Abstract

The main objective of this research study is to estimate and analyze the money demand function in Saudi Arabia applying two different approaches. The conventional way is based on non-oil GDP measures for income. The second, the consumer demand theory, is based on microeconomic and aggregation theory which involves monetary assets as durable goods, which are directly impeded in the household utility function. To prove the validity of the results Simple-Sum (M1, M2) and Divisia (M1, M2) are used. Two techniques, Cointegration and Error-correction and Back Propagation Neural Network are employed to estimate the money demand function. To analyze the different monetary aggregates, the cointegration method is used. The paper uses Divisia monetary aggregates M1 and M2 outperformed the Simple-Sum M1 and M2 for long-run money demand function analysis. Changes in interest rates exert obvious pressure on speculative holdings of cash balances or those simply having a strong taste for highly liquid asset portfolios. More attractive yields encourage ventures farther out on the liquidity spectrum. The money demand function affects desired ordinary transactions balances. At higher interest rates, firms have a greater incentive to invest funds that have piled up under the aegis of favorable cash flows; funds awaiting dispersal later in the receipts-disbursements cycle. Inconvenience and frictional expense seem less important with the increased opportunity cost of holding cash. Similarly, even if payments periods were unaffected by changed interest rates, households (et al.) would be spurred by higher interest rates to place idle funds in securities while awaiting the active phase of their expenditure cycle. The results obtained from the consumer demand theory approach indicate a significant role for the opportunity-cost variable that conforms to the theory when Divisia dual price is used as the opportunity-cost variable in the money demand function.

Introduction

Money market activity and the lightning speed at which funds can now quit countries has prompted many commentators to question its worth and, in light of heightened vulnerability to foreign investor sentiment, to emphasize its perceived dangers. In particular, strong objections to the ever-increasing trend of financial globalization have been raised because the governments of the economies most affected have ceded their economic sovereignty to international investors. Accordingly, it is said that the priorities and policy choices facing national governments can no longer be considered and implemented without first taking possible foreign investor reactions into account. Yet it can be shown that financial globalization tends to improve, rather than worsen, a nation’s overall economic welfare and that having an internationally integrated economy provides a safeguard against irresponsible growth limiting and inflationary policies.

Over recent decades, funds have mostly flowed across country borders as bank lending or to acquire debt instruments, although considerable foreign equity investment has also occurred, especially after the privatization of state enterprises in many economies. The macroeconomic significance of international financial flows and external payments imbalances critically depends on prevailing exchange rate arrangements, as well as the extent of official restrictions in the form of capital controls. To put the existing global financial system in a historical context, it is necessary to consider the evolution of the international monetary and financial system.

The paper aims to apply linear and non-linear techniques for estimating the money demand function in Saudi Arabia. Special attention is given to the theory of Divisia Monetary Aggregation. The research is based on the empirical methodology which includes a model that is consistent with the principles of microeconomic and aggregation theory. The case study is constructed by the index numbers and methods derived from economic theory. Also, a system of equations that models the wealth holder’s allocation of total expenditures between money and non-money assets are used. The Johansen cointegration technique and error correction models are used to determine and analyze the long-run and short-run concepts of the demand for money in Saudi Arabia in both approaches.

In Saudi Arabia, the fundamental causes have internationalized production and finance – improvements in technology and the liberalization of markets for goods, services and savings. Technological advances in electronics have greatly reduced the costs of communication and computing, conquering the natural barriers of time and distance. Since that time, the invention of computing and new ways of instantly transmitting information around the world in print forms, such as by facsimile, email and the internet have reconstructed international communications.

More generally, computers have revolutionized the processing and dissemination of information, its use greatly encouraged by the fact that since the mid-1970s the cost of computer processing has been falling by an average of 30 percent per year in real terms. Within the open economy models, some authors have recognized a role for the current account in terms of its implications for the international investment position and hence for financial wealth holdings. The intertemporal approach to foreign investment provides a basis for introducing offer curves, usually only employed in the pure theory of international merchandise trade, to model the external accounts. Casting the intertemporal approach in terms of offer curves serves to highlight that, contrary to the approaches to the external accounts. Despite popular assumptions to the contrary, while respecting traditional beliefs and values, Saudi Arabia has been able to effect substantive change and reform. Modernization is not being questioned; false models and false friends are being questioned. Here it is assumed that the substitution effect on present consumption of an interest rate change at least offsets any income effect.

Even if the income effect dominated the substitution effect, however, offer curves can still be constructed, provided the extra investment stemming from the lower interest rate exceeds any additional consumption in the first period. In parallel with orthodox international trade theory, the offer curves demonstrate that when foreign investment is allowed and capital markets are fully integrated, a common price, the return on capital, Foreign investment confers welfare gains if economies’ real interest rates would be different without trade. Economies would not engage in intertemporal trade, however, irrespective of the extent of capital mobility, if domestic interest rates were identical in autarky.

Linear and non-linear techniques are used to analyze money supply and determine current monetary issues in Saudi Arabia. The abolition of official restrictions governing cross border transactions over recent decades has transformed the financial markets of many economies from being heavily regulated and segmented, into ones that are lightly regulated and more internationally integrated. Access to international financial capital and services has increased greatly which has boosted borrowing and lending opportunities and enhanced capital mobility. Whereas much of the foregoing analysis focused on international flow magnitudes, this section shifts attention to aggregate stocks to model the stock adjustment effects of international financial liberalization.

In particular, it shows how financial globalization may affect a nation’s external indebtedness position, as well as the value of its capital stock and wealth. In a certain world with a competitive capital market and no transactions costs, the present value of firms’ investment is also the market value of the firms’ common shares, which in this simple model equals the value of the economy’s assets. Optimal investment decisions by firms maximize the net present value of investments and also maximize the value of national assets. The paper consists of an introduction, five chapters and a conclusion.

Chapter One: Overview of Saudi Arabian Economy

As a country, Saudi Arabia possesses three distinct characters; as a strong and independent Arabic country; as the country that provides a home for the two holiest Muslim cities; and as the single largest producer of oil in the world. On the economic front, it is the oil reserves of the country, which have turned this desert nation into one of the strongest economies of the world. It was due to the relentless efforts of the House of Saud from the year 1902 until 1932 that unified the tribes of the desert nation against the colonial powers of the United Kingdom and France. These efforts led to the creation of Saudi Arabia as an independent nation under the guidance and steering by the House of Saud as the country’s royal family.

Many of the prominent Saudis have sent their sons to the United States and Western countries to study and these people have brought Western economic thoughts back into the country. With the economic ideas brought in by these people, the extremely religious society has turned slowly into one of the progressive economies of the world. This chapter briefly outlines the background of the Saudi economy and the financial system prevailing in the country along with the monetary policies implemented in the country.

Background and Overview of the Economy

With a view to encourage the inflow of foreign direct investments into the country, the government set up the Saudi Arabian General Investment Authority in the year 2000. However, the country continued its restrictive policies in respect of certain industries. As an integral part of the economic reforms instituted by the country, the government decided to get the accession into the World Trade Organization (WTO) in the year 2005. These steps taken by the Saudi government has accelerated the economic growth to reach an average of over 5 percent in the last few years. The economic growth is in tandem with the increase in demand for oil and other petroleum products throughout the world. Because of the economic growth, the country has also become one of the active investors in other countries of the world.

Despite the rapidity of the economic growth, there are major challenges that the country faces; like the aquifer depletion and the increased cost of water supply. Continued dependence on oil and political instability in the Middle East are some of the other issues that draws the attention of the country away from the economic progress. Demographic factors also cause serious concern in the economic outlook of the country with 40% of the population with an average age of 15 or less, low education and higher unemployment levels. These issues are likely to result in major social unrests.

The Saudi Arabian economy is oil-based with the government having a strong control over major economic activities of the country. The country is in possession of more than 20% of the world petroleum reserves and is the largest exporter of oil mainly to United States and many other countries. The country is an active member of Organization of Petroleum Exporting Countries (OPEC), and plays a leading role in the activities of OPEC. As of May 2008 75% of Saudi’s budget revenues is contributed by petroleum sector and 45% of the Gross Domestic Product (GDP). During the same period, 90% of the export earnings are from petroleum exports. The country has an expatriate population of about 5.5 million workers who contribute to the development of the economy.

