Abstract

Although China is an emerging economic nation in the world, there has been the increasing collapse of small and medium-sized firms despite their contribution to social and economic stability. The study investigated the risks that affect small and Medium-Sized Enterprises in China with the objective interest of determining changes that need to be put in place in order to mitigate the risks. The study used a quantitative research method that involved the use of closed questionnaires. Quantitative research was carried out in order to make it possible to use random sampling in recruiting the participants. The data were analyzed by using statistical methods and presented in form of tables.

The results demonstrated that the risks that affect small and medium-sized enterprises in China are systemic and internal. The risks have been predisposed by the lack of small and medium-sized enterprises to timely respond to shifts in market conditions that have been characterized by deregulation of financial services, strict regulatory standards for the enterprises, and decreased access to credit facilities. The study established that small and medium-sized enterprises have not implemented China SOX on internal control and transparency in financial accounting. Small and medium-sized enterprises have been negatively impacted by credit risk rating that has had negative impacts on the value of the collateral. Weak communication structures were identified to have contributed to the lack of sustainability of customer interactivity. Lack of adequate capital and financial risks subject to limited access has negatively affected the capacity of SMSE to sustain production.

The study identified the small and medium-sized enterprises’ entrepreneurial scope is to blame for the risks that small and medium-sized enterprises have faced in the wake of globalization of financial services and integration of economies. The collapse of the small and medium-sized enterprises has been stimulated by the loss of competitive advantage subject to the shift of business practices.

Key words: risks, SMSE, capital, credit facilities, credit risk, collateral, entrepreneurship, weak communication structures and deregulation

Changes and Risks for Small and Medium Sized Enterprises in China

Introduction

Small and Medium-Sized Enterprises (SMSE) in China have not undergone economic development and growth despite the Chinese government’s deregulation of financial services and growth of the economy (Chen, 2004). Although China is the second economically developed nation in the world after the United States of America, based on Gross Domestic Product (GDP), the SMSE has failed to demonstrate equivalent economic empowerment after the 2008 credit crunch (Zongsheng, 2010). The shift of China from a traditional economy into an open market economy that has a high market for products and services provides the foundation for the growth of enterprises (Huang, 2008). Market steadiness provides the basis for enterprise efficiencies for economic growth.

The growth of enterprises is influenced positively by the capacity to culture entrepreneurial attitude that impacts on resource allocation and utility to produce products and services (Zong, 2006). Per capita innovation has been highest amongst the SMSE through economic and social development. Globalization and integration of economies however have contributed to the shift of SMSE per capita innovation (Linjie, 2010). SMSE contributes to 80% of China’s employment pool, contribute 60% to state revenue and contribute 50% to fiscal taxes (Han, 2006). The sustainability of SMSE is of national importance subject to the sustainability of the nation’s social stability.

The success of an enterprise depends on its investment in innovation and creativity (Wen, 2002). This depends on the competencies of the enterprise’s human capital and the capacity of the enterprise to integrate new knowledge into enterprise operations. The creation of new ideas and production processes contribute to the positive economic and social cohesion of the enterprise (Xia & Yi, 2007). Enterprise innovation, research and development, and human capital development determine the capacity of the enterprise to achieve competitive advantage. Positive differentiation that could translate into positive outcomes in terms of economic growth and development are based on quality and performance, design of products, pricing structure, and uniqueness of the products to the target market (Sidney, 2002). Enterprises capacity to sustain competitive advantage is influenced negatively by the competitive position of the enterprise, the technical performance of the enterprise hence the scope of quality of its products, level of production expertise of the enterprise, and financial resources (Gu, 2009).

Thesis statement

SMSE in China continues to collapse despite its strategic location in a nation that is economically growing fast (Linjie, 2010). The survival rate of the SMSE in China is minimal. The 2008 economic recession that began in the USA resulted in the collapse of 67,000 SMSE in China. Some of the SMSE have been put under statutory management by financial institutions. 20% of the SMSE that had been put on statutory management and receivership management have ceased business (Zongsheng, 2010). This poses a threat to the future of the SMSE in China. The Chinese financial market has witnessed an increasing deposit reserve ratio and increasing interest rates that are charged by financial institutions. The collapse of the SMSE in china have created an environment for lack of employment, decrease in the prices of raw materials because of lack of market for raw materials since globalized MNC’s outsource raw materials from overseas, changes in processing trade policies and export capacity for the Chinese products (Gu, 2007). The SMSE’s economic success has been instrumental in the economic development of Asian nations. The collapse of the SMSE and lack of sustainability of the SMSE in Asia and China especially negatively impact the backbone of the economy of China (Han, 2006). Convergence of globalization from below and globalization from above have contributed to the lack of sustainability of the SMSE through the reduction of the vital role played by SMSE in the economies of scale. There has been decreasing contribution of SMSE in the Chinese market in terms of productivity and market performance. Green trade barriers that have put up technical standards for production have negatively impacted the sustainability of the SMSE. Environmental barriers to trade, deficits in financing capacity of SMSE, and the inability of SMSE to exploit technologies that support emerging quality standards have put managerial incapability of many SMSE in China (He, 1999). The regulatory framework on enterprises in china market fueled by technology-driven market forces has not favored the growth of the SMSE. This study focused on risks that have affected the SMSE sector in China (Penrose, 1959).

Goals and objectives

- To determine risks that affect sustainability of SMSE in China

- To determine impacts of the risks that affect SMSE in China and their negative outcomes on SMSE economic growth

- To determine the source of the risks that affect SMSE in China hence or otherwise propose changes that need to be made to mitigate the risks

Expected outcomes of the study

The findings of the study will provide the basis for identifying sources of risks that affect the SMSE in China. The study findings will facilitate the determination of changes that need to be put in place towards the reduction of risks that affect the economic sustainability of the SMSE. The study findings will identify the roles of the regulatory framework of the Chinese market with respect to the contribution of the regulatory framework on risks and uncertainties facing the SMSE sector. The study findings will play a leading role in the development of managerial practices that should be put in place to manage SMSE internal and external environments that contribute to basic causes and underlying causes of risks that affect SMSE. The findings of the study will facilitate the classification of the risks that affect the SMSE sector in China hence the capability to develop policies and structures for managing the risks based on risk categorization framework. The study findings will provide the foundation for the management of risks that affect SMSE and hence the structure of framework that should be implemented to reduce the increasing collapse of the SMSE in China.

Theoretical framework of the study

The study builds on the commercialization model of an enterprise and integrates the capacity of an enterprise to utilize complementary resources for production in order to improve its marginal revenue through management of its marginal costs (Yang, 2002). The commercialization model affirms competitiveness of an enterprise decreases when the enterprise achieves its critical index of maturity. At maturity of enterprise, sustainability of the business model and business case is not sufficient to contribute to profitability and sustainability of the business philosophy (Tang, 2007). The shift in business model ought to be identified before the enterprise matures. This makes it possible to determine complementary resources that should be integrated into the new business model and their contribution to the sustainability of the business philosophy and architecture (Suzuki & Cobham, 2003). The success of the commercialization model depends on the type of complementary resources that are used and the mechanism the complementary resources contribute to the modeling of the business case. Generic resources contribute to the sustainability of business architecture and philosophy subject to consumer brand identity, recognition and attachment (Cross, 1997). Adoption of specialized resources requires an overhaul of the business model and training and development of human capital needed to implement the new business case. Enterprises fall into management errors and mistakes when adopting and implementing new business models to measure the demand of economies of scale. The investments might be lost due to the incapacity of the enterprise innovativeness (Ren & Jia, 2007).

