Corporate Profile

Amazon is famous for its corporate cultural trend that aims at motivating employees to take risks and explore new ideas. The organizational culture of Amazon is characterized by customer-centricity, boldness, and peculiarity. The boldness characteristic is reflected in its ability to sell a wide array of items online, from books to data-intensive technology. The centrality of the customer in Amazon business, for example, much focus is put on customer requirements and demand through determining consumer preferences. It applies them to online retail and other related services. Peculiarity as a cultural characteristic refers to the various ideas deployed to tackle challenging conventions. The company has adopted focus strategies, customer differentiation, and low cost-leadership to maintain a sustainable competitive advantage. In other words, Amazon aims at positioning itself as a company with the lowest prices and most convenient for its customers.

Competitive positing to Amazon means creating value in the market through differentiating to commodities they offer. Additionally, the company develops services and software that reach out to all consumers worldwide and innovates solutions to transport, logistics, and supply chain optimization. Besides, the structure acts as a determining element for Amazon Inc to withstand the tight competition from competitors such as Walmart, Google, Apple, and Microsoft, among other businesses with non-online and online operations (Dwoskin, 2020). The advantage of corporate organizational structure includes managerial control, which is equally crucial in implementing strategic management. The following risk wheel, cognitive map, and connectivity demonstrate the risks that affect Amazon.

Risk Identification

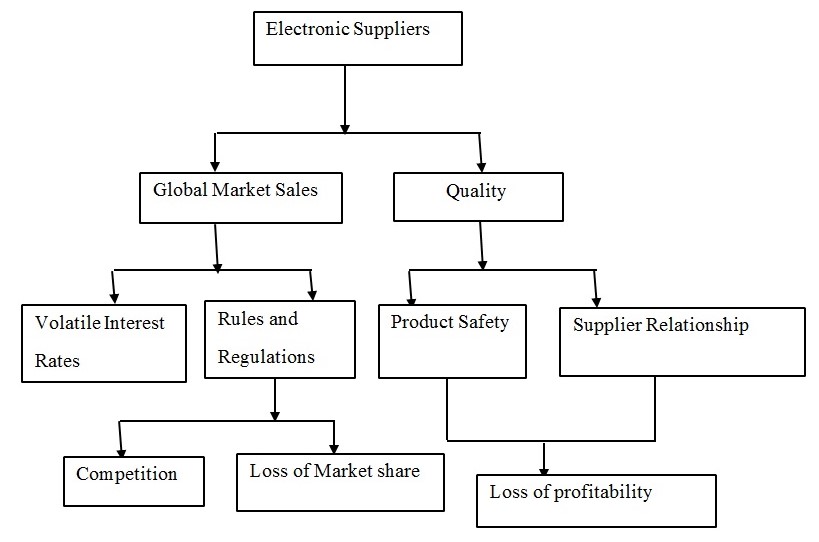

Risk Wheel

Operational Risks refer to risks because of failed internal processes, systems, controls, people, or external events. The execution of Amazon’s business function determines such risks. For example, global manufacturing operations deprive the company of the monopoly to supply a particular product worldwide. Furthermore, products such as phones are prone to duplication, thus not ensuring product safety, which means the risk may disrupt the product provided because the product’s security has been compromised.

Due to various changes to the market interest rate, and macroeconomic forces because of risk, sources of funds become volatile, especially if the underlying securities also change in value. Therefore, financial risk can be defined as the possibility of losing money invested in a business. However, the budgeting process that defines cost control assists Amazon in identifying and reducing the business expenses to boost profit earned (Denning, 2019). For instance, if the actual financial spending is high than the budget funds, the management is prompted to act.

Strategic risks such as reputational risk act as a threat to the standing of a business like Amazon. Such risk can either be derived from the company itself, how it is carrying out its daily operation, or how the employees carry themselves around customers. Additionally, strategic risks like joint ventures are disadvantageous due to their restriction of flexibility, clash of company culture, and imbalance in the market, among others.

Besides, market risk like competition hinders the company from achieving its goals as caused by competitive forces. As a result, business revenue may either decline or margins due to competitors’ activities, thus negatively impacting the business. On the contrary, competition assures the consumers of low prices, quantity, and quality of goods and services.

Cognitive Map

The cognitive mapping simplifies the company’s problem and helps in creating a strategic and operational plan. For instance, the above cognitive map describes the supplies of electronics to the global market. The electronics need to be of good quality to sell in the worldwide market. The international market sale is affected by the rules and regulations to avoid exploitation by Amazon, its competitors, and consumers. These regulations and expected interest determine how Amazon will sell the electronic device in the global market. When the rules are favorable, such as the exchange rates, the sales will go high, but the global market deal will be below when the exchange rate is low (Streitfeld, 2020).

