Basic Company Information

Walmart is a multinational retail company based in America that operates a chain of grocery stores, discount department stores, and hypermarkets. It is the biggest company globally by revenue generation (Jindal et al., 2021). Sam Walton founded the company in 1962, and it has grown over the year to have more than 2,300,000 employees globally (Jindal et al., 2021). The company is located in 27 counties in which it operates more than 11000 stores and clubs (Jindal et al. 2021). Despite its growth, Walmart has been criticized for its involvement in gun violence, wage practices, environmental impact, animal welfare concerns, and worker rights violations.

The key drivers of performance in Walmart are the vision and mission statements. Walmart’s current vision is “to be the customers’ first choice for Walmart US convenience needs and services” (Alsharari, 2021). The company’s mission is two-fold: to help its customers save money, live better, and provide unmatched service and convenience (Walmart, 2022 par. 2). In terms of how these statements relate to one another, it could be argued that Walmart’s vision is more forward-thinking, while the mission provides a clear guide for the company’s day-to-day operations. The vision statement speaks to what Walmart wants to achieve in the future, while the mission outlines the specific steps that need to be taken to reach that goal (Walmart, 2022). In this way, the vision serves as a motivating force for the company, while the mission provides a framework for turning that vision into reality.

Industry and Competitive Analysis

The Attractiveness of Walmart’s Industry

The attractiveness of the retail industry depends on the rate of returns that it accrues to the organizations operating within it. According to 2021 statistics, most retailing firms such as Walmart accrued about 16.6% on the total products, they released into the market which is a marl higher than the average returns of 10.6% (Alsharari, 2021). Increased returns on merchandise reflects the higher profitability that the industry sees, where it yields a revenue of 0.5% to 3.5% (Alsharari, 2021). These profits encourage investors, meaning the cost of capital is reduced in in this industry. With these data, the industry is likely to generate even more income beyond the average returns.

Dominant Economic Features in the Industry

Walmart is in the retail industry, meaning the company operates under a business model of low prices, low costs, and high volume. Walmart can offer low prices by sourcing from low-cost suppliers, operating efficiently, and passing the savings on to customers. The company has successfully replicated this low-cost business model across a wide range of product categories (Jindal et al., 2021). As a result, Walmart has become one of the largest retailers in the world.

Porter’s Five Competitive Forces

Porters five competitive forces include the buyer’s power, supplier’s power, market rivalry, threat of entry and substitutes. The threat of new entrants is low due to the high barriers to entry in the retail industry. For example, Walmart has many locations and a well-established brand name. New entrants would need to invest heavily to compete with Walmart. The bargaining power of buyers is high because there are many options for consumers when it comes to retail stores. Buyers are price-sensitive and will switch to another store if they can find lower prices. The bargaining power of suppliers is moderate because while Walmart is a large buyer, it lacks complete control over its suppliers (Chekwa et al., 2018). Competitive rivalry from existing firms is fierce in the retail industry. Threats of substitutes have been increasing for Walmart with the rise of eCommerce. In addition, there is the threat of small, local retailers who can offer a more personal shopping experience. These threats have led to a decline in Walmart’s market share, increasing the need to take immediate action promptly.

Industry Key Success Factors

The retail industry presents a competitive environment for the survival of Walmart. Walmart has successfully met these requirements, which explains why it is one of the dominant players in the retail industry (Jimisiah et al., 2020). Therefore, the retail industry present with convenient locations, product selections, customer service and reduced prices as the key success factors. These factors are important because they allow businesses to compete in this competitive industry (Alsharari, 2021). The retail business is an important part of the economy and has many key success factors.

Driving Forces

In the retail industry, there are a variety of driving forces that contribute to the success or failure of businesses. The most important of these driving forces is consumer demand. This client’s demand refers to the needs and wants of consumers that drive businesses to produce and sell certain products or services. For businesses to be successful, they should compete against other businesses in their industry. Jimisiah et al. postulate that it requires them to offer products or services that appeal to consumers and are priced competitively (2020). Additionally, businesses must keep up with changes in technology, as this can impact both consumer demand and competition (Jimisiah et al., 2020). Finally, businesses need to be aware of macroeconomic factors, such as inflation, interest rates, and unemployment, impacting the retail industry. By understanding these driving forces, businesses can make strategic decisions that will help them achieve long-term success.

Industry Competitors

Several major players in the retail industry, including Target, Costco, Wal-Mart, Amazon, and Alibaba. These companies have been successful by offering products that are high quality and low cost. Additionally, they have effectively promoted their products through advertising and marketing campaigns. As a result, these companies have become leaders in the retail industry. The retail industry is one of the most competitive industries globally (Alsharari, 2021). Businesses must be able to offer goods and services of high quality and at competitive prices to succeed in the market. They must effectively promote their products and services to consumers.