Innovativeness and timing of change of a business model should reflect market trends. The shift in business architecture and scope of production should be initiated subject to the demand of the market for the shift (Shang, 2008). The level of competitive rivalry and possibilities of brand switch informs the timeliness of the enterprise to shift its business model. Risks that affect enterprises emerge from the incapacity of the enterprise to timely predict the market needs, failure to develop product or service that has the capability to meet the market needs, and failure to apportion the time scale for the shift of the business into production of the service or product that the market needs (Mu, 2002; Kanamori, 2004). Failure to conduct market trends and predictions, develop forecasts on performance and appropriateness of product into market impacts negatively on the pricing model. This results in loss of competitive advantage through loss of core enterprise competencies hence loss of value creation to the target customers that the enterprise seeks to satisfy (Liu, 2008; Feng, 2007).

Organization of the dissertation

The immediate chapter provided an analysis of the performance and productivity of the SMSE in China and the status of the SMSE operations in China. The section provided the theoretical framework for the study and achievable goals. The rest of the dissertation is organized as follows. Chapter two reports on literature review on SMSE in China. Chapter three reports on the method of study that was used to conduct the studies on changes and risks that affect SMSE in china. Chapter four reports on the results that were obtained after collection of the data on risks and changes that affect SMSE in china and provide a discussion of the results. Chapter five reports on whether the study goals were achieved.

Literature review

Introduction

This section reports on the literature review on risks that affect SMSE in china. The risks are analyzed based on their capacity to negatively impact on the success of the SMSE.

The financial risks Small and Medium Sized Enterprises (SMSE)

The Small and Medium-Sized Enterprises (SMSE) in China face financial risks that have affected the capacity for the SMSE to implement employee training and development, investment in research and development, and acquisition of necessary equipment capital that is vital for the achievement of quality production (Feng, 2007; Dollar et al, 2003). Financial risks have made contributed to the inability of the SMSE to comply with the China Green trade barriers that are meant to protect China’s domestic market and as measures to strengthen quality production, improve efficiencies of production (Chitra, 2007), and restructure the consumption structure of the Chinese market (Kanamori & Zhao, 2004). SMSE are perceived to be high-risk borrowers in the Chinese industrial market. The high risk of credit facilities for financing the SMSE are brought about by SMSE low capitalization and limited assets that could be used as collateral (Yang, 2005). The SMSE are vulnerable to increasing market financial fluctuations that increase the costs of access to credit facilities.

The SMSE are not in a position to comply with high expectations for disclosure requirements (Han, 2006). The Chinese Basic Standard for Enterprise Internal Control (C-SOX) was implemented as an enterprise measure for internal control and proposed for implementation by the Ministry of Finance, China Securities Regulatory Commission (CSRC), China Banking Regulatory Commission (CBRC), the National Audit Office and China Insurance Regulatory Commission (CIRC). The primary focus of the C-SOX was to contribute to Enterprise Internal Control as a function of capacity to carry out self-evaluation and assessment, publication of enterprise financial reports through annual or quarterly financial reports, and hiring of consultants on internal control (Holden, 2001). The capacity of SMSE to comply is brought about by lack of competent human capital, and high costs of external auditing. The SMSE have not complied with standards for internal control with regard to financial reporting due to the high cost of compliance with China SOX requirements (Xin, 2007). The financial risks that affect the SMSE are predisposed by unexpectedly high administration and transaction costs that characterize the capability of an SMSE to attain the required minimum standards for financial acquisition. The costs of transactions make commercial banks’ investment in SMSE a non-profitable venture (Wu, 2007). Companies that provide financial services do not support SMSE financing. The commercial banks fail to provide the necessary support for SMSE financing because of the risk of repayment which, increases when the SMSE fails to pay, and banks are forced to use third parties or courts to make the SMSE meet their obligation of servicing their credit facilities (Tang, 2007).

As a result of the high financial risk of providing credit facilities to the SMSE, the commercial banks charge high-interest rates that don’t are not feasible or suitable for an SMSE to acquire and break-even (Ren & Jia, 2007). The high cost of interest rates has resulted in the collapse of many SMSE due to their incapacity to service the loan to full term. This has made SMSE to be characterized as loan defaulters. The high interest for credit facility acquisition by the SMSE is structured to meet the costs of acquiring financial information of the SMSE that could validate commercial bank capacity to extend the credit facility (Liu, Z. & Liu, C., 2003). Financial appraisal of the SMSE and determination of cash flow of the basis of the SMSE forms for the capability of the commercial banks to extend credit facilities to the SMSE. Cash flow analysis is used to determine the capability of the SMSE to service the credit facility. The requirement for the ability to repay financial loans has constricted SMSE access to external financing and made credit facility access a financial risk (Dong & Zhou, 2007).

SMSE in China don’t satisfactorily conform to the definition of entrepreneurship subject to capacity to demonstrate the capability to identify profitable business opportunities (Cross, 1997). As a result of the influence of financial risks, the SMSE cannot fully exploit any profitable business opportunity. The outcome manifests itself due to a lack of innovation in the SMSE sector that is caused by low creativity and capacity to identify market changes and trends that necessitate adoption or changes of the business case or business model for the SMSE (Huang, 2008). The SMSE characteristic of the low capital base has contributed to incapacity to invest in market research, inability to conduct field assessments and studies to determine the consumption structure of the products or services that they offer (Wen, 2002). As a result, the Chinese SMSE rely on the consumption structure of the market based on market trend analysis of the established global companies that operate in China that have a higher competitive advantage and higher market share (Xia & Yi, 2007). The trend shows the SMSE are not risk takers or don’t demonstrate commitment to innovation and creativity. The failure to take investment risks have made SMSE proactive in creating business opportunities that could result in higher profit margins. The SMSE should not be responding to business opportunities that are created by the large global companies that are operating in the Chinese market (Sidney, 2002; Buzacott & Zhang, 2004).

Financial risk of accountability and internal control metrics

SMSE have not complied with Chinese SOX (Linjie, 2010). As a result, commercial banks and external financial institutions don’t have enough information on the profitability of the SMSE. Due to uncertainty of profitability and lack of performance indicators of the SMSE (Dawkins, 1976), the commercial banks cannot be in a position to award capital loans to the SMSE (Biederman, 2004). In scenarios where the banks provide capital loans, the interest rates are high. This is due to the high risk of repayment. The business models for the SMSE are not in line with globalization and internationalization strategies which limits the capacity of the SMSE to compete sufficiently for the market share (Gu, 2009; Holden, 2001). As a result, the commercial banks are not in a position to determine rationale the SMSE would be able to make profits when their market share, which forms the basis for the profitability of an enterprise, is shrinking subject to lack of competitiveness and adoption of better core competencies that could increase differentiation and increase market positioning of the SMSE (Liu, 2008).

The increasing rate of collapse of SMSE has contributed to the risk of sustainability of the SMSE. As a result, SMSE face the highest market interest rates to compensate for the uncertainty risk. SMSE forms a high-risk borrower’s category in terms of capital loan acquisition. This has contributed to the crowding-out effect of low-risk borrowers (Feng, 2004). As a result, the commercial banks, by charging high interests, have decreased opportunities for low-risk borrowers from seeking financial services to finance their business opportunities for investment. The business opportunity for the SMSE is minimal in china despite the contribution of SMSE to the economy.

Risk of lack of credit history

Credit history plays an important role in determining the capacity of an SMSE to repay capital loans (Feng, 2004). In the absence of internal control data that could provide the profitability of the SMSE, credit history could form the basis for SMSE to acquire and qualify for low-interest capital. However, SMSE lack a credit history that could be used to benchmark their potential or past loan repayment procedures and success (Liu, 2008). This further constricts access to financing.

