The break-even analysis gives the number of units of output that must be produced and sold that will ensure that the total cost incurred equals the total revenue earned. Therefore, it will give the minimum number of units of goods that need to be produced and sold to enable the business to pay the total cost of production (DuBrin 201). Thus, at break-even point, total revenue (P * Q) = total cost [Variable (VC *Q) + fixed cost]. In this scenario, the units are not divisible. Therefore, the break-even number of passengers will be computed in a tabular form. The costs will be deducted from the total revenue to determine the net income. The table presented below shows the calculation of break-even analysis for the company.

Continuation of the table.

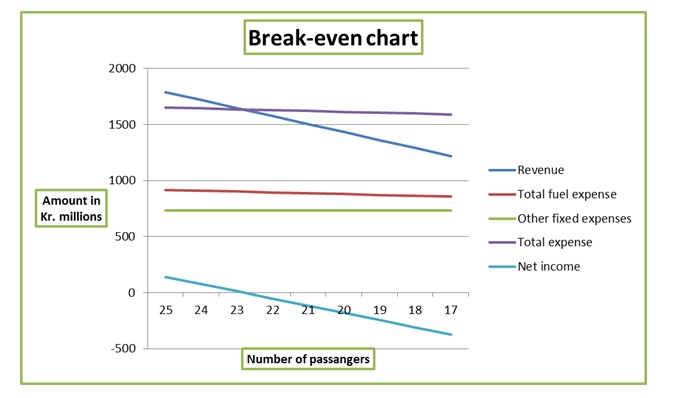

The total revenue and variable expenses decrease as the number of passengers decreases. However, the number of fixed fuel expenses and other fixed expenses are the same irrespective of the number of passengers. These costs result in an increase in the number of total expenses as the number of passengers increases. The break-even number of passengers is 22.72. Since the units in question are human beings, a whole number will be used that is, 23 passengers. At 22 passengers the revenue generated by the company cannot cover both variable and fixed costs. However, at 23 passengers, the company is able to meet the total expenses. Thus, the sales revenue at the break-even number of passengers is Kr1,645 million with a passenger mile of 5,706. The figure presented below shows the graphical depiction of the break-even analysis. In the graph, the break-even number of passengers is at the point where the net income curve meets the x-axis.

SWOT analysis

Strengths

The first strength of the company is that it has a robust financial position. The company has consistently reported improved profitability over the years. When compared to its competitors, the sound financial position puts the company in a better position for growth and expansion. Secondly, the company enjoys the support of the company. This can be attributed to the fact that the airline company is owned by the government. Besides, the government granted the airline a state monopoly in domestic market operations. Also, the support of the company has enabled the company to own aircraft with minimal debt in the capital structure. Thirdly, the company has a large flight capacity. This gives it room for growth and expansion. The fourth strength is that the company has a positive safety record. The company takes necessary measures to ensure that the safety of the passengers comes first. Finally, the company has a low-cost structure for the city routes. Low costs lead to an increase in profits.

Weaknesses

First, the survey conducted by the company indicates that the customer service of the company ranks below average. This implies that the services offered by the company barely satisfy the customer needs. Secondly, the aircraft owned by the company are quite old. The aircrafts do not have any form of entertainment. Besides, the seating arrangement in the aircraft is poorly spaced and the company does not serve beverage or snacks. Thirdly, the company has a poor scheduling of the flights. This reduces the amount of revenue due to time wastage. Finally, the company has not operated in a domestic competitive market. Thus, it may not survive competition in case the market is opened to other investors.

Opportunities

First, the company enjoys loyalty of the customers. This can be attributed to the fact that most customers have gained familiarity with the company because it has been operating in the industry for a long period. Secondly, research studies carried out indicates that demand for airline services is expected to increase in the future. This creates a viable opportunity for the company to grow and expand. Finally, the company maintains a simple fare structure. The company does not impose a surcharge on the fare because the company accepts local currency in international markets. This creates a viable opportunity for marketing.

Threat

The major threat that the company faces is competition from international airlines. The company has been operating as a monopoly and may find it difficult to survive in a competitive market. Secondly, the company faces the threat from potential private investors. Finally, fuel costs are quite unpredictable. This affects the profitability of the company.

Reference

DuBrin, Andrew. Essentials of Management, Alabama, USA: Cengage Learning, 2008. Print.