Increase in oil prices and the macroeconomic and structural reforms undertaken by the country enabled Saudi Arabia to accelerate the momentum of its economic growth. The economic reforms measures were undertaken by the government to support the comprehensive and sustainable economic development in all the economic and social areas of the country. The continued increase in oil prices until mid 2008 coupled with the supportive actions initiated by the government witnessed an all round improvement in the performance of all sectors of the economy.

The overall GDP registered a growth of 7.1 percent in current prices (Riyals 1.4 trillion) and 3.4 percent in real terms (Riyals 813.0 billion) for the year 2007. There was a surplus in the State budget to the extent of 12.3 percent of GDP (Riyals 176.6 billion) as against the surplus of 21 percent (Riyals 280.4 billion) for the previous year. The country had a very favorable balance of payments position for the consecutive ninth year with a surplus of Riyals 356.3 billion registering a decline of 4.0 percent as against that for the year 2006. Some of the economic indicators are presented in the table below:

Selected Economic Indicators

Source: Annual Report of SAMA

Economic Growth

Central Department of Statistics and Information (CDSI) has reported a growth in the GDP at current prices of 7.1 percent for the year 2007 while, the non-oil sector grew by 4.5 percent to 840.4 billion Riyals for the same year. The contribution by non-oil sector contributes about 45.6 percent of the total GDP. The growth in non-oil private sector GDP was in the region of 8.0 percent at 403.8 billion Riyals as compared to that of government non-oil sector growth of 4.2 percent, which in real terms accounted for 228.9 billion Riyals. The oil-sector registered a growth of 8.0 percent with 778.4 billion Riyals constituting 54.4 percent of the total GDP at current prices.

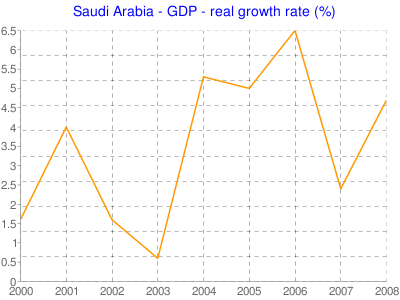

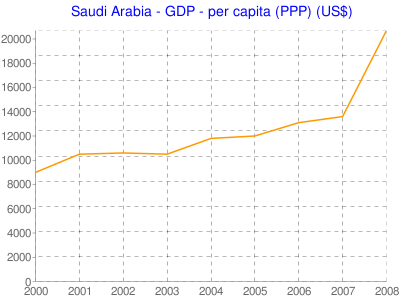

The real growth rate of GDP and the per capita GDP for the country is presented in the following tables and diagrams:

GDP – Real Growth Rate

Per Capita GDP

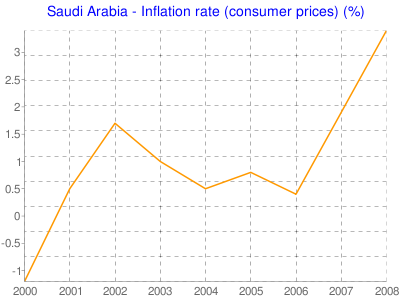

Inflation Rates

The general cost of living for all the cities registered an increase of 4.1 percent in 2007 (1999=100) and the wholesale price index showed an increase of 5.7 percent for the same year. There was an increase of 15.2 percent in the total supply for goods and services in the year 2007. At the same time, the total demand for goods and services registered a growth rate of 12.9 percent (Saudi Arabian Monetary Agency, 2008).

There was an annual increase of 40.9 percent in the general share price index to reach the position of 11,176 points as at the end of the year 2007 as compared to 7933.9 points as at the end of 2006. Market capitalization of issued shares increased to the level of Riyals 1949 billion in the year 2007 from the position of 1,226 billion as of 2006 (Saudi Arabian Monetary Agency, 2008).

Banking sector registered an impressive growth in the year 2007 with the rise in the deposits to 21.4 percent to Riyals 717.6 billion. This increase compares with the increase of 20.8 percent for the year 2006. Bank deposits accounted for 90.9 percent of aggregate money supply at the end of the year 2007 as against 89.5 percent as at the end of the year 2006 (Saudi Arabian Monetary Agency, 2008).

According to the estimates presented by Central Department of Statistics and Information, the population of the country stood at 24.24 million in the year 2007, out of which Saudis were 17.7 million constituting 73.0 percent of the total population. Non-Saudis were about 6.5 million representing 27.0 percent of the population. As per the statistics provided by the Ministry of Labor for the year 2007 the total labor force working for the private sector was about 5.8 million and out of this 13.1 percent only were Saudis and the balance of 86.9 percent represented non-Saudis. This shows the excessive dependence of the private sector on the expatriate labor force.

However, the statistics presented by Ministry of Civil service indicate the total number of work force working for the government at 830,000 of which 91.7 percent are Saudi nationals and non-Saudis are a meager percentage of 8.3 only. The Saudi male workers working for the government of the Kingdom were 508,000 and the Saudi female workers are 253,000 (Saudi Arabian Monetary Agency, 2008).

On the fiscal side the actual revenue and expenditure for the fiscal year corresponding to the calendar year 2007 has indicated a decline of 4.6 percent in the actual revenues at Riyals 642.8 billion as against the previous year revenue of Riyals 673.7 billion. However, the actual expenditure has gone up by 18.5 percent during the fiscal year to Riyals 466.2 billion whereas the expenditure for the year 2006 was Riyals 393.3 billion. Actual surplus was in the region of Riyals 176.6 billion for the year 2007 as compared to the surplus in the year 2006 of Riyals 280.4 billion. Oil revenues accounted for 87.5 percent of total revenues in the year 2007. The current account surplus was Riyals 356.3 billion in the year 2007 (Saudi Arabian Monetary Agency, 2008).

Financial System in Saudi Arabia

Medium term strategies in respect of economic diversification and acceleration to the economic growth are greatly facilitated by the financial reforms undertaken by any economy. The financial system of Saudi Arabia is quite diverse as compared to that of other economies in the region. Considering the international standards, the banking sector in Saudi can be termed as modest in size with the bank deposits constituting 90.9 percent of the money supply as at the end of the year 2007. The commercial banks claim in the domestic private sector amounted to 557.9 billion Riyals as at the end of the year 2007 recording a growth of 21.4 percent.

The financial system operating in the economy of Saudi Arabia is bank centric with the assets of commercial banks account for 1075.2 billion Riyals which increased by 24.9 percent in the year 2007. All the commercial banks are licensed to operate internationally and they can manage mutual investment funds on their own. Public ownership is found to be extensive. Five banks had more than 20 percent of the holding by public and one bank had the public holding of more than 70 percent. There is participation from the foreign banks and the participation is through significant equity contributions. Six banks are found to have more than 20 percent of foreign equity.

In terms of assets size the non-bank portion of the financial system is dominated by quasi-financial institutions of which the largest are represented by three is Autonomous Government Institutions (AGI). These AGIs dominate the primary market for the government securities. They are authorized to hold wide range of domestic and foreign investments. Saudi Arabian Monetary Agency (SAMA) the apex banking institution of the country manages some of these institutions. There are specialized credit institutions extending interest free loans to priority sectors like housing, agriculture or specific industrial needs. The operations of these institutions are controlled by board of directors appointed by the Council of Ministers.

The GOSI and the Pension Fund representing the AGIs and the Public Investment Fund (representing specialized credit institution) hold equity ownership in some of the commercial banks. Public Investment Fund has a large ownership in Saudi Commercial Bank. However, the nonbanking financial sector in Saudi Arabia is in the development stage with leasing companies, insurance companies and licensed moneychangers accounting for a meager percentage of less than one in the total financial system assets (IMF Country Report, 2006).

