Company Information

- Company name & Ticker Symbol – CENVEO Inc (CVO)

- Link to web site investors page

- Beta – 2.18

- Current Stock price – $ 5.77

- Earnings per share – (0.54)

- Dividend Yield – 0.0

- Current Risk Free Interest Rate – 10 year 3.473 30 year 4.522

- Income tax rate for the firm – 28.3%

- Projected revenue growth rate for the firm – 1.42

Sources

Beta, Current Stock Price, Earnings per Share, Dividend Yield. Web.

Projected Revenue Growth. Web.

Income Tax Rate for the Firm. Web.

Page 18

Firm Overview and Assessment

Nature of Business

Cenveo Inc ranks third among the graphic communication enterprises in North America. The main business of the company is to provide commercial printing solutions for the customers. The company is engaged in printing and packaging and manufactures labels. Envelope production is the specialty of the company. The company had 8700 employees as at the end of fiscal year 2009. The company manufactures its products in 35 locations throughout North America. The customers of the company include business houses in pharmaceutical, retail and grocery sectors. “The Company produces pressure-sensitive prescription labels for the retail pharmacy chain market,” (Reuters, 2010). There are other industrial customers from “manufacturing, warehousing, packaging, food and beverage and health and beauty.” While its forms and labels segment represented 48% of its net sales for the fiscal year 2009, 52% of the net sales were from the operations of commercial printing (Reuters, 2010). The customers of commercial printing include companies from “consumer products, pharmaceutical, financial services, publishing and telecommunication industries.” The company operates around 35 production locations for commercial printing in “North America, Canada, Latin America and Asia,” (Reuters, 2010).

Competitive Environment

The printing industry in the United States is characterized with a high-level fragmentation. It had more than 34,100 market players in 2009 according to official employment census. The total sales of the industry for the fiscal 2008 were around $165 billion. There are few large operators with revenue exceeding $1 billion. The industry has number of mid-sized companies, whose sales revenues are in the region of $100 million or more. There are also thousands of small business houses constituting the industry. The high fragmentation provides the industry a competitive nature, which influences the business of Cenveo largely. Ten largest players operating in the industry account for approximately 19% of the total industry turnover during 2008. There are number of sectors functioning within the industry such as labels and forms, envelops, commercial printing and several others. There is excess capacity in the industry, which also makes it highly competitive. Majority of the customers focus on the price of products for making their purchasing decisions. With the current economic downturn, the customers are expected to focus more on price, which necessitates Cenveo to look into cost saving measures to remain competitive in the industry.

The competition in the printed labels and forms business, Cenveo has to compete with smaller manufacturers located in various regions and local areas. Business in this segment depends on the ability of the company to ensure quick turn customization of the quality of the products. Customer satisfaction level is another important factor that determines the competitiveness of the player. In the envelope product segment, the company has to compete with few players having plants in multi-locations and many other competitors having single plants. The single plant manufacturers mainly pose competition in serving local and regional customers. Changes in the US and global economic conditions affect the purchasing decisions of the customers and in turn affect the business of Cenveo. Alternative sources of communication aided by electronic means also affect the business volume of the company. Product quality, customer service and product pricing are the key elements, which affect the competitiveness of the players in the industry.

Excess capacity is the main factor, which makes the commercial printing activity of Cenveo more competitive.

“The additional excess capacity resulted in a competitive pricing environment, in which companies have focused on reducing costs in order to preserve operating margins. We believe this environment will continue to lead to more consolidation within the commercial print industry as companies seek economies of scale, broader customer relationships, geographic coverage and product breadth to overcome or offset excess industry capacity and pricing pressures” (Form 10-K Cenveo, Inc).

Thus just as it is in any other industry price, quality and service level are the most dominating factors, which determine the competitive ability of other players as compared to Cenveo. The excess capacity and fragmentation of the industry are the other additional factors, which makes the industry competitive.