The feasibility of collateral and financial risk management

SMSE could access credit facilities through collateral. This helps to manage moral responsibility for SMSE capacity to pay capital loans (Hillson, 2003). The problem with many SMSE is to provide evidence that they could afford to pay the loans or could provide the required collateral. In China, SMSE suffers from credit rationing subject to a failure to have equitable collateral to meet the cost of the capital loan (Hallikas et al, 2002; Dollar et al, 2003). As a result of credit rationing, the capital requirement of many SMSE is based on personal savings, family and friends’ contributions. Other identified sources of capital for the Chinese SMSE include private equity and leasing and factoring (Yang, 2005).

Entrepreneurship risk amongst the SMSE

The SMSE face the risk of entrepreneurship (Feng, 2004). The SMSE don’t demonstrate the required creativity and innovation that could support competitive entrepreneurship. Creativity and innovation capacity determine SMSE’s potential to achieve entrepreneurial development and competencies (Chitra, 2007).

The SMSE failure to demonstrate innovation and branding of products and services hence attainment of competitiveness signifies a lack of capacity of the SMSE to identify opportunities for investment (Hillson, 2003). The SMSE don’t demonstrate the capacity to have human capital that could sustain a competitive advantage over globalized multinational companies operating in the China market. Lack of creativity and innovation has resulted in the inability of the SMSE to allocate resources effectively. The entrepreneurial risk has contributed to the inability of the SMSE to demonstrate a passion to achieve entrepreneurial success subject to a failure to focus on the creation of customer value that defines capacity for market share (Zhang, 2007). Entrepreneurship demands the capacity to improve business processes, adopt business models that could keep pace with market competition through ongoing market analysis and determination of the consumption structure of the target market (Tongtong & Jinmei, 2009). Entrepreneurship capability involves going against the status quo that SMSE don’t demonstrate.

The SMSE don’t demonstrate product development strategies. SMSE don’t invest in the determination of market opportunities or shift in consumer behavior that impact consumption structure (Mu, 2002). As a result, the SMSE don’t understand business threats that impact customer value creation and satisfaction of customer needs and customer expectations. As a result, the SMSE have failed to react to market trends and shift in consumer purchase intentions (French & Bell, 1979). This has resulted in high brand parity and loss of brand identity amongst the target market that has been brought about by the inability of the SMSE to react timely to the Chinese market competitive environment (Kanamori, 2004). The SMSE don’t utilize the 4P model that is characterized by Product, Price, Place and Promotion mix. As a result, SMSE products don’t get to the target market at a time when the customers seek the product which impacts negatively on the time utility of product consumption (Feng, 2007). The distribution channels for the SMSE are poor which contributes to the loss of competitive advantage. The SMSE don’t have enough capital to conduct promotions that could increase their brand awareness and recognition. The SMSE don’t demonstrate flexibility in terms of the 4P model application that has been brought about by financial risks and access to capital loans (Linjie, 2010). The SMSE should demonstrate sustainable entrepreneurship that should result in the creation of opportunities and pursuant of opportunities of investment (Holden, 2001). The SMSE should develop framework and structures for improving or elevating negative impacts of brand parity that contribute to consumer brand switch by adopting differentiation strategies that are a function of cost structure, improving efficacies of distribution channels, and improving on delivery of customer personalized services and products (Gu, 2007).

The credit system risks for the SMSE

The Chinese market financial system structure doesn’t favor SMSE credit facilities (Han, 2006). The commercial banks in China have a higher credit rating that makes it impossible for the SMSE to access credit facilities. In many instances, based on the SMSE credit rating, the credit facility that could be extended to the SMSE could not meet the SMSE financial requirements. Private financial institutions cannot meet the financial needs of the SMSE due to the financial structural limitations that private financial agencies impose on SMSE (He, 1999). This proves that the financial market and capital market for China are not well structured to cater to the SMSE financing needs. The privatization of financial institutions in china doesn’t support the financial climate for SMSE credit facilities. This has negatively affected the stock markets in China as well as the capacity for the economic development of the SMSE (Penrose, 1959). The financial capacity of the SMSE has negatively impacted the potential of the SMSE to be registered in the stock market. The capital market authority of China has set conditions for listing that don’t favor SMSE (Holden, 2001). The entry of insurance and security investment funds into the financial credit provider has not developed policies for addressing the plight of the SMSE credit facilities (Kanamori & Zhao, 2004). The capital market in China is characterized by inadequate liquidity to absorb outstanding shares. The capital market also suffers a deficiency of institutional investors due to risks of collapse and loss of returns on investment (ROI).

Risk of collateral appropriateness

Commercial banks have the capacity to provide capital loans to the SMSE sector (David, 2004). This could occur in the absence of financial information on the profitability of the SMSE. It is based on the capacity of the SMSE to provide appropriate collateral for the SMSE capital loan. Determination of the value of the collateral is easier than the acquisition of profitability of the SMSE. The use of an SMSE guarantee could form the basis for capital loan acquisition subject to the capacity of the guarantee equity (Sidney, 2002). The SMSE could make use of commonly accessible collateral: the accounts receivable of the SMSE or the SMSE inventory. The problem however occurs due to the inability of the SMSE to provide collateral. The SMSE don’t have documented accounts receivable since most of the SMSE are family-run businesses. Article 34, on Guarantee Law of the People’s Republic of China (PRC), provides eligibility rationale for capital loans for the SMSE that the SMSE cannot meet.

The credit rating risk of SMSE

The credit rating for the SMSE is very poor to guarantee commercial banks to extend credit facilities (Buzacott & Zhang, 2004). There are no credit rating assessments that are conducted on the Chinese SMSE. This is due to the lack of sustainability of the SMSE. As a result of the lack of credit rating assessment, the SMSE in china face low incentives. The SMSE don’t invest in credit reputation through the provision of data on the credit history of the SMSE. The outcome of the absence of the credit rating has been incapacitation of the SMSE to qualify for credit facilities or project future plans for possible credit facility acquisition (Xia & Yi, 2007). Due to the poor planning of the business, the SMSE quality of loans is very poor. Low quality of predicted performance or quality status for serving of the loans has negatively impacted the credit rating.

Although there was a policy that sought to identify the rationale of credit rating for the SMSE in 2001, the credit rating didn’t add value to the credit assessment system (Chen, 2004). The deficiency of the credit assessment system lay in its construct and functionality. The SMSE could not provide a mechanism for SMSE accounting and auditing (Gu, 2009). The SMSE don’t conduct internal control of their enterprises which could provide the financial position of the SMSE. Due to deficiencies in internal control and accounting practices, the financial structure of the SMSE is characterized by a lack of transparency of the financial status. SMSE don’t conduct internal control or audit their financial records.

The status of SMSE registration and boycott of financial audits

The framework for SMSE incorporation has deficiencies that contribute to SMSE’s capability to misrepresent cash flow, the number of employees permanently working in the SMSE, and the real value of the assets of the SMSE (Feng, 2004). The deficiency also affects the accounting and financial structure reporting of the SMSE. The SMSE circumvents the tax system subject to deficiencies in financial reporting. Due to commercial understanding of the SMSE capacity to misrepresent information, it becomes hard to guarantee the clarity of the SMSE internal control (Liu, 2008). SMSE under-reporting of financial position is meant to decrease the amount of tax payable. This implies the true financial reporting of the SMSE in China is very poor. Many SMSE keep duplicate accounting books that contribute to lack of transparency of the SMSE financial internal control.