On the other hand, the product’s quality determines its safety to dominate the market and create a good relationship between Amazon and its consumer, thus dictating its profit margin. Rule and regulations create a conducive environment for the competition, and help in the distribution of market share between Amazon and its competitors. All these are necessary for the company to plan according to the best electronic products supplier.

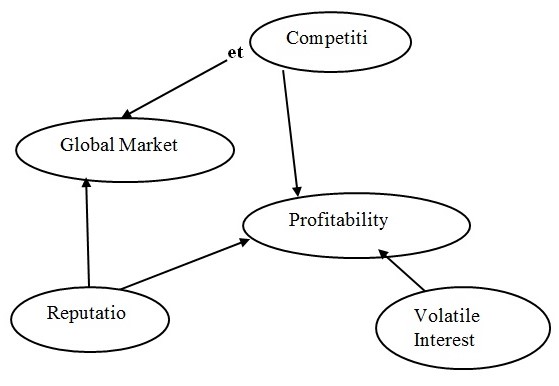

Connectivity Graph

Competition is an independent risk in the global market that affects the margin of profitability. The quality of the product will either portray a good or bad reputation, which will affect profitability and market share. The high the volatile interest rate, the increased the profit, and the lower the interest rate, the lower the profit.

Risk Assessment

Reverse stress testing analysis allows Amazon’s finance department a unique understanding of the business. For instance, despite the pandemic forcing businesses to suspend their operations, Amazon has tremendously boosted its business. Between May and July, Amazon up 60% compared the consumer spending on Amazon to the same time frame last year. And as a result, it obtained 38% of the e-commerce market, trailed by Walmart with 6% (Semuels, 2020). Additionally, it helps the management concentrate on its weak points that would otherwise affect its performance. Amazon uses reverse stress to identify organizational risks and market risks, which can cause the company to default. The company uses consistency, integration, flexibility, and scalability principles when developing a risk assessment model to drill down the specific factor that may cause harm to Amazon. Besides, with big and successful companies such as Walmart as a competitor, Amazon has a slim chance of error in its operations.

For example, the Strategic Risk Severity Matrix above reflects the event occurrences, with catastrophic causing the most serious damage on the business, while low represents minimal damage. On the top, the probability factor runs from unlikely being the lowest possible for a strategic risk to happen to frequent, which shows the highest probability of the strategic risk happening.

Risk Mitigation

There are four guidelines that Amazon uses in risk mitigation processes. For example, risk acceptance helps the company manage overspending by avoiding the risk by developing a strategy that prevents the risk. Risk avoidance is another mitigation guideline that involves keeping away from any element that would not be worth risking. On the other hand, Amazon uses risk limitation guidelines to reduce its risk exposure, for instance, accepting that the sale of firsthand products may not be productive in 3rd world States affected by war and avoiding the long-time failure by selling to such states products that they can afford. At times, Amazon adopts risk transference which involves handing the risk-off to the willing third party. For example, outsourcing operations such as payroll services and customers, hence benefiting the company since such services are not a core competence of Amazon. The company cannot diversify mitigating risk like a market risk since it affects the entire market. Therefore a hedge for minimal exposure may be necessary. Besides, volatility dispersion in prices is often considered a good measure of market risk during the mitigation process.

Conclusion

In conclusion, Amazon’s supply chain has expanded rapidly over the last five years. It continues to grow, intending to fulfill the emerging market’s demand, lower production costs, and increase its productivity. The supply chain is complex for the company; Amazon is likely to lose control of the process because of unforeseen circumstances in the next five years. For example, disruption can explain the risk event that happens at one end in the supply chain from other companies that may significantly affect the operations of Amazon.

The supply chain of Amazon Inc is not adequate to have a monopoly in the global market since its management undergoes pressing requirements to maintain its pre-determined outcome of the system in a risky situation. It is significant for the manager to determine whether to invest the resources and take the necessary action to mitigate the uncovered risks after identifying and assessing them. The need to employ the Probability/Severity Matrix will significantly benefit from establishing the severity of impact and risk’s frequency of occurrence to the business.

References

Denning, S. (2019). How Amazon tames the budget. Forbes. Web.

Dwoskin, E. (2020). Tech giants are profiting — and getting more powerful — even as the global economy tanks. The Washington Post. Web.

Semuels, A. (2020). Many companies won’t survive the pandemic. Amazon will emerge stronger than ever. Time. Web.

Streitfeld, D. (2020). As Amazon rises, so does the opposition. The New York Times – Breaking news, US news, world news and videos. Web.