Introduction

Economic stability is arguably the most essential role of any government. Unpredictable economic conditions not only scare investors, but also hinder proper planning by the government. It is important to note that among the worst scenarios in any economic problem is high increase in general prices.

Besides decreasing the purchasing power of people this can also lead to high rates of unemployment as well as slow economic growth. In this regard, the Federal Reserve Bank (FED) is always concerned with stabilizing the prices for as long as possible. In stabilizing prices, FED usually uses the monetary policy.

Federal Reserve and Price Stabilization

It is important to note that FED is the main economic unit of the country. Moreover, FED’s monetary decisions usually influence the adjustment in most of the world‘s economies, because most transactions take place using U.S. Dollars.

On the same note, the economy of US is among the world’s top economies and any action taken by their monetary committee always has spillovers to other countries in the world. Price stability can only be achieved through implementation of the monetary and fiscal policies (Mankiw, 2011). FED being the institution tasked with implementation of the monetary policy, it goes without saying that it has a role in price stabilization.

Economic Indicators to Monitor

It is important to note that FED aims at specific indicators when regulating money supply and hence stabilizing prices. These are the cash rate and the prevailing rate of interest. The interest rate paid by commercial banks for overnight borrowing from FED is the certified cash rate.

On the other hand, the market rate of interest is the prevailing rate of interest charged by the lenders on loans extended to borrowers (Fair, 2004). Unlike the market rate of interest which is influenced by the transactions between financial institutions, cash rate is affected only by the transactions between the reserve bank and financial institutions.

FED can change the cash rate through domestic market operations in the course of which the amount of money in circulation is determined. FED is able to give funds at different interest rates therefore it can control the cash rate as it is monopoly in the supply of money. When FED wishes to reduce the cash rate, this implies an expansionary monetary policy. The first step involves the announcement of the targeted cash rate which would be lower than the prevailing rate.

The target cash rate therefore determines FED’s operating activities and provides an insight on expectations about what the cash rate will be. FED will then embark on market operations which will aim at reducing the cash rate nearly to the target rate (Mankiw, 2011)). FED buys short-term government securities, thus adding cash into the banking system and with increased liquidity the cash rate reduce to the targeted rate.

Monetary Policy and Money Supply

Through domestic market operations in which the amount of money in circulation is agreed on, FED can change the cash rate. FED is able to give funds at different interest rates thus its ability to control the cash rate as it is a monopoly in the supply of money. When FED wishes to reduce the cash rate this implies an monetary policy. The first step involves the announcement of the targeted cash rate which would be lower than the prevailing rate.

The target cash rate therefore determines FED’s operating activities and provides an insight on expectations about what the cash rate will be. FED will then embark on market operations which will aim to reduce the cash rate nearly to the target rate (Carbaugh, 2010). FED buys short-term government securities, thus adding cash into the banking system and with increased liquidity the cash rate reduces to the targeted rate.

Commercial banks can create credit through issuance of loans given that they do not give cash, but simply credit the account when they extend a loan facility to a client. Most central banks use this process to increase the amount of money in circulation since commercial banks are a means of transmission for the reserve banks.

The monetary policy regulates the amount of money in circulation therefore determining the quantity of credit that can be created by the commercial banks (Fair, 2004).

If an expansionary monetary policy is pursued, then commercial banks get more cash and thus they are able to create more credit increasing the liquidity of the economy. On the other hand, contractionary monetary policy reduces the amount of cash held by commercial banks; therefore limiting the amount of loans that can be issued which in turn deters credit creation (Mankiw, 2011).

Due to greedy for income, the commercial banks will want to increase credit indefinitely which will end up being inflationary and harmful to the economy. For this reason, FED will control the credit creation of commercial banks to check the amount of money in circulation hence controlling inflation and employment levels.

Effects of Monetary Policy on Aggregate Demand and Supply

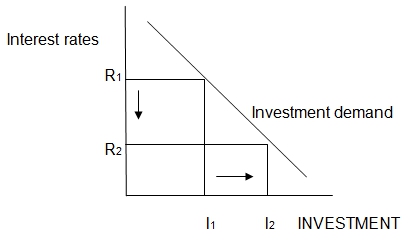

Decreased interest rate makes saving less profitable and therefore most people choose to invest because investment projects are more attractive, instead of holding deposits. As shown in the diagram below, a decrease in interest rates from r1 to r2, increases investment level from l1 to l2 ceteris paribus.

