Chipotle Mexican Grill (CMG) is one of the most prominent restaurants chains in the US, which has been facilitated by the company’s branding, its mission, and the business structure that has helped attract customers and overcome risks. However, certain challenges that have occurred in 2012 resulted in CMG’s stocks decreasing in price, creating significant problems for the organization. Such problems correlate with the need for a price increase for the products, high competition, and market-related changes. However, specific strategies helped mitigate the instability, namely avoiding sudden changes in prices and examining other brands before implementing new strategies.

Mission Statement

Chipotle’s mission statement directly illustrates the aim of the brand. Thus, “food with integrity” highlights the company’s mission to provide customers with high-quality food that was acquired based on the agenda to support sustainable farming and efficacious food sourcing (Subramanian, 2013). Since CGM is a fast-casual restaurant, the need for relying on frozen, unsustainable, and low-cost products is to be avoided. As a result, customers understand that the price is slightly higher than those marketed by fast-food chain restaurants, but the quality of the food is improved. Thus, the mission statement supports the argument that CGM offers a product that exceeds in terms of quality and integrity. This is especially relevant based on the current trend illustrated through consumer demand focused on more ethical business practices. Based on this industry change, the statement “food with integrity” fits the current agenda to support ethical and sustainable sourcing of raw materials. As exemplified through the abovementioned evidence, the mission statement does not require an upgrade since it is in line with trends and markets the brand as one that consumers can trust.

Internal Analysis

As mentioned prior, CGM is a fast-casual restaurant, which means that it balances between the low prices and quality of the fast-food restaurants and the high prices and quality of the standard ones. Moreover, the company owns all the restaurants and does not sell franchises, which helps the brand in terms of authenticity and high standards. In order for the financial difficulties correlating with such strategies to be balanced, there are several techniques that Chipotle applies. First, the restaurants are smaller than usual, which means a reduction in the price for renting and utilities. Moreover, due to the relatively small menus, the company manages to save certain expenses. However, this did not create an environment in which the company did not have to make an effort to maximize profits.

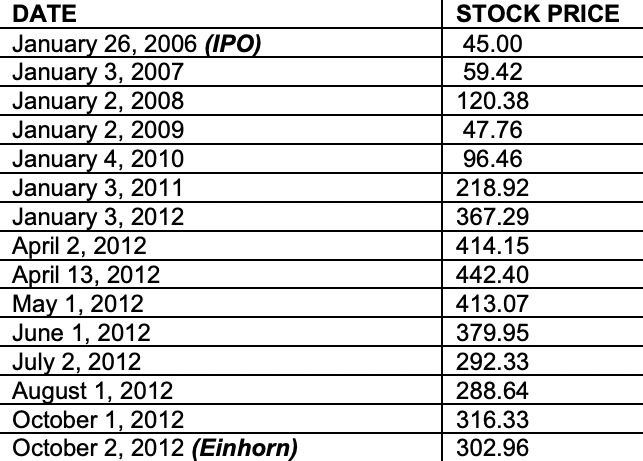

Table 1. CMG stock price

As exemplified in Table 1, the stock price has decreased in 2012, which was facilitated by the conference in which information was shared in regards to the increase in prices, which was inevitable (Subramanian, 2013). Nonetheless, the statement of cash flows shows the brand to be a prosperous one.

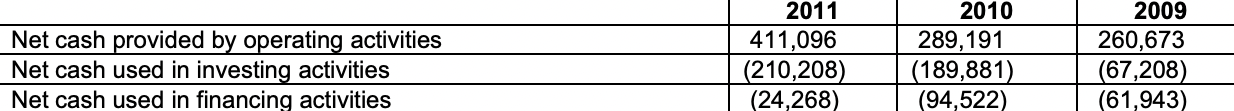

Table 2. Statement of Cash Flows

Table 2 illustrates the company’s strong basis for growth, exemplified through the almost doubled net cash provided by operating activities in 2011 compared to 2009 (Subramanian, 2013). Thus, the complete picture shows the potential of the brand, which was ultimately maximized through effective planning and strategic implementations in terms of marketing.

SWOT

The strength of the company is its branding which focuses on the integrity and cutting of the costs through wise location picking and relatively small menus. Moreover, the company’s marketing strategy to avoid usual techniques and instead opt for loyalty benefits and effective internet and TV advertising methods for attracting a wider customer base are other strengths of CMG. Furthermore, the ethical farming and food sourcing practices, as well as the prices which balance between low-end and high-cost, attract customers.