Strategic Map for Primary Competitors

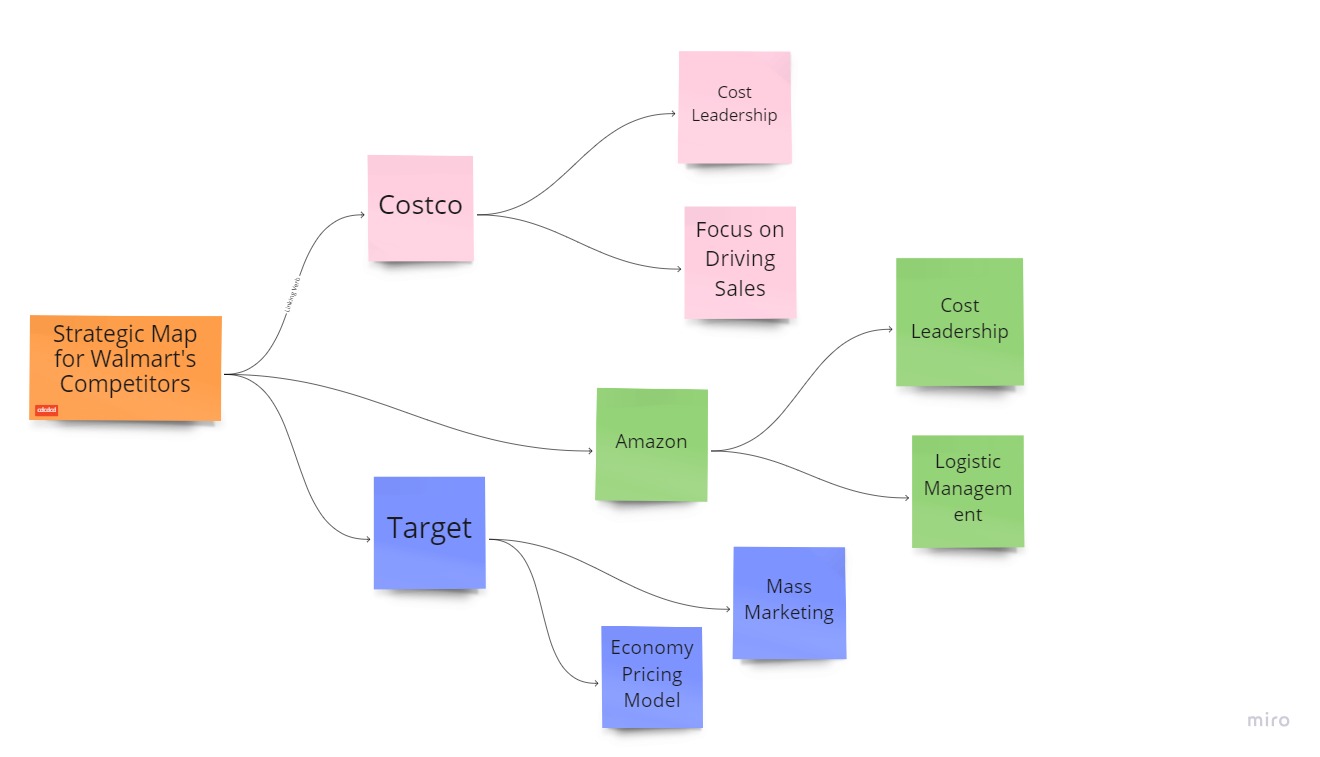

The following mapwork showcases the strategies that Walmart’s rivalries are implementing to win the market. Costco’s cost leadership has allowed the organization to present itself as the sole provider of the cheapest good in the market. For Amazon, logistics management and cost leadership are critical designs that enable it to remain viable in the market. The company has introduced robotic systems that help to automate the supply chain process and the logistic system in general. Target manifest its lowered production costs via the economy pricing model where it sells goods at cheaper prices compared to those of Costco and Amazon (Alsharari, 2021). The figure below outlines one more competition strategy employed by each company.

Summary of the Industries Prospects and Overall Attractiveness

In summation, the retail industry has experienced much profitability due to increase in the return on merchandise. The good performance has attracted both new firms and customers, making the existing firms devise strategies to survive the rising competition and to secure the current market. The Porter’s competitive analysis on Walmart reveal that the company has implemented barriers to entry into the new market by lowering its products beyond that offered by its customers. Consequently, Walmart’s competitors such as Costco and Amazon have implemented the cost leadership strategy and Target the economy pricing model to also reduce their prices (Alsharari, 2021). While competition stiffens, the industry continues to thrive due to driving forces available, including increased customer demand.

