Executive Summary

The aim of this paper is to analyze the strategy of Tim Hortons Inc.; however, in order to evaluate and assess the strategic position of the company, it is vital to outline a company overview, discuss the history, evolution, and growth of the company over time, and assess the nature of the external environment surrounding this organization. It is also very important to consider the political, economic, socio-cultural, technological, environmental, and legal factors, evaluate the Porter’s five forces model, and look at the SWOT analysis. However, this paper will also focus on the key corporate level strategies pursued by the Tim Hortons Incorporation, as well as deal with the nature of the company’s business level strategies; moreover, it will include the financial highlights, financial statements, ratio analysis, and the credit risk commentary along with the five Cs of credit at Tim Hortons and Altman’s Z-Factor. Finally, the paper will provide some very important recommendations to this quick service restaurant regarding the future growth and overall success along with some concluding remarks.

Introduction – Overview of the Company

According to the annual report of this restaurant, Tim Hortons Incorporation is fundamentally a Canada-based restaurant business with operations in many parts of the world; however, this business is famous among the customers because of the coffee and doughnut it offers; in addition, Tim Hortons is the biggest fast food chain in Canada, which possesses above 3000 restaurants countrywide. It is necessary to state that the hard works of two people, Tim Horton, and Ron Joyce, established this business in 1964; although, at first, it was located in Hamilton, today its head office is located in Oakville, Ontario; moreover, Marc Caira, the present chief executive officer of the firm, is committed to lead Tim Hortons to the utmost position.

The History, Evolution, and Growth of the Company over Time

Table 1: History, evolution, and growth of the company. Source: Self generated

The Nature of the External Environment Surrounding the Company

In order to understand the nature of the external environment surrounding the company, it is important at this stage of the paper to precisely focus on the political, economic, socio-cultural, technological, environmental, and legal factors because these are the key factors which influence the performance of the industry as well as the operation of Tim Hortons.

Political factors

It is important to state that this company has operations in Canada, the United States, the United Arab Emirates, Qatar, Bahrain, Oman, Kuwait, Ireland, and Scotland; however, the political conditions of all these countries are very stable and so this firm does not face any political troubles while operating there.

Economic factors

A number of economic factors are present in this industry, which always affect the firms operating here positively, or negatively; the factors, which influence the businesses, for example, global financial crisis, taxation rates, inflation, recession, and the gross domestic product and the per capita income in the countries of operation.

Socio-cultural factors

While serving the customers of any country, the businesses constantly require to keep in mind the fact that the societies and cultures of the countries vary to a great level, and failure to comply with those social norms or values could result in losses. For example, it would not be wise to attract customers in the Middle East in the same way in which customers are attracted in America.

Technological factors

Modern uses of technology have enhanced the performance of this industry greatly; for example, the restaurant owners always depend on the newest scientific innovations, when it comes to inventory management, transportation, communication, and supply chain management.

Environmental factors

The contemporary businesses are very much eager to protect the environment from the adverse affects of the pollution that occurs from their regular operations. It is very important to note that tough laws are present to penalize the firms that do not meet the environmental standards accordingly.

Legal factors

The firms that operate in this industry are required to comply with all the laws, which administer the regular functioning of the restaurants. However, strict laws are present to oversee the firms; for example, these include labor laws, environmental laws, and consumer protection laws, laws related to food and drug administration, as well as the taxation and custom laws.

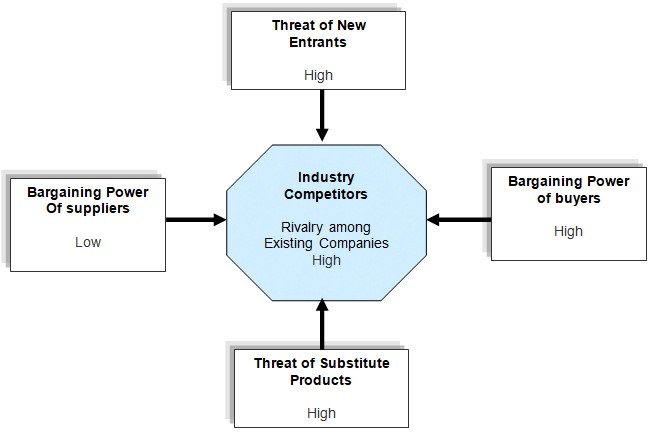

Porter’s Five Forces Model

- Threats from new entrants:

