Introduction

The European Union has a developed banking system with approximately 8,000 banks. Within this group, huge international banks have arisen, which have a considerable market stake. The legal, regulatory, and supervisory framework has not been able to keep up with this rapidly growing cross-border presence, notably the centralization of treasury and risk management functions of the LCFIs (Schmukler & Vesperoni 2011). Being a free economy, Switzerland profits by a productive and stable worldwide money framework. The Swiss National Bank adds to the universal money collaboration by partaking in different global establishments and advisory groups. The Board aggregates together the national compelling voices accountable for financial security, worldwide budgetary foundations, the universal relationship of administrative and supervisory powers, and additionally master advisory groups of national banks (European Central Bank 2005). The FSB and the IMF are as of now building up an early cautioning framework for distinguishing financial emergencies. Switzerland is effectively required in this work. The new law regulating the monetary policy gives a wide lawful premise to Switzerland’s financing commitments inside the connection of worldwide financial collaboration. This is incorporated into specific giving multilateral guide in case of disturbances to the worldwide financial framework, partaking in uncommon assets of the International Monetary Fund (IMF), and conceding respective credits to nations with which Switzerland has particularly close ties as far as a financial and fiscal strategy (Giannetti 2013).

In 2015 the test of the European Central Bank (ECB) confirmed that most European banks have an adequate level of capitalization to face future problems. In order to strengthen the banking sector mergers were carried out between banks at the European level. Therefore, the European framework increasingly stands out more for large entities and with highly diversified business, but can risk also becoming harmful monopolies for consumers. When a merger takes place between two or more bank competition between them is restricted and can thus reduce their costs (Baker & Wurgler 2012). The business potential is also extended without making additional technical support necessary. After the merger, the same customer portfolios are maintained and these in turn may be favored with better conditions, in addition it is easier to recruit new customers. The new financial blocs formed after a merger allows strengthen banks in the face of changes in the financial environment. It gives them access to more resources to expand their production capacity and also gives them the opportunity to increase their areas of operation, thus capable of a greater physical presence in the marketplace. Nowadays, different banks around the world are accountable both to shareholders and investors. The results have been positive in American banks with profits above or in line with that expected by the market consensus (Banerjee, Heshmati & Wihlborg 2014).

The observational proof demonstrates that vacillations in pattern cash development have quite often prompted changes in the patterns of inflation, with rising or downswings in the patterns of cash development having been stuck with a couple of years later the fact by rising or downswings in the patterns of rising prices. The essential stop to stretch here is that the versatility of the hint of the pattern cash development over the pattern of inflation after some time, and crosswise over fundamentally distinctive monetary administrations, unmistakably proposes that such a star is an ancillary element of the economic system – that is, inserted in the structure of the framework in society to be invariant to incidental changes in the financial administrations. This exact finding speaks to a bedrock actuality that any model – including those based on New-Keynesian combination standards – needs to face and try to copy.

After 2008 it had been revealed that the bank still held significant position in vexed resources market, particularly in illiquid securities field. Since an exacerbated emergency of certainty couldn’t be precluded, it was chosen to take measures to reinforce the general framework. The Swiss Federal Government and the Swiss National Bank (SNB) together worked out an arrangement of measures, which incorporated the dire rescue for UBS, which was too enormous to fizzle. The investors needed to be protected and assured of their returns on investment and that is the reason why the government passed a bill in 2008 to protect the investors. This bill was passed in 2008. This was done by boosting the bank’s capital base by CHF 5.9 billion and also boosting the illiquid resources by CHF 40 billion (Korajczyk & Levy 2013). The financial crisis weakened the country’s economy, which forced the government to supplement the economy with a stimulus package of more than CHF 400 million. Two extra arranges were dispatched in 2009, including the aggregate of adjustment measures up to CHF 2 billion. National banks far and wide responded to the weakening financial standpoint by receiving unmistakably reflationary financial approaches. Financing costs were brought down to generally most minimal near zero levels. The Swiss National Bank likewise reacted with an uncommon facilitating of monetary policies, which consumed the monetary downturn in Switzerland (Berglof & Bolton 2012).

Although it would be untimely announcing the end of the crisis, at the end of 2009 the world economy started to recover from the retreat. After the financial crisis, the development of the country’s economy was sluggish, especially in the second half of the financial year 2009-2010. It has weathered the emergency all around contrasted with other industrialized nations, mostly in light of the fact that it didn’t have to battle with the impacts of unnecessary land theory. Swiss banks had learned their lessons from the land crisis in the mid-1990s and presented rating plans and risk-balanced evaluating from the start, accordingly, foreseeing the key standards of capital necessities under Basel II. The strong financial state of private families and the similarly powerful work business sector were additionally a help. Be that as it may, in 2009 employment was declining without precedent for a long time (Giannetti 2013).

The aim of this study is to focus on European banks, how they acted before the financial crisis of 2008, how they overcame this crisis and what the future holds for them. The European Union is confronted by various dilemmas currently. One such dilemma is that some Eurozone countries are much more heavily indebted than others. While some of those debts are held in the US, UK or elsewhere overseas, most of it is held by the European banks, and increasingly by the European Central Bank (ECB). This is the primary reason for the recent loss of confidence in the European banking system. In 2008, European countries agreed on a European Economic Recovery Plan, The European Central Bank cut its benchmark rate to an historic low of 1 percent and adopted a series of unconventional measures to inject liquidity into the financial system and get credit flowing again. We can see that asset quality and earning profile of banks are important determinants of bank distress next to leverage, and should be taken into account when designing new financial regulation in the EU.

Banking structure

The motivation of this study is to compare the Swiss Banks and the European banks. Switzerland’s reliable ‘valid currency, low inflation’ procedure obviously developed amid the scene which can sensibly be described as the Swiss National Bank’s ‘finest hour’: the massive inflation of the 1970s. In Switzerland, while a civil argument on the way of inflation took place in the mid-1970s, it was determined quickly from the financial perspective, prompting a shunning of non-monetary related ways to deal with inflation control. The primary national banks to bargain viable with the 1970s inflation was the Bundesbank and the Swiss National Bank, and both did as such in the mid-1970s by planned decreases in cash development rates.

Various works of literature reveal that since, in the course of the most recent two centuries, changes in the currency development have quite often been associated with changes in inflation in the same bearing, a rise in the financial sectors in the presence of an upward medium to the long-run dangers to the inflation profile (Berglof & Bolton 2012). The practice of the Swiss National Bank of closely monitoring monetary trends in order to identify long-term risks to price stability is therefore authenticated by the monetary history of the last 200 years (Desai, Foley & Hines 2014).

The existence of savings and retail banks in Europe is intrinsically good for the health of the banking system. They provide stability to the system, due to their governance structure; competition in the system where commercial banks are predominant; and are essential in the provision of banking services at both local and regional levels. Another feature that shapes the European banking system that should be preserved is the model of banking intermediation (contrary to the American one). The European banking model is different from the American. Any banking reform proposal should carefully account for the specificities of the European banking model, in particular with regard to the role retail bank intermediation plays in the system.

This study is very important due to the fact that it adds to the available body of knowledge regarding the operations of Swiss Banks. The results of this study are very relevant to the financial planners because they can use it for strategic and planning purposes so that they can come up with clear-cut objectives to manage the financial sector. The prolonged times of low and stable inflation (like those that OECD nations have been encountering for quite a while now) can offer ascent to distortions in the experimental examinations, and can make it greatly hard to accurately survey the educational substance of a particular indicator of future inflation. To put it in an unexpected way, in a balance in which the national bank is fruitful at keeping the levels of inflation low and within a tight range, the experimental relationship amongst inflation and any indicator has a tendency to vanish. This is why the experience of the massive inflation, which can be viewed as a definitive off-equilibrium occasion, is imperative. Thus, the experience of the massive inflation can be viewed by today’s national banks as the foundation of their institutional design. As a result of the great inflation that occurred in the 1970s, more support has been granted to the national banks by the Federal Reserve (Giannetti 2013).