Strategic Position

Definition of Strategy by Hambrick Model

The Hambrick model can help to explain Walmart’s strategy as it highlights various critical designs applied by organizations to achieve success. The model suggests that a company’s strategy is based on four key factors: market position, product scope, development focus, and resource allocation (Li et al., 2018). The organization’s market position is based on offering low prices and being the largest retailer globally (Li et al., 2018). The firm’s product scope is based on offering a wide variety of merchandise. Walmart development focus is on expanding its online presence and improving its stores and supply chain (Li et al., 2018). Additionally, its resource allocation is based on investing heavily in technology and automation. The Hambrick model helps establish how Walmart plans to compete in the future.

SWOT Analysis

The current position of Walmart manifests the huge revenue the company accrues during its operations. These profits stem from the company’s strengths such as global emergence, especially through increased online presence allowing it to internationalize. Additionally, the company has harnessed some opportunities such as online sales, though a deficit is still present, to increase its market base. Nevertheless, Walmart’s current position may be defined by threats such as stiff competition from companies like Amazon (Alsharari, 2021). The following table shows additional components of the SWOT analysis possessed by Walmart.

Table 1: SWOT Analysis Table

Five Generic Competitive Strategies

Michael Porter’s five generic strategies entail the designs that business can apply to achieve profitability and include differentiation, low-cost provider, focused low-cost, best-cost provider and focused differentiation. Walmart offers a low cost, where its products are the sold at costs lower than those of its competitors. Secondly, Walmart offers unique products and services to customers, which is a strategy that has widened its differentiation capacity. Thirdly, the low focused cost is the ultimate strength that Walmart uses to beat its competitors where it offers the product at low prices. Fourthly, the company is focused on differentiation, where it innovates and creates highly distinct goods from its competitors (Walmart, 2022). Lastly, the best cost strategy correlates with the low costs offered by the company as the reduced prices attract many customers.

Walmart’s Resources and Competencies

Walmart’s resources revolve around the physical situation of its retail shops. The biggest crucial resources for Walmart entail the brick-and-mortar stores established in various countries. Along with these physical structures, the company has imperative resources in distribution, virtual infrastructure and distribution (Alsharari, 2021). Besides, the success of Walmart has been defined by competencies such as value, innovation, customer service and marketing, promoting its success.

Competitive Strength Assessment of Two Closest Rivals

The two closest rivals of Walmart are Costco and Amazon, whose competitive strategies prompts Walmart to fight for survival in the retail market. By performing a competitive strength analysis of both Costco and Amazon, the position of Walmart can be identified in the current market. In this evaluation, the first factor is brand awareness and reputation where Costco had a rating of 4 while Amazon 10. Based on family friendly image, Amazon is rated 10 while Costco 5, showing that Amazon has been acknowledged by most households. The online presence rating for Amazon has been assigned a 9-score mark while that of Costco 3 (Alsharari, 2021). Unequivocally, Amazon shows to have a competitive advantage compared to Costco, meaning it can create a superior value even above Walmart’s products.

Leadership and Corporate Culture

Walmart is a company known for its highly effective leadership and corporate culture. The company’s leadership team is focused on executing the company’s strategies in a way that promotes growth and profitability (Purwanto et al., 2020). The company’s culture is customer-centric, and this helps to ensure that the company’s strategies are executed in a way that is beneficial to customers. Walmart’s culture helps promote a high level of employee engagement, which is essential for executing the company’s strategies effectively (McGee, 2018). Overall, Walmart’s leadership and corporate culture are two key factors that contribute to its success in executing its strategies.

