Introduction

The financial crisis that started in 2007 on account of consumers failing to clear their subprime mortgages created far-reaching consequences on the US economy and proved to be the harbinger that led to a domino effect, which impacted all economies of the world severely. The global financial crisis of 2008 had adversely impacted firms across the entire world, particularly in regard to encountering severe liquidity issues, major decline in profitability and going bankrupt. Because of the consequent impact on business environment, firms adopted varied means with the objective of dealing with the crisis. A major measure in this regard was the adjustment and attempted correction of dividend payout. A financial crisis of the kind that began in 2007 inherently impacted companies in different ways; major amongst them being reduced availability of liquidity, declining profitability and declining sales. In essence, a firm’s value depends a great deal on its cash flows and on the value of its shares, which is heavily dependent on the expectations of receiving dividends through corporate financial decisions taken by the management. Along with financial and investment decision making, dividend policy is amongst the most debated issue in the corporate environment in view of its immense significance in the decision making process of firms. It is for this reason that financial analysts and researchers have been constantly involved in exhaustive research in determining why companies need to be careful in framing their dividend policies.

Although research on dividend policies relate to varied contexts in different situations and countries, empirical studies made in the past have mostly focused on analyzing factors that have a bearing on the decision making process during specific time periods. In this regard, researchers have mainly attempted to assess the ways in which signalling theory, agency theory or corporate governance influences the prevailing payout ratios (Baker and Kapoor 2015). However, such patterns are not critical enough in creating new information, which is why this research aims at re-analyzing the theoretical aspects that explain dividend policy and the factors that influence the same in situations when companies are involved in making a comparison between their dividend policies and the factors that influence their decision making during and after the financial crisis of 2008. Attaining this objective will allow determination of the practical implications of changes that could occur from adopting a new payout policy. From this perspective, this research aims at ascertaining the significance of dividend policy and how the decision taking policies adopted by publicly listed non-financial companies in the UK were impacted by the financial crisis in comparison to the situation that prevailed prior to the crisis.

In this regard, this research chose to analyze the UK because majority of the listed companies in the country make use of dividend policies in achieving their objectives of constantly creating additional wealth for their shareholders. In addition, the agency theory (Jensen 1986) and signalling hypothesis (Fama 2001) are clearly suggestive of the possibilities of asymmetric information risk and conflict of interests on account of separating control and ownership. In this context, past studies hold that listed companies in the UK are prone to experience high extent of ownership diffusion that leads to major issues in regard to moral hazard and agency costs. Hence, it important to use corporate mechanisms in order to do away with such issues, particularly because dividend policy appears to be the most plausible mode of study in financial affairs. The findings of this empirical research will make corporate managers, capital market analysts and policy makers to realize the extreme significance of dividend policy and its determinants. They will also get to know of the consequent changes occurring from the given variables and of the impacts of the financial crisis on payout decision making.

Research Purpose and Objectives

The objective and purpose of this study is to conduct a comparative investigation of the different factors that have a bearing on the decision making process of UK firms in the context of global financial crisis of 2008. Attaining such objectives will allow determination of changes in the given variables. The objectives of the research have been broken down as follows:

- To explore the theoretical concepts of dividend policy and its determinants;

- To establish the hypothesized relationships between the adopted study variables;

- To investigate the empirical relationships between dividend policy and its determining factors;

- To conduct the comparative analysis for the study variables to discover practical implications and importance of payout decision;

- To provide the generic policy recommendations for companies and policy makers on how to improve dividend decisions based on the findings of the research.

Overall, the objective of the paper is to ascertain the impact of the 2008 global financial crisis on the dividend payout of publicly listed non-financial companies in the UK.

Literature Review

The objective of this section is to discuss the theoretical aspects relative to dividend policy in the UK and to make a review of the current literature on dividend policies. This analysis will develop a theoretical basis for the methodology that will be adopted in this paper and will provide a means to analyze the outcomes of the study. An analysis of each theory will be made in the context of its impact on dividend policies of UK companies during the crisis. In effect, dividend policy is the practice adopted by firms in taking decisions about dividend payouts, particularly in terms of the extent of cash payments made to shareholders over time. It is apparent form theories relative to limited stock companies that the management has to take decisions in two crucial areas, which pertain to financial and capital budgeting. Financial decision making is about means of financing, while capital budgeting is about acquiring assets. Once the firm starts making profits, the management has to consider making decisions about the extent of profits that have to be distributed among shareholders (Al-Malkawi et al 2010).

Given that the main objective of firms is to maximise value for shareholders, the management has to decide in the context of how much percentage of the profits should be ploughed back into the firm through investments and what effect such decisions will have on the firm’s share prices (Bishop et al 2000). Consequently, a firm’s dividend policy and its impact on its value is considered to be amongst the major areas in financial theory that has led to development of varied theories and models, which help in substantiating on corporate behaviours in the context of dividends. Black (1976) had asserted that dividend policy was a big puzzle and it continues to be uncertain. It is argued from this perspective that the examined theories in this paper are crucial in forming a robust structure that facilitates evaluation of dividend policies of UK companies during the period prior to and subsequent to the financial crisis of 2008.

Dividends

In order to get a full grasp of the topic being researched it is important to have a thorough understanding of dividends. They are payments made to shareholders in serving as returns on investments made by them in the given company. Considerable research has been done in this area and the strategies that are used by firms with different objectives and corresponding outcomes. However, the research so far has mostly delved into examining the motives of firms in paying dividends and to find out the main determinants that motivate payment of dividends. Many of such studies have commonly concluded about the role of specific determinants in creating ground for the payment of dividends and the framing of certain competing theories that substantiate upon and explain such payment procedures. But a definite result has not been achieved in answering why companies pay dividends. Nevertheless, a number of possible explanations have come up in this regard. Some researchers hold that firms pay dividends on account of transactions costs or in keeping with requirements of tax regimes. There is no doubt that arguments in this regard have played a crucial role in the formulation of catering theory that was framed in considering the existence of diverse investor groups that have diverse needs. Some countries impose taxes on dividends at rates that vary with profits attained at the stock exchange. It is known that both equity holders (investors) and firms aim at minimizing transaction costs as far as possible; meaning that if dividend payments result in reduction of transaction costs, such payments are justified.

As per the agency theory, agency issues could arise if there is a communication gap between shareholders (principals) and the firm (agents). Firms (Agents) expect that shareholders (Principals) will work towards enhancing the firm’s interests. But this may not be true always because the firm may get involved in making investments in new projects through cash flows that is not relevant or have no bearing for principals. In order to avoid such issues, the firm may involve in additional monitoring that will add to costs. However, many theorists have held that instead of spending on such monitoring, a better option is to make dividend payouts, thus avoiding potential problems (Bisschop 2014).

The agency theory has played a major role in the formulation of the signalling theory, which focuses on asymmetric information. As per the theory, companies pay dividends in order to provide signals in the market about the possibility of future earnings. From this perspective, dividend can be viewed as a means of communication through which shareholders are provided with additional internal information about the firm they have invested in. In contrast, Bird-in-the-hand-theory is an old theory in the context of dividend payout. It holds that dividend payouts tend to increase with increase in the company’s value. According to the theory, investors tend to give more value to bird-in-the-hand situation in terms of getting cash dividends in comparison to the concept of two-in-the-bush, which pertains to attaining future capital gains, which cannot be said to be definite. It is for this reason that increase in dividend payouts is positively related with enhancement in the firm’s value (Demirgunes 2015).

