Introduction

This research paper has critically illustrated the perceptions and attitudes of the contemporary art market connecting the process of constructing value and factors touching the investor’s motivation in the international market that emerged and experienced during present and past three decades. To examine and explore these issues, this research paper has structured and contained with the eight major chapters presented introduction, construction and categories of artistic value, functioning process of the contemporary art economy, demand and supply of contemporary art, and main actors of the contemporary art economy. However, other chapters has discussed role of money in the contemporary art economy, defining the value of contemporary art and conclusion, the subsequent sub-chapters of the main chapters would be organized with more refined analytical views.

Background of the Problem

Lanzanova and Bosi (2009) pointed out that the contemporary art market is passing through tremendous crisis at Christie and Sotheby’s Contemporary Art events in London, Italian, New York along with the auctions at Chinese and Japanese contemporary art market that evidenced with unbelievable lower price, height number of unsold artworks, historical lowest revenue generation that leads to great uncertainty. The global financial crisis staring from the collapse of Lehman Brothers in September 2008 and it subsequent credit crash has flourished its dangerous impact on the contemporary art market and it has been evidencing hazardous situation that the auction houses pointed to the level of great depression of thirties. As a result, the investors in this sector are rethinking about their future strategies to encounter with the crisis; thus, it is essential for both the academia and concerned business sector to conduct research on ‘how does the international art market construct the ‘value’ of contemporary art’.

Rationale of the research

Many scholars in the area of economics of art and culture have tried to find out the solution of the question how the anthropological artworks are valuated or how the auction prices are determined; but most of them are cantered on either anthropological and sociological views rather than the economic evaluation contemporary art. Some other research has drawn their attention to stabilise the contemporary art market under the recent global financial crisis, most of the remarkable studies have concentrated on the ancient artworks, but no overarching research agenda has yet been proposed on how do the international art markets construct ‘value’ of contemporary art; thus; it is rational to conduct the present research.

Research Question and Objectives

There are so may research already conducted with the nature and shape of contemporary art, its standards and practice in the global market, but there is no research agenda has been raised with the value generation process of the contemporary art sector. The practice of the auction houses has catered to upraise the capabilities of this sector to prove its sustainability under the concurrent global financial crises based on their current knowledge to the future prospects for the investors. The objective of this research is to find out the policy and process of generating values of contemporary artworks that may reflect the economic and business reality through which the actors of the international market would be capable to formulating investment decisions, this study would engage its efforts to answer the following research questions as –

- How does the economy of this international ‘art world construct forms and categories of artistic value’?

- How does this economy function?

- How does supply and demand work?

- Who are the main actors or organisations?

- Broadly, what role does money play?

- How do we define this value – is it unique, or is it something that is shared?

Construction and Categories of Artistic Value

How the economy of contemporary art do construct forms and categories of artistic value has grounded as a part of long debate with the relation and formation economic and cultural value of arts prolonged from the Aristotelian ear. The classical economic theories during Adam Smith has tried to identify the artistic value of art from the consideration of self-love of individuals towards beauty and value of the objects related to a thought of the Divine lined with personal gratification where accomplishment of the utmost utility justifies the private consumption.

In nineteenth century, the economic theories were capable of explore credibly the diminishing marginal utility while the aesthetic philosophy has provided enough common denominator to determine the market value of are works, at this point the equilibrium prices were determined by linking with aggregate utility of the consumers along with its aggregate production cost by means of market exchange. By this time, the theory of economics has gained further maturity to express exchange value with price in terms of monetary measures and pointed out the independent effects of the subjective and objective variables that assist to commence transaction that turned price and value synonymous where cultural and artistic value considered under subjective category without any authentic research.

