Introduction

Timeline of Events in MENA

In the recent past, the Middle East and the North African States (MENA) have experienced endless periods of socio-political unrest. These unrests have spread to about 12 Arab states. Already, the unrests have claimed respected world leaders such as the former Tunisian president, Zine al-Abidine Ben Ali, former Egyptian president, Hosni Mubarak, and former Libyan leader, Muammar Gadhafi. Some reports note that initial unrests started in Tunisia while other reports suggest that the unrests started in Algeria and spread in Tunisia (then later, to other Arab states including, Egypt, Libya, Syria, Bahrain, and the likes) (The Wall Street Journal 1).

In Tunisia, the unrest started when a man set himself ablaze when he was denied a license to operate his business. The man was a university graduate but unemployed and many citizens shared the same kind of plight (unemployment). The unrest in Tunisia, therefore, started as a protest against the government’s insensitivity regarding unemployment and other social injustices. These unrests started towards the end of the year 2010. On January 13th, 2011, the former Tunisian president fled to Saudi Arabia (The Wall Street Journal 1).

After the end of the Tunisian unrests, the same uprisings also started in Egypt. On January 17th, 2011, four men set themselves ablaze in Egypt to protest government oppression. This event was possibly inspired by the events that preceded the Tunisian revolt. Egypt also witnessed a similar revolt (to Tunisia) where thousands of protestors marched in the country’s capital city, Cairo, to protest the government’s injustices. These protests yielded fruit on February 10th, 2011 when the former Egyptian leader, Hosein Mubarak, stepped down and left the country under the leadership of the army (The Wall Street Journal 1).

On 15th February 2011, protests were reported in Libya, where a group of demonstrators in one of the country’s cities Benghazi, started protesting for the release of a human rights lawyer. Scores of protestors started to demonstrate in major cities around eastern Libya (a revolt that saw the government lose control of some major regions in the Eastern part of Libya). Libya witnessed the most intense fighting in The MENA region that saw the takeover of the entire country by Libya’s transitional forces. The former Libyan ruler, Colonel Gadhafi was killed in the revolution.

The Arrival of the Events to GCC Area

Though the Arab uprising started in North Africa; currently, protests are witnessed in several parts of the Gulf Cooperation Council (GCC) states, where protestors are demanding the resignation of their leaders. These protests have affected Gulf Cooperation Council’s (GCC’s) financial markets because members of the GCC have been directly (or indirectly) affected by the uprisings. The members of the GCC are “Bahrain, Kuwait, Saudi Arabia, United Arab Emirates, Qatar, and Oman” (The Wall Street Journal 1). Most of these states have witnessed political uprisings, while some states have participated in these uprisings. For instance, UAE approved a no-fly zone against Libya (The Wall Street Journal 1).

In understanding the GCC financial market, it is important to note that, some GCC countries are important members of OPEC and for a long time, GCC’s financial markets have been driven by the oil markets. For instance, Saudi Arabia is the greatest oil producer in the world and a central member of the GCC. The MENA uprisings have had a direct impact on the operations of the GCC financial markets because they have affected the production of crude oil (in one way or another). For instance, Libya is considered to be the eighth largest producer of oil in the world and the uprising saw the production of oil almost stagnate (The Wall Street Journal 1).

Comprehensively, the MENA uprisings have significantly affected the operations of GCC’s financial markets because international rating agents have started reviewing the financial performance of some of GCC’s financial indicators (downwards). For instance, Standard and Poor (S&P) have reviewed GCC’s real estate sector downwards (on account of the MENA uprisings) and more reviews are being done to review the credit quality of some GCC companies (Global Investment House 1).

How Governments react to the MENA uprisings

Governments in the GCC have acknowledged the impact of the MENA uprisings on their economy and they have equally tried to mediate the violence by offering a peaceful solution to the impulse. Governments, across the GCC region, are however treating the unrests differently. Though there is a common call for a peaceful solution to the uprisings, some governments like Saudi Arabia are still treating the unrest with condemnation. This is why some ousted rulers in the Middle East (such as the former Tunisian president) have sought refuge in Saudi Arabia. Some governments have also tried to take part in the quelling of the violence (such as UAE’s direct involvement in the Libyan conflict where it tried to persuade the Libyan government to stop protestant killings) (The Wall Street Journal 1).

