Introduction

Foreign Direct Investment (FDI) has been widely considered as a major stimulus to economic growth and development in developing countries. This is mainly due to its perceived possession of the wherewithal to overcome the major operational obstacles that impede growth in these countries like technology, financial resources and skills (Hansen and Rand, 2006). This therefore underscores the relatively high attention accorded to FDI by the government and policymakers of the developing countries such as in Africa, as the contribution of the FDI has been perceived to be crucial to the socio-economic development of most African countries.

The classic definition of FDI entails an investor (company) from a foreign country investing on the ground in machinery, property (premises) and the needed equipment for operation in the host country (Zhang, 2001). The investment comes in two forms; direct investments that involve the physical or tangible investments (machinery and premises) that are to be laid on the ground for operation to take place and, indirect investments which are the portfolio brought in to the host country by the investor. Recently, the fast-growing and evolving global investment pattern has necessitated a broader meaning and understanding to the concept of FDI which now includes the acquisition of an enduring management interest in a business or company outside the borders of the investment business firm’ s country (Adler and Hufbauer, 2008). Moreover, FDI is also involved in investments in joint ventures and strategic alliances with local companies in addition to contributing to growth in technology and licensing of intellectual properties. Additionally, FDI may be in other forms which include; construction of facilities and direct acquisition of foreign companies.

Egypt is one of the rapidly developing economies in Africa that has immensely benefited from the impact of the FDI. According to the country’s Investment Minister, Mahmoud Mohieddin, the value of FDI in the country has continued to rise as it has successfully been able to lure about $31 in FDI since the beginning of the reform process in 2004 the end of 2008 (www.investment.gov.ag, 2010). According to the report, investment grows by 40% annually making Egypt be the leading African country in the luring of FDI to Africa.

The need to empirically assess the impact of the growing FDI on the economy of Egypt and bring to the fore the roles that FDI plays in enhancing the economic growth of developing economies is what informs this study.

This case study approach, which intends to look into the FDI as harbingers of economic development, will produce a report that would assist developing countries in the formulation of policies on investment. This researcher is a citizen of one of the developing countries that stand to benefit from the outcome of this research effort.

Preliminary Literature Review

Conceptualizing Foreign Direct Investment (FDI) and Development

The concept of FDI has been a subject of immense controversies which borders on what constitutes its meaning, structure, operation and impacts on countries. Up to the present, there is yet to be a consensus on the definition of the concept by literature as different scholars define the concept along the line of their arguments and sentiments. However, there is a trend that seems to link FDI with the transfer and operation in a different country by the investor (firm, individual(s)) in all the definitions that are provided for the term.

Hunter (2005) defines FDI as a process in which a company purchases a significant amount of assets of the foreign company. The purchase of the company’s assets then gives the foreign company a share in the management control of the target company which is offshore. A similar definition to this one is the ownership or control of at least 10 percent of an incorporated company by a person or firm from a foreign country to the host country; either in direct or indirect terms is also considered to translate to foreign direct investment (Asian-Pacific FDI in the U.S, 2009). This last definition is mainly adopted in America. Meanwhile, Hnya (2006) and, Dunning and Gray (2003) described FDI as a process of organizational knowledge transfer from one country to another. This is seen in the fact that where the foreign company brings in new skills and technology to the target company and thus it is viewed as a transfer of knowledge from one country to another. Perhaps the most comprehensive definition of FDI is transfer of real resources overseas, mainly to make profits, by firms that have been incorporated, individuals -either as sole proprietors or in partnership- to another country(s) (Corley, 1997). In this case real resources entail the technology and the skills that are needed for the incorporated company to keep control of the running of business in the country that it has transferred its real resources to. In addition, when there is the transfer of technology it is inevitable in many a case to leave equipment behind as new technology may require new machinery and equipment altogether. This is important or the new technology may fail to work in the host country. The skills will entail the transfer of the required manpower for the management, running of the business before the investing company and, training local personnel on the ground in the country(s) of transfer (host country).