In the recent decades, the mainstream literature of contemporary art has turned as an unavoidable area of anthropology, cultural theory, and sociology while economics has contributed to identify the accord between economic and cultural value integrating the financial valuation of the event in the marketplace (Cowen & Tabarrok 2000). The economist like Scitovsky first pointed out the psychological sources of utility and engaged to explore the artistic valuation of consuming cultural good keeping attention to the booming of international art market in eighties that generated an improved interest in value due to the high prices of art works. Such explanation also generated further debates with the valuation of contemporary art arguing that that future artistic prices of the contemporary artworks are random that assist to generate oddly low returns on investment of art works; other economist encountered this view with the assumption that the artistic quality would be articulated in market terms. Although this hypothesis integrated the public policy as a factor of valuating contemporary art, but has failed to take into account of reputation of artworks and also the artist, some other economists argued that the criteria of aesthetic judgment would be articulated in terms of economic values connecting with the market reality and their aesthetic quality (Belting 2007).

The contemporary literature of economics of art and culture demonstrated the affiliation between the two values are enough difficult where thus is straightforward monotonic conversion from aesthetic value to economic value, thus to distinguish their relationship it would be wise to measure by adopting economic analysis and express them in monetary terms. The multidimensional attributes of artistic value derived from wider cultural disclosures have no standard unit to measure rather than price and monetary terms as a unique expression, while the re-engineering of cultural values provide its elements such as aesthetic, symbolic, social, and other components. At the same time, the economic approach of contemporary art has argued that its value analysis is strongly correlated with the socially organised observable factors along with the purpose of value may not be separated from the social background where it happens.

Dass et al. (2008) pointed out that the global market for contemporary art has gone through an esteem exploration in the preceding decade due to establishment of new art hedge funds, art mutual funds, along with the acceleration of Information Technology and its business application while the online art auction sites provided an enhanced opportunity for the vendors and artists. The integration of e-commerce has explored the market volume of the contemporary art and the growing attention to the whole art market has assisted to popularising the emerging art markets, the traditional art market from the developed countries has shifted its keep attention to the Asian emerging contemporary art (Baumol 1985; and Caro 2009).

Moreover, the simultaneous online auctions of contemporary art with an affordable price from the Asian emerging market along with high-value items have created further opportunity for simultaneous trading from different popular auction sites linked with eBay and social media platforms in numerous ways have generated high levels of competition between the market players (Lombardi 2009). The characteristics of art marketplace have demonstrated the trend of making extremely higher profits, which is unavoidably linked with the risk of high losses due to lack of alert analysis and assessment, thus forecasting the valuation of the contemporary has turned into a significant issue for the auction house managers and market player for their decision making. Many researchers provided model to present a dynamic valuation forecasting approach to predict price for a contemporary art, which is under ongoing process of auction opening for biding and next to the closing.

Functioning Process of the Contemporary Art Economy

To realise how the economy of the contemporary art functions, it is essential to understand the market, the players, their personal identity, dynamics of supply and demand, quality and process of economic decision-making, economic rationality of transaction along with consumer risk involved in the market. Following subheads would provide a clear insight regarding the process how this economy functions-

Commodity Attributes

Plattner (1998) and Bocart & Hafner (2011) mentioned that rather than the general economic attributes of commercial commodity, the art works are considered under luxurious goods and collectable items that valued at the level of irrational cost-effectively stage where only the exploration of cultural value could provide it an economic rationality. The material of art works market presented by the artists, dealers, collectors, museum, and galleries would signify the high-end elite customers, galleries, and auctioneers both from home and abroad to sell their ‘museum-quality’ ‘cultural commodities’ while their market values are formed by the consideration of key critics, exhibitors propagation, curators, collectors and dealers marketing campaign along with social media integration.

The contemporary artists until gaining their identity as an artist have to struggle to survive, rather than the dream to produce exceptional creative works, the reality of earning from the art force them to integrate themselves with the commercial process for immediate earning. The concurrent online market for contemporary art has generated the scope for the artists to works with a variety of market segments that generated subsistence level of income for their living, such diversification of art works has increased the number of freelance graphic designer and decreased the number of dedicated artists. As a result, contemporary art has shaped as special sort of consumer goods supposed by cultural value of civilized consciousness and owner of this commodity would be treated as an individual of high cultural standing in the society, this is why the demand of contemporary art is increasing among the social elites and raising elite class as a non-utilitarian good.