Nowadays, the main difference between saving banks and commercial banks relies on the objectives pursued by the managers. The commercial bank managers care about maximizing the value of the ownership participation for shareholders by optimizing the future path of dividends, buybacks and increases in the value of the share. Saving bank managers’ concerns are not as concentrated in the value of ownership participation as they are also interested in fulfill the different targets included in their mandate. These objectives are related to providing banking services to some region or financially excluded individuals (savings banks) or to some group with some specific characteristics (cooperative banks).

Eurozone banking structure

Along with profit-maximizing commercial banks, most European countries host a significant sector of stakeholder banks, namely customer-owned cooperative banks or non-profit savings banks, where in some countries are privately-owned and in other government-owned. The German Bundesbank has become the leading central bank of the European Union, due to the success it has had in controlling inflation and the strength of the German economy. Statutes allow an enormous autonomy and independence of the German government. There is broad consensus in considering it as a basis and a model for the creation of the European Central Bank in the event of an Economic and Monetary Union taking place. However, the Bundesbank itself seems very reluctant to the project, because of concerns over the loss of sovereignty and control over inflation (Schoenmaker & Oosterloo 2007).

Switzerland banking structure

The Swiss National Bank (SNB) was created in 1907 as an autonomous national bank and is in charge of the financial and currency strategy. In line with article 99 of the Swiss government constitution, the SNB’s basic role is to seek after financial and cash approach that serves the interests of the nation (Schilit 2010). It determines the National Bank’s autonomy (power to act autonomous of guidelines) and stipulates a formal responsibility opposite the Swiss Federal Council, Parliament, and the overall population. The Swiss National Bank circulates 33% of its benefits to the Federal Government and 66% to the cantons. The 2008 concurrence on the circulation of the benefits of the Swiss National Bank visualizes a yearly dispersion of CHF 3 billion for the last 10 financial years (Giannetti 2013).

The observational evidence demonstrates that – since the main portion of the nineteenth century, and in various nations – vacillations in pattern cash development have quite often prompted changes in the patterns of inflation, with rising or downswings in the patterns of cash development having been followed a couple of years after the fact by rising or downswings in the patterns of inflation (Booth, Aivazian, Demirgüç-Kunt & Maksimovic 2011). Firstly, the versatility of the lead of the pattern cash development over the pattern of inflation after some time, and crosswise over fundamentally distinctive monetary administrations, unmistakably proposes that such a lead is an auxiliary element of the economy – that is, inserted in the structure of the framework in order to be invariant to incidental changes in the financial administrations. This exact finding speaks to a bedrock actuality that any model – including those based on New-Keynesian combination standards – needs to face and try to replicate (De Haas & Peeters 2006).

From 1974 until 1999, the Swiss National Bank reliably sought after a procedure of focusing on financial aggregates, reporting targets first for money supply, and afterward, from 1980, for the financial year. The new structure depends on three key components. The first is an unequivocal meaning of price security communicated in terms of the consumer price index. The SNB characterizes value strength in the same way as the European Central Bank, as a consumer price index inflation rate of less than 2% for each year. Secondly, an inflation gauge as the principle device, keeping in mind the end goal to disclose to general society the method of reasoning behind the new monetary policy (Groth & Ronald 2007).

At different events, the SNB focused on that it keeps on checking two arrangements of markers giving driving data on the future value advancements. The primary arrangement of markers is helpful for determining the short-run value advancements, i.e. over a range of one and a half to two years. It incorporates different indicators of the patterned condition of the economy, strikingly the yield gap and free market activity conditions in the labor market, and also the genuine exchange rate of the Swiss franc. The second arrangement of indicators contains the financial aggregates, which give helpful driving data on the long-run value advancements (Hovey 2007).

Another significant component shared to both the SNB and the ECB is that neither central bank regulates its policy by automatically responding to divergences of the inflation prediction from their respective descriptions of price stability (Korajczyk & Levy 2013). Figure 1 below shows the hierarchy of the Swiss banking system. At the top is the SNB. Below the SNB are the big banks, foreign banks, Raiffeisen group, Cantonal banks and the private banks.

Eurozone versus Switzerland banking structure

The Swiss National Bank (SNB) was built up in 1907 as an autonomous national bank and is in charge of the financial and currency strategy. In accordance with article 99 of the Swiss government constitution, the SNB’s basic role is to seek after financial and cash approach that serves the interests of the nation (Schilit 2010). It determines the National Bank’s autonomy (power to act autonomous of guidelines) and stipulates a formal responsibility opposite the Swiss Federal Council, Parliament, and the overall population. As an indispensable piece of this responsibility, the SNB needs to submit to the Swiss Federal Assembly a yearly report regarding the satisfaction of its assignments. The SNB circulates 33% of its benefits to the Federal Government and 66% to the cantons. The 2008 concurrence on the circulation of the benefits of the SNB visualizes a yearly dispersion of CHF 3 billion for the last 10 financial years (Giannetti 2013).

Between 2006 and 2009, the number of banks in the European Union went from 8,507 to 8,358 and the volume of resources held by the 30 largest banks in Europe was 6% lower in 2009 when compared to 2007. The institutions that experienced the greatest decrease in assets are: RBS (UK), Lloyds (UK), Deutsch (Germany), Commerzbank (Germany), and ABN Amro (Netherlands). Among the increase are BNP Paribas (France), Santander (Spain), Banque Populaire CdE (France), Nordea (Sweden), and Standard Chartered (UK) (European Central Bank 2006). The data also shows that there is an important difference in concentration levels among EU nations, both before and after the crisis. In economies such as Germany, France, and the UK, the banking sector features relatively little concentration. Germany, for instance, has the least-concentrated banking sector of all EU nations. However, a more concentration is noticeable in Germany after the crisis, from 2006 to 2009. In the United Kingdom, featuring a slightly higher concentration level than German, increased concentration of assets in the largest banks after the crisis: concentration levels went from 36% in 2006 to 41% in 2009.

One of the distinguishing characteristics of the European banking system, especially in Latin countries, is the role played by the state. All banking institutions in the US, Canada and England are in private hands. However, in France and Italy the government owns major banks, or most of their stock. The role of governments in the banking system is very important because often controversial. French bank Credit Lyonnais suffered much criticism in the early 1990s because the government covered its huge losses. European banks may carry out activities prohibited elsewhere, such as owning shares of other companies. Commercial banks in Europe tend to orient their activities, especially in business and often limit their long-term loans, usually providing short-term loans. The long-term loans usually grant them subsidiaries of banks. The proportion of deposits that control the major European commercial banks is very high. This is because there are no limitations to establish branches, which favors the existence of large banking networks in all European countries. The absence of an antitrust tradition explains the high degree of concentration in the sector (European Central Bank 2015).

With its monetary policy, the SNB helped essentially in conquering the financial crunch in Switzerland. In the perspective of the sensational decay of the financial and financial environment in 2008 and 2009, the SNB responded by facilitating the fiscal strategy significantly and firmly extending liquidity supply. The banking institutions had practically boundless access to liquidity at different developments. As the monetary emergency softened out up the late summer of 2008, it got to be evident that specific Swiss banks may likewise be influenced because of their exposures in the home loan upheld securities market in the US and in light of the fact that they held significant risk paying off debts. To turn away an emergency of certainty and because of the systemic pertinence of the enormous bank UBS, the Federal Council and the SNB expounded an arrangement of measures in mid-October 2008 and went for reinforcing the Swiss monetary sector. Two of these measures comprised of recapitalizing UBS by the Federal Government and moving USD 38 billion worth of the bank’s illiquid resources for an extraordinary reason at the National Bank (Groth & Ronald 2007).

