Introduction

Oil prices have been on the rise for the last decade, economic reports reveal that the prices have increased for more than four times during this period. The price of crude oil increased from $ 31.61 in 2004 to $ 131.11. While gasoline prices increased from $1.93 to $4.09 in the same period (Witt, 2010).

The market situation does not seem to improve any soon because the oil prices are reporting significant increases to date. The escalating prices have been instigated by the Gulf of Mexico oil spill, which was the worst to be experienced to date. The oil market has also been affected by the political uprising in both Libya and Egypt. Although Libya produces less than two percent of global oil production, its political influence has been felt in Saudia Arabia and Iran. These instabilities have caused panic in the market thus causing oil prices to increase steadily. Witt (2011) records that oil prices in American rose for over 11 percent in three weeks in February. This high rise in price was due to wild oil speculation rather due to a reduction in oil supply. Therefore this report seeks to evaluate how the gulf oil spill and political unrest have affected the BP Oil Company.

Business Case

BP Oil Company is one of the largest oil suppliers in the world. The company has been enjoying steady operation until last year when it experienced the worst loss due to the oil spill that occurred in the Gulf of Mexico. It is reported that around 174 million gallons have been spilled over an area of 25, 000 square miles (Amadeo, 2010). The sustained loss has adversely affected the company’s operation since over $ 6 billion was immediately allocated to clean the spill while the entire process was estimated to be around $ 40 billion.

BP faces stiff competition from other global oil distributors such as Chevron, corp, Exxon Mobil Corporation, Total SA, Conoco Phillips, and Oil Libya among others. Since the occurrence, the oil spill the BP market dominance has dealt a significant blow due to the reduction of its sales volume. The company’s shares market has also recorded a significant drop according to the preceding of the New York Stock Exchange (NYSE).

BP Oil Company has a firm strategic plan that seeks to guide the company in the next few years. The organization’s strategic plan is based on the 45 percent increase projection in the consumption of oil products by the year 2030. The strategy is sub-divided into two parts, the short-term strategy covering up 2015 and the long-term strategy that goes beyond 2015. The short-term strategy is growth-oriented and it constitutes increasing energy mix that integrates all available sources i.e. wind, oil and solar.

The strategy also seeks to enhance the company’s efficiency to reduce emissions and therefore curb environmental pollution. To finalize two carbon capture and sequestration projects in California and Abu Dhabi. The organization has a strategy to increase its portfolio balance, which currently stands at 60 percent oil and 40 percent gas. Long-term strategy aims at strengthening the organization’s expansion both in geographical and geographical frontiers. The organization aims at exploiting the Arctic region and deep waters (Gulf of Mexico, Angola, Egypt, and Libya) for more gas production (Hayward, 2010).

In marketing, the company has done magnificently well in closing the competitive gap by an annual amount of $3.5 to 4 billion. The marketing team is led by five principles, which are increasing safety performance, reduce the cost below 2004 levels, and improve on portfolio quality. The marketing team also endeavors to augment margin share growth and ensure net investment is greater than the depreciation level. Other growth impetus includes; enhancing competitive advantage through networking, value addition, and focused petrochemicals portfolios. The company’s main products are lubricants, global fuels, petrochemicals, and gas.

Analysis and Evaluation

Over the last few years, BP has recorded improving performance both in profitability and in the level of business participation. The record improvement has been credited to good management and the ever-increasing demand for petroleum production. However, the good streak of performance has been halted by the Gulf of Mexico oil spill in April 2010. Speculation also suggests that the ongoing political uprisings in the Middle Eastbound trigger further troubles to the organization.

Historical Performances

To assess the impact of the oil spills and current political unrested, a historical approach was conducted to form the basis of analysis. This report covers the company’s performance years 2005-2009. During this period the company reported increased investment in fixed assets which were recorded as follows $121, 830, $129,771, $140,169, $152,019 and $158,269 million respectively. The stable increases in fixed assets highlight the organization’s expansion and growth strategy. The expansion in operation was reflected in the steady increase in equity from $80,765m in 2005 to $102,113m in 2009.

