Creation of decision-model for second home real estate development in Turkey by foreign developers

Outline

This study seeks to examine the techniques by which intended revenues and project results of second home development projects by international property development businesses could be ensured. While it is seen that the investment climate for seeking out and pursuing ambitious land development planning and constructional activities could be drawn out, the actual implementation of these plans and drawings may indeed be a mammoth task, given the kind of bureaucratic system and permit systems that are in vogue in this part of Europe/Asia.

These issues are further exacerbated when one chooses to consider government regulations and influence exerted by local players, especially in the context of the fact that unlike other resort destinations in the world, land, and construction costs are relatively cheaper and labor costs are also economical, which accounts for why more and more foreign investors and Non-Residents Turks are seeking real estate investment opportunities in Turkistan.

The focus is on empirical studies conducted online through Questionnaire (Appendix 2) whose findings reiterate the fact that, despite constructions snags, property development in Turkey is indeed a rewarding and profitable one. The main recommendations could be in terms of allowing mortgage business to flourish in this country and also the setting up of local development agencies that could act in tandem with parent investment companies in Europe or the Americas in ensuring target conformance, and projects being completed according to schedule. A mathematical model, which is already with the writer, needs to be supplemented with the findings of empirical studies conducted in this study to arrive at a consensus by which improved ways and means could be gained to address the subject.

Evolution of investment opportunities in Turkey

Introduction

The property development sector has become one of the hotspot investment areas in Turkey. Presently it has become one of the emerging sectors in this region. Developments and implementation of the various properties have to be done carefully to make it more successful and profitable. This is the main aim of those people who are actively involved in this kind of business.

The focus of this dissertation paper mainly deals with the implementation of a very good model, which will be the solution for the problems faced by the foreign developers in Turkey to implement the project successfully. Implementation of the good model helps the foreign developers in securing intended revenues and project outcomes in property development in Turkey. The main causes for the origination of the problem are construction delays, differences in culture, bureaucratic norms, etc.

To avoid such kinds of problems and to protect foreign developers from the crises they are facing, the implementation of a very good model is a must. As mentioned above, the main focus of this paper is to create an appropriate model. The aim of this model ought to help foreign developers so that they can invest money in their developing plans without any trepidation about the future.

Background information

“Turkey is a paradise of sun, sea, mountains, and lakes that offers a complete change from the stress and routine of everyday life” (Turkey real estate: Turkey property for sale 2009).

This is the reason for foreign developers to come to Turkey and invest their money for development purposes. Another attractive feature of Turkey is good communication; no problem with transportation and the economy in turkey is stable and expanding. The cost of living and crime rate is much lower when compared to businesses of this kind. This attracts foreign developers to invest more and more money in developing new projects.

A survey conducted by the global property guide some years ago clearly shows the interest put by the foreign developers in Turkey. “More than 73,000 foreigners, mostly Britons, Germans, and Greeks, have bought properties in Turkey. They poured US$10.4 billion into the real estate market over five years (2002-2007)” (Turkey: overview 2008).

Another survey conducted by the government of Turkey mentions the interest shown by the foreigners to get a second home in Turkey. The survey states that “foreigners have spent more than $7.2 billion on an estimated 30,000 homes” (Cirik 2007).

“A recent survey of leading investors by Pricewaterhouse Cooper and the Urban Land Institute gave the Turkish metropolis of Istanbul, along with Moscow, the highest “buy” a rating of any European city, with Turkey seen as “a market offering phenomenal prospects” (Turkey property news: Turkish delight 2008).

These kinds of things are encouraging the developers to invest more and more in property development in Turkey. These results show that Turkey is one of the best places to invest money in real estate. These developers are aiming for high returns on their investment. The regions like Alanya, Antalya, and Belek are the most popular places for foreign developers.

But presently developers are facing some sort of issues. One of these is some rules and regulations placed by the Turkish government in the development. To overcome this problem there is no possible solution for the developers to influence the government. Another problem facing developers is that of communication. Most of the people in Turkey speak the local language. So these put foreign developers in a difficult situation. All these things will reflect in the foreign developers in their construction work, especially when having to deal with the local workforce and construction personnel

Application of research

The importance of this research is to find a possible way for helping foreign developers to sort their problems regarding real estate developments in Turkey. The problem is solved by creating an efficient model which provides a helping hand to the foreign developers in their construction process.

Formulation of research problem

The problems faced by foreign developers in Turkey while constructing or building their projects show the way for building the research problem.

The main objective of research

The main objective of this research is to find out the best decision model, which solves the problems faced by the developers in Turkey. The decision model must be efficient so that it must show the correct path for the developers to focus on what and how to attain success in their project. The implementing model must be able to control cost; risk and it should add value to the project. So, while creating the model one should keep all these things in mind to make the model a grand accomplishment.

Research questions and hypotheses

Considering the things mentioned in the main objective, one can put the research question in such a way that ‘Is there a way of securing intended revenues and project outcomes of home property development projects in Turkey?’

The research question mentioned here could be broken into two sub-research questions and hypotheses.

Research question 1

Is there a way of securing revenues from property development in Turkey?

Hypothesis

There are different ways to secure revenues while undertaking property development in Turkey.

Research question 2

Is there a way of protecting the project outcomes while undertaking property development in Turkey?

Hypothesis

There are ways to protect the project outcomes while doing property development in Turkey. Research model:

A good research model will always show a correct path to move forward. “The first step towards successful property development is to research the area” (Improving: property development 2009).

That means a thorough study is needed in this field. The research model implemented here is based on theoretical and practical studies. In the case of theoretical study, analyzing of existing problems faced by the foreign developers is made. This includes studies about the investment made by developers in Turkey and also about many other factors that are being faced during site development.

A comparison study has been made with past and present scenarios. The practical approach includes the distribution of questionnaires to customers to understand the profiles and preferences of the customers. The fact of this approach is to get a clear idea about customer approaches.