As exemplified prior, the small menus are beneficial price-wise, yet the limited food options make Chipotle unable to compete with the restaurants offering more choices for consumers. Moreover, since Chipotle advertises itself as a brand that offers ethically-sourced products, the suppliers are limited. This creates circumstances in which a shortage is possible and risky, an outcome that may negatively affect the business in terms of demand and consumer loyalty. As a result, the weaknesses create circumstances that put the organization in a vulnerable position.

There are multiple opportunities for Chipotle to expand as a business, the first being its relationship with trends. Aspects such as attracting millennials with fresher food and more ethical business practices create demand and are in line with the latest trends. Moreover, since the marketing strategy does not imply a major presence on television, this also attracts younger people through the image of authenticity and nuanced approaches to ads. As a result, Chipotle managed to become competitive through specific techniques designed for improving customer loyalty despite the more reasonable offers offered by competitors and the inability to sell rights for franchises.

In order for the threats to be understood, it is essential to conduct a competitor analysis, and since the main competitor is Qdoba, both are to be compared. Qdoba is a Jack-in-the-box subsidiary operating in the same market and selling Mexican-style dishes, similar to Chipotle. Its revenue per restaurant was over $900,000, considering that there were 600 Qdoba restaurants in the US.

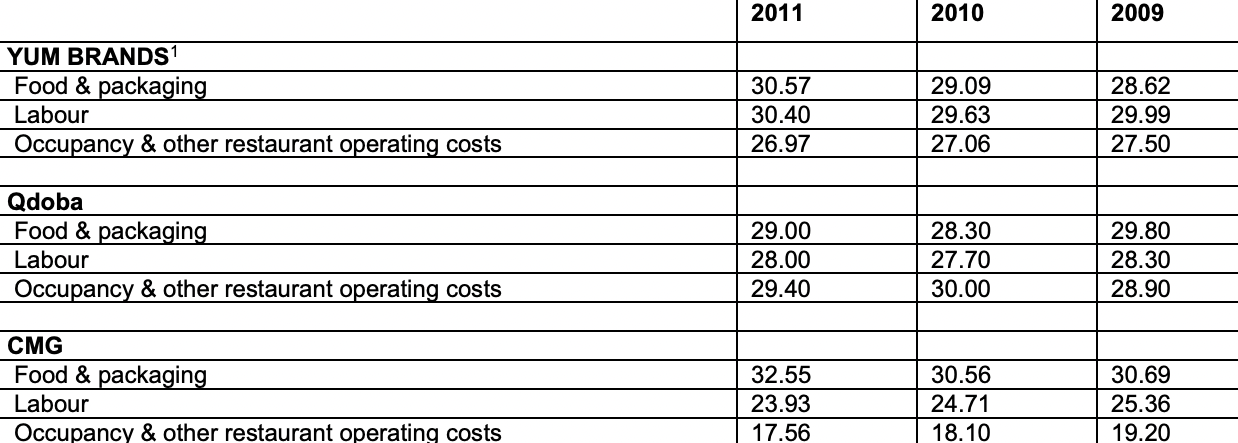

Table 3. Competitor percentage of revenue

As exemplified in Table 3, Qdoba, a chain with a franchise method of distribution, received close to 30 percent of revenue from products sold (Subramanian, 2013). While Chipotle’s rate is slightly higher, it is important to mention Qdoba’s higher opportunities in terms of being owned by another major brand with a possibility to invest and sell right through franchising. As a result, competition plays a significant role in Chipotle’s threats in terms of the external environment. Moreover, the market itself has experienced some impactful shifts in consumer demand. A study has shown that almost 80% of people are willing to either decrease their spending in eating out or radically reduce it (Subramanian, 2013). As a result, Chipotle’s position in which prices were to increase did not facilitate consumers into spending more on their products but looking for more affordable options or avoiding eating out altogether.

Challenges/Recommendations

Based on the evidence exemplified prior, the challenges included high competition and a decrease in market demand facilitated by the consumers’ aim to spend less on products provided by the brand. First, the approach, which is to wait until competitors increase prices, is effective in terms of analyzing the circumstances and the pattern before making a sudden change. However, the company may benefit from focusing on advertising themselves as more ethical and fresh substitutes for fast-food restaurants. The current trends for sustainable and innovative business practices create demand for companies that try to be more conscious and consumer-focus. As a result, marketing based on the integrity of the company can balance out the decrease correlating with the higher costs.

References

Subramanian, R. (2013). Chipotle: Mexican Grill, Inc.: Food with Integrity. Richard Ivey School of Business Foundation.