Introduction

The history of Tata is one that reveals the firm as to have embraced a unique culture and astonishing strategic moves which have left the corporate community with many questions and lessons to learn. According to Angwin and Smith (2011), the firm was started by Jamsetji Nusserwanji Tata in the late 1860s as a small trading company. As the firm progressed, Tata planned and developed a culture that focused on social welfare as an attempt to overcome racial prejudices and dismissive attitudes of the British. This led to the expansion of the company to other fields such as education and electric power production in an effort to offer opportunities to the Indians and serve them better than they had ever witnessed. His successors came to learn this culture as the norm of the company hence expanding from where the founder had left. Dorab concentrated on expanding the business in India while Ratan Tata was to take the firm global.

Tata’s international growth which began in early 90s was most unique and far-reaching in terms of spending. The company completed very many acquisitions within a very short time to an extent of becoming one of the most diversified corporations in the world. Some important acquisitions are the Tata-Corus and Tata- Jaguar and Land Rover acquisitions. Their significance lies in the amount spent on both acquisitions and the relative size of the respective business units which acquired them. Despite the criticism on these acquisitions, Tata executives insist that the move was the most strategic and forms the backbone of the future success of the company.

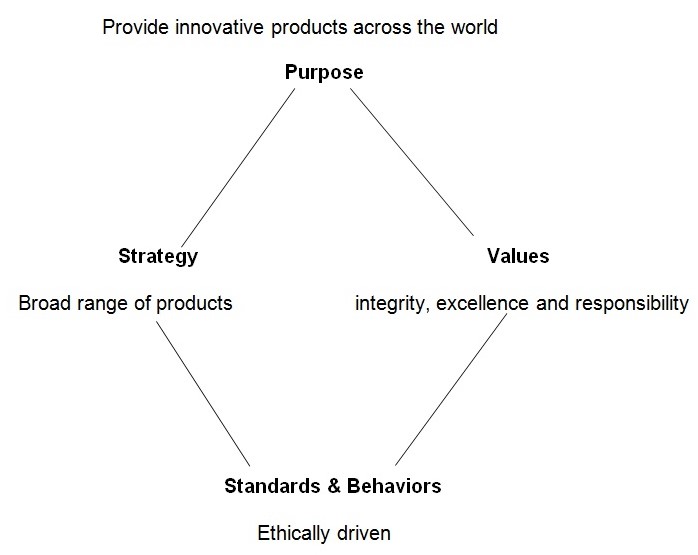

However, there is a general tendency for firm’s strategies to persist since they are organized within that which is presupposed in the firm-assumptions about the nature of the firm, its operative environment and the way things are approached in the firm. Even when a strategy is developed, perhaps grounded on sound coherent argument, firms often realize that attaining significant changes to present strategy is challenging (Fleisher & Bensoussan, 2007). This paper is built on this fact. It analyzes Tata’s corporate culture and how it influences the mission, objectives and goals using two tools-the cultural web and Ashridge diamond. There is also an analysis of Tata’s diversifications strategy and the motive behind the acquisition of Corus and Jaguar- Land Rover, as well as the challenges that the new CEO will face.

Tata’s Culture and Its Influence

Tata’s organization culture plays a great role when it comes to the unique performance and it is indeed the core of the firm’s competitive advantage. In this case, corporate culture refer to “how Tata does things around its operative areas”-McKinsey organization reference (Raisiel, 1999). This culture is also responsible for the motivation and employee turnover in the firm. So, for all its indistinctness, Mohanty and Rath (2012) observe that organizational culture has a big impact on the work environment and the output of the firm. Therefore, analyzing Tata’s culture by use of the cultural web tool is important in managing change, while Ashridge Diamond will be a good tool to ‘see’ how this culture influences the mission, vision and objectives of the firm (Caltienne, 2003; Whitehead, 2012).

The Cultural Web for Tata

- Stories: Stories in the cultural web are embedded on the belief that is held by the firm’s stakeholders (Elliot, Swartz & Herbane, 2009). One belief that has persisted and became appreciated by the Tata community is the good leadership of J. N. Tata and his line of sons and grandsons who have been the leaders of the firm. Their good character is evident to all those who have served and have been served by the company. Their belief on social consciousness is the norm that is communicated to all employees. The way things used to be done in past is transferred to the present. How the leaders of the past escaped difficult situations like threat from bankruptcy is known to the stakeholders.

