Introduction

Oligopoly market structure consists of few sellers who sell homogenous products which are differentiated in the eyes of the buyers. In South Africa, petroleum industry is an example of an oligopoly market because it has few sellers who serve the whole market (Thompson 2001). These sellers include Total South Africa, Zenex oil, Shell South Africa, Engen Petroleum and BP South Africa (Thompson 2001). These are large enough compared to the market and thus they are able to influence the price of the market (Duffy1993). This petrol industry in South Africa has entry barriers which are very high due to the high capital cost required, the specialized technical skills required and also because of patents. The industry also enjoys substantial economies of scale (Duffy1993). This is because the industry sells more units which results to reduction of the average cost of each unit in the long run. For the industry to achieve this, it carries out marketing to attract buyers, uses the latest available technology and also ensures extreme task specialization.

Oligopolistic markets are composed of few firms competing in the market (Duffy1993). The different petrol firms in South Africa increase their product in order to increase their market share. The firms also try to achieve market share through price discounting. If one firm discounts its prices in order to attract more buyers and thus increase its market share, the other firms will follow suit or even discount their prices further. This oligopoly market structure displays the following characteristics:

Barriers to entry are high

The entry of new firms in the petrol industry in South Africa is prohibited by the high capital required in order to invest in the industry. The cost of buying the right infrastructure and capital requirement is very high (Duffy1993). High technical expertise is required to run these petrol firms and thus this is also a barrier to entry. Experienced administrative management and employees are required in this industry thus posing a barrier to competitors wishing to enter in the industry. The other barrier that prevents new entrants in the petrol industry is the customer loyalty (Thompson 2001). Customers in South Africa are very loyal to these already established firms in this industry. New firms would face a hard time trying to attract buyers from these large firms (Thompson 2001).

Economies of scale

Oligopolies specialize on employees which results to efficient production and economies of scale (Duffy1993). These petrol firms aim at achieving large output in order to lower the long term cost of each unit produced. These firms also employ different strategies in order to achieve economies of scale. First, these firms are managed economically and efficiently through high labor specialization (Thompson 2001). The firms ensure division of labor where jobs are subdivided in to small tasks which are done repeatedly thus helping the highly trained employees to achieve excellent results (Duffy1993). This results to efficient outcomes because errors are reduced and also the no time is lost through reshuffling of employees.

The second strategy that these firms employ in order to achieve economies of scale is through opening other businesses besides their main duty of selling petroleum. For example, these firms open supermarkets and restaurants from which they earn profits. Oligopoly markets achieve economies of scale through merger (Duffy1993). Some competing petrol firms may merge in order to increase their market share and thus achieve economies of scale. The new firm formed after merging will also have greater ability of controlling prices in the market.

Interdependence decision making process

The few number of petrol firms in South Africa is a concern for each firm to consider when making decisions like setting of petrol prices because it may cause some reactions(Thompson 2001). A petrol firm that may decide to reduce its prices is sure that other firms will also lower and thus the elasticity effect of reducing the price is diluted (Duffy1993). On the other hand, if a firm decides to increase its prices, the competitors may not follow the strategy and thus the firm may find itself alone (Duffy1993). This may make the firm to experience the risk of losing buyers especially those who are price sensitive. The pricing, advertising and any modification is watched by other firms in the industry and it results to imitation. Therefore, when a firm is considering any market strategy, it has to consider the counter reaction of other firms in the industry (Duffy1993).

Non-collusive competition

In non-collusive competition firms make their strategies depending on the expected reaction of other firms in the industry (Duffy1993). For example, in the petrol industry in South Africa, one firm may decide to increase its petrol prices in order to increase its profits while another one may decide to lower the prices in order to cut down the sales of the first firm and thus the first firm will end up not raising the prices (Thompson 2001). The second firm applies such a strategy depending on the expected reactions of the first firm. Due to non-collusive competition the firms will end up lowering their prices or none of the firms will increase the prices.