In the wider GCC region (and more so, in countries where the protests have been strongly witnessed), there has been an almost unanimous willingness to repeal existing laws to allow for constitutional changes (The Wall Street Journal 1). This situation has been witnessed in Bahrain where the government has called off its army and resorted to discussing the protestors’ grievances. So far, the Bahrain government has reduced housing costs by 25% and reorganized the cabinet to please the protestors. However, in Oman, the government has maintained a crackdown on protestors, where many people have been jailed for violent protests. In Kuwait, there has been a strong call for the resignation of the prime minister but the government has not budged in this regard. Instead, there has been a crackdown on protestors as police use teargas and rubber bullets to contain the protests. Such varied government reactions have characterized the Arab uprisings.

Bahrain Situation

The political unrest in Bahrain has mainly been characterized by the political supremacy battles between the ruling Sunni community and the Shiite community (BBC 1). However, Bahrain is one among many countries that have experienced pro-democracy reforms, after Tunisia and Egypt revolts. Though the Bahrain revolution is mainly divided along community lines, there have been clarifications by the Shia leadership that their revolt is not informed by sectarian ideologies but rather, by nationalistic grievances (BBC 4). Nonetheless, since the uprisings, the government has remained committed to undertaking comprehensive reforms to change the country’s administrative structure. For instance, since the uprisings (in February 2011), the government has since approved 291 National dialogue recommendations to boost the country’s political, economic, and social reforms. In the spirit of reforms, the government has also embarked on an effort to entrench the 291 reforms in the constitution so that they are far-reaching. Though most of the negotiations (which bore the reforms) happened in July, the government is still in constant negotiation with opposition figureheads. Also, though there were allegations that there was going to be an opposition walk-out in the national elections that occurred in September, the government still remained focused to implement constitutional reforms. Bahrain is therefore still fragile but the government is determined to address all grievances.

Importance of the Subject

Credit Default Swaps

A credit swap is realized when there is a guarantee of a country’s creditworthiness through credit protection. As explained by Standard and Poor, the MENA crisis has had a profound impact on the creditworthiness of most companies trading in the GCC financial markets (Standard Chartered 7). Based on this fact, most GCC countries have witnessed a shift in their credit default swap figures. Agencies or institutions that buy a credit swap receive credit protection. The seller of the credit swap always guarantees the creditworthiness of the country. The credit quality outlook of major industrial sectors in GCC has suffered a significant blow from the MENA crisis but other sectors have been somewhat steady. For instance, the infrastructural sector has been cited as having maintained its credit quality but as explained in earlier sections of this study, a negative credit worthiness trend has been noted in the real estate sector and the construction industry (Global Investment House 4). Other sectors of the economy (that play an important role in GCC’s financial markets) are still under watch, considering the unfolding events of the MENA crisis. Corbett reports, “Of Standard & Poor’s 29 public corporate and infrastructure ratings across the GCC, five are currently on CreditWatch with negative implications or carry a negative outlook, with the remainder on stable outlook” (Corbett 5).

Pricing

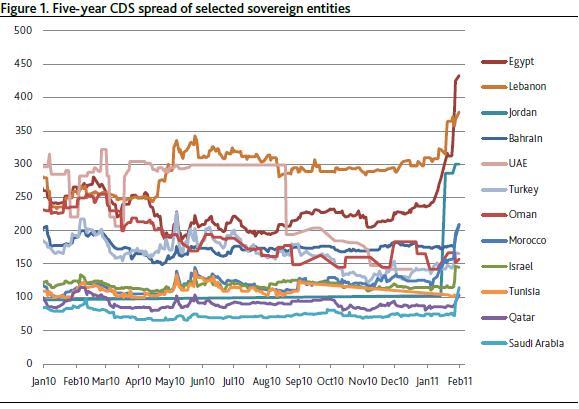

An increase in CDS rates implies an increase in political and economic risk and a decrease in investor confidence. The vice versa is also true because a decrease in CDS rates implies a decrease in political and economic risk and an increase in investor confidence. The MENA crisis has led to a significant loss of investor confidence in the GCC financial markets. As a result, there has been a significant increase in CDS rates for GCC countries. Based on the latest rankings, the highest CDS rates have been reported in Bahrain, Kuwait, Oman, Saudi Arabia, UAE, and Qatar, in that order (Global Investment House 4). These CDS prices have been directly representative of the level of unrest in the GCC countries (the stronger the unrests, the higher the CDS rates, and the weaker the unrests, the lower the CDS rates). Conversely, from the above rankings, we see that Bahrain has the highest CDS rates because it witnessed the strongest unrest (among the GCC countries). In the same manner, Qatar and UAE post the lowest CDS rates because they have managed to contain the unrest (Al-Bawaba Business 3).