Financial Analysis

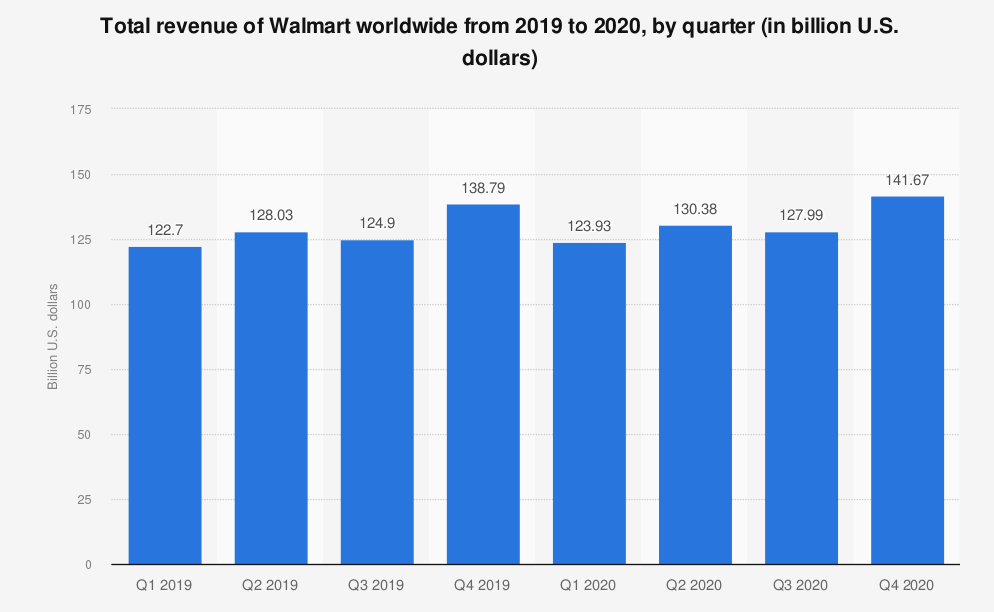

Walmart has been profitable for each of the last three fiscal years. The company’s net income for 2019 was $13.6 billion, up from $13.0 billion in 2019 (Phillips & Rozworski, 2019). Walmart’s return on equity (ROE) was 22.4% for 2020, up from 21.7% in the fiscal year 2019 (Phillips & Rozworski, 2019). The company’s return on assets (ROA) was 10.1% for 2020, up from 9.6% in the fiscal year 2019 (Phillips & Rozworski, 2019). Walmart’s profit margin was 3.3% for the fiscal year 2010, up from 3.2% in 2020 (Phillips & Rozworski, 2019). In the fiscal year 2019, Walmart had US$514.405 billion in revenue, 7th largest retailer in terms of revenue, US$288.92 billion in gross profit, 4th largest retailer, and US$11.341 billion in operating income (Phillips & Rozworski, 2019). Along with this performance, it is the 5th largest retailer with US$51.837 billion in net income and the 2nd largest retailer in US retailing industry (Phillips & Rozworski, 2019). From FY2018 to FY2019, Walmart’s revenue increased by 2.8%, while its net income decreased by 1% (Phillips & Rozworski, 2019). The following two figures, figure three and figure three, reflect the financial performance of Walmart’s branches and revenue accrued.

Conclusion Concerning Competitive Position

The analysis findings suggest that Walmart is in a strong competitive position. The company has several advantages, including its scale, efficient operations, and low prices. Additionally, Walmart has a strong brand and is well-positioned to compete in the online retail market. However, there are some potential challenges that Walmart may face. These include competition from Amazon and other online retailers and the possibility of disruptions to its supply chain (Walmart, 2022). Overall, the competitive position of Walmart appears to be strong.

Recommendations

Over the next 2-5 years, Walmart should focus on three key areas to continue its growth and success. To answer this question, it is necessary to consider both Walmart’s internal and external environment. Walmart should improve its online presence and customer service concerning the internal environment. In terms of the external environment, Walmart should focus on increasing its global expansion efforts. Walmart’s online presence is currently lacking when compared to its competitors. To improve its online presence, Walmart should develop a more user-friendly website and increase its social media marketing. These strategies are sensical since they focus on both the external and the internal business environment. For instance, improving customer service would attract more people due toe the excellent services provided, which would lead to profitability. With increased revenue, other investors and I can buy Walmart’s stocks as we will be guaranteed of good returns.

References

Alsharari, N. M. (2021). Management accounting practices and E-business model in the US Walmart corporation. Accounting and Finance Innovations.

Chekwa, E., Martin, J., & Wells, K. (2018). Riding on the waves of sustained competitive advantage: Consumers’ perspectives on Walmart corporation. International Journal of the Academic Business World, 8(2), 13-25.

Jimisiah, J., Tasnim KZ, N., Firdaus A, K., & SH, S. (2020). Study on factors that impede the success of retail and wholesale industry: A case study on consumer selection decision towards retail business at Alor Setar, Kedah. International Journal Of Innovation And Economic Development, 1(5), 44-52. Web.

Jindal, R. P., Gauri, D. K., Li, W., & Ma, Y. (2021). Omnichannel battle between Amazon and Walmart: Is the focus on delivery the best strategy? Journal Of Business Research, 122, 270-280.

Li, C. G., Dong, H. M., Chen, S., & Yang, Y. (2018). Working capital management, corporate performance, and strategic choices of China’s wholesale and retail industry. The Scientific World Journal, 2018.

McGee, R. (2018). How large is Walmart? A comparison of Walmart sales to Nations GDP. SSRN Electronic Journal.

Phillips, L., & Rozworski, M. (2019). The people’s republic of Walmart: How the world’s biggest corporations are laying the foundation for socialism. Verso Books.

Purwanto, A., Bernarto, I., Asbari, M., Wijayanti, L. M., & Hyun, C. C. (2020). The impacts of leadership and culture on work performance in service companies and innovative work behavior as mediating effects. Journal of Research in Business, Economics, and Education, 2(1), 283-291.

Walmart. (2022). Walmart and Walmart Foundation awards $3.5 million for BIPOC community programs. Corporate Philanthropy Report, 37(5), 2-3.