The Market Model of Contemporary Art

Buck (2004) and Codignola (2006) pointed out that the market of contemporary art denotes to the course of action through which the art works are presented to the vendors for buying and selling and by doing so the creativity of cultural values are transformed into commercial values while buyer achieves utility and sell gains profit. The contemporary art has the geographical classified such as local market confined with the national arena and global market scoped internationally without border barrier, the online marketplace of contemporary art are classified such as auction sites, B2B and B2C platforms. On the other hand, the contemporary art has primary and secondary market, the primary market deals with primary commodities those for the first time come into the market for selling; the secondary market deals with the old-fashioned items come into the market through brokers, art galleries, trading agents and auction houses.

However, the historical evidence of art has validated the association between the art works and money as a conventional practice, while the church, crown, and aristocrats were the patron of art, in the recent era the contemporary has generated further inextricably linked with subjective norms of the marketplace conditions. The marketplace characteristic of the contemporary art market has shaped strictly critical enough where there are private public, individual and institutional traders are actively taking part in the market form different insights. However, the process how the contemporary art market works in different categories work is different and it is not possible to discuss all of them; rather, this paper would enlighten on the process of working of the auction market.

Market Attributes

Following are the market attributes that evidence in the contemporary art market-

- Customers are generally suffers from the lack of information regarding the market and price ideal, they are also not familiar with the valuation process of contemporary art, but suffer from demonstration effects to be recognised as a highly cultured or place oneself at the aristocratic level;

- In the primary market, there are presence of direct artist, while the sellers of secondary market are mostly traders, auction managers, and brokers, the sellers of contemporary arts has both the non-investment and bulk investment attitudes;

- Artists as the producer of contemporary art has no direct integration with the customers, they do not look to the customer’s needs, rather they blame the ignorance of the customers if they do not agree to pay enough value to there artworks (Marinelli & Palomba 2008);

- A short number of contemporary artists are dedicated to their works and produce them from own love and do not bother for the market price;

- The consumers motivate themselves to demonstrate aristocracy by spending for cultural commodities without any understanding to the artistic or atheistic values and may carry enough risk to be fool;

- The general characteristics of the market demonstrate huge information gap, imperfection of market framework and lack of standard value calculation system where the transactions are unclean and confusing;

- The Contemporary art market would identified as an inheritance of the inspirational consequence of the capitalist culture industry that commoditised culture of the ultra-modern art with complex social conditions continued as a custom rooted in the early modernity (White 2009);

- Plattner (1998) pointed out the realistic paradox of the contemporary art market urged that individuals spend huge amount of money in this market to buy different artistic commodities while they have no clear idea about the actual price of that commodities,

- The artists involve their huge time and efforts to produce them knowing that there is no demand of it to the common people, but a very few people would spend for it, which is the implication for economic anthropology distinctive to wealthy societies;

How the Contemporary Art Auctions Work

Rather than different categories of contemporary art market at national level or international arena, this chapter would consider that the auction is the standard practice of market and would discuss whom the market players are, how the prices organised, how the buyers and sellers communicate and how the transactions are made.

Beggs and Graddy (2009) explained the functioning process of the auction market and added that when an individual or an artist would wish to sell an artwork, the person would contact with the auction houses or with an art dealer. Most of the world’s famous auction houses are Europe and America where there are art analysts in the auction firms to provide expert opinion and advice to the clients for the valuation of the artwork. Such analysts would provide a valuation and give an idea about the lowest and highest possible price to the seller and then they would settle a secret reserve price which the other clients and buyers never knows. Before starting the auction, the auction house would perform some groundwork; they would design a prestigious catalogue with the artwork including its title, artist‘s name, size and medium of the artwork, some cultural quotes and other lucrative information that would attract the buyers. Prior to the auction opens, the auctioneer would also declare a minimum price from where the bidding would start, but they never disclose the reserve price of the seller while the auction houses follow a traditional norm to set up the declared minimum price similar to the secret reserve price or above than that.