The creation of a good decision model should resemble these both theoretical and practical approaches. Only then implemented decision model should be able to secure the intended revenue and project outcomes of property development projects by foreign developers in Turkey.

Definitions, stakeholders, and different stages of property development

Property development

The definition of property development has been mentioned in a book named ‘Property development’ written by Richard Reed, Sara Wilkinson, and David Cadman. “The definition adopted in this text is that property development is a process that involves changing or intensifying the use of land to produce buildings for occupation’” (Reed, Wilkinson, & Cadman 2008, p.2).

Property development is one of the exciting and sometimes frustrating and complex activities which involve the use of very large amounts of money inputs. The success of property development depends upon many internal and external factors. The performance of the economy is one of the important factors that really affect the project. Also, one cannot calculate the success of property development in terms of only the financial benefits. It really depends upon the other factors such as social, emotional, visual, etc.

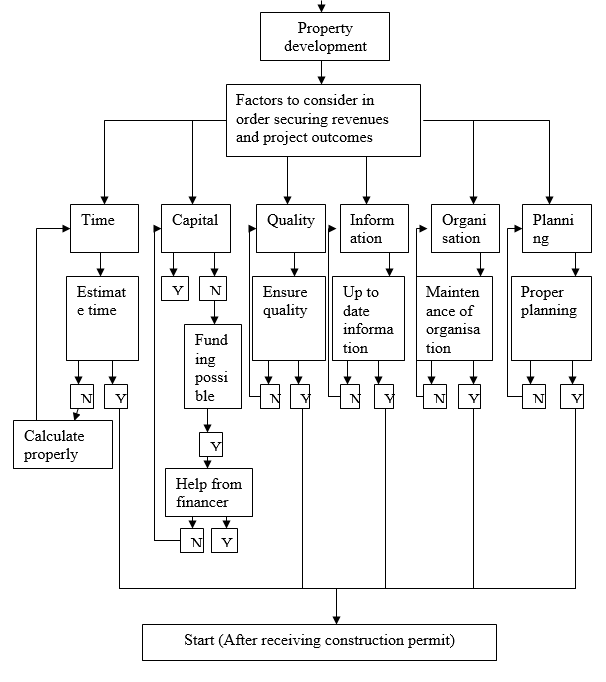

As mentioned above, the important factors that come into contact with property development are time, capital, quality, information, organization, and planning. Time, capital, and quality are the factors that are controllable at the time of development. At the same time, the factors such as information, organization, and planning must be under control. So, it is clear that property development must be under this framework. To reach the objective one should give preference to these frameworks and also this should keep in mind while making the decision model to help the foreign developers to secure intended revenues and project outcomes of property development in Turkey.

Property developer

A property developer can be defined as a person who is actively taking part in the development process. His role is to make the idea for development from scratch of the project to the finishing stage. The developer needs to be actively involved in the work to make the development an impressive success. Also, a developer must be creative, imaginative and he/she must be aware of the situation very clearly. The situation can be trends in the market, economy, etc. A developer must be able to take a risks and he/she should be very capable to act according to the situation. A strong leadership mind and very good knowledge about business should be possessed by a developer to get maximum profit from his investment.

Stakeholders in property development

Stakeholders or actors have got an important role in property development. Different stakeholders are involved in project development. Some of the stakeholders are landowners, developers, financial institutions, building contractors, agents, engineers, and project managers. The roles of each of them are described below.

Landowners

These people have got an important role. Their role is to initiate the development either by selling the land or by starting the development process. If these people do not take any initiative, the development of the projects won’t take place. Everything is related to the motivation of the landowner in letting the land be for developing property.

Developers

Their role is very clear. It is to make the financial benefit by developing various projects. Developers may be of different types – small-scale developers and large-scale developers. Their work style may be different, but their motto is the same to make a profit by developing the projects. The success of the project is really in the hands of developers and it will be based on a good decision model.

Financial institutions

Providers of finance have a key role to play in the development process. A financial intermediary can be called a financial institution, which can be a bank or any other financial agent. For development, there are two types of, funds – long term and short term. The long term can be called funding which covers the whole project, whereas short term means for each process.

Building contractors

It is the developers who employ building contractors for construction work. Everything related to the process largely depends upon the ability of the contractors and their decision-making. The financial profit of the contractor lies in the cost of building and the duration of the work. It is the contractor who takes the specialist activity and risks during the work. Many of the decisions will rely on the contractor. Contractors also play a leading role in securing revenues and project outcomes.

Agents

Agent’s role in the development process is to bring some of the actors who are required for the development process. These are the persons who act as intermediaries between the developer and the other stakeholders. These agents’ role is very crucial in every stage of the process. Agents are able to play their role just because of their knowledge in different things, such as demand and supply, financial institutions, etc. The agent’s aim is to make a profit by charging the fees from their clients at the time of development.

Engineers

Their role is to supervise the construction and make things happen very smoothly. They make the design for the development of the property. There may be different types of engineers such as civil, mechanical, and electrical. They also play an active role in securing revenues and project outcomes.

Project managers

Developers often take the role of project managers. Manager’s duty is to supervise everything neatly. The success of the project often relies on the performance of the manager.

Different stages of the development process

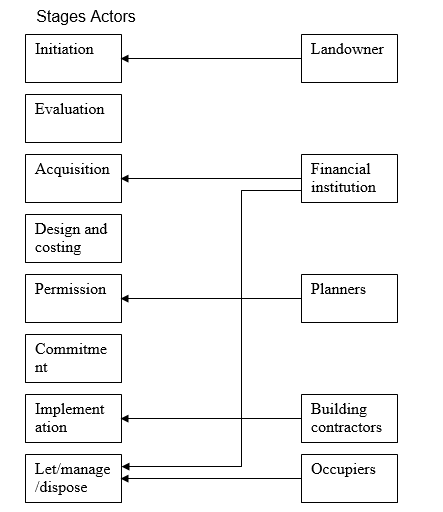

The process of property development is divided into many stages. The process mainly involves different types of combinations of inputs in order to get the desired output. These stages are mentioned in the book named ‘Property development’ written by Richard Reed, Sara Wilkinson, and David Cadman. The different stages mentioned in the book are the following: “Initiation, evaluation, acquisition, design and costing, permissions, commitment, implementation and let/manage/dispose of” (Reed, Wilkinson, & Cadman 2008, p.3).

