Introduction

Islamic Banking has proven to be one of the best financial solutions. Earlier, Muslims used to avoid placing their funds as term deposits where they could earn good interest as profit. They used to avoid as interest is strictly prohibited in Islam. However, interest can get those a good earning who cannot work due to physical illness or for any other problem. But, due to religious perspective, people used to avoid it. When Islamic banking began to use their money in interest-free way and came up with good profit (Riba Free), this Islamic system gradually became popular not only for investors but retired people, as well. On the other hand, it was also the case with those who wanted to take financial help by means of loans. They could avail of interest-free loans to meet their needs. Later, for many reasons, this Islamic system became popular even among non-Muslims.

Islamic banking system was introduced in Islamic countries at the time when the countries were socially and economically week in the late 19th century. According to Sarwar, the major big banks of some Muslim countries set up local branches in the economic hubs of the particular countries and they dealt with the problems of imports and exports required by the financial institutions and other businesses of foreign countries (Sarwar 2011).

Later on it became complicated to handle the trading nand other activities without making apply of commercial banks. The borrowing from commercial or the central banks and depositing of funds in commercial banks or any other conventional financial institutions was strictly avoided in order to stay aloof from any kind of transaction involving interest which is forbidden in Islam (General Introduction 2008).

Islam, contrary to capitalism, considers all kind of property which builds Allah’s trust with the individuals. This trust can only be acquired either in accordance with Allah’s will or as has been declared lawful by Shariah. None of the belongings is possible to be used for any business purpose contrary to Shariah law. In fact, Islam does not recognize absolute right of individual to own and use property the way whatever he likes. The individual has to follow strictly the path suggested by the Shariah. Absolute right of ownership of property opens the door of all kinds of evils like economic inequality, unjust distribution of national wealth and productive resources.

Interest Free Banking: (As an Idea)

In simple words, the most common definition of interest is defined as the price of money. It is very common and is in practice on a regular basis in conventional banking system. In conventional banking system, money can be treated as a commodity. When a bank grants some loan to the borrower, bank is least bothered about where the money would be utilized. Banks are only concerned about a fixed or defined rate interest that is charged in percentage over the total amount borrowed. Bank earns a lot this way by treating money as a commodity and charging interest over some certain amount that a person took from bank. While, on the other hand, Islamic banking does not treat money as a commodity. It is in accordance to the Shariah / Islamic principles. In Islamic banking, interest is prohibited and money is not treated as a product but is only used as a medium of exchange. The main objective of Islamic banking is to introduce a banking system where interest is prohibited. Therefore, all transactions are interest free.

According to Gafoor, the involvement of private and public institutions and the governments themselves led to practical application of the theory and led to the establishment of the first interest-free financial institutions” (Gafoor 1995). The Islamic Development Bank was established in 1975 which functioned as a link between countries where Islamic banking or financing was practiced and regulatory authority for the Islamic banks operating in the particular countries (Gafoor 1995).

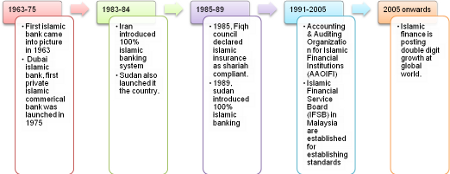

History of development of Islamic finance

In 1977, the Kuwait government proceeded with the interest free system. However, there is a chain being started in different Muslim countries to introduce the Islamic banking system in the respective countries in order to make the tractions easier for people who prohibited the interest banking. In most of the countries establishment of interest free banking system had been limited to private sectors of the banks.

Profit-making Banks

These institutions are scuttling to make a profit and owned by a group of members. While commercial banks, in addition put forward special services, to the regulars (Commercial Bank n.d). Commercial/Profit making banks serve in various ways with various products.

Principles of Quran Sharif and Sunnah

Islamic banks follow Quran Sharif and Sunnah. As per Thomas, there is nothing forbidden except for which God forbids. He added that to declare something prohibited as permissible is same as declaring something permissible as prohibited. (Thomas 2006).

In an authentic tradition from the collection of Hadith, Sahih Al-Bukhari, Hadith 8.840 narrated by Abu Huraira, the Prophet Muhammad commanded to avoid seven of the destructive sins. He listed the seven sins in a descending order starting with the joining of partners in worship with One and Only God (Allah), sorcery or magic, murder of innocent people, to deal in interest, to consume the property of orphans, to run away from the battlefield due to cowardice and to accuse a pious woman of adultery or fornication (Huraira n.d).

In a collection of Al-Tirmidhi, Hadith 2825, narrated by Abdullah ibn Hanzalah, Prophet Muhammad said, a dirham or money which someone knowingly receives in usury or interest is more serious or more sinful than committing fornication thirty-six times. Ibn Abbas’s version adds that the Prophet Muhammad said that hell is more fitting for people whose eat or live on unlawful earning (Hanzalah n.d).

With these above opening verses of the surah with a quotation of man’s humble is natural origin as well as to his awareness and intellect. Prophet Mohammad (P.B.U.H) destined to continue of his ministry and to end before his death (Abdullah n.d).

Islamic Finance

In order to define the main objectives and methodology of Islamic banking system, we have to know the darks and lights of Islamic finance, its implementation, its features; it’s grooming strategy in the modern world.

Islamic banking is all about the principles that are based on Shariah. Shariah forbade the transactions of fixed and floating acceptance of any kind of interest.

Islamic finance despites its name, is not a religious creations (Islamic Banking 2008). Predictable finance includes elements (interest and risk) which are prohibited under Shariah law. Developments in finance have motivated the Muslims to invest their savings and raise funds by different methods which do not contradict with their religious and ethical beliefs (Islamic Finance 2009).

Important Institutions of Islamic Financing

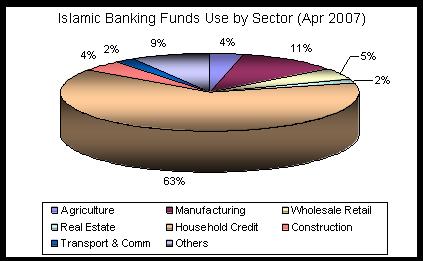

Institutions refer to those organizations, concepts and laws which are essential components of Islamic financing, Islamic banking also of Islamic economic system. Islamic finance refers to the structure of financial instruments and financial transactions to explore traditional Muslim banking in order to determine the ways which denied the payment of interest and against engaging with any type of gambling.

The most outstanding are institutions of Islamic finance are as follows:

- The institution of private ownership.

- The law of inheritance.

- The Zakat.

- Ideology of expenditure.

- The institute of sharak- partnership.

- The institute of Muzarbat- profit and loss sharing business,

- The institution of leasing- rules and regulations of commercial dealing.

- Non- interest banking and financing business

- Prohibition of every king of gambling.

- Establishment of a well-fare state.

Essential coordination among all those institutions is quite necessary. Only complete jointly they would perfectly contribute in achieving required Islamic financing goals. Individual cannot alone perform the ultimate task successfully. Combined working of all of them is necessary. In fact, they all are a necessary part of a big machine, missing any of them, will make the machine an idle one (Islamic Finance 2011).

Outstanding Features of Islamic Financing in Different Countries

The Islamic financing is an essential component of Islamic economics. Caba-Maria illustrated that Islamic financing has special features because the foundation on which it is based is the rule of Islamic law or Sharia which states that ownership of everything lies with Allah or God. And man is permitted to use and take lawful advantage of it. Accordingly, the use of funds is governed by quite a few regulations (Caba-Maria 2011). The most cream and outstanding features have been presented in modern Islamic financing which are discussed under:

Right of private ownership

Islam allows lawful right of private ownership. All individuals have a right to use their wealth to fulfill their personal needs or utilize it to earn more wealth. However, they can use this right within the limits prescribed by the Shariah. Those limits are like:

- Property must be remaining in use continuously. Non- use of property is not allowed in Islam because non- use causes deprives not only the owner but also the community from the benefit of its usage.