The general practice of contemporary art auctions demonstrate that although the bidding opens with the minimum price, but the auctioneer subsequently continues to calling higher and ever higher prices than the previous round of bids. At the stage where no bidders are willing to increase their bid price then the auctioneer would urge to ‘knockdown’ or ‘hammer down’ and the hammered price is the winning bid and the artwork would be sold out. At any case if there the auction fail to reach at its secret reserve price, the auction would be postponed and the artwork would keep unsold and it would be kept for further big auction or calling out of market.

Demand and Supply of Contemporary Art

Conceptual Framework of Demand Supply

Zakaras and Lowell (2008) pointed out that to understand the process how the supply and demand of contemporary art works it is essential to ensure that the artwork carries communicative attributes to provide the scope of interpretation of the inner meaning of that work by the viewers other than the artist himself. The creator on an artwork gets his inspiration from the society – both public and private realm and from the nature, then involves his intellectual capabilities, imagination, idea and feeling to communicate them through a certain medium and aimed to share his experience to the viewers though his works. Following figure would make sense to understand the supply and demand of contemporary art-

The above figure demonstrated the communicative cycle that necessitate more players other than the artist and his artwork and the circle organised with individuals experience to involve their considerations in the similar way that the artist has absorbed his emotion and vision and the viewer would be inspired to discover that conceptual propositions with appropriate human faculty. The communication process of the contemporary art has aimed to deliver the artist’s creative thinking and insights to the individuals who are interested to discuss artworks and keep a close look to the reviews and critique from aesthetic experience, both the individual and institutional players have the opportunity to involve in the supply and demand accord.

Heilbrun and Gray (2004) pointed out that it is precipitately clear that the size, shape, nature of the demand of contemporary art including its rate of growth is significantly depends on the consumer behaviour, while some of the consumers get pleasure from artworks by spending huge time and money, the other customers may have necessary attraction, but don’t spend enough. In the art marketplace, the customers behave in according to their choice and the customer’s choice for any particular artwork would generate demand of that item. Vlachynsky (2009) stated that there are several hypothesises that motivate the economic analysis of consumer choice and the opening hypothesis is that the income of consumers are limited for which they could not meet the expense to gratify all their needs; so, they have to choice fewer of the needs from lots of desires. The next hypothesis is that the consumer would formulate their choice rationally, they would utilise their limited income in a manner that provides highest possible satisfaction for him for every penny he spent. The highest possible satisfaction for which the consumers strive for, the economist denoted it by the term ‘utility’ and the consumers always try to maximising their utility and the final hypothesis is that the demand for each commodity has regarded to the ‘law of diminishing marginal utility’.

Measuring the Utility from Contemporary Art

Suppose a consumer of a multimedia CD has enjoyed 30 units of utility from his first purchase, while he would spend for second CD, his utility would decrease and suppose it stands at 29 units; accordingly, utility may stand at 28 for the consumption of third CD, the economic observation has identified this nature of utility as diminishing marginal utility. The law of diminishing marginal utility argues that keeping the consumption of all other goods unchanged, if the consumer increase his consumption for a particular item, the subsequent utility of that item would diminish and it would keep enough influence on the market demand and supply of that particular item.

To determine the utility, it is essential to understand the total utility (TU) and marginal utility (MU) that denotes the shifts of the quantity of aggregate utility due to increase of a single unit consumption, let assume ∆1 indicates the changes of the quantity of TU, Q indicates the quantity of specific product consumed by the consumer. Thus, the marginal utility stands ∆TU/ ∆Q, for the consumption increased just 1 unit then ∆Q = 1 and the marginal utility would be pointed out as –

MU = ∆TU … … … … … … … … … … … (1)

Due to consumer’s budgetary constrains they would engage their effort to optimise their utility for the greatest possible satisfaction by allocating their income among the required products in accordance to the marginal utility of that product bundle, thus each of the product they would purchase, the ratio of marginal utility and price of them would be same. As a result, the consumer would get same marginal utility from the last dollar that he spent on every product and this is the process how the consumers maximise their total utility of spending, utilising MU for marginal utility as well as P for price, the statute could be expressed as below –

… … … … … … … … … … … (2)

Here x and y are two different products from the product bundle consist of ‘n’ different products consumed by an individual consumer in the competitive market and the consumer could influence the market demand of that product by simply increasing or decreasing the quantity of his consumption.