Each of the steps has been explained below:

Initiation

The initiation of the process starts when an appropriate land or site is considered to be suitable for intensive use. The use can be varying according to the situation. The initiative for this development will start with the actors or any of the stakeholders who are active in the development process. It is the initiator who is actively involved in the research activity to study the land and other things available in the surrounding.

The research activity includes the study of demography, economic situation, social condition, and many other circumstances. The success of the development will really lie in the hands of the initiator and his study. According to his study, a proper plan or model must be constructed to make the development a great success. The role of the initiator may not be so active in the next stage of the development.

Evaluation

This is one of the most important stages of the development process. It is here the strength of the decision model will reflect. A very good evaluation is needed in order to make a good decision model. Very good market research is unavoidable in the evaluation process. Similarly, financial evaluation is also very important in the development process. The main aim of the financial evaluation is to set up the value of the site. Evaluation is a continuous process that will continue until the development of the project is over. The important thing is that constant monitoring is required. A good evaluation will help one make a good decision model which will result in securing the revenue and project outcomes.

Acquisition

The acquisition involves the different steps one needs to take before the site is registered for the development process. Three different steps come under this. The first one is legal investigation. This involves all the legal issues related to the project site. This requires finding the existing owners of the site, investigating whether any kind of restrictions is there for the site. The developer has to clear this aspect without fail; otherwise, it will affect the construction process very badly.

The second one is ground investigation. This involves the investigation of the load-bearing capacity of the site. It is also to make sure that services like electricity; water, gas, etc are available on the site so that it won’t affect the construction process. It is because these things should be taken care of before starting the development. If these things are not available, then the developer has to spend more to make these things available on the site.

The third thing is finance. The developer must be very much aware of the two types of finance, namely long term and short term. Short-term finance is needed at the time of the development process and long-term finance is needed until the completion of the project. The awareness of these things is very much important in order to create a good decision model.

Design and cost

It is a process that should run parallel with the other processes of development. This stage includes all members of the team. The developer must be aware of the situation to ensure that everything is going normally without any delay to the process. Also, the implemented design may vary when the development process goes on. So the developer needs to be aware of this fact.

Permissions

This is the stage where the developer should be aware that everything is going fine within both time and budget. This thing can be achieved with the help of a project manager. Also, the experience of the developer or project manager will play a key role in the decision-making as they will know when to deploy certain things. Also, the developer needs to analyze the market situation properly because he needs to change the tactics according to the situation.

Commitment

Commitment means dedication shown by the developers and other people who are actively involved in the project development for completing the project successfully.

Implementation

Implementation means completing the development project, in other words, construction.

Let/manage/dispose

This is the last stage of the project. The result of this will be according to the developer’s thinking from the beginning and it will depend on the decision model created. Here, a decision must be made with the consent of the shareholders of the property when it will be sensible to sell out. It is not the developer directly to sell the property he may keep the agent to do this job.

The above figure represents the eight-stage model, which is used for the development process. “Some of the relationships shown in this diagram are self-evident. However, three groups of actors – financial institutions, planners and occupiers – have more wide-reaching and complex effects upon development decisions than the diagram would indicate” (Guy 1994, p.35).

The development process presented in the diagram is most important and involves the total gamut of the process in the context of real estate development in Turkey. Some of the main constraints that need to be visited would be in terms of cultural inhibitions, language barriers, lack of knowledge of local rules, laws, and regulations related to real estate, and most critically the availability of workforce to carry out the real estate development program smoothly and within the reasonable time frame. In the next chapter, the economic background and important impacts on the real estate business in Turkey are being taken up for discussion.

Country profile and economic background of this country

Turkey as a work area for foreign developers

One of the important things, when foreign developers come to Turkey for property development, is that there are lots and lots of things they need to consider while moving forward with their project work. This consideration and awareness are very important factors regarding procedures in construction, culture, legislation, planning, etc. Only then, foreign developers will be successful in securing intended revenues and project outcomes for house property development projects in Turkey.

About Turkey

Turkey is called a Eurasian country because one part of Turkey is located in Europe and the other part is in Asia. The geographical area of Turkey includes 780,580 sq. km. Ankara is the capital city of Turkey. Other important cities of Turkey are Istanbul, Bursa, Adana, and Gaziantep. “Turkey includes one of the more earthquake-prone areas of the world” (Background note: Turkey 2009).

The fact that certain areas of Turkey have been subjected to massive earthquakes could also be a major hindrance when considering foreign investors setting up real estate businesses in Turkey.

The climatic conditions of Turkey are moderate in coastal areas and harsher temperatures in island areas. The nationality of the people in Turkey can be called Turks. The approximate population as per the year 2007 is 70.5 million. Major parts of Turkey include Muslims (99%) and others are Christian, Bahai, and Jewish. It was on October 29, 1923 Turkey got independence. Constitution was made on November 7, 1982. (Background note: Turkey 2009).

Turkish economy

For property developers, the economy is one of the major areas to be considered. It is the local economy that represents the market value and marketability. The position of contractors, financiers, suppliers, clients, etc is directly dependent upon the economy. Second-home real estate developers mainly look out for this before investing to make sure that they will get the return on investment. Turkey is a middle-income country. The large domination of the Turkish economy is done by modern industry, commerce, and a traditional economy. Tourism has got an important role to play in the Turkish economy. Tourism includes all sorts of investments done by foreigners. “Tourism revenues helped compensate by generating a revenue over 15 billion USD” (Turkish economy 2009).