Corley (1997) continues to argue that the firms that are involved in the FDI may be operating from both the home and the adopted country or in the adopted country alone. According to Athukorala (2003), FDI is said to take place when an investor from one country, where he/ she is based (home country), acquires assets in another country. The investor, however, must have the intent to manage the assets that have been acquired for it to be called FDI. The same definition has been adopted by the World Trade Organisation (WTO). Scholars like Dunning have in their researches noted that FDI is associated with financing and contractual activities, amongst the transfer of skills and technology, as added components that are supposed to be looked into as the major ways that the investors (especially multinational enterprises (MNEs)) undertake to affect the growth of the economies of the host countries (Dunning and Sarianna, 2008; Dunning and Gray, 2003).

Despite the lack of consensus in the definition of FDI, what remains derivable from the various definitions is the involvement of foreign companies in the running of local business of companies of other companies through investment which will see to the transfer of skill, technologies and other logistics to the local business (Zhang, 2001; Hunter, 2005; Hnya, 2006; Alder, 2008). On the other hand, development has been defined as “the growth of humans throughout the lifespan, from conception to death” (Wagner, 2009), likewise, Pringle and David, (2002) describe development as “the improvement of peoples’ lifestyles through improved education, incomes, skills and employment”. Also, another economist, Joseph Stiglitz (1999:1) perceives developments as a “transformation of society, a movement of traditional relations, traditional ways of thinking, traditional methods of production, to more modern ways. Meanwhile, social development is described as the process that results in the transformations of social structures in a manner that enhance the capacity of the society to achieve its aspirations (Burton, 2002). Girard (2001), proffers that economic development refers to a sustainable increase in living standards of a people.

Development, as linked to FDI, depends on the extent to which the investors (MNEs) undertake their activities and operations. The administration of the government and the political climate in the host country is considered a major factor in shaping the way and extent to which the MNEs operate (Dunning and Sarianna, 2008). As a result the effects that are realized in terms of the improvement in the standards of living for the people of the host country are affected, which is a major factor that many countries and economists base economic development on. The FDI impacts development in a number of ways which results in the development of individuals’ standards of living. According to Narula and Sanjaya (2006), the host countries can realize development if they can optimally utilize the FDI that is availed by foreign investors to advance their industries in new technology and at the same time deepen the already existing ones, as a way of realizing full industrialization in their countries. This results from the fact that the development of any economy is majorly linked to the development of the production sector, which is mainly the growth and sustainability of industries in a country.

The investment in the industrial sector by a country(s) can be done selectively so that they can concentrate on the areas where they need development most to uplift the performance of their economies as a whole. They continue to argue that this selective way of utilizing FDI contributes significantly to the creation of industries that are competitive even in the international arena. The competitiveness of the industries will be linked to the improved technology and efficiency in production that translates to production of high-quality goods and services. Countries like Korea and Taiwan are amongst the developing countries that have used this strategy and the result was the emergence of industries of international standards and development in their economies by a large margin (Narula and Sanjaya, 2006). Research has indicated this strategy to be a success not only in parts of Asia but also in the Latin America (Narula and Sanjaya, 2006).

The development of the economy is seen to lead to positive growth in the peoples’ standards of living that result from increased incomes from employments and provision of facilities that enhance human development. As a result the productivity is enhanced and increased. This contributes very much to the increase in the gross domestic product (GDP) of a country hence economic development.

From a study in Taiwan on economic development, FDI was found to be one of the major factors that have contributed to its development. It was noted that in the last three decades as of 1998, FDI had played a major role in the transforming Taiwan’s economy. The same was noted of India. This was from a study that was featured by Narula and Sanjaya (2006). Their evaluation concentrated, mainly on the industrial utilization of the FDI that was available and in the development of the needed infrastructure for the facilitation of the business operation. The results were evident in terms of increased job creation and increased income for the people of these countries. Due to the raised living standards, the development was therefore considered tremendous and positive (Narula and Sanjaya, 2006). Having briefly discussed the meanings adduced to the two main concepts of this essay, it is pertinent to also assess literature on the relationship that exists between the activities of FDI and developing countries.

