Introduction

Strategic management is a vital organizational function that incorporates a detailed process of formulating and implementing plans and policies for achieving goals and objectives. The retail industry is influenced by several factors that may result in uncertainty, especially from a business’ macro-environment. Therefore, it is mandatory for managers to examine the competitive landscape, internal structure, and financial set-up of a company to ensure success in the future (Adams et al., 2019). Best Buy is an international enterprise that enjoys the benefits of incorporating tactical approaches to its administrative activities. Strategic leadership approaches are imperative because they provide the groundwork for decision-making, proper allocation of resources, evaluation of performance, and understanding of the key aspects of a business environment. This paper explores the history, industry structure, setting, competitor composition, and financial analysis of the American retailer Best Buy while also offering recommendations for its strategic growth.

History of Best Buy

Best Buy is an American company operating in the retail industry specializing in selling consumer electronics and appliances to its customer segment. World’s renowned business mogul Richard M. Schulze founded the enterprise in 1966 with other colleagues where it started operating as Sound of Music in Minnesota (Wells & Ellsworth, 2018). It acquired Kencraft Hi-Fi and Bergo organization in 1967 in a bid to increase its operations. As the outlet continued to grow, Schulze expanded its product catalog, increased the size of its premises to superstore scopes, and rebranded it as “Best Buy.” In 1985, the retailer went public and was listed on the NASDAQ stock exchange to raise funds for its growth (Wells & Ellsworth, 2018). In 2001, Schulze acquired Future Shop, a company located in Canada which operated as a service unit.

Strategic growth and development are vital for any corporation planning to penetrate geographic barriers for international presence. As of 2003, Best Buy stores in the United States had exceeded the 600-mark, and the retailer launched its first global sourcing agency in Shanghai (Faulds et al., 2018). The following year, the syndicate contracted Virtucom Group to improve its website and manage its online content. As it continued to extend its mergers and acquisitions, Best Buy a significant number of shares in Jiangsu Five Star Appliance organization, the fourth leading domestic device and electronics seller in China. During this time, the business had already established a dominant presence in its industry. A significant part of its growth occurred in 2010 when it launched its first UK store in Thurrock. It also had a joint venture with The Carphone Warehouse, which ensured operations in entire Europe (Faulds et al., 2018). In 2011, it disbanded all its stores in China to entirely focus on its Five Star Model with China’s leading consumer electronics retailer (Wells & Ellsworth, 2018). Today, Best Buy is one of the world’s leading enterprises, having established a global presence in several countries.

Industry Analysis

In strategic management, market analysis is imperative since it helps managers gain insight into the forces shaping a segment. Michael Porter pioneered a diagnostic framework that has been significant in the field of business. The analytical industry tool incorporates several elements such as consumer and supplier power, the threat of new entrants and substitutes, and the competitive landscape to achieve its purposes (Adams et al., 2019). Therefore, this model can also be applied to have a comprehensive view of the influences shaping Best Buy’s competitive environment.

Substitute Products

Alternative commodities encompass businesses offering similar products to the customer segment. Therefore, Best Buy has a strategic advantage over its rivals since it has the opportunity of ensuring superior performance in the electronic retail segment (Hess, 2017). The threat associated with substitutes is considered low since few enterprises are offering similar consumer commodities. For example, online sellers are regarded as alternatives, and as such, they pose a threat to Best Buy’s long-term profitability. However, this company had managed this competitive pressure by availing online purchase options to the customers, as seen in 2018 when it generated a significant amount of revenue from internet-based orders (Wells & Ellsworth, 2018). Moreover, the retailer has also offered competent in-home consultants for the clients who can provide them assistance with their purchase decisions. In essence, this element of Porter’s industry tool is vital because it helps the company improve its pricing strategies.

Buyers’ Power

The customers’ influence explains the extent to which they control the prices of products in the market. In the case of Best Buy, this influence can be considered low, and in particular, its target market is individuals opting for electronics at a relatively low price (Hitt & Duane Ireland, 2017). This group of people is also price sensitive, suggesting that the American company cannot charge high prices for its commodities. The customers would be compelled to look for other options suppose the syndicate charges premium fees. However, since the industry does not have a wide range of options, the power of consumers remains low, bolstering Best Buy’s position in the market.

