Executive Summary

Analysts use financial ratios to tell a story about the fiscal situation of a company. Financial ratios are divided into valuation, solvency, efficiency, liquidity, and market ratios. ABC Healthcare is an American company that specializes in healthcare services. The Chief Finance Officer of the company seeks to analyze the company’s financial situation so as to recommend if they can enter into a partnership. Since financial ratios do not give much information when examined in isolation, an analysis period is chosen: the fiscal years 2017, 2018, and 2019. This period was used to conduct the trend analysis, also called horizontal analysis. After carrying out a horizontal analysis, it was revealed that the company was not doing impressively well, although it was not particularly dire. Or instance, its stock market price was stagnant over three years, indicating a failure to excite new investors. Since financial ratios vary among different industries, HCA Healthcare was chosen to be compared with ABC. HCA was discovered to have overall better results than ABC, although not radically so. This led to the conclusion that ABC was still within tolerable limits of its peers since HCA is just one company. Some recommendations were offered which would improve ABC’s situation. It was also concluded that ABC can still enter into the partnership.

Company Background

ABC Healthcare Corporation is an American company that provides healthcare services. Its activities include owning hospitals, urgent care centers, ambulatory surgical centers, and outpatient clinics. Maria Gomez is the company’s chief finance officer (CFO). In the years 2017, 2018, and 2019, the company’s stock price was 83.62 for the three years. Its Earnings Per Share (EPS) were 9.15, 7.87, and 6.9 for the three years, respectively. On the other hand, its price/earnings ratios for the same period were 9.14, 10.63, and 12.10, respectively. Financial analysis is required to be performed, and recommendations are offered based on the analysis.

Overall Financial Analysis

Price to earnings ratio is an example of a valuation ratio. Valuation is an analytical process of determining the present or projected worth of a company. Various metrics are used in determining the valuation of a company, such as management, capital structure composition, projected future earnings, and the market value of assets (Ross, 2018). The earnings per share (EPS) ratio is arrived at by dividing the earnings to common shareholders by the total common shares outstanding. EPS can indicate profit because the more the earnings, the bigger the EPS. In the case of ABC company, EPS for the years 2017, 2018, and 2019 were 9.15, 7.87, and 6.91. Performing a horizontal analysis of the three values reveals a declining trend. This is not a good sign since it shows decreasing earnings.

On the other hand, Price/Earnings (PE) ratio is used to analyze a company’s stock price. It is calculated by dividing the market price of a company’s share by its EPS (Ross, 2018). It measures how expensive the company’s stock price is compared to the produced earnings per share. For the financial years 2017, 2018, and 2019, the PE ratios for the ABC Corporation were 9.14, 10.63, and 12.10; a horizontal analysis shows an increasing trend. This trend is an indicator that people are willing to pay more for the company’s stock compared to its earnings. This could mean that the company’s stock is becoming increasingly overvalued.

Book value per share (BVPS) is also called book value per common share. It is a technique of calculating a company’s book value based on common shareholders’ equity in the company. A company’s book value is the difference between the total assets and total liabilities (Ross, 2018). If the company were to be dissolved, its BVPS indicates the dollar value remaining for common shareholders after payment to creditors from sold assets (Ross, 2018). For ABC Corporation, BVPS for the financial years 2017, 2018, and 2019 were 226, 209.05, and 199.1. This is a decreasing trend for the BVPS metric, which is not ideal since the book value is decreasing. The market price per share for the same period was 83.62 for the three years. The BVPS was higher than the market price for all three years, which indicates that the company may be undervalued.

Price to book ratio, on the other hand, is used to measure a company’s market capitalization against its book value. PB ratio is arrived at by dividing a company’s stock price by its BVPS (Nadar & Wadhwa, 2019). A lower PB ratio is an indicator that the stock is undervalued. Since the ratio varies with the industry, a truer picture for the ABC Corporation’s PB ratio will be illuminated when compared with an industry peer. However, a horizontal analysis can also be carried out. For the years 2017, 2018 ad 2019, the healthcare company’s PB ratios were 0.37, 0.40, and 0.42. Trend-wise, the PB seems to increase over the years, indicating an improved position in terms of shareholder value.