FDI and the Developing Countries

The last decade of the 20th century has witnessed a major shift in the size and composition of financial and capital flows to the developing countries (Bosworth and Collins, 1999). Likewise, the FDI flows have substantially increased while the net debt flows became less significant as the portfolio flow became fully established (Alfaro et al, 2004). The Organisation for Economic Co-operation and Development (2002) reported that in 1998, FDI was accountable for over half of the entire private capital flows to developing countries and that by the year 2000, the entire global inflows of FDI was US$1.3 out of which 80% of the recipients of the inflows were located in the developing countries. Much of the FDI comes from Europe (Twoney, 2000)

Nilsson (2008) remarked that the limited share of FDI that goes to the developing countries is unevenly shared as the major chunk of the flow goes to Asia and Latin America. Apparently, Africa’s bid to attract FDI has continued to suffer set back due to some impediments that restrict the flow into the continent (Onyeiwu and Shrestha, 2004; Hansen, H. and Rand, J. (2006)). Literature has it that the main problems inhibiting FDI flow into Africa are the high tax rates, huge risk of capital losses, lack of sustainable economic policies, poor quality of public services and closed trade regimes (OECD, 2002; Rogoff and Rienhart, 2003).

Cording to Wallace (1990) for a country to attract FDI inflows several factors must be in line with the investor. These factors contribute immensely to the inflow of FDI. First, infrastructural facilities that include transportation, communication as well as favorable working conditions and leisure must be well developed so as to attract the investors to bring their capital to the developing countries. Secondly, Macroeconomic stability which mainly requires that the rates of inflation be very minimal, and at the same time there should stability in the foreign exchange rates of a countries currency attests to the stability of the country’s economy and ensures confidence to the investors in the event that they may wish to repatriate their profits. Thirdly, stability in the political structure of the host country, and finally, monetary incentives are some of the factors that make it hard for many African countries to attract FDI.

Unlike their counterparts in Asia and Latin America who are better situated for the FDI to flow, as the investors have confidence in their investments, African countries lack the necessary conducive environment that the investors require so as to maintain a steady flow of FDI (Organisation for Economic Co-operation and Development (OECD) and Global Forum on International Investment, 2002). This, therefore, has seen Africans suffer major deprivation in terms of FDI. Recently the governance of many African countries has improved and as a result there has been a significant increase in the FDI in countries like Egypt. This has been seen especially in sectors like insurance that have attracted FDI and promoting positive growth in the development of the economy. It can, basically, be attributed to new improved legislation and structural changes that give the sector a promising future. From the government statistics the sector grew by 20% between 2006 and 2007, a growth that was majorly attributed to increased inflow of FDI (Oxford Business Group, 2009).

According to Moran, Edward and Magnus (2005) development, especially in developing countries, depend to a significant extent on FDI. They looked at the impacts of FDI in the case of developing countries and found out there is a significant contribution of the FDI in the promotion of development, economically. They note that the development results from the growth of the relevant sectors in the economy and the contribution to the improvement in the standards of living to the people of the country that is the host for the FDI. International relations play yet another important role in enhancing FDI. Various cases of capital flight and repatriation of profits relate to instances of political instability that may influence the level of confidence of the investors (Corley 599).

Zhang (2000) notes that investors highly value peaceful environment as it helps to serve as a requisite for security needs of their investments. Economic development of FDI prevailed in countries that nurture social cohesion in the developing world. In cases where communities adopt appropriate systems that descend from the top institutional hierarchy governing a people, investors forecasted a highly viscous economy that quickly translates FDI into revenue. Thus, over the last four decades, FDI has greatly spanned the economic development of developing nations with a corresponding improvement in the lives of local people (Zhang 178). However, recent trends in the pattern FDI point at strengths and flaws inherent in policies governing FDI in the developing nations. Due to their vulnerability to funds tied to FDI, developing countries constantly face the challenge of exploitative policies that seek to minimize the investor’s costs of operating their business in a developing country. Fortunately, this development helps to spur the economic and social growth of various sectors of the economy that support businesses of a particular line. As a result, FDI promotes the industrialization of developing countries along a certain path of development that often leaves it inclined toward specific market-oriented strategies.

In most developing countries, FDI has contributed towards the development of dual economy where export-oriented strategy adopted by foreign investors in a developing nation uses human and capital resources to produce finished products. The finished products re-exported to the foster nation and other parts of the world fetch high prices with gross returns of taxed revenue to the host nation in the developing country. The taxation regime in the developing country has experienced tremendous growth in the recent past following proliferation of FDI in Africa, Asia and Latin America where the majority of the nations fall in the developing category (Dunning and Narula, p. 32).

