Introduction

For ages, commerce has existed, with science and creativity altering the form and size of the market. Because no country has an absolute advantage of exactly enough of each product to meet its demands, nations participate in international trade, resulting in the global economy. When a country engages in world commerce, it must examine the feasibility of the endeavor and make a judgment. Due to considerable discrepancies that could stifle economic progress, certain countries may find it difficult to internationalize in specific states. The nature of a country’s connection with another impacts how successfully it can conduct commerce. The system of government, population, culture, and GDP are only a few of the aspects to examine. India and China are two of the world’s most powerful trading nations. Comparing different countries’ economic and political systems exposes key distinctions that might help you choose the ideal country for your business.

Brief Biographies of China and India

The history of a country is critical to study because it has a considerable impact on how it interacts with other nations. China is among the largest and most rapidly expanding economies on the planet. China is situated on the eastern side of Asia, to the west of the Pacific Ocean. It is home to about 1.4 billion residents and spans a physically wide region of over nine million square kilometers, as indicated by Xin (2020). It is in the third position among the world’s largest countries, behind Russia and Canada. It is renowned as the world’s most populous country, contributing to its large market size.

The country’s populace has been increasing rapidly, which has aided in educational improvement and technology application, resulting in a higher rate of economic growth. Before implementing financial policies and economic liberalization approximately four decades ago, China’s prohibitions left the industry underdeveloped, sluggish, centrally administered, massively inefficient, and isolated from other nations in the civilized world. Since 1979, when China entered financial markets and implemented complementing efforts, it is among the world’s fastest-growing economies (Hang, 2017). This demonstrates how a period of policy shift has shaped China’s economy.

Analyzing a country’s economic growth rate exposes its international commerce potential. According to Hang (2017), China’s real GDP would increase at a rate of roughly 9.5 percent through 2018. China has quadrupled its GDP on average every eight years, relieving poverty for at an estimated 800 million individuals (Hang, 2017). China has overtaken the US as a financial center, manufacturer, commodities dealer, and holder of foreign reserves. As a consequence, it has grown to be one of the most important commercial partners of the U.S. China is America’s greatest trading partner in terms of goods, the largest exporter, and a sizable export market.

India, usually described as the Republic of India, is South Asia’s largest country. Its capital, New Delhi, was established south of the historical hub of Old Town in the 20th century to serve as the nation’s administrative headquarters (Shrotryia & Singh, 2020). It is governed by a representational government that serves an extraordinarily diverse people comprised of multitudes of tribal groups and maybe hundreds of ethnicities. India is the world’s second-largest country, after China, accounting for around one-sixth of the worldwide total. Its economy has grown significantly since independence, providing valuable lessons for many other developing markets. Between 3500 and 1800 BC, India’s origin can be traced to the birth of the Indus Civilization as highlighted by Shrotryia and Singh (2020). The civilization’s financial situation appears to have relied mainly on commerce, which was aided by transportation developments.

The residents of India cultivated, and tamed animals, crafted sharp objects and tools, and traded in ceramic pots and colored jewels such as sapphire and other elements of exchange. They sailed to Mesopotamia and dealt with gold, precious metals, and ornaments. By 600 BC, they had developed punch-marked silver coins (Shrotryia & Singh, 2020). This economic era was marked by robust trade and rapid urbanization.

Political stability and military protection facilitated the formation of a coherent economic landscape and enhanced trade and travel, resulting in increased agricultural output. The monarchy invested much in the development and maintenance of roads in India. In collaboration with increased stability, standard measurement, and growing use of coins as payment, infrastructure spending enhanced trade. Over the next three millennia, the country built its historical kingdoms, which led to the growth of riches, and the feudal globe controlled almost a fourth of the world’s natural economic assets (Shrotryia & Singh, 2020). India is one of Asia’s fastest-growing economies, with substantial implications for global trade.

Governmental Structures

China’s system of government is characterized by extreme authoritarianism. China is notably a one-party state created in 1949 on Leninist ideals by the Chinese Communist Party (CCP), which has retained political authority ever since. Inside the CCP, the political rivalry is confined to internal strife, with senior leaders projecting an outward impression of cohesion (Xin, 2020). Every kind of justifiable opposition is forbidden. The CPP Advisory Council, a largely impotent advisory group, brings together sociopolitical organizations that advocate for the CCP’s authority. There are no genuinely elected leaders of state, government criticism is banned, the CCP regulates all religious activity, the opposition is outlawed, and civil liberties are severely limited.