The banking system in Saudi Arabia is regulated by three distinct factors; the banking assets are funded largely by deposits in the nature of low-cost demand deposits that account for more than 40 percent of total deposits. The low cost deposits when used to lend at interest rates comparable to the international level consistent profitability for the banks. Secondly, the excessive dependence on oil revenue sources makes it difficult for the banks to attempt for any risk diversification domestically more particularly credit risk. Diversifying credit risk necessitates a high level of capital requirement and provisioning which deters the efforts of banks in the direction of diversifying domestically. Thirdly, banks work on extremely conservative lending policies.

Such policies prescribe limits for lending to various sectors, limitations on lending to connected parties, prescription of liquid asset ratios, and approval from SAMA for foreign lending and imposing of limits on individual indebtedness. This promotes a managed risk environment and coupled with advanced asset-liability management the banks are able to ensure stability in the financial system. However, the intermediation by commercial banks remains modest only (IMF Country Report, 2006).

The financial system of Saudi Arabia has been structured to have multi-layers expected to play significant role in economic, exchange and regulatory areas. Saudi Arabian Monetary Agency (SAMA) has been placed at the top of the system as the apex institution and SAMA is entrusted with setting the overall monetary policy of the country. Other functions of SAMA include securing the stabilization of the currency value amidst economic openness in exchange transactions and capital flows. SAMA makes use of a number of monetary policy instruments for this purpose. Such policy instruments include setting of the interest rates close to comparable dollar rates for the commercial banks, monitoring and control of foreign assets and introduction of medium-term and short-term government papers to effectively control the budgetary and balance of payments position and to efficiently control the fluctuations in domestic liquidity. SAMA acts as the regulator of all commercial banks, exchange dealers and moneychangers. It is also the depository of all government funds. SAMA disburses funds for purposes approved by the minister of finance for improving national economy (Metz, 1992).

Broad money (M3) consisting of currency outside the banking system and bank deposits recorded an increase of Riyals 129.2 billion representing 19.6 percent and the total deposits stood at Riyals 789.8 billion in 2007. This compares with a rise of Riyals 106.9 billion and the percentage increase was 19.3 in 2006. The increase in M3 was due to growth in bank claims on the private sector. This increased by 21.4 percent. Substantial growth in net domestic expenditure of the government also contributed to the increased broad money situation.

The government increased its expenditure outlay on several development projects and social services during the year 2007. The continued increase in imports that created a large deficit in the balance of payments of the private sector greatly neutralized the impact of the expansionary effect of increase in net domestic government expenditure and the increased claim of the banks on the private sector (Saudi Arabian Monetary Agency, 2008).

Conduct of Monetary Policy in Saudi Arabia

Exchange rate has a dominant role to play in most of the economies of emerging countries than the interest rate mechanism. This is due partly to the lesser development of domestic banking systems in these countries and partly due to the fact that full range of monetary instruments is not prevalent in these countries. The exchange rate influences the transmission mechanism by affecting the aggregate demand through the net exports and by affecting the inflation rate through the pass-through effect.

During recent periods, the monetary policy in the Kingdom of Saudi Arabia has been subjected to the influence of abundant liquidity resulting from higher oil prices. The monetary policies are also influenced by the increased consumer and business lending by the domestic banks. The formulation of monetary policies in the country is subject to meeting the challenge of asset price inflation and providing wide range of financial assets to domestic banks to extend the area of operation of transmission mechanism. There is the increased focus on Islamic financing principles also (Al-Jasser & Banafe).

The monetary policy framework of Saudi Arabia is based on a fixed exchange rate policy. The country uses the exchange rate mechanism as the nominal anchor for keeping the inflation rate low and for facilitating the stability of exchange rate expectations. Due to the linking of the inflation with the exchange rate, there is the increased public confidence in the monetary policy framework. This also enlarges the opportunities for increased inflow of foreign capital for domestic investments. Since the external receipts and payments of the country are predominantly in US dollars the country adopts the policy of pegging the Saudi Riyal against US dollars. Further most of the oil revenues are subject to variations due to changes in world oil demand.

Therefore, the variations in the revenue do not allow the country to adjust the exchange rates according to these variations. To mitigate this shortcoming the government attempts to stabilize the economy by adopting a counter-cyclical fiscal policy. Under this policy, the government strives to keep the expenditures steady in the wake of volatility in the receipts. Hence, the stability of the exchange rate for Saudi Riyal against US Dollar becomes critically important in framing the overall economic policies of the country. US Dollar is therefore the anchor and intervention currency for the Riyal (Al-Jasser & Banafe).

The monetary policy of Saudi Arabia consists of different elements; (i) policy targets, (ii) strategy, (iii) operational framework, and (iv) transmission mechanism. Policy target determines the broad outlook of the monetary policy like for example whether to pursue medium-term price stability or stability in exchange rates. Based on strategies the government determines the levels of interest rates the government wants to achieve over the period. Operational framework enables the government to embark on the ways in which the required interest rate levels can be achieved by using the available instruments like repo rates and adjustment of reserves. Monetary policy transmission mechanism is the process through which the policy decisions are implemented to influence the economy generally and to achieve the policy targets in particular.

The government uses rules targeting inflationary tendency, exchange rate, monetary aggregates and the levels of bank reserve as some of the policy strategies. These strategies have the ability to limit the discretion of the central bank and to enhance its credibility. Through these strategies, the government is able to anchor the expectations of private sector effectively (Al-Jasser & Banafe).

In the Saudi Arabian context exchange rate has been a predominant factor in conducting the monetary policies of the government. In the past reserve, requirements have been the major monetary policy instrument. However, SAMA has not gone in for any changes in reserve requirements since the year 1980. After the passing of the Central Bank Bills in the year 1984,

In an economy controlling its monetary policies through fixed exchange rate mechanisms with perfect asset substitutability as in the case of Saudi Arabia, monetary policy cannot be found to be autonomous. Especially in the context of Saudi Arabia, the oil revenues and their predominant impact on setting the fiscal policy will greatly influence the framing of monetary policies. SAMA has adopted a policy of passive accommodation of system liquidity and that of non-interference with the free operation of the market mechanism. As far as the asset price inflation is, concerned SAMA continues to behave extremely cautious on targeting asset prices due to the reason that asset price valuation has always been a complex phenomenon and is challenging.

SAMA has been using repo rates as the single policy instrument for monitoring the liquidity in the day-to-day system changes and in arriving at the desired overnight rate to the market. Government Development Bonds became a part of the government debt market in the year 1988 and the Treasury Bills were replaced by the Central Bank Bills in the year 1992. Presently SAMA uses the repo rates and reverse repo rates as the effective instruments for conducting the monetary policy of the country. The recently generated budget surpluses have enabled the government to repay longer-dated government debts. However, in order to ensure that the repo rate mechanism is not hampered SAMA takes care that adequate Treasury Bills are in circulation in the market. Whenever there are more speculative activities in the forward market against Saudi Riyal, SAMA intervenes in the forward market by its repo rate policy to contain wide variations in exchange swap points and interest rates. In all respects SAMA maintains the formulation of monetary policy unhindered by its role as debt manager of the government. The monetary policies in general are formulated in response to overall macroeconomic considerations (Al-Jasser & Banafe).

During the year 2007 SAMA continued its endeavour its control on monetary policy aimed to achieve the objective of maintaining stability in domestic prices as well as to maintain the exchange rate for Saudi Riyal. The objective behind the efforts of SAMA is to encourage investments and to increase the competitiveness of the Saudi economy. SAMA had to undertake the challenge of conducting the domestic economic and monetary policies in the direction of harmonizing the spending requirements for development purposes. This is necessary to bring diversification in the economic advancement of the nation and to create more job opportunities. Such policy measures are also aimed at reducing the inflationary pressures.

In order to achieve the required results SAMA increased the repo rate by 30 basis points from 5.20 percent to 5.50 percent during the first quarter of 2007. During the same period the reverse repo rates were raised from 4.70 percent to 5.00 percent by 30 basis points. In the last quarter of 2007 SAMA has reduced the repo rates several times up to 100 basis points to bring the rate up to 4 percent. This action from SAMA was necessary to bring stability in the domestic currency. The statutory deposit percentage in respect of demand deposits of commercial banks was raised from 7.0 percent to 9.0 percent in November 2007 (Saudi Arabian Monetary Agency, 2008).