Risk Factors

Risk factors are those, which affect the operations and financial conditions of a business. The following are some the risk factors identified to have significant influence on the business operations and financial performance of Cenveo. The foremost factor is the recent downturn in the economic conditions of United States as well as the global economic conditions. The adverse changes in the economic scenario have reduced the demand for the products of Cenveo, which in turn has significant effect on the sales of the company. This factor is likely to continue to affect the business of the company in the near future with a severe impact on the business operations, financial status and cash flows of the company. This factor also affects the ability of the company to manage their inventory and receivables effectively. The uncertainties associated with the expected macroeconomic outlook make the forecasting of the expected financial performance of the company difficult.

The company has a very high level of indebtedness, which could severely affect the financial status of the company and it could affect the ability of the company to meet its financial obligations promptly. The current debt level of company as at the end of the fiscal 2009 was around $ 1.2 billion and this large debt may require the company to divert a major portion of the cash flows of the company for servicing the principal repayments and interest payments on its loans. This implies that the company may not be able to meet its working capital and capital expenditure needs on a timely basis. Because of its high indebtedness, the company may not be able to raise additional funding for expansion plans, if any. In addition, the high level of debts has a direct impact on the profitability of the company because of increased cost of borrowings.

The present financial conditions of the company with high debts will affect its operating performance and this in turn will have its impact on the ability of the company to access the capital markets and banks for further financial assistance. As reported in the form, 10-K the company has its own doubts on its ability to generate sufficient cash flows in the future to enable it service its debts. When the company is unable to meet the debt obligations, it will be forced to face a situation of restructuring or refinancing all or a certain portion of its debts. The refinancing or restructuring will entail additional costs to the company for additional borrowings as well as higher interest charges payable on the new and existing debts. This is likely to apply further restrictions on the business operations of the company and cause a decline in its profitability. It is also reported that the terms under which the company has secured its debt funds apply significant restriction on the operating flexibility of the company and it has placed the company under severe financial inflexibility.

The company in the past has made several major acquisitions including that of Nashua Corporation in September 2009. The present financial conditions of the company will put the company under pressure, as it may not be in a position to integrate the business of the acquired entities into its business successfully. In addition, Cenveo may not be able to continue with its select acquisition of other entities within the commercial printing industry. The company reports in its form 10-K for the fiscal year 2009 that

“Successfully integrating an acquisition involves minimizing disruptions and efficiently managing substantial changes, some of which may be beyond our control. An acquisition always carries the risk that such changes, including to facility and equipment location, management and employee base, policies, philosophies and procedures, could have unanticipated effects, could require more resources than intended and could cause customers to temporarily or permanently seek alternate suppliers. A failure to realize acquisition synergies and savings could negatively impact the results of both our acquired and existing operations,” (Form 10-K Cenveo, Inc).

There were formal requests from the Securities Exchange Commission (SEC) to supply information about the company, which may lead the SEC to commence a formal investigation on the affairs of the company and may institute any other action as it may deem fit. This risk will turn out to result in a negative impact on the market reputation and sales of the company. It may affect the financial status of the company by way of enormous fines and penalties that the SEC might impose on the company.

The high fragmentation and competitive nature of the industry in which Cenveo is operating is one of the other major risks the company is facing in respect of its business operations. Cenveo has to compete with several other organizations, some of which are large, diversified and financially strong companies. There are other smaller local and regional operators, who also pose a stiff competition to Cenveo. The company reports that it is taking constant efforts in the area of cost saving to remain competitive in the industry. If the company is unable to reduce its costs substantially, there is every chance that the company may not be able to compete effectively with other players in the industry.