The life-cycle theory of dividends is another theory having much relevance in the context of dividends. It puts forth arguments in explaining why companies pay dividends. The main assumption of the theory is that dividend payout by companies are reliant on the life-cycle stage of the firm in which it operates at any given time. The characteristics of a firm are known to change as it evolves over time and such characteristics tend to be important determinants of dividend payments. A typical example in this regard is of young firms that have several opportunities for growth but are constrained by limited resources. Consequently, it becomes a better option for young companies to make use of growth opportunities than to make dividend payouts. In contrast, well-established or mature companies are better placed in paying dividends in view of their potential to make higher profits and in view of the lesser investment opportunities that are available to them (DeAngelo, DeAngelo & Stulz 2006).

Dividend Policy Theories

While considering dividend policy theories, it is extremely important to consider the dividend irrelevance hypothesis put forth by Miller and Modigliani in 1961. Before the authors put forth their theory, it was commonly believed that the value of the firm increased on account of higher dividend payouts (Bishop et al 2000). Based on the concept of bird-in-the-hand, it was held in the context of the firm’s value that dividend policy proves to be insignificant under prevalence of perfect market conditions. In addition, shareholders tend to be unresponsive towards capital gains or dividends because their wealth holdings are not impacted because of firms’ dividend decisions. In other words, the wealth holding of shareholders was considered to be dependent on the profits attained by the firm and not on the ways through which profits were distributed. It was argued by Miller and Modigliani (1961) that dividend policies tend to be the same for all firms because under conditions of perfect market, investors have the option of altering their share holdings in keeping with their income and cash flow choices.

However, it is important to note that the conclusions made by Miller and Modigliani (1961) are based on assumptions relative to existence of perfect markets, which implied the existence of crucial elements such as absence of transaction costs, absence of taxation, absence of agency costs free availability of information and the condition that all investors accept the given prices without conditions. It is thus evidenc from the irrelevance theory of Miller and Modigliani (1963) that the firm’s value is unaffected by corporate dividend decision in perfect capital market and shareholders’ wealth remains unchanged regardless of cash dividends or capital gain given fixed investment policy. However, it is known that in world of real finance, assumptions of perfect capital market do not exist. There are indeed imperfections creating significant departures from the world of Miller and Modigliani which make dividend policy more relevant. Nevertheless, this section also discusses key theories representing such market imperfections to weaken the irrelevance proposition made by Miller and Modigliani (1963).

Signalling Theory

The signalling theory makes assumptions about the availability of symmetric information in markets (Al-Malkawi et al 2010), which means that firms’ market value does not necessarily convey their true value. Therefore, the management tries to share information in markets with the objective of filling the gap amongst the firm’s intrinsic value and market value, particularly when managers consider that the firm has been under-valued in the market environment. An effective means to share such information is through the firm’s dividend policies. As per the signalling theory, it is possible for investors to infer the firm’s financial position and future potential by changing the amount and stability associated with the firm’s dividends. If the signalling theory is to hold good; the management should have the ability to share information. For instance, increase in dividends could convey that the firm considers there is strong growth potential for the company in the future. On the other hand, decrease in dividends could signal the firms doubt about future potential. Hence, stability and consistent increase in dividends tends to enhance the firm’s value by way of enhancement of share prices. Declining dividends results in fall in the firm’s value and share prices. Consequently, given that firms aim at maximising value of the firm, they would not be inclined to reduce dividends if they consider that there has been a consistent increase in long term earnings. In the context of the UK, it is apparent from the signalling theory that firms were initially not forthcoming in reducing dividends with the onset of the financial crisis. But, if signalling theory is to be valued, firms in the UK would have reduced dividends in keeping with enhanced pessimism of the management. In addition it is required to have a positive relationship between dividends and earnings because enhanced earnings result in enhanced dividends.

It is thus apparent that the traditional outcome from analyzing on the basis of signalling theory clearly suggests that firms facing financial problems ought to lower dividend payouts. It is in this context that the signalling theory effectively explains why financially troubled firms continue to pay dividends. Firms that have traditionally made dividend payouts will continue making such payments because the expected costs of reducing dividends prove to be excessive. In addition, there is little incentive for firms to reduce dividend payouts till the time they have no other alternative. It is from this perspective that Nandi (2015) has asserted that in keeping with the signalling theory, firms in the UK would have refrained from cutting down on dividends in view of their unwillingness to deviate from tradition. It is noteworthy that such a hypothesis has been the subject of criticism because it is hard to test in view of its arbitrary nature. The above arguments do create varied predictions about the payout policies of different companies. The payouts made by some industries are motivated on account of associated agency costs in relation to prevailing position of cash flows, which makes such firms to adopt conservative dividend payout policies, while banks focus more on dividends in framing their payout policies. It is apparent from examining the relevance of the signalling theory in the context of the UK that firms in the country would be more inclined to keep up with their dividend payout policies in order to prevent reduction in the firm’s value (Moshirian 2010).

Asymmetric information indeed gives birth to another crucial number of dividend policy literature analysis. Signalling theory focuses on the informational content of dividend acting as useful signal sent to capital market and investors. According to Myers (2001) and Fama and French (2005), capital market interprets dividend payments as managerial forecast of changes in corporate prospects and share prices. Signalling hypothesis is a significant departure from the concepts of Miller and Modigliani because it creates profound understanding about how investors value the information content of dividends which implies the firm’s reported earnings. This theory emphasizes the increasing importance of dividend payments as positive signals that are sent to capital markets to reduce asymmetric information risk (Nandi 2015).

Empirical evidence from the research of Mubarik (2008) who tests the impact of dividend announcement on share price of oil and gas marketing sector of Pakistan, concludes that highly profitable and growing companies are likely to distribute more dividends to send positive signals to capital market, which consequently, leads to the increases in share prices. Lin and Hwang (2010) also tests the signaling hypothesis by using a large sample of non-financial firms and reports there is strong evidence for positive relationship between dividend per share and firm size and profitability variable. DeAngelo et al (2008) add that there is an inverse association between firm risk and the propensity to pay dividends as firms with increased asymmetric information risk are likely to cut dividends. Following previous empirical findings, this research employs several firm-related factors including firm size, profitability level, information risk and firm growth as determinants of dividend policy and the following hypotheses can be stated:

- Firm size, profitability and growth rate have direct influences on the propensity for firms to pay dividends;

- Information risk is negatively related to dividend payments.

Agency theory and corporate governance

Jensen (1986) proposed the agency theory to criticize the classical viewpoint which contemplated that the firm is seen as a single homogenous unit with symmetric information and no conflicting interests between owners and managers. Focusing on the self-interest principal, the agency cost approach distinctively has a different thought because it explicitly recognizes the firm as a collection of various stakeholder groups with interest conflicts. According to Jensen’s (2001) research, increased ownership diffusion and clear separation of ownership and control lead to intensified agency costs and conflict interests between managers and shareholders. Due to self-seeking behaviour, managers are likely to gain private benefits by wasteful investments which are detrimental to shareholder’s wealth. Prior studies examining the agency theory and corporate governance contend that weak governed firms with deficient director boards; ineffective leadership structure and lower audit quality could intensify the agency problems and are therefore likely to embroil in corporate scandals and to announce dividend cuts subsequently.

