Introduction

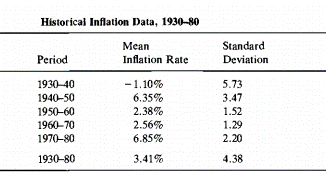

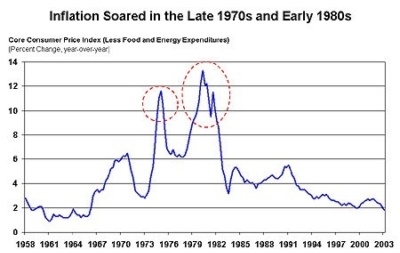

The decade of the 1970s was one marred with inflation in the United States. On average, the inflation rate during this period was capped at 6.8%, which was triple the rate recorded in the previous two decades and double the long-run historical wage (Bredin and Fountas 147). Moreover, the stock market lost about 50% in less than two years, with rapidly rising prices and predominant slow growth (Bredin and Fountas 148). Therefore, this paper seeks to explain the nature of this inflation while focusing on the two double-digit inflation episodes of 1973-1974 and 1977-1980 and the policy changes in the aftermath.

The Inflationary Bulge of 1973-1974

In 1974, the first double-digit inflation bout emerged in the United States. This was shown by a dramatic rise in the consumer price index (CPI) from 3.4% to 12.2% (Nakamura et al. 1934). This was ascribed to food shock, wage-price limits, and energy shock. The food shock resulted from adverse weather, leading to unexpected increases in retail food costs. It was indicated by a 20% increase in food CPI in 1973 and 12% in 1974, a significant supply shock (Nakamura et al. 1950). Moreover, the element alone contributed almost five percentage points of the average inflation rate reported throughout this period. These estimations imply that as an essential requirement, food prices have direct and indirect effects on inflation.

During this period, the other aspect, energy shock, was also significant. The issue initially surfaced in 1973, when the Organization of Petroleum Exporting Countries (OPEC) consolidated after an Arab-Israeli conflict leading to a quadruple in prices and a 3.5% addition to the inflation rate (Nakamura et al. 1967). However, this shock’s consequences were not as significant as those generated by food prices, even though it still increased the CPI.

Wage price regulations also significantly contributed to accelerating and decelerating inflation during this period. The problem was triggered by the United States experiment with compulsory wage and price controls that President Nixon launched through a three-month freeze (Nakamura et al. 1975). As a result, controls experienced an evolution before they lapsed in 1974, causing a 1.4% inflationary increase (Volscho 251). Nonetheless, inflation decelerated from 1974 to 1976, primarily due to a change in acceleration causes.

Accelerating Inflation of 1977-1980

Again, inflation rose substantially from 1977 to 1980 due to oil and food prices. The first element, food costs, appeared almost like the one experienced in the first inflation bout. However, it was not as severe as it resulted in a 22% increase in personal consumer expenditure (PCE) vs. 29% in the preceding quarter (Volscho 257). Despite the contrast, it had a crucial role in accelerating inflation to the 1979 double-digit range.

The other factor, energy shock, was created by Iran’s political turmoil. This instability resulted in a disruption in oil supply, which led to urgent measures to construct inventories that combined to generate confusion on the global oil market, resulting in higher spot prices (Volscho 263). As a result, the average cost of imported crude oil per barrel jumped from $15 to $33 (Nakamura et al. 1977). This saw an increase in the CPI energy component of 56% (43% annual rate) vs. 26% (58% annual rate) in the first inflationary burst (Nakamura et al. 1979). This suggests the latter shock was far more intense, though the first one was more abrupt and fast.

Policy Changes

The Problem

The inflation dominant during this period was blamed on food prices, energy prices, and wage-price controls. However, certain economists attributed it to monetary policy mistakes that financed significant budget deficits (Crouse 23). The issue started when Fed officials caused an expansionary monetary policy believing that it would propel the economy to full employment. The Phillips curve underlined this policy, suggesting a tradeoff between inflation and unemployment (Crouse 34). Consequently, policymakers believing unemployment was above its natural rate allowed a rise in inflation to push the economy to potential output. This obsession led to the Fed’s over-commitment to its expansionary monetary policy, which eventually led to inflation ticking up throughout the 1970s (Volscho 265). However, the other factors were just accelerators, which proved Milton Friedman’s notion that inflation always emanates from a monetary phenomenon (Crouse 37). Therefore, this called for alternative policies to reduce the spiraling upward rate.

The Change

Due to the high inflation rates, the Fed, under Chairman Volcker, was forced to rethink the country’s monetary policies. This led to measures that targeted the promotion of more excellent price stability, which involved unique policy actions which targeted the economy’s money stock growth rate. Consequently, there was a significant upward spiral in federal funds rate from 10% to 19%, signaling the effects of contractionary monetary policies (Crouse 76). Moreover, the policy led to a weakened economy and resulted in two recessions, rising unemployment to about 10% (Bredin and Fountas 151). Furthermore, several businesses crumbled due to capital inaccessibility which made the policy highly critiqued. However, inflation eventually started dipping to below 5%, and it has remained stable since then (Bredin and Fountas 158). This shows the essence of price stability over tolerating high inflation levels for a growing and healthy economy.

Conclusion

From the preceding, it is evident that inflation can be caused and compounded upon by several factors. For example, the 1970s double-digit inflation depicted how food shocks, wage-price controls, and energy shocks can accelerate inflation. Nonetheless, it is imperative to appreciate the role of monetary policies in the economic issue. Such regulations should always prioritize economic stability over other desired outcomes. This is why the Fed’s ability to control inflation should not be disputed despite the undesired effects that some of the measures it takes may have.

Works Cited

Bredin, Don, and Stilianos Fountas. “U.S. Inflation and Inflation Uncertainty over 200 Years.” Financial History Review, vol. 25, no. 2, 2018, pp. 141-159.

Crouse, Eric R. America’s Failing Economy and the Rise of Ronald Reagan. Springer International Publishing, 2018.

Nakamura, Emi, et al. “The Elusive Costs of Inflation: Price Dispersion During the U.S. Great Inflation.” The Quarterly Journal of Economics, vol. 133, no. 4, 2018, pp. 1933-1980.

Volscho, Thomas. “The Revenge of the Capitalist Class: Crisis, the Legitimacy of Capitalism and the Restoration of Finance from the 1970S to Present.” Critical Sociology, vol. 43, no. 2, 2017, pp. 249-266.