Suppliers’ Power

In this industry, the suppliers can moderately influence the pricing decisions of Best Buy. The changes in market crescendos can play a crucial role in shaping the suppliers’ control since an increase in companies producing electronics in China has given the manufacturers options in deciding on the required vendor (Hess, 2017). However, the American retailer has developed criteria for selecting merchants who adhere to its standards of ethics and fair treatment of workers. Examples of such parties are Samsung, Dell, Apple, and many others, which supply at least half of the products available in its warehouses.

New Entrants

New companies will have to accomplish various processes to penetrate the retail electronics sector successfully. Therefore, the threat posed by new enterprising players is considered low due to several reasons. For example, opening a business in this segment requires large capital funds to buy electronic commodities which may not be available. An efficient logistics and inventory management model are also essential for venturing into this industry, making it difficult for firms with a limited budget (Grimmer et al., 2017). In essence, Best Buy is utilizing this opportunity to improve its market share in the United States, Mexico, and Canada.

Competition

Businesses are always vigilant, especially in studying the strategies and techniques adopted by their competitors. In the case of Best Buy, this threat can be rated as low due to several reasons. The company’s environment comprises a few retailers such as Amazon and Walmart since they have a significant market share. Both of these corporations have a chain of stores selling consumer goods to customers.

PESTEL Analysis

The United States political environment has posed several risks to the operations of Best Buy. In the previous years, the Trump administration intensified the trade war between the US and China, thereby affecting the retailers operating in this region. In 2018, the former president levied trade tariffs on commodities imported from China which affected a wide range of items, including consumer electronics (Hess, 2017). The company’s most business functions are in America, where it has been affected by an economic downturn. As a result, it faces several challenges where customer behavior has dramatically changed due to this commercial slowdown. While these elements of the surrounding may come with some opportunities, they have acted as a barrier to the growth of the business.

The United States’ social environment has also had trends influencing the customers of Best Buy. For example, an emerging group of consumers is shifting their inclinations towards experiences rather than purchasing tangible products. Such developments in the market have affected the retailer, especially in its profit-making avenues. In addition, technology has enabled the American syndicate to improve its innovative strategy in several ways. For example, it has leveraged data analytics for inventory management. Big data analytics is an exceptional way of enhancing a firm’s operational efficiency and customer experience by utilizing transaction logs and surveillance cameras to drive sales (Ritti et al., 2016). Best Buy has successfully exploited this expertise to segment its customers with an alliance with ShopSavvy. In essence, technology has generally helped this retailer to improve its operations in the industry.

Best Buy’s legal environment incorporates several protocols and guidelines aimed at improving its operations. It has corporate procedures and policies intended to advance its relationship with staff members, suppliers, and consumers. Moreover, it develops equal chances in all segments while adhering to state, federal, and local governments’ regulations. Furthermore, the retailer’s ecological landscape incorporates some initiatives for sustainability and procedures for addressing climate change problems (Hess, 2017). It launched a program referred to as Greener to minimize energy costs, and disposable wastes and provide the customers with sustainable products. In essence, both the retailer’s legal and environmental landscape have helped it improve its strategic goals.

Internal Company and Environmental Analysis

Best Buy have several strengths that improve its competitive advantage over its rivals. For example, it is the largest consumer retailer benefiting from economies of scale. Moreover, it also has numerous brick-and-mortar stores, which improves its marketing strategy. Due to its massive size, this syndicate can negotiate better deals from the suppliers. Its second core capability is that it has a reliable management team. Hubert Joly, the incumbent Chief Executive Officer, is a knowledgeable leader, having brought several enhancements to the corporation. According to various researchers, the retailer’s executive management has the experience and track record required to implement its shift plan (Hill & Jones, 2012). For example, it managed to record profits in its financial year ended 2017 when it made losses in March 2012 (Hess, 2017). The third core capability of this corporation is its strategic acquisitions which have enabled it to expand since its inception. In 2018, it obtained Great Call, and in the following year, it bought Critical Signal Technologies, which facilitated its initiative of penetrating the senior health segment.