The mitigation of agency costs and interest conflicts can be circumvented by paying regular dividends. This holds true because empirical evidence from Lin and Hwang (2010) and Sapp (2008) concludes on positive relationship between board size and board independence and dividend pay-out ratio. Similarly, using a large sample of UK firms in 2007, the regression analysis of Al-Najjar and Hussainey (2009) confirms that the independence of directors is the most effective internal governance attribute available to curb managers from misusing shareholder’s funds, thus requiring them to pay more dividends. Audit quality is also an important variable, which is tested in the generalized least square regression model as put forth by Sánchez and Molina (2011), who attempted to explain of motive of firms initiating dividend distributions. Corporate governance mechanisms seem to provide effective oversights on managerial activities, making their interests with those of shareholders more aligned. Based on prior evidence, the following hypotheses can be tentatively stated:

- Board size and its independence are positively associated with the dividend payment propensity.

- Audit quality is predicted to influence the dividend decisions.

Pecking order hypothesis

Pecking order theory was developed by Myers (2001) which is a major capital structure theory. However, dividend policy is also considered as a financing decision which is related to capital structure and debt policy of the firm. Following this perspective, it can be argued that when firms finance their dividend payments, the internally generated funds tend to be the most preferred. When external finances are required, debt is preferred over equity because it involves less issuance costs and takes less time to obtain.

There are some empirical studies testing pecking order hypothesis. For example, Lie (2015) examines financial flexibility, performance, and the corporate payout choice, reporting that profitability and leverage ratio are positively associated with dividend policy even though the strength of relationship is not significant. Using panel dataset from 100 Taiwanese firms, Lin (2014) mentions that debt-to-equity ratio is significantly and positively associated with dividend policy, which is in line with the pecking order hypothesis. Following those evidence, the present research adopts debt level as an independent variable to examine its hypothesized relationship with dividend policy.

How this research fits in prior literature

While dividend policy studies vary across contextual researches and countries, the previous empirical studies merely focus on examining factors driving this decision given a specific period of times and intend to measure how corporate governance, agency theory or signaling theory affects the payout ratios. This is no longer critical because of the absence of creating any new insights. In the light of this limitation, this research intends to re-visit the theoretical explanations explaining the factors that affect dividend policy while conducting the comparative analysis on dividend policy and its determinants, given the largest-ever financial turbulence context (i.e. 2008 credit crisis) so that the practical implications on the resulting changes of payout policy and its determinants can be discovered. In other words, this research is interested to know how important the dividend policy is and how the financial crisis affected this decision among the publicly listed UK non-financial companies.

Key Concepts

This section makes a review of the key theoretical concepts in regard to dividend policy and includes agency theory and corporate governance, signaling theory and pecking order theory; main objective being to identify the most important variables that impact decisions about dividend payouts. In doing so, a detailed review is also made in the context of the 2008 financial crisis. As per the literature, a financial crisis occurs in situations when the cash supply is not in keeping with the demand for cash; meaning that there is severe shortage of liquidity because the existing cash gets quickly withdrawn from banks, which in turn forces banks to sell its other assets in order to meet the shortage. In effect, the financial crisis began in 2007 because credit institutions in the US broke down on account of their inability to cope with the risks associated with mortgage loans, which made many banks to go bankrupt in creating a pattern through which stock exchanges across the world crashed. Upon being exposed to the housing market, the financial crisis severely reduced liquidity of such assets in markets and increased the risk premiums, thus creating major apprehensions in the inter-bank market. The financial crisis quickly took within its fold the entire world to eventually impact every sector of the global economy adversely.

It is apparent from the examined literature that till 2008, the financial crisis was associated with a liquidity crisis. They have asserted that financial crisis of this kind has immense potential for providing companies motivation or reason to change their strategies in rationalizing adjustments with their dividend payout policies. During the entire period of the financial crisis, the business cycle was characterized with unrealistic expectations that took shape in most global markets and caused heavy complexities for companies in regard to their investment and funding strategies. Nevertheless, financial instability proved to be a major reason for firms to change their policies relative to dividend payouts and they tried to improve outcomes emanating from variables associated with financial and economic capacity in order to develop larger cash flows and to maintain dividend payouts.

Firms are known to have choices relative to retaining their cash flows, making investment from such cash flows or saving them, or paying it out through dividends or re-purchase of shares. In fact, the payout policy of the firm determines the choices that will be made in the context of such options. The most common means of transferring the firm’s cash flows to shareholders is known to be dividend payouts. Alternatively, stock dividends are known to be additional stock that is provided to shareholders in order to enhance the quantity of shares possessed by current shareholders. It is in this context that Modigliani and Miller (1961) have held that a firm’s dividend policy is amongst the most crucial long term funding strategies available to firms, which is why it continues to remain a major issue in the area of finance. In this regard, the model proposed by Miller and Modigliani (1961) is now acknowledged as the gold standard in the context of dividend theory. In fact dividend theory received a boost when the authors presented their decisive work in substantiating that in situations characterized with rational investors and perfect capital markets, the firm’s dividend policy is no longer relevant and creates or does away with the values associated with a given firm’s shares. In an environment of perfect competition, the authors held that markets are characterized with the following situations:

- The available information entails no costs for all people

- There are no transaction costs

- There is no conflict of interest amongst shareholders and firms.

- There is no taxation of shares or dividends.

But it is known that financial markets in the real world do not mostly comply with such strict conditions, which is why Miller and Modigliani (1961) argued that in the absence of such conditions it is not possible to deny that dividend policy of a firm is of relevance always. This also means that the dividend policy of firms can have a major influence on the wealth held by shareholders. In this context, it has been argued that a firm’s cost of capital increases with increase in dividends, primarily because investors are unable to be sure about benefiting from capital gains in the future or from receiving dividends in the present. Consequently, such capital gains occur on account of reinvesting of profits. But because the literature holds that dividends are preferred by investors, the present dividend proves to carry lesser risks in comparison to capital gains.

It is apparent from the literature there are varied empirical situations that differentiate dividend paying firms from firms that do not pay dividends. Using different variables in the context of firms, such as investment opportunities, profitability and size of the firm, Fama and French (2001) conducted a study on why dividend payments have been reducing over time. They concluded that the number of firms paying cash dividends declined by 26 percent between 1978 and 1999. It also became apparent that the above variables appeared to impact the decision making process relative to paying dividends. A major reason cited by the authors in regard to such decline was that firms had started paying dividends because they wanted to compensate investors for non-payment of dividends in the past. It also became known that such patterns existed in the past because of firms’ inability to continue with such a practice. The authors argued that the main cause for such behavior of firms was the changing circumstances of publicly traded firms that were not prone to paying dividends. The outcomes of empirical research on the issue clearly suggest that firms are now less inclined towards paying dividends. Firms that never paid dividends realized the need to pay them and hence began doing so. It also became evident that bigger companies having high profitability but low rates of growth were prone to pay dividends. In contrast, firms with low growth and high profitability tended to retain their earnings. In commenting on such patterns, Banerjee et al (1993) concluded that the changes in payment patterns by firms are well accounted for by the extent of available liquidity. At the same time, it was highlighted that rational investors will choose to deal with companies having higher liquidity, which is why they mostly expect higher discount rates when deciding in favor of companies with low liquidity. Markets characterized with low liquidity tend to have high transaction costs, which makes investors to expect dividends instead of compensating themselves by selling their share holdings (Dafe 2014).