Risks of non-performing capital loans

SMSE have the highest rate of non-performing capital loans subject to payment defaults (Ren & Jia, 2007). This has made SMSE access to credit facilities to be restricted since economies of scale, economies of scope, and cost complimentary could not be sustained by SMSE credit access. This has made commercial banks in China prefer lending to large corporations. The ownership of many SMSE is private (Shang, 2008). Thus, many SMSE are non-state enterprises. The capacity to access capital loans, therefore, depends on management connection with the local authorities. As a result, Guanxi networks play a vital role in determining the capability of an SMSE to acquire credit facilities. The SMSE face higher levels of income tax that are pegged at 33% enterprise income tax and subject to 20% tax adjustment.

Risk of inadequate SMSE standard financial strategies

The SMSE capital loan requirement doesn’t conform to the large companies’ loan requirements (Tang, 2007). Commercial banks have a preference to extend credit facilities to large MNC’s that demonstrate structural arrangements for capital utility. Large MNC’s have demonstrated compliance with C-SOX through investment in specific technical aspects that are from minimum standards for C-SOX implementation like document management, performance management, testing, and assessment of processes to different legal requirements and standards and investment of enterprise towards the development of human capital through e-learning programs. The SMSE ignore the element of asset structure allocation. The SMSE don’t demonstrate financial strategies for capital loan utility or implementation (Wu, 2007). The SMSE financial capital strategies don’t exhibit enterprise aims to be achieved. In many instances, the financial application departs from the enterprise goal for economic investment. The lack of financial strategies of the SMSE implies a corresponding lack of financial plans (Xin, 2007). The SMSE ought to demonstrate comprehensive financial strategies that are supported by financial planning for the capital loans and mechanism the capital loans create value to the SMSE. The financial strategies should provide information on the SMSE long term economic stability and sustainability.

The risks of green trade barriers

The technical standards and Chinese authentication system don’t provide a favorable climate for the SMSE (Yang, 2002). The SMSE financial risks have created a scenario where the SMSE are perceived as if they neglect to implement environmental controls in their production or implement green standards in production (Chitra, 2007). The SMSE don’t conduct strategic environmental analysis on the impacts of their activities (Zong, 2006). The capacity of the SMSE to develop and implement strategic environmental analysis influences on SMSE capacity to implement her financial strategies is negatively influenced by financial risks. Thus, SMSE ought to conduct internal and external environmental strategic analysis that could support financial strategies (Zongsheng, 2010). The SMSE ought to carry out a strategic analysis of her financial environment and ensure she is positioned to manage her financial strategies.

Loose budgetary measures for strategic financial implementation and coordination

Financial budgets impact the enterprise capacity to formulate, develop and implement financial strategies (Suzuki & Cobham, 2003). The SMSE in China have weak budgetary responsibility that makes it impossible to define and identify strategic financial implications of capital loans, the role the capital loans play in advancing employee productivity, and the new market position that is anticipated post-acquisition of the capital loans (Mu, 2002). The SMSE have high-risk human resource management which impacts negatively on productivity. Productivity efficiencies as a measure of capital loan repayment restrict access to micro-credit facilities. The SMSE has to demonstrate employee relations management strategies that are structured towards improving employee communication. The SMSE don’t use budgetary responsibility as a form of efficacies of daily SMSE operation and performance (Kanamori, 2004). Thus, the SMSE cannot determine financial goal gaps and hence incapacity to determine countermeasures for managing financial gaps.

Risk of independent financial system

The financial system in China lacks independence due to the influence of political risks. As a result, there is a deficiency of financial institution diversity of financing channels (Yang, 2005). The outcome has been constricted financial operation risks that have contributed to increasing financial costs of SMSE operation that predisposes SMSE into debts. This has contributed to SMSE diminishing credit rating (Dollar et al, 2003). The SMSE non-transparent operating processes and incidents of non-standardized financial reporting that have contributed to asymmetrical information for financial credit appraisal has constricted the SMSE capacity to acquire credit facilities. Inadequacy of financing system, diversity of financing channels, and human resource competence in the SMSE to identify best financial strategies have created an environment where SMSE financial risks and access to financial credit is minimal (Kanamori & Zhao, 2004). Administrative interferences and political risks have increased constraints hence credit facility for the SMSE lacks adequate feasibility study hence poor financial investment information.

The SMSE lack enough registered capital, diminishing operating capital due to the buildup of inventory owing to excess production. This has resulted in inadequate investment capacity in the SMSE sector (Feng, 2007). This is a strong indicator of inadequacy to comply with C-SOX minimum standards like document management feasibility, capacity to conduct performance management and carry out testing and assessment of internal control policies to ensure they meet and conform to minimum China SOX standards (French & Bell, 1979; Geert, 1997; Dawkins, 1976). Many SMSE focus on short-term investment hence fail to project on financial stability in the long term. This, in part, is fueled by a lack of market analysis. Many SMSE investment decisions are not based on research or case studies or pilot studies but based on perception. The investment decisions that are based on the perception of economic growth do not rely on principles of the market economy hence capacity to pursue economic profitability is not backed by management principles (Linjie, 2010). The SMSE hence lack expansion and shrinkage strategies hence cannot determine when to hire or reduce employees based on the financial position or when a strategy value has attained economic plateau phase. This, therefore, demonstrates that SMSE have inadequate internal control that has impacted negatively on efficiencies of control (Sidney, 2002). This has made it impossible for the SMSE to restrain their economic behavior institutionally. Internal behavior requires the presence of internal auditing that SMSE lack.

The risk of weak communication infrastructure

SMSE in China have a weak communication infrastructure which contributes to the inability of the SMSE to achieve close to real-time communication with their clients (He, 1999). Globalization and access to the internet by clients have contributed to increased demand for producers to adopt Integrated Marketing Communication (IMC) that have the capacity to facilitate close to real-time communication (Feng, 2004). Customer interactivity through IMC could make it possible for the SMSE to develop brand identity, consumer confidence and improve consumer loyalty that forms the basis for the growth of the market share. The risks of weak communication have impacted negatively on the SMSE demand and supply of her products (Geert, 1997). The SMSE cannot implement Just-In-Time strategies or develop sustainable shared objective interests with suppliers (Gu, 2009). The SMSE have not demonstrated capacity to conform to Trompenaars and Hampden-Turner cultural theorem (Dawkins, 1976) through inability to provide the foundation for ascription hence capacity to prove capacity to demonstrate gain economic status through enhanced financial reporting, accountability and internal control. As a result of poor communication strategies and structures, the SMSE could not implement e-financing or e-commerce that requires higher financial investment in terms of equipment and human capital that has competence in e-commerce, IMC and e-financing (Chen, 2004). Financial risks have played a vital role in decreasing the capacity for the SMSE to implement e-commerce. The SMSE have not implemented e-finance although it is easy to implement and assimilate or integrate into the business operations (Hallikas et al, 2002). The increasing brand switch from SMSE into the globalized businesses in China has been catalyzed by the investment of the globalized multinational companies (MNC’s) in IMC, e-finance and e-commerce. E-commerce has the capacity to improve consumer flexibility that impacts positively on consumer purchase behavior. The consumption structure of a market depends on the capacity for the manufacturers to implement and conform to 4P model elements namely Product, Place, Price and Promotion (Hillson, 2003). Due to the impacts of the weak financial background of the SMSE, and their incapacity to conform to the 4P model, consumers have engaged in the brand switch. This has resulted in consumer consumption of products and services provided by MNC’s that provide e-commence and e-finance. As a result, SMSE could improve its market competitiveness and market positioning by implementing e-commerce and e-finance.