Financial Ratio Analysis

The ratios to be analyzed in this section are Earnings Per Share (EPS), Price/Earnings (PE), Book Value Per Share (BVPS), and Price to Book (PB) ratio (Ross, 2018). Most of these ratios depend on the industry and do not tell much as isolated metrics. They’re therefore best compared with industrial peers or compared with historical values to establish a trend. In the financial years 2017, 2018, and 2019, the market price for ABC’s stock remained constant at 83.62. EPS ratios for the same period were 9.15, 7.87, and 6.91. The ratios indicate that in 2017, the company delivered $6.91 per share, which increased to $7.87 in 2018 and $9.15 in 2019. EPS in isolation does not provide much information and needs to be compared with the PE ratio. For the PE ratio, ABC Corporation recorded the values 9.14, 10.63, and 12.10. PE ratio is calculated as a ratio between the share price and EPS. A high PE ratio could mean that the company’s stock is overvalued.

Another important ratio that is under consideration in this scenario is the book value per share (BVPS). The book value per share of a company is calculated using the common shareholder’s equity. Typically, the preferred stock is excluded from this calculation since they rank above common shareholders during liquidation (Wang & Zhou, 2016). BVPS is a representative of remaining equity after debts are settled during liquidation. In the case of ABC corporation, the company’s BVPS for the financial years 2017, 2018, and 2019 were 226, 209.05, and 199.1. BVPS, much like other ratios, are not useful in isolation and are only used in comparison with past values. In this scenario, it can be observed that the organization’s BVPS improved over the three-year period. This is an indicator that the company had an improving position that favored common shareholders over the period.

Another important ratio in this scenario is the Price to Book (PB) ratio. Price to Book ratio is used to compare a company’s market capitalization against its book value. The ratio is arrived at by dividing the firm’s stock price by its book value per share. For the fiscal year 2019, the BVPS was 0.42, which is an indicator of the willingness of investors to pay 0.42 dollars for every dollar of book value. Since the amount is way below the book value, it can be concluded that the company’s stock price is undervalued for the year 2019. In the previous fiscal year 2018, the book value per share of ABC Corporation was 209.05 while the market price remained constant at 83.62. Dividing the two figures yields a PB ratio of 0.40; this figure indicates that investors were willing to pay 0.40 dollars for every dollar of book value. Once again, the price the investors were willing to pay is relatively below the book value, which is an indicator that the company is undervalued.

In the financial year 2017, the market price for ABC Corporation remained constant at 83.62 while the book value per share was 226. Dividing the two values yields a PB ratio of 0.37; this value indicates that investors were willing to pay 0.37 dollars for every dollar of book value. This value is quite low, which indicates that the company may be undervalued. Once again, it is not advisable to look at financial values in isolation but in comparison with industry peers or with historical figures to infer a trend.

Trend Analysis

Trend analysis is also known as horizontal analysis when it comes to dissecting financial statements. It is a technique that involves comparing financial values and ratios over a period of time. This helps draw patterns in data that can be useful to establish an organization’s trajectory and make decisions with the added benefit of hindsight. Typically, statements for two or three financial years are juxtaposed in horizontal analysis. The earliest year is usually used as the base year, while the values in the latter years are compared with those of the base year. Changes will then be shown in dollars or percentages.

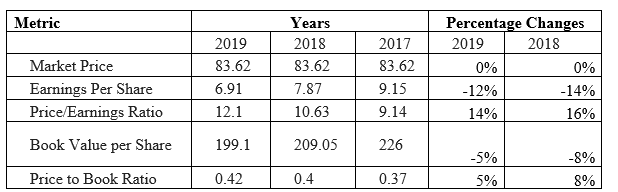

Table 1. Trend Analysis

Table 1 shows various metrics from the financial statements of ABC Healthcare Corporation. Columns 2, 3, and 4 indicate the years, while the fourth and fifth columns represent the percentage changes. The first row represents the company’s market price. The market price is the price at which the stock of an organization goes in the open market. In the financial years 2017, 2018, and 2019, the market price remained constant; automatically, the percentage change would also remain constant. This indicates that demand for the stock had not increased over the period; interestingly, the stock price had not slumped either, which could indicate loyal investors. However, the flat trend is not a good indicator since the investors who had injected their money in 2017 have lost value in their money from inflation.