A one-party authoritarian regime primarily governs elections in China. Elections are held exclusively at the municipal level, not at the national level. China is among the few remaining dictatorships headed by a single party that does not conduct countrywide direct elections, as shown by Xin (2020). The competitive aspect of the elections is badly harmed by the Communist Group’s hegemony in China, restrictions on free expression, and official interference in elections.

In theory, China’s political power is totally vested in Chinese nationals. As such, the Government argues that the country is a functional democracy with many parties. In response, Xin (2020) asserts that in practice, a functional democracy does not prevail. China resembles a healthy democracy in certain aspects, with legislative bodies ostensibly accountable to the local people. In reality, the CPC, not the people, wields true authority in China’s government. When analyzed through the lens of its government, China can be regarded as a relatively prosperous economy under a legal structure conducive to foreign trade despite its authoritarian nature.

India can be described as a Nationalist Socialist Progressive Democrat State with a federal and unified parliamentary system of governance. It is a representative system with a multi-party system, with seven recognized mainstream political organizations (Shrotryia & Singh, 2020). The government is constituted of the executive, legislative, and judiciary branches, with a national assembly, a prime minister, and a High Court executing all constitutionally bestowed responsibilities. Shrotryia and Singh (2020) argue that the Indian parliament is particularly bicameral, with one known as the Lok Sabha and the other as the Rajya Sabha. This kind of government developed the country’s political independence and fairness.

While the Supreme Court regulates all legislative laws in India, parliament retains considerable control over the government. Cabinet agencies are created by parliament or selected after six months of taking office. The government is answerable to the Lok Sabha, which is dissolvable in certain circumstances if the governing party loses a significant proportion of its party membership (Shrotryia & Singh, 2020). The Rajya Sabha, on the other hand, is a legislative house that remains undissolved; its members serve six-year terms. Taking into account the state’s power and its relationships with other institutions and the public, India’s political and legal climate is extremely conducive to foreign trade due to its stability.

Offsetting the Risk of Global Trade

Foreign trade risk includes all hazards connected with international commerce, such as administrative risk, operational risk, and currency value risk. Global trade hazards could be an objective fact, and foreign trade organizations regularly encounter a number of dangers as they organize international trade. As a result, favorably understanding the characteristics of global trade risk, defining guidelines, and mitigating measures are vital for fostering the healthy expansion of international company interactions. Real-time forecasting of international trade risks is crucial for establishing scientific risk planning and mitigation approaches (Gervais, 2018). And the key to projecting global business risk accurately is rapid detection and evaluation of the hazard’s nature and probability of impact. Owing to the intrinsic changes of international commodity prices, global trade organizations must be completely aware of the causes and prospects of price volatility in order to anticipate price risk efficiently and make logical decisions.

Global trade risk can be mitigated in a variety of ways, depending on the nature and consequence of the risk. Compliance with world trade policies and regulatory standards is critical in mitigating international trading risk. When engaging with Chinese and Indian economies, a nation must comprehend and adhere to the global regulations that govern the Asian market. Additionally, adhering to a country’s environmental, cultural, and political rules is critical for creating positive relationships that mitigate trade hazards. This is exemplified by the China-U.S. trade conflicts that shattered the two nations’ worldwide partnership (Xin, 2020). Given the complexity of multinational operations, addressing unique impediments is critical to fostering healthy interactions.

In today’s highly competitive environment, a state can handle operational trade risks by establishing an efficient supply system and enhancing the standards of production. This emphasizes the critical nature of adopting innovative solutions that facilitate global contacts and place a premium on greater convenience (Gervais, 2018). As India and China grow into major economic hubs, countries must maintain the highest standards of their exports in order to mitigate the risks associated with low-volume sales. Internal issues such as peace and stability are also critical since they increase the likelihood of developing healthy partnerships in the world market.