The process of yielding productivity in the third world by multinationals and transnational corporations that make use of local resources off-shore leaves development in key sectors of the economy in the developing country. For instance the development of telecommunication and transport infrastructure of most developing countries undergo major structural transformations following large-scale FDI activity in these countries. This study shall look at a few examples of countries in the developing world that have experienced tremendous growth associated with FDI. Since the benefits of FDI supersede the returns of Remittances, governments and multi-governmental entities consider it more important to international trade and regional development than all other export-oriented strategies combined (Corley, p. 602).

The economy of Egypt and FDI

Egypt has a well-diversified economy with no single sector contributing more than 21% of the Gross Domestic Products (GDP) (Asfour, 2008). Through its well-integrated structure that ensures sustainable growth, the country is able to create economies of scale in sectors like manufacturing, agriculture, energy, tourism and services. Through this, a balanced distribution of the country’s income, employment, export revenues and other resources is generated with the multiplication of opportunities for investments and growth (Abdel-Hameed, 2008).

The attraction of FDI into Egypt is relatively low compared to other developing countries of the world however, it ranks highest in Africa. This can be attributed to several challenges. Firstly, pressure on Egypt’s currency that saw its foreign currency bonds go to the negative, unstable. This resulted in inflation reaching 19.7% in 2008. It was also contributed to by high public debt. However, the impact of this on the economy and the investment, especially FDI, was on a short-term basis. It, therefore, did not have a lasting negative effect on the FDI inflow into Egypt (Estrin and Klaus, 2004; Oxford Business Group, 2009). According to the statistics of the United Nations Conference on Trade and Development (UNCTD), the GDP of Egypt has increased to 8.5% by 2008. This growth trend according to the investment minister of the country will invariably lead to an increase in the foreign currency reserve of the country (www.investment.gov.ag, 2010). FDI has seen certain sectors in the economy of Egypt portray tremendous growth. Sectors like the insurance have recorded positive growth that has resulted from the legislation and changes in the sector’s structures, a reflection of the country’s increased efforts in the attraction of investors’ confidence. The ultimate result, therefore, for the sector was 20% in 2006/07 fiscal year, as reported by the government finance ministry (Oxford Business Group, 2009; 2010).

Another factor that has seen the increase of FDI in Egypt is the integration of regional economic policies. The effect of this is growth through trade and as a result there is a conducive environment for trade, investment and production. This has thus attracted a lot of FDI especially in the production sector. This is because of the free movement of locally produced goods and this becomes profitable due to the reduced taxation of selling in a block market, to the countries that are of the same trading block. Acquiring raw materials that are not locally available also becomes easy, and hence profitability is realized (Phisalaphong, 2004).

Theoretical Framework

The theoretical framework of the study of FDI and development derives from either the neoclassical models of growth or endogenous growth models. The neoclassical model of growth is based on the assumption that growth takes place as a result of the exogenous improvement in technology, meanwhile the theory of exogenous growth concentrates on the economic forces that underline technological progress (Jones, 2002; Kyrkilis and Pantelidis, 2003). Continuous development of technology results in efficiency hence high profits. This attracts increased investments, FDI being included, as the confidence of the investor is boosted (Razin and Sadka, 2007).

The FDI boosts its volume of investment and efficiency under the neoclassical models of growth, and this leads to long-run level effect and medium-run developmental increase in growth. The endogenous growth models take into consideration the long-run growth as a function of technological development and make provision of the framework that can ensure that FDI permanently increases the growth rate in the host country through transfer of technology, diffusion and spill effects (Nair-Reichert and Weinhold 2001).

Justification for the Study

This research aims to study the roles that FDI plays in the economic development of host countries drawing from the case of Egypt, one of developing countries in Africa. The research is informed by the need to assess the contribution of FDI in alleviating the high poverty rate in the developing countries of Africa. Also, this research intends to investigate the factors that could attract the inflow of the FDI into Africa that continues to suffer setbacks in its bid to lure the FDI into the continent.

Research Questions and Objectives

The following research questions are generated to illuminate the grey areas of this study:

Questions

- How have the growth stages of FDI evolved in the country of Egypt over time? In order to answer this question, the stages of development of the FDI in the country for the recent 20 years will be highlighted and analyzed.

- What are the policies, laws and regulations of the government of Egypt on the inflow of FDI into the country?

- What are the contributing factors for the growth in the volume of FDI increase into the country?

- What are the direct and indirect impacts of the economic activities of the FDI on the socio-economic status of Egypt?

- How can Egypt enhance the positive impacts of the FDI on its economy?

