Analysis

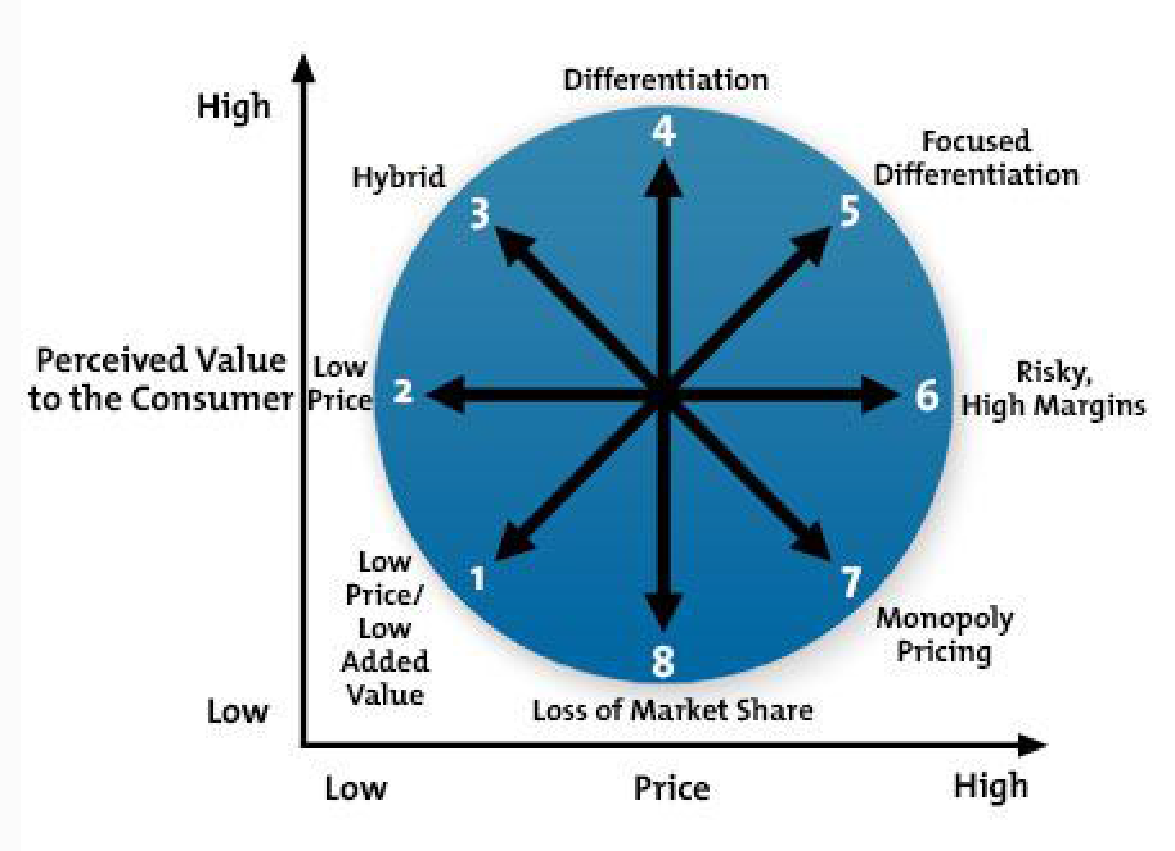

Bowman’s Strategic Clock

Bowman’s Strategic Clock demonstrates how a business can structure its commodities or services in the market using two dimensions. The first is concerned with the pricing, and the second is the perceived worth of the item, service, and organization. Additionally, this approach assesses a company’s competitiveness utilizing eight techniques designed to help a business get a competitive advantage in the marketplace. These techniques include low cost and low added value, low price, hybrid, diversification, focused differentiation, dreadful high margins, monopolistic pricing, and loss of customer base.

Low price and low added value

This element is not the most competitive field within the Bowman Strategy Clock. There is no differentiation in the commodity or service, and the buyer recognizes very little significance (Weston & Nnadi, 2021). The price remains extremely low, and the corporation’s only competitive strategy is to maintain a low price.

