Introduction

The economy cannot be considered as a stable phenomenon without fluctuations and changeable factors that affect a plethora of actors. It has both booms and slumps that are to be taken into account while undertaking any strategic management activities. History shows that the perception of the economy that contradicts the latter statement may lead to drastic consequences – both at the governmental and business levels. Hence, the investigation of events that cause a negative economic impact always tends to be relevant. This paper aims to discuss the US economy during the tough period of the Great Recession and the current one of COVID-19 to determine their peculiarities and outcomes for businesses and strategic decision-making.

Comparison of Events

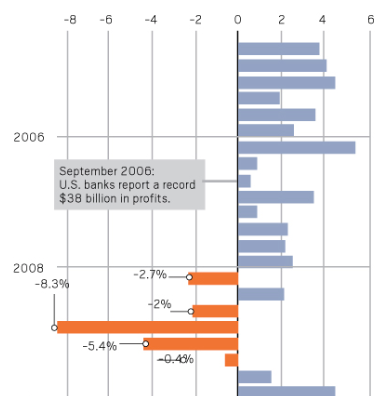

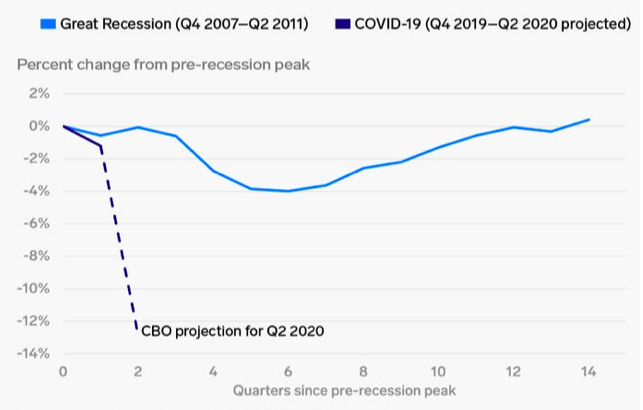

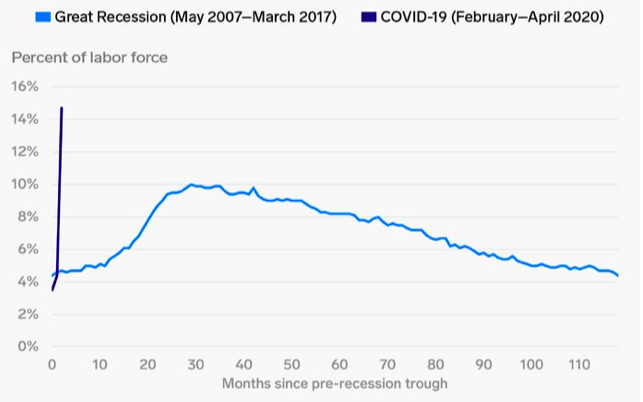

The primary economic indicators were terrifying and were subject to concern for the authorities during the Great Recession. As of the fourth quarter of 2008, the drop in the US gross domestic product was -8.3% (Chart 1). Then, according to Chart 2, the unemployment percentage as of October 2009 was 10.1%. These numbers were genuinely close to the ones of the post-war period. What is more, the essential indicator of foreclosures was above 900,000 during the period, which reflected the core and essence of the Great Recession (Chart 3). It might be assumed that these numbers depict extremely harsh conditions in which the US economy was put.

Then, the COVID-19 pandemic is a current event that affects almost all economic spheres in the United States. The economic indicators of this phenomenon are also harmful and terrific. Currently, GDP in the United States demonstrates a drop of about -1%; however, it is projected to get worse (Chart 4). Furthermore, according to Chart 5, the unemployment rate is 15%, which is much higher than during the Great Recession. The above reveals the fact that the pandemic is putting substantial pressure on the US economy, so as this Recession used to. Nevertheless, it should be mentioned that there is a smaller number of foreclosures as of the first quarter of 2020 in comparison to the period of the financial crisis (Chart 3). However, specialists claim that due to high unemployment rates and the decreased consumers’ incomes, the latter indicator will increase.

The above analysis shows that both the Great Recession and the COVID-19 pandemic put significant pressure on the economy of the United States. The former has been perceived as the fiercest economic event that happened to the US. However, it seems reasonable to suppose that coronavirus should be considered as a horrible condition of, at least, the same scale as the Recession. Such an assumption comes from rational predictions regarding the drop in GDP and the current unemployment rate.

Government Reactions

During the Great Recession, initially, the Fed took the most significant action at the governmental level. It started “reducing the national target interest rate, which lenders use as a guide for setting rates on loans” (History.com editors, 2019, para. 17). According to History.com editors (2019), “interest rates were at 5.25 percent in September 2007. By the end of 2008, the Fed had reduced the target interest rate to zero percent for the first time in history” (para. 18). It was done in order to encourage borrowing and, if possible, capital investment.

Initial adjustments to the regulations for businesses and the financial sector were as follows. The Dodd-Frank Wall Street Reform and Consumer Protection Act was the most important governmental regulation in this regard. “It branched out into many of the governing regulations already in place for setting standards in the securities and financial trading markets” (Ross, 2020, para. 1). It also created a number of new kinds of protection, in particular, the Consumer Financial Protection Bureau. The latter became an essential agency for assisting in the monitoring and protection of US consumers’ financial needs. Moreover, “the Emergency Economic Stabilization Act provided the Treasury with approximately $700 billion to purchase “troubled assets,” mostly bank shares and mortgage-backed securities” (Ross, 2020, para. 9). It seems apparent that the government demonstrated consistent action to deal with the crisis.