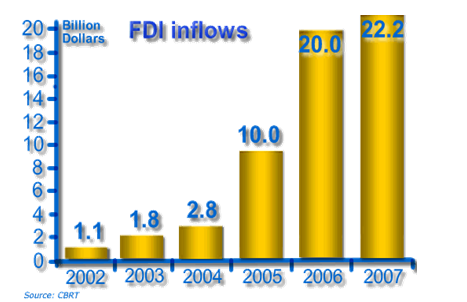

“Turkey succeeded in attracting $22.3 billion in foreign direct investment (FDI) in January-May 2008. Due to global market conditions which contracted foreign capital inflow, Turkey is expected to attract around $10-$12 billion in 2009” (Background note: Turkey 2009).

The diagram showing foreign investment statistics has been shown below.

Presently, the economic conditions in Turkey have been recovered and stability condition has been achieved. This kind of economic environment will attract foreign investors to invest more and more in Turkey.

The Second-home property market in Turkey

The second home trend has gained more and more popularity. The majority of the people owe second homes in salubrious Turkey besides their own homes in Europe or USA. “Turkey is rapidly emerging as second-home market and while most development has so far been aimed at the mass- and mid-markets, higher-quality projects are beginning to appear” (Turkey news 2007).

Turkey is becoming favorites for foreign investors and it could develop into a favorite real estate destination when the government places some relaxation over ownership of real estate business by foreigners in Turkey. Also, another attractive feature is more and more tourists are coming to Turkey to enjoy the sun, sand, and weather.

These things raise the demand for property in Turkey which helps in boosting the real estate business here. Another thing to attract the property developers to come to turkey is in terms of the fact that “Turkey offers a lot to potential property buyers” (Turkey news: Turkey provides a ray of hope 2007).

If one is from a country like the US, Canada, America, or any other Asian countries then one can buy the property freely in Turkey. These things attract foreign developers to come to Turkey and invest money in real estate.

Competition in Turkish property development

There is no doubt that competition in property development for a second home in Turkey foreign developers is very robust. One of the major factors for this is that majority of the property; at least 60% is in the hands of Turkish developers. There is a lesser local barrier or formalities for Turkish developers for acquiring the land in Turkey when compared to foreign ownerships. Being locals, they have tremendous advantages such as experience, knowledge, language, etc. These people could influence the government very easily while this could be more difficult for foreign developers to gain a competitive advantage in the Turkish real estate business in the absence of local sponsorship.

Turkish planning obligation

Regarding property development projects, there are three stages for which must take place before, during, and after development. The three stages are the foregoing stage, construction stage, and final stage.

Foregoing stage

The foregoing stage otherwise can be termed as the initialization stage. This has been explained in the stages of development. This is one of the important stages as very serious kind of inspections is needed in this stage. Otherwise, it will put the rope in the way to secure the intended revenues and project outcomes of the property development.

Construction stage

This stage is also included in the stages of development. At the time of construction, a supervisor will guide the engineer to see everything is going according to the rules and regulations. Mostly this stage involves the active involvement of various actors.

Final stage

This is the last stage before the sale of the constructed unit will take place. The local municipality will inspect the constructed unit and check whether there are any irregularities present. If the authorities find any irregularities then they will inform the developer to correct the irregularities in order to get the license. Once everything is ok, approval or license will be provided for the constructed unit and thus developer can move on to the last stage for sales.

Critical aspects that impinge upon project development of housing in Turkey

Introduction

This chapter considers the legal and administrative aspects connected with building a second home in Turkey by foreign investors. The most important factor could be in terms of getting construction permission from the local municipality and consent of various third parties for development and construction purposes. If the local government does not cooperate, there could be snags and delays that could ultimately affect the pricing and time phase aspects, causing economic and non-economic losses to the developer.

First of all the construction drawings and other supplementary details have to be submitted to the appropriate government department for permission to construct. The officials here would examine and inspect the various drawings and documents, and if satisfied with the answers to various technical queries, they would approve the construction and provide consent.

Granting of construction permits

Under Turkish laws, within a period of 30 days of its issuance, objectors could protest against the grant of permits and seek remedial measures either for rescinding the permit or making the need for further alterations or changes in drawing plans. After this period, no objections could be raised by anybody. The various factors that could be raised by neighboring households, or stakeholders, that need to be taken into account are those related to view, preferably of the sea, defects in the inherent designing of the drawings and plan proposals needing modifications, or major alterations, conspicuous loss of local environmental skyline and character which this construction could ensue, resulting in a change in the façade of buildings, or being out of line with the kind of constructions already in the vicinity, etc.

There could also be concerns that this construction could result in added woes to local traffic movements and congestions and the need to increase car parking space, due to cramping of available space and other considerations. The number of floors that the construction company would be intending on the building is another consideration vis-à-vis the permissible floor construction allowable under current Turkish laws.

Currently, under normal conditions, two-story building construction is possible

According to Turkish building construction laws, the existing norm, under normal conditions is two stories, and the constructor may find that any levels above this may not be acceptable to government permit authorities. The regulations regarding general construction activities also need to be taken into considerations, including norms regarding the projection of construction, plinth area, norms regarding constructions in coastal areas, and/or proximity to the sea, etc. The need for sunlight and air are also important considerations, as is the need for environmental security and control over the felling of trees and loss of natural landscape.

In short, it could be said that all major factors need to be addressed while taking up a second home construction project in Turkey. On the positive side, it could be said that investments in Turkey real estate are good since the value of such investments is appreciating over time, unlike in other European destinations. Besides, Turkey has a very salubrious climate, scenic beauty, and natural Mediterranean environmental charm and attraction which goad many foreign real estate investors to come and set up investment projects in this country.