The third row indicates Earnings per Share (EPS); over the three-year period of 2017, 2018, and 2019, ABC Healthcare Corporation’s EPS were 9.15, 7.87, and 6.91. The percentage changes for the same period were a 14% and 12% drop for the years 2018 and 2019, respectively. EPS is calculated by dividing the company’s earnings by the common shares. The trend from the period shows that EPS was falling over the three years. This is not a good sign since declining earnings could scare away investors. It is no surprise that the market price had remained constant over the period, given the unattractive EPS values.

The fourth row indicates Price to Earnings ratio. During the analysis period of 2017, 2018, and 2019, the PE ratios for ABC Healthcare Corporation were 9.14, 10.63, and 12.1. On the other hand, the percentage changes were 16% and 14% increases for the years 2018 and 2019, respectively. Trend-wise, this shows an increasing pattern. PE ratio measures the stock price of a company against the EPS. A high PE shows that the company’s stock is overvalued while the converse is true. Typically, the PE ratio is compared with industry peers or with historical figures. Since the PE for ABC Corporation is increasing over the analysis period, it shows that the company’s stock is becoming increasingly overvalued. This is not a surprise since the stock price has remained constant over the period while the EPS has declined.

The other metric in the table is book value per share (BVPS). Over the three-year period of 2017, 2018, and 2019, BVPS values for ABC Healthcare Corporation were 226, 209.05, and 199.1, respectively. Automatically, the percentage changes were an 8% and 5% drop for the years 2018 and 2019. Book value per share is a metric that indicates the book value of a firm based on the common stock. In the case of ABC Corporation liquidation, BVPS value shows the value the common stock shareholders would be paid after creditors, and preferred stock shareholders are paid. Trend-wise, ABC Corporation shows a declining BVPS value which is not a good sign since it indicates declining shareholder equity.

The final metric is Price to Book (PB) ratio; for the analysis period of 2017, 2018, and 2019, the PB ratios for ABC Corporation were 0.37, 0.4, and 0.42, respectively. Automatically, the percentage changes were an 8% and 5% increase in the years 2018 and 2019, respectively. PB ratio indicates a company’s market capitalization against its book value. A lower PB value could indicate that the stock is undervalued. Since the trend for ABC’s PB value shows an increasing pattern, it means that their stock is increasingly becoming overvalued. This is no surprise since the company has posted declining earnings while its stock has remained constant.

Competitive Comparative Analysis

Single financial ratio values are not very important by themselves. This is why they are compared with the firm’s values from the past or with those of peer organizations from the same industry. These metrics are compared with those of industry peers because different sectors have separate norms of gauging performance. For instance, banks have different tolerances for debt to asset values than those of construction firms that require heavy machinery.

In the case of ABC Corporation, comparative financial analysis will be carried out against HCA Healthcare Inc., based in Nashville, Tennessee, in the United States(HCA Healthcare WSJ, n.d.). The company has 275000 employees and reported a revenue of 51.53 billion dollars. HCA is involved in operating hospitals, emergency rooms, freestanding surgery centers, and urgent care centers (HCA Healthcare WSJ, n.d.). It offers a complete range of services that accommodate medical services such as general surgery, internal medicine, oncology, cardiology, neurosurgery, obstetrics, and orthopedics.

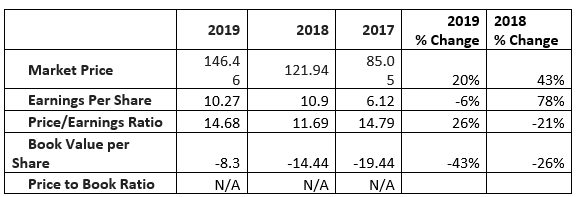

Table 2. HCA Healthcare financial ratios

The above ratios are from HCA Healthcare for the analysis period 2017, 2018, and 2019. The market price for HCA stock increased by 43% YoY between December 2017 and December 2018. It also increased by 20% YoY from December 2018 and December 2019 (HCA Healthcare – Yahoo Finance, n.d.). In comparison, ABC Corporation’s stock market price remained constant over the three-year period. This does not bode well for ABC, which seems to have been outperformed by its competitor in terms of capital gains.