Objectives

The general aim of this study is to investigate the roles that the FDI plays in the economic development of developing countries drawing specifically from the case of Egypt.

Specifically, this research intends:

- To investigate and analyze the developments of FDI inflow into Egypt.

- To explore the policies and regulations put in place by the government of Egypt to guide the activities of the FDI in the country.

- To determine the factors that contribute to the attraction and growth of the FDI inflow into the country.

- To assess the effects of the growth in the inflow of FDI on the economic development and social wellbeing of the country.

- To proffer useful suggestions on the enhancement of the inflow and positive contributions of the FDI towards the economic growth of the country.

Research Plan

This study is designed to utilize qualitative data collection methods and analyses. It will see to the use of library-based, desk-based, in-depth and key informant interviews for the collection of data.

Research Design and Perspective

This study views the proposed research from a qualitative perspective making use of a triangulation of various qualitative research methods to generate and collect data for the study as well as for the analyses of data collected. The case study approach was adopted by this research which intends to measure the roles of the FDI on the developing economies of the world. This study draws from the case study of the activities of the FDI in the country of Egypt to extrapolate the roles that FDI plays in the development of the economies of developing countries as host communities.

Since the purview of the study is to examine economic impacts and policies, quantitative data collection methods will not be applicable to the study as the study does not intend to collect data from multitudes but rather select well-informed individuals who by virtue of their position and office are well placed to adequately inform this research on the clues to answer the research questions generated by the study as well as in order to meet the research objectives.

Data Collection Methods

The study proposes to utilize both primary and secondary data collection methods of the qualitative research techniques. For the primary data collection method, the study will make use of data collected from the In-Depth Interview (IDI) with the use of an IDI guide as well as a Key Informant Interview (KII) with the use of a KII guide. For the secondary data collection, it will largely focus on the use of library literature, archival search and office records for relevant information.

In-Depth Interview (IDI): This will be one of the main methods through which salient information will be obtained for the purpose of this study. The research instrument that will be designed for this purpose is an In-depth Interview Guide (IIG) and the information solicited will be qualitative. Selected officials of the two Ministries; the Ministry of Investment and the Ministry of Finance and Economic Planning will be included in this study. The officials will be included in the study consequent upon their official capacity as senior officers that hold such offices that will make them knowledgeable about the subject of the research discourse. Information that will be gathered from them will include the government position on the inflow of FDI into Egypt, policies, regulations and measures put in place to attract and retain the inflow. Also, information that bothers on the plans and programs of the government to ensure effective spread of the positive impacts of the activities of the FDI on the socio-economic wellbeing of the nation will be obtained.

Key Informant Interview (KII): Key informant interviews will be conducted using a Key Informant Guide (KIG). The interview is designed to create an avenue for interaction between the researcher and those that are experts or very knowledgeable about the concepts and problems of this research. The type of information sought from them will also be qualitative. Selected Economic and business consultants based in Cairo, Egypt will be included in this interview to provide informed guesses on the theme of the study. Information that will be sought from them will center on their opinion on the policies and regulations of the government of Egypt on the inflow of FDI and its impact on the economic growth of the country.

Written records: In addition, the study will include a dossier analysis which deals with proper examination of desk-based information obtained from the two Federal Ministries selected for this study. In these two ministries, written records that are related to the research subject will be consulted and information that will be of good interest to the study will be extracted.

Library-based literature: Relevant library-based literature that will help illuminate the grey areas of the research will also be consulted and included in the analysis. This will help to corroborate or refute the information obtained from the two Federal Ministries included in this research exercise.

Sample Size and Selection Procedure

The nature of the study that intends to assess the roles contributed by the FDI on the economic growth of the country demands the collection of data from suitable respondents that will be able to adequately inform this research and add valuable knowledge. Therefore, this study will adopt a non-probability sampling technique as respondents for the qualitative research will be purposively selected. Twenty officials of the two purposively selected Federal Ministries; Investment and Finance & Economic Planning (Ten from each) will be purposively selected for the In-Depth Interview based on their official capacity, their level in the office and their willingness to participate in the research work. The Federal Ministries were purposively selected based on their direct involvement with policies and regulations that guides and support the FDI activities in the country.