Low price

Businesses in this position frequently manufacture in bulk since their goods are well-valued. Profitability can be maintained despite the enormous amount of production. This attitude is taken about less expensive, leading companies to place a premium on cost reductions, rapid production, and economies of scale (Weston & Nnadi, 2021). At this point, potential price conflicts are frequently undertaken.

Hybrid

This position applies to businesses that differentiate their products. As a result, its items are highly rated. On the other hand, companies place a premium on inexpensive prices, and the client is persuaded by the actually added value (Weston & Nnadi, 2021). This phase of the Bowman Strategy Clock is incredibly efficient, primarily when the economic benefit is delivered and provided continuously and appropriately.

Differentiation

Businesses that pursue differentiation strategies strive to provide the maximum possible quality at an affordable cost. Firms wish to deliver their clients with the most apparent additional value potential. They are concerned with product effectiveness and branding, establishing a credible and prominent brand on the marketplace that maintains consumers (Weston & Nnadi, 2021). Buyers stay receptive to high-quality goods from a recognized brands and choose them.

Focused Differentiation

Focused differentiation relates to the marketing tactic adopted by premium and exclusive manufacturers: a high-quality offering at a premium price. They achieve more significant profit margins through focused categorization, promotion, and dissemination (Weston & Nnadi, 2021). Since their rivals operate in the same industry, they set their costs competitively.

Risky high margins

Businesses that employ this method charge a premium for commodities with low perceived quality by consumers. Thus, this is a major threat in the long run, and this approach is prone to failure (Weston & Nnadi, 2021). Buyers will eventually cut their expenditures and seek a higher-quality item in the same budget category or a comparable good at a reduced price.

Monopoly Pricing

The competitiveness of businesses that establish a dominant market position is that they are the exclusive provider of the products in their category. As a result, they are free of competitors and have complete control over the pricing (Weston & Nnadi, 2021). Clients have little choice but to purchase the items, as they are entirely dependent on the monopolist’s merchandise.

Loss of market share

Loss of market share is not ideal for any institution as it indicates that the business cannot provide goods or services. Additionally, the price is excessively exorbitant, so clients avoid the establishment (Weston & Nnadi, 2021). Frequently, firms in this area choose a regular rate for their items to remain competitive.

Porter Generic Competitive Strategies

Michael Porter defined a categorization scheme as three broad tactics companies frequently employ to obtain and sustain a competitive edge. Two components describe these three generic tactics: strategic breadth and tactical capability (Greckhamer & Gur, 2021). The strategic span element is a demand-side metric that considers the structure and composition of the sector that organizations want to target.

Cost Leadership Strategy

This approach stresses productivity, and the corporation intends to benefit from economies of scale and knowledge curve impacts by creating large quantities of standardized items. Often, the commodity is a simple, no-frills item manufactured at a minimum expense and made accessible to a wide range of customers (Greckhamer & Gur, 2021). Sustaining this technique involves a constant hunt for cost savings across the organization. The linked supply chain aims to achieve the broadest possible dissemination.

Differentiation Strategy

Differentiation is a strategy aimed at the broad market that entails the development of a commodity or service that is seen as distinctive within its sector. Following that, the corporation may command a premium price for the product. This specialty may be linked to architecture, corporate identity, innovation, functionality, distributors, distribution network, or client care (Brenes et al., 2020). Segmentation is a realistic technique for achieving above-average earnings in a particular industry, as subsequent brand recognition reduces customers’ value perceptions.

Focus Strategy

The firm focuses on a small number of target geographies under this technique. Additionally, it is referred to as a niche approach. Companies think that by concentrating their advertising strategy on one or two specific target markets and adapting their promotional mix to these niche segments, they can adequately address the concerns of that product category (Lee et al., 2021). Generally, the corporation seeks a competitive edge through performance rather than profitability.