The Market Demand Curve of Contemporary Art

Although an individual consumer has great influence on the market demand of contemporary art, but for economic analysis of market demand has more concerned with the aggregate demand of all consumers of a particular commodity rather than a single consumer. The market demand of a contemporary art would be generated from the sum of demands of all consumers in the market; so, the market demand curve would be organised integrating the entire individual consumer’s demand curve. Suppose there are two individual consumers ‘A’ and ‘B’ in the multimedia CD market, in the figure below represented how the demand curve of two consumers have added up to generate the market demand curve –

In the figure the demand curve of Customer ‘A’ and ‘B’ for multimedia CD has graphically added to find out the market demand of that CD, the last image among three has demonstrated the total quantity of demand for the CD while the horizontal axis indicates price and vertical axis represents quantity of the product that has consumed.

In the contemporary art market, buyers are not bound to compromise with the prices; they would either reduce their consumption or look for substitute products to respond to the incensement of price of a particular product. In the marketplace price of an artwork would determine the interaction between supply and demand of that artwork, to clarify the process price settlement, it is essential to plot a supply curve along with a demand curve in the same platform to observe their interaction.

The market demand curve of an artwork demonstrates the total quantity of that artwork which the buyers are willing to buy at the given price, at the same time the supply curve specifies the total quantity of that artwork would be offered for sale at given price in the marketplace. If the price of that item deteriorates and the buyers respond to this by increasing their consumption, the demand curves slope goes downward to the right, in the short run the supply curve would interact with this shifting situation by moving its slope upward to the right and the producers would increase production to sale in the rising price. It has demonstrated that both demand and supply curves illustrate a close association between quantity and price, as the variables of supply and demand functions are similar, they could be placed in the same figure where the price would be placed through the vertical axis and the horizontal would measure quantity, following figure demonstrates assumed market demand and supply curves –

In the above figure, an artwork of multimedia CD has gained market equilibrium at the intersect point of demand and supply cure where the quantity of market demand = quantity of supply = Qe at the price Pe, in the contemporary art market for the mentioned multimedia CD, Pe refers to the equilibrium price. By any chance, if the price Pe displaces from this level, the market forces would pressurise to bring back it at that level; for instance, if the producer increase his supply of CD at the level QS1, but the customers only consume QD1 at that and the producer would suffer from excess production and would account lose. Otherwise, he has to offer a reduced price in the market to inspire the customers for increased consumption or bring back to his supply at the Qe.

Main Actors or Organizations of the Contemporary Art Economy

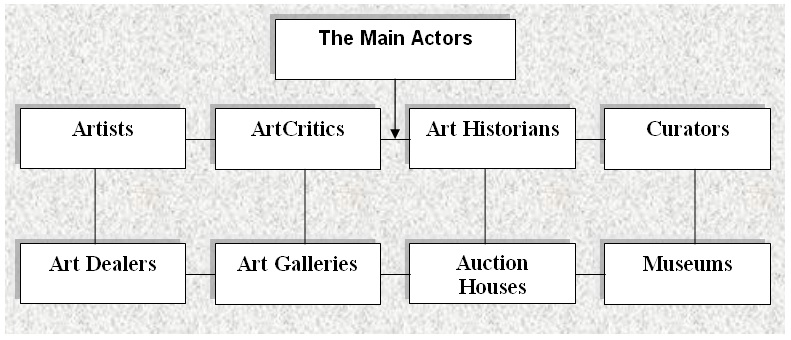

According to the view of Buendía (2006, p.2), the main actors of the markets are artists, art critics, historians, art dealers, galleries, museums and so on; however, the following figure includes eight main actors in this market, for instance –

Artists and Creative Procedure

The prime motivation of the artists is to create artworks to satisfying himself, but his secondary aim is to please his public and patrons; therefore, this group engages with numerous functions and develops collaboration with the traders, galleries, museums, art critics and historian to endeavour to establish himself as a successful person and to become celebrity from an ordinary person. At the same time, other related business organisations like commercial galleries and museums need the innovation creation of the artists for their business purpose; therefore, they develop a unique supply chain management to collect artworks from the artists, for instance, the function of the dealers is to attract the attention of critics and gain credit.