However, regarded of its core resources and capabilities, this company also has several weaknesses. For example, its over-reliance on the United States market has limited its chances of profitability. Generally, the retailer has approximately 1231 stores internationally, but approximately 75% of these are located in the US (Hess, 2017). The second weakness is that it over-depends on retailing electronics to generate income. The technology sector is constantly changing, which intensifies the risk in this business sector. Lastly, as this corporation continues its strategic expansion, increasing inventory levels have become a challenge to manage. Therefore, its administrative team should incorporate several strategies to handle the risks associated with this problem.

Best Buy’s business environment has brought several growth opportunities. For example, it has the chance to expand in emerging economies since most of its brick-and-mortar stores are situated in North America. It can also bolster its market presence by opening more outlets so that the customers can easily access its products. Moreover, by diversifying its product portfolio, the company will increase its profits (Hill & Jones, 2012). Therefore, it should focus on Senior Health, as indicated by a report by Morgan Stanley. The retailer is positioned to gain from attending to the health needs of seniors since it has acquired Great Call. Best Buy can therefore utilize these opportunities available to increase its market share on a global scale.

Regardless of the opportunities, the company is also exposed to a number of threats. For example, it faces aggressive competition from other retail giants. It operates in the same segment as Amazon and Walmart, the companies that dominate and have captured the most significant portion of the market share (Wells & Ellsworth, 2018). Another factor to consider is the emergence and increase in counterfeit products. Since Best Buy primarily relies on selling electronics, it is most likely to be affected because the digital age replicas are of high quality and affordable. Lastly, as online gaming is gaining popularity, the retailer will find it hard to sell consoles such as the PlayStation, Xbox, and Nintendo due to the decrease in demand (Adams et al., 2019). This company can, therefore, consider expanding its product catalog to prevent the consequences of these threats.

Value Chain Analysis

Best Buy’s inbound logistics enable it to develop reliable relationships with its suppliers to promote receiving, storing, and distributing its wares. In particular, this function allows this retailer to access raw materials while utilizing them to complete the production process. Its operational activities include packing products and assembling and testing equipment to identify possibilities of malfunctions. Moreover, the retailer’s outbound logistics involve the initiatives which transport the product to the end-user via different channels. Such activities include warehousing, scheduling, order processing, and transportation to the destination (Ritti et al., 2016). Best Buy’s marketing and sales process involve promotional acts, channel selection, and establishing relations with intermediaries. Under its services, the retailer participates in pre-sale and post-sale initiatives. Currently, consumers consider after-sales services a vital aspect of marketing and as such, this company engages in such activities to improve its brand image and reputation.

Competitor Analysis

Best Buy operates in the United States, also the home country, to several other dominant brands. Amazon is a multinational organization operating in the same environment as the retailer above, and it specializes in providing customers with a variety of products and services such as cloud computing, e-commerce, digital streaming, and many more (Wells & Ellsworth, 2018). It is one of the world’s largest corporations holding a significant portion of the market share due to several strengths. First, it primarily relies on differentiation, cost leadership, and focus, giving it a strong brand and rapid technological innovation, particularly in online services (Ritti et al., 2016). Moreover, it also utilizes exceptional logistics and distribution systems which has enabled it to achieve enhanced consumer fulfillment, further improving its competitive advantage. However, Amazon’s strategies have also been limited due to several weaknesses. For example, its business model has slowed its profit-making capabilities even though it dictates high volumes and considerable revenues. Moreover, it has not fully invested in emerging markets, thereby not gaining from the high economic growth of these financial systems.