In addition, ten experts from two randomly selected economic consultancy services that corroborate with the government on finance and economic planning will be included for KII. The list of such consultancy services will be obtained from the Ministries out of which two will be randomly selected consequent upon their willingness to participate in the study. Five experts from each will then be included in the Key informant interview of the study.

Analysis of Data

The data generated from the field will help in the investigation of the research goals in addition to providing answers to the research questions listed above. Information from in-depth interviews and key informant interviews collected with electronic tapes and notes will be transcribed, synthesized and organized under thematic headings.

Limitations of the Study

This research makes use of the case study approach to examine the impact of the FDI on the economy of Egypt. The data that will be processed in the research upon which the findings and conclusions of the research will be based will be limited to the information received from the respondents of the study as well as literature consulted and available office records. The research intends to extrapolate from the outcome of the study, the impacts that FDI has on the economic growth of developing host countries, however, it is worthy to mention that certain peculiarities may not make the findings of this study applicable to all developing countries.

Ethical Consideration

This research will be guided by the standards of the research ethics of the Coventry University. Participation and consent of the selected institutions and organizations for study will be obtained before the research is carried out. Appropriate applications for permission to collect data will be channeled to the two Federal Ministries and consultancy services companies through Coventry University. The ethics checklist and the compliance form will be completed by the researcher and adequate measures will be put in place to ensure that all rules and regulations guiding research are followed to the letter.

The study will uphold the principles which aim at protecting the dignity and privacy of every individual who, in the course of the research work, will provide personal or commercially valuable information about him/herself, organizations or others. The analysis will hold the identity of the respondents in confidence.

Planning and Resource Requirements for the Study

This study, being a qualitative one has the potentials to shed light and contribute to the body of knowledge on the impacts of FDI on developing countries. However, substantial resources will be dissipated to make the research work comes to fruition. Travel plans and accommodation expenses will be incurred for the duration of the fieldwork of the study which will include interviews and collection of office-based resources. Also, there will be waiting time for the processing of the approvals for the data collections from the selected Ministries for the study. This study envisages a delay might occur as a result of the processing, however, the researcher shall utilize adequate measures to alleviate this problem with the assistance of the research supervisor.

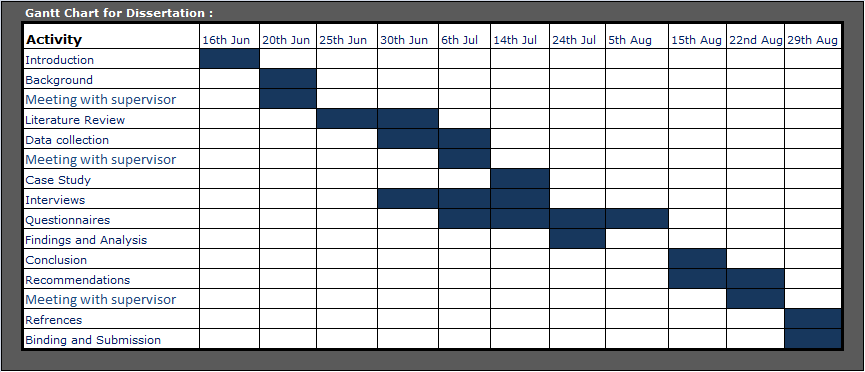

Gantt chart for the Research:

Reference List

Abdel-Hameed, N. (2008). “PPI and Measuring Inflation in Business Transactions in Egypt”. Department of Economic, Cairo University, manuscript.

Adler, M. and Hufbauer, G. (2008). ‘Policy Liberalization and FDI Growth, 1982 to 2006.’ Peterson Institute for International Economics 7, 1-58.

Alfaro, L., Chanda, A., Kalemli-Ozcan, S. and Sayek, S. (2004). FDI and economic growth: the role of local financial markets, Journal of International Economics, Vol. 64, 89-112.

Asfour, A. (2008). FDI in Egypt during the past 5 years: a paper presented at the African Association for Women Empowerment Mediterranean Congress, Cairo, 2008.

Athukorala, W. (2003). The Impact of Foreign Direct Investment for Economic Growth: A case study in Sri Lanka. University of Peradeniya, Sri Lanka.

Bosworth, B. and Collins, S. (1999). Capital Flows to Developing Economies: Implications for Saving and Investment, Brookings Paper on Economic Activity, Vol. 1999(1), 143-180.

