Information Technologies contributed to the revolution in the economy and helped companies achieve results that could have never been achieved without their incorporation (Bilgiham et al.). In the case study, TAL Apparel Ltd saw the need to invest in its infrastructure to enhance the operations and started automating all financial transactions. Over the years, the company progressed in the integration of IT systems into the business and adopted the Movex Fashion Solution, an apparel industry-specific system that helped the business streamline internal processes and improve the management of external relationships with the company’s partners. Moreover, TAL Apparel integrated vendor-managed inventory, which allowed vendors to create purchase orders based on the demands at stores and warehouses.

Despite complications and failures along the way, the incorporation and synchronization of Information Technologies helped the company achieve a sustainable competitive advantage, which, in turn, enhanced the operations in the sphere of retail and gave support when dealing with the unique requirements of customers (for example, made-to-measure offerings). With the automation of those processes that used to be conducted manually, TAL Apparel created an opportunity for itself to focus on the most important aspects of its operations, catering to the specific requirements of retailers and saving costs for customers. A significant component of the company’s competitive advantage was associated with gaining exclusive supply contracts with retail customers, which prevented competitors from cooperating with major customers and helped TAL avoid pure price-based competition in the sector of apparel production (Farmoohad). Therefore, the integration of IT had some tremendous benefits for the company because they provided insightful information about the situation in the market, helped to automate major operations, and facilitated the adoption of other technological solutions.

While the company saw tremendous potential in adopting Vendor Management Inventory (VMI) and Made-to-measure initiatives, the process of their integration was not as smooth as it could have been; although, in the end, the solutions contributed to the company’s repositioning in the apparel value chain. The first attempt to use VMI for inventory management was associated with the purchase of a U.S. wholesaler, Damon Holdings, Inc. The company lost $50 million in three years predominantly due to a lack of cohesive inventory control. This made TAL reconsider its efforts of inventory control and convince its key customers to provide VMI (Farmoohad). TAL Apparel began fulfilling orders received directly from stores, which facilitated the minimization of the stock on hand and thus the reduction of costs for customers. This also allowed to reduce the time for completing orders, because, with the integration of VMI, the company had access to sales records and thus could identify what apparel must be produced the earliest. The Made-to-measure concept also became possible with the integration of technologies. It allowed the company to provide customization services for its clients and avoid price-based competition with the rivals. As already mentioned, catering to the unique needs of customers allowed TAL to be more inventive and flexible, which suggests that the company got a perfect grasp of the idea of change and used it to its advantage. The company’s strategic positioning in the value chain was different from that of its competitors because it had exclusive relationships with customers that relied on TAL in acquiring the necessary information on their own and making sure that the products were delivered in time to replenish the stock.

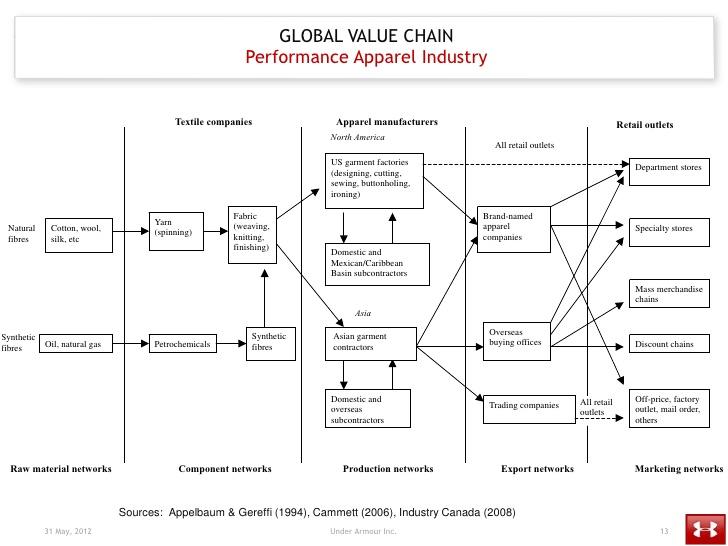

The global apparel industry is an example of a buyer-driven value chain, which is characterized by the diversity of producers, especially in the context of businesses from developed countries that work with exporters of garments in the third world (Gereffi and Memedovic). The value chain of apparel is divided into five key components, such as raw material supply, component networks, production networks, export channels created by intermediary parties, and marketing networks that operate at the level of retail (Gereffi and Memedovic), as seen from the chart below:

There are some differences in the components of the value chain. Such differences include the geographical location of various networks, specifications regarding conditions of labor, the availability of innovative technologies, types, and scales of companies (Gereffi and Memedovic). Barriers to entry are relatively low in apparel factories; however, they can increase when moving up the value chain to fibers and textiles. Brand names are regarded as competitive tools that corporations use to generate economic rents. Moreover, the substantial budgets for advertising campaigns are used by global brands to achieve sustainability and attract more customers and the sophisticated Information technologies help companies give and get quick responses to business inquiries for increasing revenue and allowing suppliers to manage inventories, as seen from the example with TAL Apparel Ltd. In the apparel industry, there is a visible split between marketing and development, which facilitated the process of lean retailing (frequent shipments of orders to replenish stocks in stores based on real-time sales information).

The characteristics of the apparel supply chain mentioned in the previous section suggest that the industry is driven by customers (buyers). The retail sector of the apparel industry is dominated by large corporations with various product specializations (shoes, clothing, accessories, etc.). These large retailers along with marketers and branded manufacturers play integral roles in establishing decentralized production networks. Moreover, buyers can increase bargaining power and set up production networks in developing countries to save costs. In such a structure of the supply chain, the production of physical products occurs separately from design and marketing processes (“Dynamics of Apparel Value Chain”). Since the barriers to entry to the apparel industry are relatively low compared to other areas, companies are constantly struggling with aligning their operational standards within the dynamics of competitiveness (Staritz and Morris).

Apart from orientation on buyers, the integration of Information Technologies has become an important component of the apparel value chain where global brands expand their presence without establishing proprietary links to specific manufacturers (Gereffi). In the value chain, brands represent information producers need to know for fulfilling the demands of their prospective buyers. Brands are used for establishing close relationships with customers and competing with other companies when they reach (choice) of products increases (Gereffi). Therefore, building an awareness of a brand is a challenge many companies face with regards to gaining market power in a buyer-driven and IT-oriented value chains. Within the context of buyer-driven supply chains, lead companies (brands and retail chains) are the final buyers of consumer products, and the profits that come from key business operations are targeted at linking the overseas factories with product segments in the main consumer market (Fernandez-Stark et al.).

Works Cited

“Apparel Industry Global Value Chain.” Image Slideshare, Web.

Bilgiham, Anil, et al. “Information Technology Applications and Competitive Advantage in Hotel Companies.” Journal of Hospitality and Tourism, vol. 2, no. 2, Summer 2011, pp. 139-154.

“Dynamics of Apparel Value Chain.” Beyond Weebly. 2015, Web.

Farmoohad, Ali. “TAL Apparel Limited: Stepping Up the Value Chain.” ACRC, Web.

Fernandez-Stark, Karina, et al. “The Apparel Global Value Chain: Economic Upgrading and Workforce Development.” CGGC, Web.

Gereffi, Gary, and Olga Memedovic. “The Global Apparel Value Chain: What Prospects for Upgrading by Developing Countries.” Unido, Web.

Gereffi, Gary. “Beyond the Producer-driven/Buyer-driven Dichotomy: The Evolution of Global Value Chains in the Internet Era.” Soc Duke Edu, Web.

Staritz, Cornelia, and Mike Morris. “Local Embeddedness, Upgrading and Skill Development: Global Value Chains and Foreign Direct Investment in Lesotho’s Apparel Industry.” Capturing the Gains, Web.