- As the management team of this company has not focused much on the product assortments, the new entrants can dominate the market with innovative product line in accordance with the customers’ preferences

- According to the annual report of 2012, Tim Hortons may see high threats from the new entrants since it requires low capital to start business; moreover, the anxieties related to return on investments are lower to some extent in the free market economy

- Moreover, it is not essential to have prior experience on specialized product management system to become successful restaurant owner

- At the same time, researchers have argued that the potentially new entrants can create competitive challenges while more and more restaurants will start operation in Canada to gain competitive advantages

- In addition, it is comparatively easy to build brand image and create customer base in this industry

- The entrepreneurs would like to enter this market because of low entry barriers, easy supply chain management system, flexible government regulations, low technological barriers, availability of human resources and many other reasons; therefore, overall threat of new entrants is high

- Bargaining power of buyers:

- Though, this restaurant chain has already captured 60% market share of quick restaurant industry, the management considers high bargaining power of the buyers because low switching costs in the US market increase inter-firm rivalry

- The customers prefer to taste new items in some extent

- Pricing strategy or quality products at reasonable price influence the customers to taste the products

- Threats of substitute products:

- The threats of substitute products are quite high in this restaurant industry by which the firm operates

- It is notable that even though the threats of substitute products are quite high, this firm would not face much rivalry due to the reason that its products are much more distinctive and special than that of the rivals

- Rivalry among existing firms:

- At the same time, quick restaurant service industry is highly competitive field for which the investors and entrepreneurs may invest in this sector

- Researchers have argued that the customers of Tim Hortons will not purchase large volumes of products

- Bargaining power of suppliers:

- It is important to state at this stage that the bargaining power of suppliers is quite low in this market owing to the reason that the suppliers are mainly poor farmers from various third world countries and these farmers are very large in number;

- On the other hand, the bargaining power of suppliers has also lowered recently for the reason that in present days, a large number of countries across the world are cultivating coffee beans (whereas previously the players of this industry mainly took their supplies from the farmers of Kenya)

Industry Life Cycle Model

It is very important to state that the industry in which THI operates possesses a mature industry environment, due to the reason that most of the key players of this industry have already established businesses and many of them have reached the highest peak of their growth. According to Yahoo Finance (1), the restaurant industry possesses numerous key players, for example, McDonald’s Corporation, Starbucks Corporation, Whitbread PLC, as well as Tim Hortons Inc; however, it is quite disappointing that Tim Horton’s position is rather bad in comparison to the major players:

Table 2: Performance summary of the major players of the industry. Source: Yahoo Finance (1)

SWOT Analysis

Strength

- Strong brand image: Hockey player Tim Horton had established this restaurant in 1964 and within three years, he opened 37 outlets by joint venturing with Ron Joyce; however, the owners had successfully created strong brand image from the very beginning.

- Financial Position: Tim Hortons Incorporation is one of the key competitors in the quick service restaurant chains for which it has strong financial ability to compete with other restaurant chains in the Canadian and the US market by offering hallmark coffee and great quality food. Net profit of the quick restaurants has enlarged from the last years though sales revenue has decreased at this period; in accordance with the annual report 2012 of Tim Horton, it has well-built financial condition, for instance-

Table 3: Financial information of Tim Hortons Incorporation. Source: Self generated from Tim Hortons (76)

- Experience: This restaurant has nearly 50 years of established accomplishment to build upon; in addition, the marketers have clear idea about the US and Canadian restaurant chains along with the preference of the customers.

- Market Share: Tim Hortons Incorporation is the leading quick-service restaurant brand in Canada and it has already occupied about 42% share of the quick service restaurant traffic in Canada (Righetti 1); as a result, it continued two-decade-long record of positive same-store sales growth.

- Service: According to the annual report 2012 of Tim Hortons, it is one of North America’s greatest rapid service and publicly traded restaurant chains; for that reason, the customers would like to visit in this restaurant.