Non price competition is also an option that the firms use to ensure non-collusive competition. The firms are providing value-added services in order to attract and retain customers. Some of the value added services that these firms offer include simple car services at the petrol stations like, car washing and alignments.

Collusive oligopoly is prone to instability

Collision is formed when competitors form agreements though negotiations (Duffy1993). This collision can help the firm make profits, prevent new entrants in the industry and also prevent uncertainties in the market. On the other hand collusion oligopoly is prone to instability. Instability occurs because the market demand curve is estimated by the management body. This is a complicated task and thus it may take long to come to an agreement (Thompson 2001). By the time the management will be arriving at an agreement, the market demand curve will probably have changed. Secondly, member firms submit the cost estimates. These cost estimates could change by the time an agreement is formed. Finally, there is an incentive to cheat. Some member firms can increase their market share more than what the cartel dictates, For example by reducing the cartel price.

Demerits of collusive oligopolies for society

Oligopolies can use collision to raise their prices at higher levels above the minimum cost and thus operating like a monopoly (Mankiw 2008). The firms will make a lot of profits and thus will have little effort for innovation because there are no competing firms. The firms may also reduce their output in order to increase their price which is a disadvantage to the society (Thompson 2001). Since there are no competing firms, these firms which have formed a collision may lack the motivation to increase the quality of their output thus selling products of inferior quality to the buyers. This collision may result to high level of unemployment to the society and contracted demand because these firms in collusive oligopoly may charge very high prices.

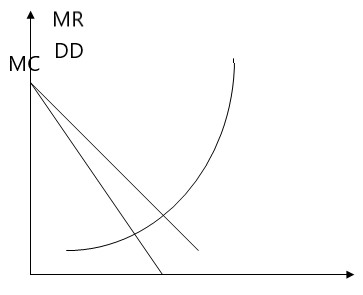

MC-marginal cost curve

DD- demand curve

MR- marginal revenue curve

The diagram shows a collusive oligopoly which results to a monopoly (Mankiw 2008). The industry demand curve represents the monopolist demand curve. Since the collision determines its prices the MR curves thus is below the demand curve. The supply curve of the industry becomes the MC curve when an industry becomes monopolist. In order for the industry to increase its profits it sets its marginal revenue to be equal to the marginal cost by raising prices and restricting output.

Policies to influence the aggregate demand and aggregate supply

In South Africa, the government uses fiscal policy as a plan in its efforts to manage its aggregate demand and supply through taxing programs and also it’s spending. When the country experiences external shock, it can change the government spending; both direct and indirect taxation and also budget balance can be used in order to do away with the reduction in national output. In South Africa, the economy is stimulated through increasing government spending in such areas as health and education and also on transportation (Thompson 2001). Keynesians argue that fiscal policy has a great influence on the aggregate demand, aggregate supply and employment particularly for an economy which is working under its full capacity national output. They also believe that the government can clearly use fiscal policies to influence the level of aggregate demand and aggregate supply in an economy.

Similarly, government in South Africa uses fiscal polices to influence the economies aggregate supply (Thompson 2001). The government cuts tax rates which results to workers to getting the incentives of saving from their earnings. This also helps the workers to work hard to produce goods and services. This results to increment of the quantity of goods and services supplied at each price level in the country.

Demand management

The main purpose of demand management is to regulate the pressure of demand. Monetary and fiscal policies are used to regulate the level of aggregate demand in an economy (Duffy1993). Demand management aims at preventing inflation and the balance of payment in an economy. It also aims at achieving high and stable activity and employment level in an economy. In order to manage demand in an economy, the government can increase the rate of income tax (Duffy1993). This will result to employees working extra hours in order to achieve the desired income. The government can also reduce the tax rate on income for these employees earning little income (Duffy1993). This will result to these employees working overtime and also saving more of what they get as income. Low rate of tax on business will help more people to invest in businesses. This results to increment in capital stock of the nation and of the workers. Favorable tax on businesses will also encourage foreign firms to invest in the country which will result to economic growth.

