a basic idea of various research philosophies. Brief description of the qualitative research approach and case study method formed part of the chapter. Next chapter presents the findings of the case study along with a detailed analysis of the findings.

Case Study – Analysis and Findings

Relationship marketing is today becoming a major element for the investment banks and other institutions providing financial services to different classes of customers. There has been increased competition within the market due to increased regulations and globalization. Attracting and retaining the customers has become more and more important for the financial service providers. In order for the financial service providers to retain the customers, there has to be a certain degree of trust among the actors in the relationship. The objective of this research is examine the influence of marketing strategies including relationship marketing on the promotion of business by investment banks and other financial institutions.

The current study uses a case study method for data collection on the role of marketing on the promotion of business by investment banks and for relating the findings of the case studies to the salient aspects of transaction marketing and relationship marketing discussed under the review of the relevant prior studies. Eisenhardt (1991) indicate that the number of studies can be decided based on the quantum of information gained from the case about the social issue. Secondly, the number of cases can also be arrived at based on the volume of information, which the study of other cases may provide. This study embarks to study the marketing strategies of HSBC and compare them with those of Citibank. Both of these institutions have many banking and financial related services and they are operating worldwide through different branch and regional offices. These institutions adopt different marketing strategies to promote and sell their products and services to their customers. These banks have established a certain level of reputation among the clients. Therefore, HSBC and Citibank are considered as the best choices for case study. The study analyzes the role of marketing in these institutions from the perspectives of the effectiveness of their marketing strategies, the need to increase the customer base to capture additional market share and the ability of them in meeting the needs of the customers. The multiple sources offered information and data on the marketing strategies adopted by these banks and the influence of marketing in promoting their respective businesses.

HSBC – an Overview

Hong Kong and Shanghai Banking Corporation (shortly known as HSBC) is one of largest banking and financial services provider in the world. The bank has established businesses in different parts of the world including Asia-pacific and African countries. There are offices established in Europe and the American continent. ‘HSBC holdings Plc’ was registered in the United Kingdom with its head office located in the city of London. HSBC established its international brand name in the year 1999, which subsequently became a popular brand name among the customers of banking companies. HSBC makes use of information technology as one of the major communication tool with its customers. The bank also maintains its own private network and the HSBC website attracted more than 900 visits during 2004.

The international network of HSBC includes 8,000 properties located in more than 88 countries. The bank earned a net income of US $ 7,079 million for the year ended December 31, 2009. The company has around 30,000 employees to carry out its international operations (Google Finance, 2010).

Financial Services Provided by HSBC

HSBC provides a comprehensive range of financial services to its customers worldwide. The division of personal banking by the bank include usual banking services and investment services. HSBC is one among the top 10 credit card service providers. Consumer finance is another major business division of HSBC. Commercial banking segment provides financial services to more than two million small, medium and middle market entities. The bank had established more than 200 branches in the UK to ensure that the bank provides better services to high value customers. The Business Centres established in Hong Kong, provide all services to the customers from one location as part of the marketing efforts to improve customer relationship.

Corporate investment banking segment of the bank is engaged in providing specially made financial service products to large corporations and other investment firms. The bank pursues several business lines such as investments in international stock markets, corporate banking, international investments and banking. Lending business using relationship management takes the central focus in serving corporate and institutional clients. The function of international investment bank is to render advisory services and financing of international investment transactions.

Marketing Strategies of HSBC

Harris (2002) observes that big four retail banks – HSBC, Barclays, Lloyds TSB and Royal Bank of Scotland – use generic marketing strategies for promotion of their banking businesses. The banks identify target markets and analyze it, to formulae the marketing strategies. Based on the strategies evolved the bank develops the marketing mix to satisfy the needs of the different classes of customers. The banks based on the future strategic goals can formalise the appropriate marketing moves. As observed by Jun & Cai (2001) and Bradley & Stewart (2003), this has become importanat for HSBC to focus on new marketing strategies to respond to the challengs in customer demand. Branding becomes important in creating specific identities of the banks and in positioning the banks in respect of different financial services offered by the banks (Polito, 2005). By creating effective brands, the banks would be able to distinguish its product offerings from the competitors. This becomes particularly important in the case of financial services products, where the banks may not be able to offer much differentiation in their products. As stressed by Gronroos (1994) and Berry, (2002) the long-term relationship with customers is considered as the key success factor in the service industry. HSBC adopts the corporate branding strategy with the aim of establishing long-term relationship with the customers. However, corporate branding elevates the approach a step further to incorporate additional issues, around relationship among the stakeholders especially towards the customers.

HSBC uses corporate branding as the major marketing strategy in promoting its business and in retaining the customers. The branding strategy adds substantial value to HSBC in implementing its vision. The branding strategy also enables to create specific position in the market. HSBC adopted the policy of acquiring a number of companies across the world to promote its international corporate brand. The creation of strong corporate brand enabled HSBC to develop and to sustain strong feeling of loyalty in the clients. The ultimate objective of corporate branding is to increase the customer loyalty. However, there is the need for customer satisfaction. Sharma & Patterson (2000) have focused on the link between customer satisfaction and commitment. HSBC was able to strengthen its market presence in the banking industry by the number of key mergers and acquisitions the bank was able to achieve using its brand name.

Investment Banking

The availability of branches of HSBC in many countries helps the bank to provide its important clients with a wide spectrum of services. HSBC provides investment-banking services across the world. This has provided HSBC a unique competitive advantage over the competitors. With this competitive advantage, HSBC was able to improve its profits during 2001, despite the economic downturn. The bank also improved tremendously on its core business relationship. HSBC is engaged in serving a number of subsidiaries and offices World over in addition to a large contingent of customers located in more than 88 countries across the world.

HSBC added client service teams as a part of its marketing strategy. This strategy initiated the appointment of relationship and product managers. These managers are trained to understand the needs and preferences of the customers. HSBC uses highly automated processes for supporting various customer services provided by the bank. The bank installed and used several software applications for risk management apart from installing central systems, to support relationship management. HSBC established intranet sites to share the knowledge on industry, product and other related information for enhancing the quality level of customer service. Petruzzellis et al. (2008) have stressed the necessity for frequent interaction of the customer with the bank, as there are wide choices of products avvalable to the customers.

Relationship Marketing by HSBC