Cost of Fund

An increase in the cost of funds is normally representative of the difficulty and high-interest rate associated with obtaining credit. Considering the significant decline in most market indices and the loss of investor confidence in the GCC market, there has been a resultant increase in the costs of funds. The increase in the cost of funds has especially been brought about by an increased sense of apprehensiveness among investors (in the GCC market) regarding the MENA unrests. Considering the unrest have halted or slowed down economic activities in most MENA states, there is an increased growth of pessimism among investors that their investments will yield the kind of profits they expect. This loss of confidence has resulted in increased costs of funds.

Does it play an Important Role?

The MENA unrest plays an important role in the future sustainability and profitability of GCC’s financial markets. Already, economic studies show that GCC countries (which have been affected by the unrests) have suffered a collective loss of about $55 billion (Al-Bawaba Business 3). With such kinds of losses, there is a strong need to stimulate the economy to overcome such economic hurdles. At this point, CDS plays an important role in rebuilding economies because it sums the perception of credit risk for different GCC countries. Poor CDS prices will deter investors from pumping their money into high-risk GCC countries. Such investors would rather invest in countries where they are guaranteed ofo returns on investments. CDS pricings direct them to such countries. Considering the need to sustain economic growth and rebuild existing GCC economies, CDS has an important role to play in sourcing investors and economic partners. CDS pricings therefore affect the perception of Arab markets (by investors), because it influences the fundamentals of economic productivity. The future profitability of the GCC market therefore depends on CDS pricings.

Rating Importance and Methodology

Rating Agencies

In assessing the GCC financial markets, viz-a-viz the MENA crisis, Standard and Poor has been on the forefront in reviewing some of the market’s fundamentals. As mentioned in earlier sections of this paper, S&P has poorly rated most of GCC’s market fundamentals (such as real estate) but it has maintained a steady rating for other market fundamentals (Corbett 5). Tristan Cooper is also another credit rating agency that has rated GCC financial markets by noting that, “Regional geo-political volatility and the quality of major institutions are holding back the sovereign ratings of wealthy GCC countries” (Corbett 5). Moodys is also another credit rating agency that has rated GCC states. Similarly, it has not posted any positive reports about some of GCC’s market fundamentals.

Accuracy of the Ratings

Rating agencies use different methodologies to rate markets. Across the board, there has been a common consensus that the credit ratings of GCC states are informed by the geopolitical environment of MENA; the increased reliance on hydrocarbon (by MENA countries) and the quality of the institutions that take part in GCC financial markets (Standard Chartered 7). MENA countries are okay with this methodology because their economies are mainly driven by the above market fundamentals. The above methodology is therefore the appropriate credit rating criteria for MENA states. From this understanding, MENA states are rated fairly.

However, there are limitations to the above credit rating methodology. The biggest limitation is experienced when there are conflicts of interest. For instance, where credit rating agencies get paid to do their job, they may feel compelled to rate their financers well. This is highly unprofessional and unethical. In such a case, the methodology of the credit rating agencies should be probed to ensure such conflicts of interest do not exist. More importantly, the professionalism and credibility of rating agencies should be quizzed before their findings are relied on. However, there are some credit rating agencies like S&P which have a transparent methodology for arriving at their conclusions. Also, such credit rating agencies conform to international professional standards. The findings from such agencies should be relied on.

CDS

The CDS market (of GCC countries) is mainly perceived from the main economic drivers of the GCC market. From this understanding, the oil market and the real estate sectors have been the main drivers of CDS pricing in the GCC market. The motions of the oil market and the real estate industry have been the main characteristic features of the GCC market because they define the main economic drivers of the GCC market. The biggest influencers of this market are Saudi Arabia (biggest oil producer) and UAE which has a thriving real estate and tourism sectors. The biggest financial institutions driving CDS pricing in the GCC market are the Al Masref bank (biggest Islamic bank) and the National Commercial Bank of Saudi Arabia (the biggest bank in GCC) because their performance reflects the performance of the GCC market (Sharewadi 2). Evaluating the performance of GCC countries from a CDS perspective, we see that, Bahrain has the highest index, at 474.2 bps (Sharewadi 2). UAE, Qatar and Saudi Arabia trail Bahrain at 283.4bps 278.3bps and 267.7bps respectively.