- Routines and rituals: Routines and rituals refer to the ways the members of Tata behave towards each other, and connect various parts of the organization (Cadle, Paul & Turner, 2010). Tata’s members are required to work together for the good of the company and the society at large. The company has endeavored to train its employees starting from the schools right up to their workplaces as a way of making them competent. There are organizational committees which oversee the conduct of the business units and the welfare of both the workers and society members.

- Organizational structures: As expected from an Indian company, organizational structure is hierarchical. This means the organization is centralized and Tata executives have the upper roles in decision making (Siggelkow & Levinthal, 2003). The business is organized into units described according to the type of operations and which are headed by managers. Indeed, this organization is becoming a great challenge to the firm mainly because of its expansion to cultures which do not support autocratic leadership style.

- Control systems: For a long time, Tata Corporation has been monitoring its profits and social developments which it has made contributions to. This has been in line with the core belief that good corporate citizenship is the force that drives sales and performance. Gopalakrishnan is quoted to say “we are hardnosed business guys who like to earn an extra buck as much as the next guy, because we know that extra buck will go back to wipe away a tear somewhere” (Angwin & Smith, 2011). However, the balance between social spending and organization growth initiatives is changing the monitoring towards budget. Tata must focus on an expenditure that can sustain growth and profitability.

- Power structures: In organizations with centralized structure such as Tata, top executives are the most associated with core belief and assumptions about what is important in the firm (Portny, 2007). These members are mostly from the Tata family and maintain the fundamental values created by the founder. The executive is headed by a CEO who must hail from the family. His obligation is to ensure that the decisions made align with the beliefs held in the firm as well ensure that they make a contribution to the firm’s growth. The managers communicate and maintain these values at the business unit levels.

- Symbols: In all symbolic aspects, the association of Tata with the city of Jamshedphur is most significant. This is the place where the founder instituted his first business and has been the iconic representation of Tata. Besides this, the company is symbolized by ethical conduct to the extent of disregarding any activity that might suggest immoral doings despite the economic gain. Involvement in social welfare and low cost goods are also aspects that Tata is associated with. Indeed, no other Indian company has contributed to the social and economic wellbeing of the country like Tata, and is one of the core purposes of doing business.

- Paradigm: The success and growth of Tata is dependent on its unique culture-observing corporate citizenship to enhance business endeavors. This culture revolves around social consciousness, low cost goods and continuous growth through global expansion.

Tata’s Growth and Diversification Strategy

Until the early 1990s, Tata was solely operating own-founded businesses and plants that were located in India. International sales even by the late 90s accounted only for 12 percent of the group turnover (Angwin & Smith, 2011). The first landmark in its growth strategy occurred in 2000 when Tata Tea made the largest acquisition ever in India of Tetley at a cost of $432 million. This acquisition was mainly triggered by the need to internationalize as foreign companies established in India and challenged the quality of home made products. Unlike other Indian firms, Tata was very swift in responding to this threat and global expansion became a major element of their strategy.

Since then, most of the Tata’s companies have grown through acquisitions. Tata chemicals acquired Brunner Mond and Magadi Kenya making the company one of the major manufacturers of soda ash in the world. Tata Power became a major stakeholder of two major Indonesian thermal coal producers. Tata Communication Services acquired TKS-Tecknosoft making it a major player in the industry. Tata Steel acquired Corus at a price of $12.1 billion, the largest deal in India up to date. Tata Motor acquired Jaguar and Range Rover car brands for $2.3 billion opening its doors to the luxury car market. In addition, there are other smaller acquisitions that the group has made for other business units that have increased their global presence significantly. For instance, Tata group ended VSNL’s monopoly on international long distance voice India by entering new domestic businesses like internet telephony and enterprise data. Evidently, Tata Group has grown to be among the most diversified firms in the word.

Despite the fact that diversification is seen as a high risk strategy, there are several reasons that prompted Tata Group to take up this risk (Tiwari & Verma, 2011). First, Ratan Tata embarked on a mission to reduce the autonomy left to individual operating subsidiaries by trimming lines of business and increasing the parent company stakes in the subsidiaries along with strengthening the corporate center with enough control to enforce discipline on the operating units. Through these initiatives, some old businesses exited, new ones entered and efficiency of traditions units improved. Second, there was progressive relaxation of foreign exchange regulations and political support from the Indian government. As a growing economy, India began to revise its economic regulation nearly 1990s which is also the time that Tata began to expand (Shand, 2003).