Plan of Dissertation

In order to make a comprehensive presentation the dissertation is structured to have different chapters. While the introductory chapter discussed the background and the overview of the Saudi economy including the financial systems and conduct of monetary policies in the country, chapter two deals with the theoretical aspects of Divisia Monetary Aggregation. This chapter presents the process of constructing Divisia Monetary Aggregates for Saudi Arabia and compares Simple-sum and Divisia Monetary Aggregates for the country. Chapter three contains a detailed review of the literature on the theoretical aspects of demand for money in general with different approaches to the demand for money explained vividly. Part of this chapter discusses the salient aspects of money demand in the context of Saudi Arabia. Chapter four contains a detailed description of the hypothesized models and the methodology followed for completing this study. This chapter details the process of the two alternative techniques of linear (co-integration and Error-correction) and non-linear (Back Propagation Neural Network) which are used in the estimation of demand for real money in the short and long run money demand functions. An empirical analysis of the methods adopted by the study is presented as chapter five. Few concluding remarks summarizing the objective and accomplishments of the study is presented at the end, which marks the end of the dissertation.

Chapter Two: Divisia Monetary Aggregates

Monetary aggregates are crucial and commonly used as the measure for money in most of the macroeconomic and monetary models. They can be a useful instrument of monetary policy. Moreover, monetary aggregates do help in explaining the behavior of the economic agents. This suggests that constructing appropriate monetary aggregates is crucial. However, the simple-sum monetary aggregates, which are simply summing monetary assets assuming perfect substitution, are the most commonly adopted by central banks around the world; hence, researchers have only those aggregates to use in their studies unless they spend a considerable time to construct their own aggregates.

At least two widely recognized theoretical deficiencies are emphasized in regard to validity of the official simple-sum aggregates. The first criticism concerns the collection of monetary assets comprising aggregates. The simple-sum aggregates are basically ad hoc bundles of monetary assets. Theoretically, to be an optimal aggregate, a monetary aggregate must contain a linearly homogeneous and weakly separable bundle of monetary assets.1 That is, a set of component monetary assets, M, is an optimal aggregate if the elasticity of substitution between any component asset in M and any asset not in M is independent of the quantity of any asset not in M. This restriction implies the weakly separable condition that the marginal rate of substitution between any two assets in M is independent of the quantity of any asset not in M.

The second defect with the simple-sum aggregates is the method used for aggregating over different components. The simple-sum aggregates are created by simply adding together the nominal values of each component included in the aggregate and assigning them an equal (unitary) weight. That is:

where xi is the ith monetary component of subaggregate M1 and n is the number of monetary assets. This form of aggregation assumes that the components are perfect substitutes for each other as money on a one-for-one basis. If this were the case, then the economic agent would hold only the one with the lowest opportunity cost (corner solution case). Furthermore, simple-sum aggregates can not internalize pure substitution effect.

The shortcomings of the simple-sum aggregation technique have long been recognized by economists. Irving Fisher (1922, pp. 29-30) describes the simple arithmetic index (simple-sum index) as follows:

…the most common form of average. In fields other than index numbers it is often the best form of average to use. But we shall see that the simple arithmetic average produces one of the very worst of index numbers. And if this book has no other effect than to lead to the total abandonment of the simple arithmetic type of index number, it will have served a useful purpose.

Milton Friedman and Ann Schwartz (1970, pp.151-152) discussed the simple-sum approach in the following terms:

This (summation) procedure is a very special case of the more general approach. In brief, the general approach consists of regarding each asset as joint product having different degrees of ‘moneyness,’ and defining the quantity of money as the weighted sum of the aggregate value of all assets, the weights for individual assets varying from zero to unity with a weigh of unity assigned to that asset or assets regarded as having the largest quantity of ‘moneyness’ per dollar of aggregate value. The procedure we have followed implies that all weights are either zero or unity. The more general approach has been suggested frequently but experimented with only occasionally. We conjecture that this approach deserves and will get much more attention than it has so far received.”

Furthermore, Barnett (1980) argues that simple-sum aggregates represent the incorrect measurement of the flow of monetary services. In a case of not-perfect assets components, Barnett emphasized the necessary use of non-linear aggregation with different weights attached to each component asset. Barnett (1978, 1980, 1982) provided a theoretical foundation for theoretically consistent monetary aggregation based on the Divisia Index (first proposed in a monetary context by François Divisia (1925)) as a viable alternative to the simple-sum aggregates. His subsequent work proved that weighted monetary aggregates could outperform simple-sum monetary aggregates.

The Divisia index weights component assets according to their varying degrees of moneyness and can account for financial innovations involving changing relative yields on component assets. Unlike the simple-sum aggregates, the sound foundation of the Divisia approach in aggregation and index number theory enable the use of the weighting strategy and ties the Divisia aggregates to the consumer’s optimization problem. Since it reflects all costs and benefits of each monetary component in order for its user to optimize consumption, the Divisia index is, in principle, very attractive from the view of monetary theory. Furthermore, none of the unrealistic conditions of the simple-sum are imposed by the Divisia aggregation approach.

Another advantage of the Divisia index is the ability to capture the exact amount of monetary services since the weights used to construct the index are the user cost-evaluated value shares (instead of price). That means a change in element of the component monetary assets leads to a change in the aggregate Divisia index, and the magnitude of the change in the Divisia index is exactly the same as that in the monetary service flow caused by the component asset change.

In what follows, a brief theoretical review of Divisia monetary aggregation will be presented first. Then the Divisia monetary aggregates (M1 and M2) for Saudi Arabia will be constructed. Next, a comparison of the historical behavior between Divisia monetary aggregates and the traditional simple-sum aggregates is discussed. At the end, concluding remarks are drawn.

The Theory of Divisia Monetary Aggregation

Barnett (1980) illustrates the derivation of the Divisia index monetary aggregates utilizing the principles of microeconomic theory and index number theory. He assumes that a consumer maximizes his utility by choosing the optimal value of consumption and monetary assets, where monetary assets are considered as durable goods. Thus, the representative consumer maximizes intertemporal utility over a finite planning horizon of T periods, in each period. The consumer’s intertemporal utility function is

(2.2) MaxU(mt,…,mt+T;xt,…,xt+T;At+T) where, for all s contained in {t, t + 1,…, t + T}:

- mt = (m1s,….,mns) is a vector of real stocks on n monetary assets,

- xs = (x1s,…..,xns) is a vector of quantities of h non-monetary goods and services,

- At+T = the real stock of a benchmark financial asset, held in the final period of the planning horizon, at date t+T,

- T = the consumer’s planning horizon.

And, subject to the following multi-period budget constraints for s constraint in {t, t + 1,…, t + T}:

where:

- Ps = (h x 1) vector of expected goods and services prices at date s,

- ws= the wage rate at date s,

- Ls = the amount of labor supplied during period s,

- rs=(r1s,…..,rns) vector of expected nominal yield on monetary asset i at date s,

- ps*= the true cost of living index at date s,

- Rs= the expected nominal holding-period yield for the benchmark asset, and

- As= the real quantity of a benchmark asset that appears in the utility function only in the final period of the planning horizon, t+T.

As, the real benchmark asset, is assumed to offer no monetary service except in the final period and is held solely to transfer wealth intertemporally. This benchmark asset could be a different asset in each period, and its main role is to provide a non-monetary alternative asset.

The representative agent maximizes the intertemporal utility function by choosing the optimal value of (mt,….,mt+T;xt,…,xt+T;At,…,At+T) in a given budget constraint. Barnett (1978) illustrates that optimizing the above consumer’s problem produces the following:

where:

- m*t=(m*1t,…,m*nt) is the current period optimal monetary assets held.

- qt=((mt-1,…,mt-T;xt,xt-1,…,xt-T;At-T)*) is the optimal vectors of all other decision variables and the past periods of monetary assets.