It is important to note in this regard and in the context of dividend payment patterns in the UK after the onset of the global financial crisis that the information about dividends tends to diverge with the stages that the economy is undergoing at any given time. Using data from the London stock exchange for the years 2007 and 2008, Bozos et al (2011) found that value of dividends declined during the period in comparison to the period of economic stability prior to 2007. But the earnings from dividends increased after the occurrence of the crisis and this fact clearly highlights the role played by dividends during poor financial conditions (Dafe 2014).

Significance of Dividend Policy

Dividend policy attains importance because it relates to the payment of dividends. In fact, a firm’s dividend policy has major impacts on the present value of its shares. In studying the impacts of a company’s dividend policy on the prevailing value of its shares, Miller and Modigliani (1961) made an assumption about the complete absence of market imperfections. They classified the assumption into three parts in terms of the existence of a perfect capital market, rational behaviour on the part of investors and firms and perfect certainty, which implied the non-existence of taxes and other attrition factors. They also assumed that the firm’s cash flows can be distributed effectively without risks of retaining excess cash. The authors concluded that it makes no difference to a firm in the context of the dividend payout policy that it uses. In addition, present prices of shares and returns to shareholders are not impacted by the firm’s dividend policy. In substantiating on such conclusions, the authors revealed that with dividend payouts, there is decline in the terminal value of shares to the same extent as the amount that is paid out through dividends. Hence, it can be said that shareholders need not be concerned about the differences between receiving dividends and higher share values.

Lintner (1956) had concluded through empirical research that different firms have different characteristics and hence use diverse policies in dealing with dividends in different circumstances. In addition, the fact that managers are not forthcoming in reducing or increasing dividends implies that the issue of dividends is quite sticky. Lintner (1956) has held that firms are prone to setting target ratios about their dividend payouts before they frame other policies. He found the average payout ratio to be 50 percent of the total share earnings. Another finding was that lagged earnings, which mean the gap between end of accounting quarter and the time of payouts, prove to be the main determinant of dividend payouts. In effect, he wanted to convey that dividend payments are less volatile in comparison with movement of earnings. Moreover, firms generally do not deviate from the given dividend payout ratio because it is set in advance. Hence, it is required of earnings to increase or decrease substantially prior to increase or decrease in dividend payouts.

Floyd, Li, and Skinner (2014) concluded that dividend payouts in the UK peaked in 2007 after which they started declining and continued to do so till 2009 when the rate of decline was by 5.4 percent. This trend indicated that with the onset of the financial crisis, firms had started reducing dividend payouts. In the following years, the overall dividend payouts increased to levels that far exceeded the 2007 peak levels. From this perspective, the authors hold that dividend payouts in the UK were not much impacted by the global financial crisis. At the same time, it was found by them that the median payout ratios for firms paying dividends as well as firms repurchasing shares and paying dividends amplified in the coming years. In fact, even during the years that followed the crisis, there was consistent though moderate increase in the ratios. Such patterns were in keeping with the unwillingness of firms to reduce dividend payouts, which resulted in increase in payout ratios of firms after 2006 because dividends were increased or kept constant on account of decline in earnings resulting from the financial crisis (Bisschop 2014).

Context of the 2008 Crisis and UK Dividend Policy

The credit crisis that began in late 2007 after onset of the subprime mortgage crisis in the US, quickly spread across the entire world. Because of having high correlation with the US economy, the UK was hit severely by the outbreak. Researchers and practitioners criticize that governance deficiencies and housing crisis are the main causes leading to the turbulence. Consequently, from 2008 to 2009, as represented in Daigram 3 in the Appendix, dividend cuts were prevalent and corporations faced business closures and job losses (Ooi 2011). As a result of the crisis, there might be some changes in the way corporations perceive regarding the essence of corporate governance effectiveness and payout policies in order to restore investors’ confidence and capital market efficiency. This necessitates an empirical study discovering how crisis affected those variables and whether corporate awareness has been raised to avoid such negative financial events.

The most important reason for the occurrence of the financial catastrophe was the subprime mortgage crisis. Prior to the crisis, investment institutions, banks and investors were ready to invest heavily in mortgage-held security in considering them to be safe because of the virtual guarantee they provided in terms of monthly income for investors. The housing market in the US flourished till 2006 and people could easily get mortgage, which is why demand for housing increased tremendously and banks and financial institutions were happy to provide the required funding. However, this led to the creation of a housing bubble; meaning that prices kept increasing, thus covering the adverse impacts of bad loans to people and firms that were not capable of repaying the loans. Because house prices increased on a consistent basis, it became easy for existing defaulters of mortgage payments to take enhanced loans against their properties in view of the artificially escalated prices of their mortgaged homes. Financial institutions considered houses to be sound collateral, which is why they readily gave loans. However, things had to eventually go wrong because even though house prices were increasing, income levels were not.

Because of inability of debtors to repay their home loans, the housing bubble burst in the US and house prices crashed across the entire country. As the numbers of foreclosures kept multiplying, banks and financial institutions across the world suffered heavy losses. There was a steep fall in the value of securities, thus causing the writing down of entire housing mortgages, which led to the writing down of book values of financial institutions and banks (Bisschop 2014). The US came in the grip of the financial crisis in 2007 after which it spread across the world rapidly. Europe was the worst impacted because of the strong interrelationship amomg its imports and exports and amongst investment companies and banks across the world (Moshiran 2010).

Research Methodology

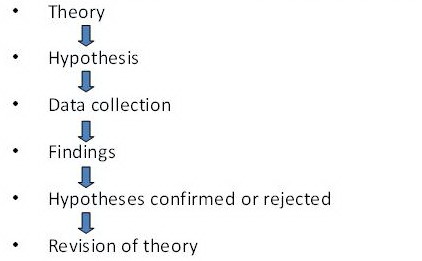

Following prior empirical research of Al-Shabibi and Ramesh (2011) and Lin and Hwang (2010), this research adopts the philosophy of positivism, which according to Saunders et al. (2012) is concerned with what constitutes acceptable knowledge in the scientific research and with how causal relationships between variables can be accounted for. As this research is empirical and quantitative in nature, a highly structured approach is adopted in order to test the proposed hypotheses, which relies on the collection of financial data drawn from authentic sources. According to O’Leary (2006) there are two main approaches utilized in business research, including induction which aims to generate the theories and deduction which aims to test the theories. The latter approach is adopted in this research in order to address the research objectives. The following diagram shows how this approach works (reproduced from Saunders et al. 2012):