- Employees: highly competent, talented, dynamic, and skilled labor force of this quick restaurant chain to ensure the best service

- Other: Performance of Subsidiaries, performance of Tim Hortons in Stock Market

Weaknesses

- Strategy: Annual report 2012 pointed out that the management of Tim Hortons designed strategic considering traditional strengths, such as, broadening of menu offerings while competitors addressed economic condition, and fragile consumer confidence

- Customer satisfaction: Righetti (1) stated that the management of this company has failed to take appropriate measure in order to increase customer satisfaction rate in the US market for which annual turnover had decreased significantly from New York, Ohio and Michigan.

- Other Issues: Financial downturn in the US market increased fixed expenses

Opportunities

- New product development: The management of this restaurant can consider different strategies of the competitors to expand business and to gain competitive advantage, for instance, it can introduce new product like Iced Coffee in Canada since it is very popular item in the US market; however, this strategy can boost sales revenue, consumer interest and conquer competition.

- Brand expansion: At the same time, quick service restaurants have the opportunity to open new outlets in the foreign market particularly in the Asian countries; however, the management of this company should assess the new markets to start business.

- Other: Tim Hortons has the chance to enter new market particularly in highly populated areas like other quick restaurant chains

Threats

- Competitors: Consistent with the annual report 2012, competition in both Canada and the USA has intensified the position of this company in the US market is modest in comparison to the US competitors, such as, Dunkin’ Donuts, Starbucks, McDonald’s and Panera Bread Co; in addition, new entrants have entered market with new strategic plans along with financial strengths.

- Sales revenue: In accordance with the annual report 2012, estimated sales growth in Canada was 4.9%, 4%, and 3.8% in 2010, 2011 and 2012 respectively, which indicates that sales had decreased from 2010 though 10-year average same-store sales growth is 5.1%; therefore, the management of this restaurant intended to increase sales in both local and foreign markets.

- Other: No assurance to achieve growth objectives, lower average restaurant sales in the new markets, adverse operating results and financial condition due to global financial crisis, risks to launching of new products and product extensions, the impact of consumer trends and initiatives, the inability to attract and retain new qualified employees and so on.

The Corporate-Level Strategy Pursued by the Tim Hortons Inc

Nath (6) argued that the corporate-level strategy indicates the actions put into practice by a company to in order to attain competitive advantage through aligning and maintaining an assortment of diverse businesses competing in the different industries, products, and service market where the degree of business within the portfolio has more appeal for the management of the company. The corporate-level strategy would also bring into line to select the nature of business that the company would choice and would illustrate in which process the corporate office would be able to manage and administer the group of businesses. Alexander, Andrew and Michael (1) added that when the gradual development of business-level strategy during the past two decades failed to address the strategic requirement of outsized organizations involved with multiple dimension of business operation, then it became emergency to formulate different strategies for each of the entities of business with a common corporate-level strategy. To meet up such needs, the corporate-level strategy has been formulated and provided the underlying principle to keeping all the business entries under a single umbrella with common ownership along with little distance from the shareholders and investors who stay outside the business operation.

From the theoretical framework, THI is a major player in the Quick Service Restaurant (QSR) Industry of the USA and Canada, which is suitable to encounter with business level strategy, but the company’s Vertical Integration, general franchising, promotion of the brand franchising, Par-baking, and special entry for ‘Variable Interest Entities’ (VIEs) made it essential to align with corporate-level strategy. Tim Hortons (6) at its annual report (2012) presented its strategic alignments arguing on the ongoing economic challenges and emphasized to boost sales growth in the same store, from the two decades of operational experience the company set up its growth strategy to emphasis on the improvement of growth for same-store sales.

To implement such growth strategies, the company aimed to increase new menu or items, increase investment guest experience, and to reinforce further value added services including innovation that would ultimately attract the new customers and increase confidence of the existing customers; in this connection, the company considers that it would be capable to overcome the recessionary impact. The company urged that to encounter with the challenging operating atmosphere, the company has integrated a multifaceted approach and engaged to increase its investment for infrastructure improvement with new design, enhanced marketing drive and boosted operational efficiency and integrated promotional activities that ultimately result with strong brand position with higher guest traffic to the restaurant.