- πit = is the nominal user cost or the price for the current period monetary asset (Barnett, 1978; Donovan, 1978).

Barnett assumes that the intertemporal utility function U is weakly separable in the current period’s consumption of goods and monetary assets.2 For a given period, the weak separability assumption enables the utility function to be re-written as:

(2.6) U(f(mt),mt-1,…,mt-T;xt,…,xt-T;At+T)

The subutility function f (mt) is the monetary quantity aggregator function. Only current period monetary assets are included in this aggregator function. Thus, it measures the amount of current monetary services that the consumer receives from holding the monetary assets m1, m2,…, mn.

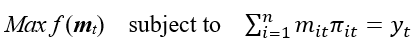

Along with the assumptions that the utility function is weakly separable in current monetary assets and linearly homogeneous, the two-stage budgeting model of consumer behavior implies the existence of the monetary aggregator function. In the first stage, the consumer optimally allocates his budget among broad categories such as monetary assets (mt), and non-monetary goods and services (xt), and their optimal expenditures are derived. In the second stage, the representative consumer allocates his resources within each category, and optimal expenditures are allocated among the current-period monetary assets. For monetary assets, the consumer chooses the optimal current period monetary assets mt=(mit,…,mnt) in the second stage subject to the optimal total expenditure on monetary assets chosen in the first stage. These optimal quantities of the current period monetary assets are a solution to the following maximization problem:

The specific form of the aggregator function is usually unknown. This means that we need to impose specific restrictions on the form of the utility function. However, an alternative to estimating the aggregator function is established by Barnett (1980) through the index number theory, to construct a specification-free statistical index number with no unknown parameters. In continuous time, the known Divisia quantity index, advocated by Barnett (1980), can track the aggregator function exactly without any errors.3 This is given by the following differential equation:

where wit is the monetary share given by

However, in discrete time, there is no statistical index that is exact for an arbitrary aggregator function. However, Diewert (1976) has defined a class of index numbers, called superlative index numbers, which are exact for second-order approximations to unknown economic aggregator functions. Barnett (1980) showed that the Tornqvist-Theil Divisia index, which provides a discrete time approximation to the optimal Divisia continuous time quantity index, is in the superlative class defined by Diewert (1976). This is given by:

Taking the logarithms of each side yields the following

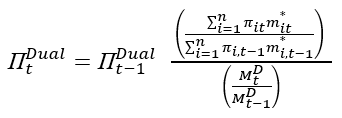

where w ̄it=1/2(wit+wi,t-1). Equation (2.11) shows that the growth rate of the Divisia index is a weighted average of the growth rate of the monetary components. The dual user cost index (ΠtDual) to the Tornqvist-Theil Divisia index is defined by the following recursive formula:

Constructing Divisia Monetary Aggregates for Saudi Arabia

Data

The construction of the Divisia monetary aggregates requires data on quantities and prices of all components of monetary assets. The prices here stand for rental rates of the assets (user costs). Following the definition of monetary aggregates in Saudi Arabia, as defined by SAMA (Saudi Arabian Monetary Agency), the central bank, M1 and M2 are composed of the following:

- M1 = currency in circulation + Demand deposit

- M2 = M1 + Time and saving deposits (various maturities)

So, the data required for the construction of the Divisia index include the following:

- Quantity of currency in circulation

- Quantity of demand deposits

- Quantity of time and saving deposits (various maturities)

- The implicit rate of return on demand deposits

- The rate of return on time and saving deposits (various maturities)

- Treasury bill rates (various maturities)

- Government bonds rates (various maturities)

The data sample is quarterly data ranging from (1993Q1) to (2006Q3). All data are obtained from the Saudi Arabian Monetary Agency (SAMA).

Calculating the implicit rate of return on demand deposits for Saudi Arabia

Usually, demand deposits yield no explicit interest rate under government regulations. However, most financial institutions pay implicit interest on demand deposits in the form of free or reduced-cost bank services, easier access to credit, and/or offer free gifts on promotional schemes. Laidler (1993) emphasizes that the assumption of zero interest on demand deposits is a false assumption and it would lead to variation in the quantity of money demanded. Some economists have suggested that such non-price competition has allowed depositories to elude the regulations that ban explicit interest on demand deposits.

According to Startz (1979), there are three hypotheses on the effectiveness of the Banking Acts of 1933 and 1935 prohibition of interest on demand deposits. The first one is the traditional hypothesis, which regards the prohibition to be fully effective. Second is the competitive hypothesis, which regards the prohibition to be completely ineffective. The third hypothesis is the modified competitive hypothesis, which regards the prohibition to be partially effective. Assuming that depositories face a perfectly competitive market, Klein (1974) derived an expression for the fully competitive implicit rate of return on demand deposits as follows:

(2.13) rD=(1-c)rA,

where rD is the implicit interest rate on demand deposits, rA is the interest rate on alternative assets, and c is the ratio of reserves to deposits. However, Startz (1979) emphasizes the use of the modified competitive hypothesis. Using functional cost analysis data, he argues that the implicit interest rate on demand deposits is well below the fully competitive Klein rate. Thus, the implicit rate of return on demand deposits is:

(2.14) rD=(1-τ)rA(α),

where τ is the maximum reserve requirement on demand deposits, and α is a coefficient that lies in the interval [0.34-0.58]. The Startz (1979) approach is adopted to calculate the implicit rate of return on demand deposits for Saudi Arabia. The three-month Treasury bill rate was used as a proxy to the interest rate on alternative asset. α which is set to its maximum value of 0.58.

Calculating the Benchmark Rate of Return for Saudi Arabia

As illustrated in the Divisia theoretical section, the benchmark rate is necessary to calculate the user costs of monetary assets. According to Barnett and Spindt (1983), the benchmark rate is the highest rate among bond rates and all component assets at each period, this approach is called the “envelop” approach. In practice, benchmark rate should be defined in such a way that the user costs for monetary assets are positive. Anderson, Jones, and Nesmith (1997), constructed the benchmark rate during each period t as follows:

(2.15) Rt*=max{rit (i=1,2,…,n),rBAA,t)+c

where rit is the rate of return on monetary asset i at time t, rBAA,t is the own rate of return on Moody’s seasoned BAA bonds at time t, and c is a small constant added to guarantee that the benchmark rate is strictly greater than the rate on any monetary asset.

To calculate the benchmark rate for Saudi Arabia we follow Anderson, Jones, and Nesmith (1997) approach. Thus, the benchmark rate for Saudi Arabia is:

(2.16) Rt*=max{rddt,rtsdit, rtbillsit,rbondit}+0.0001

where rdd is implicit rate of return on demand deposits, rtsdi is a vector of the rates of return of time and saving deposits with different maturities ( one, three, six, and twelve month), rtbillsi is a vector of rates of return on Treasury Bills with different maturities (one-week, one-month, three-month, six-month, and twelve-month), and rbondi is a vector of the rates of return on government bonds with different maturities (two, three, five, seven, and ten year).

A Comparison of Simple-sum and Divisia Monetary Aggregates for Saudi Araibia

Divisia aggregates have been computed for M1 and M2 categories defined by SAMA (Saudi Arabia Monetary Agency). Since the Divisia aggregates are an alternative to the conventional simple-sum aggregates, it will be instructive to compare them after normalizing so that both have the value of 100 at the same base period, 1993:1Q.

Table (2.1) illustrates the calculated Divisia aggregates along with their simple-sum counterpart. Furthermore, levels, annual growth rates, and income velocities are compared to contrast the behaviors of the Divisia aggregates with their simple-sum counterpart over the sample period.

M1 Graphical Analysis

Figure (2.1) plots the narrow money aggregates (M1). It shows a similar increasing trend for Divisia and simple-sum until early 1996, when they began to diverge but in the same direction. Overall, the Divisia and simple-sum M1 have a very small discrepancy between them. This could be explained by the high substitutability among M1 components, currency in circulation and demand deposits. Furthermore, simple-sum M1 reveals a higher level of liquidity compared to Divisia M1.

