There was a fall in sales due to the recession. They had to face an overall loss of about 21% of the total sales in the third quarter compared to the second quarter. They also had a loss of revenue of about 84%.

Keith Wandell, Chief Executive Officer of Harley-Davidson, Inc. said:

“While the environment remains challenging for us, we are mildly encouraged by the moderation in the decline of dealer retail Harley-Davidson motorcycle sales.”

The different reasons for the decline in the sale of the company have to be analyzed and how they can achieve an increase in sales is to be considered. As the sales are in the declining stage, they have to consider the different methods for improving the sales.

The sales decline of the company is the major factor to be considered. This can be done by adopting different strategies. Strict action plans are to be put into practice. The risks are to be considered and analyzed. The supply chain management should be implemented properly. The product should be identified, and the different ways in which the diversification can happen should also be considered.

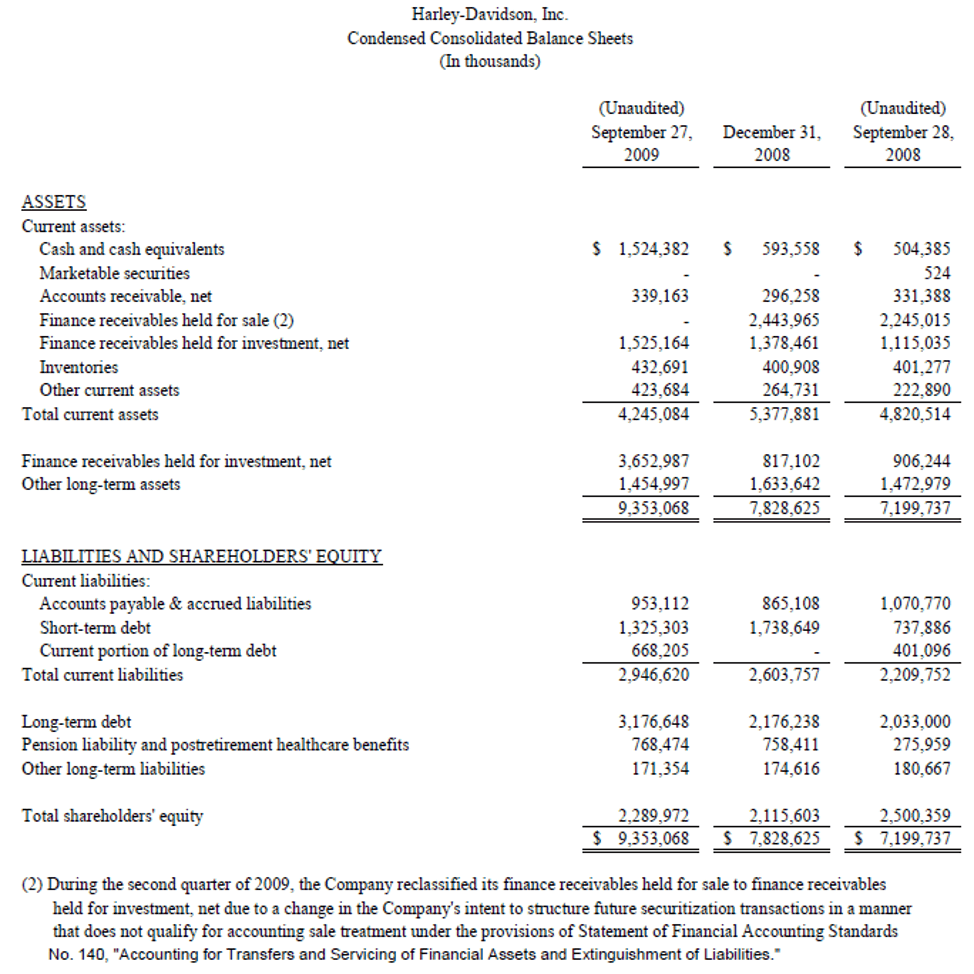

The table below shows the assets and the revenue of the H-D Company.

The company has to concentrate more on the product line, its manufacturing, and its development through the R&D department. They should introduce new products and discard obsolete technology. The business operations can also have a widespread in its mode of operations to increase the profitability of the company. The major events in the company may lead to the expansion of the business. They had a wide expansion program in 2007 with good capturing of the market. They also have plans to add different kinds of technological products or to involve in the development of new products in order to increase sales. They plan to expand the number of dealers from the current number of 60.