The Nature of the Company’s Business Level Strategy

It is very essential at this stage of the paper to note that Tim Hortons Incorporation is operating a very successful business since 1964 through the use of a smart, convenient, and competent set of business level strategies throughout the markets in which it operates. However, it is further important to add that, as Tim Hortons is a Canada-based business (being headquartered in Oakville, Ontario), it always stresses excessively on formulating the business level strategies for the Canadian market. For example, according to the annual report of the company in 2012, the company has undertaken the following set of business level strategies particularly in Canada in order to develop its business further and expand it into more Canadian markets (for example, in rural areas as well as suburbs). However, it is also important to state that the company is eager to implement the following set of business level strategies in the markets of the United States as well:

- According to Tim Hortons (30), the company has a business level strategy to franchise for above ninety-nine percent of the restaurant classification; however, one of its most important strategies is to nurture the joint trade by constructing optimistic associations and cooperating with the restaurant possessors at all markets;

- Tim Hortons (36) has also mentioned that it has business level strategy to influence noteworthy levels of upright integration (although it is enough integrated) and discover supplementary organizational profits by new horizontal integration opportunities; at the same time, the business is wishing to raise same store sells by operating more attractively in terms of promotion and different offerings;

- In addition, it is the key focus of the company to develop its overall position by controlling their marketing powers and advantages, as well as endorsing menu modernization in order to strengthen and build a competent set of pricing strategies for a better sales position;

- As it is vital for any business to focus on building brand awareness; as a result of this, Tim Hortons is also focusing on increasing its brand awareness in order to boost its distinctiveness, brand loyalty and attain the leading position in this market;

- On the other hand, Tim Hortons (41) has also mentioned that the company aims to raise its expenditure in research and development in areas of new product development for which it could offer the customers with various new foods and beverages in a regular basis, rather than offering the same menus daily.

In addition to all these business level strategies, the company has also put forward a number of other business level policies in order to strengthen its overall market position and operational efficiency and competency; these policies are mainly focused in the arenas of market competition, economic conditions, product innovation and extensions, senior management team, commodities, food safety, and health concerns. However, these policies are also focused in the areas of distribution operations and supply chain, importance of restaurant owners, litigation, government regulation, international operations, market and other conditions, reliance on systems, and other significant risk factors; moreover, in order to better assess the business level strategies, these areas are broadly highlighted in the table below:

Table 4: Business level strategies of Tim Hortons. Source: Tim Hortons (42)

Financial Highlights, Financial Statements, Ratio Analysis

Ratio Analysis

It is important at this stage to identify and analyze the key ratios of Tim Hortons Company in the subsequent portion of the paper to understand and assess the fiscal condition and overall position of the firm better.

Current ratio

- The current ratio of Tim Hortons has reduced to some extent in 2012 in contrast to 2010 (as shown in the table below), whereas it is important to state that a higher current ratio denotes that Tim Hortons is much more skillful in paying off the liabilities of this fiscal year

- On the other hand, it is important to state that Tim Hortons possesses a ratio, which is more than one, and this indeed is an optimistic signal since if the ratio had been less than one, then it could have denoted that Tim Hortons is not capable of paying off the liabilities of this fiscal year

- In addition, it is notable from the table below that the current ratio of Tim Hortons had somewhat improved in 2012 than the 2011 fiscal year, which is again a positive sign

Table 5: Working Capital and Current Ratio analysis of Tim Horton. Source: Self generated

Gross Profit Margin

- It is understandable from the table below that there has been a slow decline in gross profit margin ratio of Tim Hortons from 2010 to 2012; it is undeniably a pessimistic feature for the business since a raise in gross profit margin-ratio signifies that it could construct sensible profit on sales; nevertheless, Tim Hortons has remained unsuccessful in it

- There has been some dissatisfaction in the firm regarding the diminish in the gross profit margin ratio of Tim Hortons from 2010 to 2012; such decline can point towards the fact that the variable costs have raised whilst the selling price has remained standardized. In addition, Tim Hortons might have condensed costs for boosting sales from a general perspective

Table 6: Gross profit margin of THI. Source: Self generated

Net Profit Margin

- At this stage of the ratio analysis section, it is vital to discuss the NPM of the firm, as NPM is an important issue in deciding the overall situation of its trading activities at present; as a result, the condition of the NPM will provide the information of the level of achievements from the operations in an annum