Figure (2.2) plots the annual growth rates for simple-sum and Divisia indices. Both Divisia and simple-sum M1 appear to share similar movements and the difference in the growth rate between them seems much smaller. Furthermore, both series are highly correlated, as observed in figure (2.2). However, the period between late 2001 and early 2002 reveals significant divergence between the Divisia and simple-sum M1 growth rates. This could be attributed to the huge inflow of the national financial investments from abroad to domestic banks in the aftermath of September 11 attacks. Since Divisia applies an implicit rate of return on demand deposits, less weight has been given to demand deposits than the case in simple-sum aggregate, which explains the lower rate of growth of Divisia M1. Table (2.2) shows the basic descriptive statistics of Divisia and simple-sum M1. In general, table (2.2) suggests that the growth rates of Divisia and simple-sum M1 do not differ much from each other, and their correlation coefficient is close to unity.

The conventional way to obtain income velocity is to divide income by the monetary aggregate. Nominal gross domestic product (GDP) is most commonly used as a proxy for the volume of transactions. However, for the case of Saudi Arabia, two different series are used as a proxy for the volume of transactions. The first one is the non-oil gross domestic production. The reason for using non-oil GDP instead of total GDP is due to the nature of the economy of Saudi Arabia. The Saudi economy is largely dependent on the production and exportation of oil which accounts for more than one-third of the total GDP. The oil revenues do not affect the transactions directly since all oil revenues accrue to the government. In other words, the oil sector value added is directly regulated by the government and it does not have a direct impact on private sector investment. However, the indirect impact on the private sector is through fiscal policy and mainly through government expenditures. Another reason for using the non-oil GDP is related to the fact that non-oil GDP is relatively more stable than GDP. This is due the instability of the oil market abroad. The second series is full income or total expenditure, obtained by adding expenditure on monetary services and expenditure on consumption goods from the representative’s budget constraint. This approach is also adopted to obtain income velocity of Divisia and simple-sum M2 also.

Income velocity of Divisia and simple-sum M1 using non-oil GDP are displayed in figure (2.3). In general, the discrepancy between the income velocity of Divisia and simple-sum M1 is very small and fairly stable until 2001. From 2001 to the end of the sample, the income velocities exhibit a downward trend and slightly expand discrepancy between the velocity of Divisia and simple-sum M1. This could again be attributed to the huge inflow of the national financial investments from abroad to domestic banks in the aftermath of September 11 events. Furthermore, in order to diversify the economy and stimulate foreign direct investment (FDI), economic reforms and deregulations of the financial system are introduced from 2000 and 2003. Data on FDI shows a significant upward trend since these reforms and deregulations were introduced. These vast inflows end up into different form of financial assets, hence expanding the monetary aggregates.

Figure (2.4) plots the income velocity of Divisia and simple-sum M1 using full income as a proxy for transactions. During the period 1993-2001, the velocity of Divisia M1 was more stable than the velocity of simple-sum M1, which was exhibiting a slight downward trend. By the end of 2001, both velocities show a persistent downward trend. This could be explained by the same reasons discussed earlier.

M2 Graphical Analysis

Figure (2.5) plots the broad money aggregates (M2). It shows a similar increasing trend for Divisia and simple-sum until early 1994, when they began to diverge but in the same direction. This divergence is due to the faster growth in simple-sum M2 compared to growth in Divisia M2. Overall, the Divisia M2 and simple-sum M2 aggregates have a larger discrepancy between them than those observed for Divisia M1 and simple-sum M1. This larger discrepancy could be attributed to the fact that broad money includes more financial products and instruments than narrow money. Thus, simple-sum M2 reveals a higher level of liquidity compared to Divisia M2.4

Figure (2.6) plots the annual growth rates for simple-sum M2 and Divisia M2 indices. In general, simple-sum M2 records higher growth rates than Divisia M2 except for the period from 2001 to 2002. Furthermore, both Divisia M2 and simple-sum M2 appear to share similar movements except for the period from late 2001 to early 2002. The period between late 2001 and early 2002 reveals significant divergence between the Divisia and simple-sum M2 growth rates. This could be attributed to the huge inflow of the national financial investments from abroad to domestic banks in the aftermath of September 11 events. Table (2.2) shows the basic descriptive statistics of Divisia (M1 and M2) and simple-sum (M1 and M2) aggregates. In general, table (2.2) suggests that the growth rates of Divisia M2 and simple-sum M2 are more volatile and less correlated than their counterparts Divisia M1 and simple-sum M1.

Income velocity of Divisia M2 and simple-sum M2 aggregates using non-oil GDP are displayed in figure (2.7). In general, the discrepancy between the income velocity of Divisia M2 and simple-sum M2 aggregates is larger than those exhibited by Divisa M1 and simple-sum M1. However, fairly stable income velocity for both Divisia M2 and simple-sum M2 are observed until 2001. From 2001 to the end of the sample, the income velocities exhibit a downward trend and slightly expand the discrepancy between the velocity of Divisia and simple-sum M1. This could, again, be attributed to the huge inflow of the national financial investments from abroad to domestic banks in the aftermath of September 11 events. Furthermore, in order to diversify the economy and stimulate foreign direct investment (FDI), economic reforms and deregulations of the financial system were introduced from 2000 and 2003. Data on FDI show a significant upward trend since these reforms and deregulations were introduced. These vast inflows end up into a different form of financial assets, hence expanding the monetary aggregates.

Figure (2.8) plots the income velocity of Divisia and simple-sum M2 using full income as a proxy for transactions. During the period 1993-2001, the velocity of Divisia M2 was more stable than the velocity of simple-sum M2, which was exhibiting a slight downward trend. By the end of 2001, both velocities show a persistent downward trend. This could be explained by the same reasons discussed earlier.

Appendix A

Table 2.1: Monetary Aggregates for Saudi Arabia

Notes:

- SS. M1 and SS.M2 are simple-sum monetary aggregates M1 and M2,

- Divisia M1 and Divisia M2 are Divisia monetary aggregates M1 and M2.

Table 2.2 Summary of Basic Statistics for Divisia and Simple-sum Aggregates

Notes:

- Quarterly year-to-year change.

- (DM1 and DM2) represents Divisia aggregates.

- (SM1 and SM2) represents Simple-sum aggregates.

Chapter Three: Literature Review of the Demand for Money

One of the most important issues in the theory and application of macroeconomic policy is the stability of the money demand function. This stability is a necessary condition for the accuracy of predicting the influence of money on real variables of the economy, as often emphasized by Milton Friedman. On the other hand, money demand holds a key position in macroeconomics in general and monetary economics in particular. Therefore, a stable money demand function is generally considered essential for the formulation and conduct of efficient monetary policy. Furthermore, considerable effort has been made in the empirical literature, for both industrialized and developing countries, to determine the factors that affect the long-run demand for money and assess the stability of the relationship between these factors and various monetary aggregates.5

By the mid-1970s, however, the stability of the money demand function was questioned and the stable money demand function is no longer stable. This has been called the breakdown of the money demand function. The conventional M1 money demand function began to severely over predict the demand for money. Stephen Goldfeld labeled this phenomenon of instability in the demand for money function “the case of the missing money.”6

There are several opinions about what causes breakdown in the money demand function. However, there is general consensus among economists that financial liberalization and the advance of financial innovation in a number of developed, as well as some other developing; economies have significantly contributed to the breakdown in the demand for money.

The line that this work adopts deals with the measurement of money as the main cause for instability. All central banks around the world publish and adopt the use of the conventional Simple-Sum monetary aggregates as the measurement of money. Advocators of an aggregation theoretic approach to money demand argue that simple-sum measures are not consistent with microeconomic theory since the simple addition of components would be justified only in a case when all components are perfect substitutes for each other (see Barnett, 1980). Therefore, simple-sum monetary aggregates are likely to give an incorrect expression of the stock of money in the economy.