This section is about the research methodology adopted in this research. The research philosophy substantiates on the knowledge that is provided by the study. In fact, the research philosophy proves to be the main basis through which the research approach is outlined and assumptions highlighted in order to carry out the study (Zikmund et al 2012). Amongst the varied research methods that are available for conducting research, this paper makes use of interpretive philosophy and the positivist approach (Saunders et al 2012). The research approach comprises of the environment relative to the social and cultural value systems, which make use of interpretation repertoires. It becomes apparent that firms have to take decisions about capital budgeting, which relates to acquiring assets, while financing decisions pertain to ways through which different ways of financing are employed in acquiring assets (Damodaran 2011). At the same time, after a firm starts making profits, it has to take decision in a third area, which pertains to the extent of profits that have to be distributed amongst share holders. It becomes apparent from the literature review that a major objective of the management is to maximise value for shareholders, which is best done by deciding the percentage of the profits that have to be invested for the future and the impact that dividend payout decisions will have on share prices. It also becomes evident that in view of dividends being in the form of distributed profits, firms must take action in reducing dividends during times characterized with low profits. Nevertheless, the gathered data indicates that firms in the UK demonstrated reluctance in reducing dividend payouts. Therefore, even though profits were declining during the financial crisis dividend payouts by most firms in the UK were not reduced. Many of the firms in the UK were actively involved in smoothening dividend payouts. In view of the crucial significance of dividend policy in the corporate finance environment, this paper focuses on the ways in which the financial crisis impacted dividend policies of firms in the UK.

Identification of Issues

Bisschop (2014) classified five main issues:

- Substitution between sources and use of funds

-

- Signaling and smoothing

- Pricing issues

- Firm characteristics

The first issue of substitution amongst sources and use of funds is important because of the significance of national factors in impacting dividend behaviours, particularly because it is not appropriate to deduce behaviours from lone sources. It is known from Bisschop’s (2014) account that even though firms in North America tend to defer and reduce investments, to borrow from external sources, or sell their properties before reducing dividends, companies in the UK tend to reduce dividends only when there is possibility of reduced earnings. This means that investments are postponed, after which preference is given to borrowing and selling of assets. Signalling is the process through which dividends are used as a means to convey specific messages to investors and shareholders in the context of scope of future earnings and the adoption of transparent procedures. On the basis of such characteristics, firms having good opportunities of investment will choose to pay dividends in order to reduce costs of borrowing.

Concerns about agency occur because of the existence of circumstances in which asymmetric information is available, thus implying greater borrowing costs and creating reason for deciding in favour of dividends. This is because debt is an important element of the management process involving interest payments and debt finance, which requires greater monitoring in comparison to shareholder concerns and internal funds. In fact, debt and dividends are prone to being substituted in order to reduce agency concerns and to focus on higher leveraging to lessen the requirements of paying dividends. Agency concerns are greater in the case of bond finance because dividends are mostly considered to be a safeguard against take-overs in the UK, where such take-overs have proven to result in higher payouts (Servaes and Tamayo 2014).

Pricing issues have major potential of impacting dividend payouts because managers in an organization having internal information could involve in valuation that is portrayed differently to investors, specifically when there is investor herding on the basis of expressed bias or rumours in the context of some markets. This kind of valuation makes managers to place greater dependence on internal funding. In situations when valuation is lower than what is expected. Under such circumstances, the management tends to offer higher payouts and engages in re-purchase of shares from shareholders. In view of such behavioural patterns of firms, there could be shift in investor aspirations in the context of dividends, thus leading to different pricing impacts with inconsistent premium in the case of dividends payouts. A large part of the past literature that has analyzed payout levels has focused on theoretical basis relative to the workhorse approach for payouts and dividends. Studies have also focused on the patterns of dividend payouts in giving importance to firms that are prone to paying dividends on a regular basis because they consider it to be difficult in complying with theoretical provisions always. According to Driver, Grosman and Scramozzino (2015), the equilibrium correction model whose dynamics rely on the planned equilibrium ratios and non-linear characteristics of dividends is as follows:

∆Dt = α+β(γEt −Dt−1)+ϵt, where α+(γEt −Dt−1) > 0

and

∆Dt = ϵt, where α+(γEt −Dt−1) < 0

In the context of the above equation, Dt has been assumed to be the dividend at the given time (t), while Et has been considered to be the earnings; α is the independent variable representing patterns of dividend growth; β is the adjustment co-efficient that is prone to vary with the nature of given adjustments; and γ is the target ratio intended to be attained between earnings and dividends. It becomes apparent that when the adjustment parameter is low (β <1), there will be lesser levels of variation in dividends, thus implying lesser risks involving the need to suspend payments. Such an approach tends to work well in different circumstances despite the fact that the non-linear elements are mostly not considered while arriving at the given conclusions. In this regard, Leary and Michaely (2011) have argued that smoothing tends to increase across a lengthy time period and cannot be said to be associated with repurchase levels or patterns. The dependent variable is considered to be a ratio of real or nominal cash amount that is reflective of some target goals, which is normally represented by the stable payout ratio of dividends. It is evident from the literature that the target goals differ amongst different companies in different countries. However, widely used global practices include targeting enhanced or stable payout ratio of dividends, constantly increasing dividend per share, or fixing dividend payouts in line with the prevailing cash flows.

But the most common strategy is to evaluate dividends on the basis of cash flows because of the existence of large number of targets and because there is need to give the required weight to exchange rate adjustment and prevailing rate of inflation. Under such circumstances, economic advantage could accrue to the firm if it makes changes in its cash holdings by reducing estimation through relevant logs. In situations when the firm makes use of dividend ratios, preference should be given to scaling of assets and not to earnings in view of the chances of measurement errors and reduction in earnings. Firms also need to give value to selection bias because availability of data could lead to oversampling in the context of particular companies. Moreover, checks are often undertaken in ensuring that sample statistics involving calculation of median values and rations are in keeping with the prevailing population values. Sampling issues must be given the required attention in situations when the dependent variable is zero in the context of a large section of the observations made in regard to dependent variables. For example, when small companies pay zero dividends, they stand higher chances of recording zero payers.

Data Collection

Studies so far have indicated that because of the financial crisis, financial institutions tended to use dividend payouts to transfer risks and assets. The signalling effect was apparent in the country’s banking sector by way of use of dividend payouts in confirming solvency that has the potential of further preventing firms from reducing dividend payouts. It is apparent from Diagram 1 in the Appendix that the UK financial sector did make attempts to make dividend payouts smooth despite the environment during the financial crisis that reduced earnings drastically. In addition, the results provide a strong basis in supporting the traditional concept conveyed through the signalling theory about the need for firms facing financial hardships to lower dividend payouts. It is apparent from Diagram 1 that even though the annual total return on shares in the UK was declining and negative after 2006 to 2009, the dividend yield was stable during the same period even though it started increasing in 2008 (Siblis Research 2016). From the same perspective, Diagram 2 highlights the immense potential of FTSE 100 investors in terms of performance because it substantiates on the potential of dividends to deliver positive returns over time (This Is Money 2017). Such outcomes are in keeping with conclusions in the literature about dividend payout patterns being sticky signals in motivating company managements to continue with their well-established dividend policies (Skinner 2008).