- It is vital to state that a stumpy Net Profit Margin denotes that Tim Hortons is not generating sufficient sales or that it is not keeping the operating expenses under control; however, in case of Tim Hortons, during 2010, 2011, and 2012, the NPM has diminished so badly that it might be difficult for Tim Hortons to revive back

- On the other hand, this kind of fall in the NPM ratio in the last three consecutive fiscal annum could draw the attention to price splurges (that require capability expansion). Additionally, Tim Hortons, along with a very poor NPM, may want to engage arrears to pay its fixed costs

- Simultaneously, the entire course of action point out that it is immensely decisive in case of Tim Hortons to sincerely engage in improving its strategies to augment yearly revenues; nevertheless, Tim Hortons must concentrate on how it could be capable of lessening the outlay of commodities traded; however, the table below shows this issue in further detail:

Table 7: Net profit margin of THI. Source: Self generated

Return on assets (ROA)

- Return on assets ratio of Tim Hortons is not tempting to a certain extent; as a result, it is also a very pessimistic issue for this firm due to the reason that ROA could symbolize an explicit indication of intricacy that exists at operations of the firm; however, the outcome could be a financial disaster for Tim Hortons:

Table 8: Return on total assets of THI. Source: Self generated

Total assets turnover

- It is notable from the table below that although there has been a fall in this ratio from 2010 to 2010; in 2012, the firm tried to recover from this, and, as a result, has remained capable of boosting the ratio slightly

- This growing drift is an indication of the fact that Tim Hortons is trying to extend its economic effectiveness with time to attain economies of scale through more elegant use of existing capital and competencies. If this trial remains thriving, Tim can lower operational expenses in upcoming year and lessen prices; so, more people will purchase its products, elevating sales

Table 9: Total assets turnover of THI. Source: Self generated

Debt Equity Ratio

- It is notable that the debt equity ratio of Tim Hortons was quite superior in 2012 than 2010 and 2011; therefore, currently, its position is not quite powerful in terms of debt equity; moreover, this ratio is an assessment of the firm’s financial control; it denotes what amount of equity and debt Tim Hortons is using to finance its assets

- However, a high debt equity ratio can signify that Tim Hortons was aggressive in financing its growth with debt. Therefore, this can cause volatile earnings due to added interest-expense; in this context, to prevent further deterioration, Tim Hortons should stop financing its activities forcefully all the way through debt; rather, it should try to pay interest on such financing

Table 10: Debt Equity Ratio of THI. Source: Self generated

Financial Statement and Financial Highlights

In order to understand the financial position of Tim Hortons better, it is highly essential first to take into consideration the recent financial statement of the company and the key financial highlights; these are outlined briefly in the table below. It is apparent from the table below that the financial position of the company has improved in 2012 than the two earlier years:

Table 11: Financial Statement and Highlights of Tim Hortons. Source: Tim Hortons (121)

Credit Risk Commentary

The Five Cs of Credit at Tim Hortons

Dima (85) argued that the credit analysis is the most vital strategy for financial institutes as well as banking industry in order to mitigate financing risk; however, the 5Cs is the best practices of that assist the borrowers to identify risks of lending and to conclude about a customer by identifying his previous credit history. It provides both qualitative and quantitative analysis about the company that illustrates debt refunding capacity, character of payback, collateral to guarantee the loan amount, history of capital gain and expenditure, and the characteristics of the company to meet its of claims creditors. Tim Hortons (36) stated that the company assesses its credit rating through independent credit rating agencies that seriously hamper the targeted credit rating at investment grade; however, such analysis would significantly influence the decision of the management with diverse factors by reducing operational risks while the sinking credit rating would restrict the company’s access to capital markets. At the same time, it would also increase the cost of borrowing, the factors incorporated to assess the credit rating has presented as follows:

Capacity of Tim Hortons Inc

Under the 5Cs approach, capacity indicates the debt service capacity of a company that assists to find out the ability to pay back the principal amount of loan taken by the company, it would engage to discover, weigh up and mitigate the risks that possibly will provide a clear indication to the creditors regarding their claims (Dima 85). Tim Hortons (65) added that historically the company’s credit conditions and contemporary economic climate illustrated positive capacity of the company to evaluating, identifying, and mitigating the outstanding debts while the company enjoys the continuous access to diverse lending programs within the prevailing market conditions. The company has been evidencing huge quantity of past-due notes beneath its franchise inducement scheme accounted in the first week of January 2011 which was about 70% of the outstanding debts; thus, the company engaged to hold the debts for longer periods than its historical performance that the company put into practice with the aim to gain definite profitability targets.