A Comparative Analysis of the Two Economies

China and India are two rapidly developing economies in the globe. In terms of dollars, they are world’s placed at the second and fifth positions in the Central Intelligence Agency’s (2022) assessment of economic giants, respectively, in 2021. In terms of buying power parity, China is considered the biggest economy in the world, while India takes the third position. Regarding the real and purchasing power parity aspects, these nations contribute 21 and 26 percent of the total global yearly wealth, respectively (Central Intelligence Agency, 2022). China and India combined to produce over half of Asia’s total output. In the late 18th century, China and India had nearly comparable nominal GDPs. In 2021, China’s GDP will be 5.46 times that of India, and its GDP per capita will be 2.61 times that of India (Central Intelligence Agency, 2022). In 1998, China crossed the $1 trillion mark, whereas it reached this position almost a decade ago. Until 1990, the two countries were evenly matched in terms of GDP per capita.

Using these metrics, India was considerably more resourceful than China in 1990. The latter was anticipated to be almost 5.4 times richer in national income and 2.58 times wealthier in regard to PPP in 2021 compared to India, according to the Central Intelligence Agency (2022). In terms of per capita income, China and India are given the 63rd and 147th positions, respectively (Central Intelligence Agency, 2022). In terms of per capita GDP, they take the 76th and 130th, correspondingly. Inflation in India reached a high of 9.63 percent in the 80s and less than -5.24 percent during the same period. Within the next five decades, China grew by more than 10%, but India scarcely grew at all (Central Intelligence Agency, 2022). Both countries are made up of three sectors, according to the CIA Factbook: agribusiness, manufacturing, and commerce (Central Intelligence Agency, 2022). A thorough examination of these nations’ economic performance is required for smart decision-making.

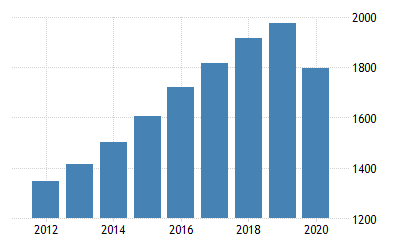

A tabular illustration of China’s annual growth rate as of December 2020 (Central Intelligence Agency, 2022).

Whereas the two countries’ economies are analogous, China seems to be doing significantly better than its competitor. On the other hand, India may expand to stay competitive with China on a larger scale due to the China-US trade wars and severe economic policies. India’s GDP went below the previous year’s record in 2021, according to the Central Intelligence Agency (2022). When these economies are compared, China’s economy may reveal to be more feasible than India’s. This conclusion is based on the sustained rate of increase observed over the last few years.

A Comparison Infrastructural and Educational Systems

Infrastructural Development

Given China and India’s divergent infrastructure development agendas, the achieved results are somewhat varied presently, despite the fact that both countries had roughly equivalent infrastructure services and resources in the mid-18th century. For instance, China’s 1952 power generated of 7.3 billion kilowatt-hours (kWh) directly correlates to India’s output of 6.3 billion kilowatt-hours (kWh) in 1950-51 (Zhezhou et al., 2021).

India’s road transport network in the 1950s was extensive, encompassing 400,000 kilometers, relative to around a third of China’s. Zhezhou et al. (2021) record that around 40% of the roads in both countries had been expanded in that period. Notably, India’s train system, at 53,000 kilometers in length, was more than thrice that of China’s at 23,000 kilometers. India and China both had similar telephone user counts, but India failed to maintain the higher growth rates experienced during the planning years.

While the bulk of Indian policy documents continues to emphasize the importance of infrastructural investment, they have only recently adopted China’s ongoing dedication to progress and infrastructural investment, anticipating future demands, and expanding in time. India’s development methodology, which started in the 18th century with a combination of socioeconomic development, was adjusted mid-stream to emphasize redistribution during a critical period of economic development (Zhezhou et al., 2021). Many developmental policies have been adopted, significantly decreasing the financial allocation for infrastructure investment.

However, in comparison to India, China’s power industry policies have proved to be significantly more effective at closing the funding gap through local and foreign private investment. Foreign sector economic investment was encouraged in China to replenish monetary input and offer production capacity for a large expansion program. The industry was reformed further in 1996 with the enactment of the electricity Supply Law, which formed the nation’s Control Corporation, a crucial move toward disconnecting oversight from actual production and delivery (Zhezhou et al., 2021). Foreign investment in china took a number of institutional units, including strategic alliances, build-operate-transfer (BOT) collaborations, unified equity ventures, grants, and shares in established energy enterprises.