However, artists get inspiration from several sources, but national and international awards reinforce the artist‘s achievement, which also help the artists to attract the curator; in addition, the art critics of major art journals garners would like to find out competent artists. There are many other ways by means of artists can please the audience and attract the curator; however, reviews of an exhibit legitimize the art, increase the demand of the artists’ artworks, help to create alliance with different organisation, and often create controversy.

Many scholars pointed out that Artists sometimes use secondary market to create audience and auction their artworks or find out traders to develop association with auction houses; however, this process has some negative impact on the art world because the new system creates long distance between artist‘s work and critics, historians and curators (Buendía 2006, p.3; and Spaenjers 2010).

Art Critics and Art Historians

Buendía (2006, p.4) Joy & Sherry (2003) stated that literature about art can take numerous forms, for instance, it can be simple labels, or may complicated structure; however, Gemtou (2012, p.2) argued that the objectives of these groups are to interpreting, evaluating, distinguishing and comprehending individual activities and intellectual work. Gemtou (2012, p.2) and Buendía (2006, p.4) further stated that the prime function of the art critics is to scrutinize the values linked with artistic creations by giving importance on several issues, such as, subjective factors in the investigation and interpretation of works, acknowledge global artistic values, and so on.

Furthermore, Buendía (2006, p.4) and Gemtou (2012, p.2) pointed out that criticism performs a gate-keeping function to assess and compare artworks with previous ideology and location to protect art from becoming a commodity; however, critics can be taken place in the journal articles, magazines, or even in research and management of visual media, which would use fundamental methodological tools. The scholars stipulate the strength of the artwork by stating whether there is a variation of a theme, an incessant innovation, or an entirety new creation to identify and promote new talents; in addition, such criticism gives the justification for setting punitive directions, assists to train new critics along with contributes to the development of academic concerns. Here, it is important to mention that the process of in-depth evaluation through critics enhance business as it is intensely embedded in the market context particularly commenting on the novelty and exclusivity of the creation to customers, art writing deeply embedded in the market context (Buendía 2006, p.4; Joy & Sherry 2003; Joy 2000; and Gemtou 2012, p.2).

Museums

Museum is another significant part of the art world and the prime vision of this institute is to collect, exhibit, interpret and to take art and convey the idea of the stability of culture to the public (Buendía 2006, p.4). On the other hand, Museums often conceal information while curator selects any creation to display considering the customer’s preference; therefore, caretakers and curators of this institute are very influential body to determine customer’s choice (Buendía 2006, p.5; and Frey & Eichenberger 1995). In this context, this institute has shifted from the traditional purpose while there are too many dominating factors to select particular artworks for the museums, such as, scholarly examination and evaluation in research and publication, conservation, the satellite activities, budgetary control over purchase of new goods, motivation and ambition of the curators, and so on (Buendía 2006, p.5).

At the same time, management can purchase a new one when they can sell old arts those where purchased at higher price; however, supervising the value is also significant power of the curators (Buendía 2006, p.5; and Frey & Eichenberger 1995). Nowadays, museums concentrate more on the commercial issues and consider higher rate of return; therefore, museums become subservient extensions of galleries (Buendía 2006, p.5; Joy 2000; and Frey & Eichenberger 1995). The top-management of public museums had to follow severe restriction and they have no right or power to sell artworks; in addition, they need permission from the specific ministry to purchase contemporary artworks (Frey & Eichenberger 1995, 5).

