Abstract

The oil and gas industry is playing a critical role in the United Arab Emirates’ economy, and Abu Dhabi National Oil Company is one of the leading players in the industry. The company is faced with the problem of ensuring that its operations do not pose any threat to the environment. The paper proposes a change in product and production strategy at the firm. It should consider embracing emerging technologies in its production. It should also consider investing in the green energy market.

Introductory Statement

Change is a force that an organization cannot avoid. According to Tiwari and Vaish (2012), in the modern competitive business environment, companies are keen on introducing new methods of delivering their products as a way of cutting down their operational cost and increasing value for their customers. Other environmental (both external and internal) forces are also forcing organizations to reevaluate and redesign their operations.

In many cases, change is often met with resistance because of the fears stakeholders have towards it. Some employees may fear change because of the possibility of the skills, experience, and expertise is irrelevant under the new system. Others may fear the possibility of them losing their jobs because of the new requirements. The management unit may fear change because of the possibility of investing massive amounts of resources in training and equipping employees and in purchasing new equipment to be used under the changed system.

Kelland (2014) warns that although stakeholders may have their fear, trying to avoid change may be a serious mistake for any firm that seeks to achieve success in the current competitive business environment. Successful organizations have mastered ways of dealing with change in a manner that eliminates any fear that the stakeholders may have. In this paper, the researcher will look at ways through which Abu Dhabi National Oil Company (ADNOC) can change its operational strategies to ensure that its activities do not pose any significant threat to the environment.

Executive Summary

The oil and gas industry is still the most significant sector in the economy of the United Arab Emirates. ADNOC is currently one of the leading companies in this sector within the country. It plays a critical role in the country’s economy. Still, its activities- just like activities of any other company in the oil and gas sector- have a significant impact on the environment. Environmental conservationists have warned about the sustainability of continued use of fossil fuel, especially due to the emerging problem of global warming and climate change. ADNOC primarily relies on the activities in the oil and gas industry for its income.

Some of the methods, which this company is using to extract process, store, and transport oil, pose a serious threat to the environment. However, oil remains an important resource that countries all over the world rely on to operate in various industries. ADNOC will need to change its operational strategies to ensure that its operations pose a limited threat to the environment as possible. It may also need to redefine its product portfolio to include green energy as the world is changing towards the use of renewable energy.

Main Issues to be Addressed

According to Kelland (2014), there are three pillars of sustainability, as explained by the Theory of Sustainability. They include the planet, people, and profits. For a long time, companies primarily focused on profits without giving significant regard to the other two pillars (planet and people). However, as competition in the market started becoming stiff, it became clear to the companies that they can no longer ignore the second pillar (people) as they had to meet the interest of their customers in the best way possible and ensure that the employees are satisfied to reduce the rate of employee turnover.

Many firms currently ignore the first pillar (planet) of sustainability. According to Oxford Business Group (2014), it is true that the planet (environment) may not have direct benefits that a company may desire. However, the truth is that it has long-term benefits, and if it is not protected, then it cannot sustain the operations of a company. In this paper, the main issue of concern is how to ensure that operations of ADNOC are changed to be in line with the emerging environmental forces, especially the need to protect the environment. The paper will discuss how this company can continue operating profitably despite the massive global pressure to reduce reliance on fossil fuel and activities related to the extraction, processing, transporting, and use of oil and gas.

Discussions of Main Issues

In a report by Tiwari and Vaish (2012), the impact of global warming and climate change is increasingly becoming evident in various parts of the world. Destructive cyclones have become common in parts of Asia and North America, claiming many lives, leaving others wounded and properties destroyed. Earthquakes have also become more common and dangerous all over the world. Flooding is becoming a common occurrence in parts of the Americas and Asia. The polar ice is melting, causing the sea levels to rise. As a result, the coastlines are disappearing, and some countries are losing their land territories to the rising waters.

In Africa and the Middle East, rainfall is becoming unpredictable, and desertification is a major concern. The polluted air in cities such as Beijing and Shanghai that heavily rely on oil and gas to run the economy is causing serious respiratory diseases, especially to children and elderly people. It is clear to the global society that nature is increasingly becoming less tolerant and less sustainable as the levels of pollutions continue to increase. The scientists have remained very consistent, explaining that most of the current environmental problems are directly caused by massive pollution from industries, especially the emission of greenhouse gases.