A Brief Overview of the Theory of Demand for Money

The fundamental theoretical literature which links the demand for money and modern macroeconomics will be surveyed in this section.7 Three essential features of money have provided macroeconomists the foundations for many theories of the demand for money. First is the use of money as the modern satisfactory medium of exchange and the customary units in which prices and debts are expressed. This feature led to transaction models which assume that the level of transactions is known and net inflows are dealt with by others as uncertain. Furthermore, the use of money as a medium of exchange boosts economic efficiency by reducing the opportunity cost of physically exchanging goods and services. Second, money functions as a store of value and serves the purpose of preserving purchasing power. Other assets can act as a store of value, but they either have an uncertain nominal return because of capital gains and losses, such as equity and bond, or they involve transaction costs in order to be converted into money. In other words, there is willingness to hold money and this is due to the convenience and liquidity of money. Third, money serves as a unit of account, which means that prices will all be quoted in terms of money.

There is widespread agreement among economists that the demand for money is primarily a demand for real balances.8 Money demand theories have evolved over time and the following will briefly shed light on the most influential developments.

The Quantity Theory

The quantity theory of money explains the role of money as a medium of exchange. In general, it is defined to hold that changes in the money supply induce proportional changes in the price level. This was presented by classical economists Fisher (1911) and Pigou (1917) under the classical equilibrium framework by two alternatives but equivalent expressions. They thought that money was neutral, with no consequences for real economic variables. Fisher analyzed the institutional details of payment mechanism in his work, which is known as Fisher’s Equation of Exchange. The concept of money holding by individuals was emphasized through the writings of Pigou, which is known as the Cambridge Approach “Cash Balance Approach.”

Fisher’s Equation of Exchange

Fisher’s equation gives special importance to the transaction demand for money, which is typically expressed by the following identity:

(3.1) Ms V = P T

Where Ms is the actual stock of money, V is velocity of transactions, P presents the price level, and T is the volume of transactions. The equation of exchange is an identity because it must be true that the quantity of money times how many times it is used to buy goods equals the amount of goods times their price.

To move towards the quantity theory of money, Fisher makes two key assumptions. First, Fisher viewed velocity as constant in the short run. This is because he felt that velocity is affected by institutions and technology that change slowly over time. Second, Fisher, like all classical economists, believed that flexible wages and prices guaranteed output, Y, to be at its full-employment level, so it was also constant in the short run.

Putting these two assumptions together, let’s look again at the equation of exchange:

(3.2) MV = PY

If both I and Y are constant, then changes in M must cause changes in P to preserve the equality between MV and PY. This is the quantity theory of money. A change in the money supply, M, results in an equal percentage change in the price level P.

The limitation of the Fisher approach is that velocity is not fixed; even in the short run it is unstable. It is, therefore, not independent of changes in money supply. In the real world, changes in money supply are not wholly absorbed by changes in price level. This approach also fails because empirical evidence does not often support the direct and proportional relationship between money supply and the price level. An example is the case of economic depression.

The Cambridge Approach

Cambridge economists such as Pigou (1917) and Marshall (1920) developed a different approach to the quantity theory of money. They recognized that money yields utility as it is accepted as a means of exchange. This approach is based on an individual’s behavior. Therefore, the determinants of money demand are different from those of Fisher’s quantity theory. The demand for money can be represented as follows:

(3.3) Md = k. PY or Md/P = k Y

Where k = 1/v is the proportion of nominal income that an individual wants to hold as money. Incorporating the classical assumption of money market equilibrium, the Cambridge Approach leads to the quantity theory formulation. Under this approach, it is assumed that the real income y is at full employment level, and income velocity (V) is fixed. Therefore, the price level moves proportional to the quantity of money, “money is neutral.”

The Keynesian Approach

Keynes argued that velocity of money is unlikely to remain the same over time. He also emphasized the important role of interest rate in the money demand function and recognizes the function of money not only as a medium of exchange but also as a store of value. Therefore, both transaction and asset theories were considered in Keynes’ analysis. According to liquidity preference theory, “Keynes’ overall theory of the demand for money,” people hold money for three motives: transaction, precautionary, and speculative.

The transaction motive follows a similar emphasis as the quantity theory on money as medium of exchange. Keynes postulated that the transactions demand for money is a positive and stable relationship with the level of income. Because of the uncertainty about the future payments which individuals want or have to make, people hold additional money as a cushion against unexpected needs. The demand for the precautionary money balances are determined primarily by the level of transactions that individuals expect to make in the future, by the level of income, and slightly by the interest rate.

However, the most significant contribution of Keynes’ analysis of the demand for money to the theory of money demand is his speculative demand for money which emphasizes the store of value function of money and depends negatively on the interest rate. Keynes assumed that there exist only two types of financial asset, money and bonds. Money is a perfectly liquid financial asset, but earns no interest. Therefore, all non-interest-earning financial assets are regarded as money. Bonds include all interest-earning financial assets. They are less liquid, but earn interest returns. Therefore, the price individuals are willing to pay for bonds depends on the future rate of interest. In other words, people tend to hold money when they expect interest rates to rise (and therefore bond prices fall) and vice versa.

Furthermore, Keynes introduced the idea of “liquidity trap” in which the interest elasticity of money demand can be infinite at low levels of interest rate. Keynes agreed with Fisher that the transaction demand for money was stable. However, he believed that the total demand for money could be dominated by unstable speculative individuals’ behaviors (Laidler, 1969) and, thus, be unstable.

Keynes assumption that individuals are to hold their liquid assets in the form of either money or bonds, but not both, is one of the major criticisms to Keynes’s analysis of the speculative demand for money. Tobin (1958) argued that people diversify their portfolio of assets to reduce risk.

By combining the three types of demands suggested by Keynes, we get the Keynesian liquidity preference function, which describes the total demand for money represented as:

(3.4) Md/P=f(R,Y)

with f1 < 0 and f2 > 0, where fi denotes the partial derivative of f (.) with respect to it ith argument. That is, the demand for real money balances is negatively related to the nominal interest rate, R, and positively related to real income, Y.

Friedman’s Modern Quantity Theory

Unlike Keynes’ analysis of the demand for money, Friedman (1956) did not notice the motivation of people keeping money any more, instead of that, he assumes that money is a kind of wealth asset, and the reason why people choose different sorts of assets to save wealth is the main complication of money demand. Friedman integrated both an asset theory and a transaction theory of demand for money within the context of neoclassical microeconomic theory of consumer and producer behavior. He argued that demand for money should be treated in the same way as the demand for goods or services. That means viewing money as a durable good (or monetary assets as durable goods), which yields a flow of non-observable services.

According to Friedman (1956), wealth is categorized into human and non-human wealth. Human wealth is defined as the present discounted value of labor income, while the non-human wealth consists of the individual’s financial and physical assets. Therefore, the total wealth of an individual is the sum of five components: money, bonds, equity (common stocks), real assets, and human capital. Friedman emphasized using the ratio of human to non-human wealth as a proxy for the individual’s degree of uncertainty of wealth.

In Friedman’s view, the demand for money is a function of the wealth and the other assets that people hold and the expected return rate. However, since data on human and total wealth were not available, Friedman used permanent income as a proxy for total wealth. Furthermore, he argued that the permanent income of people is stable; it is the average expected of people’s long term revenue. During the period of expanding business, the provisional revenue is more than the permanent income. The average fluctuant extent of income is stable, and to permanent income, it is stable. In Friedman’s theory, permanent income is the main key of the function of money.

Therefore, according to Friedman, the demand for money can be expressed in terms of the following demand function of money for an individual wealth holder:

(3.5) md=(M/P)d=f(Yp,r1,….,rn,π,ω)

where md is the demand for money in real terms, Yp is the real permanent income, P is the price level, ri is the yield in real terms on the ith asset, Π is rate of expected rate of inflation, and ω is the ratio of human to non-human wealth. In contrast to Keynes, Friedman concluded that the demand for money is insensitive and the permanent income is the determinant complication of demand for money; if the permanent income is stable, the demand for money will be stable. Thus, velocity is predictable.