Within the scope of the current situation, initially, the authorities had to take several critical actions to restrict the spread of the virus. The government was forced to close the borders, constrain the movement of citizens, and forbid many leisure activities. As a result, the hospitality, tourism, and related industries were affected to the greatest extent. The economic growth and development were hindered, and the US faced the unexpected situation to which it was not ready – so as the entire world.

After the government fully realized the scale of the disaster, several financial regulations were issued; the crucial ones are as follows. The Coronavirus Aid, Relief, and Economic Security (CARES) Act provides a loan program for a small business (The Fed, 2020). It aims to cover revenue losses that resulted from the COVID-19 pandemic. Moreover, it implies loans in order to small businesses could retain and pay their employees. Furthermore, there are plenty of regulatory decisions that delay the dates of the supervision conducted by the authorized financial institutions (The Fed, 2020). The government tends to stimulate the functioning of the crucial segments of the economy.

If to compare changes in the governmental reactions to the initial shocks to the economy and the initial adjustments to the regulation of business and financial institutions, the following might be assumed. During the launching stages of both events, the authorities undertook relatively radical actions that were aimed not to let the inevitable economic downfall that would be unrecoverable. The decisions regarding the financial sectors – these actions differ from the above ones a little. The primary purpose here was to mitigate the disasters’ consequences. Solutions do not seem so radical but rather coherent and reasonable.

Effects on Business Decision Making

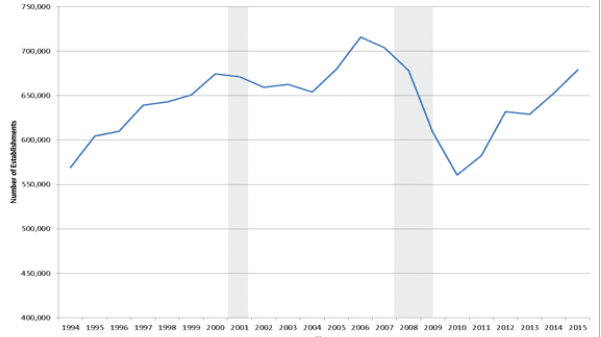

Companies had to figure out the best possible strategic decisions during the periods. “Between December 2008 and December 2010, about 1.8 million small businesses went under” (Weltman, 2020, para. 5); Chart 6 depicts these numbers. It is apparent that the Recession was forcing plenty of bankruptcies, the decrease of available jobs, and layoffs. However, the pandemic period demonstrates even more terrific indicators – “1.4 million to 2.1 million small businesses could close permanently … from just the first four months of the COVID-19” (Dua et al., 2020, para. 2). Hence, firms should operate in challenging conditions today that seem worse than the Recession ones.

The discussed events imply that the economy and its vital processes were and are slowed or even paused. It leads to a decreased level of life and severe circumstances for companies. From the historical perspective, with the flow of time, the influences of changing economic conditions on economic thinking have an increased effect. Such a suggestion comes from the fact that humanity learns more about its commercial successes and loses and accumulates this experience that, in turn, becomes a rational perception and understanding of the economy. Thus, there is a reason to hope that the officials will not forget the lessons of the past and will make appropriate decisions today.

Then, it seems important to describe some successful strategic behaviors of companies during the periods. The critical point was not to panic and adapt policies to the relevant harsh conditions. Firms tended to decrease costs on long-standing purposes, such as innovations and resource-taking acquisitions (Holland & Katzin, 2019; Starbucks, 2020). Moreover, the companies strictly followed the recommendations and requirements of the governmental financial institutions. Thus, the key element was to overcome the crises coherently and without a rush.

Given the investigation above, the thought that economic thinking plays a vital role in the nature of businesses seems rational. Without it, there would be no ability to predict or analyze events and their consequences that will affect companies’ affairs. Hence, firms would be amorphic and could not appropriately react to unfavorable circumstances. It should be emphasized that using economics can help make better policy choices. Successful strategic management, as well as decisions at the governmental level, are highly dependent on the essential indicators that economy – if analyzed properly – can provide.

Conclusion

To conclude, the events of the Great Recession and the COVID-19 pandemic through the prism of economic indicators were investigated. It was found that these events resulted in dire consequences for the US economy – and the ones of coronavirus can turn to be worse in the future. The successful strategic behaviors of companies revealed the importance of economic thinking in businesses. Finally, it was suggested that applying economics may lead to appropriate policy directions.

References

ATTOM Staff (2020). U.S. foreclosure activity below pre-recession levels in 61 percent of U.S. markets. ATTOM Data Solutions. Web.

Dua, A., Ellingrud, K., Mahajan, D., & Silberg, J. (2020). Which small businesses are most vulnerable to COVID-19 – and when. McKinsey. Web.

History.com editors (2019). Great Recession. Web.

Holland, T. & Katzin, J. (2019). Beyond the downturn: recession strategies to take the lead. Bain & Company. Web.

Kiersz, A. & Reinicke, C. (2020). 5 charts show how the coronavirus crisis has dwarfed the Great Recession in just 2 months. Business Insider. Web.

Ross, S. (2020). What major laws were created for the financial sector following the 2008 crisis? Investopedia. Web.

Snibbe, K. (2020). 4 charts show how bad the Great Recession was 10 years ago. The OCR. Web.

Starbucks (2020). Navigating through COVID-19. Starbucks Stories & News. Web.

The Fed (2020). Supervisory and regulatory actions in response to COVID-19. Web.

Weltman, B. (2020). 10 years after the financial crisis: the impact on small business. Investopedia. Web.