Selection of Samples and Data

The research takes into account dividend patterns in the UK during the period 2005-2010 for which data is obtained from the FTSE 100 Compustat Global Data base in regard to active as well as inactive listed companies with the prime objective of ensuring that bias is avoided. Information about dividends is obtained from the FTSE Compustat Global in which the variable is representative of the total dividend amounts. This is exclusive of stock dividends as declared by companies on the basis of their equity capital in the net income for the given year. It becomes known that listed companies in the UK mostly pay dividends twice every year, while also making comparatively smaller dividends payments on interim basis in the period being accounted for. At the same time, the companies pay comparatively higher dividends during periods when they report profits.

It has been found that both size and age of the firm are important determinants of the prevailing dividend payouts, which is why it is important to carry out an analysis involving collection of sub-samples on the basis of such characteristics. For the purpose of this research, the total numbers of companies under consideration were bifurcated into four broad categories on the basis of size and age. In the context of young and large companies, it was found that the earnings level and ratios were important determinants of dividend payouts. Large and old companies had a strong bearing on the earnings ratios, thus implying that these companies were associated with increasing dividend payouts.

Findings

This section makes the analysis in relation to the data that was collected in keeping with the methodology outlined for this paper. The sample population in terms of the analyzed firms in the UK was quite small in view of the fact that there are not many large financial companies in the country. It was found from the mean dividend payout ratios and the mean earnings per share of the FTSE 100 non-financial companies in the UK that the overall outcomes provide a basis for the applicability of the agency cost hypothesis and the signalling theory. It is apparent from Diagram 2 in the Appendix that the dividends in the context of FTSE 100 companies in the UK are in keeping with the trends relative to earnings per share. It is apparent that firms in the UK made use of dividends in conveying or signalling their potential in the future, which clearly implies that dividend payouts strongly resemble the earnings that are assessed on the basis of EPS. Such outcomes also add to the contention that agency cost theory is applicable because of the prevalence of agency costs, which means that firms will be forced to distribute the enhanced revenues/profits as dividends. This is the main reason why the dividends graph in Diagram 1 is negative, while earnings were falling consistently during the period 2006-2008. It is evident that in general, firms in the UK spontaneously complied with the agency costs theory and the signalling theory in terms of making adjustments in dividends to deal with their revenues/profits and future potential for revenues. At the same time, there is a smoothening effect, which had to exist because otherwise reduction in dividend payouts would have contradicted the policy of management in terms of being reluctant to lower dividend payouts.

Overall Trends

Diagram 2 reveals the average earnings per shares of FTSE 100 companies during each of the years between 2006 and 2012, along with their average dividend payout ratios. Such mean payout rations have been considered in this research as a basis through which dividend payouts by FTSE 100 firms during the period 2006 to 2012 can be examined and analysed. Diagram 2 also reveals that firms in the UK were making dividend payouts even during times when they were having negative earnings. It is noteworthy that such outcomes are consistent with those in the US as apparent from research studies carried out by Acharya et al (2013). They found that many US banks continued to make dividend payouts even after they were bailed out by the US government. The crisis made many banks and financial institutions to shift assets and risks from debtors to shareholders by way of dividend payouts and re-purchase of shares. In the banking sector, the signalling impact proves to be stronger because of banks’ tendency to portray solvency, which in turn motivates bank managers to avoid lowering of dividend payouts. In the context of the UK, such outcomes are clearly apparent from Diagram 1, which demonstrates that financial institutions in the country aimed at smoothening dividends despite the fact that their earnings had declined considerably during the financial crisis.

It is apparent that the outcomes give credence to the reluctance of firms to reduce dividends because of traditional practices in this regard, particularly because of existing perceptions amongst the management about dividends being indicators of the firm’s identity. Brav et al (2005) conducted a survey in which bank managers responded in confirming that they gave equal significance to their investment policies and to the maintenance of dividends at specific levels. A study carried out by Skinner (2008) revealed that dividends tended to be sticky indicators of previous actions of management and that in keeping with past practices they tend to continue implementing the traditional dividend policies. Such reasoning is also maintained by researchers involved in ascertaining corporate and human behaviours in concluding that dividend payouts serve as a social practice and have become practices that are difficult to change. It is known that dividends imply distribution of profits to shareholders and that firms ought to lessen dividend payouts during times of low profitability, but research has revealed that firms are mostly reluctant in reducing such payouts. Therefore, it is apparent that with declining profits during the period of the financial crisis, firms in the UK should have logically reduced dividend payouts, but they did not do so in order to continue with their traditional approaches towards smoothening dividends.

There is no doubt that the financial crisis reduced the earnings of financial institutions more in comparison to nonfinancial firms; meaning that earnings and profits of financial companies declined more sharply. Overall, it emerges that the payment of dividends and the relative ratio of nonfinancial companies ought to have been higher than the nonfinancial companies, but not much difference was found in this regard between the two categories of firms. It thus emerges that firms in the UK have the tendency of smoothening, which is why there was no statistically important variance found in terms of dividend payout ratios between financial and nonfinancial companies in the country. This aspect is supportive about the conclusion relative to smoothening of dividends by firms irrespective of their actual revenues and profits. The same conclusion is applicable for UK firms in the context of firms’ perceptions about future earning potential. Moreover, the outcomes also indicate that UK companies are not in favour reducing dividends even when faced with strong financial pressures.

Upon testing whether there was a major disparity in dividend payouts between the pre-crisis period and the post-crisis period in the context of UK firms, it was found that in the case of non-financial firms there was no significant disparity. But there was difference in the pre-crisis and post-crisis dividend payout ratios of financial companies. Upon analysis of the data in the context of comparing the differences in dividend payout between the two periods, it was found that there was 5 percent significance point; meaning that there was not much statistically important difference in the context of the dividend payout ratios of financial and non-financial companies in the UK. Such outcomes indicate in general that the available information was symmetric in the context of the prevailing market environment in the given circumstances that were characterized with the impacts of the global financial crisis. In regard to dividend payout, it was assumed initially that all firms have symmetric information about the market environment, in that, all entities have access to the available information; but in actuality, the market is characterized with asymmetric availability of information because some firms tend to have information about their financial status and their future potential for success. Consequent to such asymmetry in availability of information, it emerges that a firm’s market value may not be truly representative of its actual value. Floyd et al (2014) have argued that under such circumstances, firms try to provide the information in the market with the objective of filling the breach between the firm’s market value and its real worth, particularly in circumstances when the firm considers that it has been undervalued.

An effective way of sharing information is by means of the firm’s dividend policy. It is apparent from the signalling theory that investors are able to infer information about a given company’s financial status and future potential for growth through patterns in which dividends payouts change. However, if signalling theory is to be considered effective in analyzing dividend payout patterns, the firm should have some incentives if information sharing is to be done. For example, high dividend payouts could send signals to the firm about major opportunities for the company in the coming future. Similarly, lower dividend payouts could signal the firm’s weaknesses in terms of growth potential in the future. Therefore, it can be said that stability and growth potential of dividends is a sign of increasing firm value by way of enhanced share prices. Because firms wish to maximize their values, they will not be inclined to reduce dividend payouts. In addition, companies will aim at enhancing dividend payouts if they anticipate that their earnings will grow consistently in the long term. Such findings are in keeping with the concept of dividend smoothening according to which companies try to make dividend payouts consistent across time. They avoid increasing such payouts suddenly except in situations when increase is justified because of constantly increasing profits over time. In the context of the UK, it is apparent that the signalling theory effectively explains why firms in the country have not been eager to reduce dividend payouts even during times of financial crisis.