With an excellent climate and lesser population, Turkey could well be termed ‘a home away from home’ that accounts for its immense popularity among foreign real estate investors. It is now necessary to consider SWOT analysis to delve deeper into the matter of real estate development in Turkey.

SWOT analysis

Porter’s Five Force Competitive strategies

The intensity of competitive rivalry

It is seen that in the Turkish context, foreign real estate development companies need to compete with local ones, in terms of gaining housing development permits and other licenses. While at one time, this was possible through devious methods and influencing local officials, currently, there are no options but to compete and win bids. However, one aspect that foreign real estate investors have over local ones is the accommodation of capital and financial resources, especially international real estate developers who wish to set shop in Turkey for various economic and non-economic reasons. The absence of a strong mortgage business is keenly felt in this Mediterranean location which needs to be improved over time. This may be due to “substantial and unpredictable inflation rates, ambiguities in the economy, large down-payment requirements, and high-interest rates” (Is Turkey ready for the mortgage system? 2006).

Bargaining powers of suppliers

In the Turkish context, it is seen that the bonding between industry and its suppliers is more robust than in other countries. It is seen that in the context of real estate development, it is not only necessary that they deliver on time, but also according to quality standards and specifications. To a large extent, the final outcome of housing could depend upon the quality and strength of raw material supplied and thus the importance of these significant constituents cannot be denied or underscored. Thus, it is necessary for foreign players to have a harmonious rapport with suppliers, especially local ones in order that stages of project development and implementation could be according to quality and time schedules.

Bargaining power of customers

It is indeed a welcome sign that Turkish people prefer to own their own homes. Statistics have proved that out of the total households of 150,070,093 in various regions of Turkistan, 10,290,843 households preferred to own their own homes, accounting for nearly 68% of the total.

Only 24% of the households were staying in rented apartments, and it is believed that in future years, the trends for owning houses by expatriates or locals would only increase. Moreover, this could augment the demand for the real estate business, since greater demand could boost development projects and the government would need to give more priority to this segment of living. With local funds not coming up the way they should due to infra-structural and recessionary trends, it would have to depend upon foreign funding, which could stimulate the need and supply of real estate in this country.

Threats of substitute producers

It is seen that in the Turkish context, there is a dire need for injecting foreign capital into its real estate economy. This would not only restore and stimulate demand-supply balances but also make the cost of development and building costs economical in the long run. While local threats are real in terms of language and cultural barriers, the need to have local real estate sponsors and a greater degree of bureaucracy in the system is fundamental to ensure the soundness and risk-free nature of such development, especially in naturally calamitous countries like Turkey, where massive construction activities over the years have affected quality and strength of ground soil and may make it unviable if this is not carried out in a planned and systematic manner. Language, culture, the proximity of local players with governmental agencies, and permit officials are all crucial aspects of real estate development plans in this country.

Threats to the entry of new competitors

It could be said that the main threats could be in terms of challenges posed by local players and the extent of influence they could use with the Government officials and permitting authorities. Moreover, cost and time overruns due to delay in permissions, permits, and actual construction and its approval, at various stages could pose a threat to new competitors. But global players, well experienced in such dealings with larger investment opportunities and having the necessary skills and capital, could pose a major threat to local players, with larger financial and technical capacity.

Analysis of data

Introduction

The main instrument that could determine the outcome of this research would be in terms of the responses to questions (posed through questionnaires) received from customers (present and potential) who have been selected through lots. It is necessary that global real estate developers be aware of the needs of ultimate buyers, whether for investments or dwelling purposes, in order to work out investment marketing strategies, keeping in mind the level of interest shown by customers and the servicing that is being carried out for them. The overall objective of this research has been to prove true the twin hypothesis, regarding the ways and means by which intended revenues and project outcomes of the second home property could be established.

Response of online respondents in the hypothetical study

For this purpose, a total of 250 online respondents were selected on a global basis, including 175 owners, leasers, and present occupants of second home constructions already carried out in Turkey. They were subjected to various questions meant to analyze their investments over time and the cost benefits that have been derived through such investments. It has been found that most of the investors, who have invested, are not only the local population who do not have a distinct penchant for owning their places of residence, but also global buyers who wish to make Turkey their second home. The research study also throws open interesting facts regarding foreign direct investments (FDI), especially in real estate in Turkey.

Until the time changes in rules gained precedence in the year 2003, Turkey followed a closed economic system, and foreign persons were not entitled to own or obtain property in Turkey. However, with the passing of the Foreign Direct Investment Act (Law No. 4875) that entered into force as of June 17, 2003, foreigners are now allowed to invest safely in real estate in Turkey.

This law states, inter alia, that without prejudice to global covenants and specific laws that stipulate otherwise, “1. Foreign investors are free to make foreign direct investments in Turkey, 2. Foreign investors shall be subject to equal treatment with domestic investors.” (Investment in Turkey: foreign direct investment law 2003). This has indeed come as a bounty to a large number of foreign nationals and institutions that wish to set up real estate business in this country, not only to avoid the recessionary and falling land values in their own countries but also to gain good yields for their investments in locales where land values are comparatively high and better investment options were available, which perhaps would not be available in other global locations where they undertake business prospects.

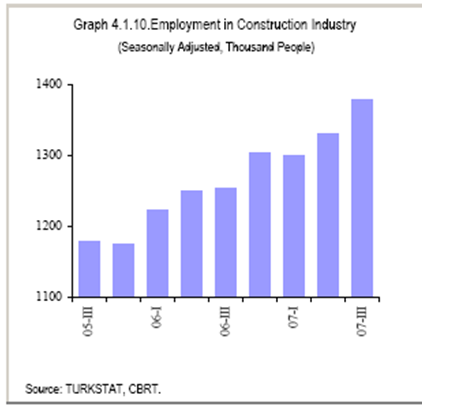

This study also needs to seek out the current trends in construction in this country. According to the report of the Central Bank of Turkey for 2008, it is seen that the permit system has impacted upon construction business in that there was a fall in the issuance of permits of nearly 10.7% as compared to the same period last year. (Inflation report 2008-I n.d., p. 41).