Comparison

Porter’s Generic approaches and Bowman’s Strategic Clock are intended to assist businesses in comprehending competition in the market environment. As Bowman envisions it, Differentiation is identical to Porter’s Generic techniques (Islami et al., 2020). While the unique selling proposition may be similar to that of another item or brand, some component of the differentiating offering elevates the perceived value. Whilst Porter’s generic strategies to competitiveness place a premium on cost-effectiveness, Cliff Bowman’s Strategy Clock examines generic strategic advantage from a strictly market-based approach (Echchakoui, 2018). He contends that a competitive edge is meaningless unless it benefits the client and that a consumer would always appreciate such merchandise over those offered by rivals.

Application of Bowman’s Strategic Clock to HSBC Holdings

HSBC Holdings is at Bowman’s differentiation position as it strives to provide the maximum possible quality at an affordable cost to its customers. HSBC can incorporate its differentiated strategy through its corporation (Fernández-Olit et al., 2018). Since this strategy increases the benefits of a product, HSBC must pinpoint the audience for the new approach. For instance, if the goal were to adopt advanced technology that was generating complications for a cohort of individuals who used banks, the procedure would target those aged 60 years and above.

Differentiating their strategy requires an awareness of clients’ willingness to spend on a value-added commodity. HSBC would need to have a thorough understanding of its marketplace; a fluctuation in value-added pricing could move into a different industry (Fernández-Olit et al., 2018). Therefore, this shift would influence the entire organization and shareholders’ view of the enterprise (Fernández-Olit et al., 2018). The company currently occupies the top spot in the UK market industry. It has a market cap of €134 billion, followed closely by Unilever Company which has a market cap of €132.9 billion (Green & Lampe, 2017). Therefore, its current position in Bowman’s Strategy Clock has improved its competitiveness in the UK marketplace.

Application of Porters Generic and Ansoff’s Intensive Growth Strategies to HSBC Holdings

HSBC Holdings plc is a global corporation with a strong presence in key business categories. The industry’s increasing competitiveness has made it difficult for HSBC Holdings plc to maintain its leadership status and grow market share without making significant efforts. The contemporary business landscape requires HSBC Holdings plc to acquire a vital competitive edge to stay competitive (Ali & Anwar, 2021). As a household name with a global footprint, HSBC Holdings plc has established its competitiveness based on many critical elements that give it a significant advantage over competitors. The competitive advantage tactics of HSBC Holdings plc can be interpreted in terms of Michael Porter’s concentrated economic model as enumerated below.

First, HSBC Holdings could utilize cost leadership tactics to achieve a competitive edge through cost reduction. Target costing should be HSBC Holdings plc’s primary generic approach in diverse consumer sectors. The key goal of this approach is to maintain market dominance through effective supply chain management. This method will allow HSBC Holding Company to grow its market share by focusing on the middle-income class, which accounts for the lion’s share of the entire customer market mix in most nations.

Given that middle-income families place a premium on price, cost leadership would be the greatest technique for catering to their preferences. Furthermore, HSBC Holdings plc should prioritize the accessibility and affordability of its products globally, as this would result in increased brand recognition and revenue growth, forming powerful competitiveness. In addition to minimizing costs through price reduction and distribution network optimization, HSBC Holdings plc should routinely offer coupons and discounts to meet sales expectations and counteract competitive pressure from its nearest opponent. These discount and marketing initiatives are meant to raise brand awareness and drive consumption.

Second, concentration is another generic competitive tactic that encourages businesses to focus their activities on strengthening tightly defined niches. When companies pursue a focused approach, they target specific consumer markets and build a competitive edge through specialized marketing (Ali & Anwar, 2021). HSBC Holdings plc should pursue a strategy of price reduction and value creation. The low-cost focus process is developed by servicing the requirements of a unique marketing group at a reduced possible cost. In contrast, the concept of focusing on the best value is implemented by stressing the commodity’s flavor, size, and specifications that best meet the clients’ conditions and expectations (Ali & Anwar, 2021). By focusing on item qualities, HSBC Holdings plc can adjust its advertising strategies and continuously identify improvements and packaging of its products to meet consumers’ psychological demands and optimize value for money.