Another major risk for the company is the existing business model of the industry. In the commercial printing business of the United States, there are no long-term customer agreements. Therefore, the printing operations of the company are subject to high fluctuations because of changes in the customer portfolio every quarter or cycle, as the customers often change the suppliers based on price factor. Since there are no contractual obligations on the part of the customers, the market players in the industry including Cenveo have to indulge in continuous marketing exercises to retain customers and to attract new customers. Moreover, the sales of companies like Cenveo are dependent on the sales of other industries like financial services, advertising, pharmaceutical and office products. Any changes in the volume of sales in these industries because of changes in economic conditions are most likely to have an impact on the sale of commercial printing companies like Cenveo.

The increased presence of Internet and other correspondence medium for communication to the people has a negative influence on the business of Cenveo and other companies operating in the industry. The company’s business largely depends on the demand for the envelopes the business organizations send through normal mail. “Such demand comes from utility companies, banks and other financial institutions, among other companies,” (Form 10-K Cenveo, Inc.). To the extent the companies functioning in these industries switch to electronic medium of communication the business of Cenveo will suffer, because there will be lesser demand for envelopes from these companies. Similarly, any hike in the US postal rates will have a significant impact on the business of Cenveo. Lesser demand implies decreased sales revenues and the resultant cash inflows into the company.

Cost of paper is another significant risk factor in the business operations of Cenveo. Paper being a major raw material for the commercial printing and envelope business, any changes in the paper prices is likely to influence the business of Cenveo negatively. Although the company may try to pass on the increase in the raw material price to the ultimate customers, the ability of the company to do so depends largely on the competitive landscape of the industry.

The application of environmental laws and their stringency has a serious impact on the business of the company. According to form 10-K of the company for the year 2009,

“Our operations are subject to federal, state, local and foreign environmental laws and regulations, including those relating to air emissions, wastewater discharge, waste generation, handling, management and disposal, and remediation of contaminated sites. Currently unknown environmental conditions or matters at our existing and prior facilities, new laws and regulations, or stricter interpretations of existing laws and regulations could result in increased compliance or remediation costs that, if substantial, could have a material adverse effect on our business or operations in the future” (Form 10-K Cenveo, Inc).

Looking at the risk factors affecting the performance of Cenveo and the actions of the management in mitigating them it can be stated that the management is going in the right direction in their actions to restructure the long-term debts as the first step to reduce the exposure to the risks. With the planned reduction in cost of production, the company must be able to improve upon not only their competitiveness, but also in their profitability and resultant cash inflows in to the company. Most importantly, the company must undertake a complete evaluation of the efficiency of their different manufacturing facilities in terms of their contribution to the overall profitability of the company. A reengineering of the facilities to look at the performance of them critically and to decide on the closure or sale of manufacturing units not contributing to the profitability is the direction in which the company has to proceed.

Corporate Growth and Outlook

The current gloomy economic conditions prevailing in the United States as well as at the global level have affected the performance of the company largely. It is expected that these conditions will continue to affect the operations of the company and they are likely to have a significant effect on the future growth prospects for the company. The company is not in a position to make a precise forecast of its future operating results, given the continuance of the economic conditions. There were certain developments that took place during 2009-2010.

“These developments include, but are not limited to: (i) increased unit volume for our direct mail envelope customers, primarily financial institutions, as compared to the first six months of 2009, (ii) positive impact on operating margins from cost savings actions that we began in the first quarter of 2009 and continued implementing throughout the first six months of 2010, and (iii) raw material price increases for some of our key manufacturing inputs,” (Yahoo.com, 2010).

The company could pass on the material price increase to the customers so that the increases did not affect the operating results of the company. The return of the direct mailers promising an increase in business in that segment is expected to enable the company to make a better utilization of its production capacities. The current economic trend was anticipated to affect the progress and performance of the company during first half of the year 2010.

To comment on the direction in which the company is moving towards assessing the corporate growth and outlook for the future is rather difficult in view of the continued slow economic activities in the United States as well as at the global level. However, the company appears to be moving in the positive direction, since there is improvement in the direct mailer segment of the business. The company should take advantage of this positive movement and combined with their cost cutting measures, the company must move in the right direction. The company must refrain from expanding or making new acquisitions until such time, the economic situation improves and the company feels confident about the future.