Meanwhile, the liquidity and capital resources of the company illustrated that it has enjoyed the credit facilities of US$ 26.6 million in 2010, which was US $21.1 million that indicated an increase of US$ 5.5 million to the lease capital of the company with elevated interest expense for its long-term debt. In 2010, the company also evidenced a loss of US$ 1.6 million in order to quick settlement on a US$ 130 million of interest rate; at the same way, the company settled on US$ 300 million terms loan in 2011 by carrying US$ 1.1 million of upper interest expense (Tim Hortons 75). On the other hand, in 2010, the company generated US$2.5 million from its interest income from cash and financial notes, which were US$ 2.0 million in the previous fiscal year; however, the boost in the interest income occurred due to the increase of rate of interest in the Canadian market and the elevated cash balances from diverse resources. Furthermore, in 2010, the company paid income tax for an amount of US$ 200.9 million, which was US$186.6 million in the previous financial year, the rate of income tax paid by the company was 23.7% in 2010 and it was 36.8% in the previous financial year. The higher interest expense paid by the company, its boosting interest income, and income tax expense carried by the company demonstrates the strong capabilities of the Tim Hortons Incorporation with its primary resource for repayment pointed to the inward cash flow as well as revenue generated by the company from its operation.

Capital

The capital is the money individually invested by the entrepreneurs, shareholders, and borrowers to commence a successful business operation, it also an indicator of risk carrying proportion among the investors in case of business failure; the financial institutions, investors and potential lenders would always look to the volume of capital before any funding (Dima 87). The capital investment at Tim Hortons Incorporation illustrates its shareholder’s commitment to the business, as the largest fourth-largest publicly-traded quick service restaurant in the scale of market capitalization in the USA with 3,750 outlets the company gained 41% market share in Canada. Tim Hortons (217) pointed out that the changing dynamics of the capital market has seriously influenced the valuation of the companies involved in restaurant business, as a result, value of stock, cost of lawsuit about the quality of food, nutritional content management and cost of other secret ingredient used by the company are not integrated in the valuation process.

Moreover, the increasing inflation, rising fuel and food costs, growing legal claims and expenses for regulatory conformity, qualified workforce, supplementary sales tax and boosting operating cost has seriously impacted the growth opportunity of the company while the capabilities of the owners to financing the new restaurant and development projects. Such strategic initiatives of the company indicates the strong capital mobilization capacity of the Tim Hortons Incorporation in order to refinancing the borrowed funds, smooth business operation; here it is significant to note that the company evidenced to encounter with diverse unforeseen events like domestic and overseas conflicts, war, and terrorism, including economic and political unrest. The annual report in 2010 presented supplemental cash flow pointing that the capital lease obligations earned US$ 29.233 million in 2011, US$ 13.85 million in 2010; interest paid by the company was US$ 24.37 in 2011 and US$ 21.10 in the previous year, and income tax paid by the company was US$ 158.65 in 2011 and US$ 159.99 in 2010. The capital investment at this restaurant has strongly demonstrated the proof of its shareholder’s commitment in the business while the downgrading of its credit rating possibly will limit the company’s easy access to capital markets as well as enlarge its cost of borrowing underneath the debt facilities and enhance the future note issuance.

Collateral

The collateral portion is an additional outward appearance of security that the borrower provides to the lender; it stands as an indication that, the borrower’s assets that are mortgaged to the lender to provide more security to the lender by making agreement that any failure to repayment of the loan amount would be backed by property of collateral. At the failure of business, the collateral ensures an alternative means of repaying loan while the most common categories of collateral included land, real estate, capital machineries, accounts receivable, inventories, and cash or any other financial guaranties and third party securities could be considered to safeguarding the lender.