According to Kelland (2014), companies in the energy sector must step out and play a critical role in addressing the problem in a way that will enhance sustainability. The global society still needs energy, and oil and gas remain the most efficient form of energy that can be used in various sectors. However, the issue of sustainability can no longer be ignored. The players in the energy sector must change their operations in a way that will not be a threat to the environment.

They must ensure that as they meet the global energy needs, they do so in a way that is friendly to the environment. Chiras (2012) says that global warming and climate change have become a reality, and society can see how it can affect the world if the current trend continues. ADNOC is one of the top global companies in the oil and gas sector.

It must understand how its specific activities as a firm and the activities of the industry within which it operates can help combat the problem of global warming, climate change, and environmental pollution. The company must understand that it has a role to play individually as an entity and collectively with other companies to address the problem in the best way possible.

Solutions

ADNOC is currently the leading player in the oil and gas industry within the United Arab Emirates, and it employs many locals and international workers. The economy relies on it to a significant level, and its operations are benefiting many people, not only at the local level but internationally. This company must continue operating so that it can support the country’s economy and enhance the job security of its employees. However, its operations can only be sustainable if the firm protects all three pillars effectively. Specifically, a lasting solution is needed to address the problem of environmental pollution.

The company must find a way of ensuring that massive emission of greenhouse gases from its operations is reduced, cases of oil spillage are eliminated, and that its products are friendly to the environment. The management of ADNOC should consider the following steps as the company tries to find the best way to solve this problem.

The first step that this company should focus on when solving the problem is to introduce new, environmentally friendly products. As mentioned above, emerging trends in the energy sector strongly indicate that green energy is the future of energy consumption both domestically and in the industrial sector. As a firm that is keen on ensuring that it remains operational and profitable in the years to come, it must invest in the future.

It must start investing heavily in the green energy sector to ensure that when oil reserves in the country dry out (or when oil and gas become less desirable energy sources), it will still be a major player in the energy sector. It should invest in solar energy, which is very viable in the Middle East and Sub-Sahara Africa that enjoys regular sunlight throughout the year. Wind energy is also becoming increasingly popular in parts of Europe, Asia, Africa, and North America. Biogas is another renewable energy source that is becoming popular. Investing in renewable energy sources will not only secure a future for this company, but it will also help in protecting the environment.

ADNOC must continue operating in the oil and gas industry not only because it is its primary source of income, but also because the global society still relies heavily on this source of energy for normal operations. However, changing its operational strategies can help in ensuring that the environment less polluted by its activities. As Chiras (2012) notes, using emerging technologies, it is now possible for oil extraction companies to extract oil with the least possible impact on the environment. This company should embrace the new technologies to ensure that its operations are more efficient and less dangerous to the environment than it was in the past.

The company will need to train its employees on how to work under the new system and structures to improve the operations of the firm and the level to which its operations of the firm remain friendly to the environment. All the stakeholders in the company must always remain positive towards change and be ready to embrace it whenever it is necessary.

Recommendations and Discussion of Recommendations

ADNOC has achieved massive success since its inception as a government-owned company that controls activities in the oil and gas industry. It has been keen on improving its operational strategies to ensure that it can compete favorably with regional and global companies in this industry. However, future success can only be achieved if the following recommendations are taken into consideration:

- Introduce new products in the green energy market as a way of meeting the emerging demand for renewable energy.

- Remain dynamic enough to change its operations in line with the changing environmental forces.

- Create a model of change that can be used within the organization to introduce and manage change.

The management unit of this company should consider introducing new products in the renewable energy market as a way of enhancing the sustainability of its operations in the energy market. This firm should specifically consider manufacturing high-quality PV solar panels because of the growing demand for solar energy not only in the UAE but also in the regional and international markets. It should also establish a wind turbine manufacturing plants for clients interested in tapping wind energy. The firm, given its financial power, can establish the plants within the country or in any other country where the overall cost of operation will be low.

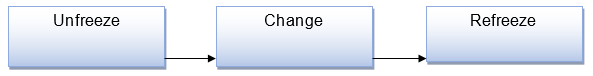

The management of this firm will need to ensure that it remains dynamic enough to change with the changing environmental forces. This firm can use the following Kurt Lewin’s Change Model:

As shown in the above model, the management should ensure that there is a smooth flow every time change is introduced within the organization. The first step, as shown in the flow chart, is to unfreeze where stakeholders are informed about the weaknesses of the current system and prepared psychologically and materially for the new system. When they are fully prepared and equipped, change is introduced. The final stage is to refreeze, where stakeholders are taken through the necessary training to enable them to work effectively under the new system.