- The owner of the property must pay Zakat in proportion to the property he owned up to a certain limit. Gold, silver, currency of any king, agricultural produce, trading enterprises are liable for Zakat payment.

- Use of property must be beneficent not only to the owner but also to the community as a whole.

- Use of property must be made in a way as to cause no harm to others or to the community.

- Possession of the property must be lawful.

- The owner use the property in a balanced way, i.e., must not be too carelessly not with excessive carefulness (almost holding back).

- Property must not be used for securing undue special benefits neglecting the interests of the community.

- Islamic laws of inheritance must be put into practice.

Realizing the dream

Islamic financing concedes the right of economic freedom. All the members of the society have an equal opportunity to consume the commodities according to their choice. Monopolies and economic privileges are not allowed to play the tricks of the trade. It is an essential duty of all the members of the society to exercise their Islamic economic freedom within the limits set by the Shariah of Islam.

They are bound to spend their lawfully earned wealth for a lawful purpose. Lavish spending on useless and harmful commodities is prohibited. Consumption of such things which have been declared unlawful is not allowed.

Equitable distribution of wealth

Islamic financing lays great stress on equitable distribution of wealth. For this very purpose, three important measures have been put into practice.

- The earning and spending of wealth has been restricted only to the limits of fair means.

- for the process of transferring wealth from the rich to the poor, two measures of Zakat and law of inheritance have been equalized

- Necessary measures have to be taken to make it possible for the factors of production to have just compensation (Abdul-Rahman 2011).

Prevent meditation of wealth

- Effective arrangements have been prescribed for promoting the circulating of wealth among a maximum number of individuals in the society.

- Muslims have been directed to spend their lawful earnings on their legitimate needs.

- Zakat is one of the compulsory requirement for every wealthy Muslim.

Imposition of certain restrictions on spending wealth

Regarding to protect collective interest of the Muslim society, Islam has imposed certain restrictions even on the spending of lawfully earned wealth.

Islam has forbidden spending money on harmful things, such as liquor and narcotics which do not only destroy morality and character of the user but also has to suffer ultimate consequences. Showy display of any kind and every unnecessary and undue spending have been firmly prohibited.

Amassing wealth is prohibited

Islamic finance disallows hoarding of wealth because it stops the flow of wealth. Eventually, a decline in the sale of the consumer good follows. The producers hold back their capital investment. Machines and other means of production are not operated to their full capacity. Consequently, demand for all kind of inputs shrinks. Such situation create a vacuum that ultimately results in unemployment. Hence the economy has to face an economic crisis.

Flexibility in the banking system

Islamic banking is not rigid rather it is flexible enough to absorb new ideas, institutions and organizations. There is no restriction to be benefited from experiences of other nations in consumption, production, distribution and exchange of wealth. Islamic finance is fully capable to absorb ideas and working of joint-stock companies, economic planning, insurance and banking institutions, modern instruments of money and credit, advanced technology and foreign trade activities with some minor modifications.

Use of fair means of earning livelihood

Islamic financing insists Muslims to do their best to earn fair livelihood only. Islam is quite against the act of parasailing on others or begging. A Muslim, whether he is doing manual or mental labor or engaged in any field of finance activities, must earn his livelihood only through lawful means. Stealing, smuggling, gambling, hoarding, bribery and selling and buying of narcotics etc. All these means of earning livelihood have been taken declared unlawful by Islam.

Regulating the controlled price mechanism

Islamic financing though firmly supports free enterprises system, yet the forces of the price mechanism, demand and supply, are not allowed to play absolutely free. In contrast to Capitalism, these forces are regulated by moral and ethical values which serve the purpose of a built–in stabilizer in an Islamic economy. Controlled price mechanism prevents the wealth from getting out of control and disrupting the economy.

Control economic crisis

Islamic economic system is not rigid rather it is flexible enough to absorb new ideas, institutions and organizations. There is no restriction to be benefited from experiences of other nations in consumption, production, distribution and exchange of wealth. Islamic financing is fully capable to absorb ideas and working of joint- stock banks, economic planning, insurance and banking institutions, modern instruments of money and credit, advanced techniques and foreign trade activities with some minor modifications.

Prevention of interest

Islam takes an interest as the mother of all economic evils. Due to this, distribution of wealth in a society becomes inequitable. It is mainly received by the capitalist who continuously use his wealth to earn more wealth. It helps in concentrating wealth in the hands of the capitalist class. It also gives birth to number of social and political evils.

Institution of Zakat

Institution of Zakat is a unique feature of Islamic financing. It is a compulsory levy on the wealth of the well- off members of the Muslim society. It is a mechanism of mandatory transfer of resources from the people in the society who have more money than they require or the surplus units to the people who are in need or who have less money as compared to their expenditure or the deficit units in the society.

Role of moral values

A comprehensive scheme of moral values has been drawn to put into practice. It is linked with a strong and coordinated system of beliefs and devotional practices. If economic factors are regulated effectively, these moral values can protect the economy from several social and economic crises. Besides, being cooperative in promoting the measures of economic prosperity, this scheme can also help the state to use its authority very effectively. With the help of this scheme of moral values just Islamic financing cam also put in practice.

Instruments of Islamic Financing

Islamic modes of financing are quite different from those being used in other economic systems. In the Islamic Finance, we have:

- Leasing (Ijarah)

- Modarba

- Musharakah

- Murabahah

- Ijarah

- Salam

- Sukuk

Leasing

History of the leasing business may be traced for back to Sumerian era before 2000 B.C. leasing as a form of trade was also practiced in Pre-Islamic era.

Leasing could be the best alternative for one person, it strength not be right for another. As per an article, “When you lease a vehicle, you purchase the use of that vehicle for a particular period of time” (Leasing vs. Financing 2011).

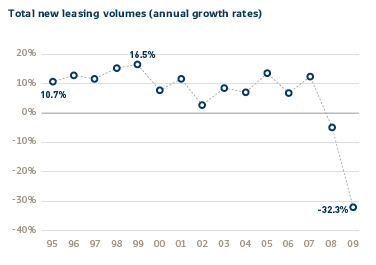

After the dawn of Islam, leasing is known today throughout the world get boost in U.S.A with enforcement of economic recovery of Tax Act of 1981. In the U.K in 1984, the fiscal step of providing generous tax concessions proved to be a boost to the leasing business there.

Definition and types

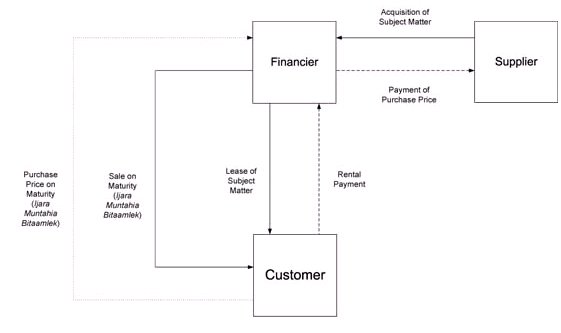

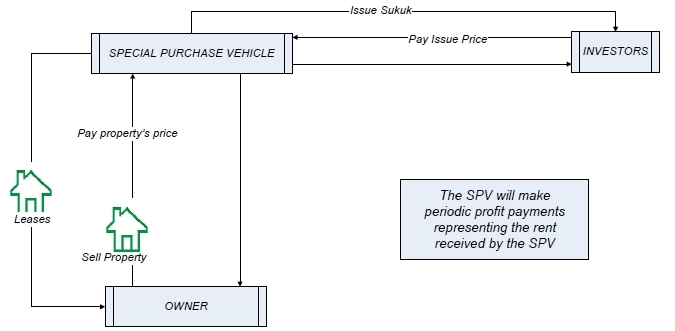

Leasing is a contractual arrangement, under which one party, in return to an agreed rental for a specific period of time, use a capital assets owned by another party. Such leased assets may be typically plants and equipments but may include a wide range of assets such as industrial and agricultural machinery, ships, aircrafts, railways and oil rigs etc.