Tim Hortons (101) pointed out that none of the company assets are used as collateral assets for the system-wide quick service restaurants where the creditors of the individual operators do not have any recourse to the company, but the variable interest entities (VIEs) are the only major exposure kept to the company to collect due to payments. However, the Tim Hortons collects the VIEs in weekly basis, while the terms and condition of the operators clearly mentioned that both parties have the same right to cancel the agreement before 30 days prior notice. Although it is considered that the company is the primary beneficiary of the VIEs implication; it generates some impact on the cash flows and consolidated net income and the influence of VIEs integration in the balance sheet; which is very negligible with minimum interest rate where the successful franchise is the main objective.

Conditions

The ‘condition’ attribute of the 5Cs indicate the economic environment in the domestic and foreign markets; moreover, it states the exact situation of the external factors those would unenthusiastically shock the business operation, which are out of control of the managers and owners. The attributes of ‘condition’ incorporated with the local competition, overall industry situation, broad-spectrum of economic environment, legal barrier along with the lenders trend in the concerned financial institutions who are wiling to finance in the food and restaurant sector.

Tim Hortons considers that the success restaurant business strongly related with the economic condition of the locality here the sales outlets situated; the outlets couldn’t guarantee that the current locations would carry on the outstanding demographic reconstruction where the economic conditions the location of the restaurants could turn down at near future and it results sales reduction in that location. The company considers that if it fails to gain targeted locations to operate restaurants at the level of rational prices that have aptitude to carry out the company’s growth strategy with negative way, and the company would be capable to acquire the injury while the business performance under expectations and unexpected modification in the business would influence the economic conditions.

Moreover, the unexpectedly lower business performance, unpredictable economic conditions, and unrecognized use of the company’s trademark and brand name by any thirds parties, violation of mutual agreement, misrepresentation, and conflict with the suppliers would result with mistrust and lack of confidence with the stakeholders and investors where the individual restaurant owners would rethink to switch to the other brand. The experience of Tim Hortons illustrated that the negative impact of the local and global economic condition of the company are not always under the control of the management of the company rather the exposure of increasing price of raw materials, forward looking hedging program, increasing operation cost, rising tax and global financial crisis may seriously deteriorate economic condition. The macro-economic environment through which the company was going on in the US market has evidenced with higher level of unemployment and reduced purchasing power of the people due to the global financial crisis from 2008 to 2009; moreover, the situation looks better in 2010 and 2011, but not recovered in the previous growth level. Move

Character

‘Character’ another vital element of the five Cs of credit for credit risk commentary that indicates the personal impression of the lenders towards the borrowers, which is the standard determination to attain the trustworthiness for payback the loan without rising any controversy where managerial skills, honesty and integrity of the borrower considered an attribute of assessment. In addition, the character of borrower provides a clear picture to the lenders by assessing the business plan of the company, its past credit history by assessing the trend of the managers and owner based on their practical experience on the industry along with its location.

At the same time, Tim Hortons (5) noted that that the unique business model of the company has strongly accorded with trustworthiness managerial skills, honesty and integrity towards its operation with effectual restaurant management attributes that has been aimed to establish a positive relationship with the stakeholders as well as lenders.

The company is also eager to establish the brand integrity along with control of development by operating strategy bannered as “we fit anywhere” that provides the conceptual framework of leveraging noteworthy part of vertical integration which repeatedly continue to stay within the system and explore supplementary system to pay back through further vertical integration.

Altman’s Z-Factor

Before identifying the Altman’s Z-Factor for Tim Hortons, it is essential to understand what is represented by Altman’s Z-Factor. Anjum (1) pointed out that there are continuous efforts predict the financial solvency of a company where financial ratio analysis are considered most prevalent indicator to settle on the operational and financial effectiveness; during sixties Edward Altman introduced the Z- Score model that could predict financial solvency and stage of bankruptcy within 2-3 years by suing ratio analysis. In addition, Altman (1) has wonderfully noted that the Altman’s Z-Factor is organized with five significant ratio analysis, which strongly accords within a single score; in fact, the Altman Z- Factor integrated with five concert ratios those are put together interested in a single score, the five ratio analysis used in this regards has generated the formula as: –