Leading banks

The major central banks of the European Union are the Bank of France, Germany’s Bundesbank and the Bank of Italy. The principal commercial banks include Deutsche Bank German A.G., Dresdner Bank A.G. and Commerzbank A.G., and in France the nationalized Banque Nationale de Paris, Credit Lyonnais and Societe Generale. There are significant structural differences that distinguish the banking system of other European industrialized countries. The principal differences are due to the type of property, the depth of the financial system and the concentration of the sector (Groth & Ronald 2007). The Swiss federal government made up to CHF 1.5 billion when it sold its stake of the UBS in 2009 after the financial crisis. Seeing the financial crisis influence the genuine economy, the SNB took measures to balance out the economy by bringing down the fancied level of the 3-month Libor step by step by a sum of 250 premise focuses on 0.25% between 2008 and 2009. Essentially, the SNB has sought a zero loan fee arrangement since the end of 2008. With the conventional financing cost instrument having achieved the limits of its adequacy, the SNB was confronting new difficulties. The quarterly appraisal in March 2009 uncovered the requirement for a further facilitating of the financial strategy, in light of the fact that the monetary circumstance had crumbled significantly and deflationary danger had expanded. Capital business sector subsidizing conditions for organizations had fixed extensively and the Swiss franc was nearly fortifying further (Hovey 2007).

The creation of the Spanish banking system has been largely determined by the financial problems of the state throughout the eighteenth and nineteenth centuries. Serious financial problems of Spanish Hacienda led to the creation, following the reform of Lerena, 1785, the National Bank of San Carlos, whose main mission was to amortize the huge public debt of the Treasury. Throughout the eighteenth century, many banks were created with the power of issuing currency to finance growing deficits. This led to frequent devaluations and huge uncontrolled inflation, so banks failed or were merged (Schoenmaker 2011). The Bank of San Carlos disappeared in 1829, becoming the Bank of San Fernando, also with the power to issue currency, in Madrid. In 1844 the Bank of Isabella II and Barcelona, both were also created with the privilege of issuing currency. It was granted a monopoly throughout Spain, except in Barcelona and Cadiz (the branch of the Bank of Isabella II of Cadiz was renamed Bank of Cadiz, retaining the exclusive right to broadcast in that province) (Murphy 2000).

In 1856 the Banking Act was proclaimed Issue with functions of short-term financing. The Spanish Bank of San Fernando was renamed, this time under the name Bank of Spain, with a monopoly of issue for the entire State which was to last 25 years. However, in 1874, by decree of law, it was granted an indefinite monopoly, breaking with the previous legislation. We can say that since then, the Bank of Spain has been the sole bank, fulfilling all the functions of a central bank, i.e. commercial banking, issuing banks, state banking and controller of the banking system. Strictly speaking, the Bank of Spain only issues notes, being the Treasury currency issuer, which distributes the Bank of Spain. The 1989 reform provided with the Bank of Spain full autonomy from the government: entirely independent and responsible for the design and implementation of monetary policy, with the primary objective of controlling inflation growth, either through control interest rates or by controlling the amount of money in circulation (banknotes, coins and bank money). Moreover, the Spanish banking system has also undergone a strong process of concentration throughout the 1980s, with the merger of Banco de Bilbao and Banco de Vizcaya (Banco Bilbao Vizcaya, BBV) and the Central Bank and the Spanish American Bank (Banco Central Hispano being created, BCH). With the merger of Banesto in 1993, industry concentration increased further when the acquisition of Banco Santander becoming the most powerful bank in the country (The transformation of the European Banking System n.d.).

Eurozone leading banks

Banking is among the most impenetrable controlled commercial ventures in any nation’s economy, but then the budgetary emergency couldn’t be turned away. Also, the financial crisis uncovered various blemishes in the global direction. In basic terms, before the financial crisis, it was expected that the wellbeing of the entire banking framework is given if every individual bank is sheltered and has a sufficient capital base to assimilate any potential misfortunes. The resulting hypothesis was that it would suffice to manage every bank at the small scale level, which would naturally block financial crisis in the whole framework (at the full-scale level). Be that as it may, all things considered, this hypothesis has turned to be delusive. The idea neglected to suit the likelihood that in a financial emergency, banks could be compelled to act as it were, which would antagonistically affect the renegotiating of other financial organizations (Nivorozhkin 2015).

It has been seen that, notwithstanding the massive inflation scene, and the temporary inflationary changes contrasting with the two world wars, the United States should successfully be portrayed, when seen from a long-run perspective, as a country with low swelling. Genuine experience suggests that Switzerland merits such a portrayal in a by and large more essential degree. Switzerland has always maintained an annual inflation rate of below 2.5%. With its new fiscal methodology, the Swiss National Bank has fundamentally repudiated its monetarist past. As pushed by the Swiss National Bank staff people, the Swiss National Bank held basic components of monetary centering in its new cash related course of action thought (European Banking Authority, n.d.). The essential plan of markers is useful for deciding the short-run esteem progressions, i.e. over a scope of one and a half to two years. It consolidates distinctive indicators of the designed state of the economy, strikingly the yield crevice and free market movement conditions in the work market, furthermore the real conversion standard of the Swiss franc. The second plan of indicators contains the cash related aggregates, which give supportive driving information on the long-run esteem progressions (European Commission, n.d.a).

This could be the situation, for example, when a bank’s capital base is impeded by losses and the bank is then compelled to lessen its loaning to different banks, with a specific end goal to reestablish its own particular capital base to statutory levels. A deficiency in inter-bank loaning on a substantial scale can trigger a liquidity emergency in the whole financial framework. Establishments work at a national and global level to propose administrative measures that would fortify the financial framework and shield it from systemic danger. Such recommendations identify with the small scale level (e.g. expanding capital necessities for banks) and also to the full-scale level. In November 2009, the Swiss Financial Market Supervisory Authority (FINMA) discharged its rules on compensation plans, which are authoritative for certain Swiss financial foundations. To decrease the systemic danger, exuding eminently from organizations that are too huge to fizzle or excessively interconnected to fail, there is a reasonable need to guarantee that ruined banks can be ended up in a controlled way. Financial institutions with a possibility to hurt the framework in the event that they fizzled ought to along these lines be required to set up a kind of last will. This implies they would need to expand the vital techniques that would come to endure if they have to petition for bankruptcy. With most systemically pertinent banks being dynamic on a worldwide scale, the individual control would need to be adjusted globally (Giannetti 2013).

The public obligation has taken off in numerous nations as an aftereffect of considerable open spending on rescue plans and to empower the economy. Numerous administrations in this way need to discover approaches to cut their costs or produce new incomes. Given the need to raise finances, governments are increasing their endeavors to repatriate cross-border resources, which are right now overseen by competitive monetary hubs in smaller nations. The Swiss Federal Council turned away this by choosing to surrender its reservation about article 26 and update the twofold tax assessment understandings. Once the parliament endorses these changed DTA, Switzerland will give authoritative help in instances of assessment extortion as well as in instances of duty avoidance (Ryen, Geraldo & Richard 2007).

Be that as it may, the weight stays high as certain EU delegates oblige Switzerland to partake in a planned trade of data on bank accounts, a standard practice existing among the EU nations. In collaboration with Luxembourg and Austria, Switzerland contradicts to change to a planned trade of data. The assurance of bank customers’ protection needs to remain justified, in light of the fact that the common trust and regard between the administration and the general population is a fundamental component of the Swiss comprehension of state administration. In any case, Switzerland has received a forward-looking procedure that would reposition its budgetary focus, imagining the development construct essentially with respect to drawing in assessment agreeable resources (European Commission, n.d.b). In addition, the existing duty sensitive remote resources are to be directed in accordance with their separate residential assessment powers’ necessities, without getting to be liable to statutory repatriation. All quantities are to be taken to help customers in following the tax prerequisites. In this manner, Switzerland compromises to guarantee improved tax assessment of outside resources and capital additions. Remote governments would hence get an immediate tax feed, which would surely be welcome in times of record spending plan deficits while securing the protection of the decent bank customers (Giannetti 2013).