The party who makes available an asset for lease is called lessor and the party who makes use of that asset is called lessee (Ijarah financing n.d).

The process is very simple, a solitary asset Trust is created, and the Trust then buys the properties, and leases the bought properties to the clients. Payments are made on a monthly basis and a portion of those payments increases the ownership of the client until the customer gains complete ownership of the asset or becomes the sole owner of the property. (Ijara n.d)

There are two main sections of Leasing:

- Operating a lease. In case, a lessor intends to operate his assets to make a profit, he can do this by providing it on hire to others for use under an agreement. Lessor is the one who tolerate complete risks and rewards of possession. Lease, generally, covers almost 75% of economic anticipated life of the equipment. The present value of the lease rentals which the lessor can receive from the lessee could not be exceeded than 90% of the fair value of the asset. In operating lease, the lessee has the opinion to cancel the lease pre-maturely without paying heavy penalty. Operating lease has also spread to industrial equipment. The lessor leases the equipments to the lessee which pays sporadically a rent. It allows the organization not to use its equity an investment that constructs no direct value (Operating Lease n.d).

- Finance lease. In current days leasing has now become an economic and financial certainty of major significance. It is the innovation of the leasing methods and their economical rewards, which have enabled it to enter the world of industrial investment in New Zealand and on the international panorama (Leasing Finance n.d).

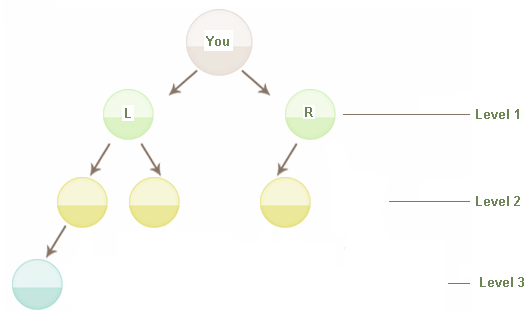

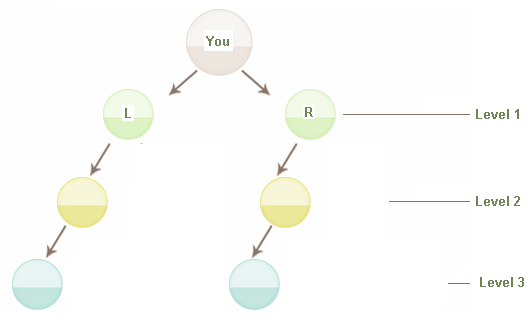

Diagram below illustrates an example:

Advantages

From leasing business, not only the lessor and the lessee but also the economy of banks can attain a number of benefits.

- It can help to attain the utmost objective to purify the economy from the involvement of interest factor.

- It may help in attaining 100%of cost of the equipment.

- It can be effectively used to induce saving propensity among religious minded persons.

- It can serve the purpose of sound hedge against intensity of inflation.

- It may cooperate in making free-flow of valuable working capital or credit line.

- The rentals beared by the lessees to the lessors are fully chargeable against their taxable income. Therefore, it may help in eliminating tax evasion practice.

- It helps in the availability of technology not the lessees but also to the economy at large.

- Under leasing contracts, the lease arrangements are thoroughly evaluated by the experts. Thus, effective use of assets becomes possible at one hand protection of interest of both the parties takes place at the other hand (Advantages of Leasing n.d).

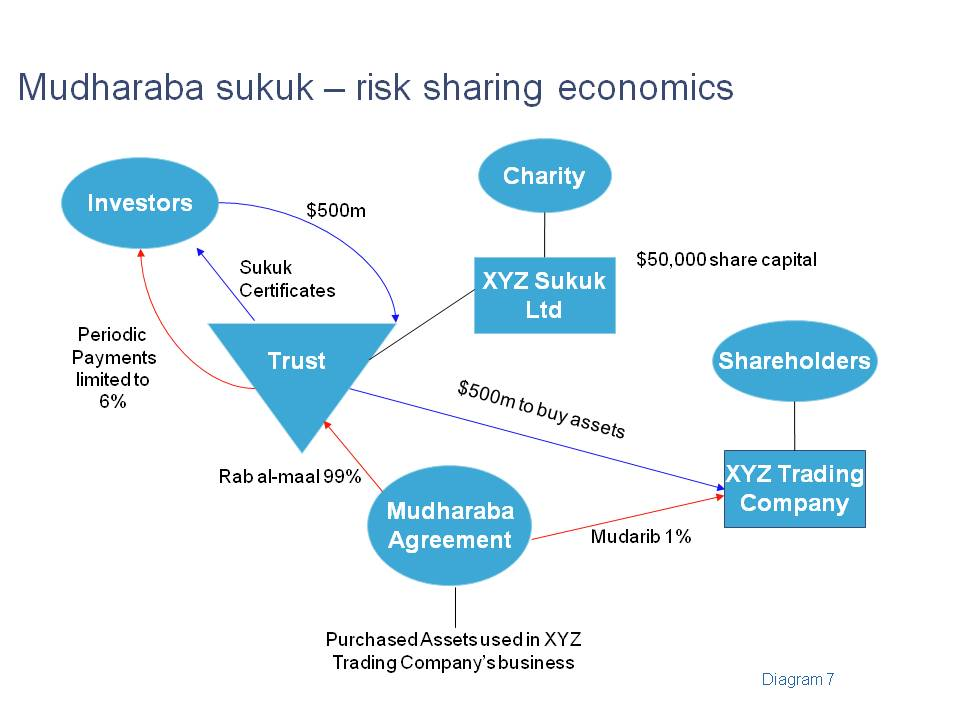

Modarba (Profit Sharing)

A Modarba is a participating type of business undertaking in which a participant participate with his money-capital (rabb-ul-maal) while the other (mudarib) with his human-capital i.e. Knowledge of the business, managerial skill, experience and expertise.

The profit earned or loss suffered is distributed between the participants in agreed proportions stipulated in the agreement. A big joint stock company or a corporation may also be set up with Modarba financing.

A Modarba can either be a multipurpose or be a specific purpose. A Modarba is floated for a certain period of time, or for a particular use. It is automatically terminated as soon as its term expires, or its task is completed.

Modarba is not an innovative idea; to a certain extent, it was practiced even in the pre-Islamic era in Arabia. After the dawn of Islam, Prophet Mohammed (peace be upon him) also accepted and declared it as a legitimate mode of financing and considered it fully in consonance with the injunction of Islam in the context of Riba (interest) and its elimination. It had been remained in practice for a long time throughout the Islamic world. Its practice came to an end with the downfall of Islamic world (Mudarabah 2006).

Modarba companies are controlled by the following six regulatory authorities (Modaraba n.d).

- Registrar Modarba.

- Regulator of capital concern.

- Corporate Law Authority.

- Monopoly Control Authority.

- Stock Exchange, and

- The Central Bank

Musharakah (Partnership Financing)

Generally Musharakah is some sort of temporary partnership on profit/loss sharing basis, for division of finance to trade and industry in the corporate sector. Technically, it is a form of a business arrangement in which the partners pool their respective resources to undertake any commercial/industrial concern.

However, in the context of Islamic banking, the Musharakah is a contractual business based on the bilateral arrangement between a bank/financial institution and the user of its funds. In this regard, the Musharakah is a joint venture contract between a bank/financial institutions and its clients.

Musharakah financing is managed through certificates of Musharakah in this contemporary world. The maturity period of these certificates has been fixed, which not less than three months is. They however may be traded over the counter.

Musharakah refers to the sharing of profit and loss between the one who lends and the one who borrows dealing with only interest. It is a pact of financing in which parties put forward funds, efforts, and skills. Profits shared among them according to the rate present by the investor.