Auction House

Heilbrun & Gray (2004, p.174) and Campbell (2006) stated that an auction houses mainly a good place for the quick or it is a market institution with a precise procedure shaping resource distribution and prices in accordance with the bids from the market participants, for instance, curator, dealers, collector, Christie, etc. adopted this same strategy for selling artworks. In addition, auction houses are not considering standard valuation of the market since sale at auction may gain the highest price for the vendor that indicates the price is raised until just a sole bidder remains (Heilbrun & Gray 2004, p.190; and Hutter & Throsby 2006); however, the following figure shows more elaborately –

However, the following table shows the auction sales revenue –

Table 1: Auction sales revenue by percentage in 2011. Source: Self generated from Artprice (2011).

Art Galleries

Heilbrun & Gray (2004, p.241) stated that art galleries can establish for commercial purpose to maximise profits or can organize on a not-for-profit basis; however, significant galleries still perform as intermediaries between artists and collector, which assists the artists to enhance new alliance.

Public and Private Institutions: there are many public and private institutions those influence the market, for example, professional symphony orchestra, opera, private collectors and agents, curators and public museums are also pertinent buyers of artworks

Role of Money in the Contemporary Art Economy

Nikodijević (2010) pointed out that contemporary art being linked with the market and money turned as an integral part of modern economy, the nature of contemporary art for its direct accord with money has generated tremendous shifts on the traditional production of artworks linking with many uncertainties, conceptual lacking, clarity to moral hazards and condemnations on the entrance art world. Money has generated the opportunity to the aesthetic works to convert its artistic values in to exchange values, at the same time it has provided many uncertainties about the interest groups and market players, money is the power that forcing the art world to turn the middle class as target audience rather than facing to the aristocratic and elite class.

In the contemporary art world while the artists turn their face towards moneymaking, the artists align themselves into seller rather than artistic creator and the buyers gain artistic judgement capacity where the buyers could force the seller to change their traditional values towards buyers liking and choice. As a result, art from its universally accepted rules shifted to the market needs that deteriorate numerous unique features of artistic creation those were aimed to explore the signs of different, regardless to the particular status of socioeconomic reproduction that entirely depend on the economic or market needs like commercial commodity where investors would be interested to ensure money flow. Money has generated the differences between the lower market efficiency of artworks comparative to the other forms of endeavour along with imperative association and process that illustrate the contemporary art market considered in a segmented way counting the diversity that prolonged to the concept and contents of the conventional artistic practice in relation to the contemporary culture industry.

The artistic works prolonged with the consideration of special form of human labour has provided aesthetic dimension with sophisticated qualitative value from the ancient era, but money in the era of contemporary art has forced the artistic creation to shift its alignment from the classical methodology towards technology involvement and to be less time-consuming. Such driving force of money has developed the sense that the market value of artworks are exclusively quantitative, it has to turn into general characteristics of production concerned with time, resources and efforts where the straightforward shape of production would encompass with easy work by avoiding all traditional complexities of artistic creation. As a result, the art world has gained value that provided enhanced opportunity of merchandising in the commercial exchange basis rather than the level of barter, a huge exploration of auction houses patronised the contemporary art industry where money still played its autonomous role.

Value of Contemporary Art – it is unique or other luxury commodities

Powhida (2012) stated in the New York Times that there is no specific scale to deter the value of contemporary art while prices jump from hundreds to hundreds of thousands of dollars rooted in branding and marketing. At the same time, Forrest (2008) argued that consumer’s perception of value is the key measurement to settle on the value of the art since the price of such artworks depends on the opinion of the buyers; as a result, the contemporary artists have the opportunity to increase the price and make profit without considering any external and internal factors. On the other hand, Ashenfelter & Graddy (2003) researched on the sale rates and prices of arts and stated that value of contemporary art varied while price levels are negatively connected to sale rates; thus, it is hard to measure whether contemporary art is unique or like other luxury commodity. However, mainly rich collectors and art customer can afford to buy artworks and they are small in number who intended to purchase artworks from primary market; therefore, it should treat as luxury unique commodity.