The SNB has the statutory syndication for issuing monetary orders, keeping in mind the end goal to guarantee money supply. The Swiss financial focus is likewise dedicated to picking up business sector access in Europe with a specific end goal to give monetary administrations from Switzerland. Global openness and a praiseworthy arrangement of directions are key components of the Swiss financial focus. Against this foundation, and in the perspective of the acknowledgment of the universal OECD measures with respect to authoritative help, unilateral segregation among firmly related exchanging accomplices is not admissible and ought to be wiped out (Giannetti 2013). SNB resources comprise basically of gold and coin reserves and additionally household budgetary resources (local securities and currency market paper). These benefits shape a portion of national resources and assume a significant part in financial and money arrangement. Part of these benefits is utilized straightforwardly as a part of the execution of financial approach: the SNB buys resources keeping in mind the end goal to supply the economy with national bank liquidity. They empower the SNB to bolster the Swiss franc in the case of a money shortcoming in the business sector. The SNB provides banking administrations to the Federal Government and instructs the selected workplaces on inquiries regarding fiscal and money approach. The SNB issues different insights, quite the fiscal totals and keeping money measurements and additionally the equalization of installments. The SNB’s power to raise insights is firmly connected to the execution of its statutory brief: fiscal and monetary policy, supervision of installment and securities handling frameworks, and the upkeep of the soundness of the financial sector (Giannetti 2013).

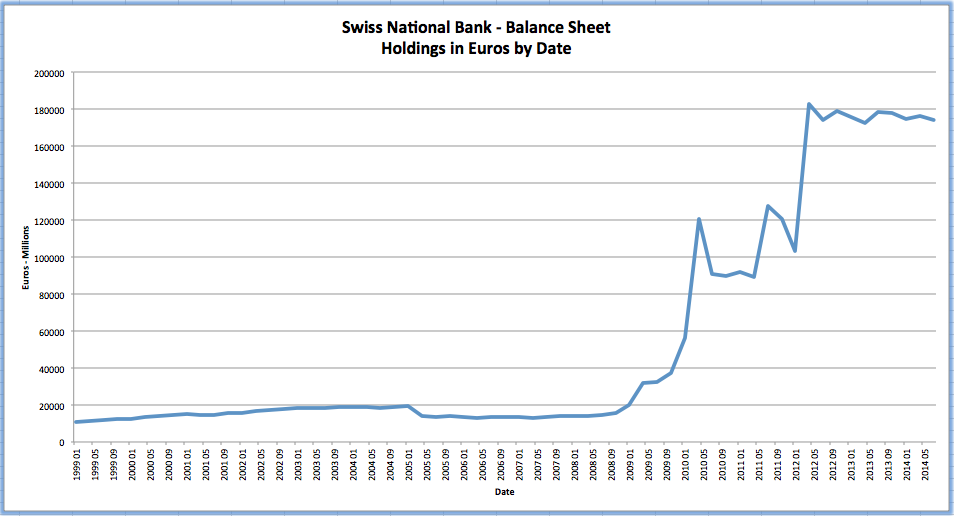

Being an open economy, Switzerland profits by a productive and stable worldwide money framework. The SNB adds to the universal money collaboration by partaking in different global establishments and advisory groups. The Board aggregates together the national compelling voices accountable for financial security, worldwide budgetary foundations, the universal relationship of administrative and supervisory powers, and additionally master advisory groups of national banks. The FSB and the IMF are as of now building up an early cautioning framework for distinguishing financial emergencies. Switzerland is effectively required in this work. The new Monetary Assistance Act gives a wide lawful premise to Switzerland’s financing commitments inside the connection of worldwide financial collaboration. This is incorporated into specific giving multilateral guide in case of disturbances to the worldwide financial framework, partaking in uncommon assets of the International Monetary Fund (IMF), and conceding respective credits to nations with which Switzerland has particularly close ties as far as a financial and fiscal strategy (Giannetti 2013).

Price soundness is a crucial requirement for development and growth. Inflation and deflation affect the dispersion of cash and similarly disturb the advancement of the economy. The SNB endeavors to guarantee value steadiness in the medium and long haul and to empower the economy consequently to augment its generation limits (Schmukler & Vesperoni 2011). Inflation gauges assume a key part in the fiscal idea sought after by the SNB (Giannetti 2013). The idea comprises of three components:

- An express meaning of value security. The SNB likens price solidness with an ascent in the national customer value file of under 2% for every annum. By keeping up the value strength, the SNB along these lines additionally tries to block any deflationary advancement.

- The utilization of a comprehensive based inflation conjecture as a fundamental indicator. This is an accord figure, which considers singular indicators, for example, swapping scale improvements, cash supply and the yield gap (i.e. the contrast amongst actual and potential production) and additionally the aftereffects of different large-scale financial models. The medium-term inflation figure serves as a premise for financial strategy choices and is an essential component of the correspondence with the general society.

- An objective extent of the 3-month London interbank offered rate as an operational focus for the usage of financial approach. Its figure in this way demonstrates how the circumstance would create were the SNB to stay idle. On the off chance that the contingent gauge demonstrates, for example, a relentless ascent of inflation above 2%, the SNB would see itself constrained to act. In any case, the SNB does not respond naturally to the inflation estimate but rather additionally considers the general monetary circumstance with a specific end goal to decide the degree of its response (Giannetti 2013).

The SNB commands the currency market rates by coordinating the liquidity supply for business banks. The banks’ interest for the current account deposits gets from statutory liquidity prerequisites and additionally the requirement for financing non-money installment exchanges (Schmukler & Vesperoni 2011). The SNB, for the most part, sets an objective scope of 1 rate point for the 3-month London interbank offered rate. While the inflation figure is characteristic of the SNB’s long haul financial strategy destinations, the loan cost range mirrors the SNB’s expectations in the short term. The SNB surveys the loan cost range on a quarterly premise and legitimizes any corrections. Using a volume tender, the SNB’s counterparts demand a predefined measure of liquidity at an altered cost (repo rate), though in a loan fee tender close out the counterparts likewise cite the financing cost they are set up to pay. Standing offices incorporate for case transient connecting credits, which conquer a startling lack of liquidity.

Both of these general financial instruments of the SNB depend on repurchase understandings (Schmukler & Vesperoni 2011). The repo rate, the extent of the individual exchanges and the separate development rely upon the financial approach prerequisites. The SNB sets the development of repo-exchanges in such way that business banks need to demand liquidity on a regular schedule so as to accomplish the normal giro parity important to meet the least hold necessities in any given reporting period (Giannetti 2013). The securities provided as guarantee reduces the counter-party risk in repurchase consent to the spread between the business sector estimation of the insurance and the measure of the credit. This spread is evaluated every day on an imprint to business sector premise and settled by an edge exchange. To be worthy of a promise, the securities need to meet the SNB’s prerequisites with respect to the guarantor’s money, liquidity, and FICO assessment. The SNB may likewise issue, purchase, or offer advances, securities, precious metals and cash sets (Giannetti 2013).

The financial crisis that has affected the world for almost eight years is showing its newest feature. After the subprime collapse of 2007, and the bankruptcy of major banks in 2008 such as Bear Stearns and Lehman Brothers, the crisis worsened and there was need for decisive action by Central Banks and governments around the world after financial markets all but came to a complete halt. In early 2009, uncertainty was decreasing but overall confidence in the system still had not been restored, thus hindering the growth of central economies and keeping the supply of credit from expanding. In 2009, the crisis expanded to the European Union and especially to the Euro Zone. Many countries, such as Portugal, Ireland, Italy, Greece, and Spain, began having trouble financing them in the market, since their long-term bonds’ interest rates had gone up significantly. This increase in interest rates originated in the general aversion to risk, which affected European financial institutions. In this scenario, markets began asserting more risk to economies within the Euro Zone that showed structural imbalances (Franco, n.d.).