The Musharakah financing mode has been begun by commercial banks to meet their operational capital required for trade and big banks and industries. The Bank brings out Musharakah functions in profit and loss accounts. Borrower receives interest –free loans on the basis of fair contribution and sharing of profit or loss passed on from the bank or any other financial institution (Musahraka 2003).

Murabahah (Sale for Mark-up)

Under this scheme of financing, a bank on the request of its clients, buys or acquires some certain items such as machinery or raw material act for a certain price. An agreement for repurchasing the same item from the bank is made in advance.

In other words, Murabahah is that type of contract or agreement for a seller purchase goods or required commodities on the request of buyer than further sale back at a high price than before. The difference in prices is called Mark-up. One who purchases pays off in different ways. It could be in one go or in partial chunks.

Murabahah agreements are major used to buy big items such as cars, homes, but it is also used to grant LC and it also finances to the business of import.

Bayie Salam (Deferred Delivery Sale)

Under this scheme of financing, advanced payments are made to the producer or the supplier for delayed supply of the specified good and commodities at a future date.

Due to these limitations, Bayie Salam scheme is most suitable and convenient way particularly for agricultural financing because in agricultural most of the goods are of that kind which may easily be counted in quantity and we also easily check them by quality wise. So this scheme is easily applicable in the agricultural sector.

“Bayie Salam is an agreement in which there is compulsory to make an advance payment for goods to be delivered in future” (Bai’Salam 2009). It is compulsory that quality of goods sold is specific and shown to the buyer before the agreement leaving no uncertainty leading to clash.

The major items of Bayie Salam are goods excluding gold, silver, or any other commodity which may be used as a currency including paper money. (Bai’Salam 2009). Excluding this, Bayie Salam coats almost everything of selling and buying that is competent of being absolutely described as to quality, quantity and workmanship (Bai’Salam 2009).

ISTISNA (commissioned manufacture)

Istisna is a Shari’ah approach of Islamic financing generally implemented by Islamic banks and financial institutions to sponsor different kind of projects such as housing, buildings, factories, highways, airplanes, ships, machines and equipment, etc. Export financing can also be done through Istisna and it also work in industries to meet the required capital where mostly the sell orders are receiving in advance.

Banks must take financing based on Istisna which also related or depend on other agreement of Istisna. As a result, they can act as both at a time like manufacturers and buyers. On the other hand, Istisna cannot be used for natural or ordinary things or goods that cannot be manufactured or renovate, such as animals, fruits and plants, etc.

In meticulous, Istisna can be regularly used by Islamic banks to finance industries where fabrications can be supervised by measurement and specifications.

The Istisna agreement can also be signed for real estate which may be owned by either the buyer or the contractor. Istisna on land can also deal with properties which are solely owned by either of the two parties. The agreement includes the construction and maintenance of particular buildings including factories, hospitals and educational institutes like schools (Istisna’a n.d).

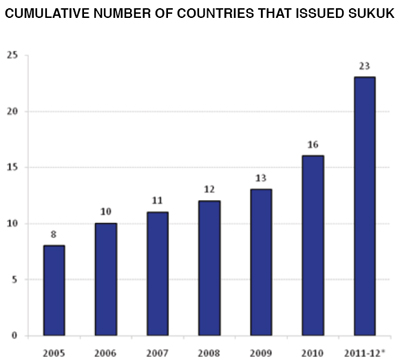

Sukuk (International Islamic Bond Market)

Sukuk is an Islamic financial certificate which endows with an investor with ownership in an essential asset. Sukuk was largely used by Muslims in the middle as written papers which defining financial terms and requirements creating from trade and other profit-making activities.

On the other hand, the present configuration of Sukuk is different from the Sukuk formerly used to years ago and is similar to the display concept of securitization. Sukuk is a process in which a specific phase of work is set-up to attain assets and to issue financial asserts on these assets which are to be attained. The possession of these basic assets is then transferred to a combined group of investors through certificates representing balanced value of the appropriate asset (Islamic Finance Industry 2011).

Sukuk as an asset-kept security may be seen as an Islamic corresponding of union. However, bonds including fixed interest are not acceptable in Islam; hence Sukuk should act in accordance with the investment principles with the Islamic laws and regulations, which disallow the charging, or paying of interest. The major clause for issuance of Sukuk is to show those assets on the balance sheet of the issuing unit that wants to marshal its financial resources.

The issuer of a Sukuk advertise an investor that certificate. Who after receiving charges it back to the issuer for a fixed rental fees. The claim made flesh in Sukuk is not simply assert but an ownership assert.

A Sukuk fundamentally represents either a comparative or an exclusive interest present in an asset or in the band of assets. The level of asset ownership privileges ensuring to the ownership interest brings the privilege to a balanced share of cash flow or other profits and all the remaining risks of ownership.

Development of Islamic Finance in New Zealand

Background

In New Zealand, in the present era, there is no Halal unconventional available for the Muslims in new Zealand who wish to borrow loan in the form of money to purchase their own homes, cars or businesses to earn their livelihood in a better way.

These circumstances prevailing in the country cause adversities to the people who wish to live on the path of Islamic ways but are close out from the growing value of real state.

As Pakistan is a Muslim country and after a long circle of Islamic banking system throughout the world, Pakistan also established a number of Islamic banks in order to aware the people about the rules and regulations which have to implement in banks under Quran and Sunnah.

Professor Zain Ali from the university of Auckland research on New Zealand’s Islamic finance strategy and developed a plan for hoe Islamic finance could benefit New Zealand.

He concluded in his research that the Islamic financing industry is one of the fastest-growing industries in the world of global finance. The Islamic finance industry was estimated to worth around $ 949 billion in 2009. (Leslie, Islamic Finance to New Zealand 2011).

He after accustomed in Shariah compliant methods and ways, clearly declared that Australia could open up investment alternates and potentially more jobs for the living people in that country.

He also ask the bakers and economy of New Zealand that if they implement the strategy of Australia than they develop New Zealand in this competition with Australia.

He also said that New Zealand is commonly unknown to the exterior world, and this is a privilege for it, since it means we can advance ourselves without having any agonize about political and social issues.

He said to the people of New Zealand that they are a broad-minded society, one who values the open freedom and wants and easy acceptable religion. The world, specially the Muslims needs to know this (Leslie, Bring Islamic Finance To New Zealand, Professor Says 2011)

Generally, in the first evaluation of financing, the risk and equity sharing feature stands out. The most significant characteristic of Islamic banking or financing is the ruling out of interest or Riba. Islamic jurisprudence accepts the capital compensation for finance providers only on a profit- and loss-sharing base, working on the principle of unfixed return related to the actual productivity and performance of the financed venture.

Caba states, “Another essential feature of Islamic banking is its entrepreneurial feature” (Caba-Maria 2011).

New Zealand Commercial Law Frame Work

The main deeds which Islam prohibits are usury, the collection and payment of interest in banks, which is also called Riba in Islamic course. As per the Chief Executive Officer of Al Islami, Islamic law also prohibits investments in illegal businesses or through illegal ways in other words are Haram. “Furthermore the Shariah law has strictly prohibited Maysir and Gharar” (Al Islami CEO 2011).

. These notions relate to the transactions or agreements for buying and selling goods in which lies the element of speculation or prearrangement.

“When asked on the efficient role by International Islamic Liquidity Management Corp (IILM), he recommended that it for IILM to offered multi-currencies products, which are is more cost effective and beneficial to other countries” (Al Islami CEO 2011).

A school of thought became known in the 19th century. “Islamic financial institutions in Iran, Pakistan and Saudi Arabia, the Dar-al-Mal-al-Islamic in Geneva contributes in the growth and development in the industry” (Al Islami CEO 2011).

This growing practice of Islamic finance will be practiced more fully in all the banks according to the Shariah and Islamic laws (Islamic Bank n.d).

Impact of Islamic Finance on New Zealand Commercial Framework

Islam is not a mere religion. It is perfect deen- a perfect code of life. Similarly Islamic financing also attains a perfect position in the state with some its major goals which are discussed below.