Sources of Funding

The company’s main source of funding is the long-term debts contracted by the company through the notes payable having varied interest and repayment terms. There are no retained earnings or reserves for the company as shown by its balance sheet as at the end of fiscal 2009. The company does not have any shareholders’ equity, as the company’s equity is negative indicating that the equity has eroded by the losses made by the company. The company has made a restructuring of its long-term notes payable during 2009 and early 2010, as there were no sufficient cash generated from the operations of the company to meet its long-term debt obligations. However, the current ratio of the company as at the end of fiscal 2009 was 1.497 indicating that the company was able to manage its short-term and current financial obligations well under control.

The company has adopted a large-scale restructuring of its notes payable of different denominations to postpone the liabilities, to repay them in the future. The company does not have an alternative except to adopt this policy, as there is no surplus left with the company to pay off the long-term debts. The other alternative is to dispose off some of the fixed assets, which are not adding to the profitability of the company and settle the long-term liabilities to some extent for maintaining the capital structure in tact.

Corporate Governance

The company has well-structured corporate governance in place. Out of the seven members of the board of directors of the company, only the CEO and the President are the employees of the company, with the remaining five directors being independent of the company’s management. The company has constituted “audit committee, compensation committee and nominating and governance committee” (Reuters, 2010), with independent members of the Board. The statutory auditors of the company report to the audit committee. The Board has adopted Corporate Governance Guidelines for regulating the operations of the board and the conduct of its members. The company states in its Website

“We have a Code of Business Conduct and Ethics which includes a conflict of interest policy to ensure that corporate decisions are made by persons who do not have a financial interest in the outcome separate from their interest as company officials. This Code of Business Conduct and Ethics is available on this website” (Cenveo, 2010).

From the claim of the company as it appears in the Website of the company, the management of Cenveo is effective in enhancing the performance of the company and shareholders’ wealth by adopting healthy corporate governance practices. The company has formed a code of ethics to be followed by every employee and director and this code of ethics covers a wide range of ethical business practices. The company follows this code of ethics as guidance to decision-making. The code of ethics stipulates the expected actions of the employees and directors to pursue business with honesty and highest ethical standards. It also insists on the compliance of all government regulations. To that extent, the ethical standards of the relative to its performance are commendable and up to the mark.

Cost of Capital Calculation

“The WACC is the weighted average of the cost of equity and the cost of debt based on the proportion of debt and equity in the company’s capital structure” (Investopedia, 2010). The cost of capital is calculated using CAPM method. The retained earnings method has not been used because the company has only retained deficit and negative earnings per share.

Because the total shareholders’ equity is negative as at the end of the fiscal 2009, the calculation of cost of capital has been done excluding the retained deficit and accumulated losses, which were part of the shareholders’ equity. Therefore, the value of common stock and the paid in capital has been taken as the equity for calculating the cost of capital. The relevant calculations are shown below.

Calculation of WACC

Cenveo’s beta 2.18

Market risk premium, rM – RF 5.0%

Risk free rate, rRF 4.5%

Tax rate T 28%

Cost of Debt rd 7.7%

Cost of Equity = Risk Free Return + Beta (Market Risk Premium)

= 4.5% + 2.18 (5%) = 15.4%

Cost of Debt = = Weighted Interest Rate x (1 – Effective Income Tax Rate)

= 7.7% x (1-28%) = 7.7% x 72% = 5.5%

Weighted Average Cost of Capital

Equity Weight (Cost of Equity) + Debt Weight (Cost of Debt)

= 21% (15.4%) + 79% (5.5%)

= 3.23% + 4.34% = 7.57%

Assumptions

The interest rate before taxation has been extracted from page 52 of Form 10-K for the fiscal 2009, which states among other things

“Interest expense in 2009 reflected average outstanding debt of approximately $1.3 billion and a weighted average interest rate of 7.7%, compared to the average outstanding debt of approximately $1.4 billion and a weighted average interest rate of 7.2% in 2008.”