In the first half of 2012, expectations became less pessimistic, primarily because of actions taken by the European Central Bank (ECB) under newly-instated president Mario Draghi2. However, both the Euro Zone and the United States have yet to show signs of a robust economic recovery. In the years following the crisis, some very important transformations have taken place, especially in the financial systems, which have faced structural and regulatory shifts. Such transformations are already affecting the way financial institutions do business, both domestically and internationally. During the integration process of the European Union, two crucial moments have to be highlighted regarding financial consolidation:

- The creation of the Single Financial Market, in 1993, and

- The introduction of the Euro, in 1999.

The creation of the Single Financial Market in 1993 brought about the legislative and regulatory environment that led to the emergence of a European Banking Industry, featuring a genuinely consolidated banking system within the Union. The goal was to allow banks to operate freely in any member nation, thus increasing competition and benefitting European business and families.

After the worldwide financial crisis, various financial institutions in the European Union reported significant losses and many were subject to restructuring. In that context, some institutions were acquired by competitors; others were nationalized, in a very complex process. Such restructuring events were not isolated not particular: the crisis, originated in the US subprime-mortgage market, generated losses for almost all the major financial institutions in the biggest economies in the European Union. The nationalization of the British mortgage bank Northern Rock, in February of 2008, kicked off the process. This event sparked the first bank run in the UK in over 100 years. In July of 2008, the Danish Central Bank announced an intervention on Roskilde Bank (Martynova & Renneboog 2006). One month later, after having a difficult time finding a buyer, the Danish Central Bank announced the purchase of Roskilde. By the end of 2008, British bank Lloyds TSB was forced to take over Halifax Bank of Scotland (HBOS); many other institutions had come down with serious problems, having been subject to some sort of intervention in order to be immediately restructured. Among them were Bradford & Bingley in the UK, Hypo Real Estate in Germany, and Fortis and Dexia in the Low Countries. A clearer picture of the global financial meltdown emerged in April 2009, when the IMF published in its Global Financial Stability Report that the total losses in the worldwide financial system had been US$ 4.1 Trillion, and that the majority of the losses occurred in Europe (US$1.4 Trillion), and not in the United States of America (US$ 1 Trillion).

Between 2006 and 2009, the number of banks in the EU went from 8,507 to 8,358 and the volume of assets held by the 30 largest banks in Europe was 6% lower in 2009 when compared to 2007. The institutions that experienced the greatest decrease in assets are: RBS (UK), Lloyds (UK), Deutsch (Germany), Commerzbank (Germany), and ABN Amro (Netherlands). Among the increase are BNP Paribas (France), Santander (Spain), Banque Populaire CdE (France), Nordea (Sweden), and Standard Chartered (UK). The data also shows that there is an important difference in concentration levels among EU nations, both before and after the crisis. In economies such as Germany, France, and the UK, the banking sector features relatively little concentration. Germany, for instance, has the least-concentrated banking sector of all EU nations. However, a more concentration is noticeable in Germany after the crisis, from 2006 to 2009. In the United Kingdom, featuring a slightly higher concentration level than German, increased concentration of assets in the largest banks after the crisis: concentration levels went from 36% in 2006 to 41% in 2009 (European Central Bank, n.d.).

Switzerland leading banks

The years 2007 to 2009 were set apart by exceptional monetary improvements. The financial crisis of 2007 caused many banks to shut down. The cause of the financial crisis is attributed to the subprime crisis that occurred in the United States. The overall effect trickled down to many countries across the world, with Switzerland not being an exception. The circumstance reached a crucial stage in September 2008 with the breakdown of the US venture bank Lehman Brothers. The following emergency of trust in the financial segment further quickened the descending twist. The financial crisis made the entire economy to slow down, with many economies across the world registering a minimal growth and development. The overall monetary and financial crisis likewise affected the Swiss economy (The legal structure of saving and retail banks in Europe 2014). The State Secretariat for Economic Affairs (SECO) reported a moderate GDP development of 2% for the financial year 2007- 2008. A financial year of a country is the period used for calculating the yearly financial statements of the country. Nonetheless, there was a sluggish growth registered in the entire economy towards the second half of the financial year. In 2009, the general economy collapsed and the growth shrunk by 1.48%. This was the lowest growth registered since more than 35 years ago. Moreover, there was low development registered from the international trade through imbalances in the balance of trade in 2009 (Berglof & Bolton 2012).

In the perspective of the banks’ troubles, numerous nations took measures to bolster their banking sector and turn away a systemic financial crisis. For example, after the financial crisis, there was an urgent need to rescue the banks and the US government purchased out all the loans that had been defaulted by the borrowers from the US commercial banks. In a few nations, including the UK, the US, and Germany, certain banks were even incompletely nationalized. In addition, numerous industrialized nations set up generous projects to empower their economies and in this way assimilate the impacts of the financial crisis on the economy. In Switzerland, UBS had a noteworthy presentation in the US contract upheld securities and was in this manner affected most seriously by the worldwide financial sector interruptions (Korajczyk & Levy 2013).

The Swiss capital business sector encountered a drop toward the end of 2008, yet recouped well in March 2009, likewise, thanks to the SNB arbitrations and numerous bonds were issued effectively. Despite the fact that the terms of loaning had fixed to some degree under the economic situations, Switzerland dissimilar to different nations had never encountered a real credit crunch. The business sector for syndicated advances – another imperative source of fund for substantial organizations – additionally kept on working great with countless exchanges. The government gained CHF 1.18 billion as revenue by offloading its stake of the UBS. The total income generated by the banks immediately after the financial crisis was lower than the normal income generated by the banks before the crisis. As opposed to the US where 165 banks needed to shut down in 2008 and 2009, none of the Swiss establishments expected to petition for insolvency. Despite all these recuperation trends, the monetary and financial crisis left enduring imprints and the development standpoint for the world’s and the Swiss economy stays unsteady. Economies may encounter another stoppage impact once the worldwide financial stimulus plans terminate. As a consequence of the financial crisis, the government was forced to adopt contractionary monetary and fiscal policies to aid the country to pick up a faster economic growth. Likewise, the banking institutions were mandated to maintain a confidential approach when handling the customers’ transactions (Giannetti 2013).

The provincial and saving banks work in comparable business zones to the little cantonal banks. They center their exercises principally on the reserve funds and home loan segments. Around half of their liabilities and the sum owed to the clients take the type of reserve funds stores and investments; contract advances represented some seventy-five percent of benefits. Toward the start of 2009, the RBA banks had a stake of more than half of the provincial and savings banks. RBA banks are autonomous establishments but work hand in hand with each other under a common universal group. The universal group is called the RBA holding. This co-operation empowers them to enhance their cost structure, advances proficient mastery and bears a joint wellbeing net and solidarity system (Giannetti 2013).

The future

The future of banking in the Eurozone

The observational proof demonstrates that – since the primary portion of the nineteenth hundred, and in various nations – vacillations in pattern cash development have quite often prompted changes in the patterns of inflation, with rising or downswings in the patterns of cash development having been stuck with a couple of years later the fact by rising or downswings in the patterns of rising prices. The essential stop to stretch here is that the versatility of the hint of the pattern cash development over the pattern of inflation after some time, and crosswise over fundamentally distinctive monetary administrations, unmistakably proposes that such a star is an ancillary element of the economic system – that is, inserted in the structure of the framework in society to be invariant to incidental changes in the financial administrations. This exact finding speaks to a bedrock actuality that any model – including those based on New-Keynesian combination standards – needs to face and try to copy (Top Banks Europe: Market Capital 2014).