![]() – (1)

– (1)

Here:

A = is the quotient of the working capital and total assets, presented as:

– (2)

– (2)

B = is the quotient of the retained earnings and total assets, presented as follow:

![]() – (3)

– (3)

C = is the quotient of the earnings before the interest, taxes, and total assets and presented as:

![]() – (4)

– (4)

D = is the quotient of the market value of equity and total liabilities and presented as:

![]() – (5)

– (5)

E = is the quotient of the sales and total assets and presented as:

– (6)

– (6)

During the analysis of Altman’s Z-Factor of a business operation, the company could evidence with lower value, higher vale, or even odd outcomes to assessing the bankruptcy and Altman explained the bankruptcy levels with particular values of the calculated score. He argued that the score less than 1.8 represent that the company is going towards bankruptcy; scored at 3.0 indicates that the company has no chance to align with bankruptcy, and score among 1.8 to 3.0 is the statistical gray area (Anjum 2).

Table 12: Required Financial Data of Tim Hortons Incorporation. Source: Tim Hortons (93-108)

Table 13: Altman Z-Factor Calculations for the Tim Hortons Incorporation. Source: Tim Hortons (93-108)

However, the Table 1 presented the financial data of Tim Hortons Inc. (in Thousands) those are required to calculate the Altman Z-Factor, in the Table 2 demonstrated that step- by- step calculation of Altman Z-Factors. The Table 2 also identified that the Altman Z-Factor for Tim Hortons Inc. for 2012, 2011, and 2010, which is 3.32756, 3.83976, and 3.00533 respectively. For all three years the Altman Z-Factors of Tim Hortons are more than three, according to the framework the score is very safe and the company has no chance to align with bankruptcy in near future the company enjoys a very strong financial health, the company passed the bankruptcy meter very successfully.

Recommendations

After analyzing the overall strategic position of Tim Hortons, it is crucial to provide the company with some very important recommendations, which are essential to achieve future growth and overall success:

- It is important for the business to advertise and promote itself more prominently in order to enhance brand image and customer loyalty. Moreover, it is vital to create more distinctiveness in its foods and drinks, for which it is essential to spend more in research and development of new tastes, combinations, and roast fusions of coffee beans

- On the other hand, the Tim Hortons authority must focus on quality control techniques and create new diversity in beverages offered by giving privilege to client’s preferences; in order to retain clients it must create numerous reward programs for old or loyal clients

- In addition, it is crucial for the business of Tim Hortons to achieve economies of scale; to achieve this, it must attain economic efficiency, and take smart decisions regarding growth of new restaurants; however, it will be wise for it to confine its growth in the United States and rather drive into new Asian markets with more demands

Conclusion

At this stage of the paper, it is essential to suggest that Tim Hortons is operating quite efficiently from an overall viewpoint. Even though, a number of the financial ratios of the company are slightly pessimistic, the firm will be able to overcome this problem if it continues to operate in this market with reasonable level of competency. In addition, it is very crucial for this company to keep in mind the fact that its market position is not quite attractive in comparison to the multinational corporations such as McDonald’s Corporation, Starbucks Corporation, and Whitbread PLC. As a result, it should employ the best possible efforts to attain the leading market position by capturing huge market share through the application of effective knowledge, modern technologies, and skilled human resources.

Works Cited

Altman, Edward. Corporate Credit Scoring Models. Stern School of Business NYU, 2012.

Alexander, Marcus, Andrew Campbell, and Michael Goold. Parenting Advantage: The Key to Corporate-Level Strategy. Adlittle, 1995.

Anjum, Sanobar. Business bankruptcy prediction models: A significant study of the Altman’s Z-score model. Ipublishing, 2012.

Dima, Alina Mihaela. Risk Assessment and Management: Credit Analysis. Academypublish, 2002.

Fisher, Will. Forces Analysis of Tim Hortons. Prezi, 2013.

Nath, Indranil. Corporate-Level Strategy. Nathonline, 2004.

Righetti, Luisa. Hortons SWOT Analysis. Prezi, 2012.

Tim Hortons. Building from Strength – Annual Report. Open Access publishing, 2012.

Yahoo Finance. Industry: Restaurants. ABC News Network, 2013.