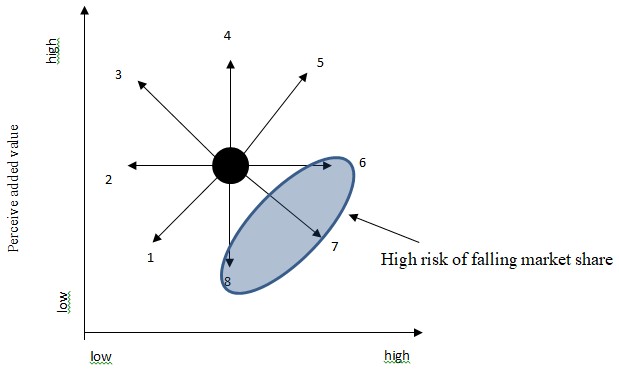

Bowman’s strategic clock

Bowman’s strategic clock is a model that helps to understand how companies compete in the market. By looking at the different combinations of price and perceived value, it becomes possible to start positioning to create and strengthen a competitive advantage that emphasizes and amplifies the organization’s competencies.

Position 1: Low Price / Low Value

Companies usually do not choose to compete in the category of low price/low value. Teh specified category is a “bargain” market and not many companies want to be in this position. Rather, they are forced into this position because their product does not have a differentiated value (Echchakoui, 2018). The only way to compete is to actually increase sales volumes and constantly attract new customers.

Position 2: Low Price / Standard Value

Companies participating in this category of competition are low-cost leaders. These are companies that are going to cut prices to remain competitive, and they are balancing with low margins and considerably high turnover (Weissenberger-Eibl, Almeida, & Seus, 2019). Walmart is a perfect example of a low-cost strategy.

Position 3: Hybrid (Moderate Price / Moderate Differentiation)

Hybrids imply that products are sold at a lower cost but with a perceived value that exceeds their budget counterparts. Discount department stores are a good example of companies that are pursuing this strategy. In case of a hybrid, quality and value are average, and the consumer can expect reasonable prices, which leads to customer loyalty.

Position 4: Differentiation

Companies that offer their customers a high perceived value follow the differentiation model. In order to afford the specified opportunity, they have the option of either increasing the price and maintaining themselves even with low turnover, or keeping their prices at a lower rate and seeking a larger market share (Helmold, 2020). Branding is an important differentiation strategy since it builds the image of a company as that one of quality. Nike has been striving to pursue high quality and premium prices; similarly, Reebok is vastly represented in the global market, but it delivers better products with a lower price rate.

Position 5: Focusing Differentiation

Differentiation suggests increased perceived value and higher prices. The perceived value of a product typically defines a customer’s intention to purchase it. There is no need to market the product as specifically meaningful in its real sense since its perceived value is enough for the customer to pay a substantial amount of money for the product. The luxury segment companies such as Gucci, Armani, and Rolls Royce exemplify the described approach.

Position 6: High Price / Standard Value

Sometimes businesses simply raise the price without adding value. When the price rises, the profitability of such a company will also increase. When prices remain the same, the companies’ market share drops until they increase a price or make a value adjustment (Yuting, 2019). As a short-term solution, the proposed approach may work, but as a long-term option, it is likely to fail quite soon due to the unreasonably high prices and the increasing rivalry in the target economic setting.

Position 7: High Price / Low Values

The observed situation is a textbook example of a company gaining monopolistic power and sets its pricing strategy based solely on its idea of its product value. As a monopolist, an owner of a business does not have to worry about added value since buyers will yield and eventually pay the full price for the desired product or service.

Position 8: Low Price / Standard Value

The specified strategy implies an immediate loss of shares for any company advocating or implementing it. For an organization to survive in a highly competitive economic setting, it must dismiss positions 6, 7, and 8. Whenever the price exceeds the perceived value, the company engages in an unequal battle because organizations selling the same product or service at a significantly lower price will always emerge in the target market, which is why one must be able to align product value and product price correctly.

The Ansoff Matrix

The Ansoff Matrix was developed by Igor Ansoff and first published in the Harvard Business Review in 1957 in an article titled “Diversification Strategy” (Khajezadeh et al., 2019). The Ansoff matrix is sometimes called the “Commodity-Market” matrix. It shows four strategies a business can use to grow.