The major central banks of the European Union are the Bank of France, Germany’s Bundesbank and the Bank of Italy. The principal commercial banks include Deutsche Bank German A.G., Dresdner Bank A.G. and Commerzbank A.G., and in France the nationalized Banque Nationale de Paris, Credit Lyonnais and Societe Generale. There are significant structural differences that distinguish the other industrialized countries European banking system. The principal differences are due to the type of property, the depth of the financial system and the concentration of the sector (Groth & Ronald 2007). The Swiss federal government made up to CHF 1.5 billion when it sold its stake of the UBS in 2009 after the financial crisis. Seeing the financial crisis influence the genuine economy, the SNB took measures to balance out the economy by bringing down the fancied level of the 3-month Libor step by step by a sum of 250 premise focuses on 0.25% between 2008 and 2009. Essentially, the SNB has sought after a zero loan fee arrangement since the end of 2008. With the conventional financing cost instrument having achieved the limits of its adequacy, the SNB was confronting new difficulties. The quarterly appraisal in March 2009 uncovered the requirement for a further facilitating of the financial strategy, in light of the fact that the monetary circumstance had crumbled significantly and deflationary danger had expanded. Capital business sector subsidizing conditions for organizations had fixed extensively and the Swiss franc was nearly fortifying further (Hovey 2007).

Against this foundation, the SNB felt constrained to take unusual measures to extend financial supplies. Such methods comprised of two components. The first one is to lengthen the maturities of repo exchanges, and the second one is to buy remote currency and Swiss bonds. The SNB along these lines meant to expand liquidity and lessen certain risk premiums. The SNB’s capricious arrangement of measures comprised prevalently of outside trade arbitrations. The cash exchanges demonstrated powerful in preventing the Swiss franc from fortifying further opposite the euro and in obviously decreasing the conversion scale unpredictability between these two monetary forms. Such exercises were entirely constrained to transferable securities exchanged at the business sector. The SNB stopped purchasing corporate securities when Swiss capital economic situations had facilitated recognizably. The measures taken by the SNB amid the emergency demonstrated general extremely powerful (Korajczyk & Levy 2013).

While applying flighty measures, specific consideration must be brought with respect to their consequences for medium and long haul value steadiness. In like manner, the resulting come back to a normal fiscal arrangement must not interfere with a developing rally. The topic of how to relinquish a far-reaching fiscal strategy steadily in the medium term is crucial to the SNB.

The future of banking in Switzerland

The Swiss financial institutions depend on the idea of an all-inclusive banking, whereby all banks can offer all banking administrations. Nonetheless, it has seen the advancement of different classifications of banks that have come to represent considerable authority in particular territories. Swiss banks are organized in the accompanying classes. These banks have a statutory premise under the cantonal law, with the canton claiming a stake of at least 33% of the bank’s assets and voting rights. Cantonal banks are no longer required to have state guarantees because it no longer exists in the Banking Law. Many cantonal banks have done away with the state guarantee apart from the canton of Berne. Another exception was the Banque Cantonale de Genève. This bank had not enjoyed the state guarantee before until the Banking law was revised (Giannetti 2013). The first bank is UBS AG is among the two banks that are considered to be large. The other bank is the Credit Suisse Group. A solid worldwide center and business system is a trademark shared by both huge banks. Both huge banks have branches and auxiliaries in more than 50 nations and are available in all major monetary bases in the world. The UBS utilizes more than 6,000 individuals, 36.9% of whom are in the Americas, and the same number in Switzerland, 15.8% in Europe and 10% in the Asia-Pacific locale. The Credit Suisse Group utilizes around 46,000 individuals around the world. Of all these individuals, only 50% are natives of Switzerland. Being all inclusive banks, the enormous banks keep up a tight system of local offices. The enormous banks offer basically a wide range of monetary administrations, including investment banking (Giannetti 2013).

FINMA (Swiss Financial Market Supervisory Authority) was built up as a successor of many financial institutions. The first institution was the Swiss Federal Banking Commission, and then there was the Federal Office of Private Insurance together with the Anti-Money Laundering Control Authority. FINMA is set up as a free central government organization under an open law. The supervision of banks, stock trades and protections and the counter government evasion control are presently joined in one power. FINMA is organized practically by a zone of skill, along these lines, giving a stage to utilizing collaborations and practicing an adjusted supervision of equal or equivalent risks in the ranges of banking and insurance (Top European Banks /assets 2015). In its ability as a free supervisory power, FINMA expects to secure the financial business sector customers, for example, lenders, speculators, and policyholders, and in addition to guaranteeing a legitimate working of financial markets (Lindsey 2006). The key target is to fortify the trust in the effectiveness, uprightness, and aggressiveness of the Swiss financial sector and to ensure its notoriety. FINMA consequently performs security undertakings:

- System insurance

- Bank customer insurance

- Protection of policyholders

- Investor insurance

- Protection of notoriety

- Competitiveness of the monetary focus

Monetary advantages and systemic dangers are intrinsic in the level of the mix and the span of the financial focus. Against the foundation of element advancements in the financial markets, this highlights the key significance joined to the direction and supervision of budgetary markets (Giannetti 2013).

The FINMASA Act administers the interior association of the establishment and stipulates the key supervisory instruments and sanctions. FINMASA is composed as an umbrella law for the accompanying seven legitimate acts:

- Swiss saving money law

- Stock trade law

- Investment store law

- Insurance supervision act

- Insurance contract act

- Anti-tax evasion act

- Mortgage bond act

As a state administrative body, FINMA is blessed with incomparable power over banks, insurance agencies, stock trades, securities merchants, aggregate speculation plans and other financial middlemen. It is in charge of fighting government evasion and, where important, conducts financial rebuilding and liquidation procedures. Also, FINMA controls the procedures authorized by the Swiss Takeover Board concerning open buyout offers for recorded organizations. FINMA awards working licenses for organizations and associations subject to its supervision screens these establishments regarding their consistency with the appropriate laws, mandates and directions, and also with the common permit prerequisites (Lindsey 2006). The obligations of FINMA incorporate the supervision of banks, securities merchants, stock trades, markets, protections and other budgetary delegates, and in addition aggregate venture plans. FINMA is additionally in charge of directing rebuilding and liquidation procedures, battling government evasion and regulating the revelation of support interests in and open offers for recorded organizations. Where essential and as given by law, FINMA forces sanctions give regulatory help and directs. At the end of the day, it takes part in the correction of laws and related mandates, issues brochures and, inside its extent of power, laws. FINMA likewise guarantees that self-direction is properly perceived (Giannetti 2013).

FINMA and SNB marked a MoU on the budgetary business sector solidness in 2007. This MoU was reexamined in February 2010 to suit the bits of knowledge picked up from the nearby collaboration between the two establishments amid and after the financial crunch. FINMA establishes strong connections with the Swiss Bankers Association (SBA), the Swiss Insurance Association (SIA) and the Swiss Funds Association (SFA). The other monetary business sector members, strikingly the SIX Group also has strong connections with FINMA. FINMA works hand in hand with other global organizations like the BCBS (Basel Committee on Banking and Supervision). Also, it collaborates with the council shaped by national banks and bank supervisory powers. In the same way, FINMA collaborates with the IOSCO (International Organization of Securities Commissions); this organization has agents of stock trade chiefs from around the globe. The last organization that FINMA collaborates with is the FATF (Financial Action Task Force); this organization is regarded as the worldwide anti-money laundering power. The target of such co-operation movement is to trade data and take an interest in forming the advancements on a worldwide level (Miller 2007).

A comparison

With a quality addition of about CHF 62 billion or 11.6% of the GDP, the financial sector of Swiss economy in 2008 was among the most valuable business segments. Financial institutions contributed CHF 41 billion to the genuine value added, which relates to 7.8% of GDP. The contribution from the insurance sector was CHF 21 billion or 4.2% of the GDP (Giannetti 2013). The value addition from the banking sector is thusly separated into the business fragments of retail saving money, wealth administration, resource administration and investment banking. This is summarized in the table below:

The key significance of the monetary sector in Switzerland as a business area turns out to be ominously more obvious when considering likewise the immediate and aberrant commitments of different business divisions. This incorporates administrations given by non-financial organizations to the monetary segment and additionally other indirect gainful impacts. To cite, however, two illustrations: a development organization fabricating a bank’s workplace, or an outside private banking customer who joins his visit to the bank with a trip to Switzerland. Budgetary firms likewise advance the development of different organizations, for example by giving advances for building or growing generation offices or by giving business disruption cover. Indeed, even by universal correlation, the financial sector positions high in Switzerland (Giannetti 2013).