When the six months period analysis is taken, it is seen that because of the slump in residential houses, this has impacted even the commercial and other construction sectors too.

However, it is believed that this would only be for a short period since employment opportunities in construction activities are on the rise.(Inflation report 2008-I n.d., p. 41).

The close association between the possibility of buying a house and permits has been depicted in the graph above. It is seen that their movements are more or less on similar patterns, and presently there is less likelihood of improvements in the present trends.

This brings us back to the central issue of whether foreign investments could resolve the present situation and bring construction and housing segments into more viable and commercially attractive ventures.

The principal model for confirming or negating the two hypotheses identified earlier in this study could be the result of deliberations with subject respondents and the results of online questionnaires submitted to them with regard to their opinions regarding methods in which intended revenues and project outcomes could be realized.

Results and implications of the hypothetical study

The results of the study, as gathered from the respondents only reinforced the fact that in the present Turkish condition, large dozes of liquidity needs to be injected, not only to stem the inflationary trends in the economy and curb volatile interest rate fluctuations but also to increase the money supply in the local community for additional real estate investments. In the Turkish context it could be said that more than cold statistics, the reputation and credibility of builders also assume great significance and importance.

While local real estate developers may find it difficult to invest a large quantum of funds for development due to lack of proper mortgage facilities and present recessionary trends in the economy, builders and construction companies in the Middle East, China, Japan, and India, among others, could gain better mileage in investing in Turkey’s real estate business. The main sub-models that need to be taken up for detailed discussions could be in terms of capital provision, land acquirement, and building up customers.

Turkey’s EU connections need to be called upon

It is seen that Turkey’s membership in the European Union and as a major partner of the EU countries could stand it in good stead in capital provision for the construction industry, especially global partnering and joint ventures with other major global construction industries. Since the private sector is the mainstay in business, it could set up a diversified business. Turkey also has the reputation of raking $22B in FDI during 2007 and this figure could be increased in future years through active business associations. One of the salient features of the Turkish economy has been that it has not suffered the impacts of global recession, thanks to a strong and resilient economy and wise and judicious economic and fiscal planning.

The overall model also seeks to consolidate Turkey’s position as a front liner in developing countries in terms of total GDP of $ 802B, the 6th largest economy in Europe. (Oxford Business Group 2009, p.28).

Considering all the facts presented, it could be assumed that the construction industry would receive a fillip once Turkey assumes full membership in the EU after the issues with Cyprus are sorted out. Again, its economy is vibrant, open, and cosmopolitan in its outlook and seeks active cooperation and consolidation with its business partners and allies on a global basis.

This business model seeks to consider the fact that the Turkish economy is a developing one on the likes of Italy, China, or India. At this stage of economic development, the assistance of EU and non-EU trading partners are important for its growth prospects, and could well place it among the top 4 countries in the EU. Further, Turkey’s strategic location, partly in Asia and part in Europe, and its large coastline, and surrounded by three different seas, could be seen as major economic determinants in future sea trade and to be fully utilized for maritime activities.

Decision Modelling: It is believed that quite a large number of factors, both external and internal do contribute to the overall success of planning construction of property management in Turkey. The external or uncontrollable factors could be in terms of customers, economy, currency movement of the Turkish lira as against major currencies, including the ubiquitous American dollar, political and natural events, etc.

However, the internal factors could be the cost of the project in terms of land and construction outlays, manpower resourcing, budgeting, and project scheduling.

However, it is now proposed to consider the decision modeling with regard to planning, cultural, legal, economic aspects of construction activities in Turkey. This is of critical importance since many first-time foreign development companies may be actually in need of data and information regarding how best their investment proposals could be translated into concrete programs and real estate development schemes in this country.

According to the Global Property Guide, “Residential apartments in Istanbul, Turkey are among the cheapest in Europe at around US$1,850 to US$2,500 per sq. m.” (Investment analysis 2008).

This is even more emphatically seen when average prices in London’s upper-class areas are in the range of US $ 21,800 to the US $ 36,200, and in the US it could be anywhere between US$13,270 and US$22,923. So for Europeans, the best destination for buying or building an economical house in Turkey. Conditions best suit current foreign investments, in terms of fairly moderate economic growth of around 4%, and rise of GDP from the US $ 3,560 in 2002 to over US $ 9,630 in 2007, a rise of 170% in just 5 years. (Turkey overview 2008).

With the lowered budget deficit, inflation pegged at 1.6% of GDP (2007 figures), and stable government, things are beginning to look up for foreign investments in Turkey. Given a culture mix of Islamic and Indo-Saracen races, Turkey is now very much a cosmopolitan destination as in any part of Europe. Thus, owning house property in Turkey would be as good as owning it anywhere else in Europe, with a lowered price tag, to boot.

Coming to the legal aspects, at one time, the laws were strict on foreign landholdings in this country, but now, property laws have been moderately relaxed, foreign investments are being more than welcomed, especially considering the fact that the Turkish Government wished to implement ambitious tourist development plans, including a program to attract over 50 million tourists by 2023. These programs would definitely impact land prices and investment yields, including accretion in rental home prices and yields. This it would be quite right to suggest that economic growth is on the anvil and major real estate planning and constructions could be taken up with the assistance of local players.

