Introduction

JUFFALI is a Saudi Arabia company that has business interests in different sectors. The main ones are automotive, technology, construction, chemicals, and AC & refrigerator services. The company has been a pioneer in bringing technology to the Saudi Arabia region. It is also a rapidly growing player in the automotive industry. Its construction sector and its AC & Refrigerator divisions play a critical role in the development and management of working environments in the country. Overall, the company has decades of experience in introducing innovative products and business practices. In some cases, it copies strategies from its global partnerships so that it can deliver the most appropriate solutions for its customers. Its global partners include Mercedes-Benz, Dow, Butler, Floor, Michelin, and Hitachi (JUFFALI par. 1). This paper looks at the overall marketing activity of the group and focuses on the tire sector in detail.

Profit for each sector

The financial information of JUFFALI is not publicly available. However, public reports show that the business conglomerate has a net worth of about USD 6 billion. The business’ concentration is on vehicle assembly and sales under the automotive sector. Tire sales are a recent addition to the business. The other major concentration is on electro-magnetic construction. Based on the outlook, an overall estimate is that automotive provides 40% of the business, construction offers 30%, and the AC & Refrigerator segment offers 10%. The other three, technology, chemicals and services, make up 20% of the business.

Tire market forecast

The Saudi tire market is going to grow by 17 percent in volume between 2014 and 2019. It arises partly from the fact that the country has the largest vehicle per capita in the world. Passenger segment leads in the tire market share, while the commercial segment follows.

Tire Market profile Saudi Arabia

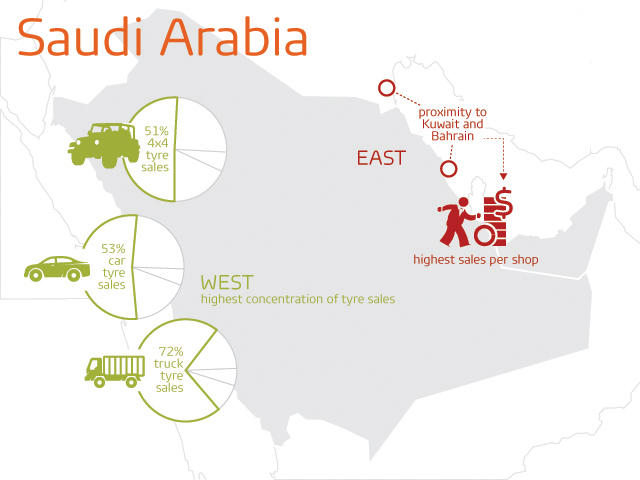

There are 3,357 retailers selling tires, and many of them are concentrated in the Western side of the country, as shown in the illustration below (Satoscar par. 4). The graph shows 51% of 4×4 tire sales are concentrated in the west. The same applies to 53% of car tire sales and 72% of truck care sales (Satoscar par. 6).

Customer strategy for Juffali Tire Company (JTCO)

The company has a detailed target customer profile. It analyses the economic performance of Saudi Arabia, the growth of particular industries that it targets, and the trends in demographics and consumer preferences. The company relies on its corporate social responsibility outreach to build its brand personality. This tactic enables it to emerge as responsible and caring about the future of the country, the welfare of its people, and their business ventures. The company also relies on its heritage to associate with the patriotism of businesses and individuals in Saudi Arabia.

The customer strategy focuses on building relationships to achieve long-term repeat business. This has been the main tactic that allows the group to grow its business interests for several decades. As a representation of multinational companies in Saudi Arabia, JUFFALI can offer an irresistible value proposition to its customers. It promises to use localised processes and designs for business performance and provide globally recognised services and products to fulfil the needs of customers at the same time. It relies on customer intelligence collected through its numerous affiliate companies to gain insights into market needs and enter into partnerships that provide sufficient solutions.

The company’s customer segmentation is done geographically to capture different market reach needs of the country. It also uses the geographic segments to introduce new services and products gradually to the most demanding sections of the market first before spreading them to the less popular markets. With this approach, it can ride on the growing popularity and rapid scaling before rival companies saturate a particular market. As an example, the Juffali Tire Company has outlets spread throughout the country. The company has a presence in Riyadh, Jeddah, Dammam, Abba, Qassim, and Medinah. With the well-structured network of outlets, JTCO can serve the entire country without compromising on customer relations, product delivery schedules, and operation schedules of individual outlets.