Achievement of well- being: Islamic financing seeks economic well-being of the people within the structure of the moral standards of Islam. Islam urges Muslims to enjoy fully the blessings provided by Allah and sets no limits to the extent of material growth. It lays stress on struggle for material well-being with an act to virtue.

Islam also urges Muslims to get complete control over nature because, according to the Holy Quran, all resources in the heaven as well as on earth came into being for the service of mankind. Islam has strictly prohibited begging and urges Muslims to earn their livelihood. In this regard following two Hadith are worth nothing. First, in a Hadith, The Prophet Muhammad said that the one who gives is better than the one who takes and in the other Hadith; he said that best earning for man is the earning from his own labor (Principles of Risk Management 2005).

Attainment of economic justice as well as bank customers trust: Islamic financing aims at maintaining economic justice so that every customer could get his due share for the contribution made for the society. There should be no exploitation by any one individual to another. The Holy Quran urges Muslim in this regard,” withhold not things justly due to others”. This command of Allah implies that every Muslim should not hold back things he/she owes to someone else and likewise take whatever is due to them by someone else. This holy verse is a warning against injustice and exploitation and protects the rights of all individuals in a society, it includes consumers or customers, manufacturers, entrepreneurs an even the employees of banks.

Relationship between employer and employee: Relationship between employer and employee holds a special significance in Islamic banking or Islamic financing. An employee is entitled to receive a fair wage for his/her efforts and contributions to the production and the productivity of the business he/she is working for. Islam, for its commitment of justice also protects the employer by putting certain moral obligation on the employee as well.

The employee is required to do the job quite willing and diligently with possible degree of care and skill. The employee is also required to show efficient performance of the job for which he is employed.

Attainment of social justice in financing sector: When it comes to justice, Islam does not allow for any differentiation between the rich and the poor, between the high and the low, between the white and the black. Islam also does not discriminate the mankind due to race or color or status. The only judgment of a man’s worth is his character, ability and the service to humanity.

The holy Prophet said in this regard:

“Certainly Allah looks not at your faces or your wealth; instead He looks at your hearts and your deeds” (Heart & Deeds 2007).

As per a source, “the most best of you are the best in character” (Musahraka 2003).

Islamic Finance Strategy in New Zealand

The early conference of World Conference of Muslims humanitarian, now renowned as the most influential forum on Muslim humanitarian throughout the world, which invites papers as well as applications for session and workshops that shows innovative, legal and experimental work.

This specific conference will focus on how the incorporated efforts of humanitarian, public and private zone which can successfully respond to the deterioration global issues of hunger, poverty, medical, weather change and conflict. The forum will also crowd interactive round table discussions on medical terms and obstruction to building competence for transformational change.

The studies observe the awareness of bank customers concerning service quality of the Islamic banks as well as unadventurous banks in Pakistan. In present and border less market, the study is important due to a promising trend of Islamic banking practices in Pakistan as well conventional banking to swap Riba based goods with the Shari’ah obedience goods.

The bank fund will secure $100 million from humanitarian foundations and corporations in the future next five to six years to fund in a long-term hunger abolition and poverty lessening in almost 20 countries that are facing the ongoing food and medical crises. Funded projects will tackle not just the average quantity of food that must be produced and spread, but also find the way that how food is produced and by whom and in what manner.

One of the funds which is called Hasanah fund will set off the commendable work of the Kingdom of Saudi Arabia, the main organization of Islamic conference and the Islamic development bank towards hunger and needy people, make obvious the continuing commitment of Muslim humanitarian to the social and economic enlistment of the poorest people (uswah ḥasanah n.d).

The International Journal of Islamic & Middle Eastern Finance and Management have strong-willed to issue a special question of the journal, focusing on the most recent financial crisis, and how this has connected to Islamic financial institutions.

Other important points include:

- Projected title of the particular issue: Islamic Financial Institutions and the Global Financial Crisis 2008/09.

- time limit for being paid papers: Friday, February 12th, 2010

- Date of newspaper: fourth issue of Volume 3 (2010).

- Papers will be appraised in the normal trend.

- Technical notes will also be good enough, and they will be assessing in the standard method.

- We are liable to have a total of five articles in the matter.

- Books related to this foremost occasion can also be reviewed for the subject matter.

- All branches of the Islamic financial services sector can be enclosed in resources within this subject, including banking, insurance (i.e. takaful), fund management, investment folder, business management, etc (Principles of Risk Management 2005).

This Research considers that the increasing population can be fed, provided that the suggested actions are to be taken, involving innovation and a transform in the system of fabrication and circulation along with constant efficiency growth in an ecological and socially sustainable approach.

During work on funds, a strategy professional for the fund industry needs to updated its analysis on Shariah scholars’ commitment in financial service organizations in various countries and now worldwide covering companies with 956 (498) Sharia Board place and 180 (121) scholars (FIANZ n.d).

Rent and Interest in New Zealand Islamic Finance

When an item is sold, the item and its use must be passed on to the buyer, so it is not applicable for the seller to collect rent for it because it is the property of the purchaser. When a property or an asset is rented, that means that the benefits of the asset or property (not the asset itself) are passed on to the renter (Al-Munajjid n.d).

- Rent is the outcome of taking bold step, facing ups and down of professional difficulties and proving efficiency. It is attained after value creating process. The owner of the asset or property has to involve in it, directly or indirectly, almost all time for its maintenance. However, when it is about Riba or Interest, this is not the case.

- The lender almost becomes unconcerned with the use of loan. In case of rent, the self-interest of the owner remains intact, whereas in case of interest the lender becomes a selfish. In case of rent, the owner has to make active productive effort to convert his money-capital into some useful asset. Hence, the element of entrepreneurship remains active. But in case of interest, since the lender remains almost concerned with the use of provided money, the element of entrepreneurship remain passive.

- The lender being inactive lives like a parasite. In other words, interest compared to rent, does not take such active and dynamic part in the value creating process which is the essence of real economic development.

- In the case of rent, the owner of the asset usually decides the nature of use of his asset. Hence its use remains restricted to some definite and gainful purpose. In case of interest, since the lender does not take interest in the case of provided loan it may be used even in wasteful purpose such as hoarding, racing, gambling, black-marketing and speculation.

- Hence interest may harm the economy in various negative ways. That is why, Islam has declared rental business a lawful one the interest-based transactions unlawful ones.

- Rent does not enter into price, whereas interest does enter into price, not once but all those different stages of production which are run through the help of credit. Hence rent makes process of production smooth to operate, rather performs the job of fine tuning. Interest on the other hand, being a part of cost of production retards production process and causes to hit hard to poor consumers in a number of ways.

- In case rent, the possibility of occurring loss cannot avoided. Due to presence of the element of failure, the utilization of assets by the proprietor for earning rent does not help to create a parasite class in the society. In the case of interest, since the element of loss is missing altogether, the rich who are frequently indulged in earning through interest due to abundance of wealth, have a fair chance to become richer. Hence a parasite class emerges in the society who does not take an active part in the process of production.

- In case of interest, the producer has to suffer a great setback when he has to pay the fixed interest in case of losses. Similarly, the lender remains in losses, when the producer makes a large profit but he has to content with a nominal rate of interest. In case of rent, both parties are safe and satisfied because no one has to face such injustice.

- Industrialist borrows capital on interest from banks but in return they pay a small part of their earnings to the depositors through the proper channel set up by the bank. It is not a direct transfer of income from the masses of depositors of low means to the industrialist of huge means. This transfer who is made through way of interest leads to concentration of income and wealth in the society. Hence interest happens to be a significant source of gross inequalities of income. Contrary to interest, rent leads to equalities of income.

Reasons of Interest Free Banking Finance in New Zealand

Interest free banking and finance, the more than trillion $ industry has shown elasticity in the global depression of 2008. The industry became a center of attention even for people living in the countries with Muslim minorities like the United Kingdom and the United States. India is one of locations that do not come up as the interest free finance industry (Aziz 2011).