In terms of earnings per share (EPS), there was a 78% increase YoY from December 2017 to December 2018. In the following fiscal year, however, the same dropped by 6% YoY. This drop, However, is well covered from the previous years’ gains of 78%. In comparison, ABC had posted declining EPS for both fiscal years 2018 and 2019. This is another metric in which ABC has been outperformed by HCA. In terms of PE ratio, HCA reported a drop of 21% over the fiscal year between December 2017 and December 2018. In the following year, however, PE ratio increased by 26%. PE ratio standardizes the comparison between different firms, and for this reason, the absolute values are comparable. Once again, HCA healthcare has reported higher values than ABC; however, higher PE values could mean that the stock is overvalued, which is in accordance with the higher increase in the value of its stock.

In terms of book value per share (BVPS), HCA reported negative values for the three years. This is an indicator that the company has more liabilities than assets. In this metric, ABC seems to have the more attractive values. In terms of PB ratio, HCA did not have relevant figures since the BVPS was negative for the three years. Overall, despite HCA Healthcare having marginally better values than ABC, it is not radically so, meaning ABC is still within tolerable limits of its competitors.

Recommendations

From the analysis, it has been observed that ABC Corporation has not been doing very well over the analysis period in terms of trend and in comparison with industry peers. This section will focus on recommendations that woud enhance shareholder value. The market price of the company has been constant for the three-year period, which indicates that only loyal customers are holding the stock; the company is failing to attract new investors who would drive the stock upwards. This can be addressed by establishing a strategic plan such as diversifying investments and venturing into new businesses. Earnings per share can be improved by increasing the company’s profits through revenue diversification. Another solution to improving the EPS would be for ABC to buy back some of its outstanding shares that have been found to be undervalued anyway.

Book value per share has been described as a company’s value when only considering the common stock. One way a company can improve its BVPS would be to buy back its common stock, which would automatically improve its BVPS. Other solutions include increasing its equity which could be increased through shrewd business practices that increase revenues and cut costs. It is recommended that ABC enter into the partnership since its situation is not dire despite needing the above improvements.

Conclusion

This paper looked at the financial situation of ABC Corporation, an American Healthcare Company. Among the metrics that have been analyzed include market price, Earnings per share (EPS), Price/Earnings ratio, book value per share (BVPS), and price to book ratio. Since financial ratios are little sense in isolation, it was necessary to compare the values over time, which was chosen to be the financial years 2017, 2018, and 2019. Upon analyzing the values over the three years, it was discovered that the company has not been performing exceptionally well over the years, evidenced by the stagnation of its stock price. Since financial ratios vary from industry to industry, it was essential to select an industry peer to juxtapose ABC results against for which HCA Healthcare Inc. was chosen which showed marginally better ratios than ABC. However, the values were not radically better than ABCs, and one firm is not sufficient to conclude a bleak situation for ABC. However, since financial values can always be improved, some recommendations were proposed to better ABC’s situation.

References

30 year financial data of HCA Healthcare Inc (HCA) (n.d.). Gurufocus. Com. Web.

HCA Healthcare Inc. Company profile & executives. (n.d.). WSJ. Web.

HCA Healthcare, Inc. (HCA)Stock historical prices & data (n.d.). Yahoo finance. Web.

Nadar, D. S., & Wadhwa, B. (2019). Theoretical review of the role of financial ratios (SSRN Scholarly Paper ID 3472673). Social Science Research Network. Web.

Ross, S. A. (2018). Corporate finance: Core principles & applications (Fifth edition). McGraw-Hill Education.

Wang, D., & Zhou, F. (2016). The application of financial analysis in business management. Open Journal of Business and Management, 04(03), 471–475. Web.