Competitor analysis: Porter’s 5 Force Analysis

Supplier power

Tire distributors in Saudi Arabia rely on multinational suppliers like Michelin. They have no manufacturing capacity, but can control supply relations through partnership agreements. This also gives them exclusive trading rights in the country. Eventually, these rights limit the suppliers’ power to dictate prices.

Buyer power

Buyers are not organized. They are segmented into commercial and passenger markets. They have no power over the price and quality delivered to the market.

Competitive rivalry

Rivalry is high in the industry. There are many independent tire sellers offering a wide range of tires. At the same time, there are established chains and dealers for brands like Michelin, Pirelli and Firestone. The main companies trading are JTCO, Almutlak Tires, Nexen Tires, and Tamimi Commercial.

Threat of substitution

Tires are essential components of motoring and have no substitute. Therefore, companies in the industry only worry about the other threats.

Threat of new entry

It is easy for new entrants to gain a foothold in the industry. However, the marketing costs are high, and the time taken to build a significant distributorship chain is a lot. Therefore, the threat of new entry remains medium.

Target customers

The target customers for the JUFFALI Tire Company are individuals and households looking for wheel balancing, wheel alignment, and light mechanical work for their vehicles. The core service of the subsidiary stores of the JUFFALI Tire Company is to sell different brands of high-quality tires. Its pricing is in the premium range, given that the company offers international recognised top brand products. The company provides sufficient services to cover the premium product segment. Its target customers with this approach are the middle-class and upper class individuals and households. It also targets small and medium enterprises, corporations, and government entities for its business-to-business market segment. At the same time, most of the target customer population fits most of the potential markets in Saudi Arabia.

Marketing Strategy for the Tire Sector

Price

The prices of the tires sold by JTCO are higher than the average prices available in the market. Although prices vary, they are in the premium range of different types of products sold by the company.

People

The group has an elaborate recruitment process that ensures talented employees join different companies under it. It also has ongoing training programmes for its staffs to make them understand the business process and client relationships in the Saudi Arabia context and the global context, as provided by its international partners.

Product

Each division within the JUFFALI group has a particular range of products that defines its involvement in an industry. In the automotive sector, JTCO offers Michelin tires for all market segments. It offers Michelin branded tires and after-sale services for passenger vehicles, industrial vehicles, and earthmovers. When Michelin, the global company, launches new products for its global markets, it sells them in Saudi Arabia through its partner, JTCO. The partnership ensures that JTCO always has enough inventories of the latest tire products to serve the Saudi Arabian market. In addition, its products can serve additional demand from customers in other nearby countries that opt to shop for tires and related services from Saudi Arabia.

Place

The selling point of products by the JUFFALI affiliate companies is within Saudi Arabia, where they use physical distribution centres and office premises. The JTCO business relies on outlets where customers can drive to and have their tire needs fixed. These outlets are in strategic locations in the main cities of Saudi Arabia. They are accessible at regular business hours. Customers can get the services at TirePlus centres that have the Michelin brand and are operated by JTCO in the country. The company also works closely with a network of dealers that extend its product reach and services to consumers around the country.