The income tax rate has been derived from Page 18 of Form 10-K which denotes the effective income tax rate for year ending January 2, 2010 as 28.3%

The risk free interest rate is assumed at 4.5% based on 30-year bond rate retrieved from the Website of The Wall Street Journal.

Analysis

The company because of its highest beta (2.18) entails a higher cost of 15.4% for the equity. In the present status of its financial position, raising additional funds through issue of stocks appears to be highly doubtful, as the investors will not look into the investment in the company’s stocks favorably. They may expect a higher return as they may have to a higher risk for investing in the stocks of Cenveo at present. This is evident from the high cost of equity calculated by this report. Further the fact that the company does not have any surplus or retained earnings also makes the risk more and leads to high cost of equity.

The capital structure of the company consists mostly of long-term debts comprising of notes payable of different types with varying maturity periods and interest rates. The company over the period has increased the long-term debts and an aggregate interest rate of 7.7% as mentioned in their form 10-K report. However, the company must have incurred substantial sums of money for issuing these debts. Because the company is within an effective income-tax rate of around 28%, the cost of debt has come down to 5.5%.

Because of the high debt content of the capital structure the overall cost of capital has come down to 7.57%. However, other considerations like the cost of issuing the debt; the chances of the company rising additional capital to increase the equity; the forecasts that the company would be able to make sufficient cash flow in the future to repay the long-term debts; and the ability of the company to claim the interest on the loans against the profits for income tax purposes will have to be taken into account while adopting this effective cost of capital.

Comments

The cost of capital of Cenveo as calculated above appears to be reasonable considering the high debt content of the capital structure of the company and the eroded stockholders’ equity. However, restructuring the capital structure with more equity proportion appears to be difficult.

Firm Valuation

The following sections present the calculation of the corporate valuation, assumptions, analysis and the comments on the valuation of the firm.

Calculation of Valuation

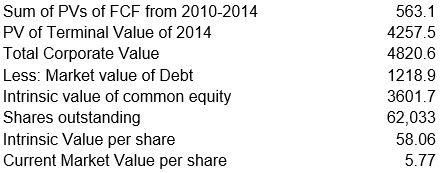

Terminal Value and Intrinsic Value Estimation

Note:

FCF 2015 = FCF 2014 (1+g) = $ 178.7 + (1+0.05) = 187.7

Terminal Value 2014 = FCF 2014/ (WACC-g) = 187.7/ (8%-5%) = 6255.7

Present Value of 2013 Terminal Value = Terminal Value/ (1+WACC) n

= 6255.7/ (1+0.08)5 = 4257.5

Calculation of Firm’s Intrinsic Value

Assumptions

The following are the key assumptions in the calculation of the value of Cenveo

Sales Growth Rate

The sales growth calculation is as follows.

Growth rate in 2009 as compared to 2008: – 18.3%

3 year Average Growth rate 3.90 Rounded to 4%

For the forecasted year T1 – 18.3 – 4% = – 14.3 or –15%

The sales for the year 2009 have been taken as the base to calculate the sales for each forecasted years. Because the company is facing stiff competition there cannot be a sudden growth in the sales during next years. Further, the company cannot expand its operations or acquire another company because of lack of adequate financial resources. Since new capital cannot be expected to be injected in the company at least for next few years, the sales have been assumed to be growing at a faster rate than 4%.

Operating Costs as a Percentage of Sales

Operating costs for 2009 = Sales – Operating Income

= $ 1714.6 – $ 32.2 = $ 1682.4

= 98.1%

The management of Cenveo is taking steps for cost reduction and hence for the forecasted years the operating costs have been assumed.

Growth in Operating Capital – Assumed at 5%

Depreciation of $ 56.6 for 2009is calculated as a percentage of Working capital of $ 162.5 and arrived at 35%.