Trials of Recommendations and Results

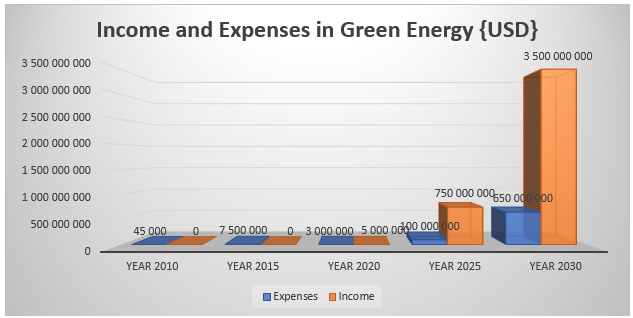

The management should consider introducing trials of the recommended strategies above. According to Chiras (2012), ADNOC has been at the forefront of championing climate change mitigation at the global level. It has also invested part of its revenues on trials in the green energy market. The green energy market has a huge potential, but the biggest challenge that small and medium firms often face is the magnitude of investment needed. As an empowered financial firm, this problem can easily be overcome. Given that this firm had started making investments in the green energy market on a trial basis, it should target to have considerable income from this sector from the year 2020.

As shown in the figure above, by the year 2020, the income from the green energy market should be 10 percent of the total revenues of the firm. It should increase to 20 percent in 2025. By 2030, 50 percent of the revenues of this firm should come from green energy.

Review and Measurements of Results

The management of ADNOC will have to review the financial performance of this company regularly after implementing the recommended strategy above. As indicated above, the firm had started spending in this sector by 2010. However, that was just on a trial basis. It is now time for the company to make a heavy investment in this industry. The focus should now be taken from the trial stage to the investment stage. The figure below shows the expected income flow.

As shown above, from 2010 to 2015, the firm had been making significant investments into the green energy industry at a trial level without expecting revenues. However, by the year 2020, the firm is expected to have commercialized this new project, and the revenues should exceed expenses. It is in that year that it should achieve a break-even point in its investment into this industry. By 2030, this firm should be earning attractive profits from this green energy market, as shown in the figure above. When measuring the results, interest should be to determine if the operations in the green energy market are capable of generating enough revenues that can meet all the expenses. In case it is established that the operations are not profitable enough, the firm may need to redefine its operations in the market.

Summary and Conclusions

ADNOC is one of the leading oil and gas companies in the global market. In the United Arab Emirates, it is one of the main employers, playing a critical role in the country’s economy. However, the industry within which this firm operates has been criticized as being the leading cause of global warming and climate change. The greenhouse gases emitted from this industry and the products they deliver in the market are responsible for the massive air pollution.

The products sometimes end up polluting the seas and land when a spillage occurs. As such, firms in this industry are under intense pressure to find a way of ensuring that their operational activities do not have a devastating impact on the environment. The firm has to ensure that it protects the first pillar of sustainability (environment) because, without it, the other two pillars cannot be sustained.

The paper has proposed two strategies that this firm should use to address the environmental concern. The first strategy should be to embrace the emerging technologies in its operations to minimize the extent to which its activities pollute the environment. This strategy is important because oil and gas are still very important sources of energy that cannot be easily phased out. As a responsible firm, ADNOC should ensure that its operations do not pose a significant threat to the environment.

The second approach is to start investing in green energy sources. The demand for green energy sources has been on the rise, and it is apparent that in the future, this form of energy will dominate both domestic and industrial sectors. As a futuristic firm, ADNOC should invest in this form of energy. The two proposed strategies involve embracing change. However, it is pointed out that sometimes stakeholders may fail to embrace change because of several reasons. It is recommended that this company should use Kurt Lewin’s Change Theory to eliminate any resistance towards change.

References

Chiras, D. (2012). Solar home heating basics: A green energy guide. New York, NY: New Society Publishers.

Kelland, M. (2014). Production chemicals for the oil and gas industry. New York, NY: Cengage.

Oxford Business Group. (2014). Report: Abu Dhabi 2014. Oxford, UK: Oxford Business Group.

Tiwari, M. & Vaish, A. (2012). Green energy. Aalborg, Denmark: River Publishers.