SWOT Analysis: Integrated Marketing Communication

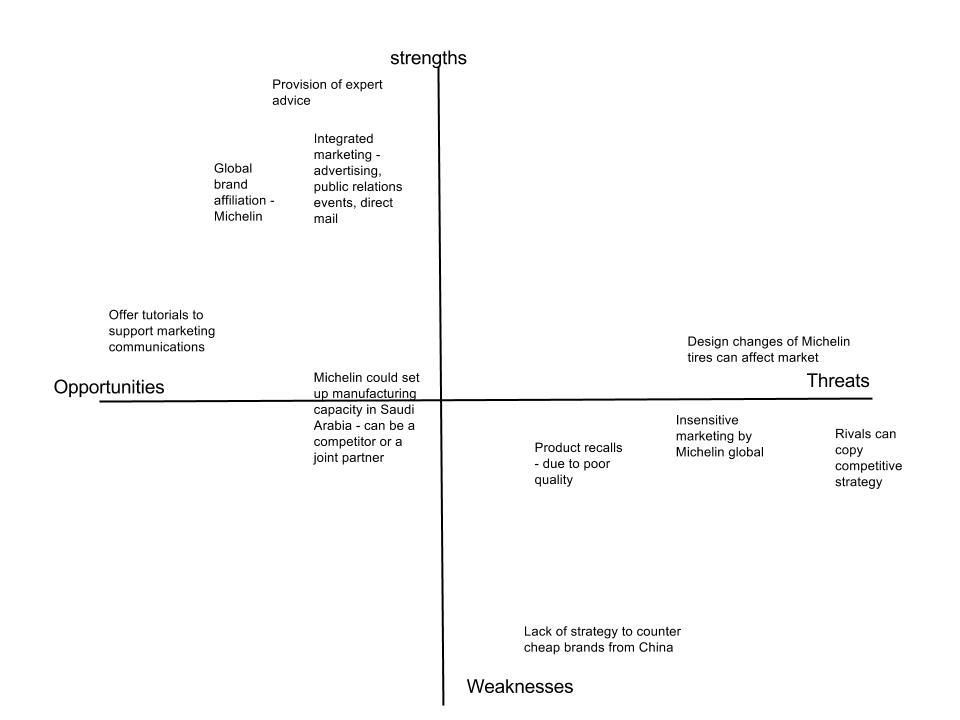

Strengths

Integrated marketing communications strategies of the company are elaborate, including advertising and public relations through sponsorship of events. The use of branding on its equipment, premises, and fleet is also a strategic move that increases the visibility of its brand to retail customers. There are also direct mail strategies used by the company on its websites. Use of catalogues and brochures to provide expert advice is a good marketing communication strategy for its brands. In addition, it rides on the popularity of the different brands that it sells in its retail repair and tire replacement outlets. It can use Michelin tires on the Mercedes Benz vehicles that it sells if customers prefer the choice of tires. Through this strategy, it is easy for customers to go on and associate other services offered by any of the company’s outlets, and even its corporate brand, with the brand personality of global brands like Michelin and BFGoodrich (JUFFALI par. 2-3).

Weaknesses

Juffali Tire Company lacks a strategy to counter the influx of cheap brands in the unorganized market segment. The company has no capacity to evaluate quality of tires and is exposed to product recalls that can damage its reputation. Much of the Michelin tyres come from factories abroad whose orientation may not fully reflect needs of Saudi Arabian market. There are no ecommerce options for customers to buy tires.

Opportunities

The company has a chance to offer tutorials and car maintenance tips that help in explaining products and services, as well as equipping customers with sufficient knowledge to self-manage their tire issues are value propositions that make the brand irresistible. There is an increasing market demand as people and companies embrace shorter tire replacement cycles and the overall number of commercial vehicles is increasing (Report Linker par. 1). Michelin is evaluating opportunities to set up a full factory in the country to build on its success with JUFFALI (Arab News par. 1-3). Government contracts can significantly increase demand for tires.

Threats

Rival companies can easily copy the strategy used by Juffali Tire Company. Low cost tire brands mainly from China are a threat to the quality and reputation of the industry (Automotive Fleet par. 3). Changes in tire design by Michelin can the cause loss of loyal customers. Marketing by Michelin for global audience may be insensitive to the conservative culture of Saudi Arabia and hurt the local sales by Juffali Tire Company.

Recommendations

Juffali Tire Company should evaluate additional partnerships with Michelin to ensure it is protected from sudden design and marketing campaign changes. It should also use exclusivity of marketing Michelin and other tire brands as a way of limiting threats from rival companies.

Conclusion

As long as Juffali Tire Company continues to rely on the success of Michelin in the market, it will be successful. However, if Michelin opts to use other dealers and also establishes its own manufacturing facility in the country, it will cause significant loss of business to Juffali Tires Company. JUFFALI group’s association with the tire company offers sufficient capital and reputation for growth, and it will secure additional marketing and sales cooperation from Michelin and other global tire brands.

Works Cited

Arab News. “Juffali & Brothers Steering Ahead With Successful Ventures.” 2014. Web.

Automotive Fleet. “Saudi Arabia tire market expected to grow 17.19%.” 2014. Web.

JUFFALI. “Busieness sectors.” 2013. JUFFALI. Web.

Report Linker. “Saudi Arabia Autos Report Q1 2015.” 2015. Web.

Satoscar, Prachi. “Clear patterns in the middle.” 2014. GFK Insights. Web.