Timbuk2 manufactures and sells two specific product categories, such as messenger bags, which are customizable, and laptop bags. The customizable messenger bags have represented the primary source of revenue for the organization, with several factors driving their popularity and sales. For example, the bags are unique to the company and, depending on clients’ needs, can be designed specifically for customers, which illustrates flexibility. The high quality of the materials and the high speed of manufacturing are also appealing to customers who can get their orders done in two days. This is indicative of the company’s responsiveness.

In addition, the tag that says “made in San Francisco” allows customers to develop a sense of patriotism among American customers as well as those who value the quality of US-manufactured items. The attention to the quality of manufactured items is also illustrated by the fact that the high-skilled and dedicated staff are making the bags, which results in the best items that meet customers’ expectations. Price differentiation and affordability are factors that many clients find appealing because a high number of products manufactured in the US, especially in the bags and accessories category, are of higher price (Jacobs & Chase, 2021).

Timbuk2 has also shown taking customers’ feedback seriously and implementing changes to the products according to customers’ opinions. Therefore, the company never compromises on the quality of the bags that it manufactures, which is the key driving point enabling the sales of custom messenger bags by Timbuk2.

Comparing the assembly line in San Francisco and China is important for understanding how the company can benefit from a multi-dimensional process of production and determine which production location is more conducive to high organizational performance. In terms of the rates and volumes of manufacturing, Chinese factories can show higher rates of performance and finish more products quicker than in San Francisco.

This is because China has a lower cost of labor compared to the US, which makes it possible to lower factory expenses. In addition, China has a robust business ecosystem that is production-focused, a lack of regulatory compliance, low duties and taxes, as well as competitive practices related to currency. Concerning the expected skills of workers, both factories in the USA and China must have a skilled and competent workforce to manufacture high-quality products on a consistent basis.

When it comes to the level of automation, the Chinese factory will have better levels of automation because manufacturing is the priority of many companies in the country. It can guarantee higher rates of production and will have more equipment for automated steps, which means that the facility in San Francisco will have to update its processes to meet the same high standard of automation. Finally, in terms of the number of raw materials and finished good inventory, both facilities, in China and the US, will have roughly the same amount of raw materials. However, the Chinese manufacturing plant will have less inventory because of the shift in consumer demand. Once the new laptop bags are introduced by the company, the messenger bags will have less demand. Consequently, there will be a change in the inventory that needs to be addressed by the factory in China for meeting the needs of customers along with staying within the expected deadlines.

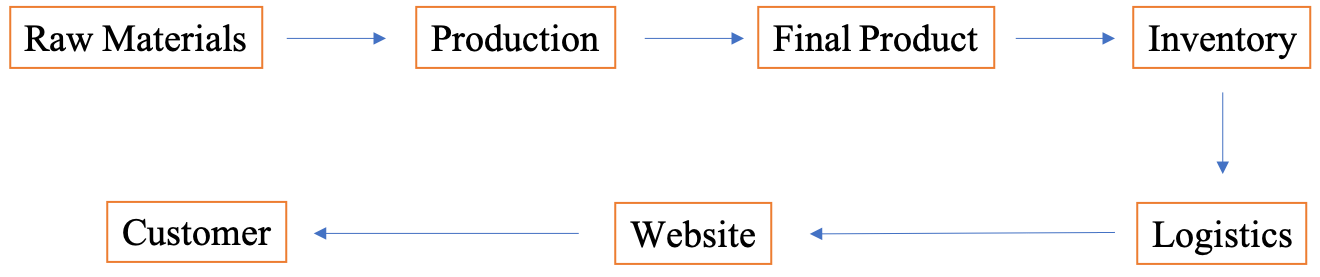

Because the supply chains for both factories follow the same pattern, it is possible to apply one framework to them. The diagram depicting the supply chains in San Francisco and China are the following:

Besides manufacturing costs, Timbuk2 should also consider transportation and inventory costs when it comes to making sourcing decisions. Transportation costs are important to consider because they can represent a significant chunk of the overall logistics spending of an organization. With possible increases in fuel prices, the proportion of funds allocated to transportation can take up to 50%. These expenses influence the price of the final products, which means that customers are the ones who get to cover the rising transportation costs in the end. In addition to transportation expenses, the company should take into consideration inventory costs because they also directly affect the prices of goods sold (COGS). Subsequently, this influences the gross profits of the entity and its taxable income. If the inventory sits at the facility for too long, it means that it is not producing money, causing a decrease in potential profit.

Reference

Jacobs, R., & Chase, R. (2021). Operations and supply chain management (16th ed.). McGraw Hill.