The liquidity of the firm reveals that BP has a stable cash flow statement, which records the ability of the form to meet its liabilities. The balance recorded for this period is recorded as $2,960, $2,590, $3,562, $8,197, and $8,339 million respectively. As the organization’s performance improved, so were the dividends paid. The total annual dividend paid during this period was as follows; $19.152, $21.104, $20.995, $29,387 respectively (FOI, 2010). Generally, from 2005 to 2009 BP Company recorded increased performance in all sectors of operation. Albeit prices increase, the company still managed to record positive results.

BP’s Performance in 2010

In 2010, the good performance streak was halted by many factors including the financial crisis that affected the entire world, the oil spillage and high oil prices. The company’s profit before tax dropped from $ 26, 426 million in 2009 to negative ($3,702) million. These drop-in profits were highly contributed to the Gulf of Mexico oil spill. During the year, the company used $ 40.858 billion in response to the spill thus affecting the organization balance sheet.

Similarly, the company also recorded a low dividend payment of $ 14.00. This was the lowest figure that was paid in the last six years. The cleaning of the oil spill was financed by the sale of fixed assets at the tune of $ 30 billion (Svanberg, 2010). This indicates a decline in total assets that the company recorded for the year. The organization also reduced the amount of money that was reinvested back in the company.

Prices

The price of oil products has been increasing steadily, due to the high crude oil prices in the production zones. The main oil producers have been increasing the cost of oil due to an increase in global demand as well as wild speculation of oil prices. In three weeks the US oil prices had increased by 11 percent. The average price of gasoline also increased from $3.14 to $3.50 (Witt, 2011).

This increase is not justified by an increase in demand. Witt (2011) disagrees with the argument that the high prices of oil are because of an increase in demand. He further argues that US production has not increased by the same margin over the period. Therefore, the only reason that has attributed to the skyrocketing of the oil is the poor market speculation that has been based on the situation in the Middle East. Webb and Bawden (2011) highlight that the company set out $ 41 billion to clean the spill, to mitigate the loss the company has decided to increase prices.

Share market

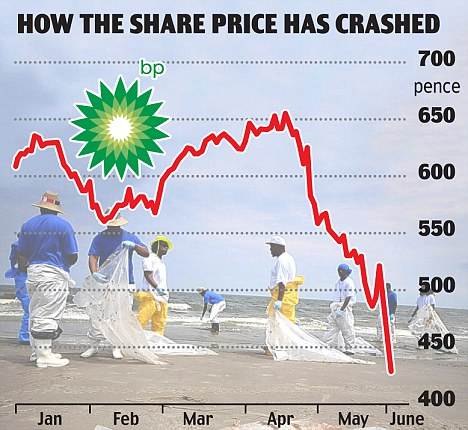

BP’s shares have also experienced a decline in the market because of the oil spill. Most investors sold their shares in fear that the company could not manage to pay dividends. Pagnamenta (2010) reveals that in a single day BP lost £6 billion when attempts to curb oil spills turned futile. In England, the value of share also recorded a slump of 8 percent equivalent to €5.39 (£4.56) after the US government declared that the spill could not be stopped until August.

Gardner (2010) asserts that the BP market recorded a 17 percent decline in London because of the spill. He further reveals that the company share value recorded a drop of £12 billion. Although the company management revealed that it will pay a dividend in full, investors’ confidence was low and few people were willing to commit to their money in the dying company (Gardner, 2010). From a high of 650p in April before the spill, the price of BP’s share has dropped to around 420 p in June. For more information about the decrease in share prices, find exhibit 1 at the back of the report.

Ratio Analysis

The company’s net debt ratio increased from 20 percent in 2009 to 21 percent in 2010 (Svanberg, 2011). An increase in debt ratio reveals that the organization has increased borrowing compared to the number of assets that the company holds. This information is useful to investors who need to know the relationship between the company’s debt ratios concerning equity. On the other hand, the firm’s current ratio increased marginally to 1.15 in 2010 from 1.14 in 2009 (Stock Analysis on Net, 2011). An increase in ratio indicates the company is still able to meet its liabilities.