Walmart is also an American-based retail giant managing several business units such as grocery stores, hypermarkets, and departmental outlets. Moreover, it is the largest retailer in the world, having employed more than 2.2 million staff members and operating more than 11,510 stores globally (Hess, 2017). Known for its cost-leadership strategy, this company has several strengths accounting for its international dominance. Its global brand recognition is one of its leading strong points, enabling it to penetrate new markets and win other customers. Moreover, its brand value has also contributed to gaining new consumer segments. Walmart has a superior supply chain model, utilizing advanced technologies for inventory management and controlling the flow of items from the manufacturers to its warehouses.

However, its strategies have also limited its operations and expansion process. For example, several surveys have reported that the retailer has been engaged in the ill-treatment of their workers. In particular, there have been cases of inequality and poor working conditions in its stores. While its cost-leadership approach has enabled it to remain dominant, this tactic has limited its profit margins because it reduces selling prices, which ultimately impacts its profitability. The company should therefore consider incorporating new strategies to improve its competitive advantage.

Financial Analysis

- Quick ratio = (Current Assets – Inventory)/Current Liabilities

- Current – inventory = $5.65B

- Current liabilities = $7.12B

- Quick ratio = 0.79

This metric is vital for accounting managers to evaluate the position of a company in handling its obligations. In particular, a decreasing quick ratio suggests that a corporation is bankrupt and strains to increase sales, cover costs, and collect receivables. However, a rising figure implies that an enterprise is experiencing consistent, remarkable growth and it can also satisfy its commercial debts. Therefore, in the case of Best Buy, its quick ratio shows that the company was not able to settle its current liabilities in the short term.

- ROA = (Net income/average total assets)

- Trailing Twelve Months Net income = $1.23B

- Total assets = $13.86B

- ROA = 9.00%

This measure plays a significant role in examining a company’s investments and profitability. It indicates the uniformity of its capital spending in generating value, thereby rendering it a vital output system of measurement for a company. Best Buy’s is 9.00% for the year ended October 2017, shown in the table above. Generally, a ROA of at least 5% is considered good, and as such, the retailer is effective in earning more money on fewer investments.

- Return on Common Equity (ROE)

- ROE = net income/shareholder’s equity

- TTM Net income = $1.23B

- Stockholder’s equity = $4.71

- ROE = 27.73%

ROE is used to evaluate the profit a company amasses from its shareholders’ equity. It is crucial for investors since it allows them to gain insight into a company’s profitability from its investments. Best Buy’s 27.73% suggests that the retailer is increasing its profit-making ventures without much capital. Moreover, it also describes how well the syndicate’s management deploys shareholder funds. Generally, it is one of the most significant options which venture capital should consider in the retail segment.

- P/E = (Share price/Earnings per share)

- Share price = 40.03

- Earnings per share = $3.83

- P/E = 10.45

A firm’s price/earnings ratio defines the correlation between its share price and its annual net gains. It is vital for shareholders to appraise the company’s stock market value as compared to its income. Therefore, an increased ratio implies a rising demand since the stockholders expect an increase in growth. Best Buy’s PE of 10.45 means that it is cheap and that the investors are not expecting any return on investment.

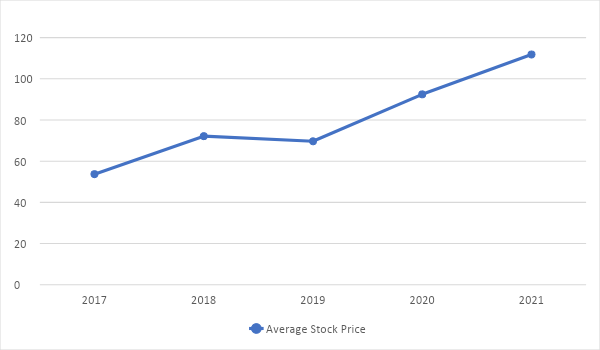

Stock Price Trend

The line graph above shows the stock price trend for Best Buy since January 2017. Generally, the figures have been increasing ever since and it implies that more people have been interested in purchasing the retailer’s stocks. In essence, if many individuals intend to buy a company’s shares than sell it, then its price increases. In contrast, if a majority decides to sell its stock, then its price would fall.