China’s funding gap in the electricity sector has been performing considerably better than India’s, owing to the double pricing scheme of “new plant, new price.” India’s transport industry is one of the most recognized large systems in the world. Indian roadways accommodate more than a billion users and contribute to about 85% of passenger traffic and nearly 70 percent of freight traffic in the country (Zhezhou et al., 2021). In the 1990s, speedy economic growth resulted in yearly increases of 13% and 8 percent in demands for cargo and passenger services proportionately (Zhezhou et al., 2021). India had a substantial road network after colonial rule, but the general standard of transport infrastructure reflected the institutional entities responsible for planning, building, and sustaining the road system, which was intrinsically weak and ineffective.

Education

Education is critical for regional and global economic development and growth. With total enrollments between 2.91 and 2.67 crore trainees, India and China have two of the largest higher learning systems globally (Zhezhou et al., 2021). While both Indian and Chinese institutions of higher learning grew in rising economies, their paths were distinct, altering their socioeconomic makeup. Higher education in India is primarily concentrated on undergraduate (bachelor’s) programs (Zhezhou et al., 2021). Indeed, it is the world’s largest system regarding undergraduate enrollment, exceeding China’s United States learner population. India accounts for nearly 75% of all students pursuing a bachelor’s degree, compared to 43 and 50 percent in China and America, respectively. (Zhezhou et al., 2021). These distinctions can be traced back to the infrastructure and policies of individual countries.

Concerning the technical school, India’s young and aspirational population is deprived of the chance to join in conventional economic growth through manufacturing. At this time, China took the chance and involved the citizens in mass manufacturing at a low cost. In contrast, China did not arrive at this result by chance; rather, it established its vocational learning institutions in order to develop a well-trained workforce for production duties. According to Zhezhou et al. (2021). China enrolls approximately 96 lakh students in technical education in comparison to India’s 40 lakh. Although China’s education system is limited in some ways, it highlights how India is passing up opportunities to enhance economic and social impact through higher education. Higher education must undergo a comprehensive and radical reform in order to address descriptive and statistical challenges at all academic achievement and offer diverse training and development opportunities and engage talent.

An Assessment of the U.S Dollar variations

For many years, the American dollar (USD) is primarily the largest and most powerful currency, to which governments have tied national currencies to determine individual global market value. Demonetization in India’s 2016 economy, which culminated in the abolition of Rs 500 and 1,000 notes, suddenly made about 86 percent of currency in circulation unusable. This harmed consumer behavior, business, and revenue. The world economic crisis that kicked in the aftermath of the 2020 coronavirus pandemic resulted in the currency being devalued to a record rate of less than 76.67 INR per dollar (Central Intelligence Agency, 2022).

While China’s economic system is declining, the Yuan has rarely been improving. Additionally, the Chinese currency has outpaced the dollar in the past two years, rising by around 2.4 percent and 2.8 percent relative to the dollar, depending on its trading area (Central Intelligence Agency, 2022). In summary, both nations’ currencies are currently performing at significantly higher levels relative to the dollar in a three-year period.

Conclusion

China and India are two of the world’s largest trading nations. Comparing different nations’ political structures and economic systems exposes key distinctions that aid in determining the ideal country for business. When comparing the two countries political systems, India offers a more favorable political and legal climate for business. China’s infrastructural development and educational systems are superior to those of India. China can be considered a better option for international business than India in regard to economic development and the value of the US dollar.

References

Central Intelligence Agency. (2022). Real GDP per capita country comparison. In The World Factbook. Web.

Gervais, A. (2018). Uncertainty, risk aversion, and international trade. Journal of International Economics, 115, 145-158. Web.

Hang, N. T. T. (2017). The rise of China: challenges, implications, and options for the United States. Indian Journal of Asian Affairs, 30(1/2), 47-64. Web.

Shrotryia, V. K., & Singh, S. V. P. (2020). A short history of India’s economy: Pre-and post-independence period. Economic and Regional Studies/Studia Ekonomiczne i Regionalne, 13(4), 388-406. Web.

Xin, T. (2020). Understanding China. Beijing Review.

Zhezhou, L., Cunjing, L., Guoyiming, Z., & Xiaolong, L. (2021). Comparison of China and India’s Planned Economy Development Policies in the 1950s-1970s: Institutional logic based on the performance difference of economic reform between China and India. Revista Argentina de Clínica Psicológica, 30(2), 783-799. Web.