Nevertheless, this ratio is low and the firm needs to improve its current ratio to be able to meet its cover all liabilities effectively. However, the profit ration recorded was in the negative zone. Operating profit margin dropped from 11.04 percent in 2009 to -1.25 in 2010. Similarly, the net profit margin dropped from 6.93 in 2009 to -1.25 percent in 2010 (Stock Analysis on Net, 2011). This drop-in profitability ratio indicates a negative performance of the firm and therefore the management should reduce expenditure to revitalize the company’s image.

Management

The escalating situation in the Gulf of Mexico and the rapid decline in the share value in the NYSE pressurized the then CEO Tony Hayward to resign. His place was taken over by Bob Dudley who is expected to rejuvenate the company’s performance. Despite working under a strenuous situation the BP management has strived to control the condition and focusing on the company’s strategic plan.

The company’s ability makes new acquisitions worth $3.6 billion shows that the firm is working towards meeting its strategic plan to expand. The report also reveals that a substantial amount of this money was used in exploration and production subdivision with Devon energy. The move strengthened the Gulf of Mexico’s potential while another segment was used in Azerbaijan. Further $3.2 billion is expected to complete a project in Brazil in 2011 (Svanberg, 2011). All these investments demonstrate management commitment to see through the strategic plan.

Recommendation

The situation at BP is currently under control and the management is working hard to restore the company to its previous glory. Conversely, this will not be an easy task for new CEO Bob Dudley. Having considered the situation at the company, the organization needs to implement the following recommendations.

The company should invest heavily in the Gulf of Mexico in terms of drilling alternative oil reservoirs to contain the situation. This should be given priority to retain shareholders’ confidence as well as safeguarding its future operations. Also, the company management should ensure the oil spill is cleaned as a means of living true to its policy of conserving the environment.

Due to the low profitability ratio, the management should solicit some loans to help fund the Gulf of Mexico spill cleaning. This move will ensure that the company does not consume a lot of its working capital in dealing with the non-profit earning operation. The effect of securing a long term loan will enable the organization to resurface it slowly. The impact of this move will enhance the company to have positive profitability and hence the shareholders and other investors will still have confidence with the firm.

Since the oil prices are regularly affected by the volatile political situation in the Middle East, the company should start drilling the oil reserve in the Mexican deep see. Although this project can take a long time before it is accomplished, once its completed BP will be able to enjoy stable prices and consolidates its market leadership.

Way Forward

The current situation at the company is the toughest that the company has ever experienced. The Gulf of Mexico oil spill and the current political unrest have set the company crumpling. However, there is still hope for the future, as the company is fighting its way out. Apart from what is being done, the company management should be vigilant, remain focused and readjust the strategic plan to fit the current situation. Readjustment in the strategic plan will enable the company to restructure its priority according to the firm’s performance.

Conclusion

Global oil prices have been on the increase for a long period now. The real cause of it is yet to be known but the recent oil spill and the political unrest in the Middle East are partly to blame. The 2010 oil spill in the Gulf of Mexico has paralyzed the giant oil company as share. The profitability ratio is operating in the negative territory while the dividend payment has drastically reduced. Nevertheless, the organization the new management is working hard to reinstate the company to its former performance level. Although the company’s shareholders had lost hope in the company the steady measures and action being implemented has helped to win the investors’ confidence back. Should the management implement the following recommendation the organization will make a great stride toward reverting the situation.

Reference List

Amadeo, K. (2010). Gulf Oil Spill. US Economy. Web.

FOI. (2010). Financial and Operating Information 2005-2009. New York, NY, BP Corp.

Gardner, D. (2010). Bp Market Plunge Wipes Billions Off UK Pension Funds as Shares In Oil Giant Suffer Fresh Falls. Web.

Hayward, T. (2010). BP 2010; Strategy Presentation. New York, NY: BP Corp.

Pagnamenta, R. (2010). BP’s Failure to Cap Oil Spill Unleashes £6 Billion Share Leak. The Times. Web.

Stock Analysis on Net. (2011). BP PLC (BP). Web.

Svanberg, C. (2011). Summary Review. New York, NY: BP Co.

Webb, T. & Bawden, T. (2011). Courts Order Halts Bp Talks With Rosneft. Guardian. Web.

Witt, R. (2011). Are Higher Gas Prices Because of Libya, or Because of Wild Oil Speculation? Web.

Exhibits 1