In its market penetration strategy, where a company attempts to grow by using its existing offerings (goods and services) in the current sales market. In other words, one need to increase their market share within existing customer segments (Loredana, 2017). This strategy involves finding solutions to achieve four main business goals:

Maintaining or increasing the market share of existing products. This can be achieved by combining competitive pricing strategies, active advertising, implementation of sales promotion mechanisms, and perhaps a greater focus on personal sales (Schawel & Billing, 2018).

Driving out competitors. This will require a much more aggressive ad campaign to support a low-price strategy designed to make the market unattractive to competitors (price wars).

Increasing the intensity of sales of one’s goods and services to an already established customer base, for example, by introducing loyalty schemes or generating package offers.

The company focuses on the market and products that it knows well. As a rule, one should have comprehensive information about competitors and customers’ needs. Thus, it is unlikely that this strategy will require much investment in new market research.

Market Development

This strategy’s name stems from the understanding that the company seeks to sell its existing goods and services to entirely new markets (specifically, new consumer segments or new regions). The described goal can be realized through further segmentation to form a new customer base. This strategy assumes that existing markets have been fully utilized in such a way that it becomes necessary to enter new ones.

There are many possible ways to approach this strategy, including:

- New geographic markets; for example, exporting products to foreign countries;

- New dimensions of the product or its packaging;

- New distribution channels;

- Different pricing policies to attract other customers or form new customer segments.

Market development as a strategy implies much higher risks than penetration by entering new markets that have to be previously explored.

Product Development

With a growth strategy based on product development, the business strives to bring new products and services to its already existing sales market. Expanding the range of products may require the development of additional sales skills in company employees. The primary condition for the implementation of this strategy is the presence of loyal customers.

For the company to remain competitive, it is necessary to focus its efforts on the following aspects:

- Detailed understanding of customer needs (and how they change over time)

- Active efforts to develop new products as the vehicle for innovation

- Acquisition of exclusive rights to sell new products

- Becoming the first to bring a novelty to the market and forming a strong association with one’s brand in the minds of consumers.

A product development strategy, such as a market development strategy, is risky. The risk emerges from the fact that a new product requires a significant investment. It will also require further investment of funds to create new sales channels, marketing, and personnel training options. In addition, if one brings the wrong product to the market that does not receive market acceptance, there is a severe risk of reducing or losing the impact of the brand on customers completely.

Diversification

As a growth strategy, diversification involves organizing sales of new products in new markets. Diversification is the riskiest strategy of all since it involves two unknown variables. Namely, during diversification, new products are created, and the company does not know the real problems that may arise during the implementation process.

Task 2

IKEA products were clearly different from competitors’ products. It was simple, high quality Scandinavian design furniture. In addition, it was sold as disassembled pieces, which had to assembled after purchasing, without waiting for product delivery, unlike what other companies offered. IKEA opened its large stores in the suburbs; furthermore, it always provided ample parking spaces, restaurants, children’s rooms with educational devices for wheelchair users. Consumers expected to find a wide variety of stylish and quality furniture at reasonable prices in these stores. The company met these expectations by offering customers to perform some of the work traditionally done by manufacturers. IKEA also reduced its costs by supplying store visitors with a measuring tape, paper and a pen so that potential buyers could write down the measurements they needed independently. Thus, the company reduced costs typically allocated to hire a number of sales consultants in the sales area.

To ensure high-quality goods at a low cost, IKEA opened purchasing offices around the world that looked for individual suppliers. Afterward, the designers at the head office updated the information from the purchasing offices and decided who would be supplying for each item. Their main goal was low cost and ease of manufacturing. Therefore, the company has always selected the most economically profitable options from suppliers, even non-traditional ones. Although it is not easy to include IKEA in suppliers, since the supplier installs part of the IKEA system, the company quickly received access to global markets, technical support, equipment for rent and advice on how to bring its products in line with world quality standards (Liedtka & Kaplan, 2019). Such cordiality to suppliers does not exclude the eternal frugality of IKEA. In the early years of its existence, the company even moved to Denmark to avoid Swedish taxation. The philosophy of low costs truly permeates the entire company and has become part of the corporate culture.