On the other hand monetary policy changes the interest of an economy which in turn affects the investment spending (Duffy1993). According to Keynesians, increase in money supply results to increase in income. This increase in money supply will result to reduction in the rate of interest charged by banks and thus more people will invest and thus increase the income.

Increased government expenditure in south Africa

By South Africa hosting the 2010 soccer world cup it got an opportunity of increasing the government spending in to its economy (Duffy1993). The government of South Africa spent around R17.4 billion in its infrastructure, communication, transportation and also the country’s security (2010 FIFA World cup South Africa). The preparation of South Africa for the soccer 2010 word cup resulted to the government spending a lot of money (2010 FIFA World cup South Africa). This resulted to the Gross Domestic Product (GDP) to increase with more than 2 percent (2010 FIFA World cup South Africa). The employment rate also rose by 2.7% due to creation of more than 300,000 jobs. The small and medium businesses in South Africa benefited from the world cup. They provided accommodation services, entertainment, health services and also travel services among others (Duffy1993).

The increased government spending was expected to result in raising the budget deficit of South Africa. This would result to increased rate of employment in the country and also growth rate (Duffy1993). Due to this, the profits of various businesses are expected to rise and this encourages more investments by firms. More workers were expected to be employed in these new investments because the firms are assured of making profits (Duffy1993).

The government of South Africa was able to adopt good technology in the country. This was expected to result to increased productivity because business owners could use the new technology in their business and thus earn profits in the long run (2010 FIFA World cup South Africa). Due to increased government spending on infrastructures, it was expected that the country would become a tourist destination. This would help the country to earn foreign exchange from the tourist which will result to increased economic growth (Duffy1993).

High employment rate in South Africa resulted to increased standard of living. High investment by business people into services like accommodation, health entertainment and insurance saw many jobless people in South Africa being employed (Duffy1993). The poverty level reduced because people could afford an income at the end of the day to cater for the basic needs. The Gross Domestic Product (GDP) of South Africa also rose. An economy which is growing produces increasing amount of jobs, goods and services, and incomes for the people (2010 FIFA World cup South Africa). The increase in gross domestic product was as a result of increased investment done by the government in infrastructure, security and electricity. It was also as a result of investment by other small and medium firms in provision of various services to cater for the large number of people. Increased consumption rate resulted to growth of economy of South Africa (2010 FIFA World cup South Africa). The foreigners who went to watch the world cup in South Africa were able to consume the goods and services produced by the country. Transportation services, accommodation, health, entertainment and insurance are some of the services that were used by the foreigners thus increasing the consumption rate (2010 FIFA World cup South Africa).

Supply policies

Supply policies are meant to directly increase the ability of the domestic productive sector in order to supply real services and goods at a given level (Thompson 2001). One of the supply side policy applied in South Africa is a policy to increase level of domestic output. This is achieved by ensuring improvement of efficiency of labor, capital and other resources (Thompson 2001). The policy also aims at formulating some measures to reduce distorts that may result to a wedge between marginal cost. For example, these wedges may include price controls, rate rigidities, taxes, trade restriction and imperfect competition (Thompson 2001).

The other policy applied in South Africa includes measures that are meant to directly stimulate the growth of productive capacity in the country. The country gives incentives to raise the rate of fixed capital formation in the economy, and to increase the rate of return to that capital (Thompson 2001). There is also incentive to expansion of education and manpower training programs and stimulation of technological innovations. More so, South Africa is putting down measures to help in specialized production. This will help the country to benefits from gains from international trade. Policies to help in export diversifications include maintenance of an appropriate exchange rate, domestic prices, freeing and import protection (Thompson 2001).

Foreign direct investment and foreign portfolio investments

Foreign indirect investment refers to the transfer of both tangible and intangible assets from one country to another in order to generate wealth under partial or total control of those assets by the owner (Mankiw 2008). On the other hand portfolio investment is the movement of money in order for a country to buy shares in a company formed or functioning in another country (Thompson 2001). For the last one decade, South Africa has mobilized relatively little foreign direct investment (FDI) but on the other hand has mobilized relatively high amounts of portfolio inflows. In 2003, the foreign direct investment (FDI) of South Africa amounted to US$0.8 billion. While on the other hand, the portfolio investment amounted to US$1.4 billion. This contrasts other countries with risk attribute similar to South Africa. This is because in other countries, foreign direct investment (FDI) is the main source of capita flows (Thompson 2001).