Effective Tax Rate for 2009 28.3% is rounded to 30%

WACC of 7.57% – Rounded to 8%

Long run FCF Growth (g) – Assumed at 5%

Analysis

The valuation of Cenveo has been undertaken using the forecasted free cash flows for the years 2011 to 2014. Since the current economic situation does not work to the advantage of the company, the free cash flows for the current year (2009) are showing a negative figure. Study of the Form 10-K confirms that the recent economic crisis has significantly affected the performance of the company during fiscal 2009. As reported the management is also not very enthusiastic about the performance of the company at least during the first half of 2010. The gloomy economic situation is expected to continue at least for next year and the sales may pick up during 2012 onwards. Despite the change in the economic conditions, since the financial resources of the company are drained they cannot expect a sudden growth.

The free cash flows has been calculated by estimating the sales for the company for the future years based on the sales turnover for the year 2009. The sales revenue for the future years are extrapolated for the future years using the growth rate of the company for the past three years as presented by the Yahoo! Finance Website. In view of the gloomy economic outlook and the management discussion on the forecasts of the company, conservative estimates on growth in sales has been assumed for the future years.

The company’s declaration in its Form 10-K, that the management is taking continued efforts in reducing the cost is considered in estimating the operating costs for the future years. The assumed reduction in the operating costs for the forecasted years has resulted in some operating income for the company and increase in the free cash flows for the years.

The present values of future free cash flows are calculated to arrive at the terminal value of the business as at the end of the forecast year 2014. The total of the present values of the forecasted years with the present value of terminal value in 2014 gives the total value of the firm. From this value, the present market value of long-term debts is deducted to arrive at the total value of the firm. Presently the company has 62,033 shares outstanding. Dividing the total corporate value of $ 3.601,700 by the total outstanding shares of 62,033 the value per share is arrived at $ 58.06.

The intrinsic value of the shares of Cenveo at $ 58.06 is much more than the market value of $ 5.77. Although the company’s equity has been eroded because of the losses the company has made in recent years, the company’s asset base is strong and it is maintaining a strong current liquidity position.

Comment

Based on the valuation of the intrinsic value of the shares of Cenveo, it appears that the company’s share is worth $ 58.06 although it is currently selling at $ 5.77. It is advisable to hold on to the shares of the company as there are chances that the company may turnaround in the years to come when the global and the US economy bounces back.

Summary

Because of the general downtrend in the economic situation in the United States and at the global level, the company was unable to perform better in the last few years. In addition, the company is operating under severe competition from both large and smaller companies, in a highly fragmented industry. The financial position of the company is not sound and the company has accumulated enormous long-term debts. The cash generation out of the operations was not sufficient to meet its long-term financial obligations fully. This has made the company to restructure its long-term debts to postpone some of its liabilities.

The intrinsic value calculated based on future free cash flows works out to $ 57.83 cents per share as against the current market value of $ 5.77.Because of the present economic conditions the company has been unable to provide an outlook for the future. This inhibits the comparison of the projections made for the valuation of the corporation with those of the management. In view of the present financial conditions of the company and the high long-term debt content of the capital structure, it is advisable for the company to have a thorough reengineering of the manufacturing facilities to evaluate the relative profitability and contribution of them to the overall organizational profitability. Based on the evaluation the company may decide to dispose off some of the fixed assets and settle part of the long-term liabilities so that the interest burden on the company will come down. The company must also stop any further acquisitions until such time it is able to stabilize its financial position.

References

Cenveo, (2010). Cenveo Governance Introduction. Web.

Form 10-K Cenvio, Inc, 2010. Web.

Investopedia, (2010). Investors Need a Good WACC. Web.

Reuters, (2010). Cenveo, Inc. (CVO). Web.

Yahoo.com, (2010).Form 10-K for CENVEO, INC. Web.