GCC Ratings (Before and after the MENA uprisings)

Moody credit rating agency disagrees with the notion that, GCC countries deserve to be rated Aaa. Moody had initially rated Bahrain’s credit worthiness to be a “negative” because there was widespread uncertainty about the future of oil prices (Sharewadi 2). This rating was reported, despite the strengthening of some economic indicators in most of GCC states. For instance, Saudi Arabia and Qatar have witnessed a significant leap in ratings from 2004 to 2007, but none of the countries have been given an Aaa rating. Instead, Moody has rated the countries as Aa2 and A1+ respectively (Sharewadi 2).

Since most GCC countries are rated according to their oil revenues, the MENA unrests have had a significant impact on the credit ratings of the GCC countries. As explained in previous sections of this study, the MENA unrests have had a profound impact on the prices of oil, and they have increased the uncertainties regarding oil production. As a result of the MENA unrests, Kuwait and the UAE have been rated Aa2 (Sharewadi 2). Compared to Kuwait and the UAE, Bahrain and Oman have been rated A2. Saudi Arabia was rated below Kuwait and Qatar, but this poor rating has been attributed to the governorship problems in the state, as opposed to the MENA unrests (Sharewadi 2).

MENA CDS Comparison

Technical Study on Five Years

The MENA uprisings have had a negative impact on the CDS pricing of GCC states. This means that there are increased fears that GCC countries will not meet their credit obligations. Conversely, many investors are likely to shy away from doing business with GCC countries. This perception has a negative impact on GCC financial markets because it leads to increased devaluation of market fundamentals. Nonetheless, the CDS figures for the GCC states have not been similar. Currently, the CDS spread across the GCC countries has shifted according to the current market dynamics. Bahrain’s five years CDS average was 149.8, 168.9, 197.5, 210.9 and 222.6 (for the last five years, respectively). Saudi Arabia posted figures of 80, 85.7, 88.2, 95.1, and 99 for the last five years (respectively) and Qatar posted CDS figures of 58.8, 69.3, 81.6, 91.9, and 97.7 for the last five years (respectively). There is an almost unanimous increase of CDS rates for the five-year analysis because of the increase in political unrests in the MENA region. Though the following graph shows different CDS values for different MENA states, it also shows the CDS values for GCC states after the MENA unrests.

Is it contagious?

The spread of the MENA unrests and its impact on GCC countries has been unprecedented (Sal 1). In this regard, there are no guarantees that, Bahrain or Saudi Arabia may contain such unrests and prevent them from escalating into fully-blown conflicts such as Tunisia’s, Egypt’s or Libya’s. In fact, by the time the uprisings started in Tunisia, there were no indications that it would spread to other Arab states, as it did. Also, some Arab rulers such as Gadhafi tried to suppress such revolts but were unable to do so. From this background, it is possible that the revolts may spread to Saudi Arabia, Bahrain and other Arab states that have been spared so far.

Conclusion

The MENA unrests have had a profound impact on the GCC markets. Its impact on this market has especially been observed from the impact of the unrests on oil production and investor confidence. This paper observes that, the unrests have significantly dented the credit ratings of the GCC countries and similarly increased their CDS values. Comprehensively, the MENA unrests have eroded the gains that the GCC countries had accrued over the last few years.

References

Al-Bawaba Business. Egypt Turmoil: Arab Stock Markets Lose Some US$50 Billion. 2011. Web.

BBC. Bahrain Unrest: Thousands Join Anti-Government Protest. 2011. Web.

Corbett, Christina. GCC Credit Ratings Fall Short. 2007. Web.

Global Investment House. GCC Sovereign Credit Default Swaps at Record High Levels. 2011. Web.

Sal, Ahmed. Tunisia- A Demonstration Effect. 2011. Web.

Sharewadi, Kristine. GCC Credit Default Swaps. 2009. Web.

Standard Chartered. Standard Chartered Middle East Regional Focus.2011. Web.

The Wall Street Journal. Middle East. 2011. Web.