Conclusion

The complexities of calculating aesthetic value and its conversion into economic values have turned the contemporary art world to align with straightforward expression of monetary terms as a unique process. The historical evidence of art has validated the association between the artworks and money as a conventional practice while the recent evidence of contemporary art has generated further inextricably linked with subjective norms of the marketplace conditions that determine the equilibrium through the interaction of supply and demand. It is thus essential to provide the contemporary art market more commercialisation, promote market entries by the new players, integrating information technology, increase familiarity of software to the artists and financial flow from the private and public inventors would contribute to overcome concurrent crisis.

Reference List

Artprice, 2011, Art Market Trend 2011, Web.

Ashenfelter, O & Graddy, K 2003, A Study of Sale Rates and Prices in Impressionist and Contemporary Art Auctions, Web.

Baumol, W. J 1985, Unnatural value: Or Art Investment as Floating Crap Gane, Web.

Beggs, A. & Graddy, K 2009, ‘Anchoring Effects: Evidence from Art Auctions’, American Economic Review, Vol.99, No.3, pp.1027–1039. Web.

Belting, H 2007, Contemporary Art as Global Art A Critical Estimate, Web.

Bocart, F.Y. R. P. & Hafner, C. M 2011, Econometric analysis of volatile art markets, Web.

Buck, L. 2004, Market Matters: The dynamics of the contemporary art market, Web.

Buendía, F 2006, The Information Problem in the Art Markets: A Formal Model, Web.

Campbell, R. A. J 2006, Art as a Financial Investment 2006, Web.

Caro, A 2009, The British Art Market, Web.

Codignola, F. 2006, Global Markets and Contemporary Art, Web.

Cowen, T. & Tabarrok, A. 2000, ‘An Economic Theory of Avant-Garde and Popular Art, or High and Low Culture’, Southern Economic Journal, 67(2), pp. 232-253, Web.

Dass, M. Jank, M. Shmuel, G 2008, Dynamic Price Forecasting In Simultaneous Online Art Auctions, Web.

Forrest, N 2008, The Price and Value of Contemporary Art, Web.

Frey, B. S & Eichenberger, R 1995, On the rate of return in the art market: Survey and evaluation, Web.

Gemtou, E 2012, ‘Subjectivity in Art History and Art Criticism’, Rupkatha Journal on Interdisciplinary Studies in Humanities, Vol.2 No. 1, Web.

Heilbrun, J. & Gray, C. M 2004, The Economics of Art and Culture, Cambridge University Press, Cambridge.

Hutter, M. & Throsby, D 2006, Value and Valuation in Art and Culture Introduction and Overview, Web.

Joy, A 2000, Artists, artworks and the discourse of art: Organizing for success, Research in Consumer Behavior, 9 (JAI Press, Greenwich, CT), pp. 71–102.

Joy, A 2000, ‘Art, works of art, and the discourse of fine art: Between art worlds and art markets’, Research in Consumer Behaviour, Vol.9, pp.71–102.

Joy, A., & Sherry, J.F 2003, ‘Disentangling the paradoxical alliance between art market and art world’, Consumption, Markets and Culture, 6, 155–181

Lanzanova , E. & Bosi, S 2009, The Art Market: An Analysis of the Crisis, Web.

Lombardi, M 2009, Social Media and Contemporary Art Market, Web.

Marinelli, N. & Palomba, G 2008, A Model for Pricing the Italian Contemporary Art Paintings at Auction, Web.

Nikodijević 2010, Art, Economy, And the Market the “Aesthetic Syndrome” And Market Rules, Web.

Plattner, S 1998, ‘A Most Ingenious Paradox: The Market for Contemporary Fine Art’, American Anthropologist Vol. 100, No.2, pp482-493, Web.

Powhida, W 2012 Why You Should Buy Art, Web.

Spaenjers, C 2010, Returns and Fundamentals in International Art Markets, Web.

Vlachynsky, M 2009, $140 Million for Pollock?! Contemporary Art Market Explained, Web.

White, L. 2009, Damien Hirst and the Legacy of the Sublime in Contemporary Art and Culture, Web.

Zakaras, L. & Lowell, J. F 2008, Cultivating Demand for the Arts, Arts Learning, Arts Engagement, and State Arts Policy, Web.

Footnotes

- Greek letter delta.