Capital flows gives some benefits to the host country and at the same time it results to economic growth (Mankiw 2008). There are different types of capital flow and each exhibits different degrees of risks and returns, sustainability, control and liquidity. The benefit of foreign direct investment also, is that it results to transfer of new technology, help in improving the skills of the employees and at the same time, it is the most form of private resilient private capital flows after financing distress (Thompson 2001). On the other hand, in portfolio investments, the countries residents do not give up control, but unpredicted market shifts can result to large reversal of portfolio flows which will in turn lead to effects which are detrimental to the economy. With such concepts, there are a lot of questions as to why South Africa composition of capital flows is biased towards portfolio flows. Some structural and institutional characteristics could be responsible for the composition of capital flow (Thompson 2001).

The important determinants of foreign direct investments include potential size of the market, labor skill and development of infrastructure (Mankiw 2008). In some of these areas of determinants, South Africa has not achieved full performance of comparator countries in spite of considerable progress the country has made towards stabilizing the economy in the last decade and laying the basis for higher growth. The factors that limit attractiveness for foreign direct investment to South Africa include lack of skilled labor, low growth rates, deep telecommunication infrastructure and trade openness (Thompson 2001).

South Africa mobilizes more portfolio investment than any other emerging market. Portfolio inflows calculated in terms of a percentage of the countries gross domestic product was double as more in comparator countries. This inflow was particularly more in 2000 with an average of 5 percent the gross domestic product. Most of the portfolio flows in South Africa take the form of equity investment. At around 2000 more than 70 percent of the portfolio flows to South Africa went into equity. Calculating this in percentage of gross domestic product, the country was unable to attract more equity flow than the average comparator country. In spite of the slowdown in equity inflows in 2000 which resulted to weak stock market performance in economies which were mature, equity flows to South Africa remained considerably high above other emerging and developing countries (Thompson 2001).

South Africa has carried out various developments and thus as a result the composition of the capital flows in the country is quite the opposite of the emerging and developing markets (Thompson 2001). In 2002, the share of the foreign direct investment in capital flows was 88 percent in the comparator countries while in South Africa it amounted to only 30 percent. In the recent years, the foreign direct investment of South Africa has increased significantly but it remains well below comparator countries.

In Africa, South Africa is by far the largest market. Following the lift of economic sanctions in South Africa, foreign investment flows increased rapidly but have remained sluggish. Foreign direct inflow in South Africa gained significant momentum, in 2000. This was as a result of the privatization (Thompson 2001). However, since then, foreign direct inflows to the country have been slow with flows which are not related to privatization not gathering momentum. A major share of the foreign direct investment in South Africa comes from just five countries which include United States, United Kingdom, Germany, Japan and Malaysia.

South Africa records a surplus every year since 2000 which results from its large but volatile portfolio flows (Thompson 2001). These surpluses have reduced recently due to regional instability and the need for foreign investment as a more stable form of financial flow. Countries look for foreign direct investment as a form of finance and also for the unique combination of factors that it can provide (Thompson 2001). These benefits of foreign direct investment vary from one sector to another depending on the size of the firm, capability of workers, and level of competitiveness of domestic industry. The main contribution of foreign direct investment should be to add capital formation. In South Africa, inward investment has taken the form of mergers and acquisitions rather than investments. This is because of government privatization (Thompson 2001).

Reference list

Duffy, J. (1993) Economics. Chicago. John Wiley and Sons.

Mankiw, N. (2008) Principles of Economics. New York. Cengage Learning.

Thompson, L. (2001) A history of South Africa. Yale. Yale University Press. 2010 FIFA World cup South Africa. Web.