Finally, Intensive development strategies focus on creating new goods or markets to achieve corporate desired goals. Ansoff’s product-market progression lattice defines aggressive expansion tactics, covering four components: customer base penetration, item development, market growth, and internationalization (Loredana, 2017). Market penetration entails promoting sales increase among existing customers. It encompasses operations to increase market share by using current products in an established market. Market probing should be the principal method for HSBC Holdings’ intensive growth.

Commodity development is Ansoff’s second aggressive expansion approach. HSBC Holdings plc should consider it as an alternative strategy for expansion. This method involves creating new items or altering existing market segments to appeal to the current consumer base. Firms seeking expansion, such as HSBC Holdings plc, should pursue this technique to identify restricted growth potential with their current brand portfolio in their existing marketplace. Market development’s primary purpose is to investigate and penetrate new segments (Loredana, 2017). Market growth should be a development tactic for HSBC Holdings plc that complements market product development and penetration. The organization’s comprehensive implementation of this approach should increase its international presence. Successful expansion into new customer markets would be critical in establishing HSBC Holdings plc as a worldwide brand.

HSBC Holdings plc’s recommendation to use cost leadership methodology has highlighted numerous benefits associated with this general strategy, including rapid name recognition, client expansion, increased intake, and meeting sales expectations by focusing on product accessibility and affordability. Although the suggestions to HSBC Holdings plc’s competitive advantage approaches identify competitive pricing as the most suitable recommended action, the corporation should also leverage the Ansoff matrix in conjunction with the focus strategy. These two strategies would establish a framework for effective competitiveness in the fiercely competitive global environment.

References

Ali, B. J., & Anwar, G. (2021). Porter’s generic competitive strategies and its influence on the competitive advantage. International Journal of Advanced Engineering, Management and Science, 7(6), 42-51.

Brenes, E. R., Ciravegna, L., & Acuña, J. (2020). Differentiation strategies in agribusiness: A configurational approach. Journal of Business Research, 119, 522-539.

Desai, C. (2019). Strategy and strategic management. In Management for Scientists, 65-84.

Echchakoui, S. (2018). An analytical model that links customer-perceived value and competitive strategies. Journal of Marketing Analytics, 6(4), 138-149.

Fernández-Olit, B., Cuesta-González, M. D. L., & Holgado, F. P. (2018). Social and environmental responsibility in the banking industry: A focus on commercial business. In Designing a Sustainable Financial System (pp. 65-88). Palgrave Macmillan, Cham.

Greckhamer, T., & Gur, F. A. (2021). Disentangling combinations and contingencies of generic strategies: A set-theoretic configurational approach. Long Range Planning, 54(2), 1-18.

Green, E., & Lampe, J. (2017). Under western eyes: Foreign banks’ archives relating to Central and Eastern Europe between the wars Edwin Green (HSBC Holdings plc, London). In Crisis and Renewal in Twentieth Century Banking (pp. 69-79). Routledge.

Islami, X., Mustafa, N., & Topuzovska Latkovikj, M. (2020). Linking Porter’s generic strategies to firm performance. Future Business Journal, 6(1), 1-15.

Lee, C. H., Hoehn‐Weiss, M. N., & Karim, S. (2021). Competing for both ways: How combining Porter’s low‐cost and focus strategies hurts firm performance. Strategic Management Journal, 42(12), 2218-2244.

Loredana, E. M. (2017). The use of Ansoff matrix in the field of business. Annals-Economy Series, 2, 141-149. Web.

Weston, P., & Nnadi, M. (2021). Evaluation of strategic and financial variables of corporate sustainability and ESG policies on corporate financial performance. Journal of Sustainable Finance & Investment, 1-17.