The given behaviours on the part of UK firms indicate that with decline in profits, they should have reduced dividend payouts on account of declining optimism amongst the management of firms. In addition, as held by Nissim and Ziv (2001), dividends and earnings ought to have a positive relationship because higher profits mostly result in higher dividend payouts. The perfect market assumptions made by Jensen (2001) mean that there is no conflict of interest amongst shareholders and management. But there is no practical basis for such assumption because in reality, separating control and ownership of the firm is not possible. In acting as agents of shareholders, management may take actions that are not in favour of shareholders; such as making excessive investments in areas that could benefit the firm but harm shareholder interests (Jensen 2001). On account of such clash of interests, shareholders are forced to meet the agency costs pertaining to scrutiny of management’s actions.

Jensen (2001) has argued in the context of emerging contradictions that dividend payouts lessen the cash left with the firm and thus leaves it with no option but to search in capital markets for investment finance. Thus, other financial institutions such as banks will start pursuing with the firm in providing it with the required funding services. This results in reduced monitoring costs for shareholders. At the same time, consequent enhancement of monitoring will dissuade managers from involving in such behaviours. In this regard, Jensen (2001) held that use of excess funds in the payment of dividends helps in reducing over-investments by firms, which mostly occurs amongst companies having funds to invest in projects that will only help the firm and not the shareholders. It is in this context that some researchers have argued that enhancing dividend payouts will resolve the problems faced by shareholders because excess cash will go out of reach from the management. Therefore, the presence of agency costs will motivate shareholders to pursue with the management to pay dividends. At the same time, it becomes apparent that in situations such as the ones that prevailed during the financial crisis of 2008 when cash was not abundantly available, it was better for firms to reduce dividend payouts.

Condition of the UK Economy and its Stock Market Performance (2005 to 2014)

The financial sector in the UK is known to be quite interlinked, which means that the UK was impacted quite strongly by the financial crisis because it experienced a major recession that dried up credit and reduced risk appetites of most firms. The country’s GDP declined sharply because the scarcity of credit adversely impacted the ability of companies to raise funds. Consequently, companies had to cut down on investments that further pushed the economy deeper into a recessionary cycle. The country’s financial sector suffered severely because of heavy retrenchment, which further led to the nationalization of three of the biggest banks in the country. Over 500 billion pounds were injected into the economy by the government in order to stabilize the commercial sector. The government took over banks such as HBOS, Lloyds TSB and Royal Bank of Scotland. Overall, the financial crisis created a damaging impact on the UK’s financial sector and on its economy, which invariably led to the decline in corporate dividend payments. In this context, the objective of this research is to evaluate whether the dividend payouts were actually reduced as a consequence of the crisis.

Results and Discussion

In terms of time and place the data is collected, it is clarified that the research has taken into account dividend patterns in the UK during the period 2005-2010 for which data is obtained from the FTSE 100 Compustat Global Data base in regard to active as well as inactive listed companies. The prime objective in this regard is to ensure that bias is avoided.

Data on dividends for the period 2005-2010 is obtained from the FTSE Compustat Global in which the variable is representative of the total dividend amounts.

It becomes known that listed companies in the UK mostly pay dividends twice every year, while also making comparatively smaller dividends payments on interim basis in the period being accounted for. At the same time, the companies pay comparatively higher dividends during periods when they report profits.

Both size and age of the firm are important determinants of the prevailing dividend payouts, which is why it is important to carry out an analysis involving collection of sub-samples on the basis of such characteristics.

Since the methodology for this research does not involve examination of respondents in view of the need to analyze patterns of dividend payouts by firms in the UK, there is no question of including questions that will be asked in this regard. Nevertheless, the following issues need to be resolved through the research:

- To explore the theoretical concepts of dividend policy and its determinants;

- To establish the hypothesized relationships between the adopted study variables;

- To investigate the empirical relationships between dividend policy and its determining factors;

- To conduct the comparative analysis for the study variables to discover practical implications and importance of payout decision;

- To provide the generic policy recommendations for companies and policy makers on how to improve dividend decisions based on the findings of the research.

Analyzing on the basis of the above will allow the research to determine the impact of the 2008 global financial crisis on the dividend payout of publicly listed non-financial companies in the UK.

The main variables for this research are mean dividend payout ratios and the mean earnings per share of the FTSE 100 non-financial companies in the UK during the period 2005-2010. Other variables that have bearing on the outcomes of the research are payout policies of firms, capital market efficiencies and audit quality.

The sample population in terms of the analyzed firms in the UK was quite small in view of the fact that there are not many large financial companies in the country. The research examined the FTSE 100 companies in terms of their data available with Compustat Global Data.

The research examined primary data available from the FTSE 100 Compustat Global Data in order to ascertain the dividend payout patterns in the UK during the period 2005-2010. The collected data pertained to data on active as well as inactive listed companies, with the prime objective of ensuring that bias is avoided. Information about dividends was sourced from the FTSE Compustat Global in which the variable is representative of the total dividend amounts.

In view of the nature of the research, there was no need to analyze secondary data.

The source of the data was the FTSE 100 Compustat Global Data base in the context of active as well as inactive listed companies in the UK during the period 2005-2010. Theoretical information was attained by means of a thorough literature review of journals, research studies, articles, library sources and internet sources.

The data and related information was collected during the course of the research

The focus of the research was on collecting data based on the mean dividend payout ratios and the mean earnings per share of the FTSE 100 non-financial companies in the UK during the period 2005-2010. Attention was also given to other variables that have bearing on the outcomes of the research; such as payout policies of firms, capital market efficiencies and audit quality. It became apparent that both size and age of the firm are important variables in determining the prevailing patterns of dividend payouts, which is why it was important to carry out an analysis involving collection of sub-samples on the basis of such characteristics. In order to ascertain the impacts of the financial crisis on dividend payout during 2005-2010, the research used measures such as substitution between sources and use of funds, processes of signaling and smoothing and analyzing pricing issues faced by firms.

The results in this section are discussed in the context of the research questions outlined in the first chapter of this research. It is apparent from the findings that in the context of the UK, there is not much statistical difference in dividend payouts amongst the country’s financial and non-financial companies. In addition, their patterns of dividend payouts have not been found to be statistically lesser than dividend payouts prevailing before the financial crisis. Nevertheless, it is apparent that the reasons for keeping consistency in dividend payouts could be different in the context of financial and non-financial companies. A major issue under consideration was whether the financial crisis created major change in dividend policy of firms in the UK and whether there was major disparity in the pattern of dividend payouts amongst financial and non-financial companies in the country. A major assumption of the research was the availability of symmetric information for all firms, which meant that all firms had the same accessibility to information. But the fact is that there was asymmetry in information availability in markets because most firms have information about their own financial status and their potential for growth in the future. On account of this, the firm’s market value does not necessarily convey its real worth, which is why the management of these firms could provide such information in markets with the objective of reducing the gap in terms of the firm’s true worth and market value. This is particularly true when the management feels that the market has undervalued the company.