Economic Reasons

From economic point of view in New Zealand, interest result in serious economic losses of the following nature:

Great source of unjust distribution of wealth: It is received by the capitalist who can gather more wealth by sheer dint of wealth. Hence, instead of circulating in the society, wealth is concerned in the hands of a few. This leads absolutely an unfair distribution of wealth in the society. The concept behind this is; Riba or interest encourages and supports those who are already rich while those who are poor turn out to be poorer.

It destabilizes the economy: The interest rate brings severe ups and downs in the economy. A high rate of interest creates situations of extreme uncertainty in the capital market of New Zealand as well as in money market. A low rate of interest, on the other hand, discourages investors to invest.

Hence, this appointment of investors creates financial crises in capital market. Since the decisions of interest rate depend in the whims of some big capitalist who always seeking protection of their own interest, the economy remains on the mercy of their material approach. Thus, the element of interest mainly causes to destabilize the banking sector.

It creates trade cycles: The element of interest also leads to creation of trade cycles because it plays a particular role in bringing about a slump in the market. The reason is the banks issue loans generously when the trade activities are active, but as soon as the signs of slump appear they start recovery of their loans. Hence trade activities shrink and slump starts moving to its lowest level.

It leads to misallocation of productive resources: Financial institutions before granting loans on the base of interest evaluate the resources of the applicants. On order to secure their loans they seek proper security to ensure that he borrower is a sound party. They do not much bother about to consider how the loan will be utilized.

They are mainly concern with earning interest and secure returning of their borrower capital. Since proper security and surety only can be provided by the rich so financial resources flow either to the rich or to the government which is considered a most creditable borrower. Hence, misallocation of productive resource tax place and their maximum utilization cannot be repaid by the society.

It affects efficiency of working of the borrowers: Interest also casts bad affects on the efficiency of working of the small borrowers in particular. The people who get loans to meet their private needs are seemed to be burdened with constant worries and mental depression. This condition adversely affects their efficiency.

They take interest in their work half-heartedly being constantly heard by the thought that a major portion of their hard earning will go to pay the interest. Constant worry and depression make them physically weak. Hence they are deprived of their efficiency of work gradually.

Capitalist loses his active interest in the banking sector: In a business; the share of the capital, i.e., interest rate is fixed. Since the interest of the capitalist is sure in all circumstances, he has no need to take an active part in the concerned business. He does not bother about whether the business earns a profit or suffers from a loss. Usually, a business, particularly of a large-scale, is run by professional managers.

The element of interest encourages creating a class of financers who merely supply money and then live like parasite. In absence of interest element, this class can be compelled to take active part in the economic struggle. Hence the nation as well as the country can be benefited by the ability and caliber of this class of financers.

A great hurdle in the way of investment: Investment is a key factor of achieving of full level of employment as well as economic development. As a capitalist economy, investment according to Keynes; the great British economist, it depends upon the one hand on the rate of interest and on the other marginal efficiency of capital; that is the expected rate of return. The process of investment continues as long as expected rate of return is higher than the interest rate or at least comes at par with it. As soon as the expected rate of return falls below the interest rate the process of investment becomes inoperative because in such a situation investment is considered non- profitable. At this stage, the only hurdle in the way of investment is interest rate.

It has been identified that when investment factor is at bottom, interest rate goes up. If the interest rate is reducing d to zero, the process of investment will continue till the level of employment is achieved. Therefore, it may be considers that the factor of interest prevents the society from attaining benefits of level of full employment of its productive resources.

Unfair burden on consumers of banks: When borrower capital used in production, it becomes the part of the cost of production. It burdens eventually paid by the consumers. More to the point, Interest is applied to the actual cost not only one time but at various phases of a deal. It sample example is manufacturing a note.

At first, it is added to the banks total shares. At second stage, it is added to the cost of production by note borrower. At third stage, it is added to the prevailing currency rate. This way, at every stage of production, interest enhances the prices of goods. Hence, consumers have to bear quite unfair burden which is absolutely unjustified.

Conversion of free economy into debt-based economy: Economic activities of all the sectors in all spheres revolve around interest-based credit.

A debt-based economy has to undergo quite a heavy loss because it has not only to return loans with interest from its merger economic resources but also has to tolerate the interference of its creditors into its internal economic as well as socio-political affairs (Hasan 2007).

Social Reasons

The main purpose of the essay is to understand the reasons why Islamic banking failed in New Zealand despite many efforts made to implement the interest free financing system. The case of New Zealand is compared to the success of this industry in the other parts of the world.

A responsible and ethical bank takes into account the social and environmental collisions of its funds and lending. Principled banks are part of a larger communal movement towards more social and environmental dependability in the financial sector (Ethical Banking n.d).

Element of interest develops the evils of selfishness and loving of self-interest in a society. In such a self-interest ridden society, prime values of mutual help, mutual cooperation and mutual brotherhood are faded. Members of such a society instead of fair dealing with others in the basis of self-interest consideration are indulged to grind their out axes.

Their selfishness and greed induce them to take advantage of the pressing needs of others. This attitude of the selfish people creates chaos, hate and disunity among the members of the society. Since Islam asserts to establish a unique Muslim society which must be free from all social evils so it firmly proscribed mutual transaction based on interest.

Islam has defined terms and ways for all fields that a person can face. It demands that every person should actively take part in earning his livelihood by lawful manner. Since a usurer gets return of interest without actively taking part in economic struggle, Islam does not allow such kind earning. Islam considers this kind of earning an unlawful earning.

Islam considers a usurer akin to a parasite who merely brings up at the earning of others. There is no room for any kind of monastic life in Islam. Parasitism is just like illegitimacy in Islam (Khan and Bhatti 2006).

Moral Reasons

Element of interest generates many moral vices like miserliness, selfishness and lust of wealth. Such vices further generate several moral weaknesses among usurers. They are deprived of virtues of self-sacrifice, sympathy and generosity. Since this moral values have to consideration in an interest-loving society. Islam does not allow any sort of dealing wherein interest is entertained (Aasiya, Ahadith 2002).

Political Reasons

Element of interest also cause to create a political imbalance in an interest-based economy.

In case a country is heavily burdened with foreign loans, it becomes an easy victim of foreign political aggressive designs. Creditor’s countries/ institutions gradually begin to interfere into its economic as well as political affairs. There dictated terms eventually deprive the debtors’ countries of their political freedom (Eijffinger and Haan 1996).

Ways to regulate Islamic finance in New Zealand

Data were collected from 720 bank customers by using random sampling. It was discovered that the opinion of the customers of Islamic banks about the service excellence is superior to the opinion of customers of conventional banks. The findings show that there is a major difference in the opinion about the quality of service amongst the customers of Islamic banks on the basis of sex. The lesson has a number of assertions for bankers, policy makers and academics. It serves as a guide to Islamic banks for providing marketable goods to meet expectations of every customer according to their particular requirements.

This study also enables bank policy makers and employers to make successful and quality oriented measures to have satisfied customers for long term payback.

Academicians are required to conduct research in the banking sector for beautiful combination of theory and practice to evaluate the quality of services for increased satisfaction among every bank customer (Leslie, Bring Islamic Finance To New Zealand, Professor Says 2011).

New Zealand policy effectiveness to restore Islamic principles

Be deficient in of capitalization of banks, households and the state is an input policy issue. as an alternative of defaults and insolvency with all its associated costs we suggests to turn debt to equity as this is efficient economic solution; calling unambiguously the relevance of Islamic finance principles for this purpose as a promising solution (Leslie 2011).

Hedge, fund, and private equity

A new concept is unconfined, reviewing the performance of the so-called new power stockbroker being independent wealth funds, private equity and get around funds during the financial crisis.

The stockbrokers’ communal performance in the financial crisis, despite the fact that better than the sharp turn down in wealth of most institutional investors, pretense an important transfer: Asian supreme ruler and investors come forward as more dominant than ever, while evade funds and private equity saw their beforehand rapid growth episodic (Aasiya 2002).