Lower interest rate also makes borrowing relatively cheaper which makes consumers have more liquid to spend. Consumers also prefer current spending as compared to future spending as they are not sure of the future rates of interest, which encourages spending hence increasing both household consumption and investment levels (Fair, 2004).

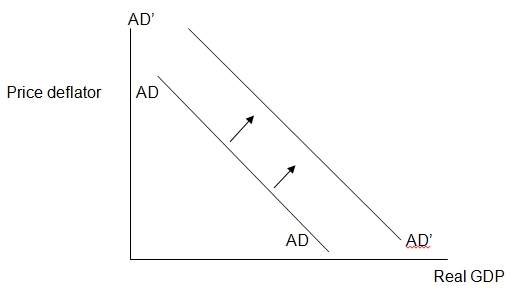

The graph below gives aggregate demand as a function of prices and real GDP. All other factors held constant, a decrease in interest rates indicates stronger economic conditions which makes the banks to loosen their lending regulations hence boosting businesses as well as household spending.

Lower interest rates also lead to currency depreciation which makes imports expensive hence increasing demand for domestically produced commodities also boosting exports (Mankiw, 2011). Increase in exports increases earning which in turn encourages consumption. Collectively, these contribute to increase in aggregate demand which shifts the aggregate demand curve rightwards from AD to AD’.

Comparison between Monetary and Fiscal Policies

It should be noted that though reduction in interest rates boosts spending, it only does so if the existing rates are not too low (Mankiw, 2011). In a situation where the nominal interest rates are near or equal to zero the monetary policy tools are unable to stimulate the economy as there is no room for interest rates to decline further.

Moreover, it has been depicted that prices especially bond prices and interest rates have an inverse relationship. As a result, in a scenario where the interest rates are too low and cannot be reduced any more expansionary monetary policy leads to reduced bond prices and hence capital loses.

Unemployment can only be reduced by reducing interests only if unemployment rate is above natural rate of unemployment otherwise the move would lead to increase in wages hence inflation. If the unemployment rate is below the natural rate of unemployment, then the decrease in interest rates ceteris paribus will not affect the unemployment rate (Fair, 2004).

Instead, firms will be forced to increase their wages so as to retain their employees. Since people will have more income to spend, the demand for commodities will increase and given the inelasticity of supply in the short-run, prices will increase to equilibrate the market hence increased inflation (Carbaugh, 2010).

The fiscal policy uses the government resources to alter aggregate demand thus, influencing economic performance of a country (Fair, 2004). To raise output, policy makers will need to implement expansionary fiscal policy. This means that the government can either choose to reduce the amount of tax that citizens have to pay, increase it purchases or increase its level of transfers.

When the government increases its level of purchases then, the level of planned expenditure in the whole country increases thus, demand for goods and services increases. Increases in demand means that suppliers can sell more commodities than they are currently selling therefore suppliers increase their output.

On the same note, when government chooses to reduce the amount of taxes that are levied, people will have more disposable income and they are likely to increase their spending thus increasing aggregate demand. This will give suppliers incentive to produce more thus increasing output, which will in turn increase the average levels of income.

It should be noted that the increase in output is always more than the increase in government spending due to government multiplier. Expansionary fiscal policy makes the IS curve to shift to the right due to increase in aggregate demand which in turn increases output (Mankiw, 2011).

Regrettably, as the IS curve shifts to the right it is not the output only that increases, but also interest rates and because policy makers do not want any effect in the interest rates, the LM curve must be induced to shift to the right. If expansionary monetary policy is implemented, for example by increasing the amount of money in the economy, the LM curve will shift to the right (Fair, 2004).

When the amount of money in circulation increases, the supply of money exceeds its demand and to boost the demand for money, banks have to reduce the interest rates thus making it cheaper to borrow.

Conclusion

Business cycles are unavoidable and investors will always speculate where high returns are possible and to invest in this sectors making bubbles somehow imminent. As such, it is upon the government to regulate the players in the various sectors of the economy through instituting strong policies to deter market crushes.

It is the desire of policy makers to boost economic growth in all ways possible. One of their main problems is always how to increase economic output while maintaining interest rates as low as possible and stabilizing prices. However, it has been demonstrated in several instances that applying only one theory can be ineffective. Therefore, policy mix is vital in reviving and sustaining the economy.

References

Carbaugh, R. J. (2010) Contemporary Economics: An Application Approach. Connecticut: Cengage Learning.

Fair, R. C. (2004). Estimating how the Macroeconomy Works. Massachusetts: Harvard University.

Mankiw, G. N. (2011). Essentials of Economics. Connecticut: Cengage learning.