The Baumol-Tobin Inventory Model

This model is based on the independent works of Baumol (1952) and Tobin (1956) and emphasizes the costs and benefits of holding money. It is argued, for example, that the benefit of holding money is convenience and the cost is the forgone interest by not holding interest-yielding assets. Furthermore, this approach viewed money as an inventory held for transactions purposes. Although higher yields could be earned by holding liquid financial assets other than money, the transactional costs of going between money and these assets justified holding such inventory.

The assumptions of the model are (a) the individual receives a known lump sum cash payment of T per period and spends it all, evenly, over the period; (b) there are only two assets, money and bonds, where bond holdings pay constant interest rate r per period and money pays zero interest; (c) a fixed brokerage fee b (transaction costs) may be incurred when the individual sells bonds to obtain cash in equal amounts K; (d) the key element in this inventory model is that all relevant information is known with certainty.

The total cost of making transactions is presented as,

(3.6) TC=b*Y/K+R*K/2

where (Y/K) represents the number of withdrawals, b*Y/K is the sum of the brokerage fee, (K/2) is the average amount of real money holdings (= M/P), and R*K/2 is the foregone interest if money is held instead of interest-yielding assets.

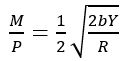

By minimizing the total transaction costs with respect to K, one arrives at the following optimal money demand,

Equation (3.7) shows that the optimal demand for money balances (M/P) depends on real income, transaction costs, and interest rate. This suggests that demand for money emerges from a trade-off between transactions costs and interest earnings.

Microfoundations and Aggregation Approach for Money Demand

Since the breakdown of the conventional money demand function in the mid-1970s, there has been a growing interest in developing firmer microfoundations for the demand for money. The focus shifted to providing a broader theory of demand for money based on simultaneous household and firm production and consumption decisions, rather than analyzing agents’ desired holdings of money as a separate problem.

Several theories have emphasized the role of microfoundations in analyzing the demand for money.9 For example, Lucas (1980) made seminal contributions in developing the cash-in-advance models to provide microfoundations for money and to extend the theoretical support for transactions demand for money. He incorporated the optimizing behavior of individuals, as discussed in Baumol (1952) and Tobin (1956), and the cash-in-advance constraint in a macroeconomic equilibrium setting to study the transactions demand for money. Also, McCallum and Goodfriend (1987) introduced the shopping-time model. They argue that the demand for money should be analyzed by taking explicitly into account the transactions facilitating services provided by money. In other words, they suggest that the use of money permits an individual to reduce the amount of time allocated to consumption. This frees up time available for labor and leisure activities, thereby boosting utility on the margin and generating implicit return.

Since the empirical methodology of this paper includes a model that is consistent with the principles of microeconomic and aggregation theory, an overview of this approach is presented in what follows. There are two branches of the microeconomic aggregation theory. The first one leads to the construction of index numbers and methods derived from economic theory. The second one leads to the construction of money demand functions in the framework of a system of equations which model the wealth holder’s allocation of total expenditures between money and non-money assets.

Diewert (1974) provides the theoretical basis for durable as well as non-durable goods in an intertemporal utility approach. Furthermore, the derivation of user cost of monetary assets by Barnett (1978) paved the way for formulation of a representative consumer’s decision problem over consumption goods, leisure, and services of monetary assets. Feenstra (1986) has shown that models which explicitly model the transaction services of money can be approximated as money in the utility function models.

Consider the representative household that is faced with the problem of allocating full income over consumption goods, leisure, and the services of monetary assets. The household must choose a vector of commodity consumption quantities (c), a quantity of leisure (l), and a vector of the services of monetary assets (x) to maximize

(3.8) U (c, l, x) subject to q‘c + π‘x + ωL = y

where y is full income (i.e., income reflecting expenditures on consumption goods as well as on time and services); q is a vector of the prices of c; π is a vector of monetary asset user costs (or rental prices) as defined in the Divisia chapter; ω is the shadow price of leisure (see Barnett, 1981b). Following Robert Strotz (1957, 1959) and William Gorman (1959), the representative household is assumed to solve a two-stage decision process. In the first stage, expenditure is budgeted among broad categories (consumption goods, leisure, and monetary services) based on price indexes of these categories. In the second stage, the budgeted expenditure on each category is allocated over its components.10

Furthermore, the assumption of homothetic weak separability of the representative consumer’s utility function is essential to ensure that the two-stage budgeting procedure is an accurate description of consumer behavior. In other words, without weak separability a utility function in money alone does not even exist. Thus, it must be possible have the utility function written as:

(3.9) u = U (c, l, f(x))

in which f is the monetary subutility function. A necessary and sufficient condition for weak separability is that the marginal rate of substitution between any two monetary assets is independence of the value c and l11. That is:

(3.10) ∂/∂ζ*((∂u/∂xi)/(∂u/∂xj))=0 for i ≠ j

where ζ is any component of {c, l }. Once the separability subset of assets is established, then we can focus on the demand for services of monetary assets alone. This can be seen by solving the following neoclassical consumer problem,

(3.11) max f (x) subject to π‘ x = ym

where ym is the expenditure on the services of monetary assets (determined in the first stage of the two level optimization problem) and π is a vector of monetary asset user costs as defined above. To derive the money demand function, we set the Lagrangean for the consumer’s problem as follows,

L = f (x) – λ (ym – π‘ x)

The first order conditions are,

fi (x) = λ πi

ym = π‘ x

where fi (x) is the partial derivative with respect to xi.

Solving the system of simultaneous equations derived from the first order conditions yields the demand system for monetary assets,

xi* = (π, ym)

which express the dependence of the demand for monetary assets on user costs and income.

Money Demand in Saudi Arabia

In Saudi Arabia, like other countries, considerable effort has been made in estimating money demand functions. For example, Darrat (1984), Nagadi (1985), Ghamdi (1989), Al-Bassam (1990), Metwally and Rahman (1990), Alkswani and al-Towaijari (1999), Al-Badi (2002), and Harb (2003), etc., have estimated money demand functions by using alternative specifications. All of these studies have also examined the stability of their estimated money demand functions. Generally, the M1 and M2 functions are found to be stable, and the effect of the interest rate on the money demand functions is low and statistically insignificant.

Alkswani and al-Towaijari (1999), investigated the determinants of the money demand function for Saudi Arabia for the period from 1977 to 1997 using quarterly data. Employing the Engle and Granger cointegration approach, they concluded that the relationship between real money M1, the real income, the interest rate, the inflation rate, and the exchange rate is significantly different from zero. However, the effect of the interest rate on the demand for money is still very low compared to the average in other countries, which is explained by the social and religious rationales of the people of Saudi Arabia.

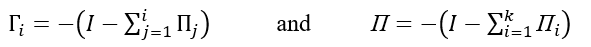

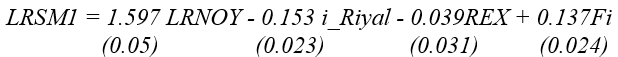

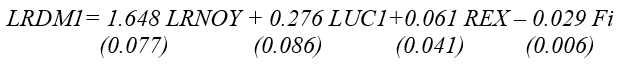

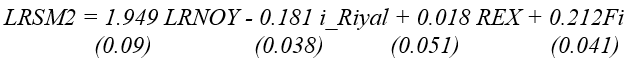

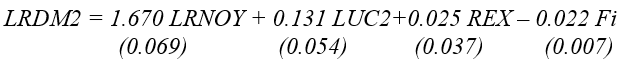

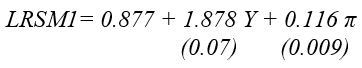

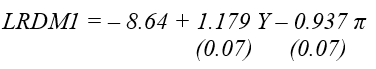

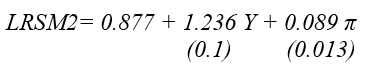

Using annual data that cover the period from 1969 to 1999, Al-Badi (2002) investigated the demand for money in Saudi Arabia. He used the ARDL approach to determine the relationship between money demand (M1, M2, and M3) and its determinants (Income, Financial Development, Foreign Interest Rate, Expected Rate of Inflation, and Real Exchange Rate). The results indicated that money demand is determined by income and the degree of financial development only.