The decoys of private equity are dual. First, hedge funds wish to regulate the money going into private equity from institutional investors. Second, and more worrying, hedge funds as a distinct faction need a way to boost up their performance ( Private Equity 2007).

Role of Sukuk in New Zealand financing

Issuance of Sukuk in banking sector of New Zealand have implied a very positive effect in the whole banking sector as well as on the whole economy of new Zealand. New issuance of sukuk (bonds accommodating with Islamic law) topped $9.3 million in the first seven to eight months of the year 2009 as compared with the same period during 2008. It has been observed that the Sukuk market has sustained to progress in 2009 even with some road locks (GIH 2008).

The lesser quantity of issuance was due not only for still-challenging market circumstances and ventilation of liquidity, but also to the less-supportive economic atmosphere in the Cooperating countries, mostly in the United Arab Emirates. The medium-term viewpoint for the sukuk market remains affirmative, though, in our view, given the strong medium with sukuk broadcast or being talked about in the market estimated at about $50 billion and efforts have made to resolve the major difficulties which are hurdle for Sukuk development.

Role of Modarba in New Zealand financing

The board of new Zealand banking in its annual meeting held on September 04, 2000 has agreed the distribution of profit of 30% certificate, subject after deduction of Zakat and other taxes at source where implemented, for the respective year ended June 30, 2000. an amount of approximately 40 million has been transferred to legislative reserve in acquiescence with the currently issued prudential regulations for Modarba in which regulations are required not less than 10% of the Modarba after deduction of taxes than transferred to such reserve till that time as the reserves equals 100% of the capital already paid.

Thereafter, a sum not less than 5% of the profit gained after payment of tax is to be transferred. As per a source, “Under the rules of prudential regulations not less than 20% of the Modarba remain after tax profits of every year was required to be transferred to this reserve account” (Amin 2009).

Role of Musharakah in New Zealand financing

Musharakah financing are not popular in New Zealand banking due to the reasons:

- There is a lack of sincere and trustworthy entrepreneurs. Some of them did not affirm their profits while others did not possess the ability to take on in business

- There is a want for of standard which is one of the conditions of Musharakah financing in New Zealand. The major portion of required funds is in the short-term with the balance, or we can say, in the medium term.

- Long-term finance ways entail higher risks and there is a lack of qualified employees and workers to carry out the operation run in the banks. Subsequently, Musharakah is not partial towards short-term investment financing. To overcome this problem, the New Zealand signifying an Islamic investment company as well as an Islamic consultancy house. These companies will firstly distinguish the feasible sectors including manufacturing, agriculture, tertiary sector, and small and medium sized businesses. They will then assess each project based on its economic and financial possibility, and recommend it to the bank for funds.

The above circumstances support the dispute why Musharakah has not really made any developmental impact in the economies where they activate.

Emerging Islamic finance industry in New Zealand

Regulation and explanation of Shari’ah law are the two major issues in the Islamic finance industry of New Zealand. When an association can offer products to the public, they have to be analyzed first and approved by a jury of Islamic scholars. “However, this is means of a clear cut issue, and the judgments of individual scholars can fluctuate” (Kuo 2009). Professionals in the Islamic banking region are often asked whether the current policies by the Islamic financial bodies will prove effective at challenging the worldwide level in the long run. As the strategy is a plan of action premeditated to achieve certain goals, that can be met in relation to these well-defined goals (Kuo 2009). From rating point of view, an effective strategy comes to take a phase and delivering a good and stable financial environment (Kuo 2009).

The banking sector serves as an international standard setting stiff of regulatory and supervisory agencies and its middle assignment is to guard the uprightness and strength of the Islamic financial services industry across the field of banking, capital markets and insurance. The floorboards also provide guidance to institutions which offer Islamic or Shariah compliant investment products and bridge with other rule-making bodies in the whole banking industry.

“At the same time as modern Islamic finance may not be as clean as some scholars and academics would like to be, the progress of financial products to cover the whole breadth of the finance and investment industry” (Kuo 2009).

It is a fact that the new industry has really only broken the surface of probable demand for Shariah compliant financing. The Islamic finance industry is likely to continue growing at a rate of knots for future years ahead.

There is an also great shortage of qualified experienced Shari’ah scholars in New Zealand in starting time, but have huge demand. Islamic banks and insurance companies of New Zealand give to consultative committees for the Bank and the Securities and Exchange Commission.

Bankers and other finance professionals are anxious that the authority of many Islamic financial transactions are open for clear understanding, and the financial institutions take help from the guidelines and rules decided by the Accounting and Auditing Organization for Islamic Financial Institutions better system for guidance. Nevertheless, there is no ultimate and compulsory set of rules which are saying that banks must bond to these rules (Ibrahim 2006).

As per Kuo, “Certainly, there are many educational institutes in the Muslim world who have been quite important of present-day Islamic finance culture, and issues were taken by the two ways that are Murabahah and Ijarah contracts” (2009).

New Ways to Facilitate the Introduction of Islamic Finance Products within New Zealand

Although the Islamic finance industry of New Zealand suffered a lot by the side of other investment regions during the credit crisis of 2008 and 2009, its long-term future seems guaranteed.

Today, major banking specialists also agree that there is a lack of consistency in the banking sector of New Zealand, the lack of accord among Shariah scholars. There is also meager “connectivity” between Islamic finance institutions across the world, and there is also worldwide deficiency of experienced Islamic finance professionals in every bank of New Zealand.

If the employers employed in the bank with care, plagiaristic matters can enhance efficiently thorough risk alleviation, in that way making them more spirited as well as likable to customers. Controversially, their application in Islamic finance industry of New Zealand is extremely divisive for reasons of assumptions and insecurity in the banking system.

In New Zealand, Islamic fund management has not seen much expansion recently. After that issue, the big scholars of New Zealand continued strong growth in the whole Shariah. A paper of International Monetary Fund said that more and more countries are hiking abroad the Sukuk issuance in order to beat the substantial pools of money in the hands of Muslim individuals and their respective companies. The UK, Japan, Thailand and France are in the midst of the countries which have freshly commenced to establish sukuk issuance programs.

In New Zealand, if we consider 2006 as the year in which Islamic finance, a concept practically useless among outside banking circles a decade back lastly crossed the border between faintly unusual alternative ways. 2007 was considered as an outburst year of demand for alternative ways along with ethically aware Islamic rules and regulations.

Even though when New Zealand is being discussed about the implementation and execution of Islamic financing system, the volume is left just as a portion on the global map, specified overall population of Muslims near about one and half bn followers. New Zealand banking has been proven to be amongst the finest in terms of the world’s biggest conventional banks, fund management companies and insurance groups. A good number of the aforementioned organizations accepted to follow Islamic laws and principles side by side to cater to the segment of the market which prefers Islamic banking.

One of the most major appeals of the Islamic financing and its institutions is that they have largely uncontaminated by the global credit crisis. Islamic finance does revealed good banking behavior that has been possibly lost over the last 10 years or so in New Zealand.

According to the Head of Islamic finance and an adviser to the New Zealand government, Islamic banks are nearer to their customers than the conventional financial institutions. A major reason for this close relationship between the banks and their customers is that the Islamic banks only do authentic transactions in which real assets can be seen, evaluated and traded. It is an eye-opener for the conventional banking system as it the conventional banks neither maintain a personal relationship with their customers nor are they concerned with the assets their customers buy with the borrowed money (Freudenberg and Nathie 2011).

Conclusion

This piece of writing has wanted to discover the relationship between religion and the law principally the tax law. It was disputed that this relationship is admirable of greater consideration, tax laws for greater facilitation of Islamic finance.

Since Islamic finance is miles to the lead of Halal industry in many areas of New Zealand among global industry it is very much natural for Islamic finance to take the escort. An Islamic or Halal finance industry has to be set up with government support. It has to attract the private sector into the industry to bring in as many shareholders as possible (Siddiqui 2011). Its authorization would be to harmonize and facilitate the junction between the two inter-related naming sectors (Siddiqui 2011).