As per the signalling theory, it is possible for investors to infer information relative to a firm’s future potential and current financial status from the changes that occur in the amount and consistency of dividend payouts. Concurrently, if the signalling theory is to hold good, there have to be benefits for the firm in order to motivate it to share the information available with it. Investors are prone to consider dividend payouts as a measure for the firm’s future potential for success. For instance, increase in dividend payout may suggest that there are major opportunities for the firm’s success in the future. On the other hand, reduced dividend payouts may indicate that management is pessimistic about the firm’s potential for growth in the future. Consequently, it becomes evident that consistently increasing dividend payouts will enhance the company’s value by means of increase in share prices, while the opposite is true if dividends result in reduced firm value and share prices. Given that firms aim at maximising their value, they would not be inclined to reduce dividend payouts if such payments lead to lower share prices.

The management is prone to enhance dividend payouts if it considers that there has been increase in revenues on a consistent basis. This kind of dividend smoothening works well for firms in the long term provided they avoid abrupt enhancement of dividend payouts. But such strategies hold good only if the firm believes that such increases can be maintained through future profits. In the context of the applicability of the signalling theory to the UK, it is apparent that firms in the country have not been inclined to reduce dividend payouts during the financial crisis. It follows from such reasoning that with decline in earnings during the financial crisis, UK firms ought to have reduced dividend payouts in keeping with the prevailing economic outlook. Moreover, it becomes apparent that there should be a positive relationship between dividend payouts and firm earnings because increase in dividend payouts can be triggered only if there is increase in revenue.

The Impacts of the Financial Crisis

It becomes apparent that stability of the variables can be impacted because of the financial crisis that started in the UK in 2007/2008. It invariably led to a new series of economic outcomes that had the potential of impacting dividend payouts. For instance, the resulting reduction in credit availability from banks after onset of the financial crisis led companies to become dependent on bond and equity markets for funding, particularly during the immediate period that followed the beginning of the financial crisis, even though many companies faced major difficulties in getting bank credit. In addition, the impacts of constant prevalence of low interest rates made firms to switch from equity to debt that was adversely impacted because of higher levels of payouts, which were occasionally funded through debt. It is for this reason that it is important to analyze the stability of coefficients for the time-period during which the financial crisis was dominant. Driver, Grosman and Scramozzino (2015) have considered the crisis variable to be a dummy variable that was given a worth of 1 during the year 2008. The objective of the authors was to assess if the impacts on the decision making process in regard to dividend payouts were changed because of the crisis that began in 2008 and continued till 2012.

Driver, Grosman and Scramozzino (2015) have inter-related the different variables such as EA, MBF (market to Book Ratio), LDAA, LEV (leverage), SIZE, CAT and LEBIAT (Earnings level) with the crisis. The objective was to determine if the coefficients pertaining to the period prior to the crisis were characterized with stability after 2008. This was important in view of the significance of the interface terms. It became apparent from the outcomes that the market to book ratio (MBF) coefficient had become negative in declining to less than half of the catering coefficient. The rate of growth of assets (DAA) that was considerably on the negative side during the period immediately preceding 2008 was found to be quite positive after 2008. No other major interaction was apparent from the analysis even though there was stability in the coefficient relative to earnings ratio. In the case of small and young companies, a major interaction was found in the context of coefficient of Market to Book Ratio (MBF), which was found to be positive during the period of the financial crisis. No major interactions were found in the case of small and old companies, perhaps because of the prevalence of a weak though significant effect. For the group comprising of large and young companies, it was found that the rate of growth of assets (DAA) coefficient was comparatively positive even though leverage in their context was negative during the period after 2008. The Market to Book Ratio (MBF) of large and old companies was impacted negatively because of the crisis, which in turn indicated the occurrence of a positive impact on rate of growth of assets (DAA).

Overall, upon using the earnings to assets ratio as the regression model and the behaviour of dividends payouts as the dependent variable in keeping with their specifications, Driver, Grosman and Scramozzino (2015) revealed that catering variables, size, age and earnings ratio are important determinants of dividend payouts during the period following the financial crisis of 2008. They found that negative impacts occurred to the extent of 10 percent in the context of firms’ Market to Book Ratios (MBF) and rate of growth of assets (DAA). A marked pattern was found in highlighting the significance of investment opportunities as assessed in terms of the Market to Book Ratios (MBF) and rate of growth of assets (DAA) of examined firms in relation to the dividend decisions taken by them. The authors also found that the lagged dependent variable (LDV) was dominant across the entire period in indicating that special dynamic panel methods need to be adopted by firms in the UK.

The authors disaggregated the sample in terms of a 2/2 matrix in keeping with median age and size on the basis of data obtained through the Computstat Database that permitted having a broad idea about firms’ behaviours. Except for the group of small and young companies examined by the authors, the earnings levels were found to be good; meaning that there is considerable importance of other groups in the context of dividend payout.

Conclusion

The issue of dividend payouts after the onset of the financial crisis of 2008 received a great deal of attention amongst researchers involved in studying the impact of the recession on firms and sharehilders. A large number of studies revealed that financial institutions kept up with patterns of stock re-purchasing and dividend payouts despite experiencing severe financial constraints because of the financial crisis. Many banks are known to have made dividend payouts even after they received bailout money from the government. Such studies have concluded that financial crisis motivated financial institutions and banks to resort to making dividend payouts and share re-purchasing in order to transfer risks to shareholders. Many studies in this regard have concluded that the crisis became a major cause for financial institutions to transfer their debts to shareholders. The outcomes of the financial crisis in the UK created a new series of economic circumstances that had the potential of impacting dividend payouts. The resulting reduction in credit availability from banks after onset of the financial crisis led companies to become dependent on bond and equity markets for funding, particularly during the immediate period that followed the beginning of the financial crisis. This was despite the fact that many companies faced major difficulties in getting bank credit. In addition, the impacts of constant prevalence of low interest rates made firms to switch from equity to debt that was adversely impacted because of higher levels of payouts, which were occasionally funded through debt. It is for this reason that a detailed analysis was made of the stability of coefficients for the time-period during which the financial crisis was dominant.

It is found that the signalling impact in the banking sector was significantly robust because banks made use of dividend payouts in demonstrating their solvent status that also prevented firms from resorting to reducing dividend payouts. Such circumstances made researchers and analysts to make varied predictions in regard to the payout strategies of financial institutions. Even though the dividend payouts by financial institutions were motivated by agency costs relative to free cash flows, such institutions actually employed a conservative strategy of dividend payout and re-purchase of shares. This was done with the objective of highlighting their perceived financial strength to different sections of consumers and shareholders. Such patterns soon became a part of the financial strategy of most financial institutions in the UK. The signalling theory and the agency theory are clearly applicable in the context of the UK during this period in explaining why UK firms chose to sustain the same dividend payout patterns as those that prevailed prior to the crisis. This was done despite the fact that many firms incurred heavy costs by way of decline in their share values.