In the year 2008, at least 196,000 individuals representing 5.9% of the Swiss working populace were utilized in the financial segment, of which 4.1% in the banking part and 1.8% in the insurance area. Right around 40% of the bank representatives work for huge banks. About 75% of all the insurance representatives work in property and casualty, trailed by life and reinsurance (Giannetti 2013).

The amount of value added divided by number of employees constitutes an indicator of efficiency growth in the financial sector of Swiss economy. It is estimated to be clearly greater equated to the regular output in other important sectors. The 5.9% of the employees in the banks account for 11.6% of the entire gross domestic product. In other terms, the efficiency per employee is almost double the overall average (Giannetti 2013).

Banks pay a huge amount of tax in Switzerland, despite the fact that there is no standard strategy for ascribing particular tax classifications to the banking segment. The expense commitment of the banking part might be organized in these four classifications:

- Taxes paid specifically by the banks, including essentially the duty on capital and pay created in Switzerland, and additionally part of the issue charge and the segment of VAT, which banks pay yet can’t deduct as a prepaid assessment because of a constrained tax collection of budgetary administrations.

- Taxes paid through the banks’ creation components. This class incorporates the bank representatives’ income tax charged on compensations and rewards, and in addition tax paid by Swiss duty occupants on profits from the banks.

- Taxes paid by customers on financial exchanges handled by banks in Switzerland. This class is incorporated into a specific part of withholding tax, also named “residual”, and appears to be a part of the stamp duty. 25% of the revenue garnered by the European Union is collected from taxes from the corporates and from VAT.

- Taxes generated through non-bank financial transactions identified with financial exchanges without the association of banks, for instance, stamp duties (Giannetti 2013).

Taking everything into account, in the course of the recent years, banks contributed more than CHF 13 billion for each annum to the general population incomes, either specifically through the assessable livelihoods paid to their workers and the assessable benefit circulations, or by implication through stamp obligation and withholding tax, the vast majority of which were created by banks.

DFI are investments made by Swiss organizations outside Switzerland with the reason for setting up a vital long haul association with the organization in which they contribute and guaranteeing a huge impact on the organization’s administration. As indicated by the OECD definition, when an investor has more than 10% of the voting rights in a venture, he or she is liable to a long-term interest. DFI subsumes an assortment of exchanges, for example, opening non-free branch workplaces, going into joint endeavors, setting up auxiliaries, or mergers and acquisitions. Advances to remote auxiliaries inside the group and benefit maintenance by outside auxiliaries are additionally esteemed direct ventures. A qualification is made between yearly direct speculations (intermittent worth) and the current arrangement of direct ventures (combined quality). The last speaks to the aggregated yearly inflows and outpourings and reflects market unpredictability and cash vacillations (Giannetti 2013). By worldwide correlation, Swiss direct speculation abroad is very considerable. This is additionally reflected in the proportion of the aggregate Swiss DFI to the nominal GDP, which was 149% at the start of 2009. Banks and insurance agencies represent around one-fourth of these immediate speculations (Giannetti 2013).

The other way around, DFI in Switzerland is similarly critical of the Swiss financial part. In the Swiss banking sector, the direct investors have a shareholder equity amounting to CHF 60.4 billion. Moreover, a considerable number of shareholders in extensive Swiss monetary organizations are non-Swiss.

Conclusion

From 1974 until 1999, the Swiss National Bank dependably looked for a system of concentrating on monetary totals, reporting targets first for cash supply, and a while later, from 1980, for the financial base. Inferable from the growing precariousness of the financial base during the time half of the 1990s, in any case, the SNB picked, around the end of 1999, to announce another financial strategy. The new structure relies on upon three key segments. The first is an unequivocal importance of value security conveyed as far as the purchaser value record. The SNB describes esteem quality similarly as the European Central Bank, as a purchaser value file swelling rate of less than 2% for every year. From an operational viewpoint, a span for the three-month Libor rate as the best way to deal with truly completes technique decisions before long.

In 2015 the results of the European Central Bank (ECB) confirmed that some European banks have an acceptable level of capitalization to face future problems. In order to reinforce the banking sector mergers were carried out between banks at the European level. Therefore, the European framework increasingly stands out more for large entities and with highly diversified business, but can risk also becoming harmful monopolies for consumers. When a merger takes place between two or more bank competition between them is restricted and can thus reduce their costs. The business potential is also extended without making additional technical support necessary. After the merger, the same customer portfolios are maintained and these in turn may be favored with better conditions, in addition it is easier to recruit new customers.

The years 2007 to 2009 were set apart by exceptional monetary improvements. The financial crisis of 2007 caused many banks to close down. Its reason is attributed to the subprime crisis that took place in the United States. The overall effect trickled down to many rural areas across the globe, with Switzerland not being exclusion. The condition reached a crucial phase in September 2008 with the breakdown of the US venture bank Lehman Brothers. The following emergency of trust in the financial segment further quickened the descending twist. The fiscal crisis hit the entire economy to suffer, with many economic systems across the world showing a minimal increase and evolution. The overall monetary and financial crisis also affected the Swiss economy. As reported by The State Secretariat for Economic Affairs (SECO), GDP increased by 2% over the fiscal year 2007- 2008. However, there was a sluggish development registered in the entire economy towards the second half of the fiscal year. In 2009, the general economy collapsed and the GDP shrunk by 1.48%. This was the lowest GDP registered since more than 35 years ago. Moreover, there was low development registered from the international trade through imbalances in the balance of trade in 2009. This was equally a result of the global financial.

It has been seen that, notwithstanding the massive inflation scene, and the temporary inflationary changes contrasting with the two world wars, the United States should successfully be portrayed, when seen from a long-run perspective, as a country with low swelling. Genuine experience suggests that Switzerland merits such a portrayal in a by and large more essential degree. Switzerland has always maintained an annual inflation rate of below 2.5%. With its new fiscal methodology, the SNB has fundamentally repudiated its monetarist past. As pushed by SNB staff people, the SNB held basic components of monetary centering in its new cash related course of action thought. The essential plan of markers is useful for deciding the short-run esteem progressions, i.e. over a scope of one and a half to two years. It consolidates distinctive indicators of the designed state of the economy, strikingly the yield crevice and free market movement conditions in the work market, furthermore the real conversion standard of the Swiss franc. The second plan of indicators contains the cash related aggregates, which give supportive driving information on the long-run esteem progressions.

Since an exacerbated emergency of certainty couldn’t be precluded, it was chosen to adopt measures to reinforce the universal fabric. The Swiss Federal Government and the Swiss National Bank (SNB) together worked out an arrangement of steps, which incorporated the dire rescue for UBS, which was too enormous to fizzle. The investors needed to be protected and reassured of their returns on investment and that is the cause why the urgency bill was gone. This measure was drawn in 2008. This was done by boosting the bank’s capital base by CHF 5.9 billion and also boosting the liquid resources by CHF 40 billion. The financial crisis weakened the country’s, which drove the government to supplement the economy with a stimulus package of more than CHF 400 million. Two extra arranges were dispatched in 2009, including the aggregate of adjustment measures up to CHF 2 billion.

References

Baker, M & Wurgler, J 2012, ‘Market Timing and Capital Structure’, Journal of Finance, vol. 57, no. 1, pp. 1-32.

Banerjee, S, Heshmati, A & Wihlborg, C 2014, ‘The Dynamics of Capital Structure’, Monetary Integration, Markets and Regulation, vol. 4, no. 2, pp. 274-297.

Berglof, E & Bolton, P 2012, ‘The Great Divide and Beyond Financial Architecture in Transition’, Journal of Economic Perspectives, vol. 16, no. 1, pp. 77-100.

