The ethical issue in this situation is an academic dishonesty involving unauthorized collaboration. The unauthorized collaboration in this situation involves receiving a copy of an old examination containing questions of class notes without permission from the professor facilitating the course. The rules and regulations of the course plainly state that students should do their work. The stakeholders of the unauthorized collaboration are the student receiving the old examination, and the student giving out a copy of the old examination. The possible consequences of the student receiving a copy of the examination are getting zero marks in the course, lowering of the grade, repeating the course, and suspension from the University. The possible consequences of the student giving a copy of an examination include cancelation of the sorority membership, receiving sanctions of the scholarship, and suspension from the University (Scanlan 180).

The possible alternatives to the situation in economic standpoint involve cost-effectiveness toward unfolding the fraud, equity, and fairness (Pinkerton et al. 73). The majority of the academic dishonesty cases gets the final verdict from the University management in collaboration with the course facilitator. The student has legal rights to appeal to the possible penalty from the council of deans of student affairs and toward receiving a justifiable academic penalty. Mediations are essential in settling academic dishonesty issues and may involve a legal advisor in giving legal rights of the parties. The ethical alternatives involve fair hearing from the administrative council and the student. The student has the mandate of asking questions if unsure of the rules and also seeking authority from the course instructor in situations of collaboration (McCabe, Kenneth, and Linda 295).

According to McCabe, Kenneth, and Linda (298), the unauthorized collaboration in this situation undermined the education and accounting course goals. The two students have engaged in unfair and dishonest conduct that requires punishment. The student studying for the accounting exam should get sanction of receiving a “0” in her examination and a letter grade reduction in her final accounting examination. The justification for the sanction is that the student is undoubtedly aware of the academic dishonesty and the academic consequence (McCabe, Kenneth, and Linda 301). The student in possession of a copy of the old examination ought to receive a verbal warning from the course professor and get a suspension of the sorority membership. The warning from the professor will ensure the student honors the course code and discourage her from collaborating with other students through sharing of the course materials without instructor’s permission. The suspension of the sorority membership will help in controlling the effects on the relationship of the sorority membership and the grade point average success (Scanlan 183).

The scenario is similar to a business situation since it involves the provision of information that have an impact on the evaluation process of business and academic efficiency (Boatright 33). The academic rules mandate the student to maintain honesty in attaining the final grade in the class. Similarly, the success of a business has relation to the observance of business conduct and ethics. The similarities of ethics in business and academics are transparency, honesty, and integrity (Boatright 45). The difference between the scenario and the business situation are trade controls, financial operations and code of conduct. The majority of business operations receives influence from trade controls and government entities. On the other hand, the ethical issues in academic receive control from the academic administration through the dean of student affairs (Scanlan 184).

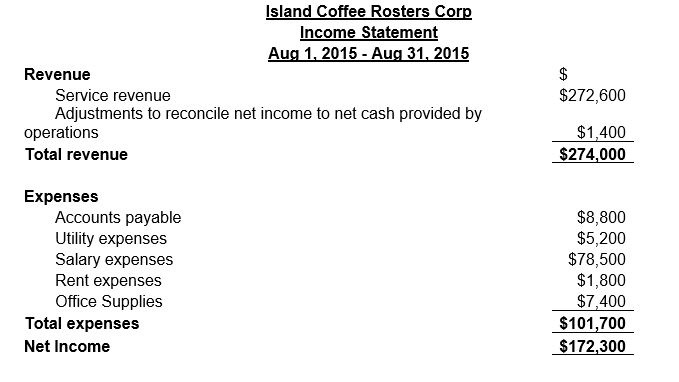

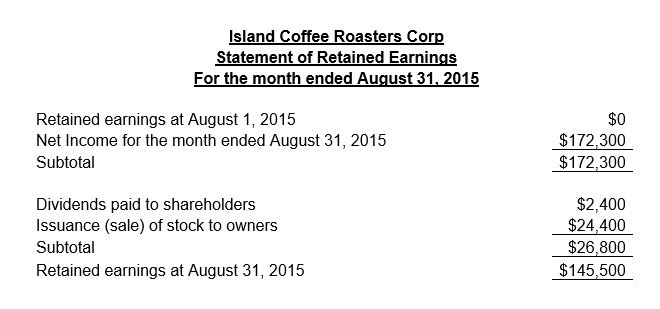

The preparation of the income statement and the statement of retained earnings involve understanding of financial accounting terms (Needles, Marian, and Susan 17) and principles involved in presentations of financial statements (White, Ashwinpaul, and Dov 21).

References

Boatright, John. Ethics and The Conduct of Business, Mumbai: Pearson Education India, 2008. Print.

McCabe, Donald, Kenneth Butterfield, and Linda Klebe Trevino. “Academic Dishonesty in Graduate Business Programs: Prevalence, causes, and Proposed Action.” Academy of Management Learning & Education 5.3 (2006): 294-305. Print.

Needles, Belverd, Marian Powers, and Susan Crosson. Principles of Accounting. Boston, MA: Cengage Learning, 2012. Print.

Pinkerton, Steven, Ana Johnson-Masotti, Arthur Derse, and Peter Layde. “Ethical Issues in Cost-Effectiveness Analysis.” Evaluation and Program Planning 25.1 (2002): 71-83. Print.

Scanlan, Craig. “Strategies to Promote a Climate of Academic Integrity and minimize Student Cheating and Plagiarism.” Journal of Allied Health 35.3 (2006): 179-185. Print.

White, Gerald, Ashwinpaul Sondhi, and Dov Fried. The Analysis and Use of Financial Statements. Hoboken, NJ: John Wiley & Sons, 2003. Print.