Third, the threats from foreign companies which targeted the glowing economies were challenging local competitors especially in terms of technology integration and quality control (Schaeffer, 2005, p.204). As a result, Tata has diversified and expanded their business to exploit the core strength which is described by their cost advantage, production efficiency, exposure to global competition and willingness to take risks. Fourth, Tata wanted to extend their social responsibility to all people across all realms. The most immediate solution was to pursue global citizenship and offer a wide range of products and services to a wider population.

The Motive of Tata’s Acquisitions

Tata Steel’s Acquisition of Corus

The acquisition of Corus by Tata did not come about as a result of ambition, but calculated guesses about the future environment of the steel industry and the company’s competitive strength. Tata steel had performed well in the Indian market until foreign companies and consumers started to challenge the quality of home-based products. With Tata Steel being a core subsidiary of the group, the firm had to maintain its margin in order to sustain the business. One of the solutions was to respond to the production quality issue. Therefore, the best way to approach this issue was to acquire a firm like Corus which had good reputation on quality, resources and capacity to satisfy customers.

The fact that Tata had access to low-cost raw material was a great motivation to expand its production capability. Driven by the low command that steel producers had over the world market as compared to iron ore producers, the firm had to act fast and fill this gap. The firm had to strategically remain ahead of competition that was emerging from China and Russia. A quick response was to acquire a firm with global recognition despite the cost in order to cumber the competitive force from the new firms in glowing economies which had already saturated their local markets. In addition, the Indian market did not serve Tata Steel efficiently as compared to the way Chinese or Japanese markets served their home-grown companies.

As early as 1990, Tata group had already started to expand globally hence witnessing the benefits of the global market (Angwin & Smith, 2011). For the steel industry, success in developed markets depended on brand recognition. Players from developing economies like Tata Steel could make little impact on such markets. Therefore, penetration in these markets called for a strategic move that could position the firm better in the market. Acquiring a company like Corus was not only the strategic move, but also changed the global image of Tata.

Although the price of steel was declining in developed markets, the demand for steel was rising steadily in the glowing economies. Russia had started to develop its infrastructure and ultimately demanded more steel. Chinese steel firms could not satisfy the home market and the country had become an importer of steel. In order to exploit these opportunities, Tata Steel had to increase its production capacity. The situation was heightened by the threat from industry consolidation in the promising markets and Tata had to act fast. So, by acquiring Corus the firm saw a double edged benefit of meeting the rising demand and avoiding the threat from industry consolidation.

Tata Motors Acquisition of Jaguar-Land Rover

The major motive behind the acquisition of Jaguar-Land Rover by Tata Motors was to increase its presence in the Indian market as well as have a share of the world luxury car market. The company manufacturing capacity could not have allowed for the inclusion of the luxury car line, yet foreign manufacturers were penetrating the Indian market with such products. Indeed, the company had begun to lose its Indian market share before the acquisition for which it had been a leader for a very long time (Angwin & Smith, 2011). Tata Motors was among the major business segments in the Tata Group that could have affected the overall revenue flow if its performance continued to decline. The best solution was to acquire a firm that could strengthen their competitive advantage through a wider product portfolio and satisfy a bigger market.

India was on the verge of economic growth and more people could afford luxury goods. However, none of Tata’s vehicles could fall into that category, yet the company was slow to respond until the market was on the move towards saturation. The luxury vehicle that were offered in the Indian market included products like Toyota Land Cruiser and Prado, Volkswagen Touareg, Audi, Mercedes Benz, Volvo XC90 and Mitsubishi Montero (Angwin & Smith, 2011). So, by acquiring Jaguar and Land Rover brands which were not offered in India, Tata could enjoy some penetration brands in this segment. Furthermore, the company was motivated by their innovation capability which could improve the failing brands that had once been the iconic vehicles in the world of luxury.

As it could be expected, the outcomes of Tata’s acquisitions could not have happened overnight. The company had spent significant sums of money in acquiring Corus and Jaguar-Land Rover. However, one impact is evident that the firm has gained footage into the international market arena in which it has acquired significant global recognition. The acquisition of Jaguar-Land Rover which came after Corus is a clear indication that the former deal was a success. The firm is however experiencing great debts due to these acquisitions with an extreme equity to debt ratio of 1:5. This can be explained by the fact that the acquisitions were followed by the 2009 global downturn which saw many companies experiencing losses (Das, 2012). Therefore, the progress and few developments seen are indications that the acquisitions are a success whose impacts will clearly surface in future.