Risk of globalization and financial service shift in access

Globalization from above and globalization from below have contributed to the convergence of technologies (Gu, 2009). Globalization and internationalization of businesses have resulted in the globalization of financial services. Globalization of financial services has decreased internal barriers to enterprise capacity to access capital loans. Although globalization has created an environment for international economic integration, subject to convergence theory on economies of scope and economies of scale, the SMSE have not benefited from globalization of financial services due to lack of access to information and risks of offshore financial trading. The distribution channels for the SMSE are not adequate to support the movement of products across political borders (Feng, 2004). Due to poor rationale for the inbound capital flow, financial institutions are incapacitated due to dependence on domestic capital flow.

The risk of deregulation and emerging financial services landscape

The economic development of the SMSE has not benefited from deregulation and the emerging landscape of globalized financial services (Linjie, 2010). This has been fueled by regulatory barriers towards financial credit facilities for the SMSE. The SMSE have not maintained the pace of integrated banking or mechanism through which globalization of financial services is delivered and produced for market consumption. Merge and acquisition of financial institutions and creation of financial synergies through merging of brand names, and mechanism financial services are distributed have not been tapped by the SMSE (Zongsheng, 2010). The SMSE have not exploited the competitive landscape that globalization of financial services has created subject to business case and business models that cannot contribute to competitive advantage.

The risks of credit crunch and financial channels on SMSE

The SMSE financial risks were increased by the 2008 global financial recession that was characterized by a credit crunch (Linjie, 2010). The credit crunch had negative impacts on credit facility structure by negatively changing the financing channels that commercial institutions were following. Credit crunch resulted in an increased restriction to SMSE access to capital loans. Although the measures that were adopted by different fiscal policies were meant to decrease the impacts of the economic recessions and protection of domestic markets from economic downturns, the recession impacted negatively on SMSE capacity to acquire capital loans (Zongsheng, 2010). The increase in deposit reserve rates and loan interest rates made it impossible for the SMSE to seek or satisfy minimum standards for credit facility access.

The monetary policy of China contributed to decreased negative impacts of economic downturns but increased financing costs for the SMSE (Liu, Z. & Liu, C., 2003). The negative impacts of the economic crisis of 2008 demonstrated the high-risk profile of the SMSE in China. It demonstrated the incapacity of the financing channels for the SMSE in china. Economic crisis negatively affected the venture capital, a listing of companies and financing capacity, as well as equity funds hence shifting rationale for future credit facility structure for the SMSE (Kotler & Keller, 2008).

The uncertainty of SMSE entrepreneurship in China

The feasibility of the economic success of SMSE entrepreneurship in China is minimal. The management of the SMSE is not a function of employee psychological capital (Yang, 2005). The remunerations are low to contribute to employee retention. The rate of collapse of SMSE is very high. Many SMSE are in liquidation or under statutory management of commercial banks with aim of recovering their loans and adding a lifeline to the SMSE (Suzuki & Cobham, 2003). The entrepreneurship of the SMSE has been affected by a lack of competency in the strategic management of the enterprises. The SMSE capacity to conform to C-SOX standards is not adequate to demonstrate enterprise internal environment hence capacity to demonstrate foundation for enterprise components for internal enterprise control. The SMSE risk assessment position is below par hence SMSE risk assessment doesn’t translate to capacity to identify and utilize risk assessment as a measure for achievement of enterprise objective interests. The inability of SMSE to comply with C-SOX has impacted the inability of the SMSE to demonstrate internal control processes subject to the development of policies, standards, and procedures for directing mechanisms internal control should be implemented and monitored. The SMSE don’t have sufficient capital to implement the requirement for information and communication tools. This has made it impossible for the SMSE to execute information exchange processes that could form the basis for integrated Marketing Communication (IMC), business-to-Business Communication (B2BC), and Business-To-consumer Communication (B2CC). This has negatively impacted the quality of the SMSE internal control. The inability of the SMSE to conduct market analysis has contributed to the inability of the SMSE to identify investment opportunities, respond timely to changes in consumer purchase behavior, and changes in consumer purchase intentions that define consumer product or service preferences.

The risk of entrepreneurship has resulted in the incapacity of the SMSE to allocate enough resources in production (Gu, 2007). The labor, capital, and knowledge that are vital for the growth of enterprises are not structured on enterprise core competencies for market positioning. Lack of fit between human resources, financial resources, and productivity has resulted in an inability to determine the quantity of product to sell (Gu, 2009). This has contributed to the buildup of inventory amongst the SMSE. The buildup of unsold inventory has resulted in a decrease in operating capital for the SMSE which has exposed the SMSE to financial risks.

Managing the risk of product launch

The SMSE don’t adopt strategies that could contribute to successful product launch into the market (Feng, 2004). The SMSE products and services are not structured and designed to provide functional advantages that could form the basis for consumer product quality preferences. The cost of production of SMSE products results in high prices compared to substitute products from MNC’s (Han, 2006). The MNC’s have a higher advantage of commercial production at lower labor costs, cheap access to materials, and have integrated distribution channels that conform to green logistics and green technology hence lower production costs. The SMSE product designs that could enhance consumer brand recognition and identity are low compared to the MNC’s (Mu, 2002). Thus, product display qualities of the SMSE don’t demonstrate attractive designs that could exploit the visual cues of the consumer purchase process.

The launch of an SMSE product doesn’t bring about the market response as the launch of a product by MNC’s (Shang, 2008). The reputation of the SMSE brands is very low. The decreased reputation of the SMSE is brought about by lack of consistency in product quality or liaison of the SMSE with research and development agencies that could advise the SMSE on technical and technological aspects that affect product quality (Zong, 2006). The SMSE don’t provide after-sales services that could help to develop consumer brand loyalty and preferences. This has made the SMSE lose on their competitive advantage. The SMSE ought to develop its competitive advantage based on parameters like being low-cost producers, conducting research on the market, and implementing product market differentiation and assessment of niche markets (Wu, 2007). The SMSE should demonstrate a capacity for entrepreneurship through adopting strategies that could contribute to SMSE as breakthrough product innovators. The innovation level of SMSE could enhance the SMSE business model and design and provide an opportunity for the SMSE to deliver and implement market-driven approaches that could contribute to the shift of consumer consumption structure in preference for the SMSE products. The SMSE should demonstrate a capacity for new product development through research and development hence producing innovative products that could help to improve the market positioning of the SMSE (Cross, 1997). Through innovative product launches, the SMSE could achieve market capitalization hence achieve profitability in the long term through new business opportunity development and design.

Risk of yield management in SMSE investing in hospitality industry

Yield management should contribute to the capability of an enterprise to sell its inventory at the right price, to the right customer at the right time. As a result, yield management is a function of the time utility of a product or service (Ren & Jia, 2007). The SMSE have not implemented strategies that could contribute to profitability through market-oriented approaches or customer-based approaches. The SMSE revenue management levels are not structured on management control, rate value management, revenue stream management, or distributed channel management (Tang, 2007). Thus, SMSE management is not based on lean manufacturing principles hence the productivity efficiencies are low. Low productivity efficiencies are brought about by a lack of waste management. On the basis of lean principles of manufacturing, SMSE don’t manage wastes of waiting where employees wait for materials to arrive or employees in a line of production wait for another line to complete a production cycle. The production processes of the SMSE contribute to the buildup of inventory in the manufacturing life cycle. The SMSE don’t manufacture to order which would reduce the build-up of inventory (Yang, 2002).