The potential strength of IKEA lies in the fact that the company uses the same principles and approaches to operate in any market. When opening the first stores in the UK, the Scandinavian furniture brand retained its original principles of work and managed to occupy its own market segment. It is worth noting that the company’s cost-effective approaches to doing business not only help to reduce production, logistics and sales costs (Gružauskas, Baskutis, & Navickas, 2018). IKEA also maintains quality standards, allowing customers to be confident that they are purchasing furniture and other products for the long term and are confident about the quality and durability of the product (Baraldi & Ratajczak-Mrozek, 2019). In addition, by using this approach to building operations, the company continues to strengthen its image as a firm that strives to produce goods with maximum efficiency.

Despite the fact that IKEA operates in the segment of inexpensive home goods and there are competitors on the market who sell furniture at much higher prices, the company manages to maintain customer loyalty in the UK. This allows IKEA to add value to products for customers. Nevertheless, instead of increasing prices due to the growing demand for products, the company prefers to enter new markets and sell its products by scaling the business. Thus, the reputation of the company is growing relentlessly as more and more people around the world are shopping at IKEA.

Looking at the company’s operations in terms of the strategic patterns suggested by Bowman’s watch, one can find that viable development paths for IKEA could be points 2 (low price / medium value) and 4 (differentiation). In addition, IKEA is already adopting these strategies today. The first option can be used because the company works with a huge number of suppliers to meet the demand in the UK and around the world. To maintain low prices for their products, IKEA is forcing them to sell raw materials and resources with minimal margins. Nevertheless, the company provides access to the world market and places large orders, which allows for beneficial cooperation for all participants in the process.

The differentiation model is also the best fit for the company since IKEA has become the most recognizable furniture brand in the world. “IKEA” has practically become a household word for simple and cheap furniture, as well as high-quality and inexpensive goods, in general (Nunes et al., 2021). Rather than raising the price of its products, the firm seeks to increase sales and expand into new markets while maintaining quality standards in each region (Desai, 2019). The described approach increases the confidence of buyers, who know that, at IKEA, they can find the high-quality goods that they need. Building a strong brand through a differentiation strategy allows IKEA to gradually expand into new markets. Today, in addition to household goods, the company offers its own products within its stores. In addition, each IKEA center has its own restaurants, where buyers can relax after a long shopping trip. It should be noted that the third-party segments, in which the company operates, also function based on the principles of economy. The specified approach not only positively affects sales, but also strengthens the position of the ideology of the entire brand.

References

Baraldi, E., & Ratajczak-Mrozek, M. (2019). From supplier to center of excellence and beyond: The network position development of a business unit within “IKEA Industry”. Journal of Business Research, 100, 1-15.

Desai, C. (2019). Strategy and Strategic Management. In Management for scientists. Bingley: Emerald Publishing Limited.

Echchakoui, S. (2018). An analytical model that links customer-perceived value and competitive strategies. Journal of Marketing Analytics, 6(4), 138-149.

Gružauskas, V., Baskutis, S., & Navickas, V. (2018). Minimizing the trade-off between sustainability and cost effective performance by using autonomous vehicles. Journal of Cleaner Production, 184, 709-717.

Helmold, M. (2020). Pricing as part of corporate strategy. In Total Revenue Management (TRM) (pp. 29-42). Cham: Springer.

Khajezadeh, M., Niasar, M. S. F., Asli, S. A., Davari, D. D., Godarzi, M., & Asgari, Y. (2019). Application of neural network in portfolio product companies: Integration of Boston consulting group matrix and Ansoff matrix. International Journal of Economics and Management Engineering, 13(6), 809-813. doi.org/10.5281/zenodo.3299381

Liedtka, J. and Kaplan, S. (2019). How design thinking opens new frontiers for strategy development. Strategy & Leadership, 47(2), 3-10.

Loredana, E. M. (2017). The use of Ansoff matrix in the field of business. Annals-Economy Series, 2, 141-149.

Nunes, B. C., Pimentel, J., Malheiro, J., Ferreira, M. R., & Proença, J. F. (2021). Life in a bag: Sustainability, green economy, and business strategy–a case study. In Handbook of research on nascent entrepreneurship and creating new ventures (pp. 335-350). Pennsylvania: IGI Global.

Schawel, C., & Billing, F. (2018). Ansoff-Matrix. In Top 100 management tools (pp. 31-33). Wiesbaden: Springer Gabler.

Weissenberger-Eibl, M. A., Almeida, A., & Seus, F. (2019). A systems thinking approach to corporate strategy development. Systems, 7(1), 16.

Yuting, G. (2019). Experience marketing strategy affects Chinese consumer buying behavior. [PDF document]