Burton, S. (2002). Development at any cost: ICTs and people’s participation in South Africa. Communication: South African Journal for Communication Theory and Research 28(2), 43-53.

Corley, T. A. B. (1997). “Competitive Advantage and Foreign Direct Investment: Britain, 1913-1938. Business and Economic History, 26(2), 599-608.

Dunning, J. H. and Sarianna, M. L. (2008). Multinational Enterprises and the global economy. 2nd Ed. London: Edward Elgar publishing.

Dunning, J. H. and Gray, P. H. (2003). Extending the Electric Paradigm in International Business: Essays in honour of John Dunning. London: Edward Elgar Publishing.

Dunning, J. H. and Narula, R. (1998). Foreign Direct Investment and Governments: Catalyst for Economic Restructuring. London: Taylor and Francis.

Estrin, S. and Klaus, M. (2004). Investment Strategies in Emerging Markets. London: Edward Elgar.

Girard, B. (2001). Next-generation radio: Community technologies for democracy and development. The Journal of International Communication 7(2), 70-75.

Hansen, H. and Rand, J. (2006). ‘On the causal links between FDI and growth in developing countries’, The World Economy, 29 (1), 21-41.

Hnya, G. (2006). How to assess the impact of FDI on an economy: FDI statistics project, 1-13. [Online].

Hunter, R. (2005). ‘An Introduction and Primer on Foreign Direct Investment.’ Foreign Direct Investment for Development Financing 5, 11-17.

International Trade Administration. (2009), Asian-Pacific Foreign Direct Investment in the United States. U.S. Department of Commerce. [Online].

Jones, C. I. (2002). Introduction to economic growth, 2nd Ed. New York: W.W. Norton Company.

Kyrkilis, D. and Pantelidis, P. (2003). “Macroeconomic determinants of outward foreign direct investment”. International Journal of Social Economics 30(7), 827-836.

Nair-Reichert, U. and Wienhold, D. (2001). “Causality tests for cross-country panels: a new look at FDI and economic growth in developing countries”. Oxford Bulletin of Economics and Statistics, Vol. 63(2), 153-171.

Narula, R. and Sanjaya, L. (EDS). (2006), Understanding Foreign Direct Investment – Assisted Economic development. London: Routledge.

Nilsson, J. (2008). The FDI and economic growth: Can we expect FDI to have positive impact on the economic growth of Sub-Saharan Africa? Department of Economics, Uppsala University, Nationalekonomiska institution.

Onyeiwu, S. and Shrestha, H. (2004). ‘‘Determinants of foreign direct investment in Africa’’ Journal of developing societies, Vol. 20(1-2), 122-130.

Organisation for Economic Co-operation and Development (OECD). (2002). Foreign Direct Investment for Development: maximizing benefits, minimizing costs, Paris, OECD.

Organisation for Economic Co-operation and Development (OECD) and Global Forum on International Investment. (2002), New Horizons for Foreign Direct Investment. Paris: OECD.

Oxford Business Group. (2009), The Report: Egypt 2009. London: Oxford Business Group.

Oxford Business Group. (2010), The Report: Egypt 2009. London: Oxford Business Group.

Phisalapong, R. (2004), The Impact of Economic Integration Programme in Inward Foreign Direct Investment. London: Rozenberg Publishers.

Pringle, I. and David, M. J. R. (2002). “Rural Community ICT Applications: The Kothmale Model”. The Electronic Journal on Information Systems in Developing Countries, 8(4), 1-14.

Razin, A. and Sadka, E. (2007), Foreign Direct Investment Analysis of Aggragate Flows. Oxfordshire: Princeton University Press.

Rogoff K. and Rienhart C. (2003). FDI to Africa: The role of price and stability and currency instability. Working paper, International Monetary Fund (IMF).

Stiglitz, J. (1999). Participation and Development: Perspectives from the Comprehensive Development Paradigm. Seoul: International Conference on Democracy, Market Economy and Development.

Twoney, M. J. (2000). A Century of Foreign Investment in the Third World. London: Routledge.

Wagner, K. (2009). “What is Development?” Developmental Psychology.

Wallace, C. D. (1990). Foreign Direct Investment in the 1990s: A New Climate in the Third World.

Zhang, K. (2001). ‘Does foreign direct investment promote economic growth? Evidence from East Asia and Latin America’, Contemporary Economic policy, 19(2), 175-185