Decision model (Please refer to Appendix 3)

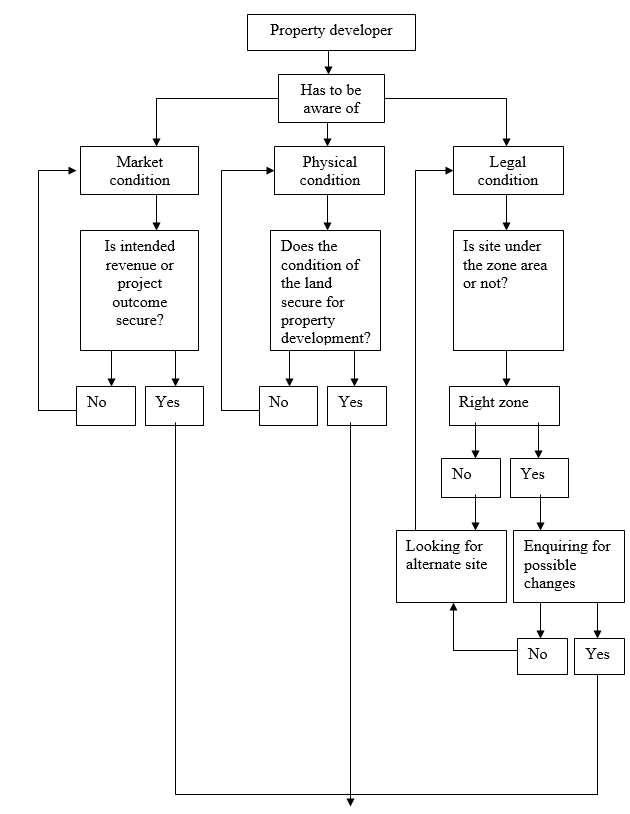

The property developer has to be aware of three conditions before he/she starts with project development. These are market conditions, physical conditions, and legal conditions. The market condition should be analyzed to check whether the developer will get the profit from it, or not. Similarly, physical conditions such as land, soil, etc must be looked out and the last one is very important thing is checking whether the site is coming under any restricted zoning areas or not. If all these conditions are favorable then the developer can move forward by making sure that the developer can secure intended revenue and project outcomes without any problem.

Once these aspects are correctly incorporated, the developer can move forward to the next development stage. Here important factors the developer needs to consider are time, capital, quality, information, organization, and planning. Time, capital, and quality must be monitored before starting the project. Similarly, information, organization, and planning are other criteria that must be under control at the time of the developing stage.

All calculations must be properly carried out, duly approved, and certified in order to make sure that the developer will be secure about the intended revenues and project outcomes of property development in Turkey.

Conclusions and Recommendations

Conclusions

Helicopter view

It is in the national interests of the government and people of Turkey to allow foreign investments to flourish in this country, whether in terms of the tourism industry, or stakes in local development programs to grow. Foreign direct investments (FDI) help consolidate a state’s economy and also tap local resources. Other transitional economies, like Spain, could be a role model for Turkey to adopt.

Coming to Turkey’s case, it is seen it has entered the mortgage loan sectors rather late, unlike other transitional economies that have ridden the crest of stronger economic performance, thanks to a transition into a mortgage loan market real estate investments in real-time and added vigor and dynamism.

IMF Country Report No. 07/364 “Selected Issues

Perhaps one of the robust Models that could be put forth for enforcing a climate of additional stimulus for the cause of foreign investments could be seen in the light of the International Monetary Fund (IMF) report entitled “IMF Country Report No. 07/364 “ Selected Issues dated 4.5.2007.

According to this authenticated Report which has been ratified by the European Department, the main redeemable factors in the Turkish case, besides its primary membership in the EU, could also be seen in terms of increased disposal incomes, fuelled by greater employment rates and positive economic growth.

Turkish high population growth figures, combined with a strong penchant for migration to urban areas, have triggered off the acute need for housing in these areas.

Thus, foreign real estate investment companies could play a decisive role in putting Turkey on the European map of large foreign investment aided tourist destinations and second home spots. With many companies now investing in condominiums and villas for executive holidaying, including a large spate of holiday home resort companies investing in attractive tourist destinations, the big stage is indeed set for foreign investments to rope in Turkey not only for tourist attraction but also as a viable second home for people from all walks of life.

Moreover, with the advent of foreign banks into Turkey, the banking sector became more customers focussed and competitive, specifically in consumer lending, of which mortgage loans form a substantive part. Further positive aspects were in terms of high owner occupancy rate in houses (around 72%) which has created a strong cause for investments, knowing that Turks believe in staying in their own homes.

“The combination of falling interest rates, households’ rising disposable income, a growing banking sector fueled by foreign capital, and large demand for better housing, drove mortgage lending higher. As in other cases, this was also associated with strong house price increases.” (Turkey: selected issues 2007, p.42). It is believed that robust growth, fuelled by demand needs would create increases in house prices in coming years and these offer a strong case for second home foreign investments, despite certain limitations and zoning inhibitions.

Recommendations

One of the principal recommendations would be in terms of setting up local management development real estate companies in Turkey, as far as is possible, with local sponsors for overseeing the construction and building of residential houses in this country. This would not only eliminate the burden of seeking permits and local governances but would also allow the global players to become more competitive in these markets. These could be on a partnership or joint venture basis, or fixed sums to be paid after the keys of the residences are handed over to the owner company.

Turkey should seek full membership in the EU

Another aspect with regard to investment planning could be the strategic need for seeking full membership in the European Union (EU). If this were to take place, Turkey’s position would be fully consolidated and it could seek better trade and commercial ventures with other member countries. “The accession talks may mark a major turning point in the history of EU-Turkish relations” (Clarke 2006, p.13).

Another aspect is that from a trade partner point of view, it is in the interests of foreign second housing projects that the West would have larger stakes in this part of the Middle East, given that it has common borders with Syria, Iraq, and Iran. European interests could be better protected by having a larger business presence in Turkey in order to maintain its hold in this region.

Another aspect that needs to be considered is that by having local property management agencies in Turkey on a contractual basis, it is possible to allocate and monitor better managerial and constructional control, in terms of costs and revenue factors. These local firms would have good knowledge of the Turkish language, have contacts with the government and third parties responsible for the development, and could ensure a higher degree of efficient service in terms of cost and time parameters in construction activities.