The SMSE lack common objectives between marketing, operations, and financial departments. SMSE don’t of shared goals between departments of the SMSE results in the adoption of different strategies by different departments (Chen, 2004). The procurement department ought to have similar strategic goals with the production department. These should be shared with suppliers of materials in order to make it possible to implement lean principles and Just-In-Time tools. Through shared strategic goals, the SMSE could gain from an optimal pricing strategy that is demand-responsive (Liu, 2008). Through the implementation of revenue management, the SMSE could be positioned to restructure the industry and achieve the capacity to serve wider market segments. As a result, the SMSE could be positioned to acquire a competitive advantage that could make it possible for the SMSE to compete effectively with the established MNC’s operating in China (Wen, 2002). The capacity of the SMSE to implement revenue management determines SMSE capacity to identify the right market knowledge that could form the basis for her production level, acquire consumer product quality preferences and implement manufacture to order strategies (Kotler & Keller, 2008).

Sustainability of revenue management for hospitality based constrained SMSE

Revenue management has the potential to contribute to the profitability of capacity-constrained SMSE (Gu, 2007). SMSE could achieve sustainability of her marginal revenue and marginal returns through the allocation of the right inventory to the right customer at the right time. The SMSE could segment its target markets through the determination of target market demand patterns for products in order to implement a distribution strategy that is structured on market demand (Xia & Yi, 2007). Revenue management of the SMSE should be based on the principle of deregulation through a pricing paradigm that is structured on product consumption patterns. A pricing paradigm contributes to SMSE centralized management of production and distribution of her products which results in the creation of customer value by satisfying the 4P model. The SMSE should analyze the price sensitivity of the target markets (Feng, 2004). Price sensitivity of the target customers influences consumer brand image, brand loyalty and identity. The SMSE should exploit market information and implement market benchmarking processes through the adoption of vertical or horizontal differentiation. This facilitates the SMSE to implement a lean manufacturing perspective that is based on demand response for the products. It positions the SMSE to conduct ongoing demand price sensitivity forecasts hence be able to project SMSE profitability and expansion strategies in the long term.

Methodology of the study

Introduction

This section reports on the method of study that was used to conduct studies on changes and risks that affect SMSE in China.

Methodology of Study

The study used the quantitative research method. The quantitative research method was adopted to make it possible for the study outcomes to be generalized across different SMSE in China (Cooper & Schindler, 2001). The quantitative research was delivered through the use of Quantitative Content Analysis, (QCA), Attribute approach and factor analysis approach. Quantitative research was carried out to make it possible to use random sampling when recruiting the study respondents.

The Research approaches

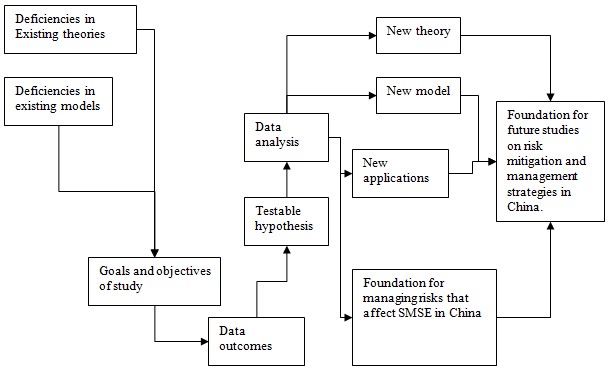

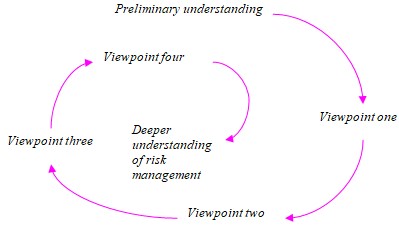

The study research approach and construct were designed to contribute to the identification of the risks that affect SMSE in China and form a basis for changes that need to be implemented in order to mitigate risks that affect SMSE in the China Market. The study approach relied on both deductive and inductive approaches. The deductive and inductive approaches were based on the exploratory research approach. The study utilized an exploratory approach to making the study independent from past studies on risks that affect SMSE in china subject to lack of a study model that could have been used to form a basis for studies in risks that affect SMSE in China. The study, therefore, was not based on conventional principles of scientific research and ideas subject to confinement to established paradigms thus scientific laws, models and theories. The research paradigms are built on theoretical frameworks or conceptual frameworks that emerge from formal theories and proved experiments that have been conducted following established trusted methods and procedures that are conducted under standard conditions that might have resulted in the generation of the research paradigm as-is. Hence exploratory approach (figure 1) was adopted to form the basis for the determination of the applicability of a theory since, through exploratory stance, the direction of the theory can be determined, exploited and its feasibility on SMSE sustainability determine (table 1)

Table one: comparative perspectives of popper and Kuhn

Source: Adapted from Kuhn, T. (1962) The structure of Scientific revolution, 2nd Edition.

The study constructs

The study construct was based on the impact of risks on the sustainability of an SMSE. The study constructs sought to identify risks that affect the SMSE in China and mechanism the risks translate into China SMSE financial stability, credit risk rating, the value of collateral, financial reporting and internal control, the capacity of financial risks to influence SMSE risks and integration of economies and financial services in China. The study sought to link cultural elements and mechanisms their impact on SMSE risks and uncertainties with references to Trompenaars and Hampden-Turner cultural theorem and model. The study constructs satisfied the Kuhn (1962) standards for exploratory approach namely:

Kuhn’s (1962) work provided characteristic elements that should be satisfied by a scientific paradigm namely

- The scientific paradigm should conform to element of accuracy such that a theorem is accurate within limits of its inquiry.

- The paradigm should satisfy consistency element by conforming to internal consistency, subject to internal attributes and be consistent with other theories

- The paradigm should have capability for broad scope applicability such that the theorem has capability to explain more concepts than it’s destined to

- The theorem should achieve the aspect of simplicity by using simple and clear language that provides explanation of complex terminologies

- The paradigm should achieve the element of fruitfulness such that the theorem should be used to identify new emerging phenomena or previously unidentified relationships between different phenomena.

Adapted from Kuhn, T. (1962) The structure of Scientific revolution, 2nd Edition.

Study variables

The study investigated impacts of the following study variables on risks that affect the SMSE in China (Yin, 1989) namely the budgetary risks, green trade barrier risks, financial risks, credit risk rating, collateral risks, deregulation risks, revenue management risks, and its sustainability, risks of weak communication infrastructure and risks of independent financial systems.

Study design

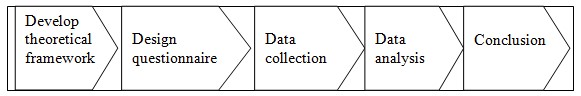

The study adopted a research design represented by figure 2:

The study was designed to investigate risks and key changes that could be made to the SMSE operating in China (Saunders et al, 2007). The study was designed to investigate the mechanism through which the risks have affected the sustainability of the SMSE in China and hence propose changes that need to be put into place to manage the risks.

Study settings

The study was carried out amongst SMSE that operate in China that employ between 10 and 50 employees and have a annual turnover not exceeding USD 225,000.

Qualification of SMSE to participate in the study

The SMSE inclusion criteria included past efforts of the SMSE to access credit facilities and failed to achieve the credit facilities (Saunders et al, 2000). The SMSE ought to have been in operations for the last ten years or has been in operations in the last ten years but has been put on statutory management. The other study inclusion criteria for the SMSE was to have an independent distribution channel and run and managed by family or family appointed Chief Executive Officer.

Study instruments

The study used questionnaires as the primary instruments for research. The questionnaires used were closed (Yin, 1989). This helped to confine the study objectives. The questionnaires were presented to the study respondents on the day of the interview. Questionnaires were used because they are easy to analyze and quantify and can fit any statistical analysis. Questionnaires are cost-effective as opposed to face-to-face interviews thus reducing the time needed to complete the study (Saunders et al, 2007, eds). Questionnaires reduce opportunities for interviewer bias subject to uniformity of the questions. Compared to interviewing, no interviews are planned for hence no verbal clues could influence respondents’ answers since interviewer voice inflections have the potential to contribute to bias responses. These threats don’t present themselves in questionnaires.