The Challenges Faced by Cyrus Mistry

The present situation in Tata is surrounded by challenges that have stemmed from its growth initiatives. Cyrus Mistry as the new CEO is faced by the challenges posed by globalization since the firm has become an active global participant. The acquisitions made by the firm have exposed it to very different environments. As a result, the CEO has to find ways to create an organization culture that can fit in the new operating environment. It is clear that the new acquisitions cannot operate as own entities due to the inter-linkages required to realize the corporate goals and objectives. The situation is heightened by the fact that the organization culture instilled by the founder is the centre of all business strategies.

Additionally, Cyrus Mistry is challenged by ensuring that the firm is making profits in order to sustain most of the business units. The firm is already experiencing staggering debts that might affect its sources of capital. Any further drop in the share value might frustrate investors who are the major sources of capital. Already, the firm has experienced great losses which affect its research and development-the backbone of its competitive advantage. The CEO is facing the challenge of persuading the governments to give loans that can sustain its functions which Ratan Taja had already begun, but in vain.

The emerging competition from other economies such as Brazil and China is a great challenge to Tata and Cyrus Mistry. McNulty, Pettigrew, Jobome and Morris (2011) insist that the CEO has the role of spearheading decisions that can position the firm strongly in the market. This means that the firm might extend its reach to other markets such as those in Africa where competition is not stiff. Unfortunately, the firm is already operating on a constrained budget, yet the capacity to expand to the markets requires substantial investment. As a matter of fact, Cyrus Mistry will have to ‘see’ that the business succeeds in its growth strategy by overcoming the obstacles that the initiatives therein present.

Conclusion

Tata has a rich history in its growth which starts with a single steel factory and ending up with one of the most diversified firms in the world. The driving force behind this success is the corporate culture which focuses on integrity, responsibility and excellence. On the platform of ethical business conduct, this culture has led to achieving the core purpose of producing innovative products across the world and pursuing a diversification strategy considered risky by many. The focus on future competitive strength has motivated the firm to make significant acquisitions such as the Corus and Jaguar-Land Rover. However, these acquisitions have made the firm to borrow funds that the current flow of revenue seems not to quench. Therefore, Cyrus Mistry or the new CEO is faced with challenges associated with the high debts as well as ensuring that the firm remains profitable.

References

Angwin, D, Cumming, S and Smith C. (2011). The strategy pathfinder. Chichester, UK: Wiley.

Cadle, J., Paul, D. & Turner, P. (2010). Business analysis techniques: 72 essential tools for success. Gloucestershire, UK: BCS, The Chartered Institute.

Caltienne, Ltd. (2003). Managing change. Web.

Das, D. K. (2012). The Asian economy: current state to play and future prospects. Asia Pacific Business Review, 18(3), 441-447.

Elliot, D., Swartz, E. & Herbane, B. (2009). Business continuity management: A crisis management approach.London, UK: Taylor & Francis.

Fleisher, C. S. & Bensoussan, B. E. (2007). Business and competitive analysis: effective application of new and classic methods. Hall, UK: FT Press.

McNulty, T., Pettigrew, A., Jobome, G. & Morris, C. (2011). The role power and influence of company chair. Journal of Management & Governance, 15(1), 91-121.

Mohanty, J. & Rath, B. P. (2012). Influence of organizational culture on organizational citizenship behavior: a three-sector study. Global Journal of Business Research, 6(1), 65-76.

Portny, S. E. (2007). Project management for dummies. Oxford, UK: John Wiley & Sons.

Raisiel, E. M. (1999). The McKinsey way: using the techniques of the world’s top strategic consultants to help you and your business. New York, NY: McGraw-Hill Professional.

Schaeffer, R. K. (2005). Understanding globalization: the social consequences of political, economic, and environmental change. Lanham, MD: Rowman & Littlefield.

Shand, R. T. (2003). Economic reform and the liberalisation of the Indian economy: essays in honour of Richard T. Shand. London, UK: Edward Elgar Publishing.

Siggelkow, N. & Levinthal, D. A. (2003). Temporary divide to conquer: centralized, decentralized and reintegrated organizational approaches to exploration and adaptation. Organization Science; 14(6), 650-669.

Tiwari, P. & Verma, H. (2011). Risk management in Indian corporate sector-an empirical analysis of business and financial risk. International Journal of Business Insights & Transformation, 4(1), 57-64.

Whitehead, J. (2012). What you need to know about strategy. Oxford, UK: John Wiley & Sons.