Use of mathematical models for individual cases

The use of mathematical models that have been developed could also be used along with factual and qualitative ones that could render better real estate prospects for a densely populated country like Turkey. It is believed that for major global business houses in the construction industry, Turkey offers enormous opportunities for development provided the right business and marketing strategies are developed. This could be in terms of right site selection, soil testing and grading, seeking permission and approvals, entering strategic alliances with third parties and developers, and ensuring thorough checks and balances methods that right techniques are used.

A higher degree of market acceptability in the Turkish construction context

Finally, it could be said that the success of models for a second hin Turkey depends to a very large extent upon the acceptance of investors, whether local Turks or Non-Resident Turks abroad and their investment capacities. While NR Turks could be a major investor target, having a closer affinity for this country, it is also necessary to explore Turkey’s European Union connections and business enterprises in global destinations, including Turkish companies abroad, for possible partnership and joint venture business networks in this country. For this, not only the active co-operation of the local government and citizens are necessary but it is also required that planned and well-organized structuring programs are undertaken, keeping in view the need for environmental concerns, traffic management, soil erosion risks, and other demographic threats that may arise due to non-planned construction activities along the coastlines.

Global construction companies need to make their presence felt in Turkey

Thus, the main objectives, according to this study could only be gained if these development companies are able to create the right environment and financial strengths needed to sustain a large scale influx of FDI into the country to foster building planning and development in this county and also seek and persuade the deployment of real estate funds from global Turks settled abroad in business or industry. Cost overruns and abnormal delays in construction also need to be avoided by setting up local-global property management companies that could liaison with municipal and local bodies for speedy and efficient construction of second homes throughout Turkey.

Appendix 1

Number of households by ownership status of housing units

Appendix 2

Questionnaire for Customers

Foreign real estate development companies need to feel the pulse of customers in Turkey. For this reason, the following questionnaire would be distributed to them either through personal interviews or through an online questionnaire method in far-flung areas.

Find out the main problems of customers

How foreign real estate investment companies influence customers choice

- Your Name?

- Your Age?

- Gender?

- Your residential address? _______________________________

- What type of dwelling do you live in?

- Dwelling blocks

- Multi-unit apartment

- Condominiums

- Length of stay? _________

- Is your construction through a second home foreign estate Investment Company?

- Yes

- No

- Are you a member of any second home foreign estate Investment Company?

- Yes

- No

- If no, why not?

- If yes, what do you feel about the functioning of a second home foreign estate Investment Company

- What are the problems in your Multi-unit dwelling?

- High rate of service charge/management fee

- Lack of clarity in decision making

- Lack of fiscal control

- Service charges not being paid

- Inefficient management agent

- Management company controlled by the developer

- No problems

- Others (please specify):

- What is the amount of management fees and service charges in 2009? ______________

- When the apartment/house was bought? (Please indicate the year) and its purchase price? Year ___________: __________ for __________

- What are the benefits derived from residing in a development administered by a good management company?

- What information you had sought when you decided to buy this property? What are the guidelines, prospective buyers all over the globe should look out for?

- Before purchasing: _______________________________________________________

- Upon taking up possession and ownership _______________________________________________

- When resale is being made _____________________________________

- Your opinion as to how mortgage companies could play a better role in Mortgaging property in Turkey? ______________________________________________________

- Any other comments? ______________________________________________

- How global property development companies could positively affect customer’s behaviour? ______________________________________________

- Could you suggest methods by which global real estate companies could play a larger role in promoting Turkey as an ultimate second home development destination in the Mediterranean, given its salubrious climate, warm people, and proactive government?

Appendix 3

Decision model

Reference List

Background note: Turkey: profile: economy 2009, U.S. Department of State: Diplomacy in Action. Web.

Background note: Turkey: profile: geography 2009, U.S. Department of State: Diplomacy in Action. Web.

Cirik, E 2007, Turkey’s tasty real estate market, Business Week. Web.

Clarke, K 2006, Crossing over Turkey and the European Union, Harvard International Review, vol.27, no.4, pp.13, Harvard International Relations Council, Inc. Web.

Guy, C 1994, The retail development process: location, property, and planning, Routledge.

Improving: property development 2009, BBC Home. Web.

Inflation report 2008-I n.d., Central bank of the Republic of Turkey. Web.

Investment analysis: most expensive cities in 2008. 2008, Global Property Guide. Web.

Investment in Turkey: foreign direct investment law: principles concerning foreign direct investments 2003, Turkish Embassy-London: Office of the First Economic Counsellor. Web.

Investment in Turkey: FDI statistics 2008, Turkish Embassy-London: Office of the First Economic Counsellor. Web.

Is Turkey ready for the mortgage system? 2006, IFLR: International Financial Law Review: Clear Thinking for Bankers’ Counsel. Web.

A number of households by ownership status of housing unit n.d. Web.

Oxford Business Group 2009, The report: Turkey 2009, 7th edn, Oxford Business Group.

Reed, R, Wilkinson, S, & Cadman, D 2008, Property Development, 5th edn, Taylor & Francis.

Turkish economy 2009, All about Turkey: With Tour Guide Burak Sansal. Web.

Turkey news: Turkey provides a ray of hope 2007, HHI: Henderson Homes International. Web.

Turkey news 2007, HHI: Henderson Homes International. Web.

Turkey: overview: Turkey-pause for breath? 2008, Global Property Guide: Residential Property Data. Web.

Turkey overview: Turkey- pause for breath 2008, Global Property Guide. Web.

Turkey property news: Turkish delight 2008, Home in Turkey. Web.

Turkey real estate: Turkey property for sale 2009, Turkey Real Estate: Turkish Vacation and Holiday Property for Sale. Web.

Turkey: selected issues: box 2. Examples of mortgage market liberalization and mortgage growth 2007, International Monetary Fund. Web.