Benchmark Comparison of Best Buy Against its Rivals

Table 1. Benchmark Comparison

Best Buy has the highest quick ratio of Amazon and Walmart. This implies that the retailer has more liquid assets to meet its short-term debts. However, the figures for these three companies are below the required ratio of 1 for them to utilize their immediate marketable assets to satisfy their liabilities. It also leads with a 9.00% Return on Total Assets against its primary competitors in the industry. According to this metric, Best Buy is effective in turning its financial resources and investments into net income. A high ROA figure means that the corporation is utilizing its investments to earn more money.

Based on Return on Common Equity, Best Buy’s 27.73 is the highest as compared to its key competitors. Generally, shareholders are always searching for corporations with high and growing ROE which renders the consumer electronics company a viable option for investment. Under the PE ratio, Amazon holds the most significant portion above its core rivals. With a price-earnings percentage of 166.64, this company’s share value is considered most expensive than both Walmart and Best Buy. This fact implies that its shareholders are paying more money for its stock as compared to its returns.

Du Pont Analysis

Table 2. Du Pont Analysis (2017)

Table 3. Du Pont Analysis 2017

Utilizing the DuPont model enables an investor to realize that although Best Buy has the highest return on equity ratio than its competitors, a significant percentage of Amazon’s ROE comes from its equity multiplier. The venture capitalist also understands that a considerable portion of Amazon’s ROE results from its 2.5% net profit margin. Therefore, when considering investment options, the shareholder will choose Amazon as the appropriate selection.

Recommendations

Based on the attractiveness of the consumer electronics segment, Best Buy should consider expanding its product portfolio to prevent the various cases of market risks. Generally, different companies operating in this industry use different strategies to generate profits. Considering the results of the strengths, weaknesses, opportunities, and threats and industry analysis models, this retailer should consider incorporating a cost-leadership approach to attract new groups of clients while also increasing its market share. Moreover, its sources of competitive advantage emanate from its globally recognized brand, reliable management team, and its strategic acquisitions. While it remains the leading retailer in the world, there are several threats to its competitive edge. For example, the emergence of high-quality counterfeits has posed a significant challenge to its differentiation strategy. Therefore, the retailer can manage this by improving its research and development approaches. In essence, the company should consider increasing its brick-and-mortar stores to easily reach to the end-users. As a result, the company will find it easy to penetrate other emerging markets while eliminating its over-dependence on the US market.

Conclusion

This paper has explored the vital aspects which constitute Best Buy’s strategic approaches to excellence. This retailer is a consumer electronics seller operating in the United States. Therefore, Best Buy should consider its growth opportunities for further expansion by utilizing its core resources and capabilities to capitalize on its threats. In essence, by revamping its generic competitive strategy, the corporation will find it easy to manage its rivalry with brands such as Amazon and Walmart.

References

Adams, P., Freitas, I. M. B., & Fontana, R. (2019). Strategic orientation, innovation performance and the moderating influence of marketing management. Journal of Business Research, 97, 129-140.

Faulds, D. J., Mangold, W. G., Raju, P. S., & Valsalan, S. (2018). The mobile shopping revolution: Redefining the consumer decision process. Business Horizons, 61(2), 323-338.

Grimmer, L., Miles, M. P., Byrom, J., & Grimmer, M. (2017). The impact of resources and strategic orientation on small retail firm performance. Journal of Small Business Management, 55, 7-26.

Hess, E. D. (2017). Best Buy Co., Inc. Darden Business Publishing Cases.

Hill, C., & Jones, G. (2012). Essentials of strategic management (3rd ed.). South-Western/Cengage Learning.

Hitt, M., & Duane Ireland, R. (2017). The intersection of entrepreneurship and strategic management research. In D. L. Sexton & H. Landström (Eds.), The Blackwell handbook of entrepreneurship (pp. 45-63). Blackwell Publishers.

Ritti, R., Levy, S., & Tocher, N. (2016). The ropes to skip and the ropes to know (9th ed.). Chicago Business Press.

Wells, J.R., & Ellsworth, G. (2018). Reinventing Best Buy [PDF Document].