Study sample

The study relied on a population sample of 200 respondents, based on the turnout of expected 210 respondents (Cooper & Schindler, 2001). The reliability based on the response rate was determined to be 95.23%.

Method of recruiting study respondents

The study respondents were recruited through Random sampling. This ensured a greater proportion of SMSE were represented in the study based on SMSE inclusion criteria.

Method of data collection used

The study used closed questionnaires in order to gain respondents’ perspectives on changes and risks that affect SMSE in China (Yin, 1989). The study used a five-point Likert scale whose values ranged from one (strongly disagree) to five (strongly agree).

Method of data presentation

The collected data was presented in form of tables. Tabulations of data have the capability of ensuring data could be summarized, could be rank-ordered and it could be easier to institute statistical data analysis. Tabulation makes it possible to construct visual measures of central tendency (Yin, 1989).

Data validity, reliability and generalizability

The credibility of collected data is instrumental in the determination of the accuracy and precision of the results. Credibility impacts the validity of the conclusion and policy development on risks and changes that need to be implemented on SMSE in China (Cooper & Schindler, 2001). A validity construct was designed such that the study outcomes reflected study objectives and satisfying study theoretical construct (Saunders et al, 2000). A study validity construct was developed to ensure study outcomes provided foundations for risks that affect SMSE in China. The risk of reliability measures was reduced by decreasing the possibility of respondent bias. The vulnerability of the study’s reliability to the homogeneity of the results and findings was reduced by the use of random sampling. This made it possible to represent voice on risks that affect different SMSE operating in China. (Saunders et al, 2007, eds).

Data analysis

The data analysis was achieved by entering the collected data into an excel database followed by determination of measures of central tendency namely mean, followed by determination of measures of the spread of data or dispersion, through the determination of moments of skewness and moments of kurtosis (Cooper & Schindler, 2001). The impact of every risk on SMSE was identified and analyzed based on figure 3.

The data analysis determined impacts of the risks based on source and mechanism through which different risk mitigation approaches could be implemented, measured, and monitored hence the emergence of new theories and models on SMSE risk management procedures and standards in China (figure 4)

Ethical considerations

The study satisfied research ethics on studies that involve human subjects as was recommended by the committee on business ethics namely the principle of autonomy, the principle of anonymity, and the principle of voluntary participation (Saunders et al, 2007). The study respondents were provided with the required knowledge on procedures of the study, the rationale of the study, and expected study outcomes before signatory of informed consent were received.

Results and discussion of the findings

Financial risks

The study findings established that SMSE in China face financial risks that negatively affect the financial position of the SMSE (Appendix E). SMSE face financial risks because commercial banks and financial institutions prefer to advance credit facilities to large companies that have the capacity to pay (table EA). The preference of financial institutions to offer credit facilities to large companies achieved a mean of 3.825, Moment of skewness of +0.2564, and moment of kurtosis of -1.6209. Therefore the likelihood of an SMSE to acquire credit facility from commercial institutions is minimal and presents a risk to SMSE in terms of access to capital. The SMSE do not suffer financial risks that are internally hard to control (table EB) which achieved a mean of 2.175, moment of skewness of +0.4393, and moment of kurtosis of -0.4515. The findings on table EB determined that the SMSE have the capacity to manage financial risks. The capacity of the SMSE top manage financial risks should be structured on SMSE internal control and accounting (table EE, table EF, table EG, table GB, appendix J, appendix A and appendix L). The results demonstrated a lack of compatibility with the Trompenaars and Hampden-Turner theory and model on Cultural adaptation and mechanism culture impacts on the productivity, performance, and economic growth of an enterprise. The Chinese Market has not differentiated application of universality and particularism element of culture with respect to the role of financial rules, the contribution of credit risk rating on the capacity of SMSE to acquire financial capital. The specific and diffusion element of culture that determines the level of external stakeholder interference with internal business processes demonstrated the SMSE are prone to external forces that impact their economic capacity that is dependent on political risks and Guanxi networks. This demonstrated the particularism of the business environment in China. The SMSE have failed to implement C-SOX demonstrating incapacity to external business process orientation hence the failure of the SMSE to conform to Trompenaars and Hampden-Turner dimension of Cultural influence on business economic growth. The SMSE ought to develop policies for risk management and improve on transparency of accounting standards and internal control.

SMSE demonstrated increased credit facility payment default. The SMSE credit default has contributed to poor credit rating risk (appendix F). Financial institutions cannot advance loans to SMSE due to the financial risks (appendix E) that are associated with SMSE. The profitability of a financial enterprise is based on its capacity for moving capital and the absence of non-performing loans. SMSE credit facility could contribute to the build up of inventory (table EC) which has the capacity to decrease a financial institution operating capital. Due to the need to achieve stability of financial systems and financial position, financial institutions develop and implement strategies that limit SMSE capacity to seek credit facilities. Build up of inventory or non-performing loans realized a mean of 3.875, a moment of skewness of 0.1138, and a moment of kurtosis of -1.8380 (table EC).

The SMSE in China business operations are characterized by unethical business practices with regard to transparency and accountability hence lack of conformity to C-SOX standards and policies. SMSE don’t conduct financial reporting of their businesses that could provide the basis for the determination of cash flow. Cash flow analysis provides the foundation for determining the profitability of a business and the capacity for the business to service its credit facilities. The inability of the SMSE to conduct financial reporting achieved a mean of 2.155, a moment of skewness of +0.1386, and a moment of kurtosis of -0.0679 (table ED). SMSE ought to change their financial reporting policies in order to improve on their credit risk rating (appendix F). Lack of transparency in financial accounting and reporting was evident by the presence of duplicate accounting books (table EE). SMSE, therefore, have duplicate accounting books that are meant to manage tax payable. Duplicate accounting processes achieved a mean of 2.125, a moment of skewness of -0.0851, and a moment of kurtosis of -0.1359. This affirms a lack of transparency in financial reporting and internal control (table EF) that achieved a mean of 2.145, a moment of skewness of +0.1666, and a moment of kurtosis of -0.5648. This demonstrated a lack of transparency in financial reporting amongst the SMSE. It further confirms the lack of SMSE compliance with China SOX for enterprise internal control (table EG) subject to a mean of 2.115, moment of skewness of +0.3009, and kurtosis of -1.6185. As a result the SMSE in China function as individual entities. This has contributed to the isolation of the SMSE hence satisfaction of the individualism component of the Trompenaars cultural element. In addition, SMSE have not achieved sequentially leadership and management strategies. Inability to conform to C-SOX subject to lack of internal control has questioned the framework of programmed activities that should contribute to the timeline for implementing enterprise processes. SMSE in China have limited access to credit facilities if the SMSE are privately owned (table EH) subject to a mean of 2.06, moment of skewness, and kurtosis of +0.4168, and -1.7073 respectively. The privately-owned SMSE have a high credit risk rating (appendix F) compared to state-owned SMSE. The potential of a state-owned SMSE access to credit facilities were found to be higher (table EI) that achieved a mean of 3.935, a moment of skewness of +0.2861, and kurtosis of -1.7571. This is subject to the transparency of SMSE internal control and compliance with China SOX enterprise internal control and accountability of financial accounting.