The article initially considered the potential benefits to New Zealand becoming core of Islamic finance in the South East Asian region, for the most part given the low diffusion levels to blind date. The historical relationship between religion and law was then well thought-out, with a particular prominence on New Zealand. This included consideration of the special tax treatment afforded to different religious groups, as well as the view towards taxation.

After that, the constitutional requirements dealing with religion where evaluated, with different vision reflection as to whether they amounted to a ‘freedom of religion’ in New Zealand. The Commonwealth’s authority towards tax was then considered, as well as its contact with the religious guarantees in New Zealand.

It was disagreed that it is constitutionally feasible for the Commonwealth to pioneer tax reforms to smooth the progress of faith based transactions, such as Islamic finance. The question arises that now increase in whether reforms should be put into operation, and if so, how superlative can they be implemented. These questions will be addressed in future research by the authors in New Zealand research documentation.

According to Dr. Mahathir Mohammad, ex-Prime Minister of Malaysia, the combination of faith and finance are intellectually inspiring and it is concerned with the businesses and the real economy (Siddiqui 2011).

The foregoing discussion makes a clear concept that Islamic finance is not an unimportant or merely short-term phenomenon. According to Ariff, Islamic banks in New Zealand are likely to stay for a long period of time as they show good signs of rapid growth, innovation and development contrary to the conventional finance industry. Even if people do not follow the Islamic law which prohibits interest, they can find room for growth and innovation which may contribute positively to the existing financial services industry (Ariff 2001).

One of the major selling points of Islamic finance, at least in hypothesis, is that, nothing like conventional financing, it is mainly concerned with the feasibility of the project and the effectiveness of the operation but not the volume of the collateral.

Islamic finance in New Zealand can play a major role in the thought- provoking economic development. In several developing countries similar to New Zealand development financing is believed to be performing this role.(Conclusion 2001)

Islamic finance is likely to survive further creatively as compare to the unadventurous counterpart. Short-term trade financing is not trusted by numerous scholars and systems but Islamic finance emphasizes on it.

Component of the enrichment is that long-term financing of New Zealand requires know-how which is not always available. A further reason is that there are no backup institutional organizations such as secondary capital markets for Islamic financial appliances.

Short term financing by the financial institutions shows clearly the early or birth and growth period of time the Islamic finance industry is in currently. Some of the reasons for selecting short term financing may be the ease in administering the business, lesser risk and the quick returns. The Islamic financial institutions may focus on equity financing later as they grow in size and worth at a rapid rate.(Conclusion 2001).

References List

Aasiya, Abu. 2002. Ahadith Concerning Usury (Interest). Etori. On-line. Web.

Ahadith Concerning Usury (Interest). 2002. Etori. On-line. Available from Internet, Web.

Abdullah, Ali Yousuf. n.d. The Meaning of The Quran. 11th Edition. Amana Publications.

Abdul-Rahman, Yahia. 2011.The Art of Islamic Banking and Finance: Tools & Techniques for Community Based Banking. New Horizon. John Wiley & Sons. Web.

Advantages of Leasing. n.d. Enterprise Financial Solutions Inc. 2011. Web.

Allah looks to your Heart & Deeds (not your Faces & Wealth. 2007. Muxlim. Web.

Al-Munajjid, Shaykh Muhammad. n.d. Ruling on rent-to-own schemes. IslamQA. 2011. Web.

Amin, Mohammed. 2009. Would Islamic finance have prevented the global financial crisis? Mohammed Amin’s website. Web.

An Introduction to Islamic Finance. 2009. Cima. Web.

Ariff, Mohamed. 2001. Islamic Banking. Islami City. University of Malaya. Web.

Atomy-Partnership Diagram Example. n.d. Atomy Members. Web.

Aziz, Tariq. 2011. Islamic Banking-Should India Promote Interst Free Banking and Finance? JurisOnline. Web.

Bai’Salam. 2009. Albaraka. Web.

Caba-Maria, Flavuius. 2011. Islamic Banking System: Threats and Opportunities. World Press. Web.

Commercial Bank. n.d. Investor Word. 2011. Web.

Conclusion. 2001. Web.

Eijffinger, Sylvester C.W, and Jakob De Haan. 1996. The Political Economy of Central Bank Independence. Special Papers in International Economics (Princeton).

Ethical Banking.n.d. Wikipedia, 2011. Web.

FIANZ. n.d. Would You Use Islamic Loans/Mortgages in New Zealand?” FIANZ. n.d. FIANZ. 2011. Web.

Freudenberg, Brett, and Mahmood Nathie. 2011. The Constitution and Islam: Are Tax Reforms Possible To Facilitate Islamic Finance? Revenue Law Journal 20, no. 1.

Gafoor, Abdul.1995. Islamic Banking. Interest-free Commercial Banking.

General Introduction.2008. Gulf African Bank. 2008. Web.

GIH. 2008. Sukuks-A new dawn of Islamic Finance Era. Global Investment House. Web.

Guiding Principles of Risk Management for Institutions (Other than Insurance Institutions) offering only Islamic Financial Services. 2005. Islamic Financial Services Board. Web.

Halal and Islamic finance markets will converge, says Al Islami CEO. 2011. Global Islamic Finance. Web.

Halawi, Adnan. Slash Taxes, Spur Sukuk: Countries issuing Sukuk triple between 2005 and 2012 as countries slash taxes. 2010. Islamica. Web.

Hanzalah, Abdullah ibn. n.d. Al-Tirmidhi Hadith 2825.

Hasan. 2007. Interest Free Banking. Directory Journal. Web.

Hedge Funds Jump Into Private Equity. 2007. Business Week. Web.

History and Evolution of Islamic Banking. n.d. Shariah Fortune. 2011. Web.

Huraira, Abu.n.d. Sahih Al-Bukhari Hadith 8.840.

Ibrahim, Ali A. 2006. Georgetown Law. nZibo. Web.

Ijarah financing. n.d. Financial Islam. 2011. Web.

Islamic Banking. 2008. Wikipedia. Web.

Islamic Banking Statistics. 2009; Islamic Bankers : Resource Centre. Web.

Islamic Finance – Ijara. Ijara Loans. n.d. 2011. Web.

Istisna’a. n.d. Financial Islam. 2011. Web.

Khan, Mohammad Mansoor, and M. Ishaq Bhatti. 2006. Why interest-free banking and finance movement failed in Pakistan. Ideas. Web.

Kuo, Christine. 2009. Islamic Banks – Their strategies and ratings. CPI Financial. Web.

Leasing Finance. n.d. Bank Alfalah. 2011. Web.

Leasing vs. Financing. 2011. Caasco. Web.

Leslie, Liz. 2011. Bring Islamic Finance to New Zealand, Professor Says. Muslim Voice. Web.

Bring Islamic Finance To New Zealand, Professor Says. 2011. Muslim Voice. Web.

Mudarabah. 2006. Word Press. Web.

Musahraka Financing Model. 2003. Islamic World. Web.

Oman charts out strategy to become part of expanding Islamic finance industry. 2011. Albawaba. Available from Internet, Web.

Operating Lease.n.d. Wikipedia. Available from Internet, Web.

Practice Guide 69: Islamic financing. 2010. LandReg. Web.

Sandstad, Ben.2009. Australia: Introduction To Islamic Finance – Part II. Mondaq. Web.

Sarwar, Imran. 2011. Modes of Islamic Finance. Imran Sarwar. Web.

Siddiqui, Rushdi. 2011. Islamic finance, halal industry and the media. Business Times. Web.

The Islamic Development Bank. n.d. Financial Islam. 2011. Web.

Thomas, Abdulkader S.2006. Interest in Islamic economics: understanding riba.

Uswah Hasanah. n.d. Britannica. 2011. Web.

What Is Modaraba? n.d. Blurt. 2011. Web.