Booth, L, Aivazian, V, Demirgüç-Kunt, A & Maksimovic, V 2011, ‘Capital Structure in Developing Countries’, Journal of Finance, vol. 56, no. 1, pp. 87-130.

De Haas, R & Peeters, M 2006, ‘The Dynamic Adjustment Towards Target Capital Structures of Firms in Transition Economies’, Economics of Transition, vol. 14, no. 1, pp. 133-169.

Desai, M, Foley, C & Hines, J 2014, ‘A Multinational Perspective on Capital Structure Choice and International Capital Markets’, Journal of Finance, vol. 59, no. 2, pp. 2451-2487.

European Banking Authority n.d., Regulation and Policy, European Union, Web.

European Central Bank 2005, EU Banking Structures, October (Frankfurt: European Central Bank), Web.

European Central Bank 2006, EU Banking Structures, October (Frankfurt: European Central Bank), Web.

European Central Bank n.d., Mergers and acquisitions involving the EU Banking Industry, facts and implications, European Union, Web.

European Central Banks 2015, Report on financial structures, Page 6,18, Web.

European Commission n.d.a, Economic and Financial Affairs, European Union, Web.

European Commission n.d.b, Prudential Requirements, European Union, Web.

Franco, F n.d., Mergers and acquisitions in Europe Banking, Palgrave Macmillan, Web.

Giannetti, M 2013, ‘Do Better Institutions Mitigate Agency Problems? Evidence from Corporate Finance Choices’, Journal of Financial and Quantitative Analysis, vol. 38, no. 3, pp. 185-212.

Groth, C & Ronald, C 2007, ‘Capital Structure: Perspectives for Managers’, Management Decision, vol. 3, no. 1, pp. 1-19.

Hovey, J 2007, ‘A Source of Funds in Search of Work’, Nation’s Business, vol. 1, no. 1, pp. 17-19.

Korajczyk, R & Levy, A 2013, ‘Capital Structure Choice: Macroeconomic Conditions and Financial Constraints’, Journal of Financial Economics, vol. 68, no. 2, pp. 75-76.

Lindsey, J 2006, The Entrepreneur’s Guide to Capital, Probus: Chicago.

Martynova, M & Renneboog, L 2006, ‘Mergers and Acquisitions in Europe’, Finance working paper, vol. 1, no. 114, pp. 1-26.

Miller, M 2007, ‘Debt and Taxes’, Journal of Finance, vol. 32, no. 3, pp. 261-275.

Murphy, N 2000, European Union Financial Developments: The Single Market, The Single Currency and Banking, Web.

Nivorozhkin, E 2015, ‘Financing Choices of Firms in EU Accession Countries’, Emerging Market Review, vol. 6, no. 4, pp. 138-169.

Rajan, R & Zingales, L 2015, ‘What do We Know about Capital Structure? Some Evidence from International Data’, Journal of Finance, vol. 50, no. 4, pp. 1421-1460.

Ryen, T, Geraldo, M & Richard, J 2007, ‘Capital Structure Decisions: What Have We Learned?’, Business Horizons, vol. 1, no. 1, pp. 17-19.

Schilit, W 2010, The Entrepreneur’s Guide to Preparing a Winning Business Plan and Raising Venture Capital, Prentice Hall: Englewood Cliffs, NJ.

Schmukler, S & Vesperoni, E 2011, Firms’ Financing Choices in Bank-based and Market-based Economies, MIT Press: Massachusetts.

Schoenmaker, D & Oosterloo, S 2007, Cross-Border Issues in European Financial Supervision, The Structure of Financial Regulation, Web.

Schoenmaker, D 2011, The European Banking Landscape After the Crisis, Web.

The legal structure of saving and retail banks in Europe 2014, Web.

The transformation of the European Banking System n.d., European Banking: past, present and future, European Union, Web.

Top Banks Europe: Market Capital 2014, Web.

Top European Banks /assets 2015, Web.

Appendices

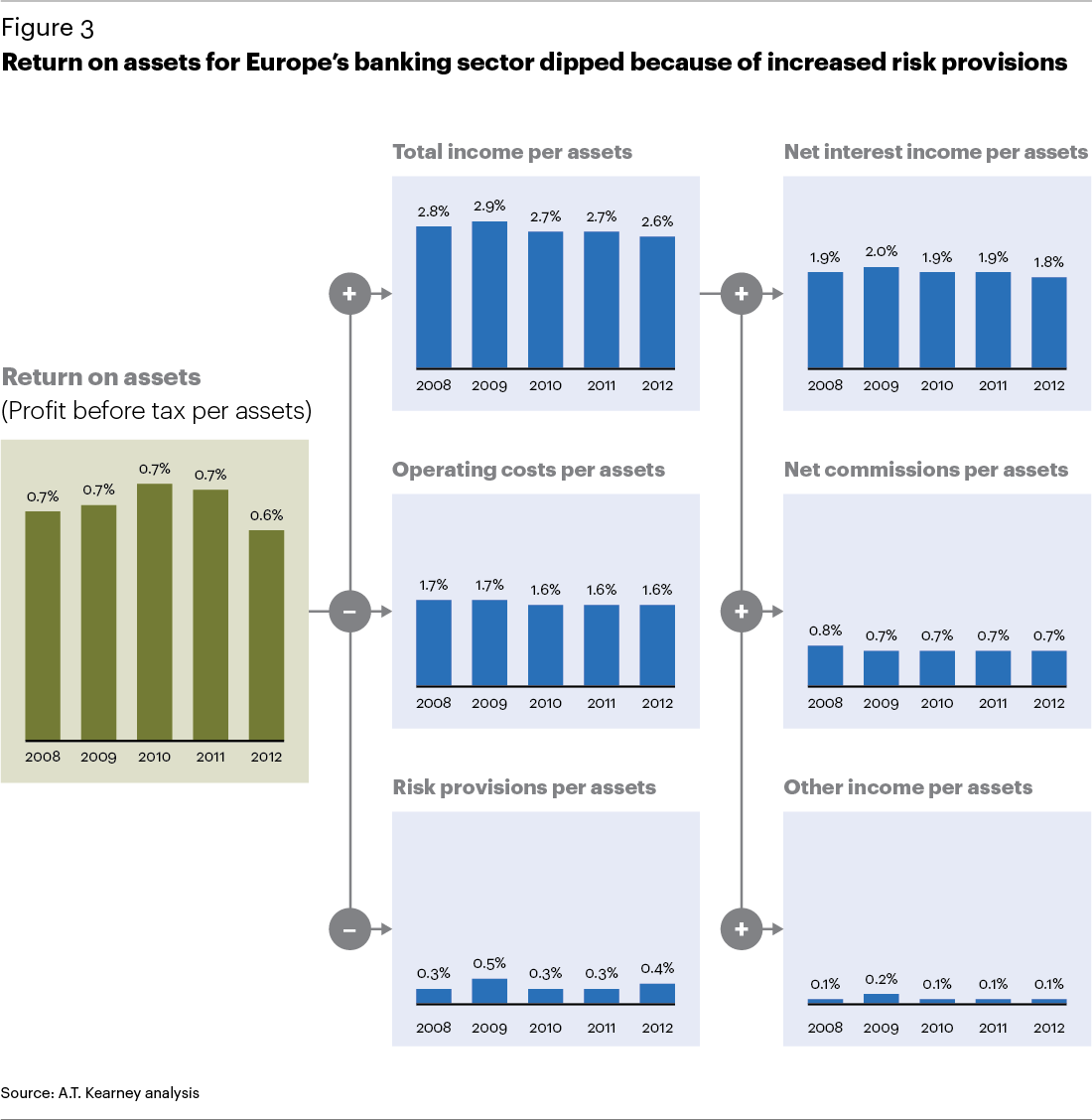

Appendix 1. ROI on EU’s banks

Appendix 2. SNB balance sheet