Credit risk rating

Credit risk rating determines the capacity of an SMSE to access credit facilities. Credit risk rating (appendix F) is a measure of the capacity of SMSE to service its credit facility, the health of the SMSE credit history, and transparency and accountability of its internal control that influence and exposes SMSE to financial risks (appendix E). Credit rating risk was found to contribute to SMSE incapacity to access credit facilities (table FA) that achieved a mean of 2.165, moment of skewness, and kurtosis of -0.0897 and -0.7716 respectively. Credit risk rating positively impacts SMSE capacity to access credit facilities. Credit risk rating impacts negatively on the SMSE capability to use other avenues to access credit facilities like collateral (appendix G) and management of budgetary risks (appendix C), management of product launch (appendix K), and utility of entrepreneurial management strategies (appendix J). Therefore, credit risk rating could form the basis for SMSE inadequacy to access capital loans (table FB; see also table FA) that achieved a mean of 2.07, a moment of skewness and kurtosis of +0.3960, and -1.8327 respectively. Accountability in financial reporting and level of internal control (table FC) influences credit risk rating. Lack of transparency and internal control of the SMSE (table EF, table EG and table ED) negatively affects credit risk rating (appendix F).

The SMSE don’t conform to Trompenaars theorem with regard to power distance and mechanism power distance contributes to the healthiness of business processes and their sustainability. The Chinese market has traditional roots that are built on collectivist cultural elements hence sustainability of business growth on Guanxi social networks. The measure of enterprise is based on material success hence the dominance of masculinity. The SMSE suffer from uncertainty avoidance hence incapacity to predict and project economic growth. This has impacted on Confucian dynamism of the SMSE hence incapacity to project on SMSE long term and short-term business orientation. This prevents SMSE to access credit facilities hence decreasing the potential of SMSE to invest due to decreased operating capital (table FC) that achieved a mean of 2.115, moment of skewness and kurtosis respectively.

The SMSE collateral risk

Credit risk rating (appendix F) has the capacity to decrease the value of SMSE collateral or the capability of the SMSE to use collateral to access micro-credit (table GA). Many SMSE in China don’t have sufficient collateral that could be used to access capital loans. The incapacity of SMSE to use collateral achieved a mean of 3.935, a moment of skewness of +0.2861, and kurtosis of -1.7571. The capacity for the SMSE to use accounts receivable as collateral was minimal. SMSE don’t document their accounts receivable which could act as a form of enterprise internal control and form the basis for security in form of collateral (table GB). Failure of SMSE to document her accounts receivable achieved a mean of 2.17, moment of skewness of +0.7253, and kurtosis of -1.7405. Due to the inability to document her accounts receivable, financial institutions cannot determine the cash flow of the SMSE. This means the credit risk rating that SMSE suffer is based on the incapacity of the SMSE to document her cash flow and manage her internal control (table GC). This achieved a mean of 3.94, a moment of skewness of +0.2923, and a kurtosis of -1.9225. Accountability and transparency are an important element that influences credit risk rating hence incapacity to use collateral. Lack of transparency decreases the valuation of collateral. This trend has been brought about by the inability to conform to Trompenaars and Hampden-Turner Theorem on Confucian dynamism through the inability to manage uncertainties and threats that impact the economic sustainability of the SMSE and the orientation of the businesses to short-, medium- and long-term business objectives interests. As a result of collateral risks (appendix G), the SMSE are not able to meet their financial obligations (table GD) that achieved a mean of 3.995, moment of skewness of +0.3424, and kurtosis of -1.5495. The SMSE cannot, therefore, implement strategies that could improve their market positioning (table GD). This has contributed to the uncertainty of entrepreneurship of the SMSE (appendix J), risks of product launch (appendix K), and exposed the SMSE to budgetary risks (appendix C).

Deregulation risks

Following deregulations of financial services, SMSE were expected to have the capability to access financial credit easily. Deregulation of financial services has not contributed to increased access to SMSE credit facilities. This has been brought about by a lack of strategic management of problems that have decreased the failure of the SMSE to access the micro-credit facilities. SMSE have not benefited from the deregulation of financial institutions and financial services (table HA) that achieved a mean of 2.075, moment of skewness of +0.3952, and kurtosis of -1.1745. Deregulations of financial institutions and financial services have not contributed to improved outcomes of the SMSE in terms of accountability and internal control. The incapacity of the SMSE to benefit from the deregulation of financial institutions is based on political risks. The success of the SMSE to access credit facilities is dependent on political networks and Guanxi business networks. The incapacity of SMSE to demonstrate affiliation into Guanxi business networks translates into decreased market share and decreased brand visibility and identity. China is emerging from a traditional economy model where consumers have had greater value and attachment to social networks. Guanxi business networks determine consumption structure hence political risks impact the capacity of SMSE to access credit facility (table HB) that realized a mean of 3.855, moment of skewness, and kurtosis of +0.1957 and -1.9607 respectively.

Deregulations of financial institutions didn’t change the SMSE business case and model. Mergers and acquisitions of financial agencies and privatization of state-owned enterprises have made it harder for the SMSE to access credit facilities (table HC). Mergers and acquisition capacity to improve SMSE potential to access credit facility achieved a mean of 2.31, moment of skewness, and kurtosis of -0.6961 and -0.9401 respectively. There has been little investment of SMSE to improve their business model (table HD). This has been brought about by a lack of innovation and creativity in the SMSE sector. Innovation and creativity that contribute to branding and new product development are stimulated by the financial capacity of an enterprise to hire and retain competent staff, invest in research and development of products and train its employees. The role of the SMSE business model towards capacity for credit facility access achieved a mean of 3.935, moment of skewness, and kurtosis of +0.2861 and -1.7571 respectively. The business model of SMSE plays a leading role in determining SMSE capacity to access credit facilities. The business model of SMSE determines the level of financial risks that an SMSE is exposed to and its capacity for the sustainability of operations.

Deregulation of financial services that have been brought about by the convergence of financial services and institutions has not contributed to SMSE capacity to manage financial risks and credit risk rating (table HE). This achieved a mean of 2.19, and moment of skewness and kurtosis of -0.4354 and +0.2509 respectively. The convergence of financial services has been fueled by the globalization of financial services and the integration of economies. SMSE in China have not achieved a competitive advantage from the integration of economies or the possible transition of the China market from a traditional economy into an open market economy (table HF). The incapacity of SMSE to gain benefits from the globalization of financial services achieved a mean of 2.24, and moment of skewness and kurtosis of +0.1173 and +0.1366 respectively. This shows that the integration of economies has not contributed to the change of business philosophy and structure of the SMSE. Many SMSE in China are founded and managed by family members as a form of income-generating activities. The framework and objective interests of family businesses are different from achievable goals of integration of economies. As a result, the SMSE have not benefited from capital flow across political borders (table HG). This achieved a mean of 2.25 and moment of skewness and kurtosis of -0.0954 and +0.1445 respectively.

SMSE Risk of credit crunch

The SMSE don’t have the capacity to manage the impacts of the credit crunch (appendix I). Credit crunch results increase in interest rates and limitation of enterprise capacity to access credit facilities. The environment for credit crunch is predisposed by an increased buildup of non-moving inventory and the presence of non-performing loans in financial institutions. Somehow, the environment for SMSE in China presents a scenario where SMSE are exposed to limited credit facilities and high-interest rates. This presents a situation where SMSE experience a local credit crunch. It cannot be hypotheses that in China, SMSE suffer from local crunch due stability of the china economy. The SMSE in China don’t demonstrate the capability to manage negative impacts of the credit crunch and economic recession (table IA) that achieved a mean of 2.15, moment of skewness, and kurtosis of -0.1671 and +0.2276 respectively. This provides the basis for the increased collapse of SMSE in china.